IRS Form 9465 Instructions

If you owe significant back taxes to the federal government, you might not be able to pay the full amount at one time. Fortunately, the Internal Revenue Service may allow you to work down your unpaid balance with monthly payments by filing IRS Form 9465, Installment Agreement Request.

This article will walk you through what you need to know about IRS Form 9465, including:

- How to complete and submit IRS Form 9465

- Ways to set up an IRS online payment agreement

- Available options when setting up a monthly installment plan

- Understanding when an installment agreement isn’t enough

Let’s start with step by step instructions on how to complete the tax form itself.

Table of contents

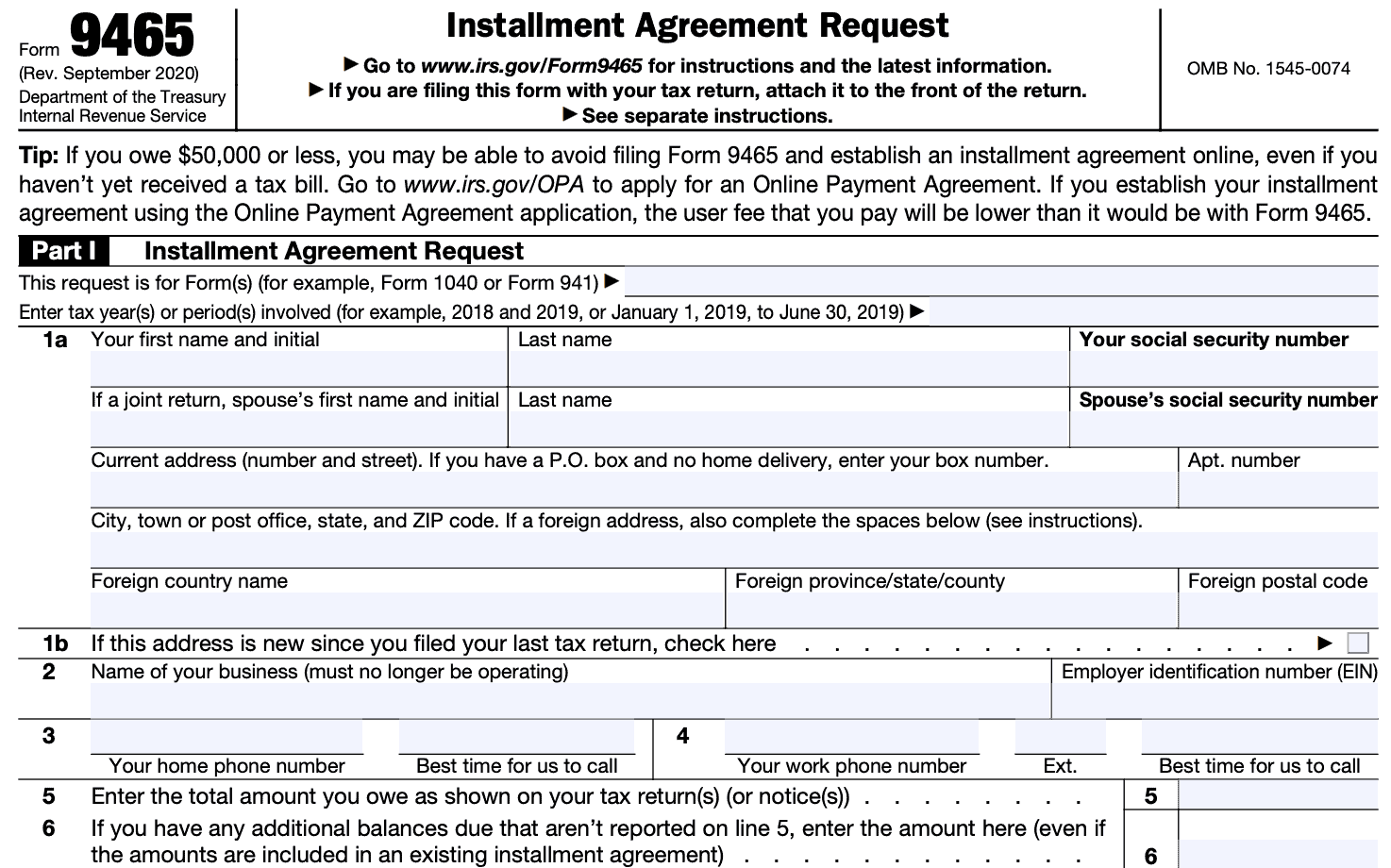

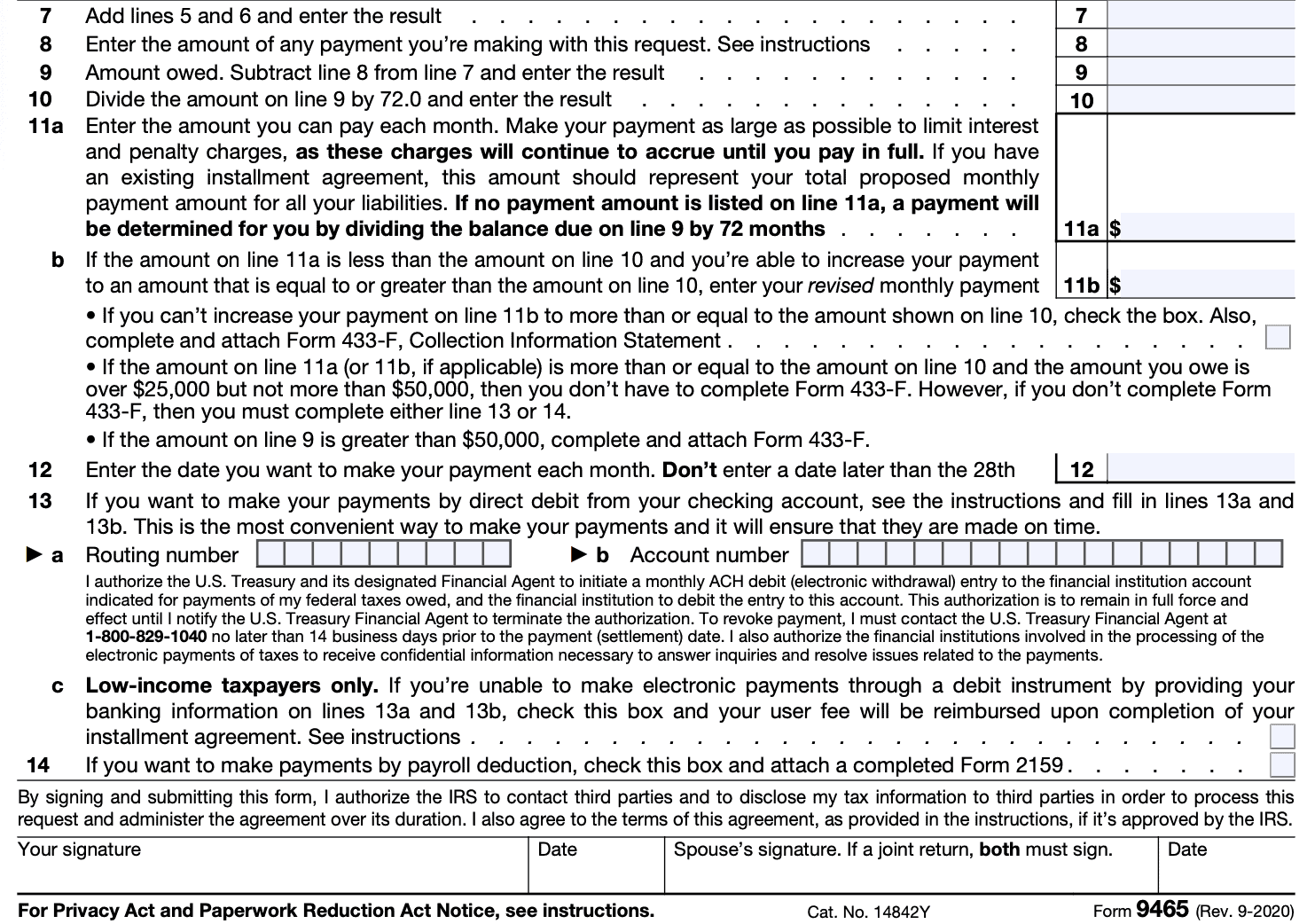

How do I complete IRS Form 9465?

