IRS Form 4835 Instructions

If you’re a farmer making supplemental income by leasing some of your real estate to a farm tenant, you might be tempted to report this as farm income on Schedule F. For federal income tax purposes, you should consider whether you need to report this farm rental income on IRS Form 4835 instead.

This how-to guide will walk you through this tax form, to include:

- How to complete this form

- When you should use this form to report taxable income

- When you should NOT use this form to report income

- Frequently asked questions

Let’s start by walking through how to complete Form 4835, step by step.

Table of contents

How do I complete IRS Form 4835?

IRS Form 4835 is a fairly straightforward form. We’ll walk through this one-page tax form step by step, to avoid confusion.

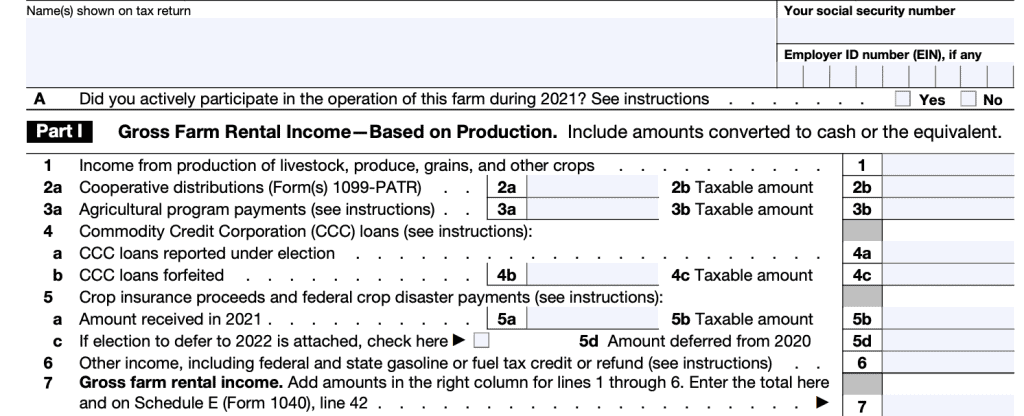

Part I: Gross Farm Rental Income–Based on Production

Above Part I, you’ll enter the following:

- Taxpayer’s name, as shown on tax return

- Social Security number

- Employer ID number, if applicable

- Whether or not you actively participated in farm operations during the tax year.

Employer ID number

An employer ID number (EIN) is only required if:

- You have a qualified retirement plan, OR

- You were required to file one of the following tax returns:

- Employment tax

- Excise tax

- Estate

- Trust

- Partnership

- Alcohol, tobacco, and firearms

Active participation

Active participation occurs when the taxpayer participated in making management decisions or arranging for others to provide services. Examples of management decisions include:

- Approving new tenants

- Deciding on rental terms

- Approving capital expenditures or repair expenses

Active participation does not exist if the taxpayer’s activity was less than 10% of all interests in the activity.

Line 1: Income from production of livestock, produce, grains, and other crops

This includes income based on production from:

- Livestock

- Produce

- Grains & other crops

Under both cash and accrual methods of accounting, taxpayers must report livestock or crop share rentals received in the year they are converted into money or a cash equivalent.

Line 2: Cooperative distributions

Enter total distributions from cooperatives (as shown on IRS Form 1099-PATR) under Line 2a. On Line 2b, report the taxable amount.

See the instructions for Schedule F, Lines 3a and 3b, for additional information.

Line 3: Agricultural program payments

Enter on Line 3a the total agricultural program payments you received. On Line 3b, report the taxable amount.

See the instructions for Schedule F, Lines 4a and 4b, for additional information.

Line 4: Commodity Credit Corporation (CCC) loans

Report the full amount of Commodity Credit Corporation (CCC) loans forfeited, even if you reported the loan proceeds as income.

See the instructions for Schedule F, Lines 5a and 5b, for additional information.

Line 5: Crop insurance proceeds and federal crop disaster payments

In general, you must report crop insurance proceeds in the year you receive them. Federal crop disaster payments are treated as crop insurance proceeds.

However, if you use the cash method of accounting you can elect to include certain proceeds in income for the following tax year. See the Farmer’s Tax Guide for more information.

Usually, if you defer any eligible crop insurance proceeds, you may have to defer ALL eligible crop insurance proceeds.

See the instructions for Schedule F, Lines 6a and 6b, for additional information.

Line 6: Other income

Use this line to report items of income not included in Lines 1 through 5.

