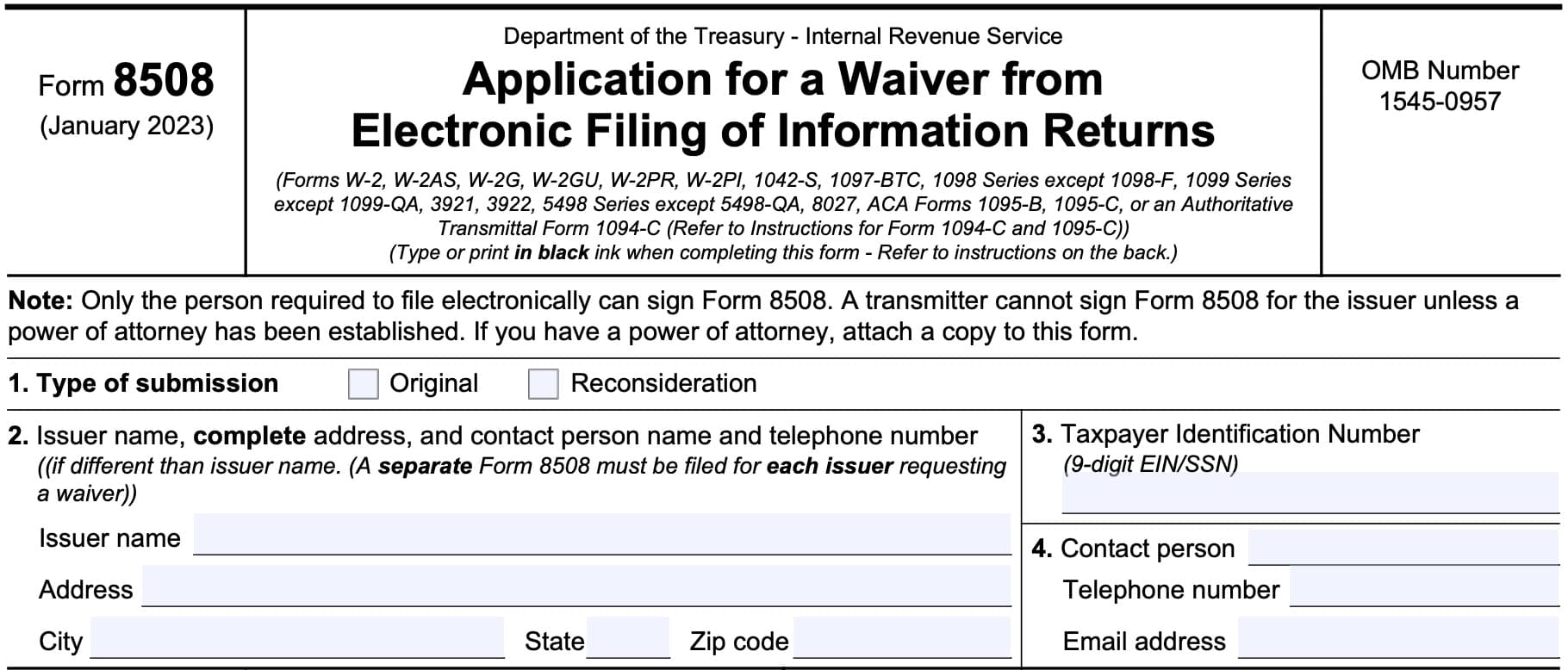

IRS Form 8508 Instructions

In 2019, Congress introduced the Taxpayer First Act, which forced the IRS Commissioner to provide options for more efficient tax administration, such as creating an e-filing requirement for filing information returns. If complying with the new requirement creates a hardship, taxpayers may file IRS Form 8508 for a hardship waiver.

In this article, we’ll walk through IRS Form 8508, specifically:

- How to complete IRS Form 8508

- Types of tax forms may qualify for hardship waivers

- Other frequently asked questions

Let’s start by going through IRS Form 8508, from the top.

Table of contents

How do I complete IRS Form 8508?

This one-page tax form is fairly straightforward. Let’s walk through it one step at a time.

Block 1: Type of submission

Check the type of submission request being filed.

Original: An original form submission is your first request for a waiver for the current tax year.

Reconsideration: A reconsideration indicates that you are submitting additional information that you think may result in an approved waiver request.

The Internal Revenue Service will not consider waiver requests for a prior tax year or a future year.

