Your 401k Expense Ratio – Everything You Need to Know

If you’re putting money into a 401k, you’re already ahead of the game compared to most people. A recent study by the Pew Charitable Trust found that 28% of employees who don’t have access to a retirement plan at work don’t contribute to any retirement investment vehicle at all. No IRA (individual retirement account), no individual investor brokerage account, nothing.

So, if you have a 401(k) account, it might be tempting to pat yourself on the back and call it a day.

But do you have any idea what’s actually going on with your account fees? You might check out your account balance or review your quarterly statements every now and then.

But do you know how much you are paying in 401k fees? Those investment costs come out of your accounts, and keep your investment performance lower than it could be. Fortunately, there are simple changes that can help you manage the fees within your 401k. Managing those expenses can help you improve your investment performance.

Let’s look at what this article aims to cover.

Contents

What you should know about your 401k expense ratio

In this post we’ll talk through easy steps you can take to:

- Understand the investment fees that make up your 401k expense ratio.

- Identify retirement plan investments that meet your investment objectives with lower fees

- Make sure your asset allocations are in line with your risk tolerance

- Understand how you can diversify your investments within your 401k

Ready? Let’s get started!

What is a 401k expense ratio?

Your 401k’s expense ratio is the percentage of the 401k plan’s total assets that goes towards paying 401k fees, or expenses. According to a 2019 CNBC article, 95% of 401k plan participants pay fees in their investment accounts. For those participants, the average expense ratio ends up to be approximately .45% per year.

401k fees are paid from within your retirement portfolio to cover administrative costs. But according to a study by TD Ameritrade, only around 27% of Americans know how much they are paying in 401k fees.

You may only pay a few hundred dollars a year, but this money can significantly detract from your long-term retirement savings. The more you pay in 401k fees, the less you benefit from compound interest.

What types of fees make up the 401k expense ratio?

According to the U.S. Department of Labor, within a 401k there are three types of fees that go into the total expense ratio.

Plan administration fees

The first fee is known as an administration or plan fee. which is charged by your 401(k) plan administrator. This fee covers administrative expenses that plan providers incur in the day to day operation of the 401(k). Examples of these administrative expenses include:

- Recordkeeping

- Accounting

- Legal services

- Trustee services

- Providing customer service representatives

Some plan providers incorporate administrative expenses into investment management fees, while others do not.

Investment management fees

Generally speaking, investment fees make up most of the plan expenses in your 401k. Most 401k plans provide investment options in the form of mutual funds. Mutual funds are where the bulk of these fees and expenses reside.

There are three types of expenses you can look for in the mutual fund options within your retirement plan:

Sales charges

Sales charges are also known as commissions or sales loads. Basically, mutual funds are traded by investment managers who receive a commission from each transaction. These commissions can happen in one (or more) of the following manners:

- Front-end load: The commission is paid whenever the mutual fund is first bought.

- Back-end load: The commission is paid whenever the mutual fund is sold

- Both: Some mutual funds have a front-end AND back-end load

Management fees

These are also known as account maintenance fees or investment advisory fees. Most of the time, management fees are calculated as an annual expense ratio, known as a fund expense ratio, rather than a flat fee or specific dollar amount.

Other fees

These fees might cover the administrative costs within the investment fund. They might also include what is known as 12b-1 fees. 12b-1 fees are used to pay brokerage commissions, fund advertising campaigns, or compensate plan service providers as part of their service arrangement.

You can learn more about these costs in the mutual fund’s prospectus. A prospectus is a comprehensive document that describes the mutual fund’s purpose, investment approach, and investment returns. Mutual fund companies are required to provide an updated prospectus to each shareholder annually.

Individual service fees

Individual service fees might be charged in addition to plan administrative expenses. These service fees are usually charged for one-off expenses, like taking out a 401k loan.

How can I find my 401k expense ratio?

The first place you should look is in the annual statement provided by your 401(k) administrator. The Department of Labor requires plan administrators to provide an annual fee disclosure to individuals enrolled in their plans.

Within that document, you should find a section that identifies the administrative fees. Sometimes the fee disclosure will identify the operating fees charged by the mutual funds, but not always.

Many of these are indirect fees that are hidden within the investment expenses of the mutual funds inside the retirement plan. The good news is there are not hard to find on your own.

