IRS Form 5754 Instructions

If you’ve recently won the lottery or bet on the horses with some friends, you might be asked to complete IRS Form 5754 by the state gaming commission or by the payer.

In this article, we’ll walk through this tax form, including:

- How to complete IRS Form 5754

- What IRS Form 5754 is used for

- Frequently asked questions about gambling winnings

Let’s start with a walkthrough of how to complete IRS Form 5754.

Table of contents

How do I complete IRS Form 5754?

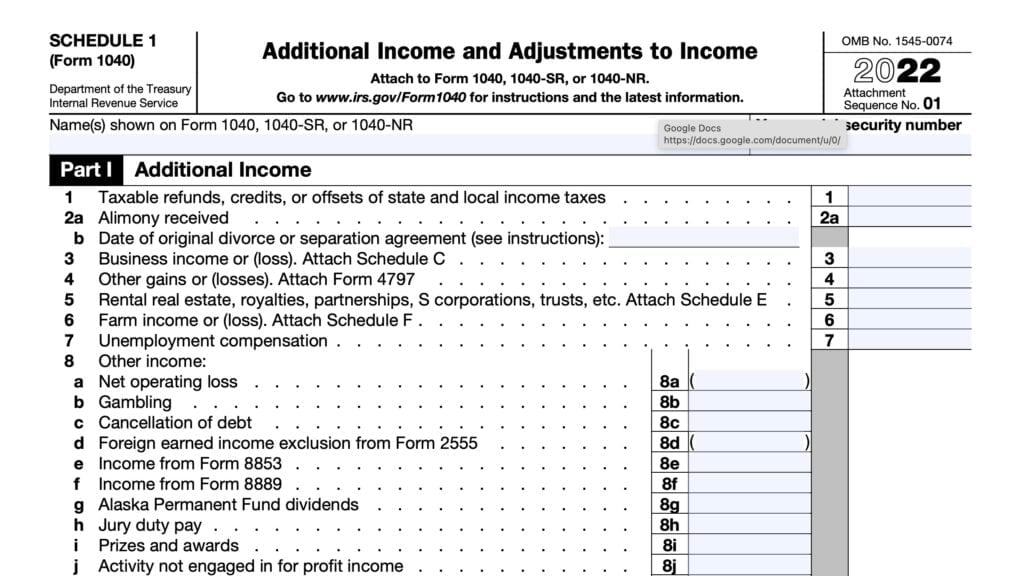

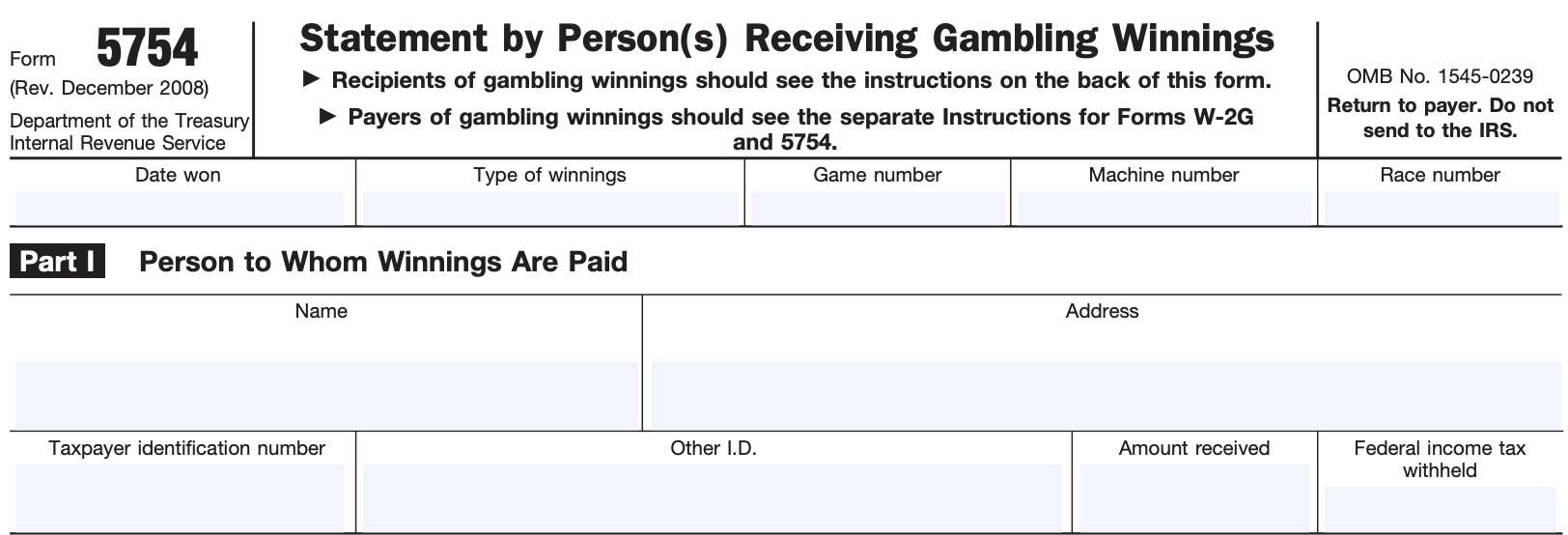

IRS Form 5754 is fairly straightforward to complete. There are two parts:

- Part I: Person to whom winnings are paid

- Part II: Person to whom winnings are taxable

Before we start with Part I, let’s take a look at the information fields at the very top of the form.

Top of form

At the very top of the form, you should see the following information:

- Date won: This should be the date of the winning event, not necessarily when the winner or winners actually received their share of the winnings.

- Type of winnings: This should indicate the type of event involved (i.e. state-conducted lottery)

- Game number: If a specific game was involved, the game number associated with that event

- Machine number: For machine-related winnings, such as slot machines, the machine number

- Race number: For winnings involved with pari-mutuel betting, such as horse racing or jai alai, then the associated race or event number

Let’s now proceed to Part I.

Part I: Person to whom winnings are paid

In Part I, we’ll enter specific information about the person who is receiving the gambling winnings.

If you are the person to whom gambling winnings are paid, then enter the following information about yourself in Part I:

- Name

- Address

- Taxpayer identification number

Your taxpayer identification number (TIN) can be your Social Security number (SSN) or an individual taxpayer identification number (ITIN). If you do not have an ITIN and are not eligible for an SSN, you may need to complete and file IRS Form W-7, Application for IRS Individual Taxpayer Identification Number, for tax purposes.

