IRS Form W-2c Instructions

If your employer incorrectly reported tax information to you on your Form W-2, it is their responsibility to issue a corrected tax statement, known as IRS Form W-2c. This tax form not only goes to the employee, but to government authorities so they can properly understand your tax situation.

In this article, we’ll break down everything you need to know about IRS Form W-2c, including:

- What to look for if you receive IRS Form W-2c

- Who receives a copy of your corrected Form W-2

- Frequently asked questions

Let’s start by walking through this tax form, step by step.

Table of contents

How do I complete IRS Form W-2c?

If you are the taxpayer, you probably will not be completing IRS Form W-2c yourself. Instead, you should receive a copy of your corrected wage statement from your employer.

In this section, we’ll walk through your corrected wage statement, so you can better understand the corrected tax information as you see it.

Before we go over the tax form itself, we should note that there are at least 4 copies of IRS Form W-2c. However, there can be up to 6 copies to this tax form in situations that involve state or local taxes.

Here is a breakdown of the intended recipient for each copy, if your employer needs to issue a W-2c form:

- Copy A: Social Security Administration

- Copy B: To be filed with the employee’s federal income tax return

- Copy C: Employee’s records

- Copy D: Employer records

Copy B and Copy C are employee copies, although you should include Copy B with your tax return.

If necessary, the following copies are also issued:

- Copy 1: State, city, or local tax department

- Copy 2: To be filed with the employee’s state, city, or local income tax return

Although all Form W-2c copies are the same, this article contains screenshots from Copy B. Let’s take a closer look for better understanding.

