IRS Form 9325 Instructions

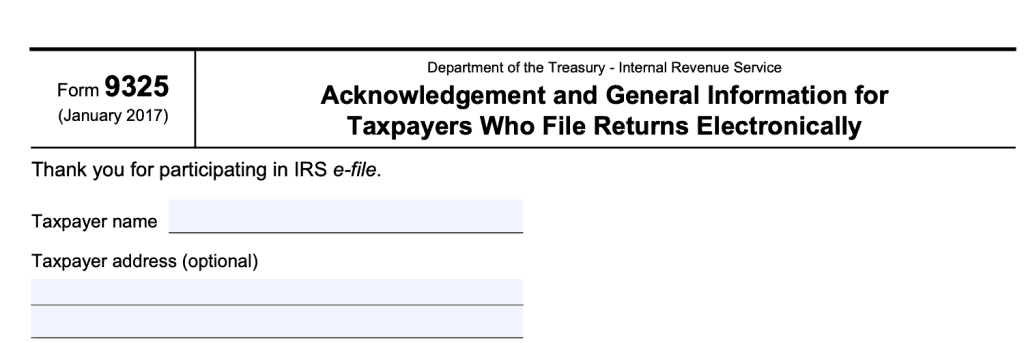

Your tax professional has completed your tax return and sent it off to the Internal Revenue Service. But how do you know that the IRS accepted it? IRS Form 9325, Acknowledgement and General Information for Taxpayers Who File Returns Electronically, is the official form that the IRS uses to inform taxpayers that their federal return was accepted.

In this article, we’ll take a closer look at IRS Form 9325 so you can better understand what to look for when your accountant electronically files your individual income tax return.

Table of contents

IRS Form 9325 instructions

Let’s take a closer look to see what important points you, as the taxpayer, may want to look out for.

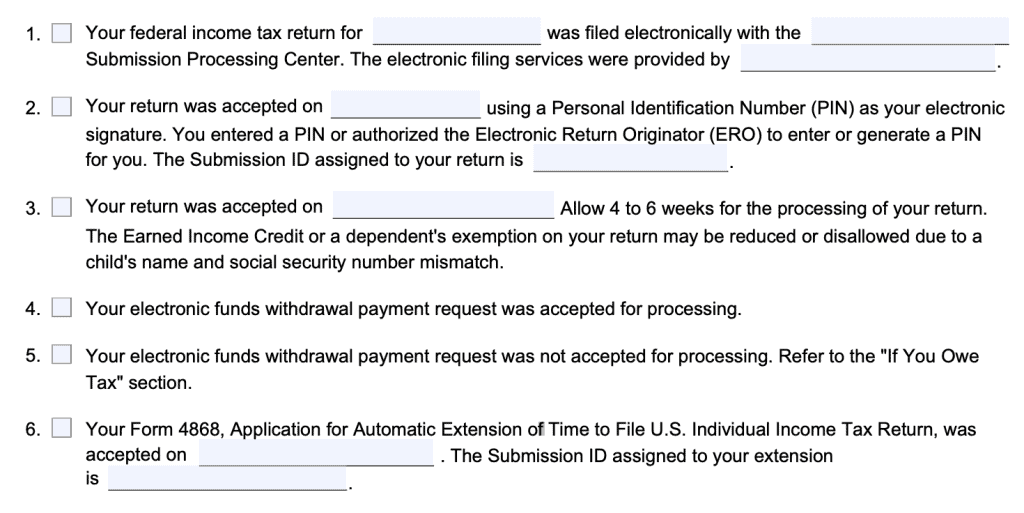

Box 1

Box 1 simply states the tax year of your tax return, and which processing center received it. It will also list the ERO’s information.

Box 2

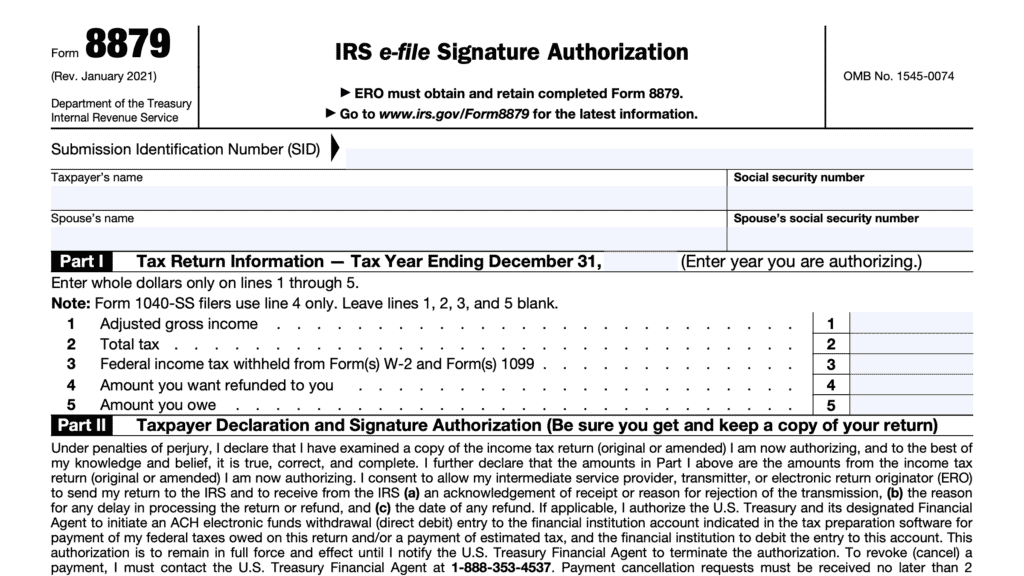

If you entered a personal identification number (PIN), or you authorized your ERO to generate one on your behalf, you’ll see this box checked. The IRS requires your ERO to obtain an IRS Form 8879, IRS e-file Signature Authorization, from their client if the ERO generates the PIN or enters one on the taxpayer’s behalf.

