VOO vs VFIAX: Which Vanguard S&P 500 Fund is Better?

VOO (Vanguard S&P 500 Index ETF) and VFIAX (Vanguard S&P 500 Index Fund Admiral Shares) are two of Vanguard’s most popular low-cost funds. Each of these Vanguard funds:

- Is very tax-efficient

- Has a lower expense ratio than their peers

- Is arguably a better investment than most active funds with similar investment objectives

This article will explore both of these Vanguard funds in depth. Specifically, we will discuss their

- Investment focus

- Relative performance

- Investment holdings & size

- Turnover & tax impact in an investment portfolio

However, there are differences between each of these funds. The main difference is that one is a mutual fund while the other is an exchange-traded fund (ETF).

Since VOO is an ETF and VFIAX is a mutual fund, we’ll start by discussing the differences between ETFs and mutual funds.

Contents

The differences between mutual funds and ETFs

ETFs and mutual funds are investment vehicles which provide individual investors the means to invest modest amounts of money into a wide variety of different assets. These assets might be bonds & CDs, equities, commodities, or other assets that an individual investor might not have access to without an investment broker.

In the case of VOO and VFIAX, those pooled investments consist solely of individual U.S. stocks. In fact, for both funds, that pool is limited to the 500 largest U.S. companies.

Let’s look at some of the key differences between an ETF and mutual fund.

Liquidity

Liquidity is arguably the biggest major difference between mutual funds and ETFs.

Mutual funds are managed by a manager. The responsible mutual fund company sells shares of a mutual fund to individual investors.

The value of these shares is called the net asset value (NAV). The NAV is based upon the combined value of the underlying investments. The NAV is calculated daily, after the stock market closes at the end of the trading day.

When an investor redeems a mutual fund, the mutual fund manager is buying back those shares. But the transaction does not occur until after the exchanges have closed. After market hours, the NAV is recalculated, and the mutual fund shares are redeemed at the new NAV value.

ETFs are traded on a stock exchange, just like stocks are. That means ETFs can be bought and sold throughout the day. Since another investor is the other party, the trade executes immediately.

This might not be a big deal during normal times. However, does matter during times of greater volatility in the stock market. Especially when severe stock market changes force the markets to close during the trading day due to excessive selling.

For example, during the early days of the coronavirus pandemic, the entire U.S. stock market closed in the middle of the trading day. This happened several times on multiple occasions.

ETF holders who wanted to sell shares could do so more quickly than mutual fund investors. Accordingly, most ETF investors experienced smaller declines than their mutual fund counter parts.

Tax efficiency

Index funds, whether they are ETFs or mutual funds, can be extremely tax-efficient. But ETFs have an edge over mutual funds.

When a shareholder redeems shares of a mutual fund, the manager needs to retain sufficient cash to ensure they are able to redeem those shares. When if there are a lot of investors that want to sell at the same time, that fund manager might need to sell additional stocks to come up with the cash. This generates more capital gains, which are passed onto the remaining shareholders.

On the other hand, when ETF investors sell their shares, another ETF investor is buying those shares. That means there a fund manager doesn’t have to generate capital gains to buy those ETF shares.

Differences in trade execution

There are several differences in how ETF trades work and how mutual fund trades work. Here are three ways that ETFs trade differently from mutual funds.

ETFs have different purchase minimums.

The purchase minimum for an ETF is 1 share. Since ETFs trade like equities do, most ETFs can be traded on any trading platform with minimal or zero transaction fees. So an investor can buy 1 share, or 10,000 shares of the same ETF at the same transaction cost.

Mutual funds usually have a minimum initial investment. This minimum investment is expressed in dollars.

For example, when the minimum investment for new investors purchasing VFIAX at Vanguard is $3,000. You can buy shares of VFIAX at Schwab for less than $3,000. However you would also pay a $49 transaction fee for each executed trade, which makes investing in this manner cost-prohibitive.

It’s easier to buy fractional shares of a mutual fund

Most trading platforms will allow you to buy fractional shares of a mutual fund when purchasing a specific dollar amount. This makes dollar-cost averaging very popular amongst mutual fund investors.

But you usually can only buy whole shares of an ETF. The main exception appears to be M1 Finance. M1 Finance allows investors to invest in fractional shares.

Finally, mutual funds are more widely available than ETFs.

