How to Fire Your Financial Advisor

There are a variety of reasons you might hire a financial advisor. Perhaps you just retired. You might want to know how your nest egg is going to support your retirement? But what if you need to FIRE your financial advisor? Determining how to fire your financial advisor doesn’t get discussed nearly enough.

In this article, we’ll break down:

- Things that your advisor should be doing for you

- Warning signs that your advisor might not want you as a client any more

- How you can break off your relationship with your advisor and how to find a new advisor

Contents

Introduction

Your financial advisor should be more than just an investment advisor. The right advisor will do more than select mutual funds and talk about investment strategy and asset allocation.

Maybe your career is taking off. In that case, you’d like to make sure you’re taking the right steps to ensure financial success. Or perhaps you have a tricky financial situation, and you hire a financial adviser to help fix it. From there, the advisor helps you identify other opportunities to improve your financial picture.

A good advisor will be that person you go to for any financial question. Any problem, and your advisor is only a phone call away. And they want to be involved in all the important financial decisions.

Even if it’s just as a consultation before you go ahead.

Your advisor should inspire confidence through financial education. You might not want to know everything, but you should feel like you’re establishing a better relationship with your own money and investments.

And all the financial professionals make these things their selling point. But there’s one thing that you can only know through personal experience. And that’s the weight being lifted off your shoulders.

What a client should expect from their financial advisor

An often-overlooked quality of a good financial advisor is the ability to do work that you might not have time for. After all, hiring someone to write a financial plan is completely useless if you can’t put the recommendations into action.

Even when people feel they just need a checklist of action items to do on their own, life has a funny way of interrupting at the wrong time. Hiring a professional financial planner can make sense if you are looking for someone who can help you get things done. That way, you can be confident that you’re taking the right steps towards achieving your financial goals.

Hiring the right financial advisor should make you feel like a load is being lifted from your shoulders, or work is being taken off your busy plate. While that might be hard to quantify at times, here are 7 things your financial advisor should be doing to help reduce your workload:

#1. Putting together the big financial picture…and keeping track of it for you

Before making any major financial decision, you should always ask: “What impact does my decision have on the bottom line?”

You might have an important issue that needs to get resolved right NOW! There might be a couple of options to choose from.

But how do you know which is the right one? You don’t, if you can’t see the big picture.

For example, if you need quick cash, you might need to sell something from your stock portfolio to get the cash. Which stock do you sell, and what account do you sell it from?

The answer is, “It depends.”

It depends on what impact there is to your tax picture and the impact to your long term financial plan. And your wealth advisor should give you good advice on how to address these impacts.

Understanding the big picture is more than just a couple of charts presented in a nice binder. It’s about having a good idea of how seemingly different aspects of your finances work. And it’s knowing how your decisions impact them.

It’s about understanding that there might be much information you still need to gather before making the decision in the first place.

And finally, after starting down that road, it’s about knowing when you’re staying on course. Or knowing when you might be veering off track.

That latter part is the most important thing. When you leave the office, you’re back to dealing with life.

You have to balance the time you spend handling your finances with everything else that comes your way. A good financial planner has a clear understanding of what still needs to be done. And they should gently remind you when you need it.

#2. Handling routine paperwork you don’t have time for

One thing you don’t need reminding for is routine paperwork. All the great ideas captured in a financial plan are just that—great ideas.

Unfortunately, one of the biggest obstacles to implementing those ideas is the drudgery of paperwork:

- Paperwork you might need to open and fund that Roth IRA you read about

- Decisions you might need to consider when updating your estate planning documents

- Pay stubs and other documents you might need to put together your mid-year tax projection

- Routine paperwork for transactions like transfer requests from your retirement accounts

Hopefully, your financial advisor isn’t going to start signing documents on your behalf. But your advisor can simplify your life by:

- Helping you eliminate unnecessary paperwork

- Doing the research into and knowing what paperwork you do need to sign and pay attention to

- Organizing the paperwork in a manner that is easy to digest and easy to sign

This seems pretty routine and ordinary. And most good investment advisers are adept at making this appear to be seamless.

