IRS Form 8582-CR Instructions

If you own passive activities, you may already be familiar with passive loss rules. However, there are other rules that apply to passive activity income. For example, taxpayers use IRS Form 8582-CR to calculate limitations on passive activity credits they may take during the tax year.

In this article, we’ll walk through everything you need to know about this tax form, including:

- How to complete this IRS Form 8582-CR, step by step

- Worksheets associated with IRS Form 8582-CR

- Frequently asked questions

Let’s start with an overview on the tax form itself.

Table of contents

How do I complete IRS Form 8582-CR?

There are six parts to this two-page tax form:

- Part I: Passive Activity Credits

- Part II: Special Allowance for Rental Real Estate Activities With Active Participation

- Part III: Special Allowance for Rehabilitation Credits From Rental Real Estate Activities and Low-Income Housing Credits for Property Placed in Service Before 1990 (or From Pass-Through Interests Acquired Before 1990)

- Part IV: Special Allowance for Low-Income Housing Credits for Property Placed in Service After 1989

- Part V: Passive Activity Credit Allowed

- Part VI: Election To Increase Basis of Credit Property

Let’s start at the top of the tax form with Part I.

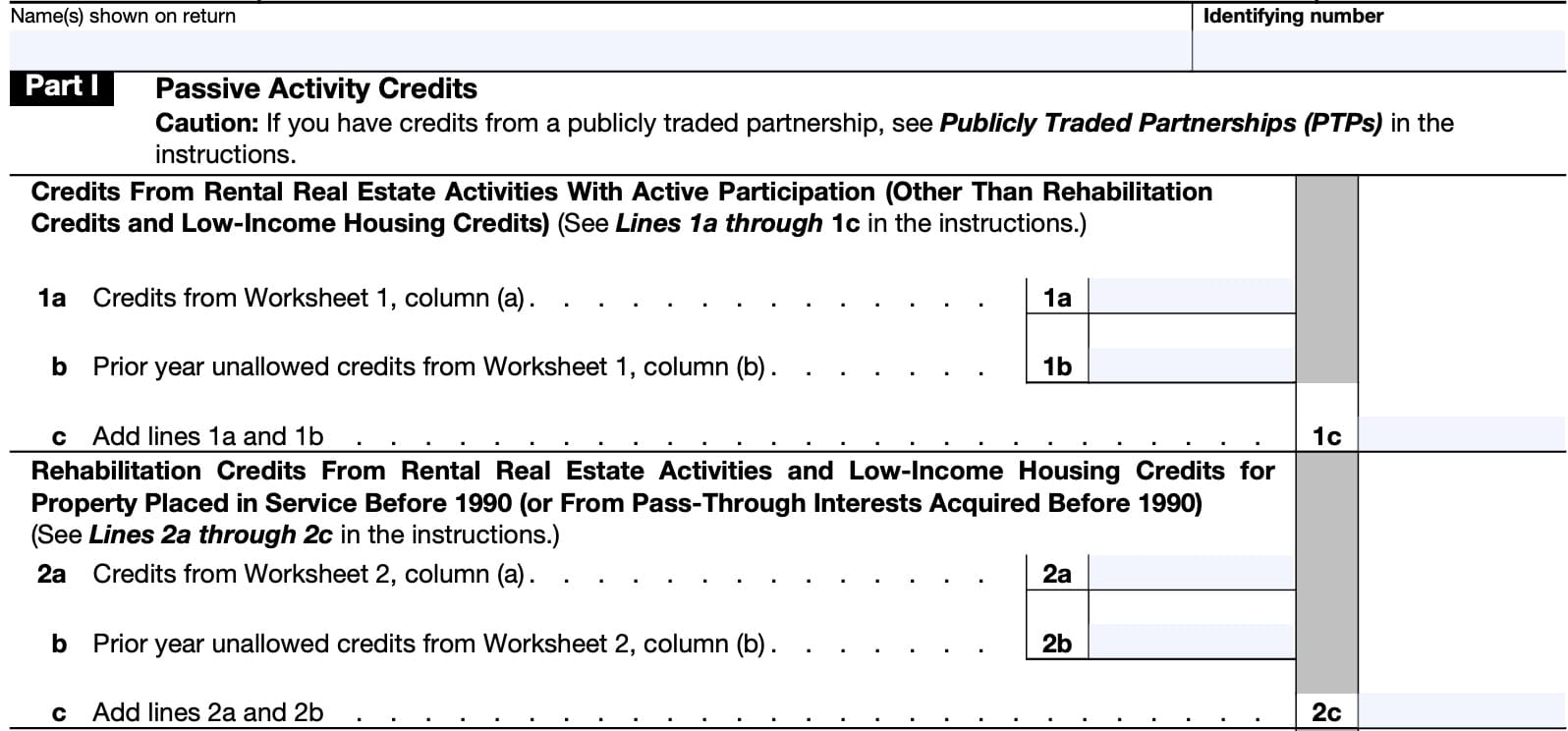

Part I: Passive Activity Credits

Before starting with Part I, you’ll need to ensure that the taxpayer name and identifying number match that of your income tax return.

IRS Form 8582-CR Worksheets

There are 4 worksheets located in the form instructions. As applicable, each worksheet provides information related to credits from passive activities as calculated on other tax forms.

