IRS Form 1099-G Instructions

If you received certain government payments, such as unemployment compensation or a refund from your state tax department, you might receive IRS Form 1099-G for these payments.

In our article, we’ll cover everything you need to know about IRS Form 1099-G, including:

- How to read IRS Form 1099-G

- Reporting payments on your federal income tax return

- Frequently asked questions

Let’s start with a comprehensive breakdown of this tax form.

Table of contents

IRS Form 1099-G Instructions

In most of our articles, we walk you through how to complete the tax form. However, since Form-1099 is issued to taxpayers for informational purposes, most readers will probably want to understand the information reported on their 1099-G form, instead of how to complete it.

Before we start breaking down this tax form, it’s important to understand that there can be up to 5 copies of Forms 1099-G. Here is a break down of where all these forms end up:

- Copy A: Internal Revenue Service center

- Copy B: For recipient’s tax records

- Copy C: For payer’s records

- Copy 1: For state, city, or local tax department

- Copy 2: To be filed with employee’s state, city, or local tax return

For employees who do not pay state, city, or local income tax, copies 1 and 2 are optional.

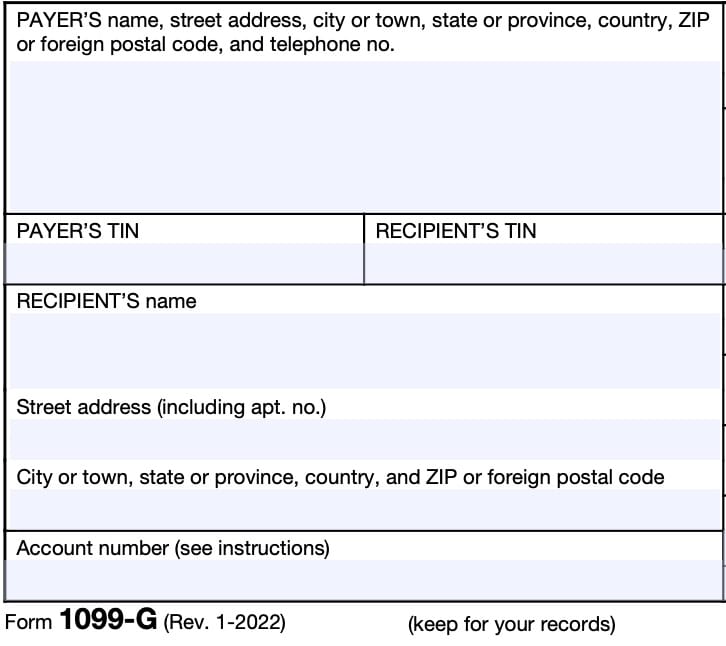

Let’s get into the form itself, starting with the information fields on the left side of the form.

Taxpayer identification fields

Payer’s Name, Address, And Telephone Number

You should see the payer’s complete business name, address, zip code, and telephone number in this field.

Payer’s TIN

This is the payer’s taxpayer identification number (TIN). In most situations, this will be the employer identification number (EIN).

The payer’s TIN should never be truncated.

Recipient’s TIN

As the recipient or payee, you should see your taxpayer identification number in this field. For payees, the TIN can be any of the following:

- Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

- Adoption taxpayer identification number (ATIN)

- Employer identification number (EIN)

Please review this field to make sure that it is correct. However, you may see a truncated form of your TIN (such as the last four digits of your SSN), for privacy protection purposes. Copy A, which is sent to the Internal Revenue Service, is never truncated.

Recipient’s Name And Address

You should see your legal name and address reflected in these fields. If your address is incorrect, you should notify the financial institution and the IRS.

You can notify the IRS of your new address by filing IRS Form 8822, Change of Address. Business owners can notify the IRS of a change in their business address by filing IRS Form 8822-B, Change of Address or Responsible Party, Business.

Account Number

This field is present in many information returns, such as IRS Form 1099-NEC or IRS Form 1099-MISC.

Your payer have established a unique account number for you, which may appear in this field. If the field is blank, you may ignore it.