Many clients appreciate how much time they saved because the advisor did the heavy lifting. This frees you up for the things that really count, like making important decisions.

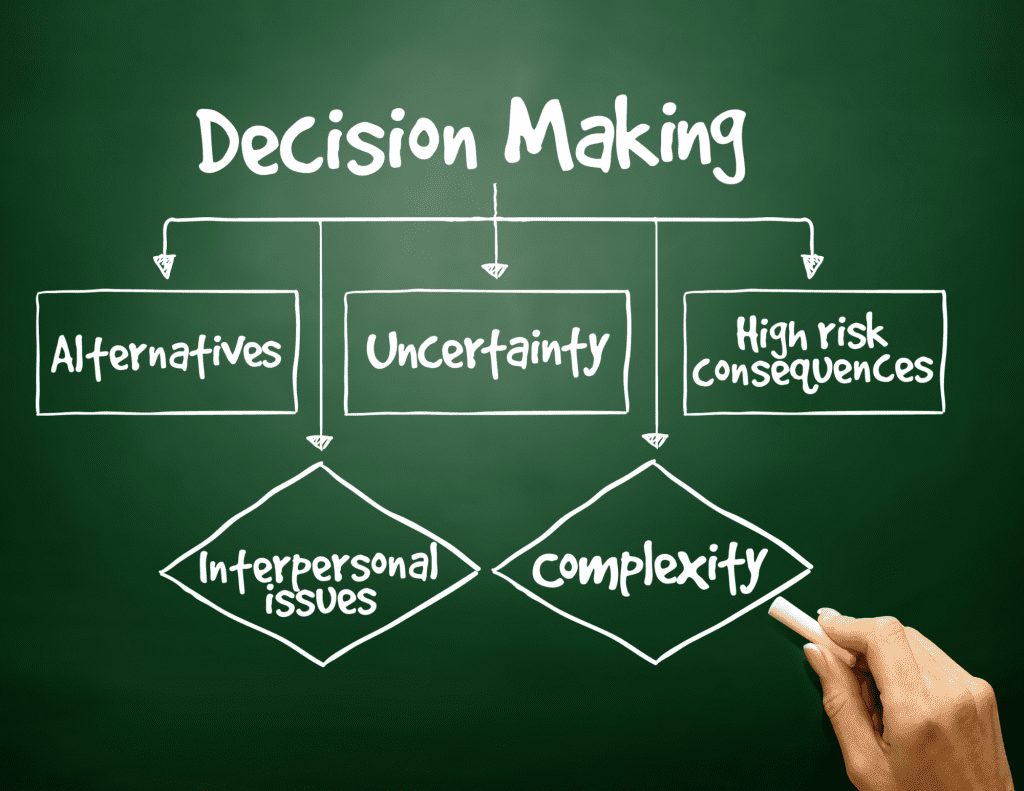

#3. Guiding you through major financial decisions

Before a client makes an important decision, 100% of good advisors would rather hear:

“I’m thinking of doing this, but I’d like to hear your thoughts before I do it,” rather than:

“I did this, but I think I made a mistake. Can you help me fix it?”

No advisor wants to clean up a mess that could have been avoided, had the client asked their opinion in advance.

First, there’s the additional work that might be involved. Second, some things just can’t be undone. Third, there’s a general feeling of, “If you’re not going to ask me for my advice, why are you paying me?”

The final part is a very valid question—on both sides of the relationship. If your advisor ever asks that question, then your relationship will probably go one of several directions:

Do you trust my recommendations?

The advisor might ask you why you didn’t feel comfortable talking with them beforehand. If there’s a way to identify concerns you might’ve had, and address them, the advisor might recommend this.

The advisor might outline some framework on how the two of you can avoid this in the future. Hopefully that’s the route they take.

Perhaps we’re not the right firm for you.

