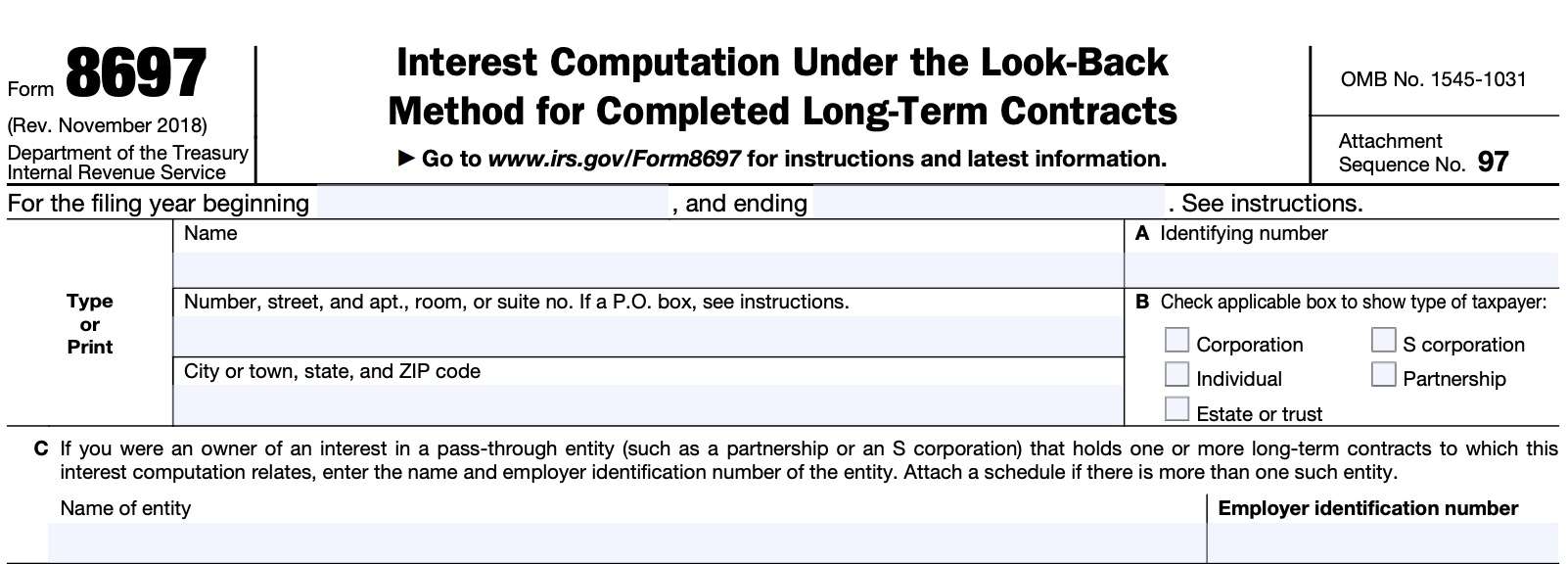

IRS Form 8697 Instructions

If you operate with long-term contracts, you may need to make adjustments to prior year income tax liability based upon the difference between estimated and actual costs. In addition to those changes in your tax bill, you have to calculate interest on IRS Form 8697.

In this article, we’ll walk through this tax form, including:

- Different interest computation methods used, as well as how to select the correct method for your tax situation

- How to complete IRS Form 8697

- Frequently asked questions

Let’s start with an in-depth over view of the tax form itself.

Table of contents

How do I complete IRS Form 8697?

There are two parts to this tax form:

Before we start with Part I or Part II, let’s take a look at the taxpayer information fields at the top of the form.

Taxpayer information

Let’s start with the filing year at the top of the form.

Filing year

At the very top of IRS Form 8697, enter the beginning date and ending date of the tax year in question. Specifically, the contracts for which you are filing this form should have been completed or adjusted in the specified tax year.

If you were an owner of an interest in a pass-through entity that has completed or adjusted one or more contracts, then enter your tax year that ends with or includes the end of the entity’s tax year in which the contracts were completed or adjusted.

Taxpayer name and address

Enter the name shown on your federal income tax return for the filing year. If you are an individual filing a joint return, also enter your spouse’s name as shown on IRS Form 1040.

Enter your address only if you are filing this form separately. If you have a post office box, only enter the P.O. Box number if the U.S. Postal Service does not deliver to your street address. Otherwise, enter your street address as follows:

- Street number

- Street name

- City or town

- State

- Zip code

Identifying number

If you are an individual taxpayer, enter your Social Security number. Otherwise, enter the business entity’s employer identification number.

Type of taxpayer

Check the applicable box:

- Corporation

- Individual

- Estate or trust

- S corporation

- Partnership

Pass-through entity

If you were an owner of an interest in a pass-through entity that holds one or more long-term contracts related to this interest computation, then enter the name and employer identification number of the tax entity.

Examples of pass-through entities include partnerships or S corporations, but not corporations.

Deciding on the computation method

Instead of completing Part I and Part II, each taxpayer must decide which computation method to use.

Taxpayers will use Part I only if:

- You are not electing to use the simplified marginal impact method

- You do not already have an election in effect for the simplified method, and

- You are not required to use the simplified method.

Taxpayers will use Part II only if:

- They are a pass-through entity required to apply the look-back method at the entity level

- They are electing to use the simplified marginal impact method.

To elect the simplified marginal impact method, attach a statement to your timely filed income tax return (determined with extensions) for the first tax year of the election.