ETFs probably won’t be an investment option in your workplace retirement plan

Because they require whole shares to be traded, you probably won’t see ETFs in a 401k or 403b plan. Realistically, their tax-efficiency doesn’t do much good in tax-deferred accounts.

But you’ll see mutual funds. Many times, there are different versions of the exact same mutual fund. And that’s because mutual funds often exist in different share classes.

Mutual funds have share classes

ETFs do not have a share class.

Mutual funds do, because larger investment in a mutual fund means less investment risk for the mutual fund manager. In exchange for less risk, mutual funds often offer lower expense ratios.

For example, Vanguard’s Core-Plus Bond Fund exists in two share classes: Investor and Admiral. You can start with the Investor share class (VCPIX) at a $3,000 minimum investment, but the expense ratio is 0.30%. Admiral shares (VCPAX) have a lower expense ratio at 0.20%, but the minimum investment amount is $50,000.

VFIAX has a $3,000 minimum investment for Admiral shares, which is the only share class for that fund.

Aside from share class differences, you might see some fees in a mutual fund that you won’t usually see in ETFs.

Mutual funds might have transaction fees

ETFs generally don’t have transaction fees, since they’re traded like stocks.

But for mutual funds, transaction fees largely depend on who is issuing the mutual fund, and how you are buying the fund.

For example, if you are a Vanguard account owner buying a Vanguard mutual fund, there are zero transaction costs. But if you’re buying that same Vanguard fund in your Schwab trading account, you’ll likely incur transaction fees.

And that’s for no-load funds. No load-funds, like Vanguard, are mutual funds that do not have a commission attached to them. Many mutual funds are called load funds. This means they charge a commission every time you

- Buy shares of the fund

- Sell shares of the fund

- Or both

But if you’re into dollar cost averaging, then mutual funds have an advantage over ETFs.

Since both VOO and VFIAX have the same investment focus, let’s take a look.

Investment Focus

VOO and VFIAX are both low-cost whose investment objective is to track the Standard & Poor’s 500 Index. Both VOO and VFIAX purchase individual stocks in the proportions represented in the S&P 500 Index.

Both funds focus on replicating their benchmark index, not outperforming it. This leads us to wonder what exactly is the S&P 500 Index?

What is the S&P 500 Index?

The S&P 500 is one of the world’s oldest stock indices, and arguably one of the most famous. Created by Standard and Poor’s (now known as S&P Global) in 1957, the S&P 500 Index represents the 500 largest publicly traded U.S. companies.

In fact, John Bogle, Vanguard’s founder, created the indexing investment approach by creating the Vanguard S&P 500 Index fund as the world’s first index fund.

As of the quarter ending 3/31/2022, the S&P 500 Index had 505 U.S. companies representing approximately $40.3 trillion in market capitalization. This represents about three-fourths of the U.S. stock market.

As of 3/31/2022, VOO and VFIAX held individual stocks in 506 publicly traded U.S. companies.

Where this might fit in an investor’s portfolio

To pick either VOO vs VTSAX as the best index fund is not practical unless you look at the overall investment strategy. Each of these low-cost index funds has a specific purpose in an investment portfolio.

VOO & VFIAX would appeal to investors who feels that they have enough exposure to small-cap stocks and international stocks in other holdings. That investor may choose VOO or VFIAX to focus on large-cap stocks while getting into some mid-cap companies at the lower end of the index.