Block 2: Issuer information

In Blocks 2 through 4, you’ll enter requested information about the issuer. The issuer can be any of the following:

- Individual

- Trust

- Corporation

- Government entity

- Employer Plan administrator

In Block 2, enter the following information with regards to the issuer:

- Issuer name

- Complete address, including city, state, and zip code

Please note that each issuer seeking a waiver from electronic filing of information returns must submit a separate Form 8508.

Block 3: Taxpayer identification number

In Block 3, enter the taxpayer identification number.

For individuals, this is a Social Security number (SSN). For all other taxpayers, this field should contain your employer identification number (EIN).

Block 4: Contact person

Enter the following information for the contact person that the IRS can follow up with if additional information is required:

- Name

- Telephone number

- Email address

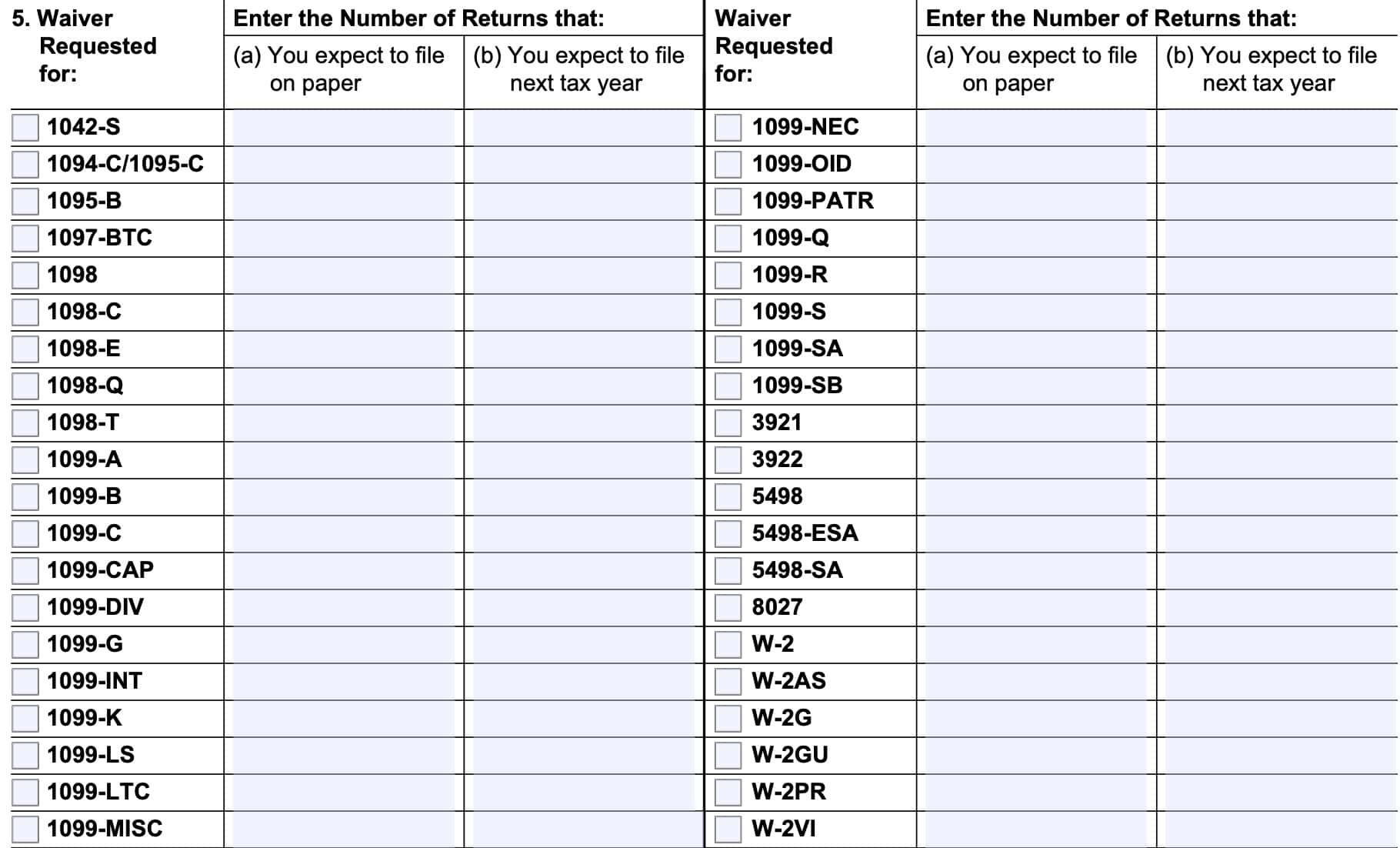

Block 5: Type of tax form waiver is requested for

You can select multiple forms as part of your waiver request. For each selected form, you’ll need to complete the following information:

- Column (a): Number of returns you expect to file on paper

- Column (b): How many tax returns you expect to file next year

Below is a little more information about each of the different types of information returns you can request a waiver for:

IRS Form 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding: Used to report income and taxes to foreign persons that may be subject to withholding under Internal Revenue Code Sections 3 or 4.