Line 7: Gross farm rental income

This is the sum of the first 6 lines of income and represents gross income from farm rental. Enter the total here and on Schedule E, Line 42.

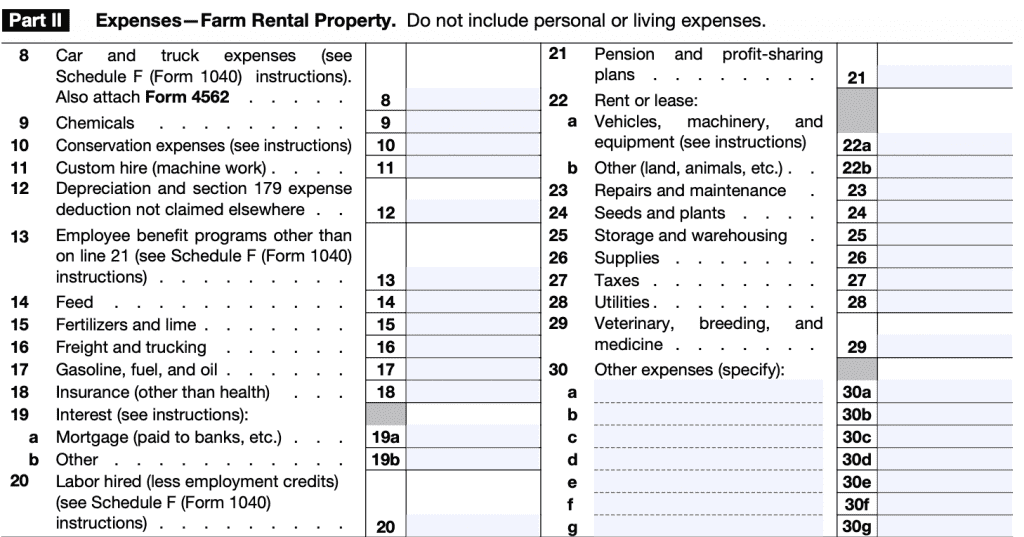

Part II: Expenses–Farm Rental Property

In Part II, you’ll document various expenses to offset the farm rental income in Part I.

Line 8: Car & truck expenses

Enter car and truck expenses associated with the farm rental property. Attach a copy of IRS Form 4562, Depreciation and Amortization, as applicable.

Line 9: Chemicals

Enter expenses for chemicals that do not belong to another category (i.e. fertilizers, gasoline, fuel, oil)

Line 10: Conservation expenses

According to the form instructions, expenses paid for soil and water conservation, erosion prevention, or endangered species recovery only qualify for a tax deduction if:

- Consistent with a conservation plan approved by the Department of Agriculture’s Natural Resources Conservation Service, or

- Consistent with a plan from a comparable state agency

Deductions for conservation expenses cannot exceed 25% of the gross income from farming.

Line 11: Custom hire

Enter expenses associated with machine work.

Line 12: Depreciation and Section 179 expense deduction not claimed elsewhere

Enter depreciation and Section 179 expenses not claimed elsewhere, and not capitalized or included in inventory. This might include depreciation on:

- Tangible personal property (other than cars and trucks)

- Capital assets, such as farm equipment

- Farm buildings

Line 13: Employee benefit programs other than Line 21 (Pension & profit-sharing plans)

Self-explanatory

Line 14: Feed

Self-explanatory

Line 15: Fertilizers and lime

Self-explanatory

Line 16: Freight and trucking

Include costs you spent on trucking, shipping, and freight expenses.

Line 17: Gasoline, fuel, and oil

Be sure to include gasoline, fuel, and oil costs under Line 17, not Line 9.

Line 18: Insurance (other than health insurance)

Include all insurance expenses, other than health insurance.

Line 19: Interest

For tax purposes, your interest expense deduction could be limited. Instructions for IRS Form 8990-Limitation on Business Interest Expense Under Section 163(j) contain more information.

Since home mortgage interest and investment interest are treated differently, you’ll need to separate mortgage expense (Line 19a) from other interest expenses.

Line 20: Labor hired

Refer to Schedule F instructions for more details. Include the total labor costs, minus any employment credits.

Line 21: Pension and profit-sharing plans

Include the cost of administering any pension or profit-sharing plans.

Line 22: Rent or lease

If you rented or leased vehicles, machinery, or equipment, enter the business portion of the rental cost on Line 22a. If you leased a vehicle for 30 days or more, you may need to refer to Leasing a car in IRS Publication 463, Travel, Gift, and Car Expense, for more details.

