IRS Form 8845 Instructions

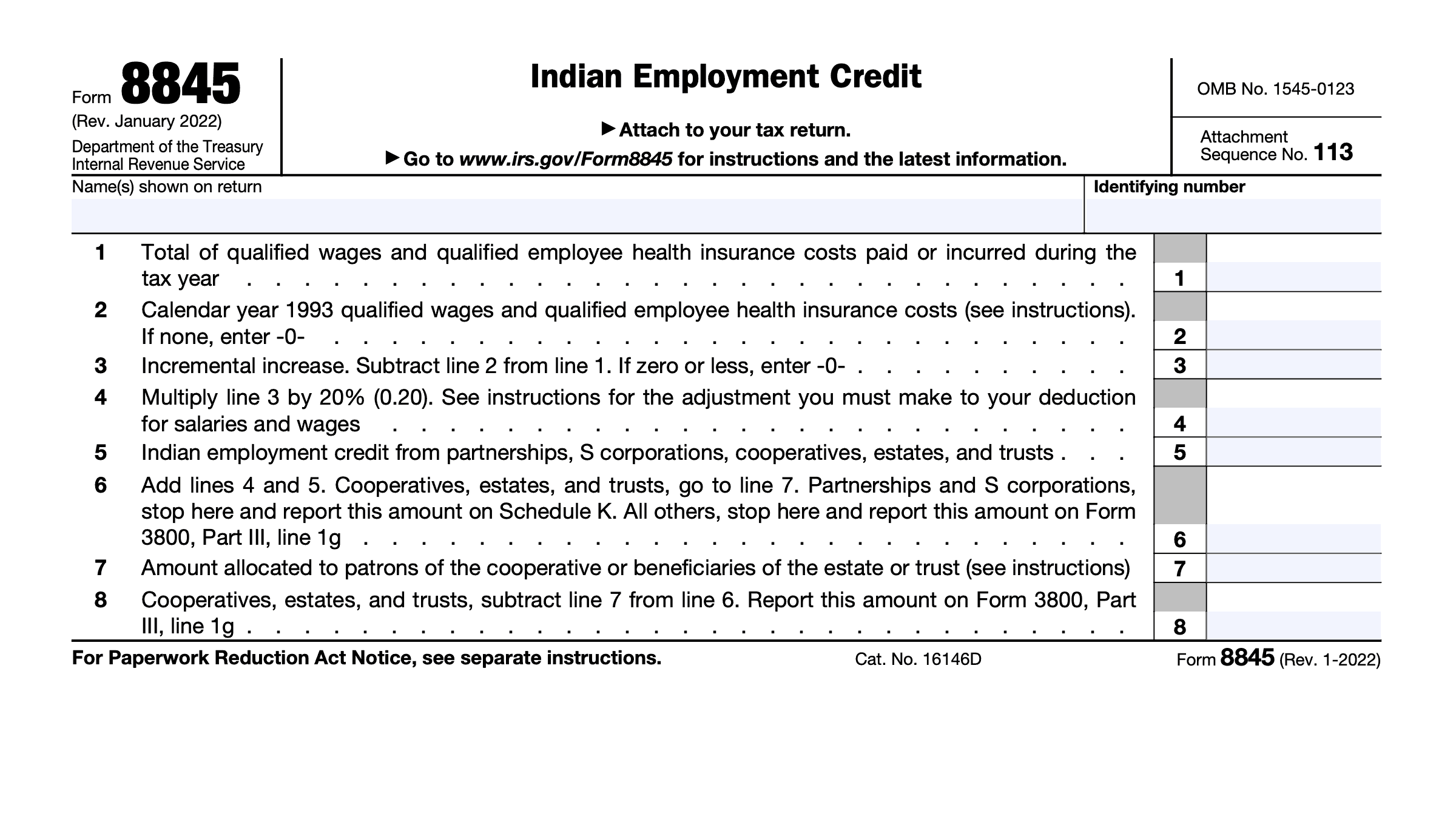

Certain qualified taxpayers who hired Native Americans from 1993 through 2021 were entitled to tax savings, in the form of a tax credit. This federal tax credit, known as the Indian Employment Credit, is not available for new tax filings after the 2021 tax year. However, taxpayers may still claim this tax credit for tax years through 2021 filing IRS Form 8845.

