IRS Form 1040-X Instructions

According to the Internal Revenue Service, over 3 million taxpayers file amended tax returns every year on IRS Form 1040-X, Amended U.S. Individual Income Tax Return. If you’re one of these taxpayers, then this article will cover what you need to know about IRS Form 1040-X, including:

- How to complete IRS Form 1040-X

- Filing considerations

- Common reasons to file an amended return

- Frequently asked questions

Let’s begin with step by step instructions on how to file an amended tax return.

Table of contents

How do I complete IRS Form 1040-X?

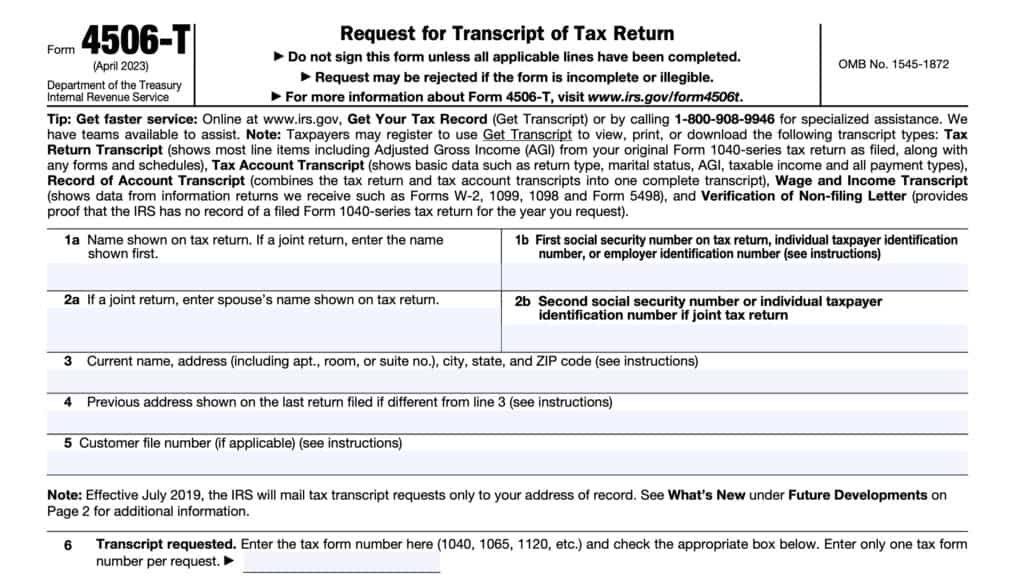

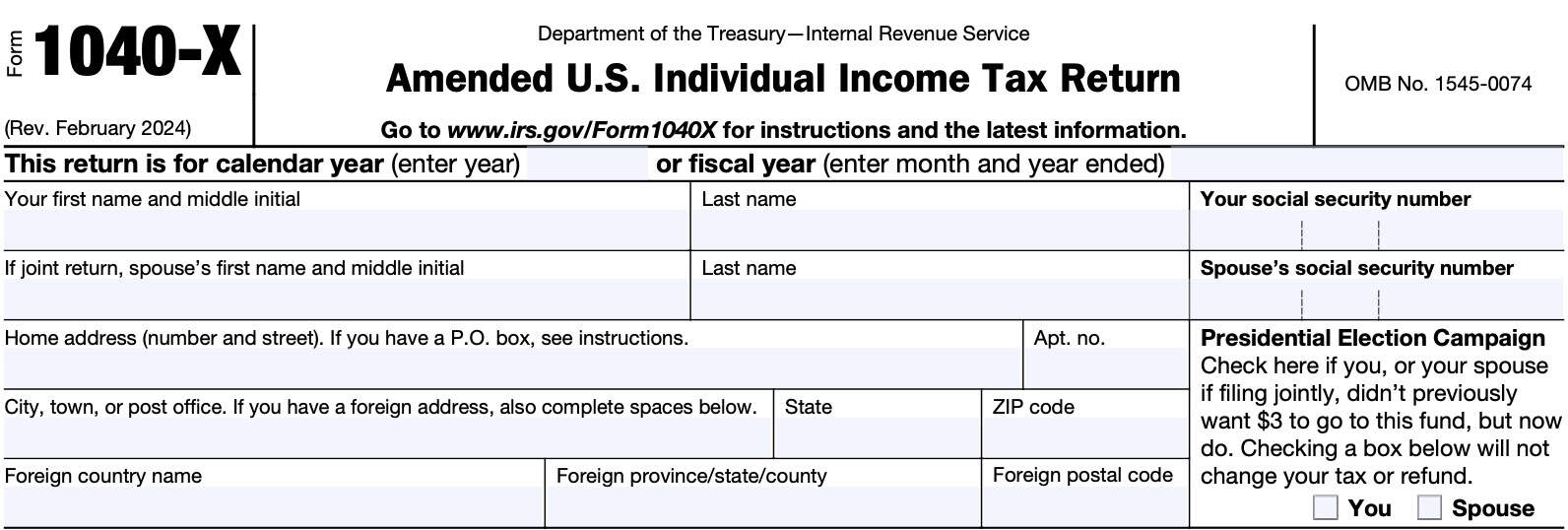

This two-page tax form might appear daunting. Let’s break this down into manageable parts, beginning with the taxpayer information fields at the top of Page 1.