On the statement, indicate that you are making an election under Treasury Regulations Section 1.460-6(d) to use the simplified marginal impact method. Once made, the election applies to all applications of the look-back method in the year of the election and all later years, unless the IRS consents to a revocation of the election.

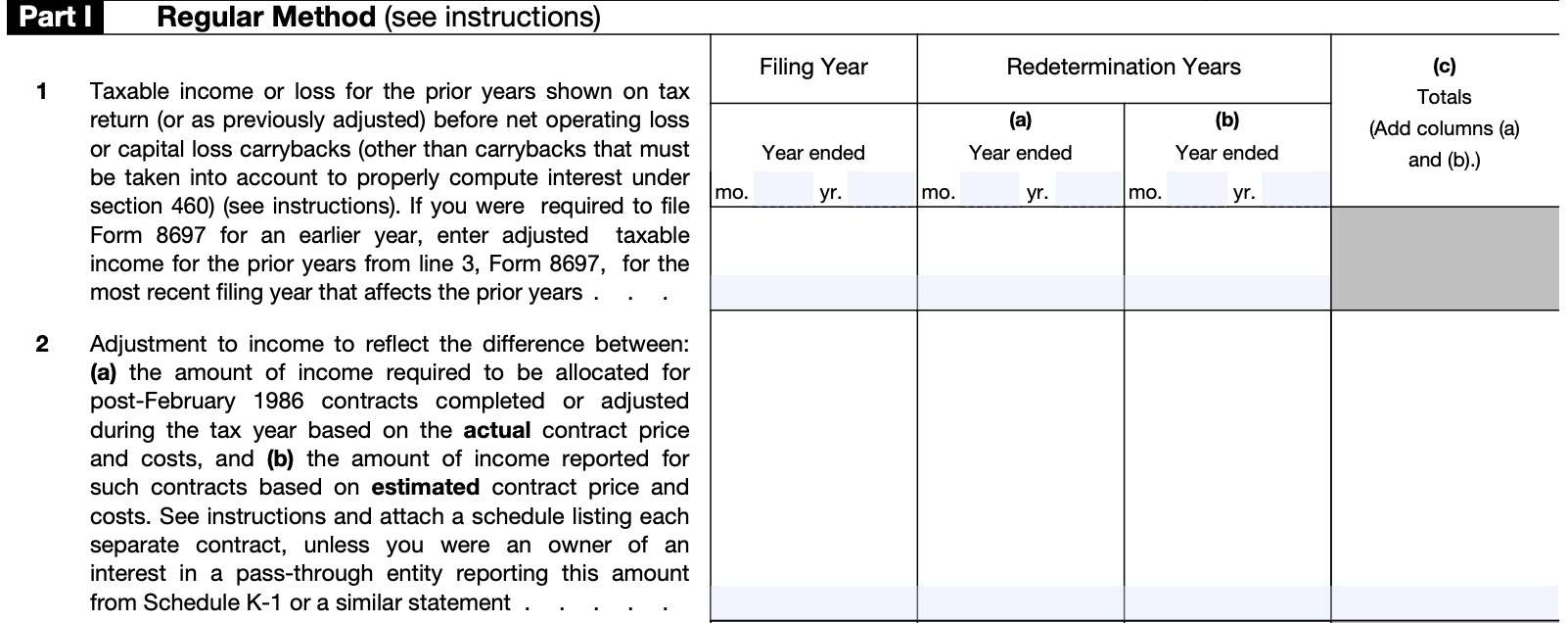

Part I: Regular Method

If you have not elected to use the simplified marginal impact method, and if you’re not otherwise required to do so, then you may use the regular method to calculate interest.

Before going to Line 1, you’ll need to enter the ending month and year for the tax year, under filing year.

Under redetermination years, enter the ending month and year at the top of each column for

- Each prior tax year in which you were required to report income from the completed long-term contract(s) and

- Any other tax year affected by these tax years.

If there were more than 2 prior years, you may attach additional copies of IRS Form 8697 as required. On the additional forms, enter the following information:

- Name

- Identifying number

- Tax year

Also, complete lines 1 through 8, as applicable, but do not enter totals in column (c). Enter totals only in column (c) of the first copy of IRS Form 8697.

Line 1: Taxable income or loss for prior years

In Line 1, enter any taxable income or loss for the prior years as shown on your income tax return, or as previously adjusted. This taxable income or loss should be before considering:

- Net operating loss

- Capital loss carrybacks

- Other than carrybacks that must be considered to properly compute interest under Internal Revenue Code Section 460

If you were required to file IRS form 8697 for a prior taxable year, then enter the adjusted taxable income for the prior years. You’ll find the adjusted taxable income on Line 3 from the most recently filed Form 8697 that affects the prior years.

Line 2: Adjustment to income

For all lines, beginning with Line 2, you will combine any amounts in columns (a) and (b), then enter the net amount in Column (c). If you are using more than one IRS Form 8697, then you must enter the total of all columns (a) and (b) into the column (c) for the first Form 8697 only.

In Line 2, you will enter adjustments to income. For each column, you will show the following:

- Net increase to income as a positive number

- Net decrease to income as a negative number

In doing this, you must account for other income and expense adjustments that may result from the increase (or decrease) to income from long-term contracts.

For example, you might need to include a change to adjusted gross income affecting medical expenses under IRC Section 213.