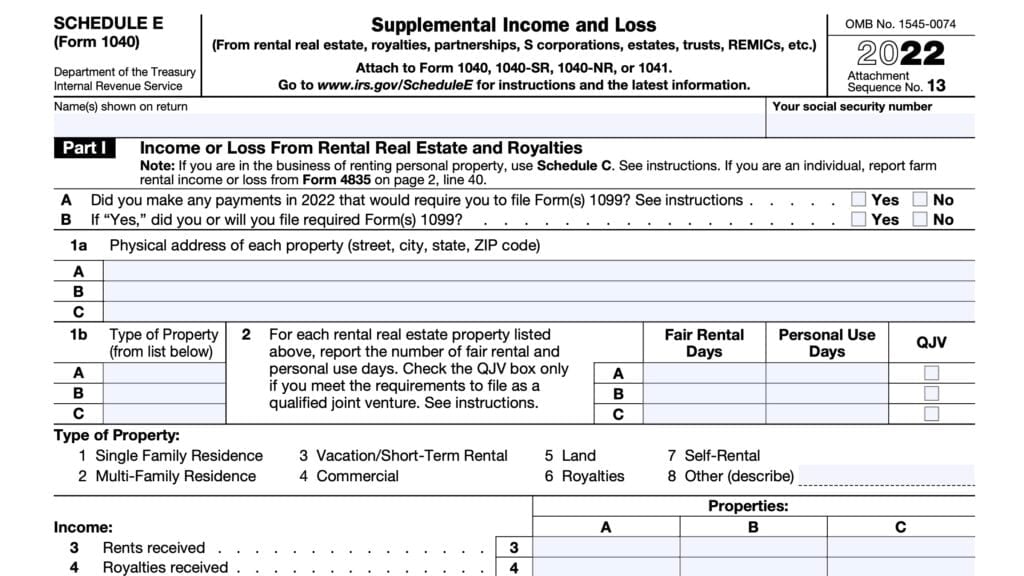

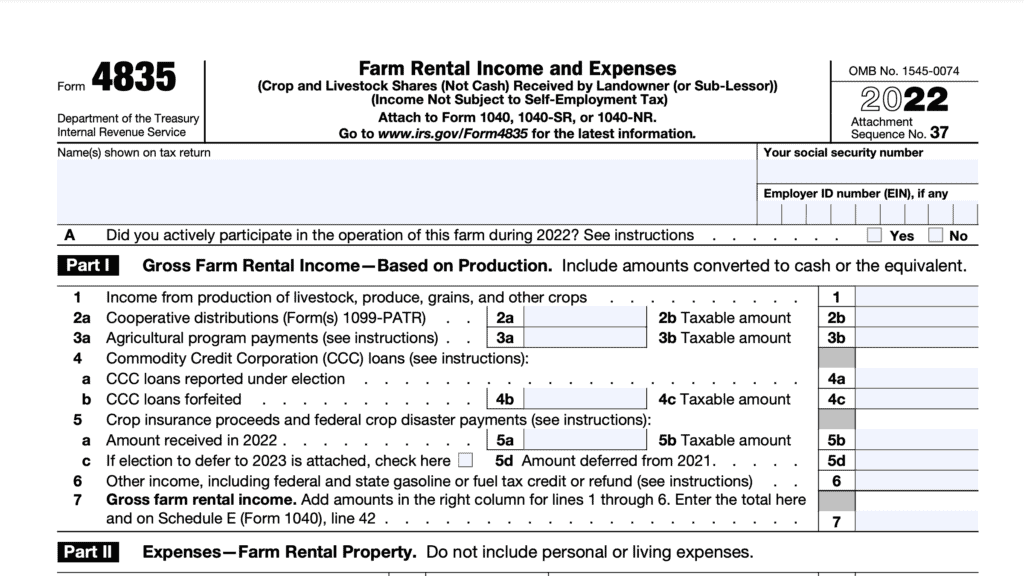

Most information that you provide in the worksheets will come from one of the three following tax forms:

- IRS Form 3800, General Business Credit

- IRS Form 8586, Low-Income Housing Credit

- IRS Form 8834, Qualified Electric Vehicle Credit

Although most taxpayers will not need to use every worksheet, it’s important to understand each worksheet’s function so we can best understand which worksheet(s) to use.

Let’s take a look at each worksheet in more depth.

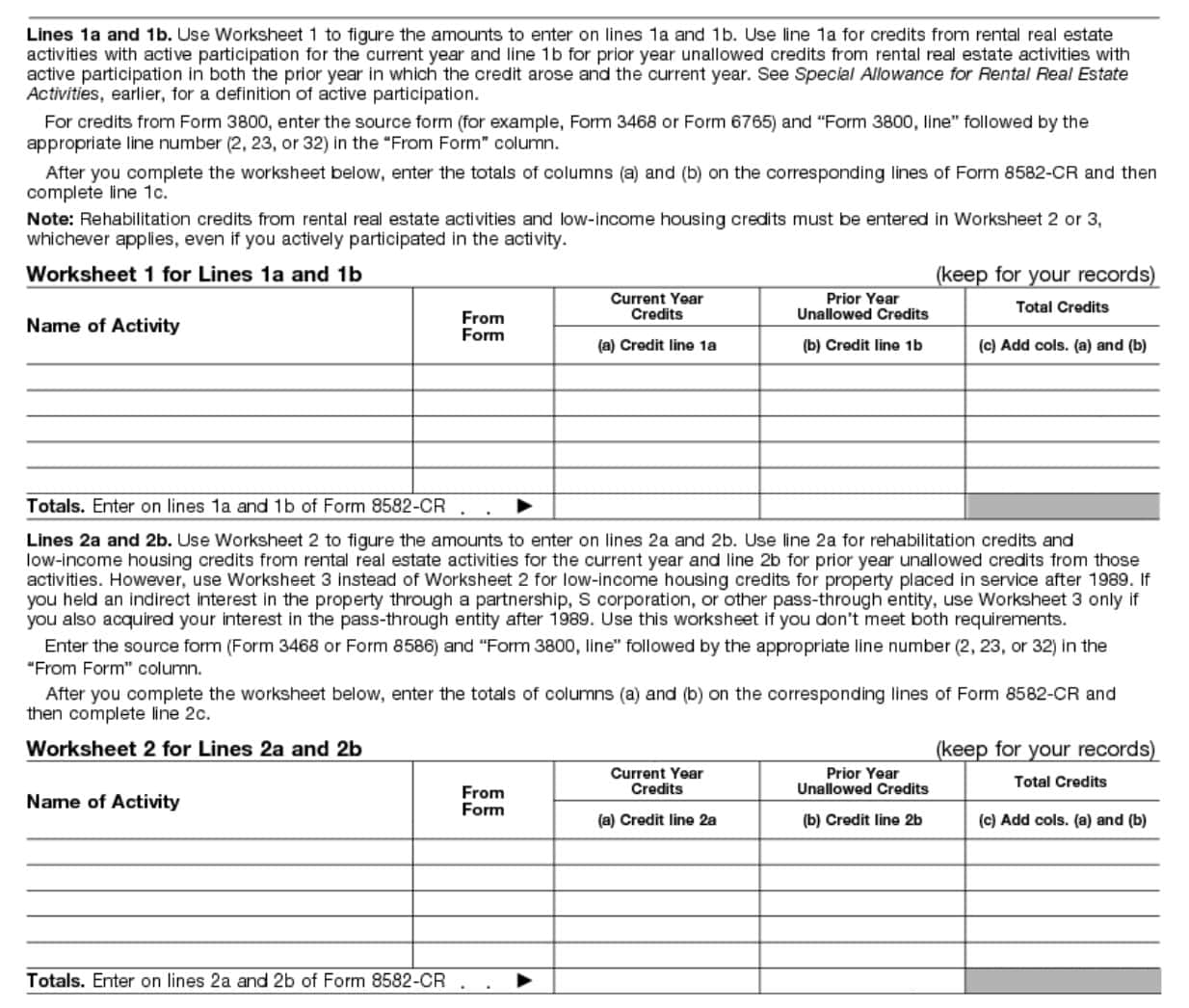

Worksheet 1

Worksheet 1 is for credits (other than rehabilitation credits and low-income housing credits) from passive rental real estate activities in which you actively participated.

