IRS Form 5884 Instructions

Employers, especially small businesses, rely upon tax incentives to help make investments that might otherwise not benefit their business. The work opportunity tax credit (WOTC) helps to create a tax break for employers hire people facing difficult challenges to financial stability and maintaining employment. Employers claim the WOTC on IRS Form 5884, Work Opportunity Credit.

In this article, we’ll walk through:

- How to calculate & claim the work opportunity credit on IRS Form 5884

- Understanding the meaning of key terms, such as targeted groups & qualified wages

- Understanding limitations and availability of this credit.

Let’s start with a brief walkthrough of IRS Form 5884 itself.

Table of contents

How do I complete IRS Form 5884?

This one-page tax form is fairly straightforward. We’ll walk you through how to complete IRS Form 5884 step by step. Let’s go to Line 1.

Line 1: Qualified wages earned

First, enter the taxpayer name and identifying number. Now, we’ll start calculating the work opportunity tax credit (WOTC) based upon qualified wages.

Line 1 contains the total qualified first year or second year wages paid or incurred during the tax year, that you paid to employees certified as members of a targeted group.

Targeted group employee

The federal government has recognized and identified groups of people who may face significant barriers to gainful employment and financial stability. The Internal Revenue Service (IRS) recognizes these groups as targeted groups.

Targeted group employees are any employee who started working for you before 2026, and who belong to one of the following groups:

- Long-term family assistance recipient

- Qualified recipient of Temporary Assistance for Needy Families (TANF)

- Qualified veterans

- Qualified ex-felon

- Designated community resident

- Vocational rehabilitation referral

- Summer youth employee

- Supplemental Nutrition Assistance Program (SNAP) benefits (food stamps) recipient

- Supplemental Security Income (SSI) recipient, or

- Qualified long-term unemployment recipient

Each eligible employer must ask for and be issued a certification for each employee from the state workforce agency (SWA) of the state where the employer’s business is located. The certification proves that the new employee is a member of a targeted group.

You must either:

- Receive the certification from the SWA by the day the individual begins work; or

- Complete IRS Form 8850, Pre-Screening Notice and Certification Request for the Work Opportunity Credit, on or before the day you offer the individual a job

- You must receive the certification before you claim the credit.

If you use Form 8850, both you and the individual must sign it. Then, you must submit the completed form to the SWA of the state in which your business is located (where the employee works) by the 28th calendar day after the date the individual begins work. For additional information about eligible employees in each targeted group, see the Targeted Group Criteria section below.

For each line, you will enter the total wages of all qualified employees meeting the criteria, then multiply those wages by the applicable percentage. Enter the product in the appropriate line.

Line 1a

For Line 1a, enter the total wages for every eligible employee in their first year of employment who worked at least 120 hours, but fewer than 400 hours in the given tax year.

Since this qualifies for a tax credit equal to 25% of wages paid (wage limitations apply), multiply this amount by 25% (0.25), and enter the result in Line 1a.

Line 1b

For Line 1b, enter the total amount of qualified wages for every eligible employee in their first year of employment who worked at least 400 hours in the given tax year.

Multiply this amount by 40% (0.40), and enter the result in Line 1b.

Line 1c

For Line 1a, enter the total wages for all employees in their second year of employment who are also recipients of long-term family assistance.

Multiply this amount by 25% (0.25), and enter the result in Line 1a.

Wage limitations

The IRS places certain limitations to the amount of wages that a business owner may use to claim work opportunity credits. You may find these limitations in IRS form instructions, but we’ve summarized them below.

