IRS Form 1098-F Instructions

As part of the Tax Cuts and Jobs Act, the federal government now requires governmental agencies to report certain settlement made by companies and employers whose total payments exceed $50,000 in a given tax year. The Internal Revenue Service created IRS Form 1098-F to report these payments.

In this article, we’ll walk through everything you need to know about IRS Form 1098-F, including:

- How to read and understand IRS Form 1098-F

- How to find out if you can take a tax deduction on amounts reported on IRS Form 1098-F

- Other frequently asked questions

Let’s take a closer look at the tax form itself.

Table of contents

IRS Form 1098-F Instructions

In most of our articles, we walk you through how to complete the tax form.

However, since Form-1098 is issued to taxpayers for informational purposes, most readers will probably want to understand the information reported on their 1098-F form, instead of how to complete it.

Before we start breaking down this tax form, it’s important to understand that there can be up to 5 versions of 1098-F forms.

Here is a break down of where all these forms end up:

- Copy A: Internal Revenue Service center

- Copy B: For payer’s tax records

- Copy C: For filer’s tax records

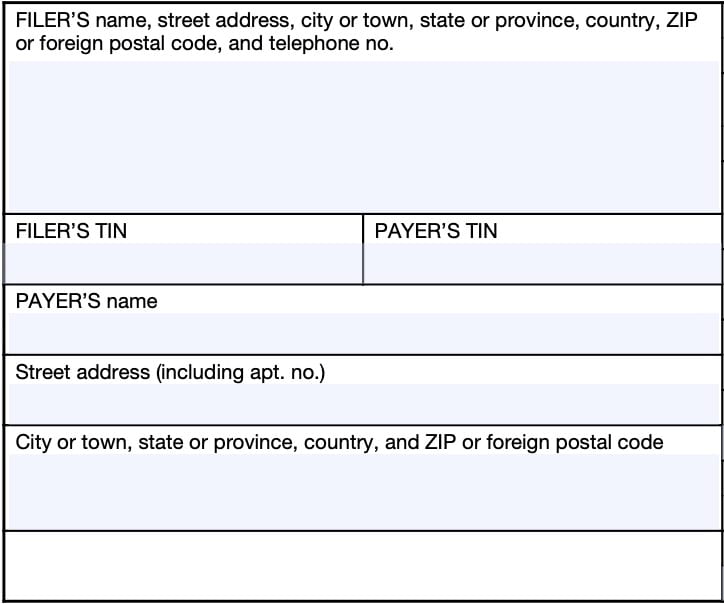

Payer information

On most informational returns, the term ‘payer’ refers to the financial institution or other entity that issued the tax form. On IRS Form 1098-F, the term payer refers to the tax form recipient. So if you received this tax form, you are the payer in this case.

Let’s take a look at the taxpayer information on the left-hand side of the form.

Taxpayer Information

On the left side, you’ll see the information for both the filer and the payer. You’ll want to review these for accuracy.

Filer’s Name, Address, And Telephone Number

You should see the government entity’s complete name, address, and phone numbers in this field.

Filer’s TIN

This is the filer’s taxpayer identification number (TIN). This should be an employer identification number, or EIN.

The payer’s TIN should never be truncated.

Payer’s TIN

As the recipient or payer, you should see your taxpayer identification number in this field. For payers, the TIN can be any of the following:

- Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

- Adoption taxpayer identification number (ATIN)

- Employer identification number (EIN)

Please review this field to make sure that it is correct.

However, you may only see part of your taxpayer identification number (such as the last four digits of your SSN), for privacy protection purposes. Copy A, which the financial institution sends directly to the Internal Revenue Service, is never truncated.

Payer’s Name And Address

You should see your name and street address reflected in these fields. If your address is incorrect, you should notify the government entity and the IRS.

You can notify the IRS of your new address by filing IRS Form 8822, Change of Address. Business owners can notify the IRS of a change in their business address by filing IRS Form 8822-B, Change of Address or Responsible Party, Business.

Next, let’s look at the numbered boxes on the right-hand side of the form.

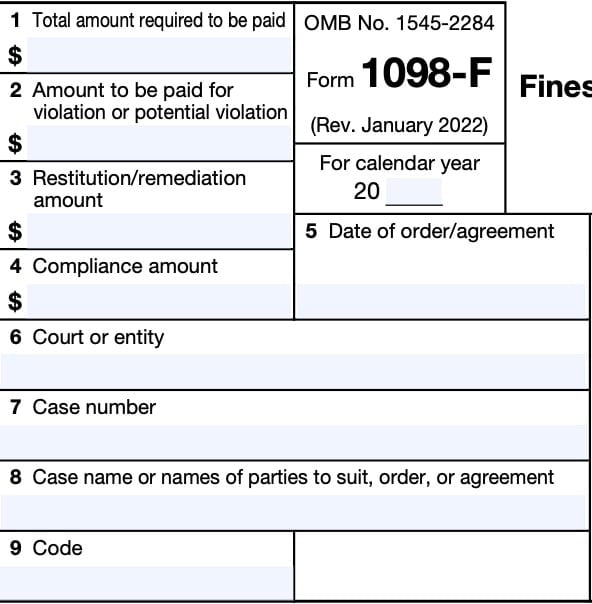

Boxes 1 through 9

Box 1: Total amount required to be paid

Box 1 shows the aggregate amount required to be paid under the suit, order, or agreement if the amount equals or exceeds $50,000.