These calculations go into Line 1, below.

Worksheet 2

Worksheet 2 is for rehabilitation credits from passive rental real estate activities and low-income housing credits for property placed in service before 1990.

This worksheet is also used for low-income housing credits from a partnership, S corporation, or other pass-through entity if your interest in the pass-through entity was acquired before 1990, regardless of the date the property was placed in service.

The calculations from Worksheet 2 go into Line 2, below.

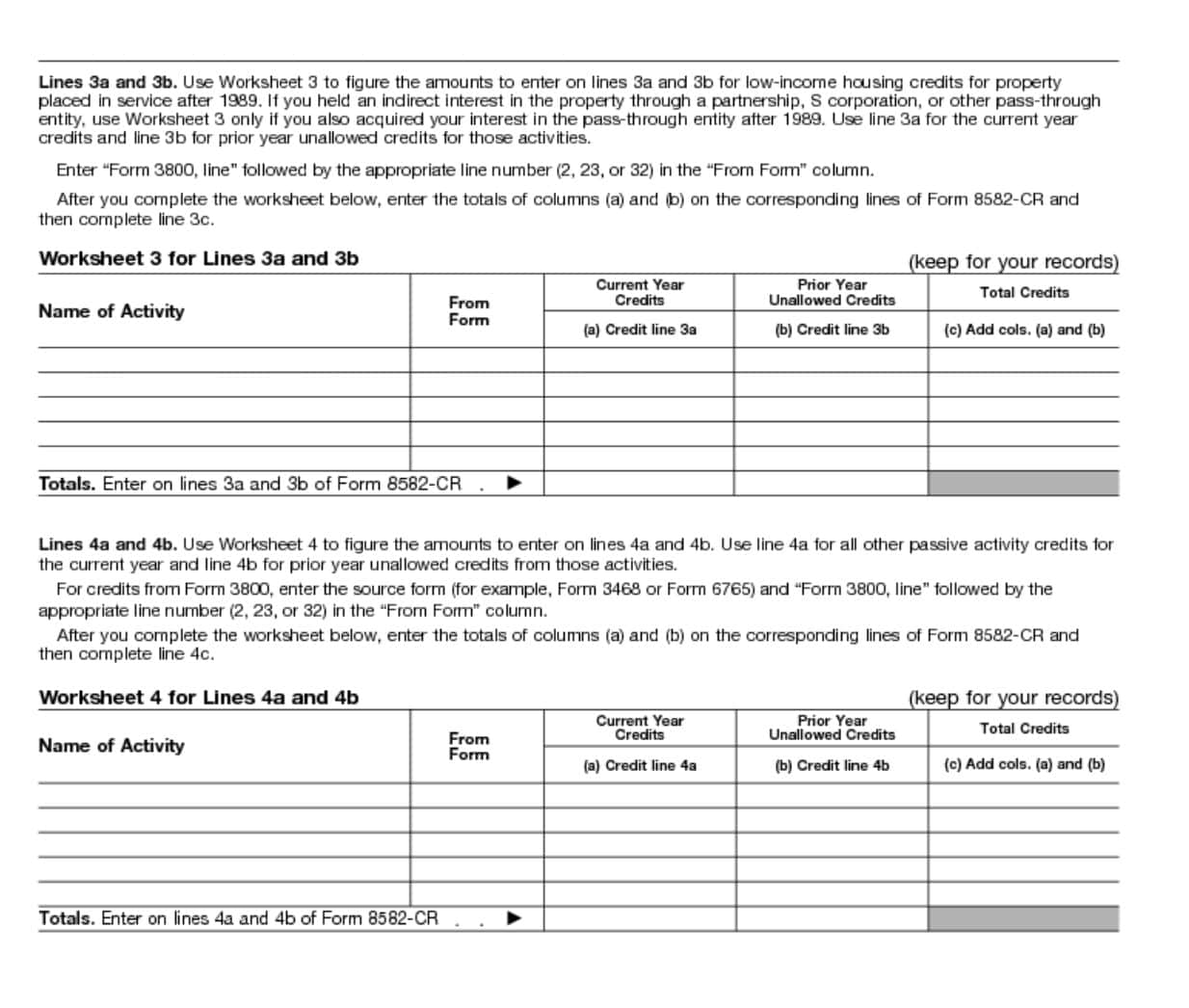

Worksheet 3

Worksheet 3 is for low-income housing credits for property placed in service after 1989, unless held through a pass-through entity in which you acquired your interest before 1990.

These calculations go into Line 3, below.

For taxpayers who are married filing separate returns, and you lived with your spouse at any time during the tax year, enter any credits that would nor

Include any applicable credits in Worksheet 4, but not in Worksheet 2 or 3, if you are married filing a separate return and lived with your spouse at any time during the year.

Worksheet 4

Worksheet 4 is for credits from the following:

- Passive trade or business activities in which you didn’t materially participate, and

- Passive rental real estate activities in which you didn’t actively participate

- Not including rehabilitation credits from passive rental real estate activities or low-income housing credits

Calculations from Worksheet 4 go into Line 4, below.

Line 1: Credits from Rental real estate activities with Active Participation

There are 3 parts to Line 1. But first, let’s discuss active participation, as compared to material participation. Let’s first discuss material participation.

Material Participation

According to the Internal Revenue Service, material participation in a business activity means that the activity is not a passive activity. Accordingly, the taxpayer can report tax credits directly on the specified tax form without respect to any passive activity loss limitations or passive activity credit limitations.

Conversely, trades or business activities in which the taxpayer did not materially participate are subject to special rules, known as passive loss rules.