Taxpayer information

At the top of the amended return, you’ll need to enter your personal information. Let’s go through this, step by step

Tax return year

At the very top, enter the calendar year or the fiscal year of your tax return. For calendar year taxpayers, simply enter the tax year.

Fiscal year filers will have to end the month and year of the end of their tax year. For example, if your fiscal year begins on 1 October, you would enter September 2023 for the 2023 fiscal year.

Taxpayer name and Social Security number

Enter the taxpayer’s first name and initial, last name, then Social Security number (SSN) in the top row.

If you and your spouse are amending a joint return, list your names and SSNs in the same order as shown on the original return.

If you are changing from a separate to a joint return and your spouse didn’t file an original return, enter your name and SSN first.

Spouse’s name and Social Security number

For married couples filing a joint return, enter the spouse’s information in the corresponding fields.

Home address

Enter your home address in these fields. If you have changed addresses since you filed your original tax return, enter the new address here, including city, state, and ZIP code.

Presidential election campaign

If you wish, you may select the Presidential Election Campaign to receive $3. This will not change your income tax liability or the amount of your tax refund. You must make this designation within 20 1/2 months after the original due date for filing your income tax return.

If you previously designated $3 to go to the Presidential Election Campaign, you cannot reverse this selection.

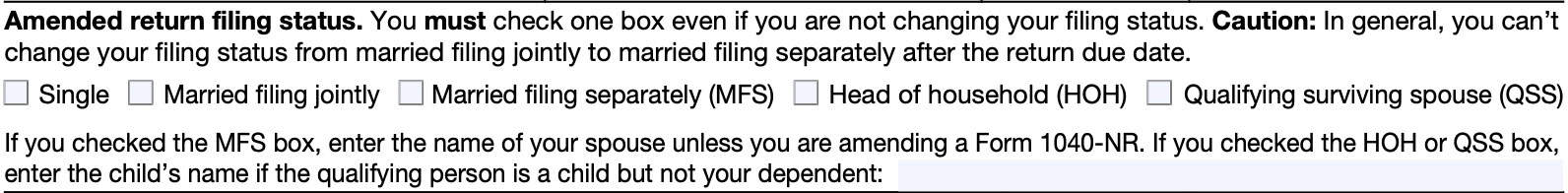

Amended return filing status

You must check one box, even if you are not changing your tax filing status:

- Single

- Married filing jointly (MFJ)

- Married filing separately (MFS)

- Head of household (HOH)

- Qualifying surviving spouse (QSS)

As a general rule, you cannot change your filing status from married filing jointly to married filing separately after the tax return due date. Below are some IRS instructions based on certain filing status changes you may be considering.

Changing from married filing separately to a joint return

If you are married and file a separate return, you generally report only your own income, deductions, and credits. Generally, you are responsible only for the tax on your own income.

If you file a joint return, both you and your spouse (or former spouse) are generally responsible for the tax and interest or penalties due on the return. If one spouse doesn’t pay the tax due, the other may have to. Or, if one spouse doesn’t report the correct tax, both spouses may be responsible for any additional taxes that the IRS assesses.

If you are changing from a separate to a joint return, you should enter ‘Changing filing status’ in Part II (or Part III if e-filing your amended return) as a reason for amending your Form 1040 or Form 1040-SR.

Innocent spouse relief

However, a spouse who is impacted by the other spouse’s tax debt may qualify for innocent spouse relief by filing IRS Form 8857, Request for Innocent Spouse Relief.

Changing to head of household filing status

If the qualifying person is a child but not your dependent, enter the child’s name in the space provided under the filing status checkboxes. In Part II (Part III if e-filing) of Form 1040-X, you should state “Changing the filing status” as a reason for amending your tax return.

Although married people generally cannot do so, there are certain exceptions that can enable a married person claim head of household filing status. IRS Publication 501 contains additional details.

Changing from a joint tax return to Married filing separately

When checking the box for married filing separately, enter your spouse’s name in the space provided below the filing status checkboxes.

If your spouse doesn’t have and isn’t required to have a Social Security number or individual taxpayer identification number (ITIN), enter “NRA” next to their name in the entry space below the filing status checkboxes.

If you check the box for qualifying surviving spouse, and the qualifying person is a child but not your dependent, enter the child’s name in the space provided under the filing status checkboxes. Do not enter the child’s name anywhere else on the tax form.

In Part II (Part III if e-filing) of Form 1040-X, you should state “Changing the filing status” as a reason for amending your tax return.

How to report changes in Lines 1 through 23

For Lines 1 through 23, you’ll notice three columns:

- Column A: Original amount

- Column B: Net change

- Column C: Correct amount

Let’s walk through each one to get a better understanding of how to report a particular change.

Column A: Original amount

In Column A, enter the amounts from your original return. However, if you previously amended that return or it was changed by the IRS, then you should enter the adjusted amounts.

Column B: Net change

Enter the net increase or decrease for each line that you are changing. Enter net decreases in parentheses.