We’ll walk through how to complete Form 9465, step by step. There are two parts, so we’ll start at the top.

Part I: Installment Agreement Request

Before you begin, you should note the online payment agreement option at the top of the form.

If you think you can avoid having to file Form 9465 and paying a setup fee, you should go to the IRS website before starting this application.

Top of form

At the top of the form, enter the following information:

- Type of tax form involved

- Tax years or tax periods involved

For most individual taxpayers, an example might look like:

- IRS Form 1040

- Tax year 2021

If there are one or more prior years involved, ensure you include all tax years. If you think there might be different tax forms involved, you might need to have a tax professional, such as an accountant or tax attorney, help you complete this form.

Line 1: Taxpayer information

In Line 1a, enter all applicable information, including:

- Taxpayer’s full name

- Social Security number

- Current address

- City/town

- State

- Zip code

- Foreign country name, state, postal code (if applicable)

If you are a married couple requesting an installment agreement for a joint tax return, you’ll need to include your spouse’s name and both Social Security numbers on the form.

If your listed address has changed since you filed your most recent tax return, then check the box in Line 1b.

Line 2: Name of business (if applicable)

If you had a business or were a business owner, enter the name of your business and employer identification number (EIN).

Please note, your business must no longer be operating in order to file form 9465.

Line 3: Home phone number

List your home phone number and the best time for the IRS to call.

Line 4: Work phone number

List your work phone number and the best time for the IRS to call.

Line 5: Amount of tax you owe

Enter the total amount of tax that you owe, as shown on your tax return(s) or IRS notice. This could include taxes for the current year and prior tax years.

Line 6: Additional balances

If you have additional balances not listed in Line 5, list them here, even if they are already included in another installment agreement.

Line 7

Add Lines 5 and 6. This should represent your complete balance due (not including interest charges and penalties).

Line 8: Current payment amount

Enter the payment amount that you’ve included with this installment request. The IRS will always encourage taxpayers to pay as much of their tax as possible, to reduce interest and your failure to pay tax penalty.

If filing this form by itself, do not send cash. Instead, use a check or money order made out to: “United States Treasury.” Be sure to include the following information:

- Your name, address, SSN/EIN, and daytime phone number.

- The tax year and tax return for which you’re making this installment request.

Line 9

Subtract Line 8 from Line 7 and enter the new total.

If you still owe more than $50,000

If the amount you owe is greater than $50,000, you cannot file Form 9465 electronically. Instead, you must also complete Form 433-F, Collection Information Statement, and file it with this form.

If you still owe between $25,000 and $50,000

Generally, if the total amount you owe is greater than $25,000 but not more than $50,000, you must either:

- Complete Lines 13a and 13b and agree to make payments by direct debit, or

- Check Box 14 to make your payments by payroll deduction and attach a completed, signed Form 2159, Payroll Deduction Agreement.

- A payroll deduction agreement isn’t available if you file Form 9465 electronically.

Line 10

Divide the amount on Line 9 by 72 and enter the result. For example, if Line 9 were $36,000, then Line 10 should be $500.

Since the IRS requires installment agreement requests to be fully paid within 6 years, this is the minimum payment amount that the IRS will accept without additional information.

Line 11

In Line 11a, enter the amount you can afford to pay each month.