IRS Form 1094-C and IRS Form 1095-C:

Employers use both IRS Form 1095-C, Employer-Provided Health Insurance Offer and Coverage and IRS Form 1094-C, Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns, to report health care information for full-time employees during the tax year.

IRS Form 1095-B, Health coverage: Used by taxpayers to document their health care coverage during the tax year.

IRS Form 1097-BTC, Bond Tax Credit: Issuers of certain tax credit bonds (or their agents) issue IRS Form 1097-BTC to recipients who may be eligible for a tax credit from a tax credit bond or a stripped credit coupon held during the tax year.

1098 Series Forms

The 1098 forms series generally reports payments made by a person or entity who can either:

- Exclude part or all of the payments from taxable income, or

- Claim a tax deduction as a result of the payments

Here are the different versions of Series 1098 forms:

IRS Form 1098, Mortgage Interest Statement

The issuer generally has to report mortgage interest of $600 or more received during the year in the course of trade or business from an individual, including a sole proprietor.

The recipient may be able to deduct mortgage interest paid if itemizing deductions on IRS Schedule A on their income tax return.

IRS Form 1098-C, Contributions of Motor Vehicles, Boats, and Airplanes

The issuer generally is a tax-exempt organization reporting the donation of a qualified vehicle, such as a car, airplane, or boat.

The recipient may be able to deduct the value of their vehicle contribution documented on IRS Form 1098-C as a charitable deduction if itemizing deductions on their tax return.

IRS Form 1098-E, Student Loan Interest Statement

The issuer has received student loan interest of $600 or more during the tax year, and must report this to the IRS.

The recipient may be able to deduct up to $2,500 of student loan interest as an above the line deduction on IRS Schedule 1 for the tax year.

IRS Form 1098-T, Tuition Statement

The issuer generally is an eligible educational institution that is filing Form 1098-T for each enrolled student.

Recipients may be eligible for either the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC), by filing IRS Form 8863 with their income tax return.

For most filers, receiving IRS Form 1098-T is a requirement for eligibility.

1099 Form Series

This form type is generally used by issues to report payments to a recipient. The different variants usually reflect one of the following:

- Type of payment made

- Type of issuer, or

- Reason for the payment

In each case, the recipient should receive a copy of the form filed with the IRS well before the reporting deadline for their own tax return.

- IRS Form 1099-A, Acquisition or Abandonment of Secured Property: Used by lenders who receive abandoned property, or receive property as payment for a debt.

- IRS Form 1099-B, Proceeds from Broker and Barter Exchange Transactions: Issued by brokerage firms or barter exchanges to report taxable sales transactions.

- IRS Form 1099-C, Cancellation of Debt: Issued by lenders who canceled at least $600 in debt.

- IRS Form 1099-CAP, Changes in Corporate Control and Capital Structure: Furnished to shareholders who receive cash, stock, or other property from an acquisition of control or a substantial change in capital structure.

- IRS Form 1099-DIV, Dividends and Distributions: Used by banks and other financial institutions to report dividends and other distributions to taxpayers and to the IRS.

- IRS Form 1099-G, Certain Government Payments: Federal, state, and local governments use IRS Form 1099-G to report certain taxable payments.

- IRS Form 1099-INT, Interest Income: Used to report interest income exceeding $10 to a single taxpayer within a given tax year.

- IRS Form 1099-K, Payment Card and Third Party Network Transactions: Used to report third-party payment card transactions or network transactions exceeding $600.

- IRS Form 1099-LS, Reportable Life Insurance Sale: Used to report reportable life insurance sales.

- IRS Form 1099-LTC, Long-Term Care and Accelerated Death Benefits: Payers issue this form when issuing any long-term care benefits, including accelerated death benefits.

- IRS Form 1099-MISC, Miscellaneous Information: Reports miscellaneous amounts above a certain threshold paid for reasons not covered under another Form 1099.

- IRS Form 1099-NEC, Nonemployee Compensation: Used to report nonemployee compensation

- IRS Form 1099-OID, Original Issue Discount: Used to report interest income from original issue discount (OID) instruments.