You should explain each change in Part II (Part III if e-filing). If you need room for additional information, you can attach a statement. Attach any schedule or form relating to the change.

For example, if you originally took the standard deduction, but wish to itemize deductions, you would attach a copy of Schedule A.

If you are amending your return because you received another Form W-2, attach a copy of the new Form W-2.

Column C: Correct amount

To figure the amounts to enter in Column C:

- Add the increase in Column B to the amount in Column A, or

- Subtract the decrease in Column B from the amount in Column A

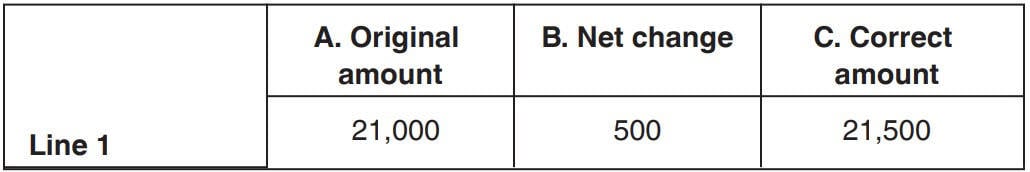

Example

Below is an example from the Form 1040-X instructions:

You originally reported $21,000 as your adjusted gross income on your 2023 Form 1040. You received another Form W-2 for $500 after you filed your return. Line 1 of Form 1040-X should be completed as follows:

Finally, for any item you don’t change, enter the amount from Column A in Column C. Leave Column B blank.

Let’s move on to the first section, where we’ll adjust income and deduction items.

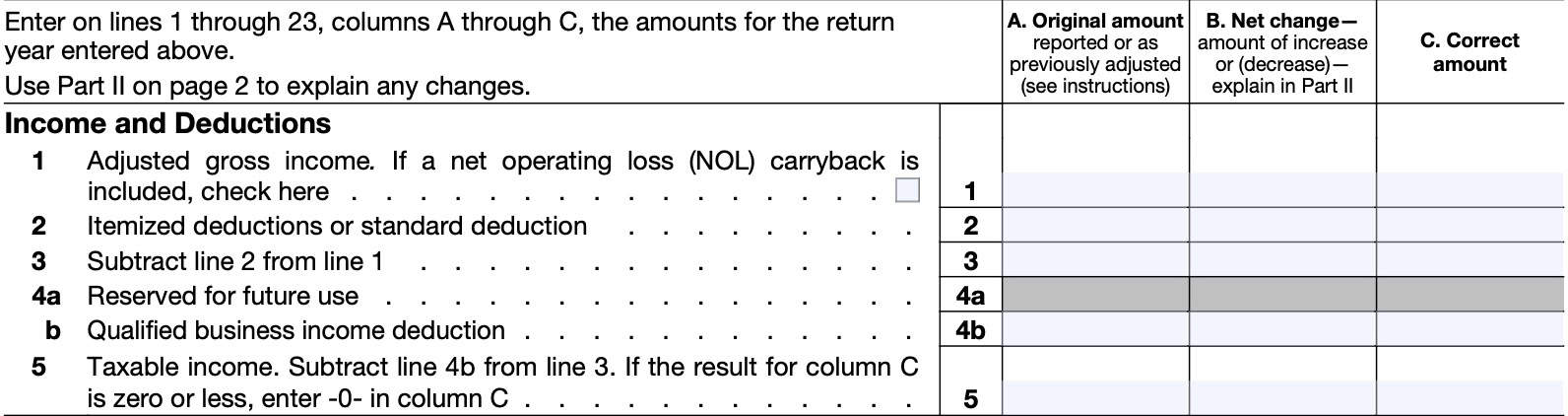

Income and deductions

For each item that you change, you need to explain the changes in Part II.

Line 1: Adjusted gross income

Enter your adjusted gross income (AGI) in Line 1. This is the total of your income minus certain deductions or adjustments to income. This line will reflect any change to the income or adjustments on the return you are amending.

Changes to your AGI can cause other amounts reported on your tax return to go up or down. For example, changing your AGI can change:

- Tax credits, such as the ones reported on the following forms:

- Allowable charitable contributions deductions

- Taxable amount of Social Security benefits

- Total itemized deductions

If you change your AGI, you may need to recalculate the above items as applicable, as well as any other credit or tax deduction that has a limitation based on AGI.

Correcting wage or employee compensation

If you received an additional or corrected Form W-2 after filing your original federal return, you should attach a copy of your new form. Also, attach any additional or corrected versions of IRS Form 1099-R that reflect taxes withheld.

Changing your IRA deduction

Indicate this change in Part II by entering ‘IRA deduction,’ as well as the amount of increase or decrease. If you are changing from a deductible to a nondeductible IRA contribution, you’ll need to fill out and attach IRS Form 8606, Nondeductible IRAs.

NOL carryback

If Line 1 includes a net operating loss (NOL) carryback, then check the box. Watch this video if you are interest in learning more about calculating an NOL deduction.

