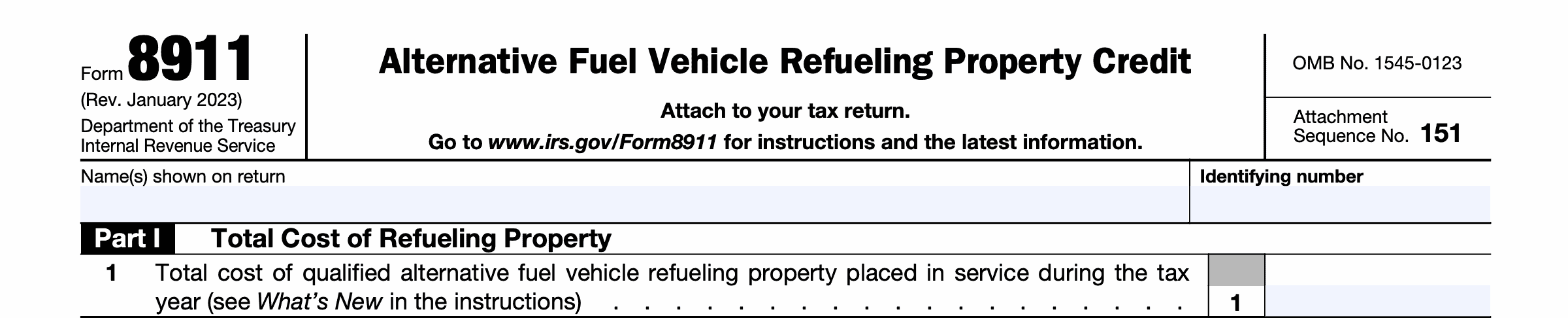

IRS Form 8911 Instructions

In late 2022, the federal government passed the bipartisan Inflation Reduction Act, which provided tax incentives for taxpayers who invest in certain clean energy projects. One such incentive is called the Alternative Fuel Vehicle Refueling Property Credit. This nonrefundable tax credit allows property owners to deduct part of the installation costs of qualified equipment from their federal tax returns on IRS Form 8911.

In this article, we’ll walk through Form 8911, Alternative Fuel Vehicle Refueling Property Credit, so you can better understand how to claim this tax credit on your tax return. Let’s start with instructions on how to complete the form.

Table of contents

How do I complete IRS Form 8911?

There are three parts to this one-page tax form. Let’s go through it, step by step.

Part I: Total Cost of Refueling Property

Line 1

Enter the total cost of qualified alternative fuel vehicle refueling property placed in service during the tax year.

Qualified alternative fuel vehicle refueling property

Qualified alternative fuel vehicle refueling property is any property that the taxpayer uses for either of the following purposes:

- To store or dispense alternative fuel, other than electricity, into the fuel tank of a motor vehicle that is propelled by the fuel, but only if the storage or dispensing is at the point where fuel is delivered into the fuel tank

- To recharge an electric vehicle, but only if the recharging property is located where the vehicle is recharged

Additional requirements include:

- Having placed the refueling property into service during the tax year

- Original use of the property begins with the taxpayer

- The property is used predominantly in the United States

- For personal use property, the property must be installed at your main home or primary residence

- After 2022, property must be located in an eligible census tract.

- An eligible census tract is any population census tract that is described in Section 45D(e) or is not an urban area as designated by the Secretary of Commerce