Qualified veterans

- $6,000: Limit for a qualified veteran certified as being either

- A member of a family receiving SNAP assistance (food stamps) for at least a 3-month period during the 15-month period ending on their hiring date, or

- Unemployed for a period (or periods) totaling at least 4 weeks, but less than 6 months in the 1-year period ending on the hiring date

- $12,000: Limit for a qualified veteran who is:

- Certified as entitled to VA compensation for a service-connected disability, AND

- Hired not within 1 year after being discharged or released from active duty

- $14,000: Limit for a qualified veteran as being unemployed for at least 6 months in the 12-month period prior to the new hire’s start date

- $24,000: Limit for a qualified veteran who is:

- Certified as entitled to VA compensation for a service-connected disability, and

- Unemployed for at least 6 months in the 1-year period prior to their first date of employment

Other wage limitations

Employees certified as a long-term family assistance recipient: The amount of qualified first-year wages and the amount of qualified second-year wages that may be taken into account is limited to $10,000 per year.

Summer youth employees: The amount of qualified first-year wages that may be taken into account is limited to $3,000.

All other targeted groups: The amount of qualified first-year wages that may be taken into account for an employee is $6,000.

Line 2: Total qualified wages earned

Add Lines 1a, 1b, and 1c, from above.

Generally, employers must reduce their deduction for salaries and wages by the amount on Line 2, even if you cannot take the full credit this year and must carry part of it forwards or backwards.

If you capitalized any costs on which you figured the credit, then you must reduce the amount capitalized by the credit attributable to these costs.

Line 3: Work opportunity credit from pass-through entities

In Line 3, report all work opportunity tax credit from partnerships, S-corporations, cooperatives, estates, and trusts

You should see this federal tax credit reported as follows:

- Partnerships: Schedule K-1 (IRS Form 1065), Partner’s Share of Income, Deductions, Credits, etc., Box 15 (code J);

- S-corporations: Schedule K-1 (Form 1120-S), Shareholder’s Share of Income, Deductions, Credits, etc., Box 13 (code J);

- Estates & Trusts: Schedule K-1 (Form 1041), Beneficiary’s Share of Income, Deductions, Credits, etc., box 13 (code F); or

- Cooperatives: IRS Form 1099-PATR, Taxable Distributions Received From Cooperatives, Box 11 (Box 9 for 2019; Box 8 before 2019), or other notice of credit allocation.

Partnerships, S corporations, cooperatives, estates, and trusts, must report the above credits on Line 3.

All other taxpayers must report the above credits on Line 3 if they are using earlier lines to calculate a separate credit. Otherwise, they can report the above credits as a general business credit directly on IRS Form 3800, Part III, Line 4b.

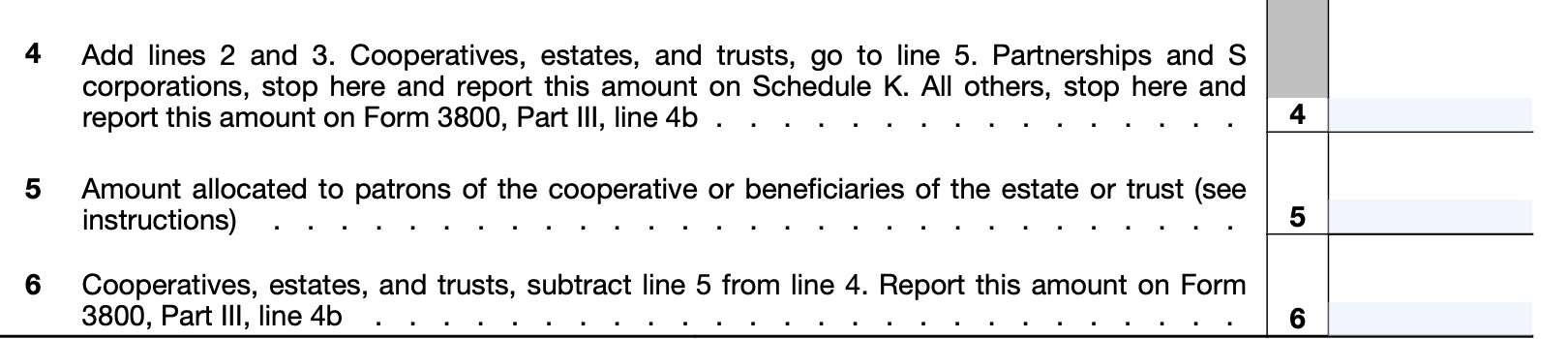

Line 4: Total work opportunity credit

Cooperatives, estates, and trusts: Go directly to Line 5.