If there are no adjustments besides the look-back adjustments, the sum of all Line 2 amounts should be zero and reflected in column 2(c). If there are additional adjustments that result from the application of the look-back, leave column 2(c) blank and reflect the amounts in the schedule below as described in item 3.

Attached schedule

Include the following on an attached schedule.

- Identify each completed long-term contract by contract number, job name, or any other reasonable method used in your records to identify each contract.

- For each contract, report in columns for each prior year:

- The amount of income previously reported based on estimated contract price and costs

- The amount of income allocable to each prior year based on actual contract price and costs.

- Total the columns for each prior year and show the net adjustment to income from long-term contracts.

- Identify any other adjustments that result from a change in income from long-term contracts.

- Also show the amounts in the columns for the affected years so that the net adjustment shown in each column on the attached schedule agrees with the amounts shown on Line 2.

Reporting on Schedule K-1

An owner of an interest in a pass-through entity is not required to provide the detail listed in 1 and 2 above with respect to prior years. The entity should provide the Line 2 amounts with Schedule K-1 or on a separate statement for its tax year in which the contracts are completed or adjusted.

Taxpayers reporting Line 2 amounts from more than one Schedule K-1 or similar statements must attach a schedule detailing the net change to income from long-term contracts, by entity.

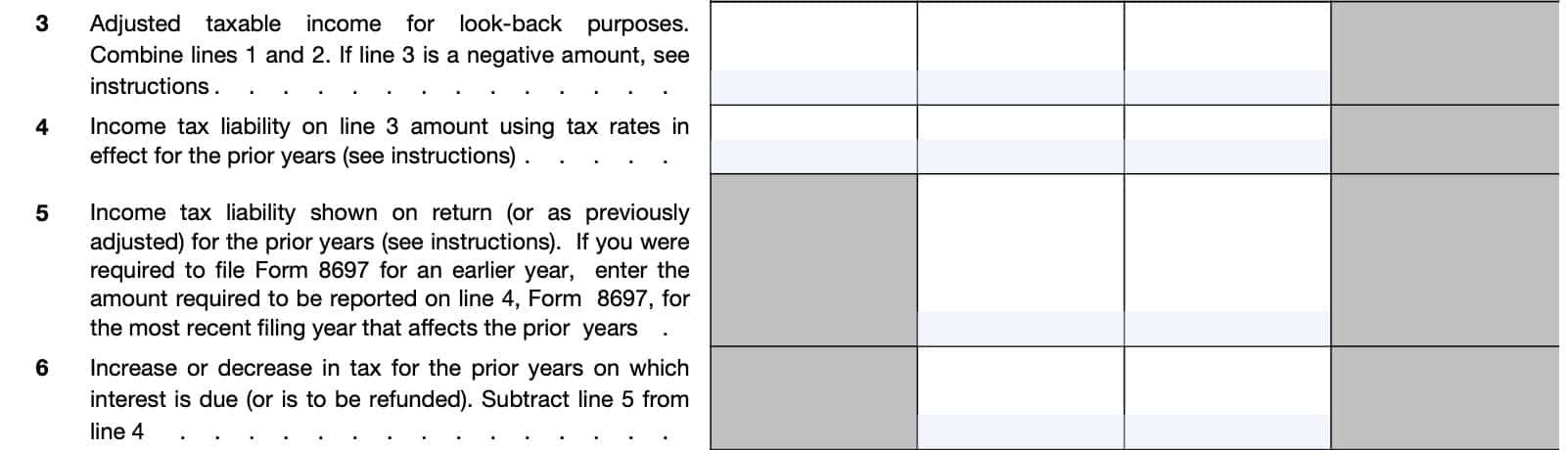

Line 3: Adjusted taxable income

Combine Line 1 and Line 2. This represents your adjusted taxable income for look-back purposes.

If this calculation results in a negative amount, there is a look-back net operating loss (NOL). The Line 2 adjustment either created, increased, or decreased the net operating loss.

The change in the amount of the net operating loss would be carried back or forward to the appropriate tax year. Then, you would have to recompute the hypothetical tax in the carryback/forward year.

Treasury Regulations Section 1.460-6(c)(3)(v) contains additional information about recomputing the hypothetical tax under the look-back rule.

However, the computation period for computing interest on NOLs is different. See the exceptions listed on Line 7 and Line 8 below.

The 2-year carryback rule does not apply to net operating losses arising in tax years ending after 2017. However, an exception applies to farmers and non-life insurance companies.

See IRC Section 172(b) contains additional information.

Line 4: Income tax liability on Line 3 amount

Using the tax rates in effect for each year, enter the income tax liability on the adjusted taxable income in Line 3.

After calculating the total tax liability, you’ll need to reduce this amount by allowable credits, except for refundable credits. Examples of refundable credits would be:

- Credit for taxes withheld on wages

- Earned income tax credit

- Credit for federal tax on fuels

Do not take into account any credit carrybacks to the prior year in computing the amount to enter on Lines 4 and 5. Exception: you may take into account carrybacks that resulted from or were adjusted by the redetermination of your income from a long-term contract for look-back purposes.

Also include on Lines 4 and 5 any taxes, such as alternative minimum tax for individuals, that you must account for when computing your tax liability.

Line 5: Income tax liability shown on tax return or as previously adjusted

If you filed IRS Form 8697 in prior tax years, enter the amount that you had to report on Line 4 of the most recent Form 8697 that impacted those prior year returns.

Use the same rules that applied for calculating the tax liability in Line 4.

