7 Key Facts About Splitting IRAs & 401Ks in a Divorce

When dividing marital property in a divorce, a common way to make a mistake is in the division of retirement assets. Many people assume that individual retirement accounts (IRAs) and 401k accounts are the same. Both are retirement plans.

But there are some key differences. If you don’t account for those differences during a divorce, you could be making a mistake with huge tax implications.

Here are seven key differences between IRAs and 401ks that you should know in a divorce case.

Contents

1. You don’t need a QDRO to divide an IRA.

In the event of a divorce, to access your ex-spouse’s 401k, you must give the plan administrator a qualified domestic relations order (known as a QDRO).

What is a QDRO?

A QDRO is a judgment, decree, or court order that gives an ‘alternate payee’ the right to receive a portion or all of the benefits of a retirement plan. An alternate payee can either be the ex-spouse of the retirement plan participant. It can also be another dependent, such as a child.

A QDRO is drafted by the involved attorneys, usually the divorce attorney representing the non-employee spouse. Once the attorneys agree on the QDRO, they submit the draft to the appropriate jurisdiction (such as a court).

From there, the QDRO is issued, either as part of the divorce decree, or as a separate order.

Finally, the QDRO is sent to the retirement plan administrator. The administrator has specific duties and responsibilities to determine whether the order actually ‘qualifies’ or whether it needs to be amended.

Needless to say, there are a lot of variables here, and a lot of ways this process can go awry. A good QDRO attorney can identify, and help you avoid these pitfalls when dividing a 401k.

This treatment applies to any qualified retirement plan, not just 401k plans.

However, none of this applies to an ex-spouse’s IRA. Regardless of whether it’s a traditional IRA or Roth IRA, IRAs are treated differently from qualified plans.

What is needed to split an IRA during a divorce?

The IRA custodian needs only the copy of the divorce decree. The divorce agreement should clearly define how the IRA should be divided.

The best way to do this is to specify that the IRA division is to be treated as a transfer incident to the divorce. This will result in a direct trustee-to-trustee transfer or rollover of IRA funds into the former spouse’s own account.

For example, let’s imagine Kevin and Anne are getting a divorce.

Anne is to receive 50% of Kevin’s IRA. Kevin’s IRA is currently valued at $100,000. The divorce decree should clearly state how much Anne is to receive.

The best thing for Anne to do would be to present a copy of the divorce decree to the custodian. From there, Anne would ask for her share to be transferred to her own IRA.

If Anne does not already have an IRA, the custodian should new IRA for her. In this case, Anne’s IRA would receive a direct transfer of $50,000. Done correctly, this IRA transfer should not be a taxable event.

In other words, dividing an IRA can be much simpler than dividing a 401k. However, there are some limitations, particularly if you need to generate cash.

2. The 10% early withdrawal penalty doesn’t apply to a 401k withdrawal—pursuant to a QDRO.

Before we go too far, let’s discuss the early withdrawal tax penalties for IRAs and 401k plans.

As a general rule, for withdrawals from a retirement plan before age 59 ½, the IRS imposes a 10% early withdrawal penalty. This tax penalty is in addition to the federal income taxes that would apply.

There are exceptions, such as if the account owner dies or becomes permanently disabled. One of those exceptions, is outlined under Internal Revenue Code 72(t)(2)(C). The exception is payments to alternate payees pursuant to a qualified domestic relations order.

The QDRO exception only applies to qualified plans

However, it’s clear that this exception only applies to qualified retirement plans. An IRA is not a qualified plan.

Not being a qualified plan is what allows you to divide an IRA without a QDRO. That also means that this exception does not apply to IRA assets.

Using the above example, let’s imagine that Anne needs $10,000 in cash. She and Kevin are both 45, so they would be subject to the IRS’ 10% penalty for early withdrawal.

If Anne takes $10,000 from her share of the IRA, she would owe taxes on the withdrawal (at her ordinary income tax rate), plus $1,000 (10% of the $10,000 withdrawal).

Let’s assume that Kevin also has $100,000 in a 401k at work. If Anne were to have a QDRO drafted as part of the divorce settlement, she could have the QDRO state that $10,000 be distributed directly to her. Anne would still pay the same taxes on the 401k withdrawal as she would on the IRA withdrawal.

