IRS Form 8932 Instructions

To lessen the burden of military deployment on families, the federal government has created a tax credit for business owners who make differential wage payments for qualified employees. Eligible employers may claim this tax credit by submitting IRS Form 8932 with their income tax return.

In this article, we’ll walk through this tax form, including:

- Step by step guidance on how to complete IRS Form 8932

- How to report differential wage payments on your income tax return

- Tax credits and deductions that might be reduced as a result of claiming this tax credit

Let’s start with a step by step walkthrough of IRS Form 8932.

Table of contents

How do I complete IRS Form 8932?

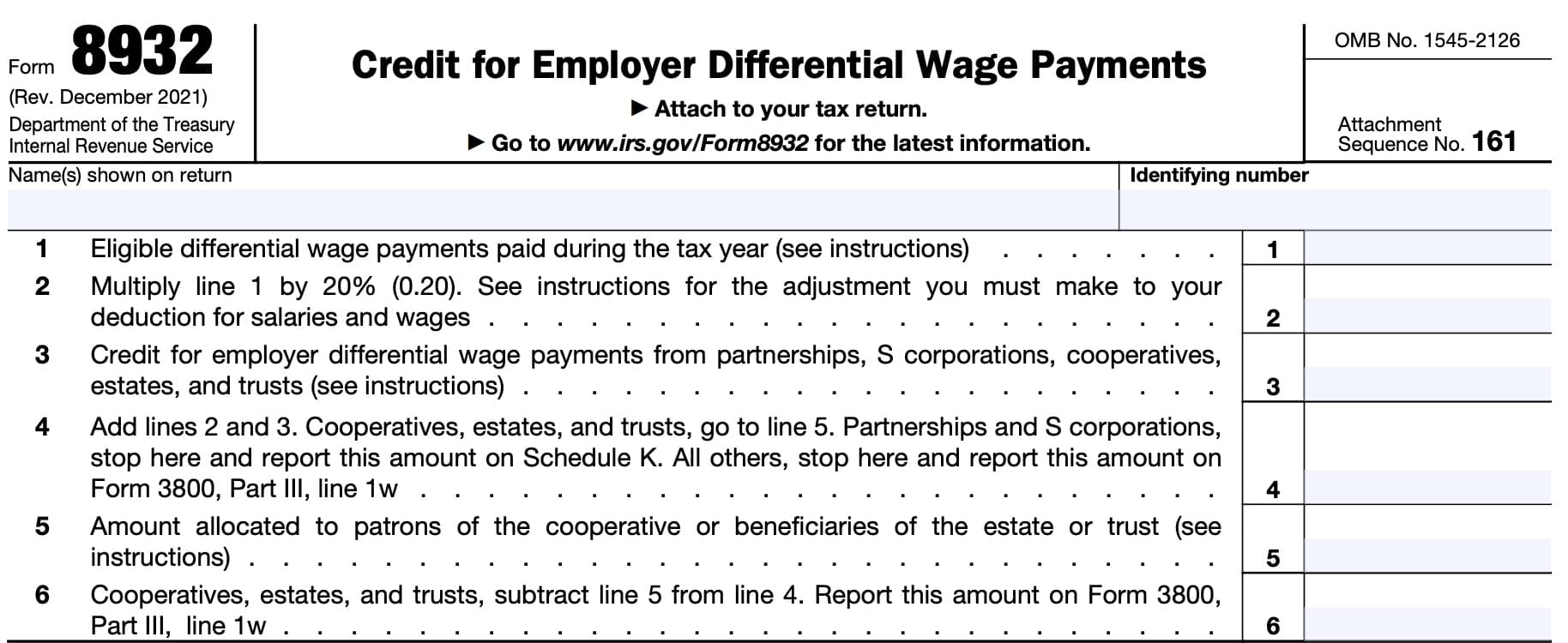

At the top of the tax form, enter the taxpayer name and identifying number, as indicated on your tax return.

From there, we’ll start completing each line, beginning with Line 1, below.

Line 1: Eligible differential wage payments paid during the tax year

In Line 1, enter the total amount of eligible differential wage payments made to qualified employees during the tax year.

Eligible differential wage payments

Eligible differential wage payments are the total differential wage payments paid to a qualified employee for the tax year, up to $20,000 for each employee.

To be considered a differential wage payment, the payment must meet both of the following requirements.

- The payment is made to a qualified employee for any period during which the employee is performing service in the uniformed services of the United States while on active duty for a period of more than 30 days.

- The payment represents all or a portion of the wages the employee would have received from the employer if the employee were performing services for the employer instead of serving in the Armed Forces.