Below are other related fields and how to complete them.

Other I.D.

A recipient of winnings from a state-conducted lottery need not provide identification other than his or her taxpayer identification number (TIN). If you are completing this form for a state agency reporting lottery winnings, then you may leave this field blank.

For other event winners, the payers of gambling winnings may need to verify your identity with a second form of identification. This information would go into this field.

Amount received

Enter the amount received in this field.

Federal income tax withheld

This field should reflect the amount of federal tax withheld from gambling winnings. There are two types of mandatory federal tax withholding rates:

- Regular gambling withholding rates

- Backup withholding rates

Although regular withholding and backup withholding are both 24% of total winnings, it’s worth taking a closer look to see when this is required.

Regular withholding

A payer of gambling winnings must withhold federal income tax from the winnings if:

- The winnings minus the wager exceed $5,000, and

- The winnings are at least 300 times the wager

If regular withholding applies, the payer must withhold 24% of net winnings. For example, if John Smith spent $10 on a lottery ticket and won $10,100, then he would be subject to regular tax withholding as follows:

Total winnings: $10,100 – $10 = $10,090

Tax withholding: $10,090 * 24% = $2,421.60

The other type of withholding, backup withholding, is outlined below.

Backup withholding

If the winner of reportable gambling winnings doesn’t provide a TIN to the payer, then the payer must backup withhold on any such winnings that aren’t subject to regular gambling withholding.

The backup withholding rate is identical to the regular withholding rate of 24%. Backup withholding of 24% applies if the winnings are at least:

- $600, but not more than $5,000, and

- 300 times the wager

In other words, if you provide a TIN or SSN, then you will not be subject to backup withholding if your gross winnings are less than $5,000. However, if your gross winnings exceed $5,000, then you will still be subject to regular tax withholding on your winnings.

Let’s go on to Part II.