A taxpayer is said to have materially participated in their business activity if the taxpayer can pass one of the following material participation tests:

- Participating in the activity for more than 500 hours in the current taxable year

- Taxpayer’s participation for the current year was substantially all of the participation in the activity of all individuals

- Taxpayer participated in the activity for more than 100 hours during the year and at least as much as any other individual

- The activity is a significant participation activity, and the taxpayer participated in all significant participation activities for more than 500 hours

- A significant participation activity is any trade or business activity in which you participated for more than 100 hours during the year and in which you didn’t materially participate under any of the material participation tests

- Taxpayer materially participated in the activity for any 5 of the 10 prior tax years

- Activity is a personal service activity in which the taxpayer materially participated in for any 3 preceding tax years

- Taxpayer demonstrates participation in the activity on a regular, continuous, and substantial basis during the tax year

Active participation

Active participation is a less stringent requirement than material participation. The Internal Revenue Service will consider a taxpayer to be an active participant if the taxpayer participated in making management decisions.

Examples of management decisions that prove active participation in a rental real estate activity include:

- Approving new tenants,

- Deciding on rental terms,

- Approving capital or repair expenditures, and

- Other similar decisions.

Line 1a

In Line 1a, you’ll enter any credits from real estate activities with active participation, as outlined above. This number comes from Worksheet 1, column (a).

Line 1b

Enter any prior year unallowed credits from Worksheet 1, column (b).

Line 1c

Add Line 1a and 1b, then enter the total in Line 1c.

Line 2: Rehabilitation credits from rental real estate activities and low-income housing credits for property placed in service before 1990

Line 2a

In Line 2a, enter applicable tax credits from Worksheet 2, column (a).

Line 2b

Enter any prior year unallowed credits from Worksheet 2, column (b).

Line 2c

Add Line 2a and 2b, then enter the total in Line 2c.

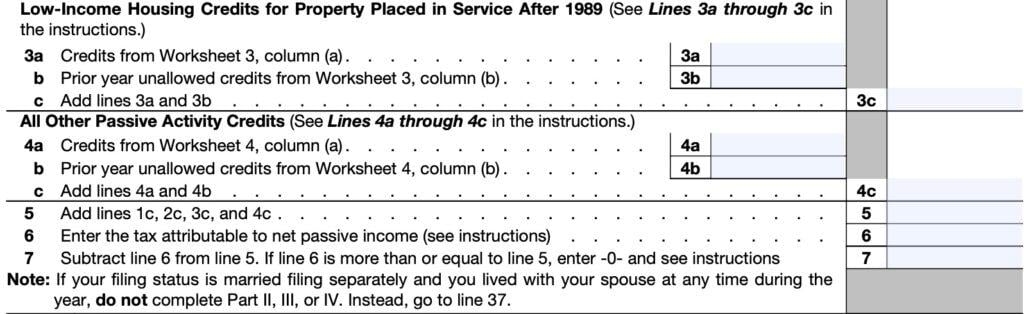

Line 3: Low-income housing credits for property placed in service after 1989

While Line 2 includes tax credits for rental property acquired before 1990, Line 3 includes low-income housing credits for rental property placed into service after 1989.

These figures will come from Worksheet 3, above.

Line 3a

In Line 3a, enter applicable tax credits from Worksheet 3, column (a).

Line 3b

Enter any prior year unallowed credits from Worksheet 3, column (b).

Line 3c

Add Lines 3a and 3b, then enter the total in Line 3c.

Line 4: All other passive activity credits

Individuals must include on Lines 4a through 4c any tax credits from passive activities that weren’t entered on Worksheets 1, 2, or 3.

Trusts must include credits from all passive activities in Worksheet 4.

Line 4a

In Line 4a, enter applicable tax credits from Worksheet 4, column (a).

Line 4b

Enter any prior year unallowed credits from Worksheet 4, column (b).

Line 4c

Add Lines 4a and 4b, then enter the total in Line 4c.

Line 5

Add the following:

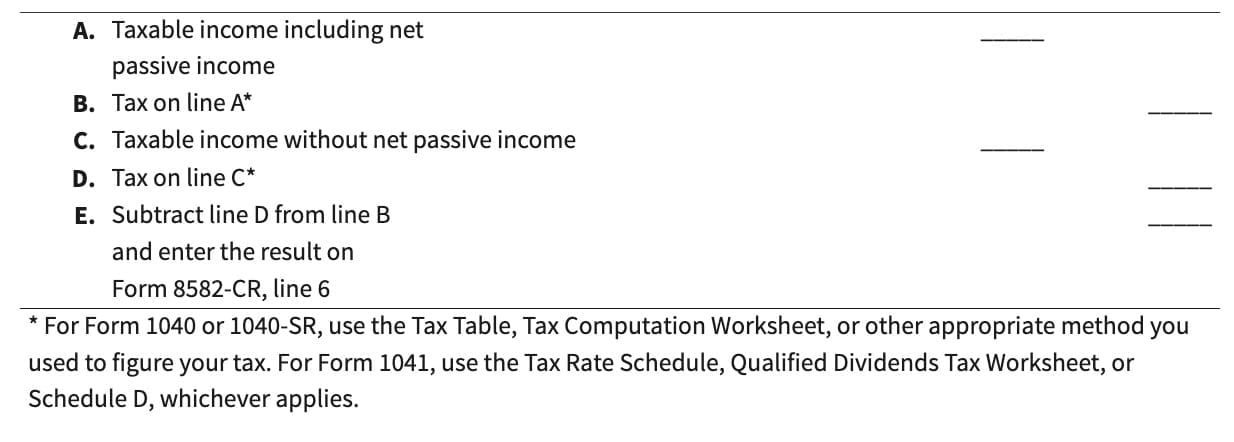

Line 6: Tax attributable to net passive income

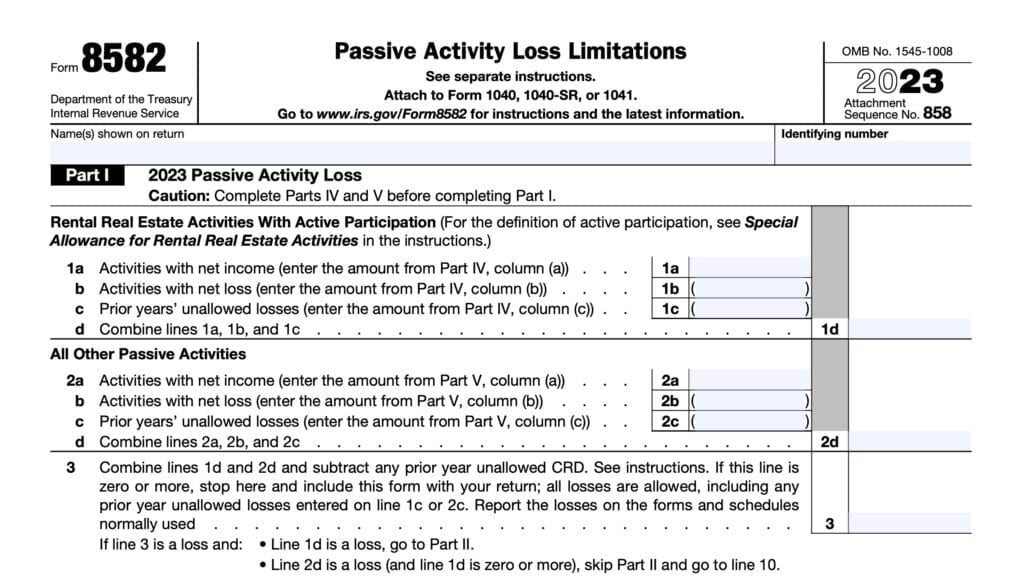

If IRS Form 8582, Line 4, shows net income or you didn’t complete the form because you had net passive income, you must calculate the tax liability on the net passive income.