How to identify your mutual fund expenses

It’s not too hard to identify mutual fund expenses. Let’s take a look at two different mutual funds so you can compare their expense ratios:

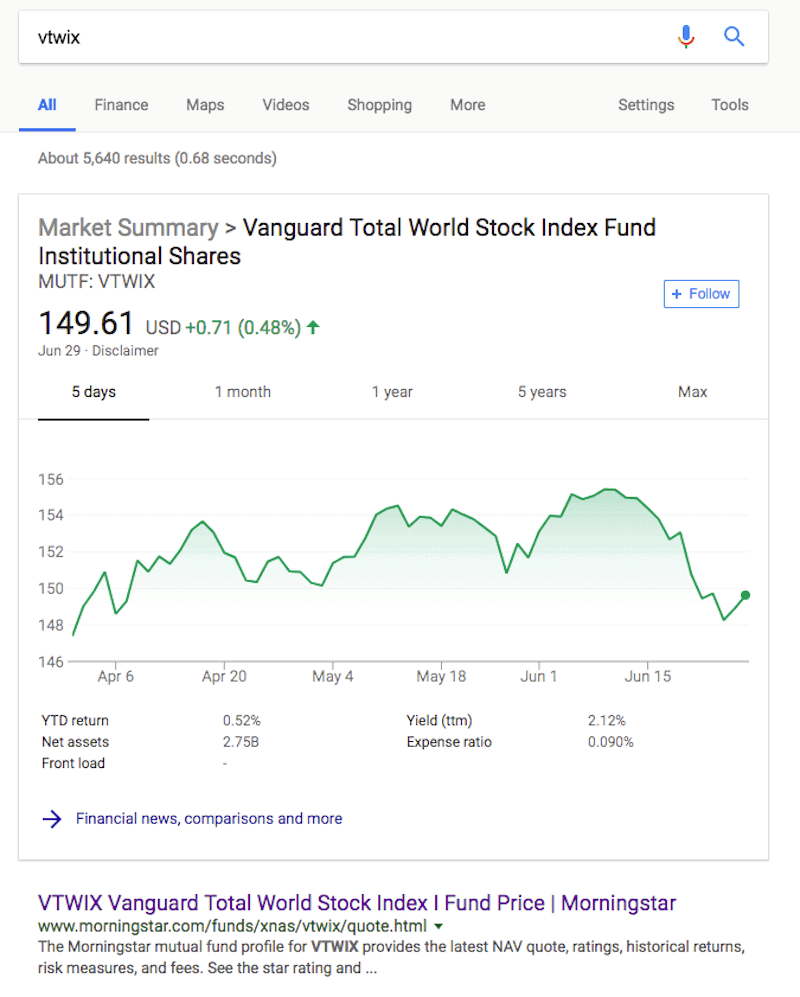

- Vanguard Total World Stock Index Fund Institutional Shares (VTWIX)

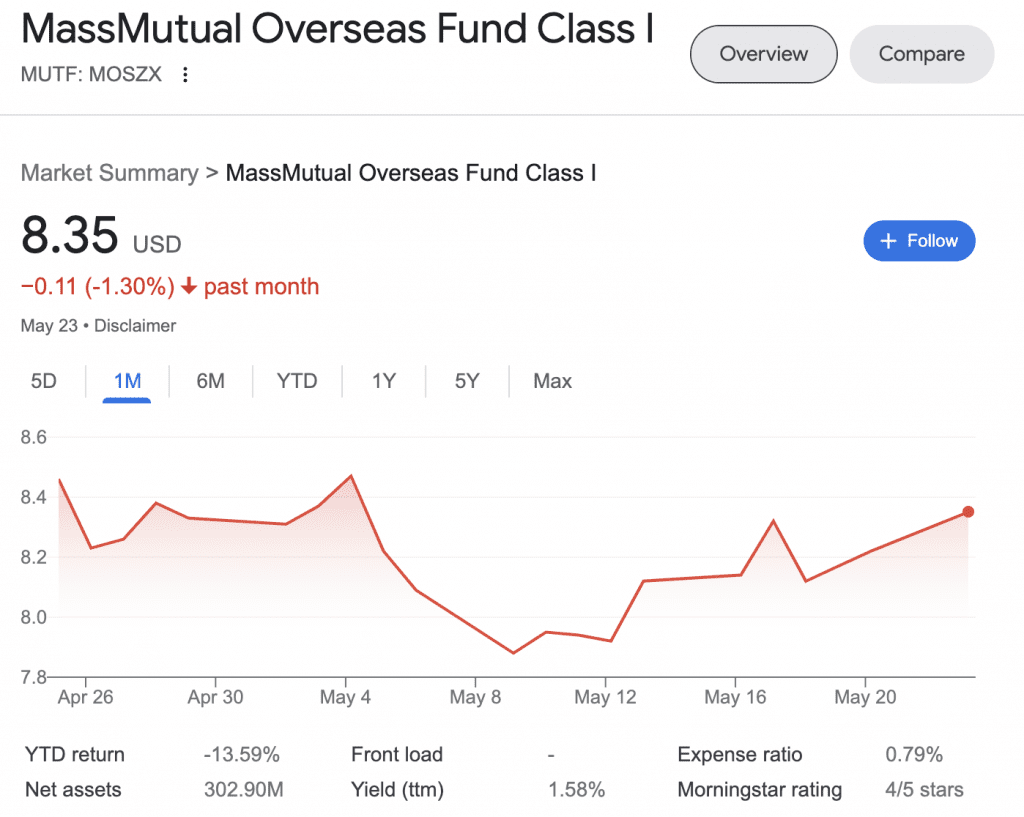

- MassMutual Overseas Fund Class I (MOSZX)

Let’s look at VTWIX first. Below is a screenshot of the ticker symbol in Google search.

