IRS Form 8453 Instructions

The Internal Revenue Service highly recommends that taxpayers use electronic filing to submit their federal income tax return. However, there are still some forms that taxpayers cannot file electronically, even with an IRS e-file return. You must send these forms with an IRS transmittal document, known as IRS Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return.

This article will walk through IRS Form 8453, so you can better understand:

- Which forms cannot be submitted electronically

- How your or your tax professional can properly send the required paper forms, documentation, or additional information to the IRS

- Other filing considerations

Let’s start with understanding how to complete this tax form.

Table of contents

How do I complete Form 8453?

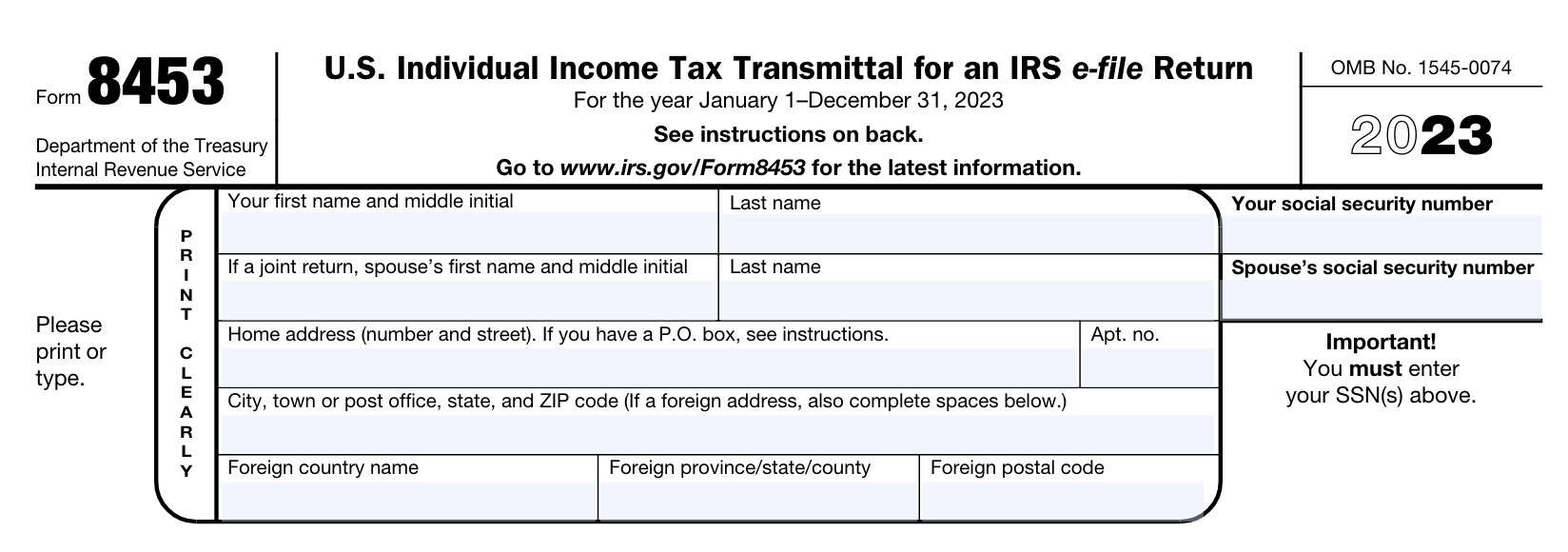

Fortunately, this is a straightforward form to complete. Below are the screenshots of the form, and we’ll walk through the form step by step.

For simplicity’s sake, we’ll start with the top portion.

Top portion

If you use tax preparation software, it may auto-populate these fields from your tax return. If not, you’ll need to include the following information:

- Taxpayer’s full name

- Spouse’s name (on a joint tax return)

- Home address, including city, state, and zip code

- Social Security number

- Spouse’s Social Security number (if applicable)

Note: Since you probably will mail this document to the Internal Revenue Service, and it contains valuable SSN information, you may want to send it via secure means. You can do this either through:

- Priority mail, if using the U.S. Postal Service, or

- FedEx, UPS, or other secure carrier that provides receipt confirmation

Bottom portion

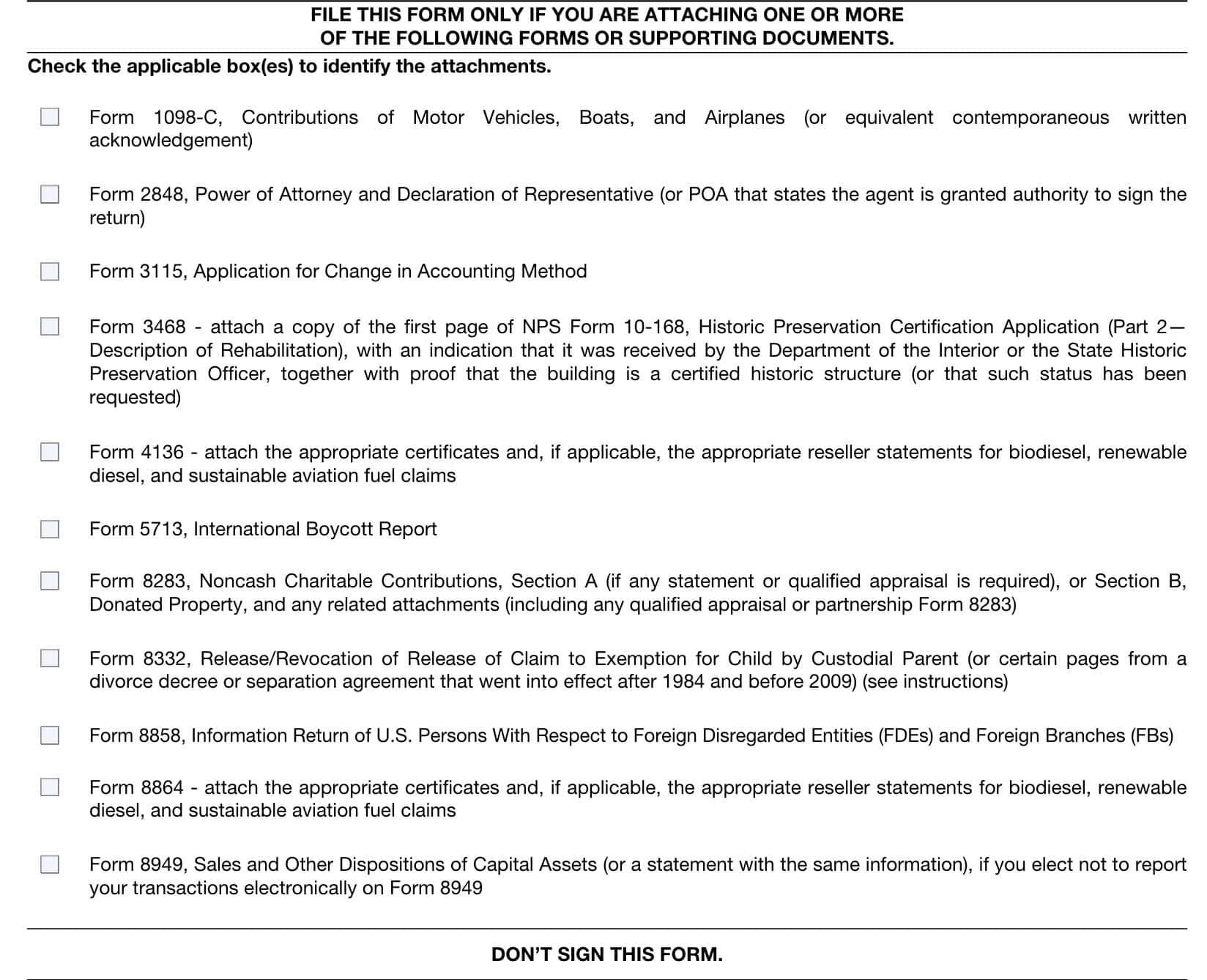

In the bottom portion, you simply check the applicable box(es), based upon the form or forms that you are submitting. Do not sign the form.

Below is a list of the forms on this transmittal document. Click the link on the form that you’re interested in for more information:

What forms do I submit using Form 8453?

Below is the list of forms that the IRS requires taxpayers to mail accompanied by Form 8453. We’ve also included any required supporting documentation and links to additional resources for each form:

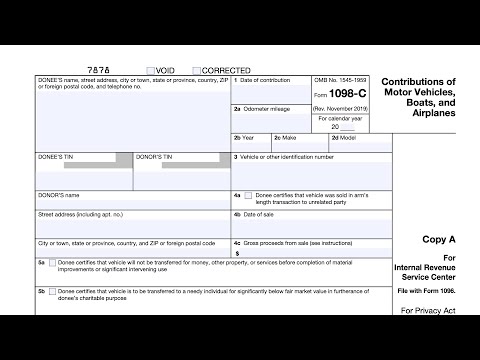

IRS Form 1098-C, Contributions of Motor Vehicles, Boats, and Airplanes

Generally speaking, a taxpayer will receive IRS Form 1098-C when making a charitable donation of a motor vehicle, airplane, or boat with a fair market value of $500 or more. The charitable organization must file this form with the IRS and provide a copy to the taxpayer.