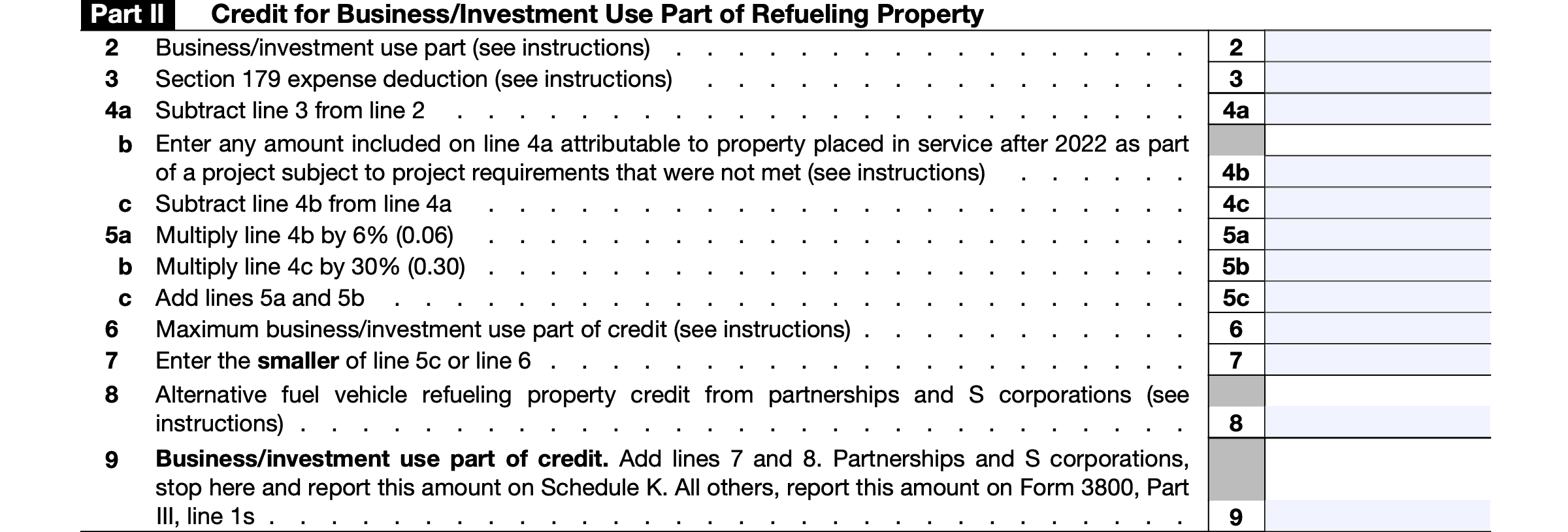

Part II: Credit for Business/Investment Use Part of Refueling Property

In Part II, we’ll calculate the amount of credit you can take for business or investment use.

Line 2: Business/investment use part

Enter the business/investment use part of the property costs for property placed into service during the tax year.

To calculate the business/investment use, multiply the cost of each separate refueling property by the percentage of business/investment use for that property.

If, during the tax year, you converted the property from business use to personal use or vice versa, first calculate the percentage of business/investment use for the number of months used in your business. Then multiply that percentage by the number of months of business use, and divide the result by 12.

Line 3: Section 179 expense deduction

If you took any Section 179 expense deduction, enter that number here. You will find this number in Part I on IRS Form 4562, Depreciation and Amortization.

Line 4

For Line 4a, subtract Line 3 from Line 2. If you took no Section 179 deduction, this number will be the same as the number in Line 2.

In Line 4b, enter the amount attributable to property placed in service after 2022 as part of a project subject to project requirements that were not met. The allowable credit for these costs is 6%, instead of 30%, as we will calculate in Line 5.

This restriction does not apply to property placed into service in 2022.

In Line 4c, simply subtract Line 4b from Line 4a.

Line 5

For Line 5a, multiply the amount in Line 4a by 6%.

In Line 5b, multiply the amount in Line 4b by 30%.

Combine Lines 5a and 5b to arrive at the amount to enter into Line 5c.

Line 6: Maximum business/investment use part of credit

For refueling property with business/investment use placed into service before 2023, enter the number from Line 5c, not to exceed $30,000. If you placed refueling property into service in more than one location, enter the total separate amounts for each location, not to exceed $30,000 per location.

For refueling property with business/investment use placed into service after 2022, replace the $30,000 limitation with a $100,000 limit.

Line 7

Enter the smaller of:

- Line 5c

- Line 6

Line 8: Alternative fuel vehicle refueling property credit from partnerships and S-Corporations

Enter the total alternative fuel vehicle refueling property credits from:

- Schedule K-1 (Form 1065), Box 15, Code P, and

- Schedule K-1 (Form 1120-S), Box 13, Code P

Line 9: Business/Investment Use of Tax credit

Add Lines 7 and 8. This represents the business/investment use of the credit.