Partnerships & S-corporations: Stop here. Report this credit amount on Schedule K.

All other taxpayers: Stop here & report this amount on IRS Form 3800, Part III, Line 4b.

Line 5: Amount allocated to patrons or beneficiaries

Special rules apply to cooperatives, estates, and trusts. Enter any amounts in Line 5 based upon the following guidelines.

Cooperatives

Cooperatives described in IRC Section 1381(a) must allocate the credit in excess of their tax liability limit to their patrons. To determine the amount of unused credit, a cooperative must first calculate its tax liability.

If the cooperative is subject to passive activity rules, then include on Line 3 any Form 5884 credit from passive activities that were disallowed in previous tax years and carried forward to the current year. You may need to complete IRS Form 8810, Corporate Passive Activity Loss & Credit Limitations, to determine the credit that must be allocated to patrons.

Estates & trusts

Estates & trusts must allocate the work opportunity credit between the estate or trust and the beneficiaries. They must allocate this credit in the same proportion as they allocated income. Once allocated, enter the beneficiaries’ share on Line 5.

If the estate or trust is subject to the passive activity rules, include on Line 3 any Form 5884 credit from passive activities disallowed for prior years and carried forward to this year. You may need to complete IRS Form 8582-CR, Passive Activity Credit Limitations. This will help you determine the allowed credit that must you must allocate between the estate or trust and beneficiaries.

Line 6: Total work opportunity credit for cooperatives, estates & trusts

Cooperatives, estates, and trusts must subtract Line 5 from Line 4. Report this on IRS Form 3800, Part III, Line 4b.

Filing considerations

Below are some topics related to filing IRS Form 5884:

Targeted group employees

For WOTC purposes, the IRS has given specific guidelines for each targeted group. These criteria are outlined below.

Qualified IV-A Recipient

A “qualified IV-A recipient” is an individual who is a member of a family receiving assistance under a state program funded under part A of title IV of the Social Security Act relating to Temporary Assistance for Needy Families (TANF). The assistance must be received for any 9 months during the 18-month period ending on the hiring date.

Qualified veteran

A qualified veteran is a veteran who meets any of the following criteria:

- A member of a family receiving assistance under the Supplemental Nutrition Assistance Program (SNAP) (food stamps) for at least a 3-month period during the 15-month period ending on the hiring date

- Unemployed for periods of time totaling at least 4 weeks (whether or not consecutive) but less than 6 months in the 1-year period ending on the hiring date

- Unemployed for periods of time totaling at least 6 months (whether or not consecutive) in the 1-year period ending on the hiring date

- Entitled to compensation for a service-connected disability and hired not more than 1 year after being discharged or released from active duty in the U.S. Armed Forces or

- Entitled to compensation for a service-connected disability and unemployed for periods of time totaling at least 6 months (whether or not consecutive) in the 1-year period ending on the hiring date

IRS Notice 2012-13 contains more details.

Qualified ex-felon

A qualified ex-felon is someone hired within a year of being convicted of a felony, or being released from prison for the felony.

Designated community resident

A designated community resident (DCR) is an individual who, on the hiring date:

- Is at least 18 years old

- Under 40 years old

- Has a principal residence within one of the following:

- An Empowerment Zone (EZ) or

- A Rural Renewal County (RRC)

For purposes of the work opportunity credit, qualified wages do not include wages paid or incurred while the employee’s principal place of residence is outside an EZ or RRC.