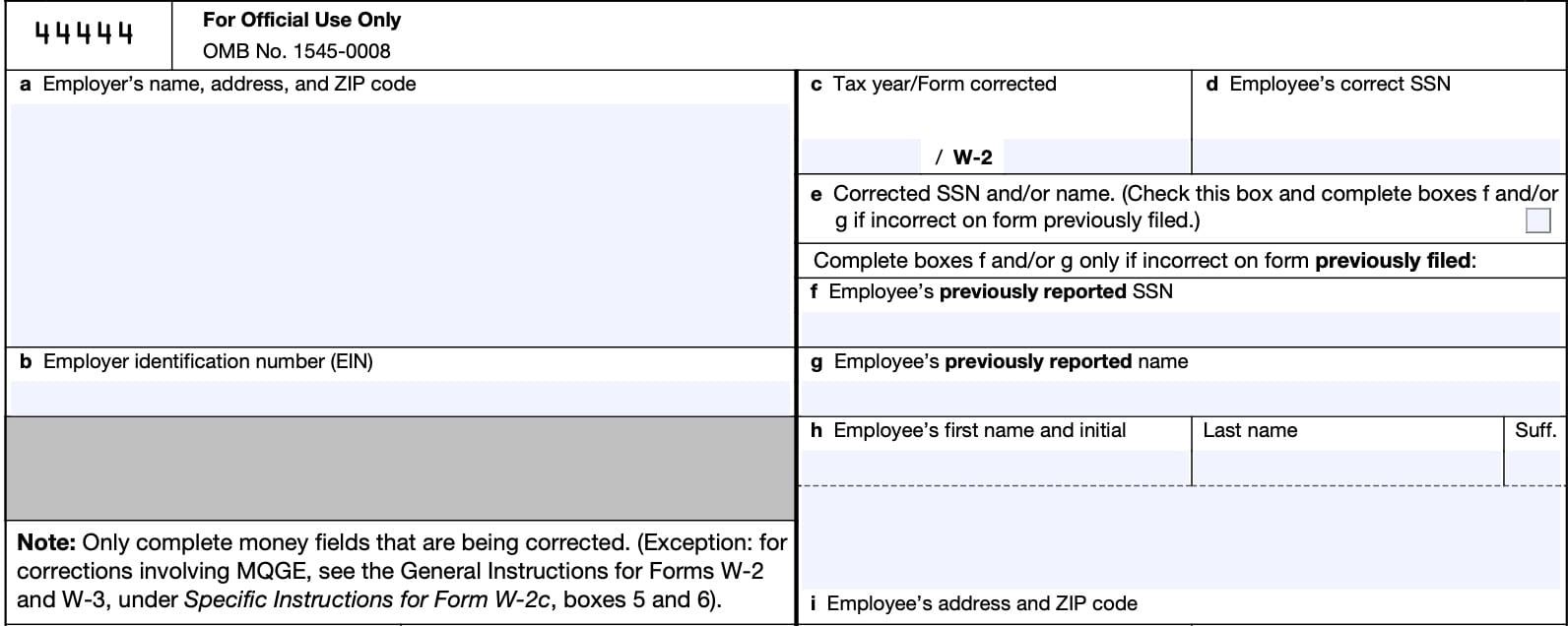

Top of Form W-2c

Let’s take a look at the top of the tax form.

When reviewing your corrected W-2, you should note that the form instructions may direct your employer to leave certain fields blank. For example, Box f and Box g may only contain information if your employer previously incorrectly reported your name or Social Security number (SSN).

Box a: Employer’s name, address, and ZIP Code

For employers, this entry should be the same as shown on any of the following:

- IRS Form 941, Employer’s Quarterly Federal Tax Return

- IRS Form 941-SS, Employer’s Quarterly Federal Tax Return – American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. U.S. Virgin Islands

- IRS Form 943, Employer’s Annual Federal Tax Return for Agricultural Employees

- IRS Form 944, Employer’s Annual Federal Tax Return

- IRS Form CT-1, Employer’s Annual Railroad Retirement Tax Return

- IRS Schedule H, Household Employment Taxes

Box b: Employer identification number (EIN)

This box should show the employer’s 9-digit EIN, as assigned by the Internal Revenue Service.

Box c: Tax year/Form corrected

Box c should indicate all 4 digits of the current tax year for the original Form W-2 being corrected. If you are correcting a Form W-2c, then indicate that by placing ‘c’ after the tax year.

Box d: Employee’s correct SSN

If originally correct, Box d will still contain the employee’s correct SSN. Employers who are correcting an employee’s SSN from the original W-2 form must complete Boxes e through i.

Box e

This box should be checked only when it is necessary to correct errors to employee’s name or Social Security number, or both, from the original Form W-2.

If this is the case, then the employer must also complete Box d, as well as Boxes f through i, below.

Box f: Employee’s previously reported SSN

Employers will complete this box to correct an employee’s previously reported incorrect SSN.

If the previous SSN was reported as blanks or not available, then Box f should contain all zeros.

Box g: Employee’s previously reported name

Employers will complete this box to correct an employee’s previously reported incorrect name.

The employer must enter the employee’s previously reported full name in Box g exactly as it was previously reported. If the previous reported name was reported as blanks or not available, then Box g should be left blank.

Box h: Employee’s name

The correct employee name should go into Box h, if previously reported incorrectly.

Box i: Employee’s address and ZIP code

This box should contain the employee’s correct address, with ZIP code.