For partnerships and S-corporations, stop here and report this amount on Schedule K. All other taxpayers should report this amount on IRS Form 3800, General Business Tax Credits, Part III, Line 1s.

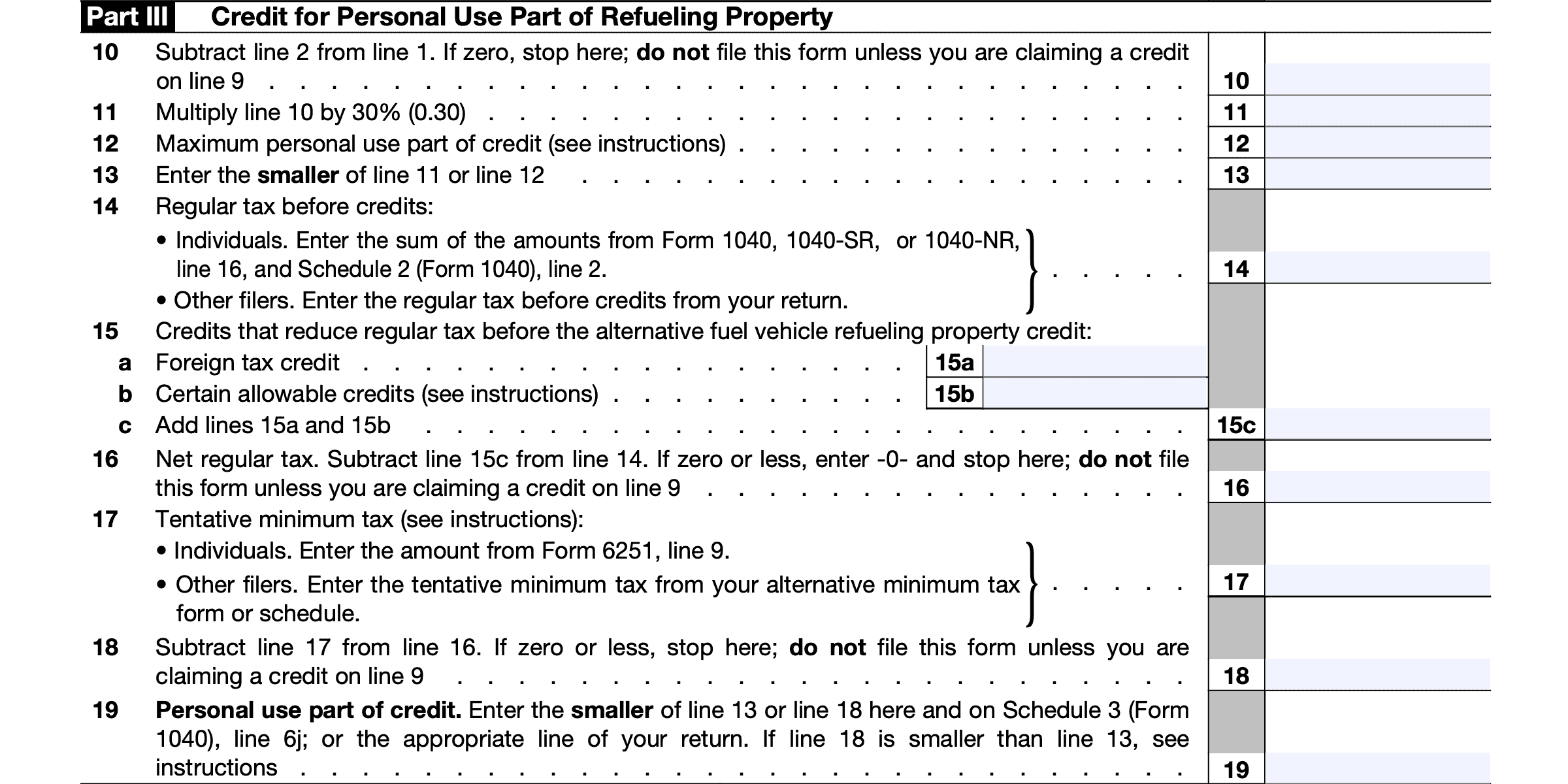

Part III: Credit for Personal Use Part of refueling property

In Part III, we’ll calculate the personal credit for qualified fueling equipment placed into service during the tax year.