Vocational rehabilitation referral

A vocational rehabilitation referral is a person who has a physical or mental disability and has been referred to the employer while receiving or upon completion of rehabilitative services pursuant to:

- A state plan approved under the Rehabilitation Act of 1973

- An employment network plan under the Ticket to Work program or

- A program carried out under the Department of Veteran Affairs

Qualified summer youth employee

A qualified summer youth employee is one who:

- Is at least 16 years old, but under 18 on the hiring date or on May 1, whichever is later

- Only performs services for the employer between May 1 and September 15

- Cannot be employed prior to May 1

- Resides in an Empowerment Zone (EZ)

Qualified SNAP benefits recipient

A qualified SNAP benefits recipient is an individual who on the hiring date is:

- At least 18 years old

- Under 40 years of age

- A member of a family that received SNAP benefits for at least 3 of the previous 5 months

- the previous 6 months or

- at least 3 of the previous 5 months

Qualified SSI recipient

A qualified SSI recipient is an individual who received SSI benefits for any month ending within the 60-day period that ends on the hire date.

Long-term family assistance recipient

A long-term family assistance recipient is an individual who, at the time of hiring, is a member of a family that meet one of the following conditions:

- Received assistance under an IV-A program for a minimum of the prior 18 consecutive months

- Received assistance under an IV-A program for a minimum 18-month period beginning after 8/5/1997 and it has not been more than 2 years since the end of the earliest of such 18-month period or

- Ceased to be eligible for assistance under an IV-A program because a federal or state law limited the maximum time those payments could be made, and it has been not more than 2 years since the cessation of such assistance

Qualified long-term unemployment recipient

A qualified long-term unemployment recipient is an individual who:

- Has been unemployed for at least 27 consecutive weeks at the time of hiring and

- Who received unemployment compensation during some or all of the unemployment period

Qualified wages

Wages qualifying for the work opportunity tax credit have the same meaning as wages subject to the Federal Unemployment Tax Act (FUTA), determined without regard to the $7,000 FUTA tax wage base.

Agricultural employees

If the work performed by any employee during more than half of any pay period qualifies under FUTA as agricultural labor, that employee’s wages subject to social security and Medicare taxes are qualified wages.

Railroad employees

For a special rule that applies to railroad employees, see IRC Section 51(h)(1)(B).

What is not considered qualified wages?

The amount of qualified wages for any employee is zero if:

- The employee didn’t work for you for at least 120 hours

- The employee worked for you previously

- The employee is your dependent

- The employee is related to you (see section 51(i)(1)), or

- 50% or less of the wages the employee received from you were for working in your trade or business

Also, the following are not considered qualified wages:

- Wages paid to or incurred for any employee during any period for which you received payment for the employee from a federally funded on-the-job training program;

- Wages paid to or incurred for a summer youth employee for services performed while the employee lived outside an empowerment zone;

- Wages paid to or incurred for a designated community resident for services performed while the employee lived outside an empowerment zone or rural renewal county;

- Wages paid to or incurred for services performed by a summer youth employee before or after any 90-day period between May 1 and September 15;

- Wages for services of replacement employees during a strike or lockout;

- Wages paid to or incurred for any employee after December 31, 2020, and before July 1, 2021

- If you use the same wages to claim the coronavirus-related employee retention credit on an employment tax return such as IRS Form 941;

- Wages paid to or incurred for any employee after March 31, 2021, and before October 1, 2021

- If you use the same wages to claim the credit for qualified sick and family leave wages on an employment tax return

- Wages paid to or incurred for any employee generally after December 27, 2019, and before April 17, 2021

- If you use the same wages to claim the 2020 qualified disaster employee retention credit on IRS Form 5884-A.

Video walkthrough

Watch this instructional video to learn more about claiming the work opportunity tax credit for hiring targeted group employees using IRS Form 5884.

Frequently asked questions

The work opportunity credit is a tax incentive for employers to hire employees from certain targeted groups who historically have faced significant barriers to gainful employment and financial stability. Tax credits range from 25% to 50% of qualified wages paid.

Targeted group employees include groups such as disabled veterans, government assistance program recipients, ex-felons, and long-term unemployment recipients.

Taxpayers may claim the work opportunity tax credit by completing IRS Form 5884 and submitting it as part of their original or amended tax return.

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Where can I find IRS Form 5884?

You can find this tax form on the IRS website. For your convenience, we’ve attached the most recent version below.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!