But Anne would avoid paying the $1,000 early withdrawal penalty that applies to IRA accounts.

This assumes that the withdrawal is pursuant to a QDRO, which is an important distinction. If you have emergent cash needs, and the QDRO is taking too long, you might be tempted to take a short cut.

You might be better off trying to find another source of cash than dipping into the qualified plan without a QDRO.

3. There’s another early withdrawal exception that applies to 401ks.

For IRAs, the early withdrawal rules apply to people who younger than 59 1/2. There are exceptions that allow early withdrawals without penalty. But none of those are age-based exceptions. public safety employees of a state, or political subdivision of a state, in a governmental defined benefit plan)

For qualified plans, one of the exceptions is based upon separation from service. According to the IRS, If an employee separates from service, he or she may withdraw from their company plan without penalty if:

- The employee is age 55 or older

- The employee is age 50 or older and a state public safety employees in governmental defined benefit plans (or a political subdivision of a state).

In either case, the withdrawals are fully taxable. But this might be a consideration for people getting divorced in their 40s and 50s.

4. A 401k may contain unvested employer contributions.

One of the most attractive parts of an employer-sponsored retirement plan is employer matching contributions. This provides an incentive for people to start saving in the first place.

If your employer matches your 3% contribution dollar for dollar, that’s a 100% return on your money, before any investment results! Who doesn’t like free money?

There’s a catch. In qualified plans, there’s a vesting schedule. In other words, the employee has to stay with the company for a certain period of time before the employer’s contributions vest.

If the employee leaves before the employer’s contributions vest, then they forfeit those contributions. Keep in mind, this only applies to employer contributions. Employee contributions are always 100% vested, from day one.

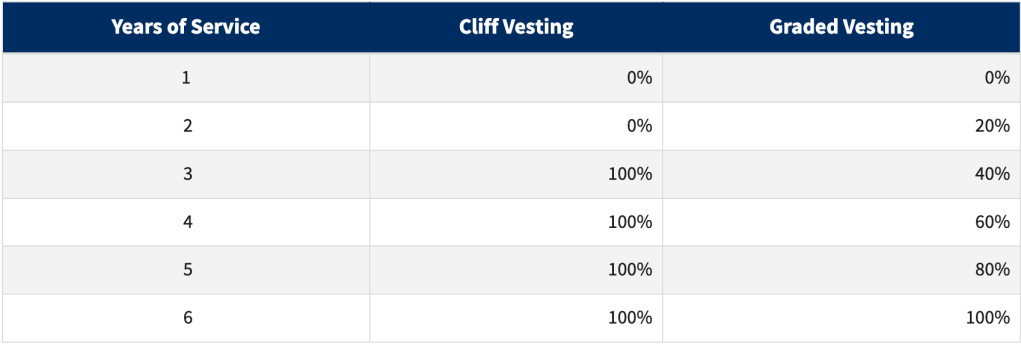

In order to be a qualified plan, a 401(k) has to offer a vesting schedule that is no more restrictive than either of the following:

- 6-year graded vesting. This means that an employer can ‘vest’ contributions gradually over a 6 year period.

- 3-year cliff. An employer can choose to not vest for the first 2 years. After that, the employer must vest 100% of the employer contributions at the end of the third year.

So what do you need to know? If the 401k has unvested contributions, then you need to take this into account. Specifically, you’ll want to ensure that your QDRO addresses what happens to unvested employer contributions.

Depending on your circumstances and applicable state laws, there is a wide range of things that could happen. A QDRO attorney can help you achieve a desirable outcome.

With an IRA, none of this applies. Since there are no employer contributions in an IRA, there are no restrictions on how you can choose to divide them.

5. Tax withholdings are different for IRAs than for 401k plans.

By law, a 401(k) plan must withhold 20% of any distribution made payable to the plan participant. This occurs for every single 401(k) distribution that is not directly transferred to another eligible plan or to an IRA account. If the distribution is made directly to an eligible plan or an IRA, no taxes are withheld.