If you made a decision that goes against a specific recommendation, your advisor might say something. It might sound like,

“We’re not able to give you our best advice if you go against our recommendations.”

Depending on what is actually said, this could be considered a warning, or they might decide they can no longer work with you.

They might say nothing.

For a while. After all, they’re being paid, even if you don’t take the advice.

But you might notice that the extra effort they used to put into client service isn’t there anymore. At least for you.

Then, eventually, you decide they’re not a good fit and decide not to work with them anymore. And that will be fine with the advisor.

Conversely, there are times when the client is trying to talk with the advisor about major decisions, but the advisor can’t make the time. If that’s the case, you should ask the advisor to clarify:

- What issues they consider to be emergent, versus routine

- How they accommodate meetings or conversations about emergent versus routine matters

- What they are competent and able to discuss

You might decide retain or fire the financial advisor based upon their response. But you’ll at least have a clearer understanding of how the advisor handles client requests.

In the case your experience was due to a misunderstanding, you’ll have a better idea of what to expect next time.

For example, something you think is emergent might be something the advisor believes can be addressed at the next appointment. But they should at least have a good explanation that leaves you feeling that they’ve got you covered.

And for the areas where they don’t feel like the expert, your advisor should be able to bring in experts to help you out.

#4. Bringing in other professionals as part of your team

Your financial advisor probably isn’t going to be an expert in every question that you ask. But that advisor should be able to reach out to peers, colleagues, and other professionals to ensure that your questions get answered.

Tax planning is a big area where we see the difference between fiduciary financial advisors. Even if they’re not a tax expert, every financial advisor should be able to help you with tax planning.

There is a wide range of acceptable options.

Partner with outside professionals

Perhaps they will help you set up a tax planning appointment with your CPA. Maybe your financial advisor sits in on especially technical discussions to discuss an advanced tax strategy.

That way, your advisor can make investment recommendations or give financial advice within that context.

And you feel like your financial planner and your accountant are a team. That you’re in charge of.

This could happen annually (at a minimum), or before a major decision.

Have in house expertise

Perhaps your financial advisor might does the tax planning in house. And the might include the tax discussion as part of a scheduled appointment.

Many financial advisors also do tax preparation for their clients.

Whatever the answer, your advisor should give you an option that doesn’t make you feel like the project manager for your finances. That’s your adviser’s job—if they’re doing it correctly.

If you hear, “I don’t know how much you’ll pay in taxes, you’ll have to talk to your accountant,” that’s a big red flag.

Tax planning is becoming table stakes in the financial planning world, and you deserve better than that answer. Even worse is the advisor who makes recommendations that actually cause big tax events. That is simply unacceptable.

You can (and should) expect a similar level of service in estate planning, insurance planning, and virtually every other area of your finances. Your financial advisor isn’t going to draft estate documents for you or give you unlicensed insurance advice.

However, they can help make it easier to get the advice you need from the professionals they have access to. And your financial advisor should help you review their work as well.

#5. Providing a second set of eyes

Whether it’s your tax return, a new insurance policy, or your estate planning documents, it doesn’t matter. You should always be able to have your financial advisor give these documents a second look.

If nothing more, having a second set of eyes will at least identify questions you might want to ask before you put pen to paper. And in most cases, you can sign knowing that at least a professional set of eyes was helping you to look out for mistakes.

#6. Making meetings more comfortable for you

If your advisor is scheduling meetings that force you to sit through traffic while they go through a canned speech about the latest investment reports, that’s not good enough. Just know there’s something better.

Sometimes, if you’re a higher-end client, you might be invited to meetings 4 times a year, while the ‘lower-end’ clients only have to sit through traffic once or twice. And what’s the point if you don’t get anything out of it that you couldn’t have read in a report.

After the coronavirus pandemic shut down offices, many advisors were forced to schedule virtual financial planning appointments. Your advisor should give you the choice on how you’d like to meet.

Your advisor should:

- Only schedule meetings that have specific topics of discussion. The advisor shouldn’t schedule a meeting, then turn around and ask you what you want to talk about.