The IRS website contains a copy of this form as a fillable PDF document. However, the taxpayer probably will receive a paper copy of this form, which they cannot include in an electronic return.

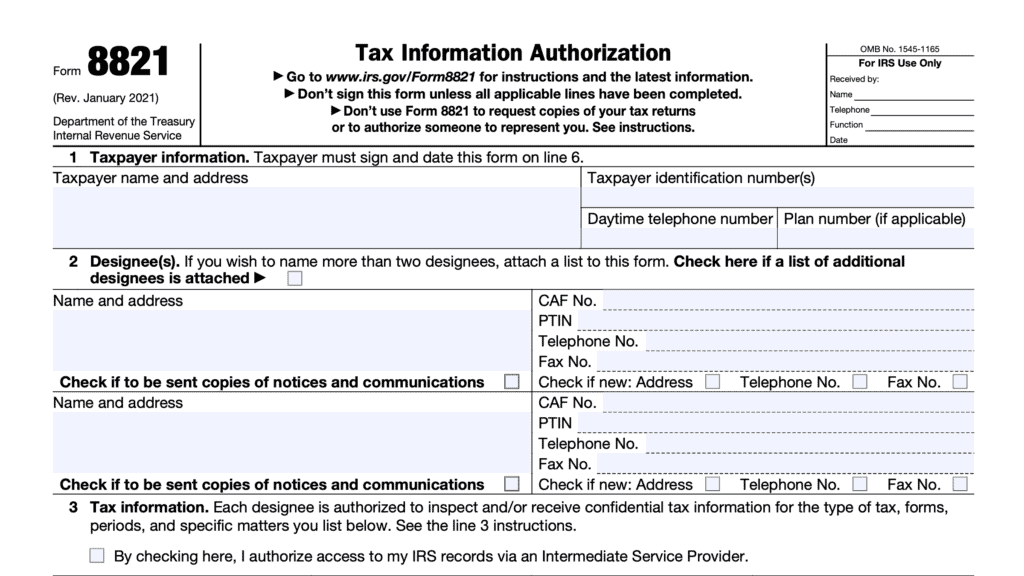

IRS Form 2848, Power of Attorney and Declaration of Representative

If the taxpayer’s representative e-files the taxpayer’s return, then they should attach a copy of IRS Form 2848 to Form 8453 and mail it as instructed. If the representative files a paper return, then they should attach Form 2848 to the tax return itself.

IRS Form 3115, Application for Change in Accounting Method

The Form 3115 instructions do not contain any specific references to Form 8453.

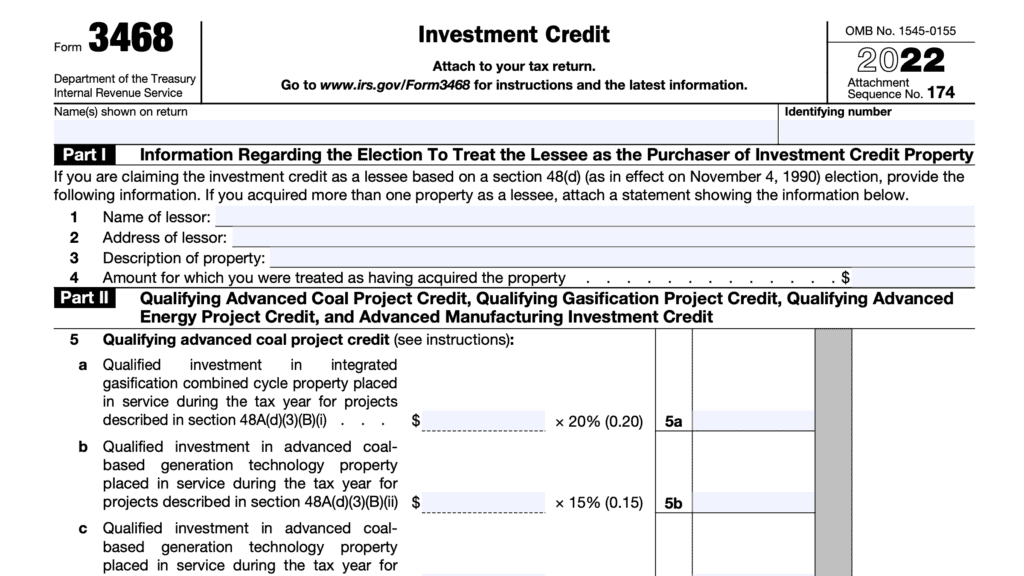

IRS Form 3468, Investment Credit

The taxpayer may file IRS Form 3468 electronically in order to claim the investment credit on their tax return. However, the IRS may require the taxpayer to send paper documents to justify the credit. These documents may include:

- A copy of the first page of NPS Form 10-168, Historic Preservation Certification Application, with receipt acknowledgement from the Department of the Interior or State Historic Preservation Officer

- Proof that the building is a certified historic structure

If these documents are required to support a tax return, then the taxpayer must submit them with Form 8453 attached.