If the amount in Line 11a is less than the amount in Line 10, you will either have to:

- Revise your payment in Line 11b to be equal or greater than the amount in Line 10, or

- Check the box and complete Form 433-F, Collection Information Statement

If the amount in Line 11a (or Line 11b) is greater than Line 10, but less than $50,000, then you do not have to complete Form 433-F. But if your balance is greater than $25,000, you must complete one of the following:

- Line 13 to set up direct payments from your bank account

- Line 14 to set up payments from payroll deduction

Line 12: Payment date

Enter the date that you would like each payment to post. This date must be between the 1st and 28th of each month. When the IRS approves your request, they will tell you when your first payment is due.

Line 13: Direct debit information

In Line 13a, enter the routing number of your financial institution.

On Line 13b, enter the account number for the account that you would like to be debited each month.

In Line 13c, check the box if you are a low income taxpayer and unable to make payments through direct debit. Your user fee will be refunded to you via direct deposit after you have paid off your tax debt.

Line 14

Check this box if you plan to include a completed Form 2159 to make payments via payroll deduction.

Signature

Sign and date this tax form. If filing on behalf of a married couple, you and your spouse must sign.

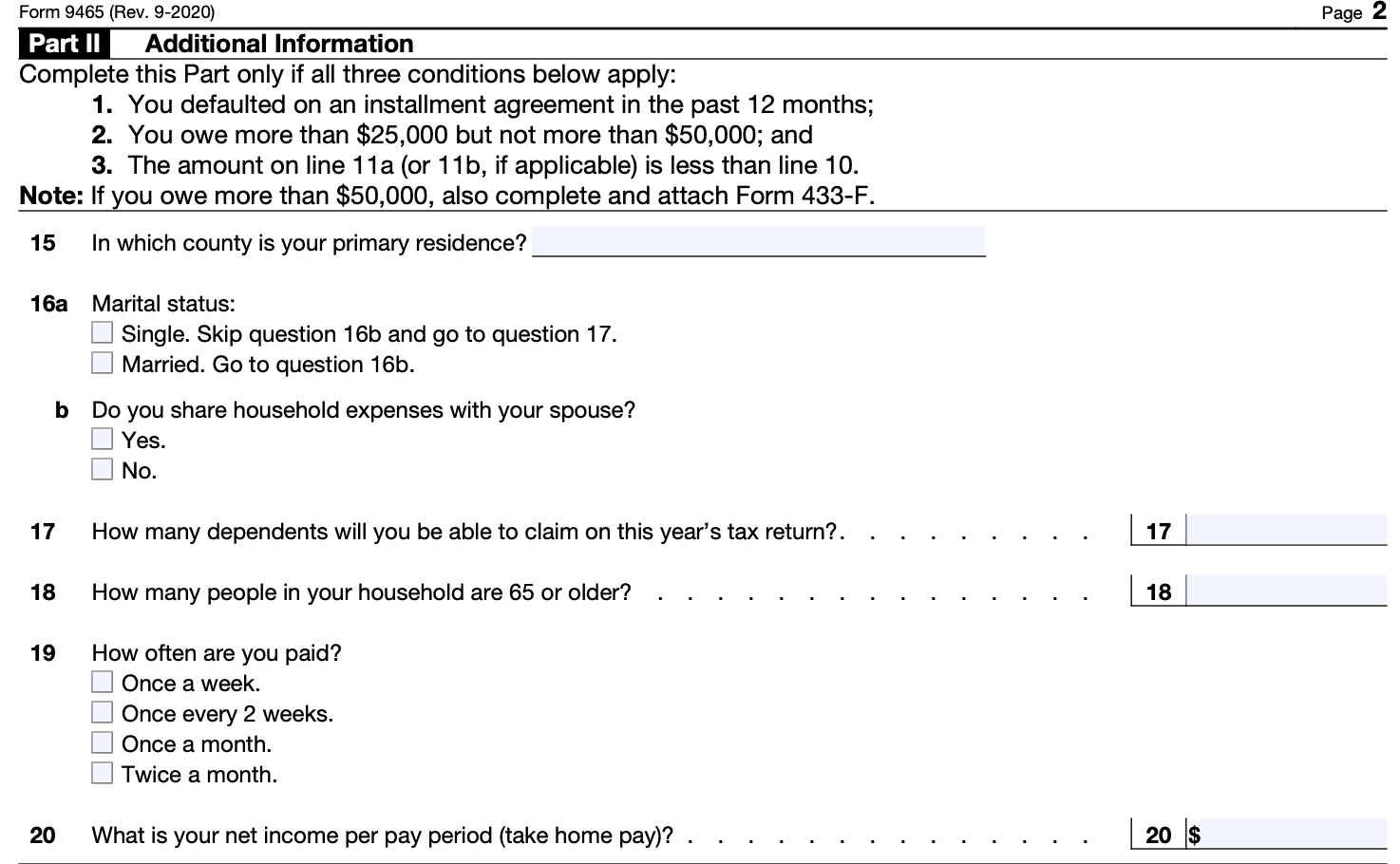