- Be flexible to scheduling meetings. So you can get expert advice if there is an emergent issue, event or situation you want to discuss.

- Offer the opportunity to schedule meetings in advance. That way, you can plan around them.

- Offer the opportunity to schedule remote or in-person meetings. In the aftermath of the coronavirus pandemic, this is something every advisor should be able to offer. Many advisors will offer meetings by phone or video teleconference.

The point is that your time is important. Keep in mind that this is a two-way street.

An advisor who has a policy regarding no-shows, late canceled appointments is very clear about how their time is treated. That advisor will probably be flexible to your needs and respect your time in return.

#7. Always acting in your best interest

This shouldn’t have to be written down. It should be a safe assumption, much like the assumption that a doctor won’t prescribe medicine that will harm you.

Unfortunately, that’s not the case in the real world. Although they are beyond the scope of this article, there might be a number of reasons why your current advisor might not give you a recommendation that is in your best interest.

Or the recommendation might be okay for you, but not the best one—usually because there is a bigger commission involved. And many investment professionals do this.

Many of these reasons are perfectly legal. In fact, it’s surprising what someone can recommend, as long as it is properly disclosed as a potential conflict of interest.

What’s not legal: Telling you they’re always acting in your best interest, then not giving you advice or recommendations that are in your best interest.

So how do you know? Ask them.

Say, “Can you tell me, in plain English, in what situations you might have to give me advice that’s not in my best interest?” Specifically ask, “In which cases might you give me advice that puts your interests above mine?”

Any answer other than, “No,” should send you looking for a new financial advisor. But ask your advisor to back it up by putting it in writing.

Even if your financial advisor passes this test, your relationship might change over time. And the secret is that at the beginning of a financial advisor’s career, EVERY client is an ideal client. Until they’re not.

Warning signs that your advisor might not want you as a client.

Here’s the scenario. You were your financial advisor’s third client.

At the beginning of your relationship, it felt like your advisor did everything! And if you ever needed something, your advisor would personally answer the phone! Every time.

And as his practice grew, he added more staff to help him with all the work. Eventually, someone else took over the paperwork. And someone else started answering all the phone calls.

It seems like you only saw your advisor during your client meetings. Or maybe you met with an ‘associate advisor,’ while your advisor just dropped in to say a quick hello.

THAT’S NOT A WARNING SIGN! THAT’S THE WAY A FINANCIAL PLANNING PRACTICE WORKS! Before we start discussing warning signs, let’s go into this a little bit more.

How a financial planning practice matures over time

Everything I just outlined above–that happened to me as a financial advisor. In the beginning of a business, a financial advisor plays every role. From CEO to head janitor, a new advisor does all the legwork.

Eventually (hopefully), the practice takes off. And the advisor has to bring in people to help. Because your advisor is ineffective if he or she cannot learn to let go of tasks that someone else can do.

Also, your advisor is best at a handful of things. They are (at best) mediocre, at a LOT of things they delegate to a staff.

But the one thing a financial advisor cannot delegate–their relationship with you! So my clients also knew that if someone else was handling their paperwork or task, it was because: my staff was better at that task than I was.

If there was something they needed from me, my clients always knew that I was available. That’s really the most important part.

But what if your advisor is trying to send you a message? Here are some red flags:

Red flag #1: You no longer feel like you fit their ‘ideal client’ profile.

You check out your financial advisor’s website. It says, “We specialize in working with doctors in their 40s and 50s to help them envision their retirement goals and achieve them.”

You’re already retired. As a teacher. And you don’t feel like you have as much money in your own accounts as the doctors probably do.

Odds are, if you came to the firm today, they wouldn’t have brought you on as a client. If that’s the case, one of two things will happen:

- Your fees might go up

- Your financial advisor might tell you that it’s time to move on

Red flag #2: Your fees will probably go up over time.

Everyone’s financial planning fees will go up over time. Hopefully, your advisor is building capacity and adding value to justify the new fee structure.