If you have an overall loss on an entire disposition of your interest in a passive activity, then do the following:

- Reduce any net passive income from Line 4 on IRS Form 8582 to the extent of the loss, then

- Not below zero

- Use only the remaining net passive income in the below computation, from the form instructions

If you had net passive activity losses, enter ‘0’ on Line 6 and go to Line 7.

Line 7

Subtract Line 6 from Line 5, then enter the result here.

If Line 7 is zero or a negative number all your credits from passive activities are allowed.

In this case, enter the amount from Line 5 on Line 37 and report the credits on the forms normally used.

Married individuals who file separate returns but lived with their spouse at any point during the tax year are not allowed to claim any special allowance in Part II, Part III, or Part IV. In this case, proceed directly to Part V, below.

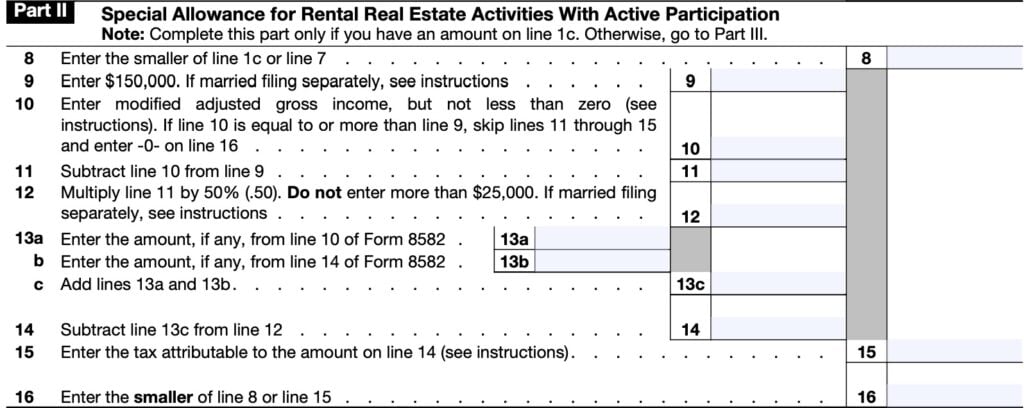

Part II: Special Allowance for Rental Real Estate Activities With Active Participation

Taxpayers will use Part II to calculate the amount of credit allowed from rental real estate activities in which they actively participated. This does not include rehabilitation credits or low-income housing tax credits.

Only complete Part II if you have an amount entered on Line 1c. Otherwise, go directly to Part III.

Line 8

In Line 8, enter the smaller of:

Line 9

Most individual taxpayers will enter $150,000.

Married taxpayers filing separate returns who lived apart from their spouse throughout the tax year must enter $75,000. Married couples filing separate returns who lived together at any point during the tax year are not eligible for this special allowance.

Line 10: Modified adjusted gross income

In Line 10, enter your modified adjusted gross income (MAGI), as long as it is not a negative number.

Calculating Modified Adjusted Gross Income

For passive activity purposes, include all items used to calculate adjusted gross income (AGI). From there, take out the following items:

- Any passive activity loss as defined in Internal Revenue Code Section 469(d)(1),

- Any rental real estate loss allowed to real estate professionals

- Any overall loss from a publicly traded partnership (PTP),

- The taxable amount of Social Security and Tier 1 railroad retirement benefits,

- Deductible contributions to either:

- Traditional individual retirement accounts (IRAs), or

- Section 501(c)(18) pension plans,

- The deduction allowed for self-employment tax purposes,

- The exclusion from income of interest from Series EE and I U.S. savings bonds used to pay higher education expenses,

- The exclusion of amounts received under an employer’s adoption assistance program,

- The student loan interest deduction,

- The tuition and fees deduction, or

- Foreign-derived intangible income and global intangible low-taxed income

Line 11

Subtract Line 10 from Line 9. Enter the result here.

Line 12

Multiply the Line 11 amount by 50% (0.50).

Do not enter more than the following:

- Taxpayers other than married individuals filing separate returns: $25,000

- Married couples filing separately, who lived apart from their spouse the entire year: $12,500

Line 13

There are three parts to Line 13:

Line 13a

Enter the amount from IRS Form 8582, Line 10, if applicable.

Line 13b

Enter the amount from IRS Form 8582, Line 14, if applicable.

Line 13c

Combine the amounts from Line 13a and Line 13b. Enter the result here.

Line 14

Subtract the Line 13c amount from Line 12. Enter the difference in Line 14.

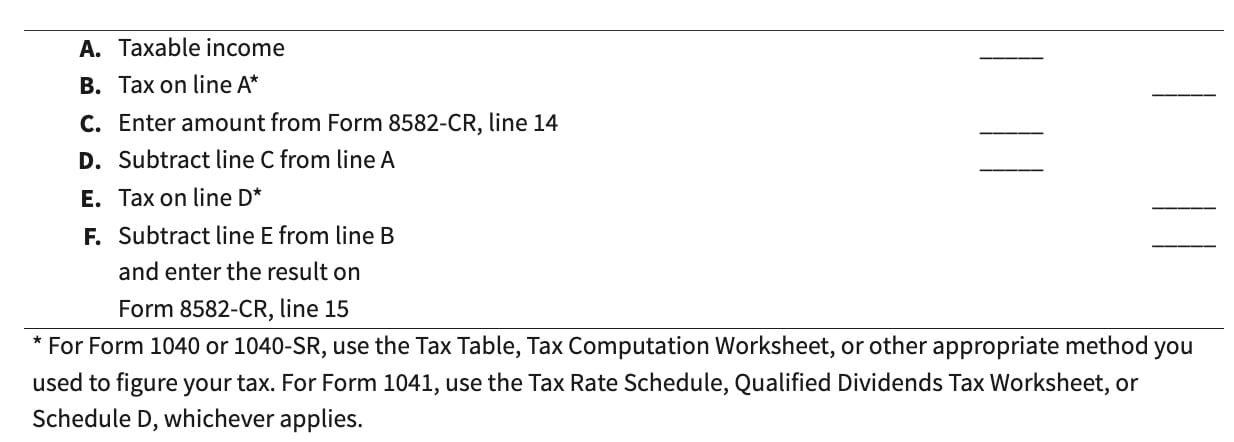

Line 15: Attributable tax

Enter the tax attributable to the income amount located in Line 14, using the steps outlined below.

