What to Bring to a Tax Appointment

For taxpayers who are used to preparing their own taxes, it can be intimidating to go to a tax professional’s office for the first time. The most daunting task is understanding what to bring to a tax appointment, and what to leave home.

This article will help provide a better understanding of what your accountant or enrolled agent looks at when preparing your tax return. That way, you’ll better understand what to bring to a tax appointment.

Let’s start at the top, with your personal information.

Contents

Personal information

If this is your first time working with your tax preparer, then you need to bring documents that identify yourself, your spouse, and any dependents you might claim on your federal income tax return.

Specifically, your certified public accountant will need the following information:

- Social Security numbers for each person in your household

- Dates of birth for every member of your household

- Banking information, such as your bank account routing number and account numbers for direct deposit

As a new client, you should plan to bring 2 forms of identification (preferably, at least one photo ID) to your tax professional at your first tax appointment. This could include any of the following:

- Social Security cards

- Driver’s license or state-issued identification card

- Passport

Why do I need to bring photo ID to my accountant?

In order to cut down on various types of tax fraud, the Internal Revenue Service requires tax pros to verify the identity of their clients. For a first-time client, IRS Publication 1345, which provides guidance to tax return preparers, specifies that each tax preparer should request at least 2 forms of identification for unknown tax clients.

After the first tax year, most tax pros don’t require your ID or banking information, as they keep most client information on file or can look it up in your previous year’s tax return.

What if I do not have a Social Security number?

If you do not already have an individual taxpayer identification number (ITIN), you should ask your accountant how to proceed.

If you have not already done so, your tax preparer may ask you to complete Form W-7, Application for IRS Individual Taxpayer Identification Number. Your accountant can send this completed form, along with documents to verify your identity, with your income tax return.

What to bring to your appointment

You should plan to bring:

- Two forms of identification for you and your spouse

- A document containing the names, Social Security number, and date of birth for all dependents you plan to include in your tax return

- A voided check, if you would like any tax refund via direct deposit

Next, let’s take a look at sources of income.

Income information

The IRS states that all taxpayers must declare all income, from all sources. Depending on your tax situation, this could look like any of the following:

- Compensation from employment, either as an employee or independent contractor

- Self-employment income

- Retirement income, such as Social Security benefits, annuity income, pensions, or retirement plan distributions

- Capital gains, interest, or other investment income

- Business income

- Miscellaneous sources of income, such as alimony, gambling winnings, debt cancellation or rental income

What to bring

Here is a list of some of the most common tax forms you might be asked to bring to your tax appointment. Bring all of the following important tax documents that apply (including your spouse’s documents, if you’re filing a joint return).

- W-2 Form: If you’re an employee, your employer must give you a Form W-2 by January 31 of the following year.

- All versions of Form 1099 you receive: This is a common form, but there are many varieties:

- Form 1099-INT: Interest income

- Form 1099-DIV: Dividend income

- Form 1099-B: Brokerage transactions

- People who work with financial advisors should be able to get their brokerage statements from their advisor

- Form 1099-MISC: Commonly used for independent contractors

- Form 1099-Q: Distributions from college plans, like a 529 savings plan

- Form 1099-R: Retirement plan income (such as IRA distributions)

- SSA-1099: Social Security benefits

- K-1 Forms for income received as a shareholder or partner

- Documentation of alimony payments from a divorce finalized before 2019

- Documentation of rental property income

- Documentation of other sources of income, including:

- Business income: If you’re a small business owner, you may ask your accountant to prepare your business tax returns in addition to your individual return. If you already have a business accountant, ask that person for an income statement.

- Farming income

- Scholarships

In short, if you earned money during the year, then you should include it with your income documents.