But if your advisor is trying to send a message, you won’t feel like you’re getting any additional value. This happens to ‘low-maintenance’ clients, where the financial planning needs are simple.

Meeting preparation can be done with a minimum investment of time, and there’s probably not a lot of work going on. Because the hard work has already happened.

But the other thing is that your advisor might be trying to see if you’ll go elsewhere. And if you don’t, then they’ll simply tell you outright.

Red flag #3: Your advisor will tell you, “We’re not a good fit any more.”

I’ll let you in on two secrets:

- Every financial advisor keeps track of their PIA clients. A PIA client is someone who is a “pain in the ass.” And when the advisor can afford to, they’ll show their PIA clients the door.

- Your advisor is firing you. If you ever hear these words, you don’t have to worry about firing your advisor.

If this happens, just ask for a referral to another advisor. As an advisor who has had to end client relationships, I’ve always offered another advisor’s services.

Most advisors will say, “XX advisor is a better fit for your unique situation.” But if your advisor doesn’t offer any referrals, then you might have really upset that advisor.

Maybe there are less obvious red flags.

Red flag #4: You feel like there’s less responsiveness than there used to be.

You used to get phone calls answered immediately. By YOUR advisor. But now there’s an office manager, client specialist, or an automated service.

Perhaps your office has standardized its services. To be fair to all clients.

In that case, you might ask what their service standards are. For example, many advisors strive to answer phone calls and emails within 1 business day. Many advisors no longer respond to texts.

But if they don’t tell you their standard, or if their delays exceed the standard, then there’s one of two problems.

- They’re getting overwhelmed, and you’re on the short end of the stick. Growing pains happen. To everyone. But clients shouldn’t feel the pain.

- Your advisor is trying to send a message.

Either way, you should prepare to find a new financial advisor. But have a plan.

How to fire your financial advisor

The mechanics of firing your financial advisor aren’t that hard. It’s mostly an emotional decision. For you.

It might be hard for the advisor as well. But if it’s in your best interest to fire your financial advisor, then they’ll move on and help you with the exit process. Here are 5 steps I would recommend.

Step 1: Review your client agreement.

You’ll want to make sure you’re aware of any fees to leave the relationship. Is there a transfer fee to move your investments out of an account? Are there client termination fees?

Most of the time, you’ll see these termination fees at brokerage firms. And if you’re moving to a different person at the brokerage firm, you might be able to get the fees waived.

Although the fees shouldn’t be so onerous that you can’t leave, you need to know what those fees look like. Then you can look at your options.

Step 2: Review your options.

Do you have another financial planner in mind? Have you gotten recommendations from friends or family?

Perhaps there’s someone who specializes in your financial planning niche.

Before you fire your advisor, you need to have a second option lined up. And that you’ve identified the end date for your current relationship.

Step 3: Review all outstanding action items.

Most financial planning firms keep track of who is doing what. Action items.

Firing an advisor in the middle of a fairly important project (like doing backdoor Roth conversions), might not be a good idea. Because if things get hung up during the transition, your accounts will feel the impact.

Make sure you’ve identified everything that is supposed to get done (by the advisor or by you). That way, you know what the new advisor needs to look at.

Step 4: Hire the new advisor.

If you hire a new advisor, they can take care of all the paperwork for you. This makes it easier for people who wish to avoid an awkward conversation with their old advisor.

Step 5: Tell your advisor why you’re leaving (if you want to).

Maybe you’re terminating the relationship for a good reason. And you want to share that reason with your old advisor. Then you should.

But you don’t have to.

In our investments firm, if a client left, we would reach out to see what we could have done better. And most of them were pretty honest with us.

Sometimes, the client expected something we were no longer willing (or able to provide). And sometimes, someone made a mistake. Either way, I never begrudged a client for leaving our firm.

Conclusion

Have you made the decision to fire your financial advisor? It’s not a light decision to make.

But if you do make that decision, do it with purpose. And if you find the right new advisor, everyone will be better off in the long run.