Line 2: Itemized deductions or standard deduction

Itemized deductions

If you itemized your deductions, enter in Column A either of the following:

- The total from your original Schedule A, or

- The deduction as adjusted by the Internal Revenue Service

Attach a copy of your corrected Schedule A to the amended return if any of the following apply:

- You are itemizing deductions instead of using the standard deduction

- You have changed the amount of any deduction

- Your AGI limitations have changed the amount of a deduction

Standard deduction

If you are using the standard deduction, enter the amount for your filing status for the year you are amending.

Charitable contributions

For adjustments to a cash charitable deduction for any year, refer to the tax return instructions for the year of the return you

are amending to determine the limits on amounts of cash contributions you can claim for that year.

For additional information, see IRS Publication 526, Charitable Contributions (for the year of the return you are amending). In particular, you should be able to find the following information:

- Definition of what qualifies as a cash contribution ,and

- Information on the types of organizations that qualify

Line 3

Subtract Line 2 from Line 1 for each column. Enter the results in the corresponding column in Line 3.

Line 4a: Reserved for future use

Do not enter anything in Line 4a.

Line 4b: Qualified business income deduction

Enter any change to qualified business income (QBI) that you may have calculated on either of the following:

- IRS Form 8995, Qualified Business Income Deduction Simplified Computation

- IRS Form 8995-A, Qualified Business Income Deduction

Line 5: Taxable income

Subtract Line 4b from Line 3. If the Column C amount is zero or less, enter ‘0’ in Column C.

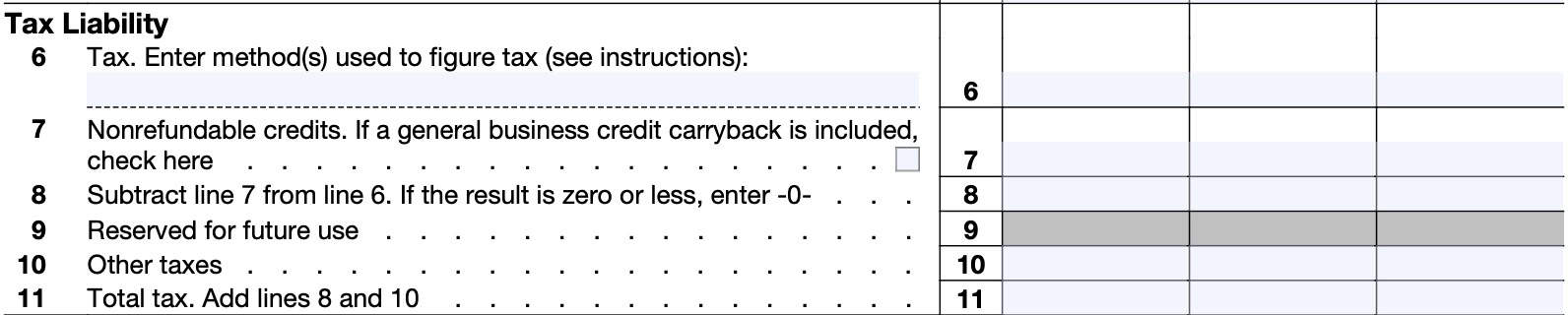

Tax liability

In this section, we’ll determine changes to your tax liability.

Line 6: Tax

Calculate the tax on your taxable income reflected in Column C on Line 5. You should use the same method that you previously used to figure your original tax bill. However, you might need to use a different method if you change or include certain types of income.

Below is a table that reflects the type of tax calculation method you should use.

| If you calculated your corrected tax liability using… | Then you should enter the following on the dotted line next to Line 6 |

| Tax tables | Tax table |

| Tax Computation Worksheet | TCW |

| Schedule D Tax Worksheet | Schedule D |

| Schedule J | Schedule J |

| Qualified Dividends and Capital Gain Tax Worksheet | QDCGTW |

| Foreign Earned Income Tax Worksheet | FEITW |

| IRS Form 8615, Tax for Certain Children Who Have Unearned Income | F8615 |

Additional instructions

On Line 6, include the amount that you reported on IRS Schedule 2, Additional Taxes, Line 3, for the year that you are amending. Line 3 includes:

- Alternative minimum tax, calculated on IRS Form 6251

- Excess advance premium tax credit repayment, from IRS Form 8962

Attach copies of any forms or schedules, if any, that you used to figure your revised tax. Don’t attach worksheets.

Line 7: Nonrefundable credits

Enter your total nonrefundable credits in column A. If you’re carrying back a general business credit, check the indicated box.

Nonrefundable credits are those that reduce your tax liability, but not below zero. In other words, any excess nonrefundable credit will not be refunded to you.

If you made any changes to Lines 1 through 6, you may need to refigure your original credits. Attach the appropriate forms for the credits you are adding or changing.

Line 8

Subtract Line 7 from Line 6. If the result is zero or a negative number, enter ‘0.’

Line 9: Reserved for future use

Do not enter anything in Line 9.

Line 10: other taxes

In Column A, enter the amount that you reported for total other taxes on IRS Schedule 2 for the tax year of the return that you are amending. If you made any changes in Lines 1 through 6, you may need to recalculate other taxes from your prior return.

Line 11: Total tax

Add Line 8 and Line 10. Enter the total here.