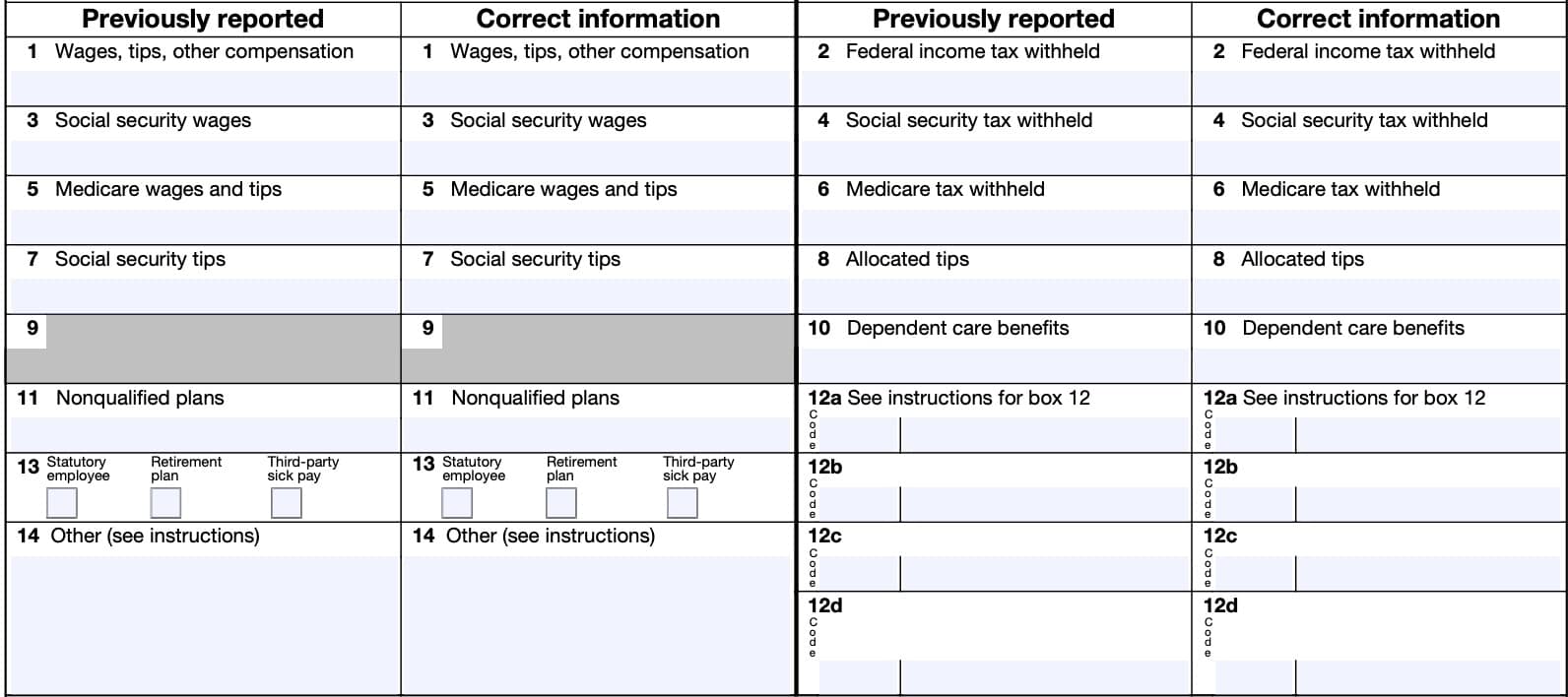

Federal tax information

In the rest of the form, from Box 1 through Box 20, you will see two information columns:

- Previously reported

- Correct information

As you may suspect, any corrected information should be in the right column, when compared to the incorrect information previously reported.

For simplicity’s sake, each box will indicate what your employer should enter in that box. When you see your corrected form, you should be able to determine where the corrected amount is located.

Most employers will not enter any information in any boxes on Copy A unless a change is warranted for Social Security or Medicare purposes.

Box 1: Wages, tips, other compensation

This box should contain the correct amount of employee’s annual wages and tip income that should be reported on the employee’s individual tax return.

Box 2: Federal income tax withheld

Employers should use this box only to make corrections because of an administrative error.

An administrative error occurs only if the amount entered in Box 2 of the incorrect Form W-2 was not the amount actually withheld.

Box 3: Social Security wages

This box should reflect the total wages paid that are subject to Social Security tax withholding. This will not include Social Security tips or allocated tips.

Box 4: Social Security tax withheld

Box 4 shows the amount of Social Security tax actually withheld. on Social Security wages.

This box normally will not show taxes withheld in excess of the contribution and benefit base, also known as the taxable maximum. However, employees with multiple employers should ensure that the total Social Security tax withheld by all employers does not exceed the taxable maximum.

If excess Social Security tax is withheld

For taxpayers with multiple employers, you may be able to claim the excess as a tax credit against your income taxes for the year. This would reduce the amount of taxes you owe when you file your tax return, or result in a refund.