Line 23: Repairs and maintenance

Self-explanatory

Line 24: Seeds and plants

Include any costs for seeds or plants incurred.

Line 25: Storage and warehousing

Self-explanatory.

Line 26: Supplies

Self-explanatory

Line 27: Taxes

This might include state or local taxes paid during the tax year.

Line 28: Utilities

Include the cost of utilities.

Line 29: Veterinary, breeding, and medicine

Include any veterinary and breeding costs, as well as the costs of medicine.

Line 30: Other expenses

Fill in other expenses not included elsewhere. Include documentation. Enter capitalized expenses on Line 30(g).

Total income or loss

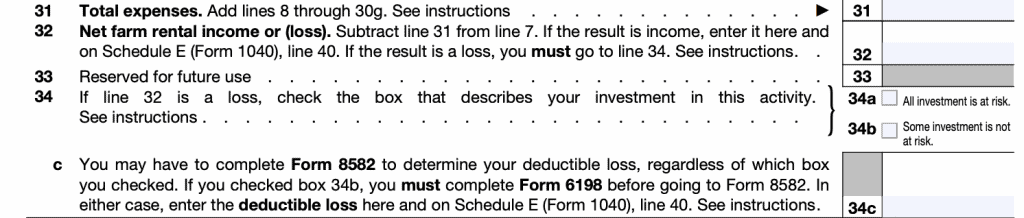

Line 31: Total expenses

Add Lines 8 through 30g. If you entered capitalized expenses on Line 30g, your total expenses on Line 31 will equal the total of Lines 8 through 30f reduced by the amount on Line 30g.

This represents your total expenses attributable to farm rental.

Line 32: Net farm rental income (or loss)

Subtract Line 31 from Line 7. If Line 31 is more than Line 7, do not enter your loss here.

If you have a loss, you must apply the at-risk rules and passive activity loss rules by following the instructions for Line 34 and IRS Form 8582.

When Line 7 is more than Line 31 and you don’t have prior year unallowed passive activity losses from this activity, subtract Line 31 from Line 7. The result is your net farm rental income.

If Line 7 is more than Line 31 and you have prior year unallowed passive activity losses from this activity, do not enter net farm rental income on Line 32 until you have figured the amount of prior year unallowed passive activity losses you can claim this year. Use Form 8582 to determine this amount.

If there is a net loss, enter zero on Line 32 and enter the net loss on Line 34(c), and enter ‘PAL’ on the dotted line to the left of Line 32.

Line 33: Not used

Line 34: Investment at risk

To determine your deductible loss, you may need to complete Form 8582 regardless of whether you

checked box 34a or 34b. However, if you checked box 34b, you must complete IRS Form 6198, At-Risk Limitations, before you complete Form 8582.

See the instructions for Schedule F (Form 1040), line 36.

Do not complete Form 8582 if either of the following applies:

- You meet all of the conditions listed under Exception for Certain Rental Real Estate Activities in the Instructions for Schedule E (Form 1040). Instead, enter your deductible loss on line 34c and on Schedule E (Form 1040), line 40.

- You were a real estate professional (as defined in the Instructions for Schedule E (Form 1040)) and you materially participated in the operation of this activity (under the passive loss rules). Your loss is not subject to passive activity loss limitations. Instead, enter your deductible loss on:

- Line 34c

- Schedule E, Line 40

- Include the loss in the total for Schedule E, Line 43

What is IRS Form 4835?

IRS Form 4835-Farm Rental Income and Expenses, is the tax form that landowners and sub-lessors use to report income who did not materially participate in the farming activities, such as crop production, by their tenant. This form is used to report income if the activity was considered rental activity for the purpose of passive activity loss limitations.

This brings us to two questions:

- What is material participation?

- What is a passive activity?

What is material participation?

According to the Internal Revenue Code, material participation exists when “a taxpayer works on a regular, continuous, and substantial basis in operations.” IRS Publication 925, Passive Activity and At-Risk Rules, contains 7 tests to determine material participation. A taxpayer must pass at least one of the 7 tests to demonstrate material participation in the activity over the course of the tax year.

Material participation tests

- You participated for more than 500 hours in the activity.

- Your participation was substantially all the participation in the activity of all individuals for the tax year, including the participation of individuals who didn’t own any interest in the activity.