Line 6: Increase or decrease in tax for prior years

This represents the increase (or decrease) in tax for the prior years on which interest is now due, or owed to you.

For increases in tax responsibility, go to Line 7. For decreases in total tax liability, go to Line 8.

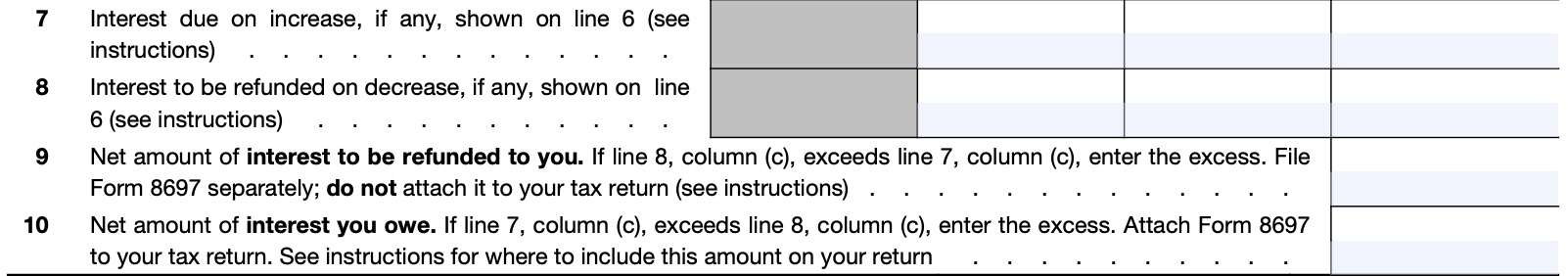

Line 7: Interest due on increase

Before we get into calculating Line 7 or Line 8 interest, we should first discuss the applicable interest rates, which will impact these calculations. These interest rates apply to both Line 7 and Line 8 calculations.

Applicable interest rates

The overpayment rate designated under IRC Section 6621 is used to calculate the interest for both hypothetical overpayments and underpayments. The applicable interest rates are published quarterly in revenue rulings in the Internal Revenue Bulletin available at IRS.gov.

However, for contracts completed in tax years ending after August 5, 1997, an interest rate is determined for each interest accrual period.

The interest accrual period starts on the day after the return due date (not including extensions) for each prior tax year. The interest accrual period ends on the return due date for the following tax year.

For the entire interest accrual period, the interest rate in effect is the overpayment rate determined under IRC Section 6621(a)(1) applicable on the first day of the interest accrual period.

Even though the interest rates change quarterly, for look-back purposes the interest rate stays the same for the accrual period which is generally one year.

Exceptions

- Loss or credit carrybacks or carryovers: The time period for determining interest may be different in cases involving loss or credit carrybacks or carryovers in order to properly reflect the time period during which the taxpayer or IRS had use of the hypothetical underpayment or overpayment.

- See Treasury Regulations Section 1.460-6(c)(4)(ii) and (iii) for additional information.

- Net operating loss, capital loss, net Section 1256 contracts loss, and credit carrybacks: If any of these increases or decreases as a result of the adjustment made to net income from long-term contracts, the interest due or to be refunded must be computed on the increase or decrease in tax attributable to the change to the carryback only from the due date (not including extensions) of the return for the prior year that generated the carryback

- Not from the due date of the return for the year in which the carryback was absorbed.

- See IRC Section 6611(f) for more details.

Interest calculations

For the increase or decrease in tax for each prior year, interest due or to be refunded must be computed at the applicable interest rate and compounded on a daily basis. The interest generally accrues from the due date (not including filing extensions) of the return for the prior year until the earlier of:

- The due date (not including extensions) of the return for the filing year or

- The date the return for the filing year is filed and any income tax due for that year has been fully paid.

Enter the total amount of interest increase in each applicable column in Line 7.

Line 8: Interest to be refunded on decrease

In the case of a decrease in tax on Line 6, if a refund has been allowed for any part of the income tax liability shown on Line 5 for any year as a result of a net operating loss, capital loss, net section 1256 contracts loss, or credit carryback to such year, and the amount of the refund exceeds the amount on Line 4, interest is allowed on the amount of such excess only until the due date (not including extensions) of the return for the year in which the carryback arose.

Using the same interest calculations as outlined in Line 7, enter the amount of interest decrease here in all applicable columns.

If Line 8, column (c) exceeds Line 7, column (c), then go to Line 9. Otherwise, proceed to Line 10.

Line 9: Net amount of interest to be refunded

Enter the net difference between Line 8, column (c) and Line 7, column (c). This represents the look-back interest that the federal government owes you.

Do not file IRS Form 8697 with your income tax return. Instead, file it separately at one of the addresses below.

Individuals

Individual taxpayers will send their completed Form 8697 to the following address.

Department of Treasury

Internal Revenue Service

Philadelphia, PA 19255-0001

All other taxpayers

All other taxpayers will send their completed form to this IRS address.

Department of Treasury

Internal Revenue Service

Cincinnati, OH 45999-0001

Complete the signature section of Form 8697 following the instructions for the signature section of your income tax return. If you file a joint return, the signature of both spouses is required on your completed IRS Form 8697.

If additional Forms 8697 are needed to show more than 2 redetermination years, sign only the first Form 8697.

The IRS will compute any additional interest to be refunded for periods after the filing date of Form 8697, and include this amount in your tax refund.

Report the amount on as interest income on your income tax return for the tax year in which it is received or accrued.