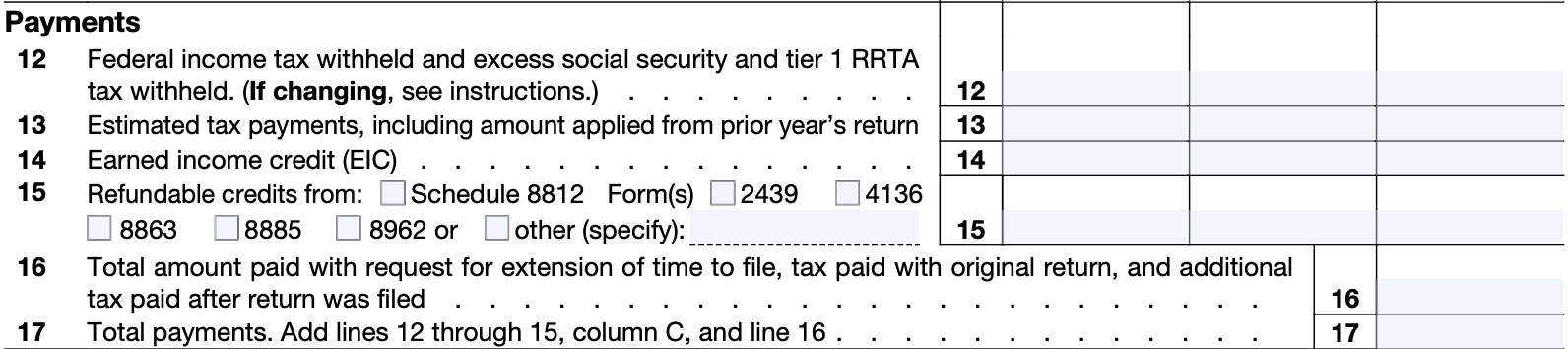

Payments

In Lines 12 through 17, we’ll calculate any changes to tax payments made. Let’s start with Line 12.

Line 12: Federal income tax withheld and excess Social Security and Tier 1 RRTA tax withheld

In Column A, enter any of the following:

- Federal income tax withheld

- Excess Social Security or Tier 1 RRTA tax (SS/RRTA) withheld

If you are changing your tax withholding or excess SS/RRTA withholdings, then you’ll need to attach a copy of any additional or corrected W-2 forms or 1099-R forms that reflect your tax withholdings.

Line 13: Estimated tax payments

In column A, enter any estimated tax payment you claimed on your original return. If you filed Form 1040-C, U.S. Departing

Alien Income Tax Return, then you should include any tax payment you made as the balance due with that return.

Also include any of your prior year’s overpayment that you elected to apply to estimated tax payments for the year you are amending.

Line 14: Earned income credit

In Column A, enter the amount you reported on the line for the earned income credit on Form 1040 or 1040-SR for the year you are amending.

If you are amending your return to claim the EIC and you have a qualifying child, attach Schedule EIC to your amended return. If you

changed the amount on either Line 1 or Line 5, this might impact the amount of any EIC you claimed on your original return may change.

IRS Publication 596, Earned Income Credit contains additional guidance for the year you are amending.

Nontaxable combat pay election

If you are amending your EIC based on a nontaxable combat pay election, enter “nontaxable combat pay” and the amount in Part II (Part III if e-filing).

Social Security number requirement

If you didn’t have an SSN on or before the due date of your return for the tax year being amended (including extensions), you can’t claim the EIC on your amended return.

Also, if a child didn’t have an SSN on or before the due date of your return for the tax year being amended (including extensions), you can’t count that child as a qualifying child in figuring the amount of the EIC on your amended return.

Line 15: Refundable credits

You’ll enter any refundable credits in Line 15.

A refundable credit can give you a refund for any part of a credit that is more than your total tax. In other words, a refundable credit can result in a tax refund (or an additional refund if you’re already expecting one), even if your tax liability is zero.

Enter, in column A, the total of the refundable credits from the following:

- Child tax credit, additional child tax credit, or credit for other dependents on Schedule 8812

- Education credits calculated on IRS Form 8863

- IRS Schedule 3, Additional Credits and Payments

As applicable, check the box (or boxes) for the following:

- Schedule 8812

- IRS Form 2439, Notice to Shareholder of Undistributed Long-Term Capital Gains

- IRS Form 4136, Credit For Federal Tax Paid On Fuels

- IRS Form 8885, Health Coverage Tax Credit

- IRS Form 8863, Education Credits

- IRS Form 8962, Premium Tax Credit

If you are amending your return to claim or change a refundable credit, attach the appropriate schedule(s) or form(s).

In addition, in the blank area after “other (specify),” list all of your refundable credits for which there is not a checkbox. Include the form number for the credit if there is one.

Line 16: Total amount paid

In Line 16, enter any amounts paid. This should include the following:

- Any amount paid with your request for an extension on either of the following:

- IRS Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, or

- IRS Form 2350, Application for Extension of Time To File U.S. Income Tax Return

- Also include any electronic payments made in connection with your filing extension, but do not include the convenience fee that you may have paid

- The amount you paid with your original return, regardless of method.

