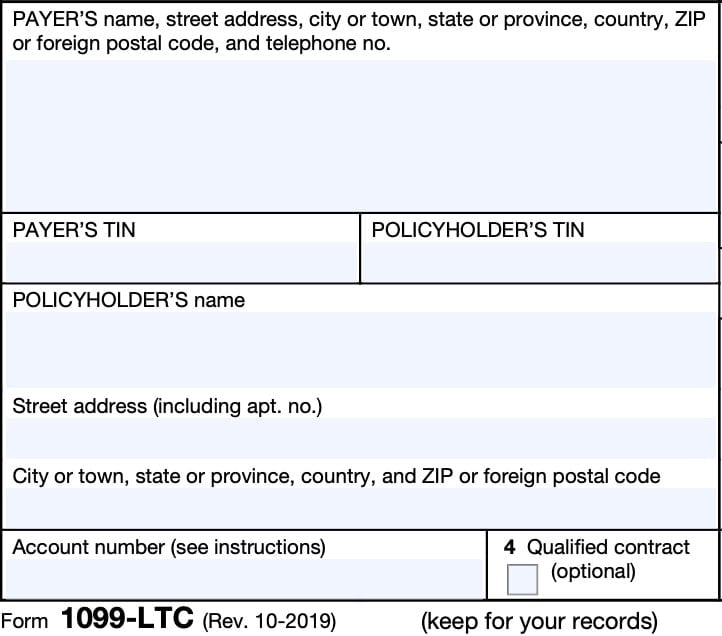

IRS Form 1099-LTC Instructions

Insurance companies and viatical settlement providers are required to report proceeds from long-term care and life insurance policies on IRS Form 1099-LTC.

In this article, we’ll walk through everything you need to know about IRS Form 1099-LTC, including:

- How to read and understand Form 1099-LTC

- How you may need to report insurance benefits on your income tax return

- Other frequently asked questions

Let’s begin with an overview of the tax form itself.

Table of contents

IRS Form 1099-LTC instructions

In most of our articles, we walk you through how to complete the tax form. However, since Form-1099 is issued to taxpayers for informational purposes, most readers will probably want to understand the information reported on their 1099-LTC form, instead of how to complete it.

Before we start breaking down this tax form, it’s important to understand that there can be up to 4 copies of Forms 1099-LTC. Here is a break down of where all these forms end up:

- Copy A: Internal Revenue Service center

- Copy B: For the policyholder

- Copy C: For the insured

- Copy D: For the payer (insurance company or viatical settlement provider)

Let’s get into the form itself, starting with the information fields on the left side of the form.

Taxpayer information

Payer’s Name, Address, And Telephone Number

You should see the payer’s contact information, with complete business name, address, zip code, and telephone number in this field.

Payer’s TIN

This is the payer’s taxpayer identification number (TIN). In most situations, this will be the employer identification number (EIN).

The payer’s TIN should never be truncated.

Recipient’s TIN

As the policyholder and recipient of IRS Form 1099-LTC, you should see your taxpayer identification number in this field. The TIN can be any of the following:

- Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

- Adoption taxpayer identification number (ATIN)

- Employer identification number (EIN)

Please review this field to make sure that it is correct. However, you may see a truncated form of your TIN (such as the last four digits of your SSN), for privacy protection purposes.

Copy A, which is sent to the Internal Revenue Service, is never truncated.

Policyholder’s Name And Address

You should see your legal name and address reflected in these fields. If your address is incorrect, you should notify the lender and the IRS.

You can notify the IRS of your new address by filing IRS Form 8822, Change of Address. Business owners can notify the IRS of a change in their business address by filing IRS Form 8822-B, Change of Address or Responsible Party, Business.

Account Number

This field is present in many information returns, such as IRS Form 1099-NEC or IRS Form 1099-MISC.

Your payer have established a unique account number for you, which may appear in this field. If the field is blank, you may ignore it.

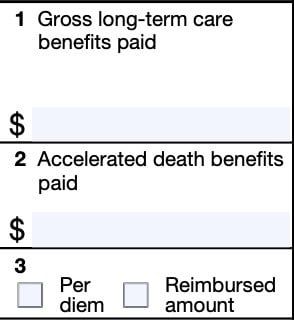

Boxes 1 through 5

On the right-hand side of Form 1099-LTC, you’ll see the relevant tax information.

Generally, proceeds from a long term care policy are tax free. However, individual circumstances vary, and the information on the right side of the form will help individual taxpayers understand the tax implications of their LTC benefit.

Let’s start with Box 1.

Box 1: Gross long-term care benefits paid

Box 1 shows the gross benefits paid under a long-term care insurance contract during the year.

Your payer must enter the gross long-term care benefits paid out during the current tax year. However, this does not include accelerated death benefits, which are reported in Box 2.

These benefits are all amounts that were paid out in one of the following manners:

- Per diem basis: Payments made on any periodic basis without regard to actual expenses

- Reimbursed basis: Payments made for actual long-term care expenses incurred

Box 1 includes the following payment amounts:

- Amounts paid to the insured

- Amounts paid to the policyholder

- Amounts paid to third parties

Your payer is not required to determine whether or not any LTC benefits are taxable or nontaxable. This is the responsibility of individual taxpayers.

Determining taxability of long-term care insurance benefits

IRS Form 1099-LTC does not contain enough information to determine whether your LTC insurance proceeds are includible as taxable income.

To make this determination, you’ll need to complete and file IRS Form 8853, Archer MSAs and Long-Term Care Insurance Contracts. Taxpayers may use IRS Form 8853 to determine the taxability of any of the following:

- Tax-qualified long-term care insurance benefits

- Proceeds from a non-tax qualified policy

- Proceeds from a life insurance policy with an accelerated death benefits clause

Box 2: Accelerated death benefits paid

Box 2 shows the gross accelerated death benefits paid during the year.