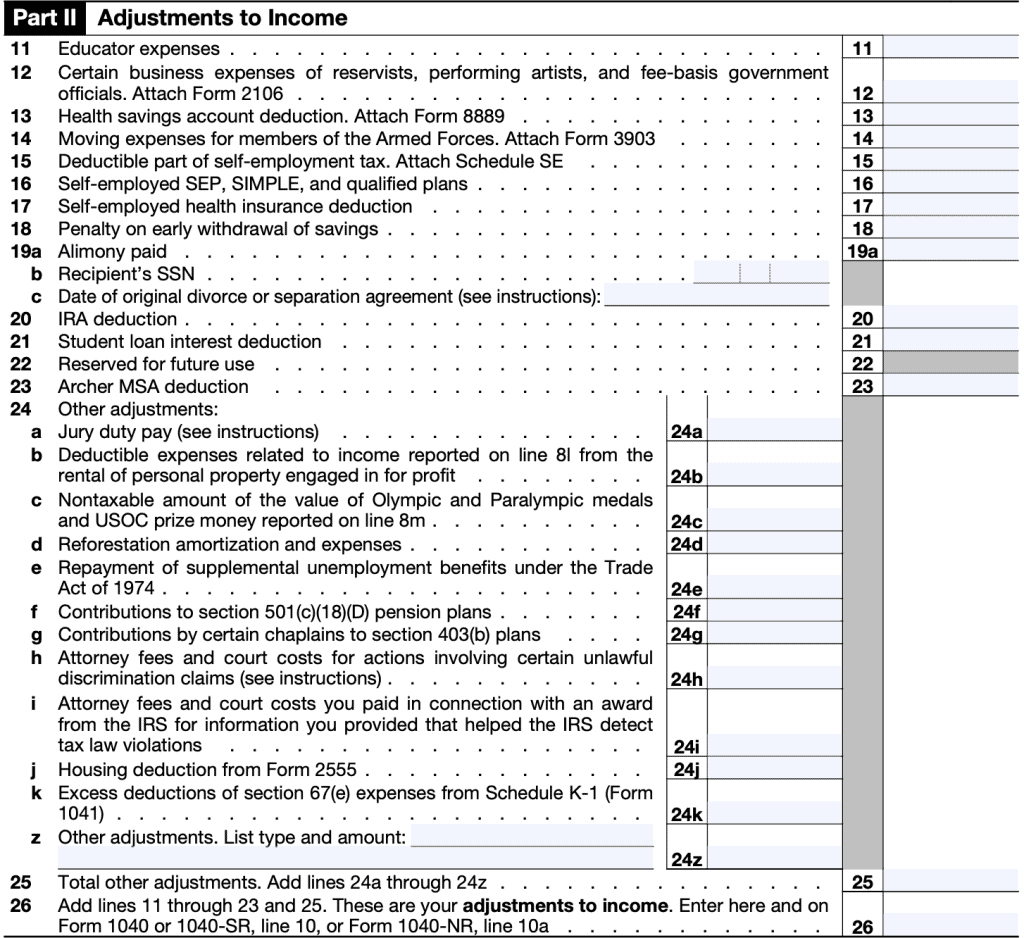

Adjustments to income

Adjustments to income are also known as above the line tax deductions. This means that they are adjustments to adjusted gross income, or AGI.

What to bring to your appointment

You’ll find a list of all adjustments to income in Schedule 1, Part II. Below is a list of the most common ones that your accountant will ask for.

- Educator expenses: Educators should keep records (including canceled checks, bank statements, and/or receipts) for classroom supplies

- Business expenses: Certain non-business owners, such as reservists, performing artists, and fee-basis government officials may be able to deduct specific expenses on Schedule 1.

- Health savings account (HSA) contributions

- Moving expenses (military members only): Servicemembers and their families may be able to deduct unreimbursed moving expenses incurred during a permanent change of station (PCS)

- Retirement plan (IRA) contributions: This includes traditional IRA contributions as well as SEP and SIMPLE IRA contributions

- Student loan interest payments

- Alimony paid on divorces finalized before 2019

Be sure to ask your accountant about any possible deductions. Even if it’s not an above the line deduction, it might still count as a tax deduction.

