IRS Form 15101 Instructions

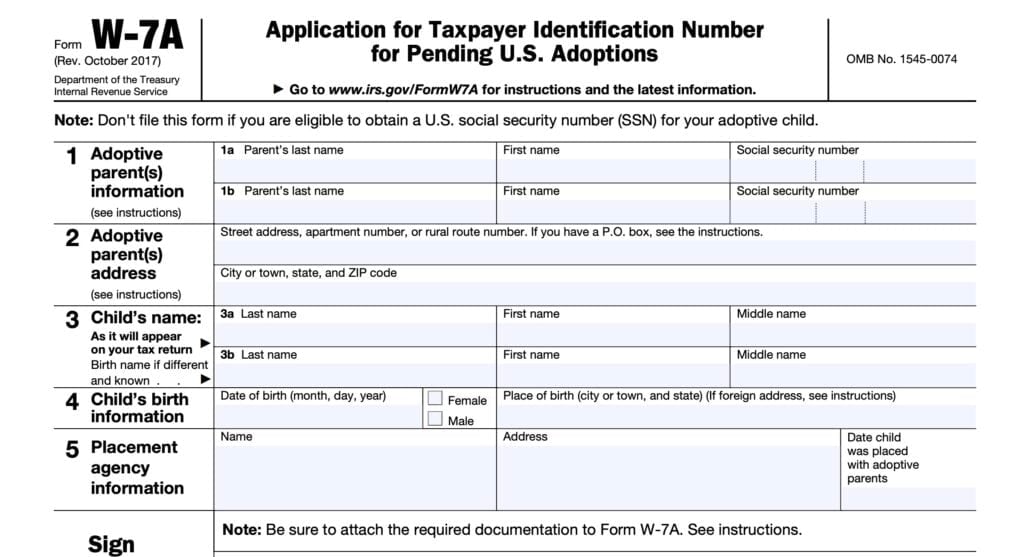

Taxpayers adopting a child may obtain a temporary adoption taxpayer identification number (ATIN) for tax purposes. After the adoption is final and their child has a Social Security number, they should report the change to the Internal Revenue Service on IRS Form 15101.

In this article, we’ll walk through everything you need to know about IRS Form 15101, including:

- How to complete IRS Form 15101

- Filing considerations

- Frequently asked questions

Let’s start by walking through this tax form.

Table of contents

How do I complete IRS Form 15101?

This one-page form is relatively straightforward to complete. Let’s start at the top.

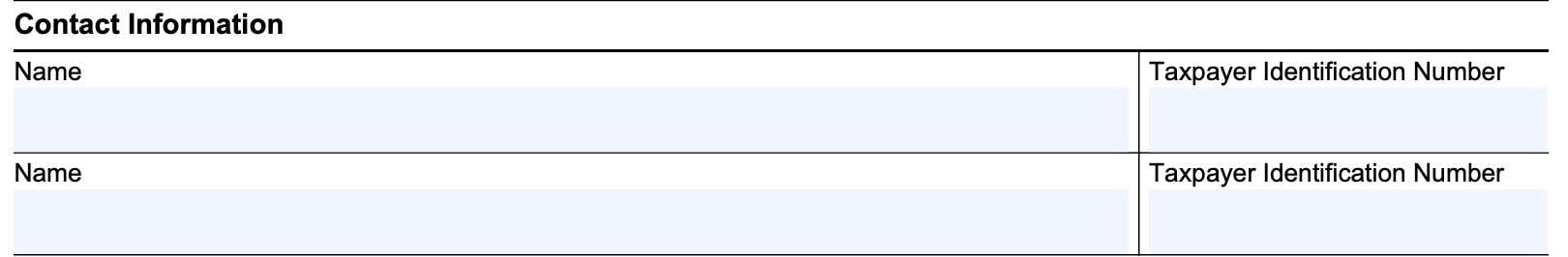

Contact information

This part contains name and taxpayer identification number fields for up to two taxpayers. Enter your name and Social Security number (SSN) here.

For a married couple filing a joint tax return, both spouses should enter their name and SSN here.