Your payer must enter the gross accelerated death benefits paid under a life insurance contract. This includes accelerated benefits paid to an insured who has been certified as terminally or chronically ill, or on the insured person’s behalf.

Terminally ill individual

The Internal Revenue Service defines a terminally ill individual as someone who has been certified by a physician as having an illness or physical condition that can reasonably be expected to result in death in 24 months or less after the date of certification.

Amounts paid as accelerated death benefits are fully excludable from gross income if the insured has been certified by a physician as terminally ill.

Chronically ill individual

The IRS defines a chronically ill individual as someone who has been certified (at least on an annual basis) by a licensed health care practitioner as one of the following:

- Being unable to perform, without substantial assistance, at least 2 of the following daily living activities for at least 90 days due to a loss of functional capacity:

- Eating

- Toileting

- Transferring

- Bathing

- Dressing

- Continence

- Requiring substantial supervision to protect the individual from health and safety threats due to severe cognitive decline

Accelerated death benefits paid on behalf of individuals who are certified as chronically ill are excludable from income to the same extent they would be if paid under a qualified long-term care insurance contract.

Box 2 also includes amounts paid by a viatical settlement provider for the sale or assignment of the insured’s death benefit under a life insurance contract.

Viatical settlement providers

A viatical settlement provider is any person who:

- Is regularly engaged in the trade or business of purchasing or taking assignments of life insurance contracts on the lives of terminally or chronically ill individuals, and

- Is licensed in the state where the insured lives. If licensing is not required in the state, the provider must meet other requirements (see below) depending on whether the insured is terminally or chronically ill.

If the insured is terminally ill

For terminally ill individuals, the provider must meet the requirements of Sections 8 and 9 of the Viatical Settlements Model Act of the National Association of Insurance Commissioners (NAIC), relating to disclosure and general rules.

The provider must also meet the requirements of the Model Regulations of the NAIC for evaluating the reasonableness of amounts paid in viatical settlement transactions with terminally ill individuals.

If the insured is chronically ill

If the insured is chronically ill, the provider must meet requirements similar to those of sections 8 and 9 of the Viatical Settlements Model Act of the NAIC and must also meet any standards of the NAIC for evaluating the reasonableness of amounts paid in viatical settlement transactions with chronically ill individuals.

Box 3

Box 3 indicates whether or not the amount of benefits paid in Box 1 or Box 2 were paid on a per diem basis, or as reimbursement for actual long-term care expenses.

As mentioned in Box 1 above, per diem refers to payments made on a periodic basis without regard to actual long-term care expenses incurred. This usually is on a daily basis.

Conversely, reimbursed basis refers to benefit amounts paid to reimburse the policy holder for actual expenses incurred for long-term care services.

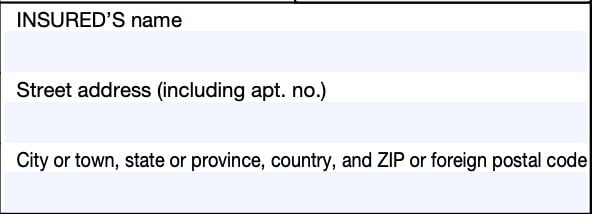

Insured’s information

To the right of Box 3, and just below are information fields for the insured individual. Let’s take a closer look.

Insured’s TIN

This field should contain the insured’s Social Security number or other federal tax identification number.

Insured’s name & address

This field should contain the insured individual’s name and street address, if different from the policyholder.

Box 4: Qualified contract

This optional field may show if the benefits were from a qualified long-term care insurance

contract.

Qualified long-term care insurance contract

A contract issued after 1996 is a qualified long-term care insurance contract if it meets the requirements of Internal Revenue Code Section 7702B, regarding tax treatment of qualified long-term care insurance contracts.

This includes the requirement that the insured must be a chronically ill individual, as previously defined.

A long-term care insurance policy contract issued before 1997 generally is treated as a tax-qualified long-term care insurance contract if it:

- Met state law requirements for long-term care insurance contracts when issued, and

- Has not been materially changed

However, this field is optional, and may not contain any information.

Box 5

Box 5 may contain a check depending on the insured’s status.

If the covered individual meets the requirements for a chronically ill person, the Chronically ill box should be checked. If the person meets the requirements for a terminally ill individual, then the Terminally ill box should be checked.

Next to these boxes, the Date certified field should indicate the most recent date that the status was certified by a licensed healthcare practitioner or physician.

Filing IRS Form 1099-LTC

For tax entities who must file this tax form with the Internal Revenue Service, the IRS requires certain paper versions of information returns to be accompanied by IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

Check out our step-by step instructional guide for more information on how to submit your information return with IRS Form 1096.

Video walkthrough

Learn more about IRS Form 1099-LTC by watching this informational video.

Frequently asked questions

It depends. Generally, the amount of money received from a tax-qualified policy is not considered taxable income, while part of the benefits from a non-tax qualified policy may be taxable. You may need to complete IRS Form 8853 to determine taxability of LTC proceeds.

Generally, taxpayers should expect to receive recipient copies of their 1099-LTC forms no later than January 31 for proceeds issued in the prior tax year. If you have not received your Form 1099-LTC by February 15, you should contact your policy holder or the IRS for assistance.

In general, benefit payments that you receive under a qualified long-term care insurance policy are tax free. Qualified policies must be guaranteed renewable, and they can’t have any cash value.

Where can I find IRS Form 1099-LTC?

As with most free tax forms, you can find IRS Form 1099-LTC on the IRS website. For your convenience, we’ve enclosed the most recent version of IRS Form 1099-LTC in this article, just below.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!