In this article, we’ll walk through this tax form, including:

- How to file IRS Form 8845

- Qualifications for the Indian employment tax credit

- Other frequently asked questions

Let’s start with an overview of this tax form.

Table of contents

How do I complete IRS Form 8845?

This one-page IRS tax form is fairly straightforward. Let’s start at the top.

Before beginning with Line 1, enter the taxpayer name and identifying number, as shown on your income tax return.

For individuals, the identifying number is your Social Security number or individual taxpayer identification number (ITIN).

For all other taxpayer entities, the identifying number will be the employer identification number (EIN). This includes:

- S corporations

- Partnerships

- Estates

- Trusts

- Cooperatives

After completing the taxpayer information fields, we’ll go to Line 1.

Line 1: Total qualified wages and qualified employee health insurance costs

In Line 1, enter the total qualified wages and qualified employee health insurance costs you either paid or incurred for qualified employees during the tax year.

Qualified wages

Qualified wages refers to any wages paid or incurred by an employer for services performed by an employee while such employee is a qualified employee.

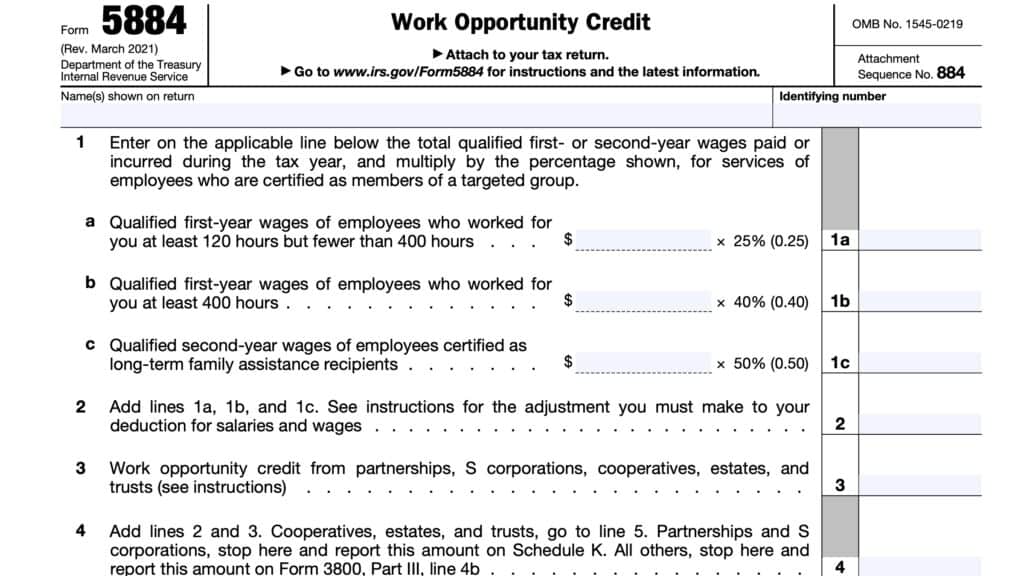

This doesn’t include wages attributable to services rendered by a new hire during the first year that the employee begins working for the employer if any portion of wages is also used in calculating the work opportunity tax credit on IRS Form 5884. If the employee is a long-term family assistance recipient under IRC Section 51, this restriction is for two years, not just the first year.

For tax years 2019 through 2021, qualified wages also do not include:

- Wages paid to or incurred for any employee after December 31, 2020, and before July 1, 2021, if you use the same wages to claim the employee retention credit on an employment tax return such as IRS Form 941;

- Wages paid to or incurred for any employee after March 31, 2021, and before October 1, 2021, if you use the same wages to claim the credit for qualified sick leave and family leave wages on an employment tax return such as IRS Form 941; and

- Wages paid to or incurred for any employee generally after December 27, 2019, and before April 17, 2021, if you used the same wages to claim the 2020 qualified disaster employee retention credit on IRS Form 5884-A.

Qualified employees

A qualified employee means, for any tax period, any employee who meets all three of the following tests.

- The employee is an enrolled member, or the spouse of an enrolled member, of an Indian tribe.

- For tax purposes, Indian tribe means any Indian tribe, band, nation, pueblo, or other organized group or community. This includes any Alaska Native village or regional or village corporation, as defined in, or established under, the Alaska Native Claims Settlement Act, that is recognized as eligible for the special programs and services provided by the United States to Indians because of their status as Indians.