Once that opens, you’ll see a little dashboard with a bunch of information, including “Expenses”, which lists “.09%” as your expense ratio.

In comparison, here’s a screenshot of MOSZX.

You can see that MOSZX’s expense ratio is .79%, which is significantly higher than the Vanguard offering.

Most mutual fund companies will price their investment funds in a fairly similar manner. So if your 401k provides Vanguard funds, then most of those investments will be in the ballpark of VTIWX.

Unfortunately, you’re stuck with the investment options that are available within your 401k. The good thing is that 401k fund expense ratios have been on the decline for several years, as people continue to demand lower fees and lower expense ratios from their administrators.

Employees of large companies are more likely to benefit from low fees than those from small businesses. Large companies benefit from economies of scale, as the plan administrator can spread its administrative costs across a wider group of plan participants.

Second, determine what your asset allocation should look like.

If you work with a financial advisor, they might be able to help you with this, especially if they’re helping manage outside investments. Don’t hesitate to ask your financial planner for help in selecting from the available investment choices.

Many 401k plans provide target date funds. Target date funds automatically manage the asset allocation between the different mix of investments (stocks and fixed-income instruments).

They usually start as very aggressive investments for younger investors. Over time, target-date funds will reallocate more of the portfolio towards fixed income instruments (bonds) and cash.

Target-date funds usually appeal to those who would like to take a ‘set it and forget it’ approach to investing.

Identify your available investment options.

At this point, you know how much you’re paying in 401k fees, and what a reasonable asset allocation should be. Now you need to diversify your investments across multiple funds.

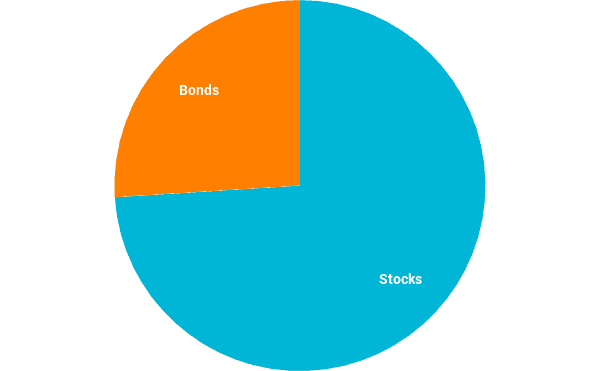

Here is a fictional example of an investor who decided that their asset allocation should be 74% equities and 26% cash and fixed income.

He might find a large-cap, small-cap, and international fund within his 401k options. From there, he can rebalance current investments so that 74% gets invested into them (total). For the remaining 26%, he finds a nice, short-term bond fund and an inflation-protected bond fund.

In your situation, you’re limited by the funds available inside your 401k.

So if you are able to find Vanguard funds for everything except international investments, you might have to make a choice:

- Select the more expensive international fund

- If you have outside investments, invest in the cheaper options available in your 401k plan, and invest the overseas portion in one of your outside accounts.

Savvy investors, or investors who work with a financial advisor, might select the second option. If you don’t feel too comfortable with this, you might stick with the first choice.

In either case, you probably should not let fees deter you from participating in your 401k. Likely, you’re getting matching contributions from your employer.

So if you’re getting a 100% matching contribution, you can absorb a slightly uncomfortable fee.

Make sure you are comfortable with your choices

Remember that personal finance is personal, and my tolerance for risk is different than yours. The key is for you to feel informed and comfortable with your decision. Also, make sure you are analyzing each fund’s expense ratios to identify fees, and then select the right mix for you based on your target asset allocation and diversification strategy.

If you want to make it easy check out our review of Blooom. Blooom is a robo advisor who provides a free 401(k) fee analysis tool.

Their analysis tool will show you what fees you are paying in your 401(k). In addition, Blooom will also give you some ideas to optimize your portfolio. Why not let them do a lot of the heavy lifting for you?

Next steps

Go dig into your investment account and learn what you’ve been paying in 401k fees. If you don’t like what you see, take action to see how you can make the most of your available investment options.

Or if you need some assistance, perhaps you can give a service like Blooom a try.