Line 10: Net amount of interest you owe

Enter the net difference between Line 7, column (c) and Line 8, column (c). This represents the look-back interest due to the IRS. Attach your completed Form 8697 to your income tax return.

The signature section of Form 8697 does not have to be completed by you or the paid preparer.

Individuals

For individuals, include any interest due in the amount to be entered for total tax (after credits and other taxes) on your return.

Write on the dotted line to the left of the entry space “From Form 8697” and the amount of interest due.

Partnerships

For partnerships (that are not closely held), write “From Form 8697” and include any interest due in the bottom margin of the tax return.

Attach a check or money order for the full amount made payable to “United States Treasury.” Write the following information on the check or money order:

- Partnership’s EIN

- Daytime telephone number

- Form 8697 Interest

S corporations

For S corporations that are not closely held, include any interest due in the amount to be entered for additional taxes. Write on the dotted line to the left of the entry space “From Form 8697” and the amount of interest due.

A closely held S corporation would also follow these procedures following a conversion from a C corporation for the contracts entered into prior to the conversion.

Closely held pass-through entities

For closely held pass-through entities, look-back interest is applied at the owner level and not the entity level.

Corporations

For corporations, include the amount of interest due on the appropriate line of Form 1120, Schedule J, Part I.

Tax deductibility of interest expense

Corporations (other than S corporations) may deduct this amount (or the amount computed by the IRS if different) as interest expense for the tax year in which it is paid or incurred.

For individuals and other taxpayers, this interest is not deductible.

Look-back interest owed is not subject to the estimated tax penalty.

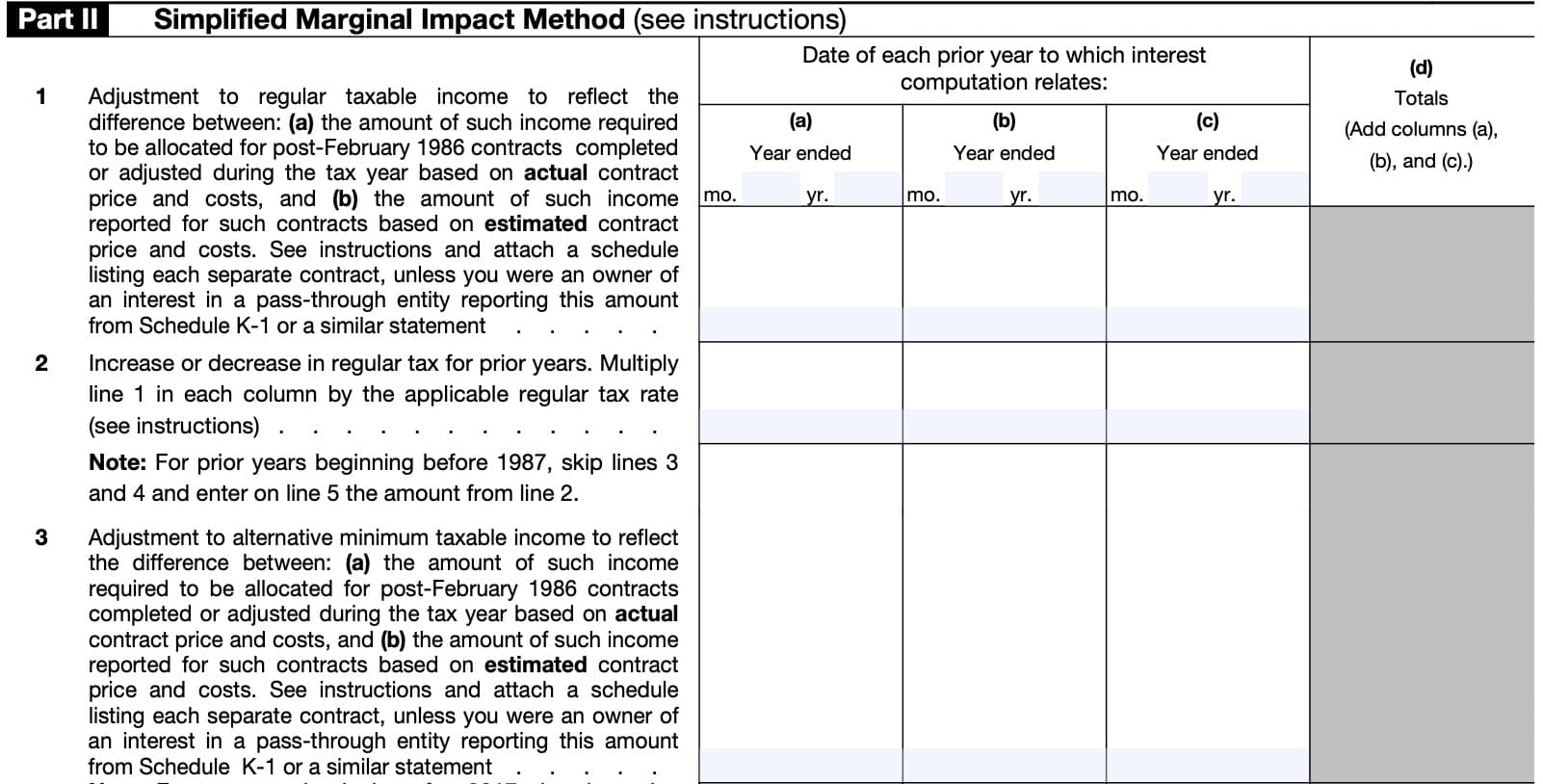

Part II: Simplified Marginal Impact Method

Under the simplified method, you will calculate prior year hypothetical tax underpayments or overpayments using an assumed marginal tax rate. This marginal tax rate is generally the highest statutory rate in effect for the prior year under either

- IRC Section 1 (individuals)

- IRC Section 11 (corporations)

This method eliminates the need to refigure your tax liability based on actual contract price and actual contract costs each time the look-back method is applied.