- IRS Form 1099-PATR, Taxable Distributions Received From Cooperatives: Cooperatives issue this Form 1099 to each patron whom they paid at least $10 in the taxable year, or for whom they withheld taxes

- IRS Form 1099-Q, Payments from Qualified Education Programs: Paid to recipients who withdrew funds from a qualified tuition program or Coverdell ESA.

- IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.: Reports distributions from pensions, annuities, or retirement plans.

- IRS Form 1099-S, Proceeds from Real Estate Transactions: Used to report certain real estate transactions.

- IRS Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA: Reports distributions from a tax-advantaged account, such as Health Savings Account distributions or Archer MSA distributions.

- IRS Form 1099-SB, Seller’s Investment in Life Insurance Contract: A life insurance issuer files this form to report certain transactions.

5498 Form Series

This form series reports contributions to a tax-advantaged account, such as an IRA, health savings account, or education savings account.

- IRS Form 5498, IRA Contribution Information: Reports contributions to an individual retirement arrangement, or IRA.

- IRS Form 5498-ESA, Coverdell ESA Contribution Information: This tax form reports contributions to a Coverdell Education Savings Account, or ESA.

- IRS Form 5498-SA, HSA, Archer MSA, or Medicare Advantage MSA Information: Reports contributions to a tax-advantaged medical savings account.

- IRS Form 8027, Employer’s Annual Information Return of Tip Income and Allocated Tips: Large food and beverage employers file IRS Form 8027 to report income and tips to the IRS, and to allocate tip income amongst employees.

W-2 Form Series

- IRS Form W-2, Wage and Tax Statement: Employers report employee income on Form W-2.

- IRS Form W-2AS, American Samoa Wage and Tax Statement: This tax form is used to report American Samoa wage income.

- IRS Form W-2G, Certain Gambling Winnings: Used to report gambling winnings and tax withholdings from gambling income.

- IRS Form W-2GU, Guam Wage and Tax Statement: This tax form reports Guam wage income.

- IRS Form W-2PR, Puerto Rico Income: Used to report Puerto Rico income.

- IRS Form W-2VI, U.S. Virgin Islands Wage and Tax Statement: Used to report U.S. Virgin Islands wage income.

Miscellaneous series

IRS Form 3921, Exercise of an Incentive Stock Option Under Section 422(b): Companies issue IRS Form 3921 when employees exercise stock options.

IRS Form 3922, Transfer of Stock Acquired Through An Employee Stock Purchase Plan: Companies issue IRS Form 3922 when employees purchase discounted stock through an employee stock purchase plan.

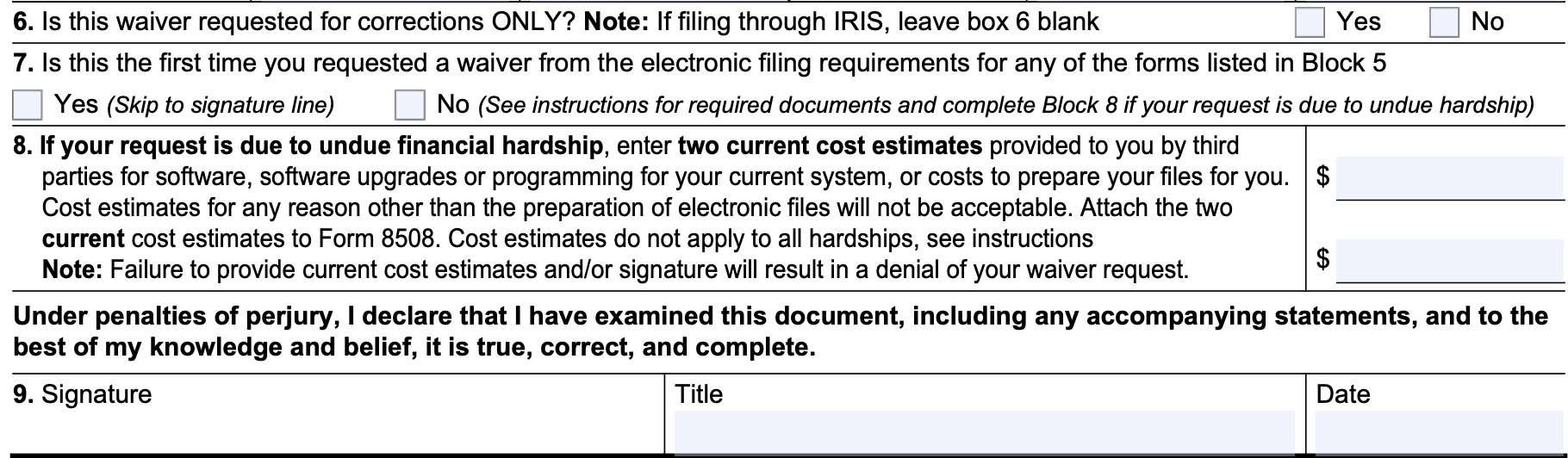

Block 6: Is this waiver requested for corrections only?