Conversely, the default withholding for an IRA distribution is 10%. But you can elect out of withholding or choose to have a different amount withheld, according to the IRS.

This distinction can be crucial if cash flow is an issue. Let’s imagine that you’re looking at a $10,000 withdrawal from a 401k or a $10,000 withdrawal from an IRA.

401k: 20% would be withheld for taxes. This leaves you with $8,000 of a $10,000 withdrawal.

IRA: 10% would be the default withholding for taxes, or $1,000. But you could change this to zero if you wanted to. That means you could take the full $10,000 out.

Will your tax liability change? No. But if you needed a full $10,000 now, then you’d have to take more out of your 401k plan. That would result in a higher tax bill.

6. Different creditor protection laws apply.

Qualified plans, such as 401(k) plans, are protected from creditors by the Employee Retirement Income Security Act of 1974 (ERISA). Generally, is no limit to the amount you can have protected in a 401(k) plan. Also, 401(k) plans are protected in bankruptcy and non-bankruptcy cases.

There are two exceptions to this:

- IRS. While the IRS may choose to go after other financial assets first, retirement plan assets are not off limits.

- Divorce proceedings

Not only are retirement funds in a 401(k) plan protected, they’re also protected in bankruptcy cases if you roll them over to an IRA. Again, this protection does not have a limit.

This does not apply to solo 401(k) assets.

Conversely, IRAs are protected in bankruptcy cases by a federal law called the Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA). BAPCPA protection does have a limitation. but with a dollar limit.

As of this writing, that limit was $1,362,800. However, there are some additional limitations:

- IRAs do not have federal protection in non-bankruptcy cases.

- Inherited IRAs have no federal bankruptcy protection.

By all means, this is not a comprehensive list of the differences in creditor protection. If you expect to deal with creditors and/or file bankruptcy, you should discuss your concerns with your lawyer or with a bankruptcy attorney.

That way, you’ll be able to take these factors into consideration as part of your equitable distribution.

7. You don’t always have to start taking distributions from a 401(k) at age 72.

30 years ago, gray divorce didn’t really exist, so this was an unnecessary statement. However, gray divorce has been on the rise in recent years, particularly for individuals aged 65 and older. Additionally, a recent AARP study shows that more people are working past retirement.

In light of these two trends, it’s important to discuss how required minimum distributions (RMDs) might impact divorce planning.

Both 401(k) plans and traditional IRAs allow you to defer distributions for a limited time. Generally speaking, a taxpayer who reaches age 72 has to start taking distributions from either plan each year for the rest of their life. To do this, the taxpayer must calculate their RMD using an IRS worksheet.

This worksheet is called an IRA Required Minimum Distribution Worksheet. Despite the name, the same worksheet is used for IRAs and 401ks. But the rules are slightly different.

RMD rules for IRAs

Since there are different types of IRAs, there are slightly different rules for each.

Traditional IRAs: Generally speaking, distributions from a traditional IRA must by April 1 of the year after you turn age 72. No exceptions.

Roth IRAs: Roth IRAs have no RMDs.

Inherited IRAs: There are no RMDs for most beneficiaries, as inherited IRAs are now subject to a 10-year withdrawal rule.

For eligible designated beneficiaries, RMD rules do apply. The calculation of these RMDs depends on several factors:

- Whether the IRA owner died on or after the date they were supposed to take distributions

- Whether the beneficiary was the spouse or a non-spouse beneficiary

RMD rules for 401k plans

Generally speaking, 401k distributions must begin by either:

- April 1 of the year after you turn 72, just like an IRA

- The year that you retire

In other words, if you are a 401(k) plan participant, and never retire, you never have to take RMDs. Consequently, you never have to pay taxes on anything. When you eventually pass away, your beneficiaries will pay taxes on their withdrawals.

These differences offer different tax planning opportunities for those who wish to defer taxes, but do not plan to stop working in their retirement years.

Conclusion

By no means is this an all-inclusive list of differences between IRAs and 401(k) plans. But by acknowledging these differences between the two, you can better determine how to divide marital assets in a tax-efficient and equitable manner. Doing this will help both spouses avoid adverse tax consequences.