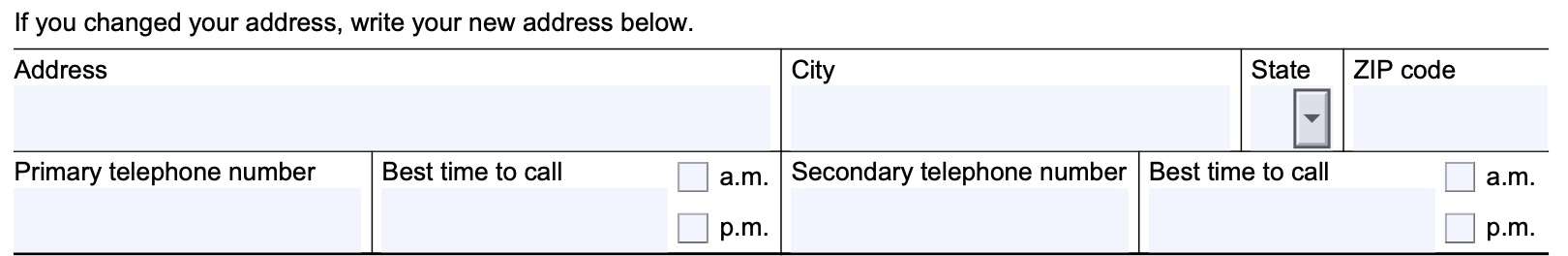

Address

Enter your mailing address in the spaces provided. Include the city, state, and ZIP code. If you’ve recently changed your address, write your new address below.

Although not stated in the form instructions, you may consider filing IRS Form 8822, Change of Address, to notify the IRS of your new address. This is especially true if you’re expecting to receive IRS correspondence in the near future.

Telephone number

You can enter up to two phone numbers, as well as preferred times for the IRS to call, if needed.

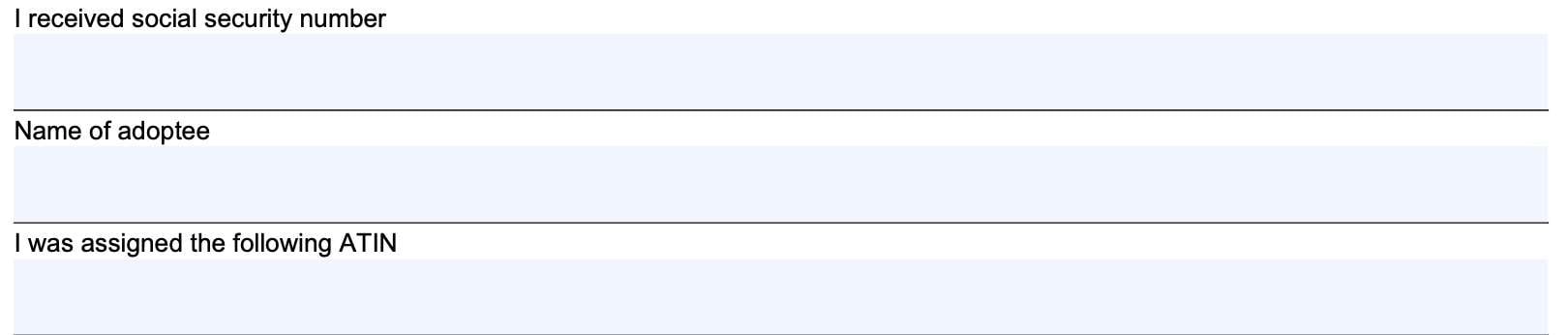

I received Social Security number

Enter the SSN as it appears on your child’s Social Security card.

Name of adoptee

Enter the name of your adoptive child here.

I was assigned the following ATIN

Enter your child’s Adoption Taxpayer Identification Number (ATIN) in this field.