Indicate whether this waiver is requested for corrections only.

If you request a waiver for original documents and it is approved, you will automatically receive a waiver for corrections. However, if you can submit your original returns electronically, and are requesting to submit corrections on paper, a waiver must be requested for corrections only.

If you are filing through the information returns intake system (IRIS), then leave Block 6 blank.

Block 7: Is this the first time you requested a waiver from the electronic filing requirements for any of the forms listed in Block 5?

If this is your first application, you can check Yes, skip Block 8, then sign the form in Block 9 below.

If this is not your first application to waive the electronic filing requirement, then check ‘No, then attach justification for the waiver to the completed form.

Justification for the waiver

You can attach required cost estimates, as outlined in Block 8, or a written statement to justify your application for a waiver of the requirement to electronically file your information returns.

Examples include:

- Undue financial hardship in which the cost of filing the information returns, in accordance with this section, exceeds the cost of filing the returns on other media.

- Provide two cost estimates comparing the filing of information returns, in accordance with this section, with the cost to file in paper form.

- Complete Block 8, below.

- Rural filers without access to internet and filers that lack digital literacy are expected to make a good faith effort to comply with the electronic filing requirement.

- Filers may submit a Form 8508 if obtaining the necessary assistance to file electronically would cause an undue hardship.

- Provide two cost estimates comparing the filing of information returns, in accordance with this section, with the cost to file in paper form.

- Complete Block 8, below.

- Business suffered a catastrophic event in a federally declared disaster area that made the business unable to resume operations or made necessary records unavailable.

- Fire, casualty, or natural disaster affected the operation of the business.

- Death, serious illness, or unavoidable absence of the individual responsible

for filing the information returns affected the operation of the business. - Business was in its first year of establishment.

- Foreign entity who is unable to file electronically due to inability to obtain software, third party provider, or other issues outside of their control.

Block 8

If your application for a waiver is based on undue financial hardship, you must obtain current cost estimates from two service bureaus or other third parties.

These cost estimates must reflect the total amount that each service bureau will charge for:

- Software or software upgrades

- Programming for your current system, or

- Costs to prepare or obtain assistance to comply with electronic filing requirements

Enter the current costs in Block 8 and attach the cost estimates to Form 8508. The cost estimates should reflect, in good faith, that this is a more cost-effective way to comply with IRS guidance. The IRS will automatically deny any request for hardship waivers without written cost estimates.

Cost estimates from prior years will not be accepted.

Block 9: Signature

The waiver request must be signed by either:

- The taxpayer

- A person duly authorized to sign a return by the taxpayer, or

- A person who can execute agreements that are contractual and legally enforceable against the taxpayer

A transmitter cannot sign IRS Form 8508 on the issuer’s behalf unless a power of attorney has been established. If you have a power of attorney on file, attach a copy to this form.

Video walkthrough

Check out this video to learn more about obtaining a waiver from filing information returns of any type by filing IRS Form 8508.

Frequently asked questions

You should file at least 45 days prior to the due date of the returns for which you are requesting a waiver. The IRS will process waiver requests beginning January 1st of the calendar year for which the returns are due.

If meeting the e-file rules conflicts with a filer’s religious beliefs, then the taxpayer is automatically exempt and does not need to file IRS Form 8508 to submit a paper return. If this results in an IRS notice, you may respond that e-file conflicts with your religious beliefs.

Prior to the Taxpayer First Act, there was a 250-return threshold, where the IRS could not force taxpayers filing fewer than 250 annual returns to use an e-file form. This requirement is now 10 annual returns. For partnership returns, the threshold is 100 partners per year.

Where can I find IRS Form 8508?

You can find IRS Form 8508 on the IRS website. For your convenience, we’ve attached a fillable version of IRS Form 8508 right here, in this article.

Related tax articles

There are a number of forms provided by the Internal Revenue Service to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this one.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as in-depth video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!