- You participated in the activity for more than 100 hours during the tax year, and you participated at least as much as any other individual for the year

- The activity is a significant participation activity, and you participated in all significant participation activities for more than 500 hours. A significant participation activity is any trade or business activity in which you participated for more than 100 hours during the year and in which you didn’t materially participate under any of the material participation tests, other than this test.

- You materially participated in the activity (other than by meeting this fifth test) for any 5 (whether or not consecutive) of the 10 immediately preceding tax years.

- The activity is a personal service activity in which you materially participated for any 3 (whether or not consecutive) preceding tax years. An activity is a personal service activity if it involves the performance of personal services in the fields of health (including veterinary services), law, engineering, architecture, accounting, actuarial science, performing arts, consulting, or any other trade or business in which capital isn’t a material income-producing factor

- Based on all the facts and circumstances, you participated in the activity on a regular, continuous, and substantial basis during the year.

If a taxpayer does not materially participate, this is known as a passive activity.

What is a passive activity?

According to IRS Publication 925, a passive activity is one in which either of the following occurs:

- The taxpayer does not pass one of the material participation tests, outlined above, OR

- Rental activity, even the taxpayer materially participates, unless the taxpayer is a real estate professional

Passive activities are subject to certain income tax rules.

Most notably, passive activity losses can only be deducted from passive income for purposes of determining net income. During a tax year in which there is a passive activity loss, but no passive income, that passive activity loss must be carried forward to the next year, or subsequent years, until it can offset passive income.

IRS Form 4835 helps taxpayers calculate passive income or loss from leasing out property used in the business of farming.

Who must file Form 4835?

Because there is so much confusion on when to use Schedule F and when to use Form 4835, it’s worth taking some time to better understand when to use Form 4835.

When to use Form 4835

If you were the landowner or sub-lessor and did not materially participate (for self-employment tax purposes) in the farming activity, use IRS Form 4835 to report farm rental income based upon production of the farm commodities, such as crops or livestock produced by the tenant.

Farm landlords who have net income reported on Line 32 may be able to reduce their tax liability by completing Schedule J on Form 1040 of their federal tax return.

When NOT to use Form 4835

According to the form instructions, a taxpayer should not use IRS Form 4835 if one of the following applies:

You were a tenant.

Tenants should use Schedule F (IRS Form 1040) to report farm income and expenses.

You were a landowner who materially participated in the operation or management of the farming business.

Landowners (and sub-lessors) with material participation in the farm operations should use Schedule F to report income and expenses.

If you were a landowner and received cash rent for pasture or farmland based on a flat charge.

Taxpayers who earned rental income based upon a flat charge should report this on Part 1, Schedule E.

If the taxpayer is an estate or trust with rental income and expenses from crop and livestock shares.

Estates and trusts with rental income and expenses from crop and livestock shares should report this as income on Schedule E.

If the taxpayer is a partnership or S corporation with rental income and expenses from crop and livestock shares.

Partnerships and S corporations with rental income and expenses from crop and livestock shares should report this as income on IRS Form 8825-Rental Real Estate Income and Expenses of a Partnership or S Corporation.

Qualified joint ventures

Under certain circumstances, a married couple jointly operating a farm rental business may elect to be taxed as a qualified joint venture instead of a partnership. This only applies for a married couple who:

- Each materially participated as the only members of a jointly owned and operated farm rental business

- Filed a joint tax return

If you qualify to be taxed as a qualified joint venture, your tax liability probably will not change. However, each spouse will receive credit for:

- Social Security earnings, on which retirement benefits are based, and

- Medicare coverage

If you make the election, but did not materially participate in the operation or management of the farm, but maintained the farm as a rental business, then each spouse may file a separate Form 4835 to report shares of farm rental income based upon tenant production.

If both spouses did materially participate, then each spouse must file a separate Schedule F on their Form 1040.

For additional information, see the Schedule C instructions (Line G).

Video walkthrough

Watch this instructional video to learn more about using Form 4835 to declare farm rental income and expenses as a landowner.

Frequently asked questions

You should file Form 4835 when all three of the following are true:

-If you are the land owner

-You did not materially participate in farming activities, and

-Your income is based upon a share of farming production, not based upon a flat rate

No. Instead, you should claim your farming income and expenses on Schedule F of your Form 1040.

Where can I find a copy of Form 4835?

You can find a copy of the current version of this form on the IRS web site in PDF format or download the copy below.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!