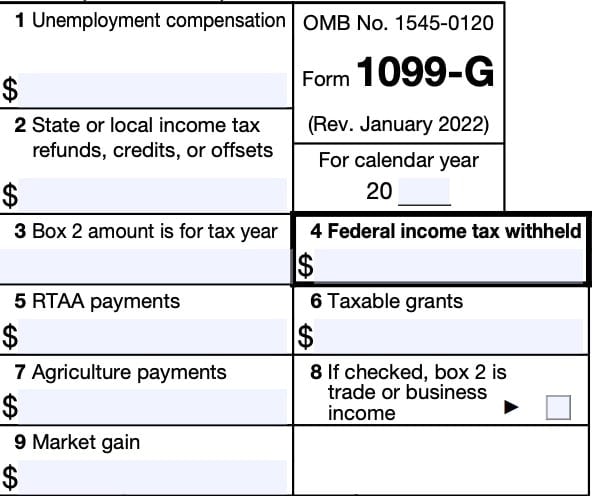

Boxes 1 through 9

On the right-hand side of the form are Boxes 1 through 9, as well as state tax information in Boxes 10 through 11. In most circumstances, some of these boxes will be blank.

However, let’s go through each box so we can better understand what you should expect to see, and where you should report it on your federal income tax return.

Box 1: Unemployment compensation

If you received unemployment benefits from your state government during the last year, then Box 1 will show the total unemployment compensation paid to you.

You should report the total of the Box 1 amounts from all Forms 1099-G, and report the total as gross income on the unemployment compensation line of your federal tax return.

Contributions to a government sponsored program

If you made contributions to a governmental unemployment compensation program or to a governmental paid family leave program, and you received a payment from that program, then the payer must issue a separate copy of Form 1099-G to report the amount of payments.

If you itemize deductions on Schedule A of your federal return, you may include the amount you paid as an itemized deduction. Otherwise, only include the total amount of benefit payments that exceeded your contributions as gross income.

Box 2: State or local income tax refunds, credits, or offsets

Box 2 shows any tax refunds, tax credits, or offsets of state or local income tax that you received. This amount may be taxable to you if you included these taxes as itemized deductions on Schedule A.

Even if you did not receive the amount shown, this amount may be taxable if it was deducted because:

- The amount was credited against state income taxes

- The amount was offset against federal or state debts or other offsets, or

- You made a charitable contribution with part of your refund amount

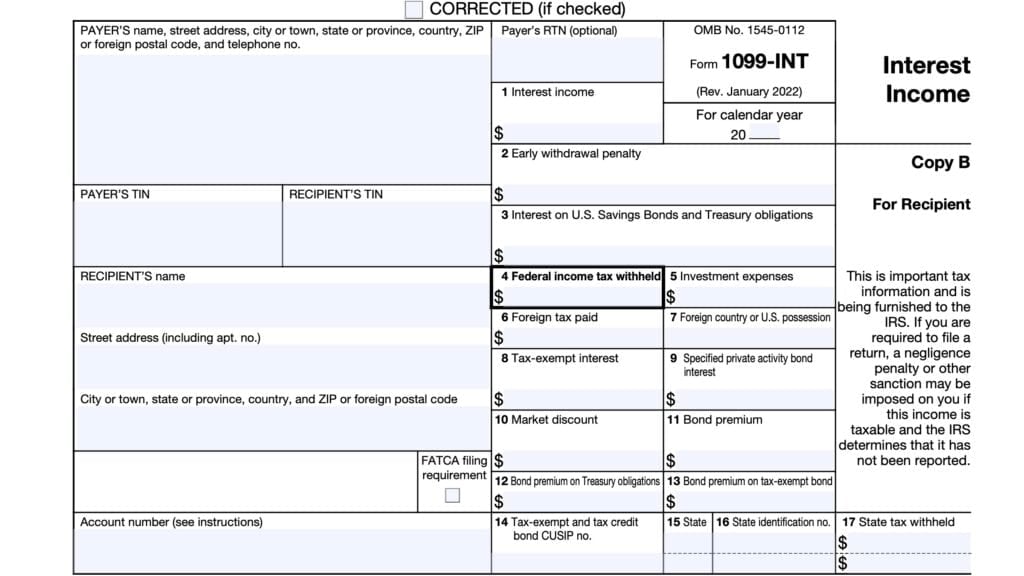

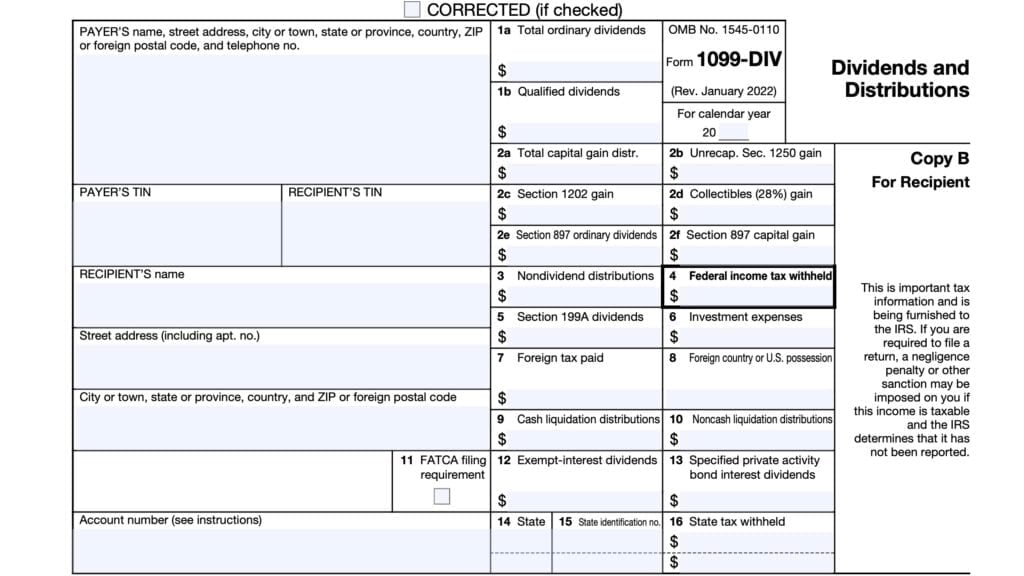

If you received interest income from this amount, you may also receive IRS Form 1099-INT to report the interest amounts. However, the payer may also include interest payments of less than $600 in the blank box next to Box 9, below.

Regardless of whether the interest is reported to you on Form 1099-G or Form 1099-INT, you must include it in gross income on your tax return.

Box 3: Tax year

Box 3 identifies the tax year for which the Box 2 refunds, credits, or offsets shown were made.

No entry is required here if the refund, credit, or offset is for the current tax year. However, if the refunds, credits, or offsets are for multiple tax years, then you should expect to receive a separate Form 1099-G reporting the amounts for each prior year.

Box 4: Federal income tax withheld

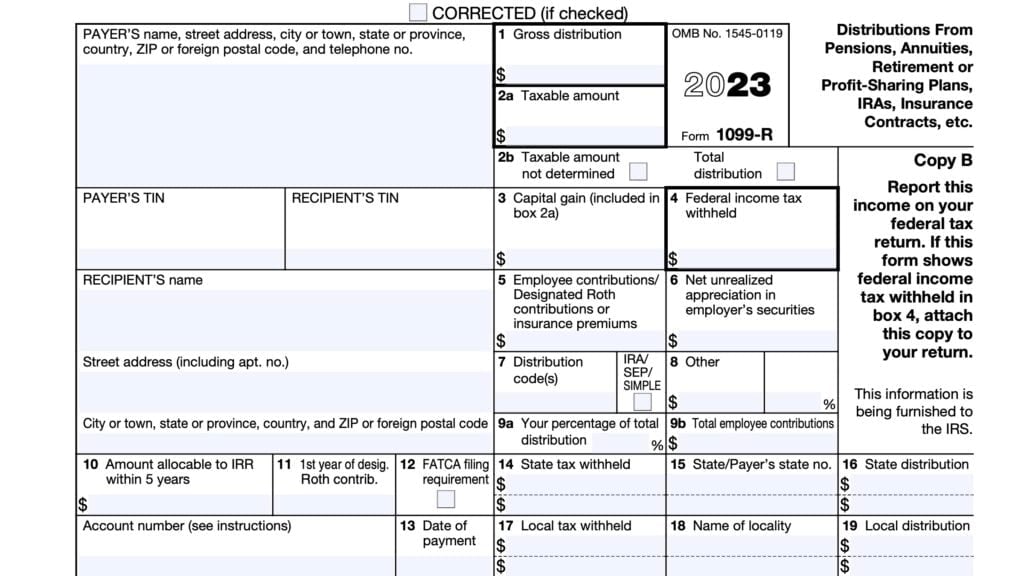

You should see backup withholding amounts reported in Box 4. If you have not given your TIN to the payer, you may be subject to backup withholding rules on payments made on IRS Form 1099-G.