Line 16

In Line 16, enter the smaller of:

This represents your special allowance for rental real estate activities with active participation.

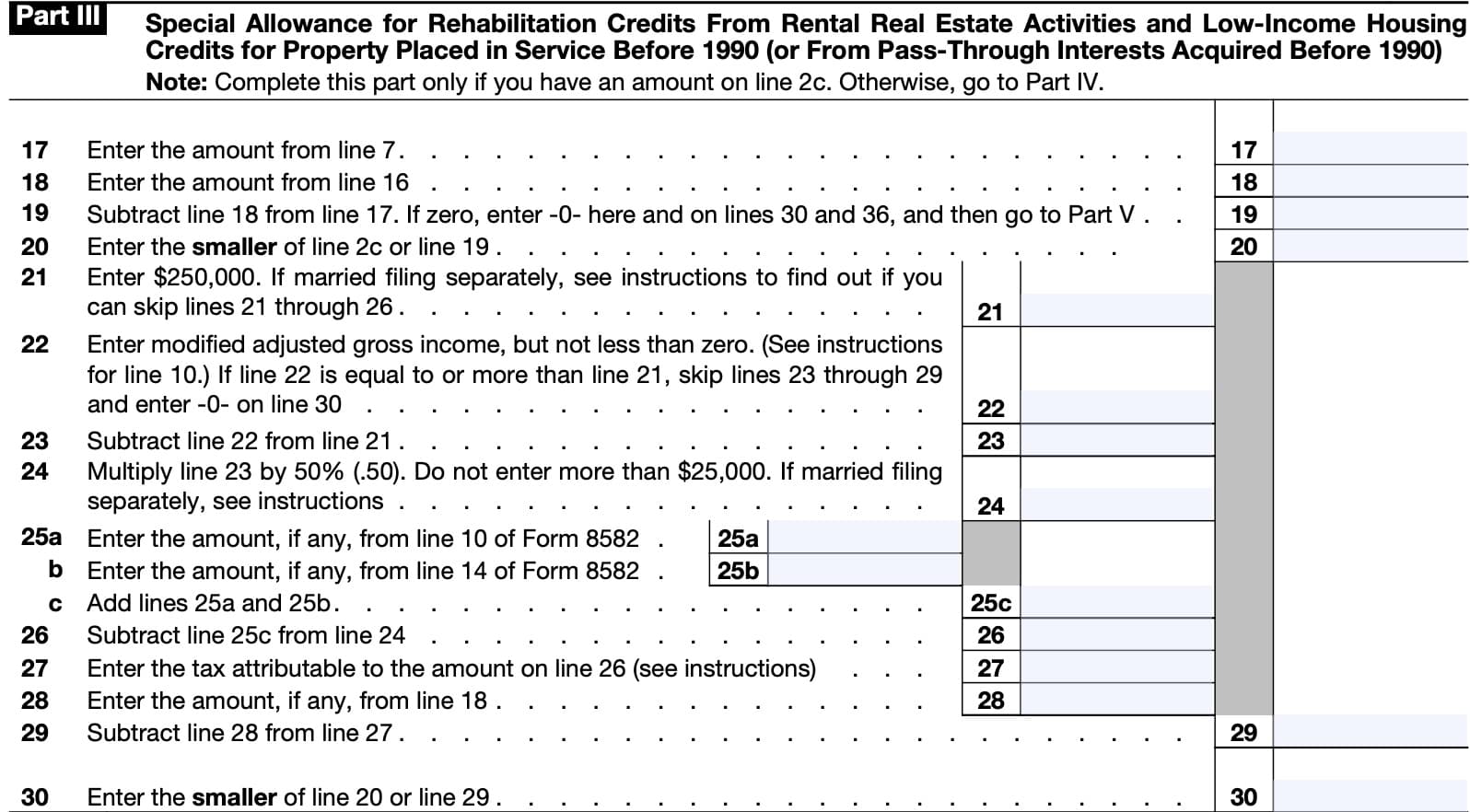

Part III: Special Allowance for Rehabilitation Credits From Rental Real Estate Activities and Low-Income Housing Credits for Property Placed in Service Before 1990 (or From Pass-Through Interests Acquired Before 1990)

In Part III, we’ll calculate the amount of credit allowed if you have either:

- Rehabilitation tax credits, or

- Low-income housing credits for property placed into service before 1990

You can also use Part III if your low-income housing credit is from a pass-through entity, such as a partnership or S corporation, in which you acquired your interest before 1990, regardless of when the property was placed into service.

Line 17

Enter the Line 7 amount here.

Line 18

Enter the Line 16 amount here.

Line 19

Subtract Line 18 from Line 17. If the result is a positive number, go to Line 20.

If this results in zero or a negative number, then enter ‘0’ here and on:

Afterwards, go directly to Part V.

Line 20

In Line 20, enter the smaller of:

Line 21

Skip Lines 21 through 26 if:

- You completed Part II, above, and

- Your MAGI from Line 10 was $100,000 or less

- $50,000 for married taxpayers filing separate returns who lived apart from their spouse the entire tax year

Instead, enter the Line 15 amount directly on Line 27, then go to Line 28.

Most taxpayers will enter $250,000 here. For married individuals filing separate tax returns who lived apart from their spouse for the entire tax year, enter $125,000.

Line 22

Line 23: Modified adjusted gross income

Using the instructions outlined in Line 10, enter your MAGI, but do not enter a negative number.

If Line 22 is equal to or greater than Line 21, then:

Line 24

Multiply the Line 23 amount by 50% (0.50).

Enter the result here, but do not enter more than:

- $25,000 for most taxpayers

- $12,500 for married taxpayers filing a separate return who has lived apart from their spouse for the entire year

Line 25

There are three parts to Line 25:

Line 25a

Enter the amount from IRS Form 8582, Line 10, if applicable.