- Also include any additional payments you made after filing your return.

- Don’t include interest payments, penalties, or the convenience fee you were charged.

Taxes paid to the U.S. Virgin Islands

Include any amounts from IRS Form 8689, Allocation of Individual Income Tax to the U.S. Virgin Islands, that you are including in the total payments line on your Form 1040 or 1040-SR.

Example

For example, you plan to amend your 2022 tax return. Originally, you had sent a check for $1,500, which reflected:

- $1,400 in taxes

- $100 estimated tax penalty

When completing your 1040-X form, you would enter $1,400 on Line 16.

Line 17: Total payments

Add the Column C figures for Lines 12 through 15. Add Line 16 to this result.

This represents your total tax payments.

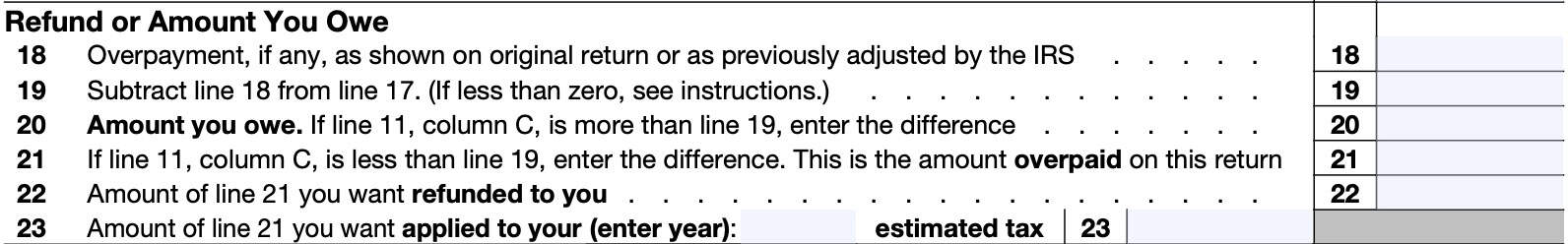

Refund or amount you owe

In Lines 18 through 23, we’ll calculate the change to your tax refund or outstanding tax balance.

Line 18: Overpayment

Enter the overpayment from your original return.

If your original return was changed by the IRS and the result was an additional overpayment of tax, also include that amount here. Don’t

include interest you received on any refund.

Any additional refund you are entitled to on Form 1040-X will be sent as a separate payment from any refund you haven’t yet received from your original return.

Line 19

Subtract Line 18 from Line 17, then enter the difference here.

If Line 18 is larger than Line 17

If Line 18 is larger than Line 17, Line 19 will be negative. This means that you will owe additional income tax.

To figure the amount owed, treat the Line 19 as positive and add it to the Line 11. Enter the total on Line 20, below.

Line 20: Amount you owe

If Line 11, Column C, exceeds Line 19, then enter the difference. This represents the amount of tax you still owe.

If you elected to apply any part of an overpayment on your original return to your next year’s estimated tax, you can’t reverse that election on your amended return. In other words, if your amended return results in a tax deficiency, you cannot use your tax refund against the new tax bill.

Line 21: Amount overpaid

If Line 11, Column C, is less than Line 19, then enter the difference. This represents the tax refund that the IRS owes you.

Line 22: Amount you want refunded to you

If there is an amount in Line 21, enter the amount of your tax refund that you would like to be paid to you for the current year.

The refund amount on Line 22 will be sent separately from any refund you claimed on your original return. The IRS will figure any interest and include it in your additional refund.

This refund will come in the form of a check. A refund on a paper-filed amended return can’t be deposited directly to your bank account.

If you have tax debt

If you owe past-due federal or state debts, the IRS will apply part or all of your overpayment to pay the past-due amounts. You will receive a notice if any of your overpayment has been applied to past-due amounts. This is known as a tax refund offset.

To learn more about tax refund offsets, check out this article.

Line 23: Amount you want applied to another tax year

If there is an amount in Line 21, you can enter the amount of your tax refund that you would like to be set aside for next tax year.

You can’t change your election to apply part or all of the overpayment on Line 21 to next year’s estimated tax.