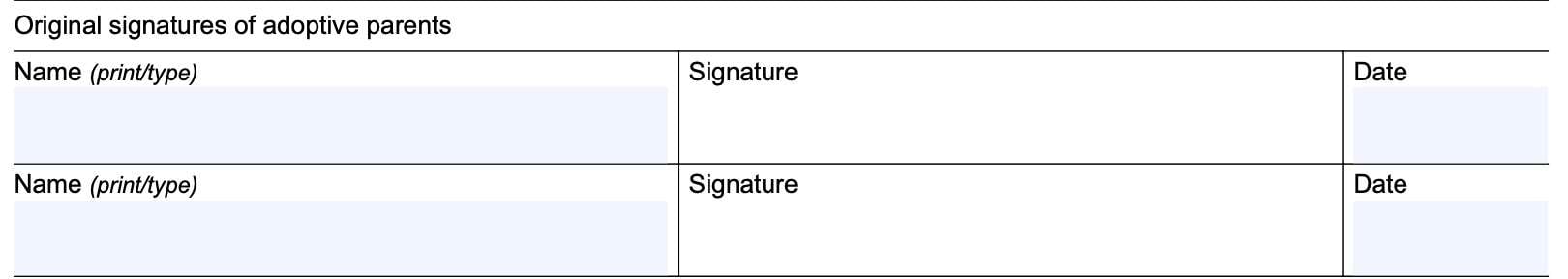

Original signatures of adoptive parents

There are up to two signature blocks here. Each signer should:

- Print or type their complete name

- Sign in the signature area

- Enter the date of signature

For a married couple filing jointly, both spouses should sign, especially if both names appear at the top of the form.

Filing IRS Form 15101

There are several considerations each taxpayer should know about filing IRS Form 15101.

Purpose of IRS Form 15101

Taxpayers file IRS Form 15101, Provide a Social Security Number (SSN) for Adoptive Child, only to inform the Internal Revenue Service of an adoptive child’s SSN after the IRS initially provided an adoption taxpayer identification number (ATIN) for tax purposes.

When not to file IRS Form 15101

There are several occasions where IRS Form 15101 is not appropriate.

Obtaining your child’s SSN

Do not file IRS Form 15101 to obtain a Social Security number for your child. Only the Social Security Administration (SSA) can assign an SSN.

Instead, you should wait until the adoption is final before trying to obtain an SSN. After the adoption is final, you may apply for an SSN on the child’s behalf by filing Form SS-5, Application for a Social Security card with the SSA.

If your SSN application is denied

If the SSA denies your application for an SSN, then you should contact the IRS to request an extension or reactivation of the ATIN. You may do this by filing IRS Form 15100, Adoption Taxpayer Identification Number (ATIN) Extension Request.

When you request the extension or reactivation of the ATIN, include the SSA’s denial letter or an explanation with your correspondence.

When to file IRS Form 15101

You should file IRS Form 15101 as soon as your child receives his or her Social Security number. Do not continue using the ATIN after you receive the child’s SSN.

After receiving a CP561C Notice

If you received a CP561C notice from the IRS, this means that your child’s ATIN expired. If your child has an SSN, you may detach the notice stub and mail it with your completed Form 15101.

How to file IRS Form 15101

You may file IRS Form 15101 by mail or fax. Below are further instructions on how you may file.

Standard mail

Internal Revenue Service

Stop 6182

Austin, TX 73301-0066

Note: There is a different address at the bottom of page 2 on the form, reflecting the following address:

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0066

Express mail

If mailing by overnight or express service, the IRS gives the following address:

Internal Revenue Service

3651 S. Interregional Hwy 35

Stop 6182

Austin, TX 78741

Fax

If filing by fax, you may fax your completed form to the following fax number: (855) 250-1731

Telephone number

For further questions about your form, you may contact the IRS at: (737) 800-5511. This is not a toll-free number.

Video walkthrough

Watch this informational video to learn more about using IRS Form 15101 to notify the Internal Revenue Service of your adoptive child’s new SSN.

Frequently asked questions

According to the Social Security Administration, when a parent receives Social Security retirement or disability benefits, or dies, their child may also receive benefits. Under certain circumstances, this may include an adopted child.

