IRS Form 1099-SB Instructions

In 2019, the Internal Revenue Service issued new reporting requirements for the sale of certain life insurance contracts, mandated by the Tax Cuts and Jobs Act. These reporting requirements cover the acquisition of an interest in insurance policies by unrelated persons or companies. As a result, life insurance companies must file IRS Form 1099-SB to report the seller’s investment in their life insurance contract.

In this article, we’ll go over IRS Form 1099-SB in depth, including:

- How to read and understand IRS Form 1099-SB

- Reporting requirements

- Frequently asked questions

Let’s start with an overview of this tax form.

Table of contents

IRS Form 1099-SB instructions

In most of our articles, we walk you through how to complete the tax form. However, since Form-1099-SB is issued to taxpayers for informational purposes, most readers will probably want to understand the information reported on their 1099-SB form, instead of how to complete it.

Before we start breaking down this tax form, it’s important to understand that there can be up to 3 copies of IRS Form 1099-SB. Here is a break down of where all these forms end up:

- Copy A: Internal Revenue Service center

- Copy B: For seller

- Copy C: For issuer

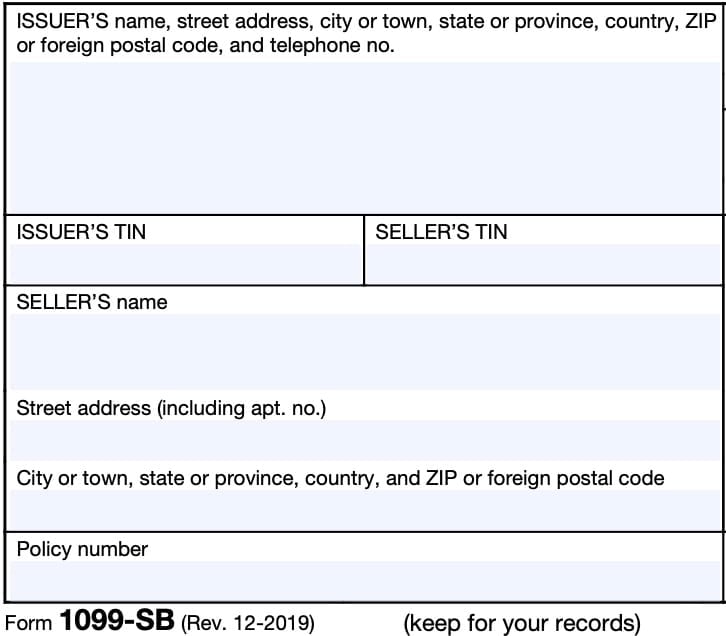

Let’s get into the form itself, starting with the information fields on the left side of the form.

Taxpayer identification fields

On the left-hand side of the tax form, you’ll see taxpayer information for both the issuer and the seller.

Lender’s Name, Address, And Telephone Number

You should see the lender’s contact information, with complete business name, address, zip code, and phone number in this field.

Issuer’s TIN

This is the filer’s taxpayer identification number (TIN). In most situations, this will be the employer identification number (EIN).

The issuer’s TIN should never be truncated.

seller’s TIN

As the recipient of IRS Form 1099-SB, you should see your taxpayer identification number in this field. The TIN can be any of the following:

- Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

- Adoption taxpayer identification number (ATIN)

- Employer identification number (EIN)

Please review this field to make sure that it is correct. However, you may see a truncated form of your TIN (such as the last four digits of your SSN), for privacy protection purposes.

Copy A, which is sent to the Internal Revenue Service, is never truncated.

Seller’s Name And Address

You should see your legal name and address reflected in these fields. If your address is incorrect, you should notify the lender and the IRS.

You can notify the IRS of your new address by filing IRS Form 8822, Change of Address notice. Business owners can notify the IRS of a change in their business address by filing IRS Form 8822-B, Change of Address or Responsible Party, Business.

Policy number

This field shows the policy number the life insurance company assigned to the life insurance contract transferred.

Let’s check out the numbered fields, which start on the right-hand side of this tax form.

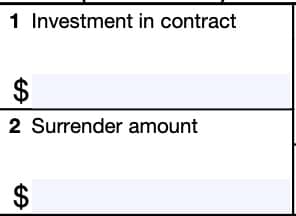

Boxes 1 and 2

The information fields on the right side of this tax form is relatively straightforward. Let’s start with Box 1.

Box 1: Investment in contract

Box 1 shows the issuer’s estimate of your investment in the life insurance policy.

How investments in insurance contracts are determined

Investments in insurance contracts are defined by Internal Revenue Code Section 72(e)(6).