- Substantially all the services performed by the employee for the employer are performed within an Indian reservation.

- The Internal Revenue Service considers Indian reservation to mean a reservation as defined in:

- Section 3(d) of the Indian Financing Act of 1974, or

- Section 4(10) of the Indian Child Welfare Act of 1978

- The Internal Revenue Service considers Indian reservation to mean a reservation as defined in:

- The employee’s principal residence while performing such services is on or near the reservation where the services are performed.

In other words, a qualified employee is a member, or spouse of a member, of an Indian tribe, performing services within an Indian reservation, who lives on or near that reservation.

Qualified employee exceptions

However, the employee shall be treated as a qualified employee for any tax year only if more than 50% of the wages paid or incurred by the employer to the employee during the tax year are for services performed in the employer’s trade or business.

No wages shall be taken into account with respect to an individual who:

- For business entities: Is related to, or has ownership in, the taxpayer’s business. This includes:

- Relationships described in subparagraphs (A) through (G) of IRC Section 152(d)(2)

- Ownership, directly or indirectly, more than 50% in value of:

- The outstanding stock of the corporation, or,

- The capital and profits interests in the entity, as determined by applying IRC Section 267(c)

- For estates & trusts: Is a grantor, beneficiary, or fiduciary of the estate or trust

- Includes anyone who is related to to a grantor, beneficiary, or fiduciary of the estate or trust as IRC Section 152(d)(2)

- Is a dependent of a taxpayer described above

The following are also not qualified employees:

- A 5% owner: If the employer is a corporation, any person who owns more than 5% of the outstanding or voting stock of the employer or more than 5% of the capital or profits interest in the employer.

- Any individual who performs services involving the conduct of Class I, II, or III gaming, as defined in section 4 of the Indian Gaming Regulatory Act

- Includes any individual performing any services in a building housing such gaming activity.

Qualified employee health insurance costs

Qualified employee health insurance costs refers to any amount paid or incurred by an employer for health insurance coverage for a qualified employee.

Don’t include amounts paid or incurred for health insurance under a salary reduction agreement

Line 2: Calendar year 1993 qualified wages and qualified employee health insurance costs

In Line 2, enter the total qualified wages and qualified employee health insurance costs paid or incurred by the employer (or predecessor) for qualified employees during calendar year 1993, as if IRC Section 45A had been in effect during 1993.

If none, enter zero.

For this purpose, an employee isn’t a qualified employee if the total amount of wages paid or incurred by the employer to the employee during calendar year 1993 exceeded $30,000.

Line 3: Incremental increase

Subtract Line 2 from Line 1. Enter the total here.

Line 4

Multiply the Line 3 amount by 20% (0.20).

You must reduce your tax deduction for salaries and wages by the Line 4 amount, even if you cannot take the full credit in the current tax year due to the tax liability limit.

If you capitalized any salaries and wages on which you figured the credit, reduce the amount capitalized by the amount attributable to these costs.

Line 5: Indian employment credit from pass-through entities

In Line 5, enter any Indian employment credit that you received from partnerships, S corporations, cooperatives, estates, or trusts. These specific credits are reported as follows:

- Partnerships: IRS Form 1065, Schedule K-1, Box 15, Code P;

- S-corporations: IRS Form 1120-S, Schedule K-1, Box 13, Code P;

- Estates & trusts: IRS Form 1041, Schedule K-1, Box 13, Code L; or

- Cooperatives: IRS Form 1099-PATR, Taxable Distributions Received From Cooperatives, Box 12

- Box 11 for tax year 2019

- Box 10 for prior years

Partnerships, S corporations, cooperatives, estates, and trusts report the above credits on Line 5. If you calculated a separate credit amount in earlier lines, report the above credits on Line 5.

All other taxpayers who did not calculate a separate credit can report the above credits as part of the total general business credit directly on IRS Form 3800, Part III, Line 1g.

You do not have to file IRS Form 8845 if the only credit you are reporting is one that was reported to you by a pass-through entity.

Line 6

Cooperatives, estates, and trusts, proceed to Line 7.

Partnerships and S corporations, stop here. Report this amount on Schedule K.

All other taxpayers, stop here. Report this amount as part of the business tax credits on IRS Form 3800, Part III, Line 1g.