Top of Part II

Enter at the top of each column the ending month and year for each prior tax year in which you were required to report income from the completed long-term contract.

If there were more than 3 prior tax years, attach additional forms as needed. On the additional forms, enter your name, identifying number, and tax year.

Complete Lines 1 through 9 (as applicable), but do not enter totals in column (d). Enter totals only in column (d) of the first Form 8697.

Line 1: Adjustment to regular taxable income

Enter any adjustments to regular taxable income to reflect the difference between:

- Amount of such income required to be allocated for post-February 1986 contracts completed or adjusted during the tax year based on actual contract price and costs

- Amount of such income required to be allocated for post-February 1986 contracts completed or adjusted during the tax year based on estimated contract price and costs

In each column, show a net increase to income as a positive amount and a net decrease to income as a negative amount.

Unless you are the owner of an interest in a pass-through entity reporting on Schedule K-1, you’ll need to attach a schedule that:

- Identifies each completed long-term contract by the following:

- Contract number

- Job name, or

- Any other reasonable method used in your records to identify each contract; and

- For each contract, report in columns for each prior year:

- The amount of income previously reported based on estimated contract price and costs, &

- The amount of income allocable to each prior year based on actual contract price and costs.

- Total the columns for each prior year and show the net adjustment to income from long-term contracts.

An owner of an interest in a pass-through entity is not required to provide the detailed schedule listed above for prior years. The entity should provide the Line 1 amounts with Schedule K-1 or on a separate statement for its tax year in which the contracts are completed or adjusted.

Line 2: Increase or decrease in regular tax for prior years

Multiply the Line 1 amount for each column by the applicable regular tax rate in each year.

The applicable tax rates are as outlined below.

Individuals and pass-through entities in which, at all times during the year, more than 50% of the interests in the entity are held by individuals directly or through other pass-through entities:

| a. Tax years beginning before 1987 | 50% |

| b. Tax years beginning in 1987 | 38.5% |

| c. Tax years beginning in 1988, 1989, or 1990 | 28% |

| d. Tax years beginning in 1991 or 1992 | 31% |

| e. Tax years beginning in 1993 through 2000 | 39.6% |

| f. Tax years beginning in 2001 | 39.1% |

| g. Tax years beginning in 2002 | 38.6% |

| h. Tax years beginning in 2003 through 2012 | 35% |

| i. Tax years beginning in 2013 through 2017 | 39.6% |

| j. Tax years beginning in 2018 or later | 37% |

Corporations (other than S corporations) and pass-through entities not included

| a. Tax years ending before July 1, 1987 | 46% |

| b. For tax years beginning before July 1, 1987, that include July 1, 1987, the rate is 34% plus the following: Number of days in tax year before 7/1/1987 divided by number of days in tax year multiplied by 12%. | |

| c. Tax years beginning after June 30, 1987, and ending before 1993 | 34% |

| d. For tax years beginning before 1993 that include January 1, 1993, the rate is 34% plus the following: Number of days in tax year after 12/31/1992 divided by number of days in tax year multiplied by 1%. | |