IRS Form 4136, Credit for Federal Tax Paid on Fuels

If applying for this credit on IRS Form 4136, the taxpayer must attach the Certificate for Biodiesel and, if applicable, either:

- Statement of biodiesel reseller, or

- A certificate from the provider identifying the product as renewable diesel and,

- A statement from the reseller (if applicable)

IRS Form 5713, International Boycott Report

Taxpayers may be able to file IRS Form 5713 in electronic form with their tax return. If so, they do not need to submit a duplicate copy.

IRS Form 8283, Noncash Charitable Contributions

The instructions for IRS Form 8283 do not specifically reference transmittal or Form 8453. However, certain situations may require a qualified appraisal or statement, which cannot accompany the tax return.

File Form 8453 with Form 8283 and respective appraisal documents attached.

IRS Form 8332, Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent

For divorces and separations that went into effect after 1984 and before 2009, the noncustodial parent may attach certain pages from the agreement in lieu of IRS Form 8332.

However, the decree must state all of the following:

- The noncustodial parent can claim the child as a dependent without regard to any condition (such as payment of support).

- The other parent won’t claim the child as a dependent.

- The years for which the claim is released.

The noncustodial parent must attach the following pages from the decree or agreement:

- Cover page (including the other parent’s SSN).

- The pages that include all of the information identified in (1) through (3) above.

- Signature page with the other parent’s signature and date of agreement.

Note: The noncustodial parent must attach the required information even if it was filed with a return in an earlier tax year.

IRS Form 8858, Information Return of U.S. Persons With Respect to Foreign Disregarded Entities (FDEs) and Foreign Branches (FBs)

According to the IRS Form 8858 instructions, taxpayers electronically submitting a corporate tax return (IRS Form 1120) or partnership return (IRS Form 1065) will submit Form 8858 as an electronic attachment to their return.

Taxpayers filing Form 1040, 1040-SR, or 1041 will attach Form 8858 to Form 8453.

IRS Form 8864, Biodiesel and Renewable Diesel Fuels Credit

The Form 8864 instructions do not state anything specifically about required paper forms. However, taxpayers may need to attach one of the following documents to Form 8453 to claim this credit:

- Certificate for Biodiesel

- Statement of Biodiesel Reseller (if applicable)

- Certificate from the provider identifying the product as renewable diesel

- Statement from reseller (if applicable)

IRS Form 8949, Sales and Other Dispositions of Capital Assets

According to the IRS Form 8949 instructions, taxpayers may have to either:

- Submit Form 8949 electronically with their tax return

- Submit Form 8949 separately, attached to Form 8453

Video walkthrough

Check out our video to learn the latest on IRS Form 8453.

Frequently asked questions

IRS Form 8453 is the tax form that a taxpayer may use to submit certain IRS forms via mail when they cannot be electronically submitted with the income tax return. If the taxpayer is using a professional tax preparer, such as a certified public accountant or enrolled agent, the tax preparer will do this on the taxpayer’s behalf.

No. The instructions clearly state that you should not send payment of federal taxes with this form. Instead, you should send the payment, attached to Form 1040-V, to the IRS Service Center that applies to your state.

According to the IRS website, an electronic return originator (ERO) must mail IRS Form 8453 within 3 business days after the IRS has acknowledged receipt of the taxpayer’s tax return. Normally, the taxpayer or tax preparer will receive this acknowledgement from their intermediate service provider or the third-party transmitter that submitted the return to the IRS.

The instructions clearly state that taxpayers should not attach any form or document not shown on Form 8453. Specifically, do not mail your completed Form 1040-series tax return. If you are required to mail in any documentation not listed on Form 8453, you can’t file the tax return electronically.

No, IRS Form 8453 is not the same document as IRS Form 8453-EMP. IRS Form 8453-EMP is the Employment Tax Declaration for an IRS e-file Return. Employers file this form to document employment taxes paid to the IRS.

Within 3 business days of the IRS confirming receipt, you must send Form 8453 and supporting documentation by mail to the following address:

Internal Revenue Service

Attn: Shipping and Receiving, 0254

Receipt and Control Branch

Austin, TX 73344-0254

Where can I find a copy of Form 8453?

You may find a copy of this tax form on the IRS website or by selecting the file below.

Related tax forms

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!