Part II: Additional Information

You only need to complete Part II if all three of the following conditions apply:

- You’ve defaulted on an installment agreement in the past 12 months

- You owe between $25,000 and $50,000 in tax debt

- The amount you entered in Line 11a (or Line 11b) is less than Line 10

If you owe more than $50,000, then you must include Form 433-F.

Line 15: Country of residence

List the country of your primary residence.

Line 16: Marital status

In Line 16a, check the appropriate box. If you are single, skip question 16b and go to Line 17. If you are married, answer question 16b.

In Line 16b, check the appropriate box.

Line 17: Dependents

List the number of dependents that you claim (or will claim) on the tax return for the current year.

Line 18

List the number of people in your household aged 65 or older.

Line 19: Pay schedule

Check the appropriate box. If your pay schedule is biweekly, you should check the ‘Once every 2 weeks box.’ If your pay schedule is semi-monthly, you should check the ‘twice a month box.’

Line 20: Net income

List your net income (after taxes and deductions) per pay period.

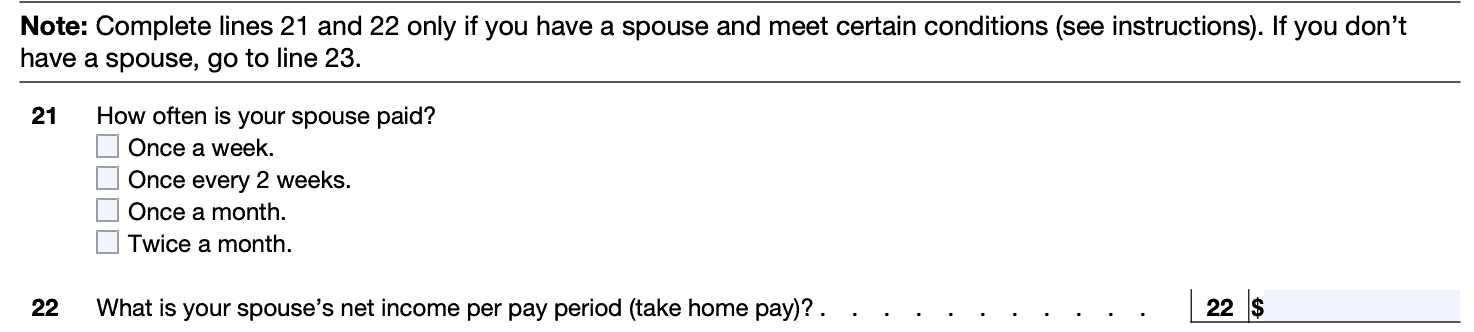

Line 21: Spouse’s pay schedule

Complete Lines 21 and 22 if one of the following applies:

- You live with and share household expenses with your spouse. Even if only one spouse is liable for the taxes owed, the total household income and expenses are relevant in determining the liable spouse’s ability to pay the taxes owed.