According to the tax code, a seller’s investment in an insurance contract on any date is:

- The aggregate amount of premiums or other consideration paid for such life insurance contract before the date, minus

- The aggregate amount received under the contract before such date, to the extent that this amount was excludable from gross income

In other words, premiums paid minus dividends or other payments received.

Box 2: Surrender amount

Box 2 shows the amount that you would have received upon surrender of the life insurance contract transferred.

Issuer’s information

This box shows the contact information of the issuer of a life insurance contract.

The contact information provided will give you direct access to a person who can answer questions about this form.

If this field is blank, the contact information is the same as the issuer.

Filing IRS Form 1099-SB

For tax entities who must file this tax form with the Internal Revenue Service, the IRS requires certain paper versions of information returns to be accompanied by IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

Check out our step-by step instructional guide for more information on how to submit your information return with IRS Form 1096.

Who must file IRS Form 1099-SB?

Life insurance companies must file IRS Form 1099-SB for life insurance policies they have issued if either of the following events occurs:

- The insurance company receives a statement from an acquirer in a reportable policy sale provided under Internal Revenue Code Section 6050Y(a) reporting the transfer of the life insurance contract in a reportable life insurance sale, or

- As indicated on IRS Form 1099-LS, Reportable Life Insurance Sale

- The issuer of a life insurance contract receives notice of the transfer of the life insurance contract to a foreign person

Treasury Regulations Section 1.6050Y-3(a) and Section 1.6050Y-1(a)(8) contain additional information on reporting the sale of life insurance policies.

Video walkthrough

Watch this instructional video to learn more about IRS Form 1099-SB.

Frequently asked questions

The issuer of an insurance policy must furnish this form to you upon receiving notice of a transfer of your life insurance contract in a reportable policy sale under Section 6050Y or the

transfer of your life insurance contract to a foreign person reportable under Section 6050Y.

A reportable policy sale is any direct or indirect acquisition of any interest in a life insurance

contract if the acquirer, at the time of the acquisition, has no substantial family, business, or financial relationship with the person insured under that contract, apart from the acquirer’s interest in such life insurance contract.

Insurance companies must file Form 1099-SB with the IRS by March 1 after the tax year of the sale. The due date for copies to be furnished to the policy owner is February 15 or within 30 days of notice of a transfer of the life insurance contract to a foreign person, whichever is later.

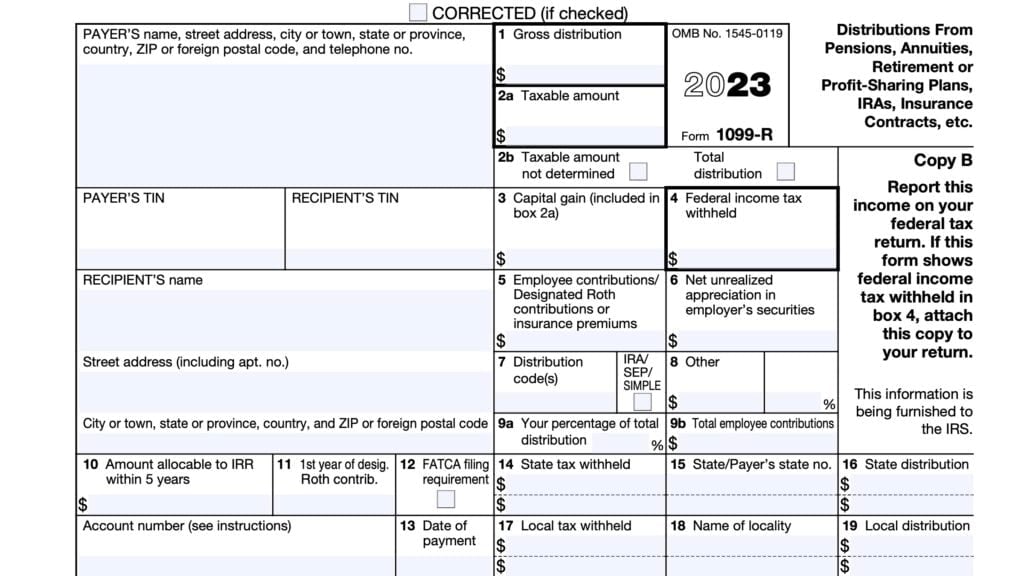

Generally, taxable distributions or death benefits from insurance contracts are reported on IRS form 1099-R. IRS Form 1099-SB is filed to notify the IRS of the insurance contract transfer as well as the seller’s investment basis in that contract.

Where can I find IRS Form 1099-SB?

You can generally find IRS Forms, such as the new Forms 1099-LS or 1099-SB forms, on the Internal Revenue Service website. For your convenience, we’ve enclosed the latest version of IRS Form 1099-SB right here in this article.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!