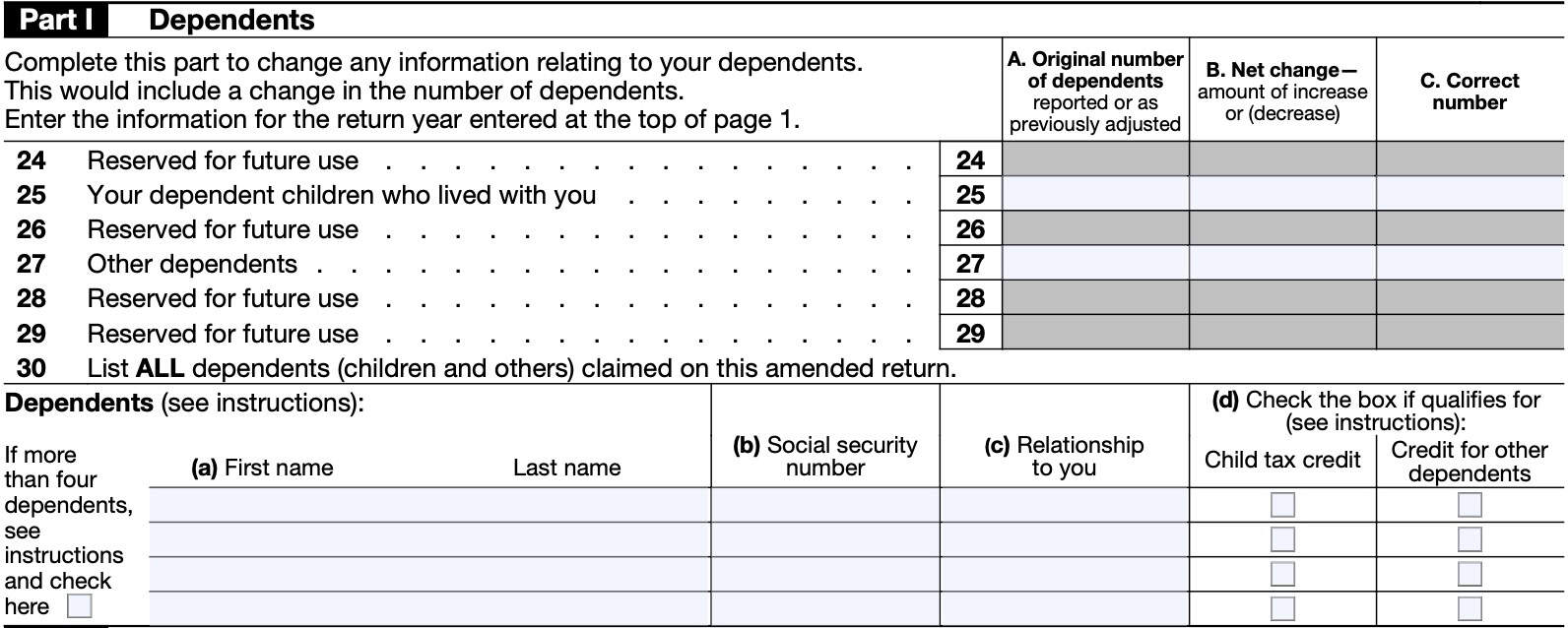

Part I: Dependents

In Part I, we’ll document information about your dependents. This includes:

- Dependents claimed on your original return who are still being claimed on this return, and

- Dependents not claimed on your original return who are being added to this return.

Only Line 25 and Line 27 are used here. All other lines are set aside for future use.

Line 24: Reserved for future use

Do not enter anything in Line 24.

Line 25: Dependent children who lived with you

Enter any changes in the number of dependent children who lived with you as follows:

- Column A: Original number of dependents

- Column B: Net change

- Column C: Correct number

Line 26: Reserved for future use

Do not enter anything in Line 26.

Line 27: Other dependents

Enter any other dependents, other than dependent children, as follows:

- Column A: Original number of dependents

- Column B: Net change

- Column C: Correct number

Line 28: Reserved for future use

Do not enter anything in Line 28.

Line 29: Reserved for future use

Do not enter anything in Line 29.

Line 30: List all dependents claimed on this amended return

Include the following information for all dependents claimed on this return:

- (a): First name & last name

- (b): Social Security number

- (c): Relationship to you

- (d): Tax credit claimed

- Child tax credit or credit for other dependents, but not both

Part II: Explanation of changes

In Part II (Part III on an e-filed return), enter the reason (or reasons) you are making these changes. Below are common examples from the IRS instructions:

- You received another Form W-2 after you filed your return,

- You forgot to claim the child tax credit or the credit for other dependents,

- Changed your filing status from qualifying surviving spouse (or, if amending a 2021 or earlier return, qualifying widow(er)) to head of household,

- You are carrying a credit to an earlier year, or

- You are claiming a tax benefit from recently enacted legislation for disaster relief.