Line 25b

Enter the amount from IRS Form 8582, Line 14, if applicable.

Line 25c

Combine the amounts from Line 25a and Line 25b. Enter the result here.

Line 26

Subtract Line 25c from Line 24, then enter the difference here.

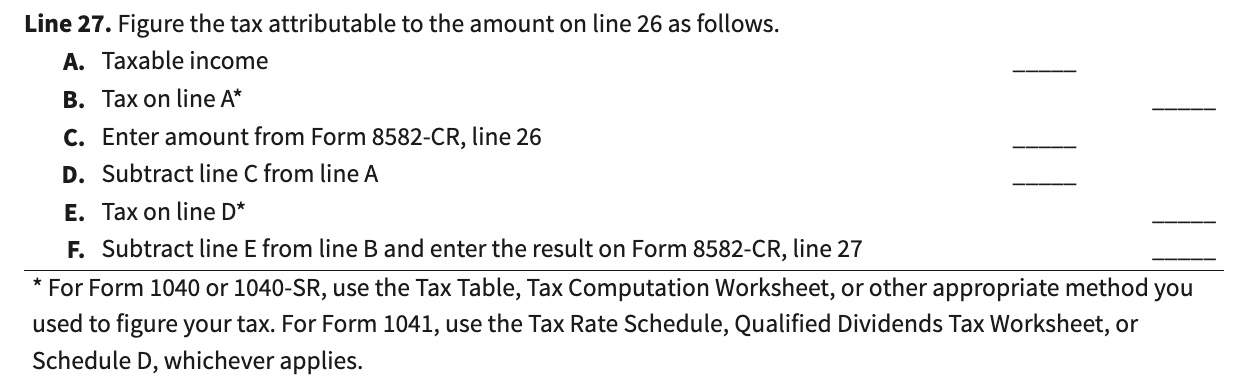

Line 27: Attributable tax

Calculate the tax attributable to the income items in Line 26, using the instructions outlined below.

Line 28

Enter the Line 18 amount, if applicable.

Line 29

Subtract Line 28 from Line 27. Enter the difference here.

Line 30

In Line 30, enter the smaller of:

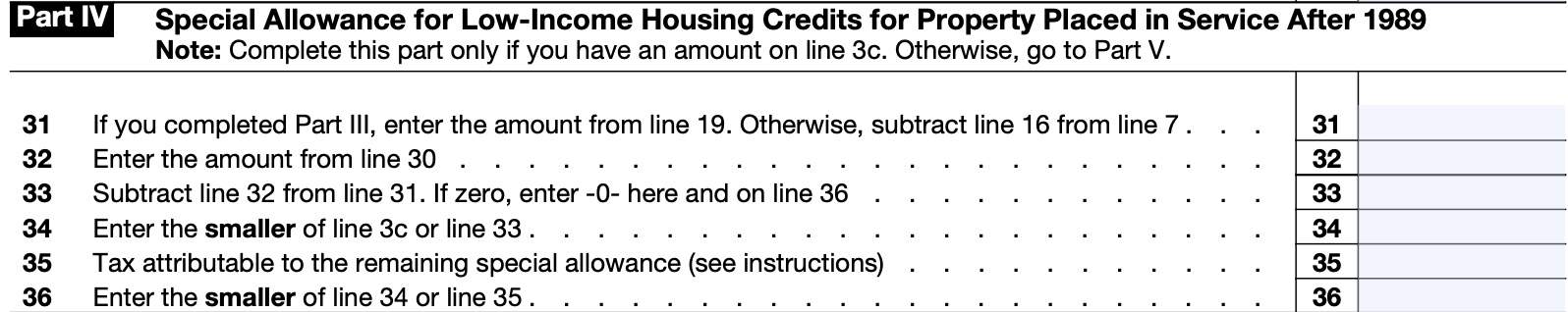

Part IV: Special Allowance for Low-Income Housing Credits for Property Placed in Service After 1989

Use Part IV to figure the credit allowed if you have any low-income housing credits for property placed in service after 1989.

If you held an indirect interest in the property through a partnership, S corporation, or other pass-through entity, use Part IV only if your interest in the pass-through entity was also acquired after 1989.

Line 31

If you completed Part III, enter the Line 19 amount.

Otherwise, subtract Line 16 from Line 7, then enter the difference here.

Line 32

Enter the Line 30 amount here.

Line 33

Subtract Line 32 from Line 31.

If the result is zero or a negative number, enter ‘0’ on this line and on Line 36, below.

Line 34

In Line 34, enter the smaller of:

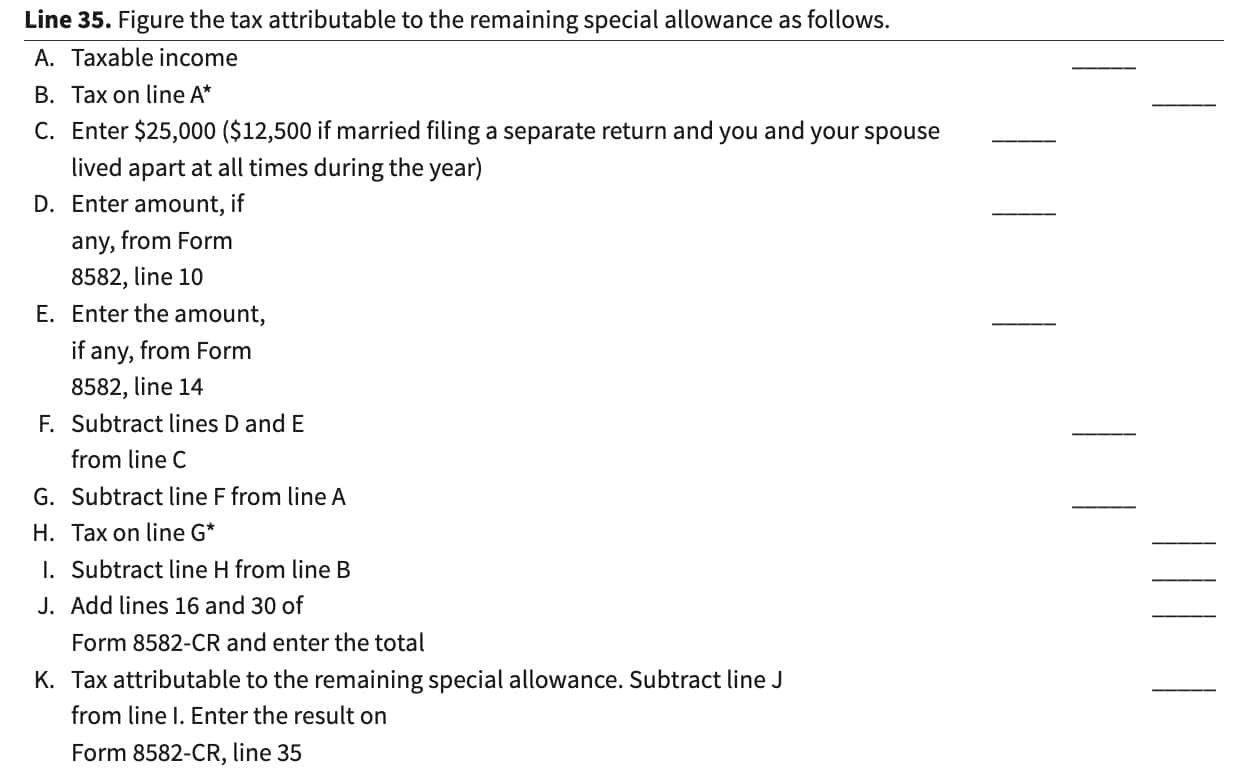

Line 35: Attributable tax

Using the following instructions, enter the tax attributable to the remaining special allowance.

Line 36

In Line 36, enter the smaller of:

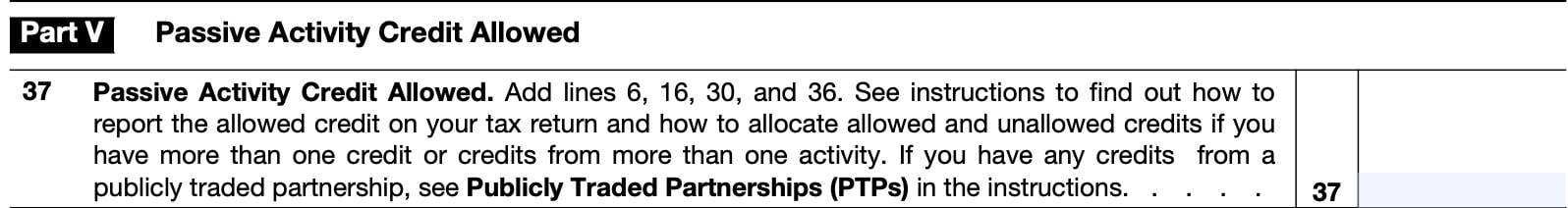

Part V: Passive Activity Credit Allowed

Use Part V to figure the passive activity credit, as determined in Part I, that is allowed for the current year for all passive activities.

Line 37

In Line 37, enter the total of the following lines:

If you have tax credits from publicly traded partnerships (PTPs), further guidance can be found in the form instructions.

However, you may need to use one or more of the following worksheets to allocate allowed and unallowed credits if:

- You have tax credits from more than one passive activity, or

- You have more than one type of tax credit

Worksheet 5 & worksheet 6

Use Worksheet 5 if:

- You have an amount on Line 1c, and

- You have credits from more than one activity

Use Worksheet 6 if:

- You have an amount on Line 2c, and

- You have credits from more than one activity

Worksheets 7 through 9

Use Worksheet 7 if:

- You have an amount on Line 3c, and

- You have credits from more than one activity

Use Worksheet 8 if:

- You have tax credits from Line 4c from more than one activity or reported on different forms, or

- You have amounts in column (d) of Worksheets 5, 6, or 7

For Worksheet 9, enter all activities from Worksheet 8. The credits in Column (a) should reflect the tax credits shown in Worksheets 1 through 4 for all activities listed in Worksheet 8.

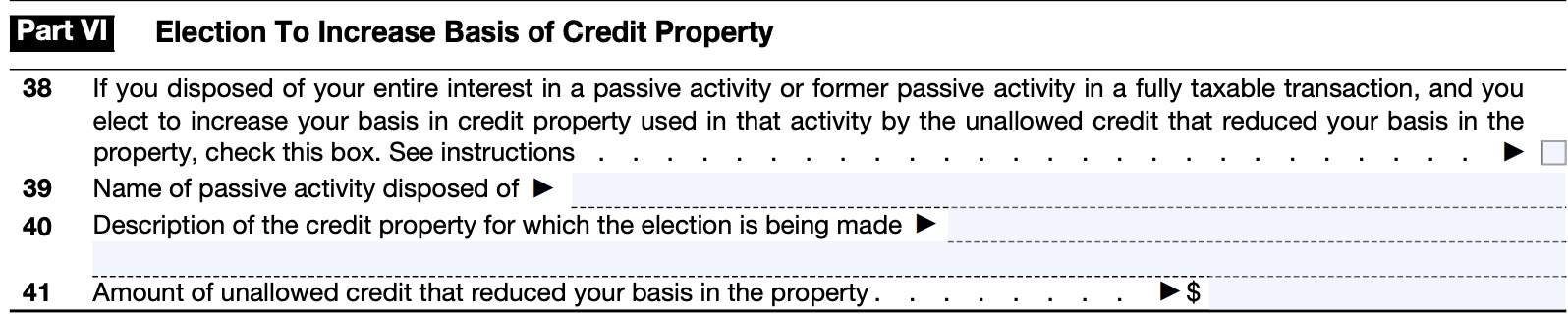

Part VI: Election To Increase Basis of Credit Property

Complete Part VI if you disposed of your entire interest in a passive activity and elect to increase the basis of the credit property used in the activity by the unallowed credit that reduced the basis of the property.

Line 38

Check the box in Line 38 if:

- You disposed of your enter interest in a passive activity or former passive activity in a fully taxable transaction, and

- You elect to increase your basis in credit property used in that activity by the unallowed credit that reduced your basis in the property

Line 39: Name of passive activity disposed

Enter the name of the specific passive activity that you disposed of.

Line 40: Description of credit property

In Line 40, enter a description of the credit property for which you are making the election to increase basis.

Line 41: Amount of unallowed credit

Enter the amount of unallowed tax credit that reduced your basis in the property that you disposed of.

Video walkthrough

Watch this instructional video to learn more about passive activity credit limitations and IRS Form 8582-CR.

Frequently asked questions

IRS Form 8582-CR is filed by individuals, estates, and trusts with either general business credits or a qualified plug-in electric and electric vehicle credit from passive activities.

As a general rule, passive activities include trade or business activities in which you didn’t materially participate, or rental activities, regardless of participation. Certain exceptions exist for real estate professionals, working interests in oil or gas wells, and for trading certain personal property.

Where can I find IRS Form 8582-CR?

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!