| e. Tax years beginning after 1992, and ending before 2018 | 35% |

| f. Tax years beginning after 2017 | 21% |

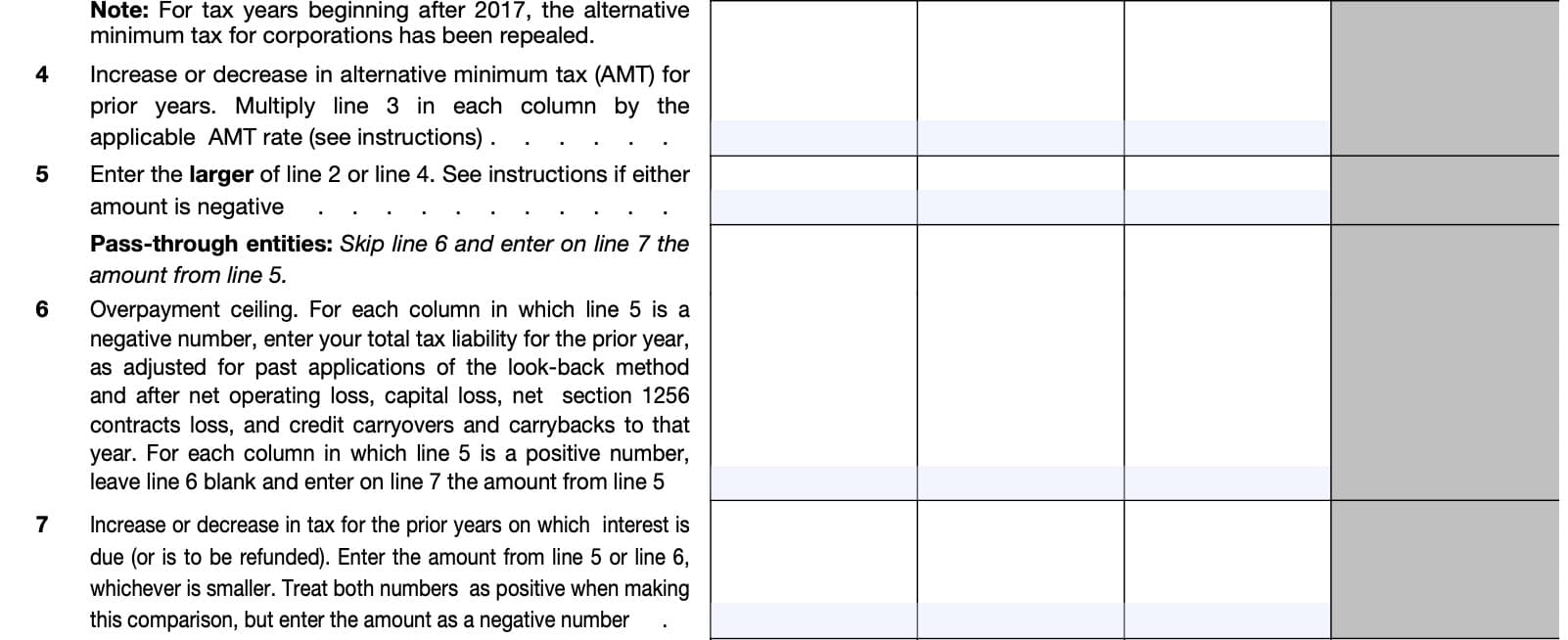

Line 3: Adjustment to alternative minimum taxable income

Complete Line 3 in the same manner as Line 1, above. However, only use income and deductions allowed for alternative minimum tax purposes (AMT).

For tax years beginning after 2017, the corporate minimum tax has been repealed.

Line 4: Increase/Decrease in AMT for prior years

Multiply the Line 3 amount by the applicable AMT rate, which is as follows:

Individuals and pass-through entities in which, at all times during the year, more than 50% of the interests in the entity are held by individuals directly or through other pass-through entities:

| a. Tax years beginning in 1987 through 1990 | 21% |

| b. Tax years beginning in 1991 or 1992 | 24% |

| c. Tax years beginning in 1993 or later | 28% |

Corporations (other than S corporations) and pass-through entities not included in 1 above:

| a. Tax years ending before 2018 | 20% |

| b. Tax years beginning after 2017 | 0% |

Line 5

Enter the larger of either:

- Line 2

- Line 4

If both Line 2 and Line 4 are negative, enter the greater amount. Treat both numbers as positive when making this comparison, but enter the amount as a negative number.

If the amount on one line is negative, but the amount on the other line is positive, enter the positive amount.

Pass-through entities

Pass-through entities skip Line 6, then enter the Line 5 amount on Line 7, then go to Line 8, below. All others, go to Line 6.

Line 6: Overpayment ceiling

For each Line 5 column where there is a negative number, enter your total tax liability for the prior tax year, as adjusted for:

- Past applications of the look-back method, and after

- Net operating loss

- Capital loss

- Net Section 1256 contracts loss, and

- Credit carryovers and carry backs to that year

For each column where the number is positive, leave Line 6 blank, then carry the Line 5 number to Line 7, below.

Line 7: Increase or decrease in tax for prior years

Enter the smaller of:

- Line 5

- Line 6

Treat both numbers as positive when making this comparison, but enter the amount as a negative number.

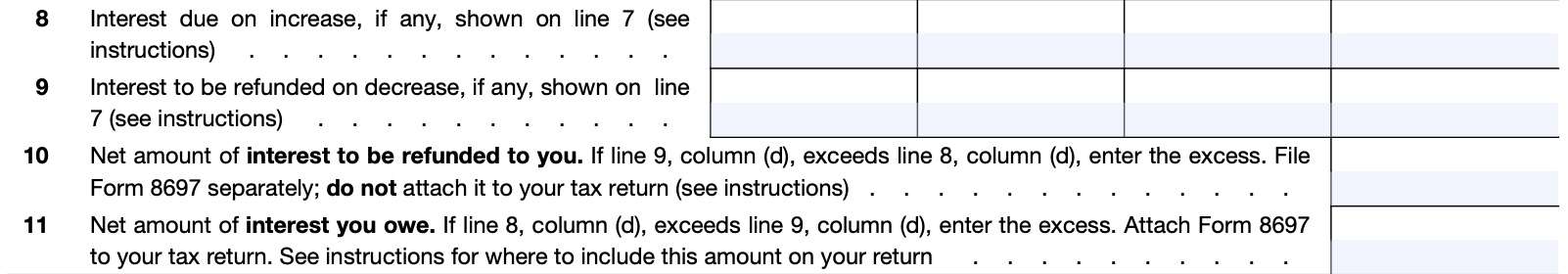

Line 8: Interest due on increase

For the increase (or decrease) in tax for each prior year, interest due or to be refunded must be computed at the applicable interest rate and compounded on a daily basis from the due date (not including extensions) of the tax return for the prior year until the earlier of:

- The due date of the return for the filing year, or

- Not including extensions

- The date the return for the filing year is filed and any income tax due for that year has been fully paid.

Enter the sum of all columns in Line 8 into Column (d).

Line 9: Interest to be refunded on decrease

Using the same calculations as on Line 8, enter any interest on tax decreases the IRS owes you on Line 9. Enter the sum of all columns in Line 9 into Column (d).

If Line 9, Column (d) exceeds Line 8, Column (d), go to Line 10 to calculate the net interest to be refunded to you. Otherwise, go to Line 11 to calculate how much interest you owe the IRS.