This reporting rule applies:

- Whether any separate amount required to be paid pursuant to a suit, order, or agreement is less than the threshold amount, and

- If the aggregate amount of all suits, orders, or agreements relating to the same violation, investigation, or inquiry equals or exceeds the threshold amount.

Payment amount not identified

If Box 9 contains Code E, and Box 1 contains exactly $50,000, this might mean the following:

- The suit, order, or agreement does not identify some (or all) of the amount to be paid for violation of a law or the investigation, or inquiry into the potential violation of any law, and

- The government or governmental entity reasonably expects the aggregate amount of the payment to be at least $50,000

Multiple Payers

If the the total amount multiple payers equals or exceeds $50,000, and multiple payers are responsible for the total amount then the filer should:

- List your individual and joint and several payment liability

- Use Code B in Box 9 to indicate multiple payers

If you do not have a payment obligation or obligation for costs to provide services or property, then you should not see a copy of Form 1098-F.

Box 2: Amount to be paid for violation or potential violation of The Law

Box 2 indicates the total amount required the payer must pay in relation to the violation or potential violation of law as stated in the suit, order, or agreement.

Payment amount not identified

If some or all of the amount to be paid for the violation or potential violation of a law is not identified, the filer will leave Box 2 blank and use Code E in Box 9.

Box 3: Restitution/remediation amount

This box shows the amount identified in the suit, order, or agreement to be paid as restitution or remediation.

Payment amount not identified

If some or all of the amount to be paid for the remediation of property is not identified, Box 3 will be blank and Box 9 will contain Code E.

Box 4: Compliance amount

Box 4 shows the amount identified in the suit, order, or agreement that the payer must pay to come into compliance with a law.

Payment amount not identified

If some or all of the amount to be paid for the correction of noncompliance is not identified, Box 4 will be blank and Box 9 will contain Code E.

Understanding the totals

The Form 1098-F instructions warn taxpayers of the following:

- The Box 1 amount may not equal the amounts entered in Box 2, Box 3, or Box 4,

- The Box 1 amount may not equal the sums of Box 2, Box 3, plus Box 4

Example

To help understand this point, the IRS offers the following example:

Corporation A enters into an agreement with State Y’s environmental enforcement agency (Agency) for violating state environmental laws.

Pursuant to the agreement, Corp. A pays the following:

- $40,000 to Agency in civil penalties

- $80,000 in restitution for the environmental harm that the Corp. A has caused

- $50,000 for remediation of contaminated sites, and

- $60,000 to conduct comprehensive upgrades to Corp. A’s operations to come into compliance with the state environmental laws.

Pursuant to the settlement agreement, the aggregate amount that Corp A must pay to, or at the direction of the governmental agency exceeds $50,000. As a result of the court order entered, an appropriate governmental official of Agency must file IRS Form 1098-F as follows:

- Box 1: $230,000 ($40,000 + $80,000 + $50,000 + $60,000)

- Box 2: $40,000 (civil penalties)

- Box 3: $130,000 ($80,000 in restitution + $50,000 for remediation)

- Box 4: $60,000 (compliance amount)

Box 5: Date of order/agreement

Shows the date the suit, order, or agreement became binding under applicable law. This reflects the date that:

- The court enter the court order, or

- The parties fully executed the agreement

Box 6: Court or entity

The filer will enter the name of the court, or any other entity, that entered the order or approved the agreement into Box 6, if applicable.

Box 7: Case number

The case number associated with the order or an agreement will appear in Box 7, if this applies.

Box 8: Case name or names of parties to suit, order, or arrangement

The filer will enter the case name or names of the parties to the suit, order, or agreement in Box 8.

Box 9: Code

If applicable, Box 9 will contain 1 or more codes. Here is what each code means:

- Code A: Multiple payments. The filer will use Code A if the payer has made or must make multiple payments to satisfy the total payment required by the suit, order, or agreement

- Code B: Multiple payers. This means that multiple payer have a payment obligation pursuant to the suit, order, or agreement

- Code C: Multiple payees. The filer will use Code C if if there are multiple payees pursuant to the suit, order, or agreement

- Code D: Provision of services or provision of property required. The filer will use Code D if the suit, order, or agreement requires the payer to provide services or to provide property.

- Code E: Payment amount not identified. Code E indicates that the suit, order, or agreement does not identify some or all of:

- The amount required to be paid for the violation, investigation, or inquiry

- The aggregate amount of a penalty that the payer must pay

- The amount the recipient must pay to provide property or to provide services

If Code E applies, the IRS requires government agencies to issue a separate Form 1098-F for each payer or entity that is part of an agreement.

Filing IRS Form 1098-F

For tax entities who must file this tax form with the Internal Revenue Service, the IRS requires certain paper versions of information returns to be accompanied by IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

Check out our step-by step instructional guide for more information on how to submit your information return with IRS Form 1096.

Video walkthrough

Watch this instructional video to learn more about how to read your IRS Form 1098-F.

Frequently asked questions

If you receive IRS Form 1098-F, you do not need to report it on your tax return, nor do you need to include a copy with your tax return when you file it.

Generally, the IRS will not allow a tax deduction for amounts paid as a result of a violation or potential violation of the law. However, Internal Revenue Code Section 162 may contain additional information about situations in which you may be able to take a tax deduction.

The IRS requires filers, such as state government agencies or local governments to issue copies of the form to payers by January 31 of the calendar year following the tax year of the payment.

Where can I find IRS Form 1098-F?

You may find fillable 1098-F forms on the official IRS website. For your convenience, we’ve included the most recent version of this form in PDF format right here in this article.