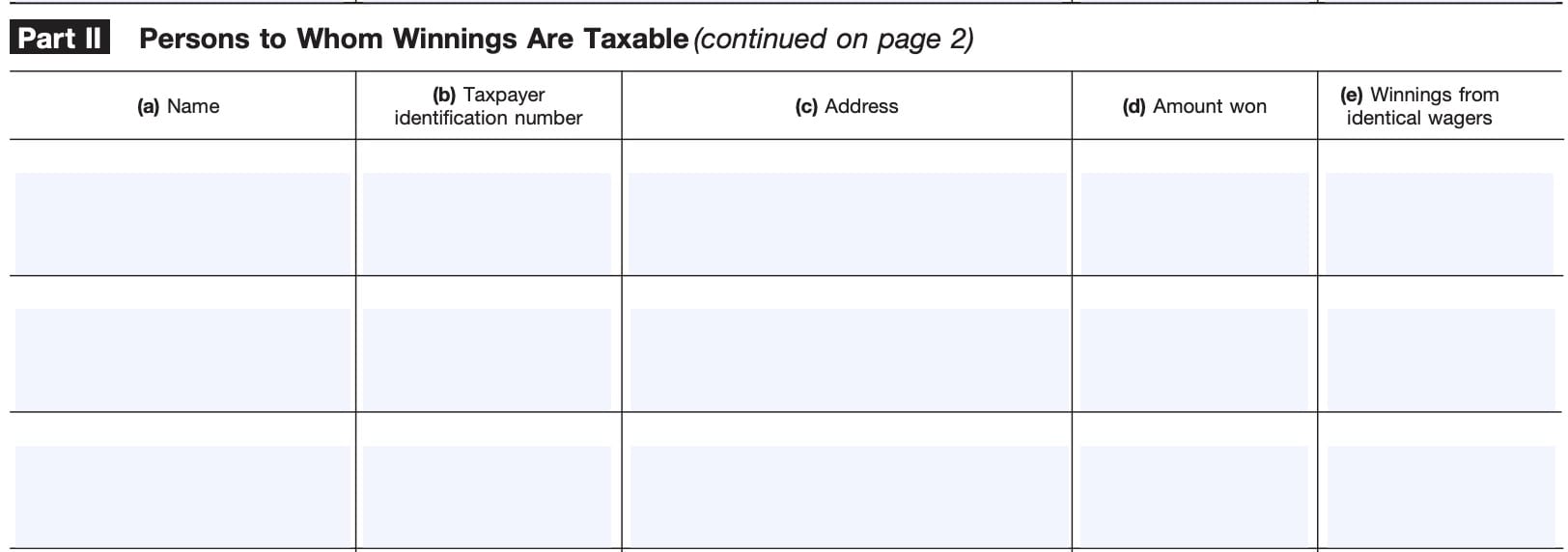

Part II: Persons to whom winnings are taxable

In Part II, we’ll name and provide information about each person who may be entitled to part of the gambling winnings.

For each winner, you’ll need to enter the following:

- Person’s name

- Taxpayer identification number

- Address

- Amount of winnings

- Winnings from identical wagers

If you are also one of the winners, you should enter your information in Part II first. You may enter ‘Same as above’ in columns (a), (b), and (c) and the applicable amounts in columns (d) and (e). Afterwards, complete columns (a) through (e) for each of the other winners.

Identical wagers

Winnings from “identical wagers” are added together for purposes of reporting and withholding requirements.

Two or more wagers are identical wagers if:

- They are placed with the same payer, and

- Winning depends on the occurrence or non-occurrence of the same event or events

In the case of horse races, dog races, or jai alai, wagers must also be placed in the same parimutuel pool to be identical wagers. For example, the Internal Revenue Service would consider multiple bets placed in a parimutuel pool with a single payer on the same horse to win a specific race to be identical wagers.

Video walkthrough

Watch this video to learn more about IRS Form 5754 and how to use it.