- You live in a community property state. In a community property state, the income of a non-liable spouse may be factored into the other spouse’s ability to pay the taxes owed.

If single, go directly to Line 23.

If applicable, list your spouse’s pay schedule. Then list your spouse’s net income in Line 22.

Line 22: Spouse’s net income

If applicable, list your spouse’s net income (after taxes and deductions) per pay period.

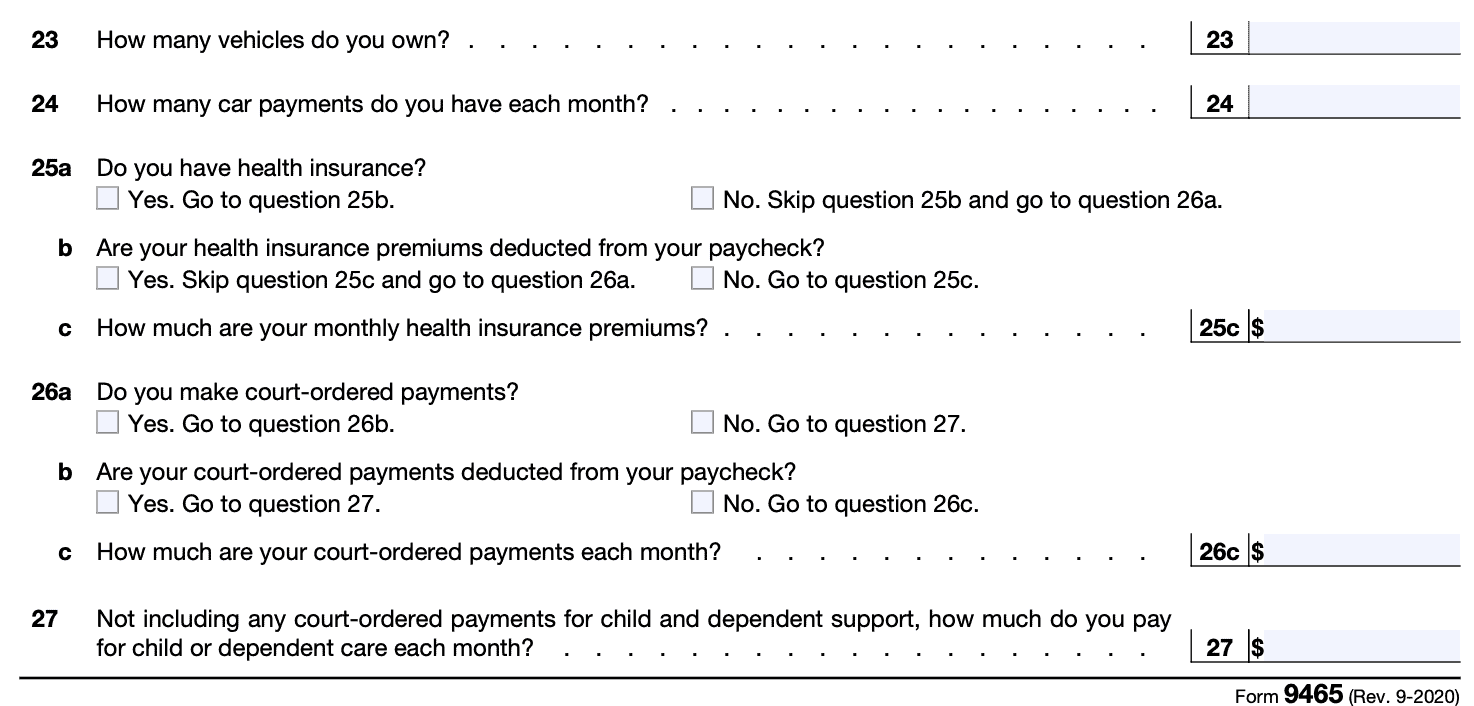

Line 23: Number of vehicles

List how many vehicles you own.