For taxpayers whose single employer withheld too much tax on Social Security wages, you must first attempt to have your employer adjust the overwithholding. If your employer cannot or will not do this, then you can file IRS Form 843, Claim for Refund and Request for Abatement, to claim a refund of the excess amount withheld.

Box 5: Medicare wages and tips

If incorrect, employers will complete Boxes 5 and 6 to correct Medicare wages and tips and Medicare tax withheld.

Box 5 must equal or exceed the sum of Box 3 (Social Security wages) and Box 7 (Social Security tips).

Box 6: Medicare tax withheld

If incorrect, employers will complete Boxes 5 and 6 to correct Medicare wages and tips and Medicare tax withheld.

However, this does not apply to Additional Medicare Tax withheld unless the employer needs to correct an administrative error. This occurs only if the amount entered in Box 6 of the incorrect Form W-2 is not the amount actually withheld.

State, local, or federal government employers should also use these boxes to correct wages for Medicare-Qualified government employees (MQGE).

Box 7: Social Security tips

For tipped employees, Box 7 should indicate the amount of tips reported to the employer.

All tips reported by an employee to their employer should be reflected in Box 1, in addition to total wages and other compensation. Any tips that are reported in Box 7 should also be reflected as part of the Medicare wages and tips entered in Box 5.

The total of Boxes 3 and 7 should not exceed the maximum Social Security wage base for the year.

Box 8: Allocated tips

In Box 8, certain large food or beverage establishment operators must show the tips allocated to the employee. Allocated tips should not appear in any of the following:

- Box 1: Wages, tips, or other compensation

- Box 3: Social Security wages

- Box 5: Medicare wages and tips

- Box 7: Social Security tips

Box 9: Not used

Box 10: Dependent care benefits

This box should show the total dependent care benefits paid by an employer under a Section 129 dependent care assistance program (section 129) an employee’s benefit. This amount should include:

- The fair market value of care in a daycare facility provided or sponsored by the employer for the employee’s benefit, and

- Amounts paid or incurred for dependent care assistance in a Section 125 plan, known as a cafeteria plan.

Box 11: Nonqualified plans

The purpose of Box 11 is for the Social Security Administration (SSA) to determine if any part of the amount reported in Box 1 or Boxes 3 and/or 5 was earned in a prior year. The SSA uses this information to verify that they have properly applied the Social Security earnings test and paid the correct amount of benefits.

Employers will also report distributions to an employee from a non-qualified plan or nongovernmental Section 457(b) plan in Box 11.

Box 12

Employers will complete these boxes to correct any of the coded items shown on Forms W-2. Examples include the following:

- Uncollected Social Security and or Medicare taxes on tips

- Taxable cost of group-term life insurance coverage over $50,000

- Elective deferrals

- Sick pay not includible as income

- Employee business expenses

Box 13

Check the boxes in Box 13, under “Previously reported,” as they were checked on the original Form W-2. Under “Correct information,” the employer will check them as they should have been checked.

For example, if the employer mistakenly checked the “Retirement plan” box on the original Form W-2, they would do the following:

- Check the “Retirement plan” checkbox in Box 13 under “Previously reported,” but

- Not check the “Retirement plan” checkbox in box 13 under “Correct information.”

Box 14: Other

Employers will use this box to correct items reported in box 14 of the original Form W-2 or on a prior Form W-2c.