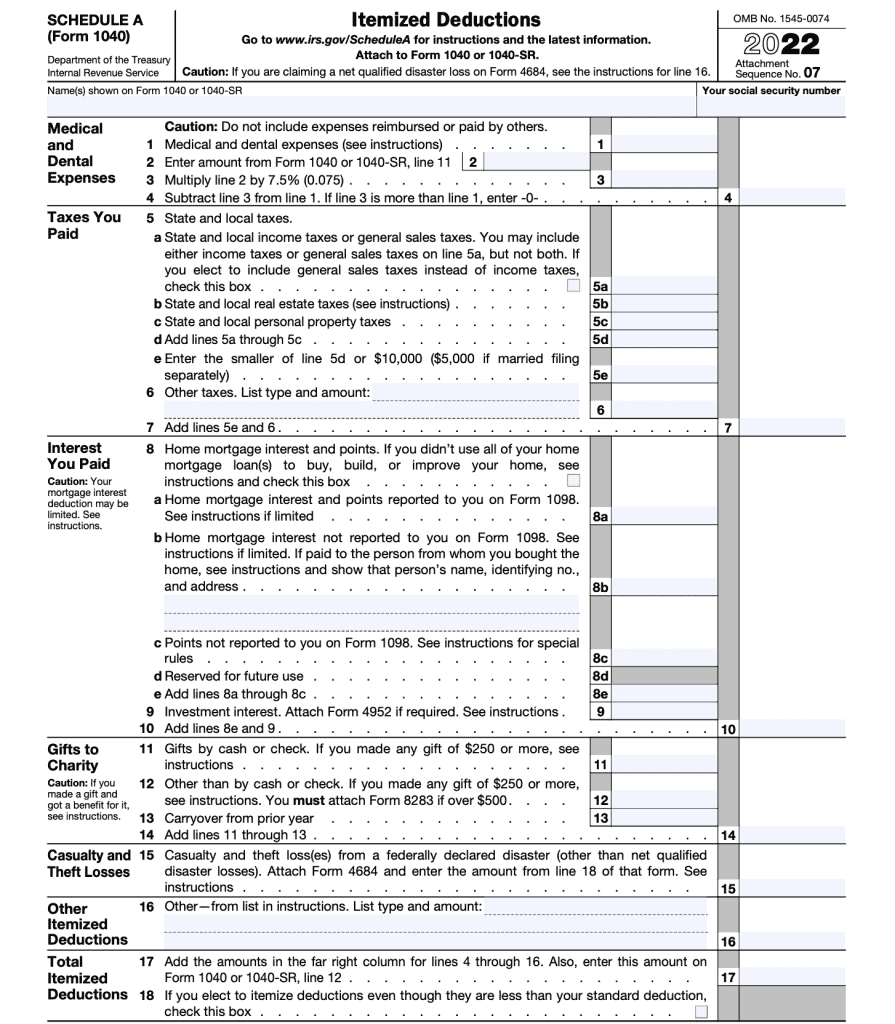

Tax deductions

After the Tax Cuts and Jobs Act (TCJA), the standard deduction increased dramatically. This makes it less likely that taxpayers will itemize deductions on their income tax return. But you should let your accountant figure that out for you.

Here’s how it works.

Standard deduction vs. itemized deductions

Every taxpayer has the option of itemizing certain tax deductions, such as charitable contributions, on their income tax return. The other option is to take the standard deduction, which applies equally to each taxpayer, depending on filing status.

- For 2022, the standard deduction is:

- For 2023, the standard deduction is:

- $13,850 for single taxpayers and married filing separately

- $27,700 for married couples filing jointly

- $20,800 for heads of household

You can choose the higher of the two, but you cannot choose both. So part of your accountant’s job is to figure out whether your itemized deductions total more than the standard deduction that you’re already entitled to.

If your tax return includes Schedule A, that is your itemized deductions list.

This includes:

- Medical and dental expenses: You can itemize medical expenses and dental expenses that exceed 7.5% of your AGI

- Taxes you paid: You can itemize up to $10,000 in state and local taxes you paid in the tax year ($5,000 if married filing separately)

- Interest you paid: You may itemize certain home mortgage, home improvement, or investment interest expenses.

- Gifts to charity: You can itemize charitable contributions

- Certain casualty and loss deductions: If you were in a federally declared disaster area during the tax year, you may be able to itemize losses that were not covered by insurance

That’s where your paperwork might come in.

What to bring to your tax appointment

You’ll want to bring all supporting documentation about the above. This might include:

- Form 1098: This is your mortgage interest statement. It contains your mortgage interest paid, as well as private mortgage insurance (PMI), and mortgage points you may have paid during the year

- Statements indicating investment interest expenses

- Medical and dental expense records: If you believe they are significant enough to exceed 7.5% of your AGI

- Documentation regarding casualty losses

- Records of your charitable donations

If you are self-employed, operate a business from your home, or own rental real estate, you can bring other documents. They might include:

- A list of home business expenses

- Rental property records

- Professional dues, unreimbursed work expenses

- Travel expenses, if not reimbursed by your employer

If there’s a place for your accountant to find a deduction, your tax pro will find it.

Tax credits

Tax deductions directly reduce your taxable income. In turn, this lowers your tax bill. But tax deductions do not reduce your tax bill 100%.

On the other hand, tax credits result in a dollar-for-dollar reduction in your overall tax bill.

The difference between a tax credit and a tax deduction

Let’s imagine that you have the choice between a $1,000 tax credit and a $1,000 tax deduction. You’re in the 24% tax bracket. Which one is better?

Tax deduction: This reduces your taxable income by $1,000. Since you’re in the 24% tax bracket, you would have paid $240 on that $1,000 of income. So your tax deduction reduces your tax bill by $240.

Tax credit: A $1,000 tax credit reduces your tax bill by $1,000. No math required.

List of common tax credits

Here are some of the most common tax credits taxpayers might be eligible for:

- Child tax credit

- Child and dependent care credit

- Foreign tax credit

- Education tax credits

- American Opportunity Tax Credit (AOTC)

- Lifetime Learning Credit

- Plug-in electric vehicle credit

- Adoption credits

What to bring to your appointment

Like with deductions, you should bring copies of all documentation you might need. If in doubt, bring it, then set up a time for your accountant to answer questions (after tax season ends).

Taxes paid throughout the year

Your Form W-2 will contain information about taxes withheld throughout the year. So will any of your other income statements. For example, if your financial institution withholds taxes on your IRA distributions, that will be noted on your Form 1099.

But if you’ve paid estimated taxes during the year, or you’ve been advised to send an estimated tax payment, be sure to include that information as well.

Miscellaneous information your accountant might need

State-specific income items

If you’re a taxpayer who pays state income taxes, you should make sure your accountant can answer questions relevant to your state’s specific tax situation. Definitely plan to bring your state income tax returns as well as a copy of last year’s federal return.

Prior year returns

For a first time appointment with a new tax preparer, you should count on bringing prior year tax returns. This is relevant information that will help your tax preparer understand more about your situation. That way, if you’re missing an important document, they’ll likely give you a call so you can address it before filing.

That will help avoid amended tax returns, which are both time-consuming and costly.