Line 24: Car payments

List how many car payments you have each month.

Line 25: Health insurance

In Question 25a, check the appropriate box. If yes, go to Question 25b. If not, go to Line 26.

For Question 25b, answer the appropriate box. If yes, go to Question 25c. If not, go to Line 26.

In Line 25c, enter the amount of your monthly health insurance premiums.

Line 26: Court-ordered payments

In Question 26a, check the appropriate box. If yes, go to Question 26b. If not, go to Line 27.

For Line 26b, answer the appropriate box. If yes, go to Question 26c. If not, go to Line 27.

In Line 26c, enter the monthly amount of your court-ordered payments.

Line 27: Child or dependent care

Not including amounts entered in Line 26c, enter the amount you pay each month for child or dependent care.

What is IRS Form 9465?

IRS Form 9465, Installment Agreement Request, is a federal form that an individual taxpayer may use when requesting permission to pay down their tax liabilities in monthly installments. However, using this form is not the only way taxpayers may set up an IRS payment plan.

Can I set up a tax payment plan without filing IRS Form 9465?

Eligible taxpayers may go to the IRS website and set up a payment plan online. There are three different payment methods for people to set up an online payment plan:

- Lump sum payment of the entire balance

- Short-term payment plan

- 180 days or less

- Long-term payment plan

- More than 180 days

- May set up automatic withdrawals or make monthly payments

Paying the balance in full or setting up a short term payment plan are completely free. There is a one-time setup fee to create a long term monthly installment payment plan. This user fee is:

- $31 if setting up automatic installment payments through a direct debit installment agreement

- $130 if setting up a monthly installment payment plan

Low-income taxpayers or taxpayers with financial hardships may use IRS Form 13844, Reduced User Fee Application if they qualify for a reduced fee.

What fees will I pay if I file IRS Form 9465?

If you use Form 9465 instead of an online application, your user fees will be as follows:

- Direct debit installments: $107

- Payments by check, money order, credit card, or debit card: $225

As with the online applications, low-income taxpayers may be eligible for reduced installment agreement user fee, user fee waivers, or reimbursement of the user fee.

When do I need to file IRS Form 9465?

The IRS recommends that you file Form 9465 if one of the following applies:

- You are an individual taxpayer who owes income tax on Form 1040 or Form 1040-SR,

- You are an individual taxpayer who is or may be responsible for a Trust Fund Recovery Penalty,

- You are an individual who owes employment taxes related to a sole proprietor business that is no longer in operation

When should I NOT file IRS form 9465?

Conversely, the IRS recommends that you not use the installment agreement request form under the following circumstances:

- You can pay the full amount you owe within 120 days

- If you plan to pay the taxes, interest and penalties due in full within 120 days, you can save the cost of the set up fee

- You want to request a payment plan online, including an installment agreement

- Your business is still operating and owes employment or unemployment taxes

- Call the telephone number on your most recent notice to request an installment agreement

Will the IRS automatically approve my installment agreement request?

The IRS does not always approve an installment agreement request. The IRS website states that taxpayers will generally be notified within 30 days whether their installment request was approved. However, during tax season, waiting times may be longer.

There are certain conditions in which the IRS installment agreement is automatically approved. This is known as a guaranteed installment agreement.

What is a guaranteed installment agreement?

Section 6159(c) of the Internal Revenue Code requires that the IRS automatically accepts installment agreement requests under certain circumstances.

Taxpayers filing Form 9465 may be eligible for a guaranteed installment agreement under the following conditions:

- The taxpayer is an individual, not a business

- Taxpayer owes income tax only of $10,000 or less

- This excludes penalties and interest

- Taxpayer has filed all tax returns and has paid any tax shown on previous returns during any of the preceding five taxable years;

- The taxpayer cannot pay the total amount immediately

- IRS policy is to grant guaranteed installment agreements even if the taxpayer can pay the full tax balance

- Taxpayer agrees to fully pay their tax liability within the earlier of:

- Three years or

- Before the Collection Statute Expiration Date (CSED)

- Taxpayer agrees to file and pay all tax returns during the term of the installment agreement; and

- Taxpayer has not entered into a previous installment agreement during any of the preceding five tax years.