However, eligible differential wage payments do not include the following:

- Wage payments made after December 31, 2020, and before July 1, 2021, if you use the same wage payments to claim the employee retention credit on an employment tax return,

- For example, Form 941, Employer’s QUARTERLY Federal Tax Return

- Wage payments made after March 31, 2021, and before October 1, 2021, if you use the same wage payments to claim the employer credit for qualified sick and family leave wages on an employment tax return, and

- Wage payments made generally after December 27, 2019, and before April 17, 2021, if you use the same wage payments to claim the 2020 qualified disaster employee retention credit on Form 5884-A, Employee Retention Credit for Employers Affected by Qualified Disasters

Qualified employees

A qualified employee is any person who has been an employee for the 91-day period immediately preceding the period for which any differential wage payment is made.

Uniformed services

According to the federal government, the uniformed services consists of the following:

- The Armed Forces of the United States

- Army National Guard and Air National Guard

- When on active duty for training, inactive duty training, or full-time National Guard duty

- The commissioned corps of the Public Health Service

- Any other category as designated by the President during war or national emergency

Coordination With Other Credits

The amount of any research credit or orphan drug credit otherwise allowable for compensation paid to any employee must be reduced by the amount of the credit for differential wage payments calculated for that employee.

Disallowance for Failure To Comply With Employment or Reemployment Rights of Members of the Reserve Components of the Armed Forces of the United States

No credit will be allowed to any business owner for:

- Any tax year in which the taxpayer is under a final order, judgment, or other process issued or required by a district court of the United States under Section 4323 of Title 38 of the United States Code with respect to a violation of chapter 43 of Title 38; and

- The 2 following tax years

Do not include more than $20,000 of differential payments for any employee.

Line 2

Multiply the Line 1 amount by 20% (0.20), and enter the result here.

As a general rule, you must reduce your deduction for salaries and wages by the amount on Line 2, even if you cannot take the full tax credit this year because of the tax liability limit.

If you capitalized any costs on which you figured the credit, you will have to lower the capitalized amount by the credit attributable to these costs.

In other words, you cannot use the same costs for two different credits or deductions.

Line 3

In Line 3, enter any tax credits for employer differential wage payments from any of these pass-through entities as reported on one of the following forms:

- Partnerships: Schedule K-1 (Form 1065, Box 15, Code P

- S corporations: Schedule K-1 (Form 1120-S), Box 13, Code P

- Cooperatives: Form 1099-PATR, Box 12

- Estates & Trusts: Schedule K-1 (Form 1041), Box 13, Code Q

Partnerships, S corporations, cooperatives, estates, and trusts will report the above tax credits on Line 3. All other filers figuring a separate credit on earlier lines will also report the above credits on Line 3.

All other taxpayers who do not use Line 1 or Line 2 to calculate a separate credit can report the credit for employer differential wage payments as one of the general business credits directly on IRS Form 3800, Part III, Line 1w.

Line 4

Add Line 2 and Line 3, then enter the result here.

Cooperatives, estates, and trusts: Proceed to Line 5, below.

Partnerships and S corporations: Stop here. Report this federal tax credit on Schedule K of your respective tax returns.

All other tax filers: Stop here. Report this amount as part of the general business credit on IRS Form 3800, Part III, Line 1w.

Line 5: Amount allocated to patrons of the cooperative or beneficiaries of the estate or trust

Enter the amount that you allocated to either:

- Cooperative patrons

- Trust or estate beneficiaries

Cooperatives

A cooperative described in Internal Revenue Code Section 1381(a) must allocate to its patrons the credit amounts in excess of its tax liability limit. Therefore, to figure the unused credit allocated to patrons, the cooperative must first calculate its tax liability. Although any excess is allocated to patrons, any credit recapture applies as if the cooperative had claimed the credit.

If the cooperative is subject to the passive activity rules, you must include any Form 8932 credit from passive activities disallowed in a prior year and carried forward to this year.

Complete IRS Form 8810, Corporate Passive Activity Loss and Credit Limitations, to determine the allowed credit that you must allocate to patrons.

Estates and trusts

Allocate the credit for employer differential pay on Line 4 between the estate or trust and the beneficiaries in the same proportion as you allocated. Enter the beneficiaries’ share on Line 5.

If the estate or trust is subject to the passive activity rules, include on Line 3 any IRS Form 8932 credit from passive activities disallowed for prior years and carried forward to this year. Complete IRS Form 8582-CR, Passive Activity Credit Limitations, to determine the allowed credit that must be allocated between the estate or trust and the beneficiaries.

Line 6

For cooperatives, estates, and trusts, subtract Line 5 from Line 4, then enter the result here.

Also, report this tax credit on IRS Form 3800, Part III, Line 1w.

Video walkthrough

Frequently asked questions

The amount of credit a business owner may claim for employer differential wage payments is 20% of the total differential wage payments made to qualified employees during the tax year. There is a maximum wage limit of $20,000 per qualified employee.

Business owners use IRS Form 8932 to calculate and claim the credit for eligible differential wage payments made to qualified employees after 2008. The credit is 20% of up to $20,000 of differential wage payments paid to each qualified employee during the tax year.

Where can I find IRS Form 8932?

The Internal Revenue Service keeps copies of all tax forms on the IRS website. For your convenience, we’ve attached the most recent version of IRS Form 8932 to this article in PDF format.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!