Line 10: Net amount of interest to be refunded to you

Enter the net difference between Line 8, column (d) and Line 9, column (d). This represents the look-back interest that the federal government owes you.

Do not file IRS Form 8697 with your income tax return. Instead, file it separately at one of the addresses below.

Individuals

Individual taxpayers will send their completed Form 8697 to the following address.

Department of Treasury

Internal Revenue Service

Philadelphia, PA 19255-0001

All other taxpayers

All other taxpayers will send their completed form to this IRS address.

Department of Treasury

Internal Revenue Service

Cincinnati, OH 45999-0001

Complete the signature section of Form 8697 following the instructions for the signature section of your income tax return. If you file a joint return, the signature of both spouses is required on your completed IRS Form 8697.

If additional Forms 8697 are needed to show more than 2 redetermination years, sign only the first Form 8697.

The IRS will compute any additional interest to be refunded for periods after the filing date of Form 8697, and include this amount in your tax refund.

Report the amount on as interest income on your income tax return for the tax year in which it is received or accrued.

Line 11: Net amount of interest you owe the IRS

Enter the net difference between Line 8, column (d) and Line 9, column (d). This represents the look-back interest due to the IRS. Attach your completed Form 8697 to your income tax return.

The signature section of Form 8697 does not have to be completed by you or the paid preparer.

Individuals

For individuals, include any interest due in the amount to be entered for total tax (after credits and other taxes) on your return.

Write on the dotted line to the left of the entry space “From Form 8697” and the amount of interest due.

Partnerships

For partnerships (that are not closely held), write “From Form 8697” and include any interest due in the bottom margin of the tax return.

Attach a check or money order for the full amount made payable to “United States Treasury.” Write the following information on the check or money order:

- Partnership’s EIN

- Daytime telephone number

- Form 8697 Interest

S corporations

For S corporations that are not closely held, include any interest due in the amount to be entered for additional taxes. Write on the dotted line to the left of the entry space “From Form 8697” and the amount of interest due.

A closely held S corporation would also follow these procedures following a conversion from a C corporation for the contracts entered into prior to the conversion.

Closely held pass-through entities

For closely held pass-through entities, look-back interest is applied at the owner level and not the entity level.

Corporations

For corporations, include the amount of interest due on the appropriate line of Form 1120, Schedule J, Part I.

Tax deductibility of interest expense

Corporations (other than S corporations) may deduct this amount (or the amount computed by the IRS if different) as interest expense for the tax year in which they paid or incurred the interest expense.

For individuals and other taxpayers, this interest is not deductible.

Look-back interest owed is not subject to the estimated tax penalty.

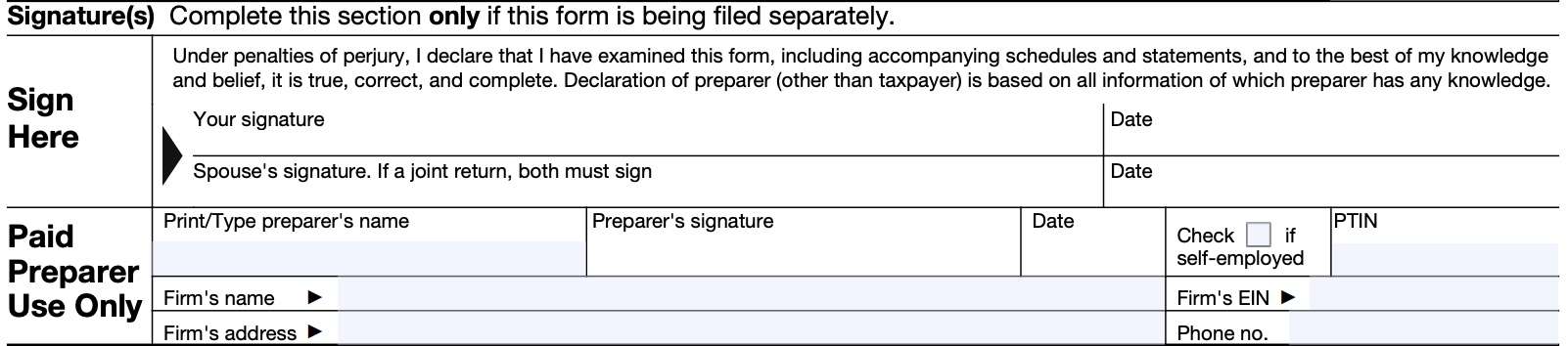

Taxpayer signature

Only complete the taxpayer signature field if:

- The IRS owes you interest due to a decrease in tax liability

- You do not need to file IRS Form 8697 with your federal tax return

Sign the form, under penalties of perjury. If you are married filing a joint tax return, both spouses will have to sign and date the form.

If you are using a paid tax preparer, your preparer should complete the bottom field, including:

- Tax preparer name and signature

- Preparer Tax Identification Number (PTIN)

- Firm name and address

- EIN

- Phone number

Video walkthrough

Watch this informative video to learn more about computing interest under the look-back method using IRS Form 8697.

Frequently asked questions

Taxpayers use IRS Form 8697 to compute interest on changes in tax liability under the look-back method for completed long-term contracts.

You may used the simplified method if you have elected to do so. Pass-through entities are required to apply the look-back method at the entity level.

Where can I find IRS Form 8697?

As with other tax forms, you can find IRS Form 8697 on the IRS website. For your convenience, we’ve enclosed the latest version below.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!