Line 7: Amount allocated to patrons of the cooperative or beneficiaries of the estate or trust

In Line 7, estates, trusts, and cooperatives must report any individual credits passed on to patrons or beneficiaries.

Cooperatives

A cooperative described in IRC Section 1381(a) must allocate to its patrons the credit in excess of its tax liability limit.

Therefore, to calculate the unused amount of the credit allocated to patrons, the cooperative must first figure its tax liability. While any excess is allocated to patrons, any credit recapture applies as if the cooperative had claimed the entire credit.

If the cooperative is subject to the passive activity rules, you must include on Line 5 any Form 8845 credit from passive activities disallowed for a prior year and carried forward to this year.

Complete IRS Form 8810, Corporate Passive Activity Loss and Credit Limitations, to determine the allowed credit that must be allocated to patrons.

Estates and trusts

Allocate the Indian employment credit on Line 6 between the estate or trust and the beneficiaries in the same proportion as income was allocated. Enter the beneficiaries’ share on Line 7.

If the estate or trust is subject to the passive activity rules, include on Line 5 any Form 8845 credit from passive activities disallowed for prior years and carried forward to this year.

Complete IRS Form 8582-CR, Passive Activity Credit Limitations, to determine the allowed credit that must be allocated between the estate or trust and the beneficiaries.

Line 8

Cooperatives, estates and trusts, subtract Line 7 from Line 6, then enter the result here. Also enter the result on IRS Form 3800, Part III, Line 1g.

Video walkthrough

Watch this instructional video to learn more about claiming the Indian employment credit for prior years by filing IRS Form 8845.

Frequently asked questions

Unfortunately, no. The Taxpayer Certainty and Disaster Tax Relief Act of 2020 extended the Indian employment credit to cover qualified wages and qualified employee health insurance costs paid or incurred in tax years beginning in 2021. However, it was not extended in future acts of Congress.

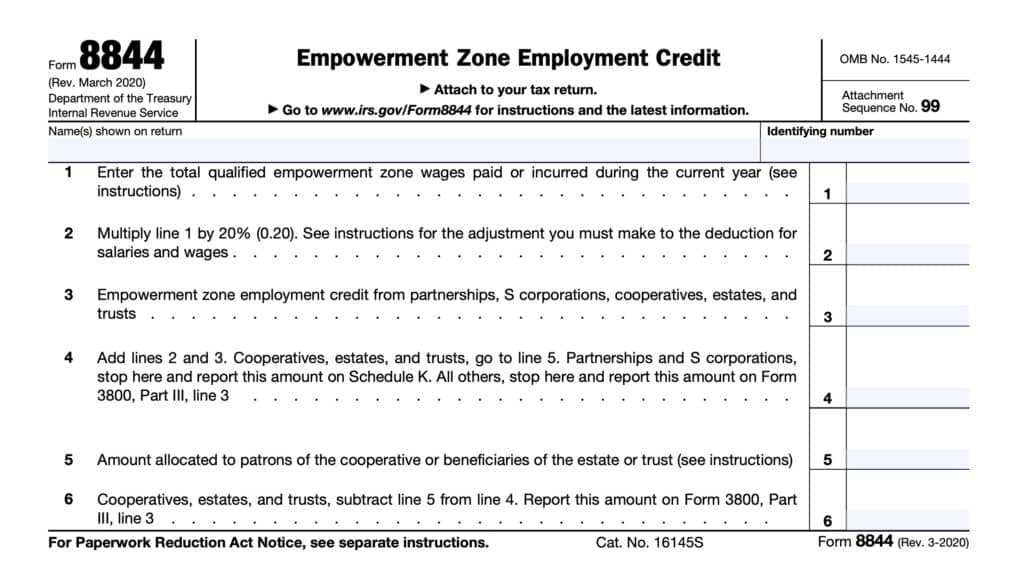

Although the Indian employment credit was not extended beyond 2021, eligible small business owners may claim the Empowerment Zone Employment Credit or the Work Opportunity Credit.

The Indian employment credit is 20% of qualified wages and employee health insurance costs paid to qualified employees for tax years beginning in 2021 or earlier.

How do I find IRS Form 8845?

You can find IRS Form 8845, as well as other tax forms, on the IRS website. For your convenience, we’ve enclosed the latest version here in this article, as a PDF file.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!