Frequently asked questions

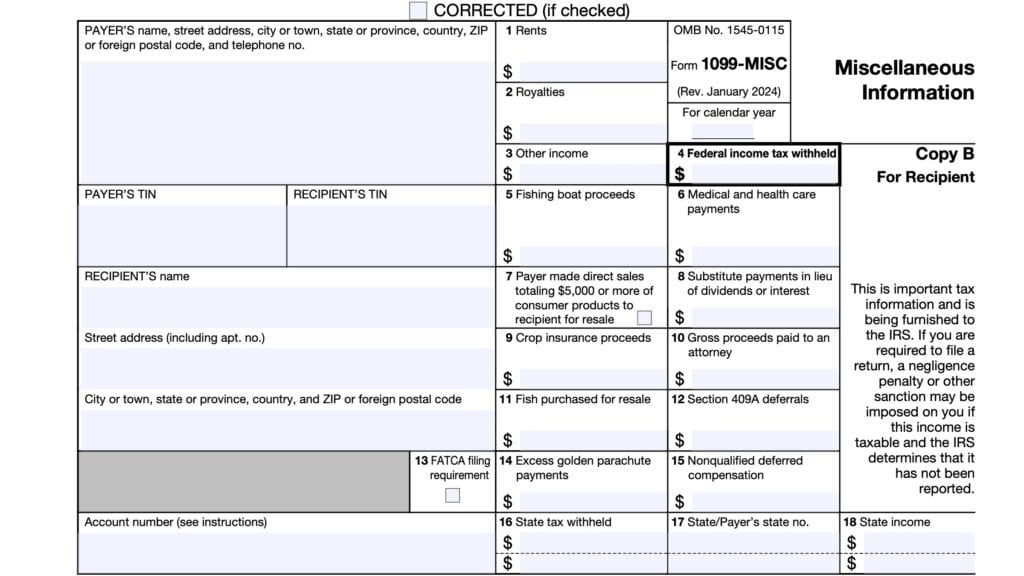

You must complete Form 5754 if you receive gambling winnings either for someone else or as a member of a group of two or more people sharing the winnings, such as by sharing the same winning ticket. The payer uses this information to complete IRS Form W-2G for each winner.

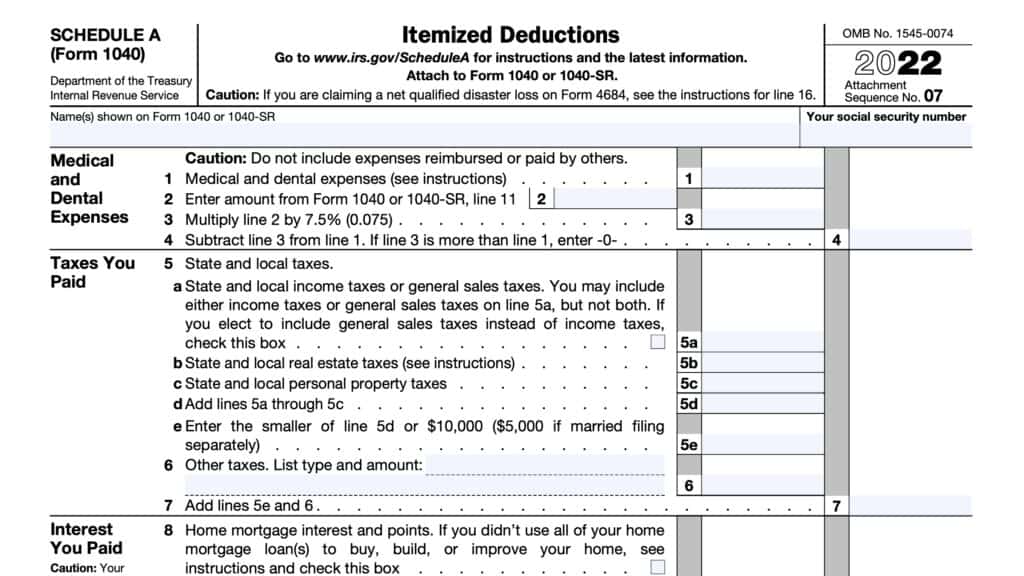

Taxpayers may be able to deduct gambling losses for federal income tax purposes, up to the amount of gambling winnings. However, gambling losses must be claimed on Schedule A as an itemized deduction.

Lottery winners should expect to receive a copy of federal form W-2G from the lottery commission. Winners should expect to receive their Form W-2G no later than January 31 of the year after winning the lottery.

Where can I find IRS Form 5754?

As with most tax forms, you can find IRS Form 5754 on the Internal Revenue Service website. For your convenience, we’ve uploaded the most recent version of this tax form right here.