How do I file IRS Form 9465?

You must file IRS Form 9465 by paper. The IRS does not accept electronic form submissions at this time, although it does accept online agreement requests.

The filing location depends on:

- The taxpayer’s physical address

- Whether or not the taxpayer is filing one of the following schedules with his or her tax return:

Below is a chart for each taxpayer category.

For all taxpayers EXCEPT those filing Form 1040 or 1040-SR with Schedule(s) C, E, or F for any tax year for which this installment agreement is being requested

| If you live in… | Then use this filing address |

| Alaska, Arizona, Colorado, Connecticut, Delaware, District of Columbia, Hawaii, Idaho, Illinois, Maine, Maryland, Massachusetts, Montana, Nevada, New Hampshire, New Jersey, New Mexico, North Dakota, Oregon, Rhode Island, South Dakota, Tennessee, Utah, Vermont, Washington, Wisconsin, Wyoming | Department of the Treasury Internal Revenue Service 310 Lowell St. Stop 830 Andover, MA 01810 |

| Alabama, Florida, Georgia, Kentucky, Louisiana, Mississippi, North Carolina, South Carolina, Texas, Virginia | Department of the Treasury Internal Revenue Service P.O. Box 47421 Stop 74 Doraville, GA 30362 |

| Arkansas, California, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, New York, Ohio, Oklahoma, Pennsylvania, West Virginia | Department of the Treasury Internal Revenue Service Stop P-4 5000 Kansas City, MO 64999-0250 |

For taxpayers filing Form 1040 or 1040-SR with Schedule(s) C, E, or F for any tax year for which this installment agreement is being requested

| If you live in… | Then use this filing address |

| Connecticut, Maine, Massachusetts, New Hampshire, New York, Rhode Island, Vermont | Department of the Treasury Internal Revenue Service P.O. Box 480 Stop 660 Holtsville, NY 11742-0480 |

| Alabama, Arkansas, Georgia, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Michigan, Minnesota, Mississippi, Missouri, Nebraska, New Jersey, North Dakota, Ohio, Oklahoma, Pennsylvania, South Dakota, Tennessee, Texas, West Virginia, Wisconsin | Department of the Treasury Internal Revenue Service P.O. Box 69 Stop 811 Memphis, TN 38101-0069 |

| Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, Washington, Wyoming | Department of the Treasury Internal Revenue Service P.O. Box 9941 Stop 5500 Ogden, UT 84409 |

| District of Columbia, Delaware, Florida, Maryland, North Carolina, South Carolina, Virginia | Department of the Treasury Internal Revenue Service Stop 4-N31.142 Philadelphia, PA 19255-0030 |

For all taxpayers living outside the 50 states, for any tax year for

which the installment agreement is being requested

| If you live in… | Then use this filing address |

| A foreign country, U.S. territory, or use an APO or FPO address, or file Form 2555 or 4563, or are a dual-status alien | Department of the Treasury Internal Revenue Service 3651 South I-H 35 5501AUSC Austin, TX 78741 |

Video walkthrough

Watch this educational YouTube video to walk through your installment agreement request, step by step.

Frequently asked questions

If you’re filing this form with your income tax return, you should send this form to the address listed in your tax return booklet. If you’ve already filed your tax return, if you’ve lost your tax return booklet, or are responding to an IRS notice, then you can file this tax return based upon the location indicated in the IRS form instructions.

Unfortunately, no. You must mail your installment agreement request form to the IRS service center listed in your tax return booklet or IRS notice. If you have already filed your tax return or cannot find your tax return booklet, then you should refer to the form instructions for guidance on where to mail your completed form.

Where can I find IRS Form 9465?

You may find this tax form on the IRS website or by selecting the file at the bottom of this article.