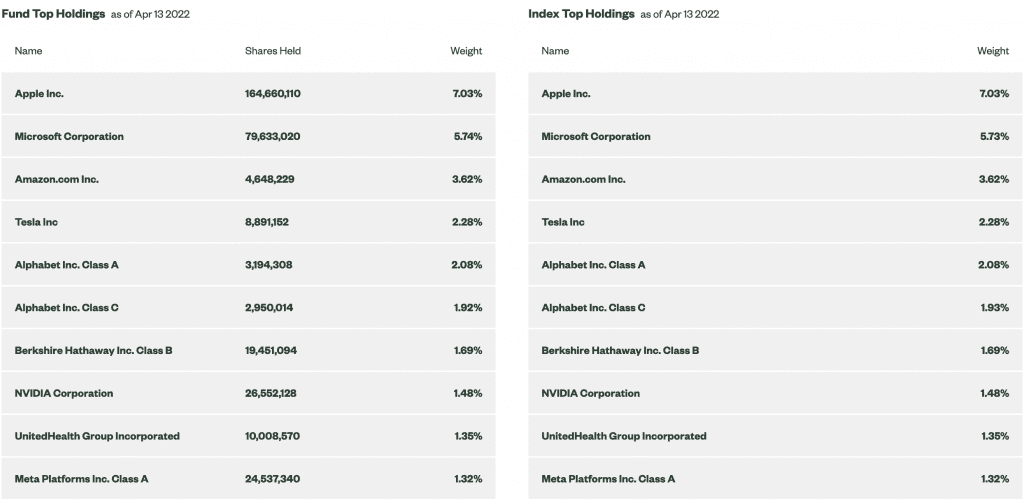

Top Ten Holdings

Let’s take a closer look at the top ten holdings in VOO and VFIAX.

Tech companies dominate the S&P 500’s top ten holdings. There are two exceptions:

- Berkshire Hathaway, managed by Warren Buffett

- UnitedHealth Group, another health care company

The top ten comprise a little more than 30% of the overall net assets for VOO and VFIAX.

That leaves the remaining 70% allocated to about 490 or so remaining S&P 500 companies.

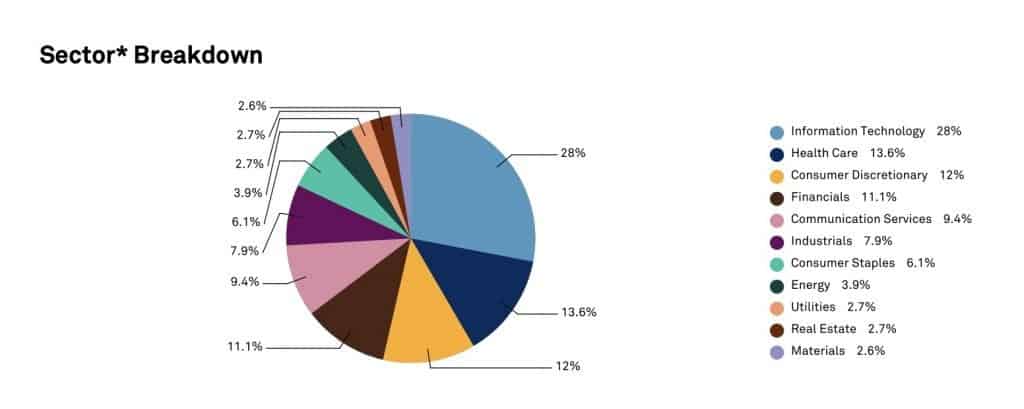

Let’s take a look at the overall holdings, by sector, of the S&P 500. Each fund’s holdings is represented by a pie chart from its respective index. This should make it easier to visualize.

Overall Holdings

In the S&P 500, the tech sector reigns supreme (28% of holdings), followed by health care (13.6%), consumer discretionary goods (12%), and financials (11%).

Let’s look at the total assets under management (AUM).

AUM Comparison

Vanguard’s index funds are some of the most popular funds in the world. Whether you’re discussing mutual funds or ETFs, their low fees make them highly desired, particularly by long term investors.

Since they are two versions of the same fund, VFIAX and VOO have a combined $841 billion in net assets.

Let’s take a look at their performance, both in absolute terms, and compared to their benchmark, the S&P 500 Index.

Performance comparison

The goal for both VFIAX and VOO is to emulate the S&P 500 Index. That means their investment returns will always lag behind due to two factors: management expenses & taxes.

Expense ratios

Also known as management fees, expense ratios are taken from the investment (in both cases, Vanguard) to cover the operating costs of the fund. Usually, expense ratios are reflected by an adjustment to the end of day share price.

An advantage of an index fund over similar funds is that you do not have to pay an active fund manager, investment analysts, or other staff to manage the investments. So the fund managers can charge very low expense ratios, which make index funds a good choice for many investors.

VFIAX has a slightly higher expense ratio at 0.04%, while VOO is 0.03%. That means for every $10,000 invested, Vanguard takes $4 (for VFIAX), or $3 (for VOO) per year. For comparison, most financial advisors consider a fund to be cheap if the fund’s expense ratio is less than 1% per year.

Tax drag

Mutual funds and ETFs do participate in taxable events. Examples of a taxable event include harvesting capital gains or receiving dividends from the underlying companies.

It’s hard to view the impact of taxes on market returns because the companies do not pay taxes on these events. These transactions are passed on down to the investor.