The ERO will also use IRS Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return, to send required paper forms or supporting documentation listed.

Finally, Box 2 will contain a submission ID number. This is a unique item for your specific tax return.

Box 3

This box might be checked if the return has previously rejected, and if this submission still has invalid data.

For example, if you claimed the Earned Income Credit on your income tax return, but your child’s name and Social Security number are mismatched, this might require more time to process.

If you receive a notice from the IRS and you don’t know what to do with it, you can look it up on the IRS Notices playlist, located on our YouTube channel. If we haven’t covered your notice in one of our videos, drop a comment and we’ll create one!

Box 4

If you see Box 4 checked, that means that the IRS accepted your electronic payment.

Box 5

If you see Box 5 checked, that means the IRS did not accept your electronic payment.

You must pay your outstanding tax liability by check, money order, debit card, or credit card. You can do this through the IRS website.

Box 6

Box 6 is only selected if you requested an automatic extension on IRS Form 4868 and the IRS approved your request.

However, IRS Form 9325 only gives you general information about your tax return. For example, if you made a mistake in filing your return, or if you experience a tax offset for unpaid debts, this form will not address them.

In case of an audit, this form can show that your tax return was:

- Filed on time

- Accepted by the Internal Revenue Service

- Accompanied by tax payment, if applicable

Just as importantly, your form should show what, if anything, you need to do regarding your tax liability. But there are some things you should watch out for as well.

What you should keep an eye out for after you’ve filed

Here are some things you might not see when you receive your Form 9325.

Mistakes you made when filing your tax return

Everyone makes mistakes. Even if you hire a tax professional to help you complete and file your tax return, you might make a mistake on your income tax return.

What you should do: If it turns out that you made an error in filing your tax return, you’ll eventually need to file IRS Form 1040-X, Amended Tax Return, for the year in question. However, you should not do this until after the IRS has processed your first return.

If your mistake resulted in an underpayment of tax, you should discuss your payment options with your tax professional.

Pro tip: Most tax professionals will cover the cost of filing an amended tax return if the mistake was one they made on your tax return. If this happens to you, ask your tax preparer what their policy is.

If your tax pro made a mistake and is charging you an extra fee to fix it, then you should probably find another tax preparer.

Status of your refund

The IRS notifies your ERO when your tax return has been accepted, and is being processed. This usually happens within 48 hours of receiving the electronic file containing your tax return.

But this doesn’t help taxpayers wanting to know the status of their electronic returns, or when they’re going to receive their refund. There are some options available, but you’ll probably need to wait at least 3 weeks before you see any new information.

Exception: If your Form 9325 has Box 3 checked, you may have to wait 4-6 weeks before finding the status of your refund.

Let’s go over the options that might be available for you to check the status of your tax return.

Call the TeleTax number

You can reach the IRS’ automated number, 1-800-829-4477 to obtain information. You won’t talk to a live person, but you can check the status of your return here. You’ll need the following information:

- First social security number shown on your return

- Filing status

- Exact refund amount you’re expecting

Check the status of your return on the IRS website

If you navigate to the IRS web site, you should see, “Where’s my refund?” as one of the navigation options. Simply select that option and you can check the status of your return online.

If you owe additional tax

If your tax return has a balance due, you must pay that by the filing due date. For taxpayers paying by funds withdrawal from a bank account, or by credit card, you do not need a voucher.

You may use IRS Form 1040-V, Payment Voucher, if you want to pay by check or money order.

Tax refund related financial products

Financial institutions might offer a variety of financial products or entice their taxpayer with offers for their favorite products. If you’re using a commercial tax preparation service, such as TurboTax, you might receive emails from their marketing partners.

The IRS clearly states that they have nothing to do with any of these marketing activities. If you have any questions, it might be a good idea to ask your tax professional for more information.

Video walkthrough

frequently asked questions

IRS Form 9325 is the IRS acknowledgement that they have received your electronic individual income tax return data. Technically, your ERO uses acknowledgement file information from transmitted returns to generate the Form 9325. This serves as the taxpayer’s receipt that the IRS accepted your electronically filed tax return.

According to the IRS website, an electronic return originator, or ERO, is “the Authorized IRS e-file Provider who originates the electronic submission of a return to the IRS. The ERO is usually the first point of contact for most taxpayers filing a return using IRS e-file.”

If you paid a tax prep fee for someone to help you file your tax return, then your tax preparer is most likely your ERO as well.

Possibly not. Your ERO should generate a version simply to let you know that the IRS has received your income tax return. However, any outstanding action items should be clearly outlined on your completed form. Some tax preparers print this report automatically for every return and extension. They might do this for their own recordkeeping purposes as well as to provide a copy to the taxpayer.

Where can I find a copy of Form 9325?

You can always find reproducible copies of federal tax forms, such as Form 9325 on the IRS website. For your convenience, you can also download the copy provided below.