In this case, you may be asked to complete IRS Form W-9, Request for Taxpayer Identification Number and Certification. This will allow the payer to report the correct TIN to the Internal Revenue Service.

Foreign recipients may be asked to complete IRS Form W-8 instead.

This box may also contain voluntary withholding of federal taxes for:

- Unemployment compensation

- Commodity Credit Corporation (CCC) loans, or

- Crop disaster payments

Box 5: RTAA payments

Box 5 indicates the amount of payments you may have received for reemployment trade adjustment assistance, otherwise known as RTAA payments.

Include Box 5 amounts on the ‘Other Income’ line of IRS Schedule 1, Additional Income & Adjustments to Income, when filing your tax return.

Box 6: Taxable grants

In Box 6, you should see any taxable grants you received from a federal, state, or local government.

This might include the following:

- Any taxable grant administered by federal, state, or local government agencies to provide subsidized energy financing

- Grants for projects designed to conserve or produce energy, specifically for properties located in the United States, or

- Any taxable grant administered by an Indian tribal government

This should not include scholarship grants, as they are either not considered reportable, or they are reported as wages on Form W-2.

Box 7: Agriculture payments

Box 7 shows your taxable Department of Agriculture payments.

If the payer shown is anyone other than the Department of Agriculture, it means the payer

has received a payment, as a nominee, that is taxable to you.

This may represent the entire agricultural subsidy payment received on your behalf by the

nominee, or it may be your pro rata share of the original payment.

IRS Publication 525, Farmer’s Tax Guide, contains additional information about how you might report these agricultural government payments on Schedule F of your income tax return.

Box 8

If this box is checked, the Box 2 amount is attributable to an income tax that applies exclusively to trade or business income and is not a tax of general application.

If taxable, report the Box 2 on either Schedule C or Schedule F when filing your tax return, as appropriate.

Box 9: Market gain

Shows market gain on CCC loans whether repaid using cash or CCC certificates.

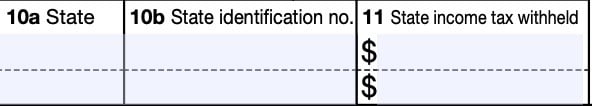

State tax information

Box 10a: State

If you live in a state without income tax, you may not see any information in Boxes 10a through 11. However, Boxes 10a, 10b, and 11 may contain relevant tax information for up to 2 different states.

If applicable, Box 10a will contain the two-letter abbreviation for the state for which your state income tax was withheld.

Box 10b: State Identification Number

If your financial institution has a specific state tax identification number, that TIN will appear in Box 10b.

Box 11: State Income tax withheld

Box 11 contains the state income tax withheld by the state listed in Box 10a.

Filing IRS Form 1099-G

For tax entities who must file this tax form with the Internal Revenue Service, the IRS requires certain paper versions of information returns to be accompanied by IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

Check out our step-by step instructional guide for more information on how to submit your information return with IRS Form 1096.

Video walkthrough

Watch this informative video for more details about IRS Form 1099-G.

Frequently asked questions

You may receive IRS Form 1099-G if you received unemployment compensation benefits, state or local income tax refunds, credits, or offsets, Reemployment Trade Adjustment Assistance (RTAA) payments, taxable grants, or agricultural payments from a federal, state, or local government.

If you file your return and later receive a Form 1099-G for income that you did not fully include on that return, you should file an amended return to report the income and take credit for any income tax withheld.

Taxpayers should receive copy B of the Form 1099-G no later than January 31 of the following tax year. If you have not received the form by then, contact the payer. If you still do not get the form by February 15, call the IRS for help at 1-800-829-1040.

Where can I find IRS Form 1099-G?

As with most tax forms, you can find IRS Form 1099-G on the IRS website. For your convenience, we’ve included the most recent version of the tax form right here, in this article.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!