Dividends

In most investment accounts, it’s hard to notice. But each quarter, you’ll likely see quarterly dividend transactions for each of the mutual funds or ETFs in your investment portfolio.

In taxable investment accounts, you will pay taxes on dividends. If your fund has a low dividend yield, you’ll likely see a relatively low tax on the dividends in your investment account. This could be qualified dividends (subject to capital gains tax), ordinary dividends (subject to income tax at ordinary income tax rates), or a combination of both.

Capital gains distributions

And at the end of the year, towards the end of December, you’ll see capital gains distributions in each of your funds. The amount of distributions depends on the amount of activity in your fund.

If your fund has a high turnover rate, you’ll probably have a lot of capital gains distributions. High turnover means an active fund manager is consistently buying and selling underlying securities within the fund. Those capital gains are required to be passed on to the fundholder (that is you).

Fortunately, index funds are subject to relatively minimal turnover. Each of these indices is reset annually. And the rebalancing in the funds is done quarterly. So there isn’t a lot of buying and selling. And this makes a huge difference in performance.

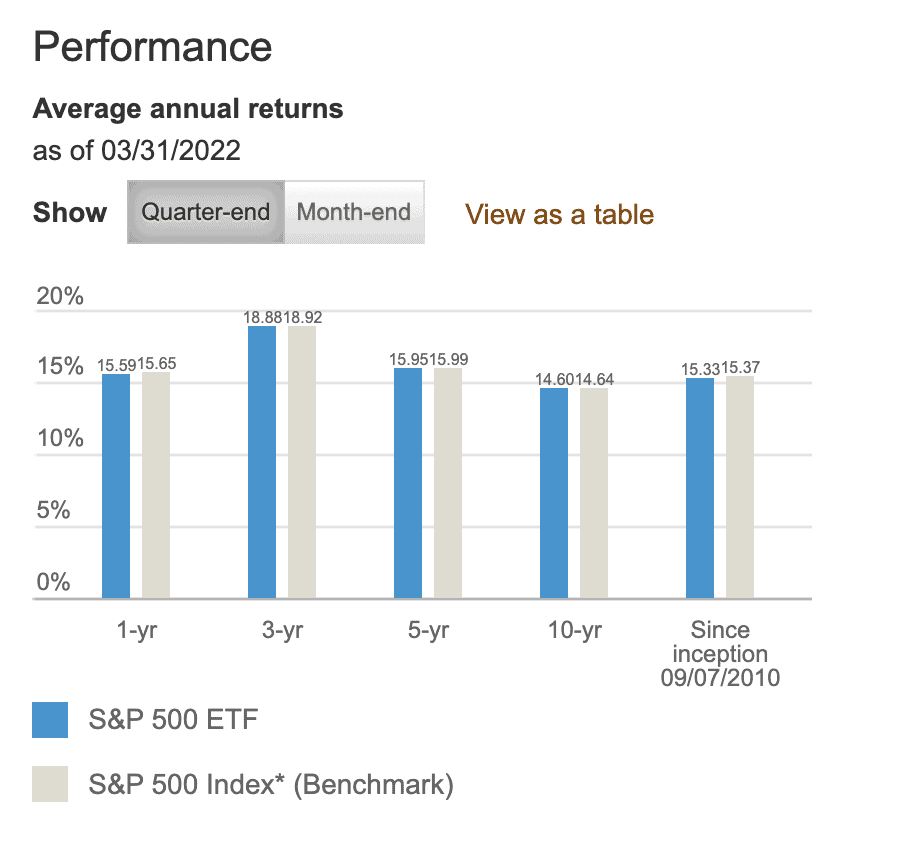

Let’s take a look at the relative performance of each fund (minus management fees), compared to its underlying index.

VOO & VFIAX vs. S&P 500 Index

As of 03/31/2022, this is the breakdown of Vanguard S&P 500 funds’ annual investment performance over the past year, 3 years, 5 years, and over their history:

- 1-year: 15.59%

- 3-year: 18.88%

- 5-year: 15.95%

- 10-year: 14.60%

- Since inception (VOO): 15.34%

- Since inception (VFIAX): 7.87%

It’s important to note that VFIAX had been around about 10 years prior to VOO. You can see this in the performance chart below.

Where You Can Purchase VOO & VFIAX

You can purchase VFIAX and VOO through almost any online brokerage firm or through your financial advisor.