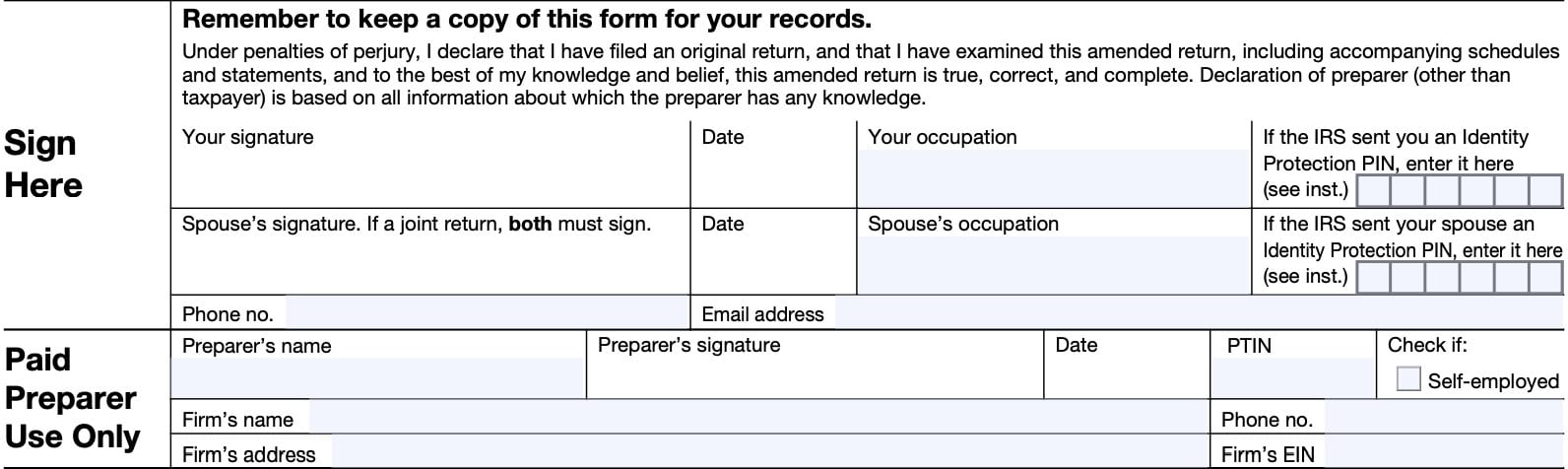

Signature

Below, you (and your spouse, if filing jointly), must sign and date your tax return. If the IRS sent you an Identity Protection PIN (IP PIN), then enter all six digits in the field provided. If you did not receive a PIN, then leave this blank.

Below your signature, your tax professional will sign, with the following information:

- Preparer tax identification number (PTIN)

- Firm’s name, address, and employer identification number

- Contact phone number

- Self-employment status

How do I file IRS Form 1040-X?

If you are filing your tax amendment electronically, then you can follow the guidance provided by your tax software provider.

If you are filing by paper, then you may need to follow some additional steps. First, you must ensure that your tax return is properly assembled.

Assembling your amended return

Assemble any schedules and forms behind Form 1040-X in the order of the “Attachment Sequence No.” shown in the upper-right

corner of the schedule or form. If you have supporting statements, arrange them in the same order as the schedules or forms they support and attach them last.

Don’t attach a copy of your original return, IRS correspondence, or other items unless required to do so.

On the front of your Form 1040-X

Attach to the front of Form 1040-X copies of the following:

- IRS Form W-2 or IRS Form W-2c,

- IRS Form 2439, Notice to Shareholder of Undistributed Long-Term Capital Gains, that supports changes made on this return

- A copy of any IRS Form W-2G, Certain Gambling Winnings

- IRS Form 1099-R that supports changes made on this return

- Only if tax was withheld

- IRS Form 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding

- IRS Form SSA-1042S, Social Security Benefit Statement (Nonresident Aliens)

- IRS Form RRB-1042S, Payments by the Railroad Retirement Board (Nonresident Aliens)

- IRS Form 8288-A, Statement of Withholding on Dispositions by Foreign Persons of U.S. Real Property Interests

On the back of Form 1040-X

Attach any copy of IRS Form 8805, Foreign Partner’s Information Statement of Section 1446 Withholding Tax, to the back of your amended return.

Where to file

If filing your amended return in paper form, your filing location might depend on your circumstances or where you live.

Special circumstances

If you’re filing an amended return in response to an IRS notice, then you should mail your tax amendment to the address listed on the notice.

If you’re filing with either IRS Form 1040-NR or IRS Form 1040-NR-EZ, then send your amended return to:

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0215

Filing by location

Unless otherwise directed, you should file an amended return with the IRS center based on your location:

| IF you live in… | THEN mail Form 1040-X and attachments to… |

| Alabama, Arkansas, Florida, Georgia, Louisiana, Mississippi, Oklahoma, or Texas | Department of the Treasury Internal Revenue Service Austin, TX 73301-0052 |

| Alaska, Arizona, California, Colorado, Hawaii, Idaho, Iowa, Kansas, Michigan, Montana, Nebraska, Nevada, New Mexico, North Dakota, Ohio, Oregon, South Dakota, Utah, Washington, or Wyoming | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0052 |

| Connecticut, Delaware, District of Columbia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, North Carolina, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, or Wisconsin | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0052 |

| A foreign country, U.S. territory;* or use an APO or FPO address, or file Form 2555 or 4563, or are a dual-status alien *-*If you live in American Samoa, Puerto Rico, Guam, the U.S. Virgin Islands, or the Northern Mariana Islands, see IRS Pub. 570 | Department of the Treasury Internal Revenue Service Austin, TX 73301-0052 |

Video walkthrough

Watch this video to learn more about filing your amended return on IRS Form 1040-X.

Frequently asked questions

According to the IRS website, you should generally allow 8 to 12 weeks for the processing of the tax return once it has been received. However, in some cases, processing could take up to 16 weeks. You can use the online tool on the IRS website to track your tax return status.

You may file an amended tax return for the current year or two prior tax years. However, if you originally filed your tax return in paper form, then you must file your amended return on paper as well.

Generally, an amended tax return must be filed within 3 years of the due date of the original return (without extensions). For example, an amended tax return for the 2021 tax year must be filed by April 15, 2025.