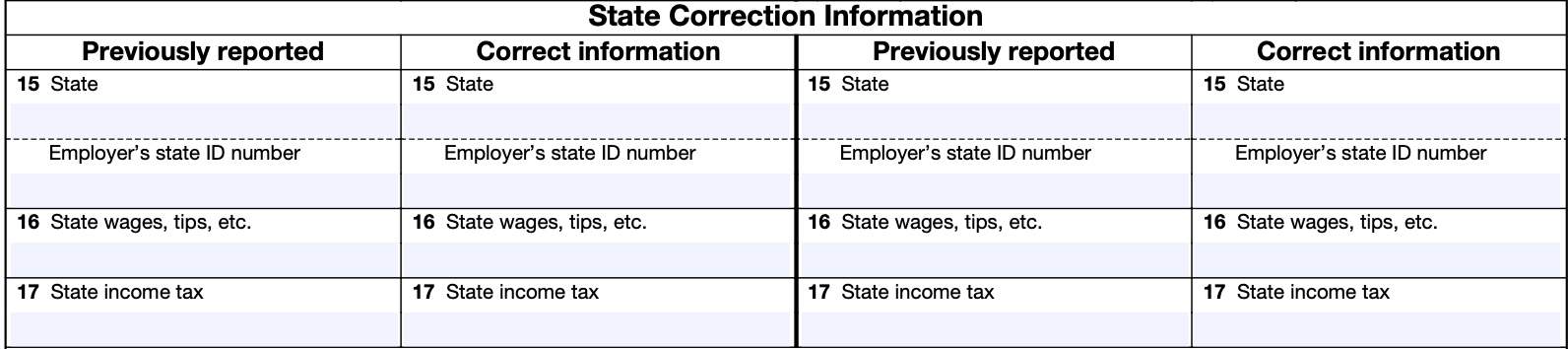

State tax information

If an employer’s only changes to the original Form W-2 are to state or local data, they should not send Copy A of Form W-2c to the SSA. Instead, they will send Form W-2c to the appropriate state or local agency, and furnish copies to employees.

Box 15: State

This should contain the correct state, as well as the employer’s state ID number for that particular state.

Box 16: State wages, tips, etc.

This box should reflect the total state wages and tip income information for state income tax purposes.

Box 17: State income tax

This box should contain the correct state income tax information, according to the applicable state’s tax calculation guidelines.

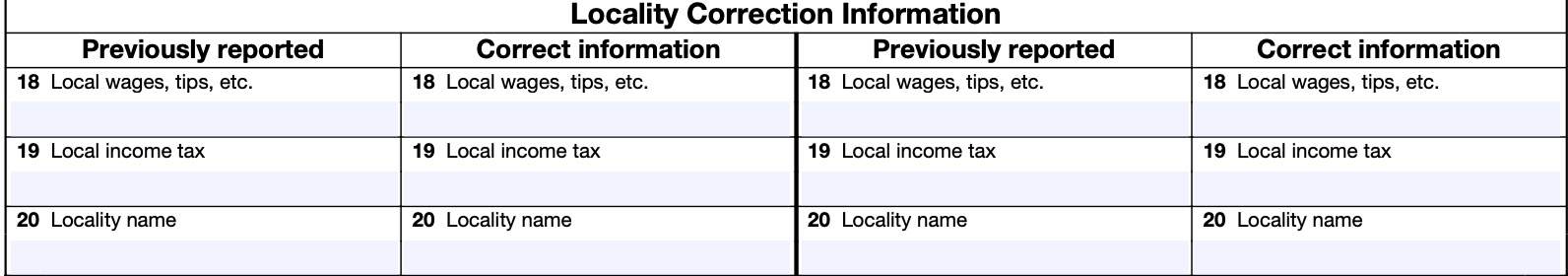

Locality tax information

Box 18: Local wages, tips, etc.

In Box 18, the employer should enter the total local wages and tip income information for local income tax purposes.

Box 19: Local income tax

This should contain the actual local income tax withheld.

Box 20: Locality name

Contains the name of the locality where wage income is being reported.

Video walkthrough

Watch this video to learn more about corrected wage and tax information on Form W-2c.

Frequently asked questions

Employers must furnish their employees their correct wage and tax information by January 31 following the end of the previous year. This applies to any corrected information reported on Form W-2c.

You can contact the Internal Revenue Service at (800) 829-1040 or by making an appointment through the Taxpayer Advocate Service. The IRS will send your employer a letter to ensure compliance within 10 days. You can also file IRS Form 4852 to report corrected income information.

Where can I find IRS Form W-2c?

Your employer should give you three copies of this tax form:

- Copy B: For your federal income tax return

- Copy C: For your records

- Copy 2: For your state or local income tax return

If you want to know what this form looks like, you can download the sample located below.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!