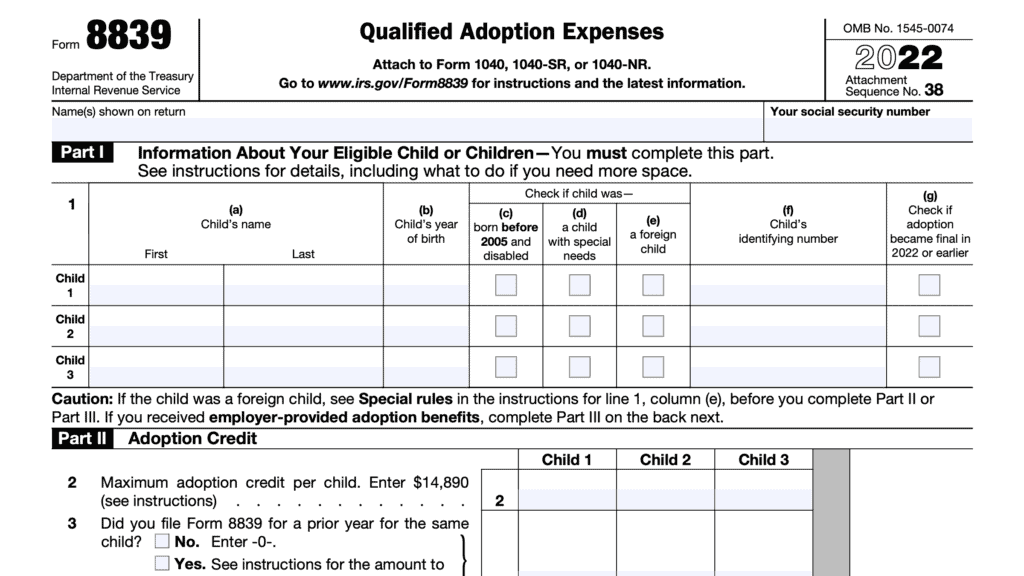

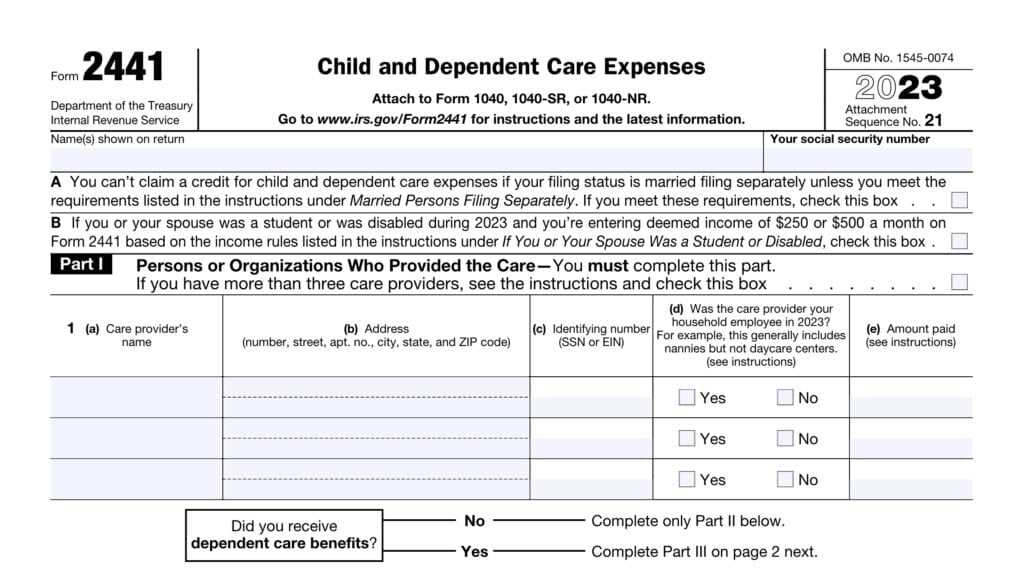

No. An adoption taxpayer identification number (ATIN) is a number that the IRS temporarily assigns to a child while he or she undergoes the adoption process. An ATIN may allow adoptive parents to claim certain tax benefits until the child is eligible for an SSN.

Where can I find IRS Form 15101?

You can find the latest versions of IRS forms on the IRS website. For your convenience and easier access, we’ve embedded the latest version of IRS Form 15101 here, in our article.