Line 10

Enter the amount of qualified residential fueling equipment costs for equipment placed into service during the year. To do this, simply subtract Line 2 from Line 1.

If the result is zero or less, stop here. Do not file this form unless claiming a tax credit under Part II.

Line 11

Multiply Line 10 by 30%.

Line 12

For refueling property placed into service before 2023, enter $1,000. If the location of your main home or primary residence changed last year, and you placed personal use refueling property in service at both locations during the tax year, you may enter $2,000.

For refueling property placed into service after 2022, enter $1,000 for each item of refueling property placed into service during the year, not per location.

Line 13

Enter the smaller of:

- Line 11

- Line 12

Line 14: regular tax before credits

For individuals, enter the sum of the following:

- Line 16 from Form 1040, 1040-SR, or 1040-NR

- Line 2, Schedule 2

For other filers, enter the regular tax before credits from your income tax return.

Line 15

In Line 15, we’ll enter the total of credits that reduce regular tax liability before the alternative fuel vehicle refueling property credit applies.

In Line 15a, enter the amount of foreign tax credit. You should find this on Line 35 of IRS Form 1116, Foreign Tax Credit.

For Line 15b, enter the total of tax credits reported on your tax return.

For Form 1040, 1040-NR, or 1040-SR filers, this is the total of:

- Form 1040, 1040-SR, or 1040-NR: Line 19

- Schedule 3, Lines 2 through 5, plus Line 7

From this total, subtract the following, as found on Schedule 3:

- General business credit reported on Line 6a

- Credit for prior year minimum tax on Line 6b

- Credits to holders of tax credit bonds on Line 6k

For Form 1040 filers, you’ll find this number on Schedule G, Line 2e (not including any credits from Lines 2a through 2d).

Line 16: Net regular tax

Subtract Line 15c from Line 14. If the result is zero or less, stop completing this form. Do not file unless you are claiming a credit on Line 9.

Line 17: Tentative minimum tax

You may not owe alternative minimum tax (AMT), but you must still calculate the tentative minimum tax to figure your tax credit.

For individuals, complete IRS Form 6251, Alternative Minimum Tax, and enter the amount from Line 9.

For other filers, enter the tentative minimum tax from your AMT form or schedule.

Line 18

Subtract Line 17 from Line 16. If the result is zero or less, stop completing this form. Do not file unless you are claiming a credit on Line 9.

Line 19: Personal use part of credit

Enter the smaller of:

- Line 13

- Line 18

Also enter this number on Schedule 3, Line 6j (Form 1040), or the appropriate line of your tax return.

If Line 18 is smaller than Line 13, there is a portion of this tax credit that you may not use. Unfortunately, this credit is lost, as you cannot carry unused credits for personal use forwards or backwards into another tax year.

Video walkthrough

Watch this instructional video to learn more about how to claim this federal tax credit on your income tax returns.

Frequently asked questions

The recently passed Inflation Reduction Act extended this tax credit to 2032. Taxpayers may take a credit on any qualifying property placed into service before 2033.

For tax years 2022 and earlier, maximum tax credit amount is $1,000 per location, if you had qualifying property at each location and you changed your main home during the tax year. For 2023 and later, the base credit is $1,000 per piece of property placed into service during the tax year.

This bipartisan infrastructure law raised the maximum credit for business and investment use property from $30,000 to $100,000. For personal use property, taxpayers may take the credit on more than one piece of property during a tax year, even if at the same location.

Electric car chargers

The Internal Revenue Service guidelines cite the following census tract requirements: Census tracts for eligible projects must be designated as low-income by 26 U.S. Code Section 45D(e), or not declared an urban area by the Secretary of Commerce.

Where can I get IRS Form 8911?

You may download this tax form from the IRS website as a PDF file. For your convenience, we’ve included the latest version in this article, below.

Related tax forms

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!