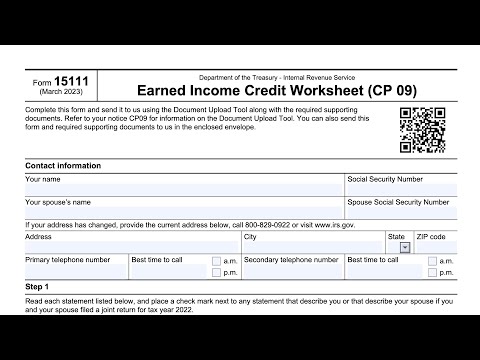

IRS Form 15111 Instructions

If you’ve received a CP09 letter from the Internal Revenue Service, you may be entitled to an additional tax refund for claiming the earned income tax credit (EITC) by filing IRS form 1511.

This applies to taxpayers who might not have claimed the EITC on their most previous tax return, but the IRS later determines that the taxpayer may be eligible for the EITC. In this case, you may need to complete IRS Form 15111 to determine your eligibility and to claim an EITC refund.

In this article, we’ll walk you through:

- How to claim the EITC using IRS Form 15111

- EITC basics

- Frequently asked questions

Let’s begin with a brief rundown of this tax form.

Table of contents

How do I complete IRS Form 15111?

The earned income credit worksheet is fairly straightforward. This two-page document should take no more than several minutes to complete.

Let’s start at the top, with your taxpayer contact information.

Contact information

In the contact information field, enter the following information:

- Taxpayer name, as it appears on your income tax return

- Valid Social Security number

- Spouse’s name and SSN, if applicable

- Current mailing address, including city, state, and zip code

- Telephone number, as well as preferred time to call

Changing your address

You can call the IRS’ toll-free phone number or visit the IRS website to update your address. However, the best way to ensure that the IRS properly handles your completed EIC worksheet is to include your current address on the worksheet before you submit it.

Also, you may consider including a secondary telephone number, if you have a mobile device. This will help the IRS reach you to address any questions or concerns as they arise.

Let’s move on to Step 1.

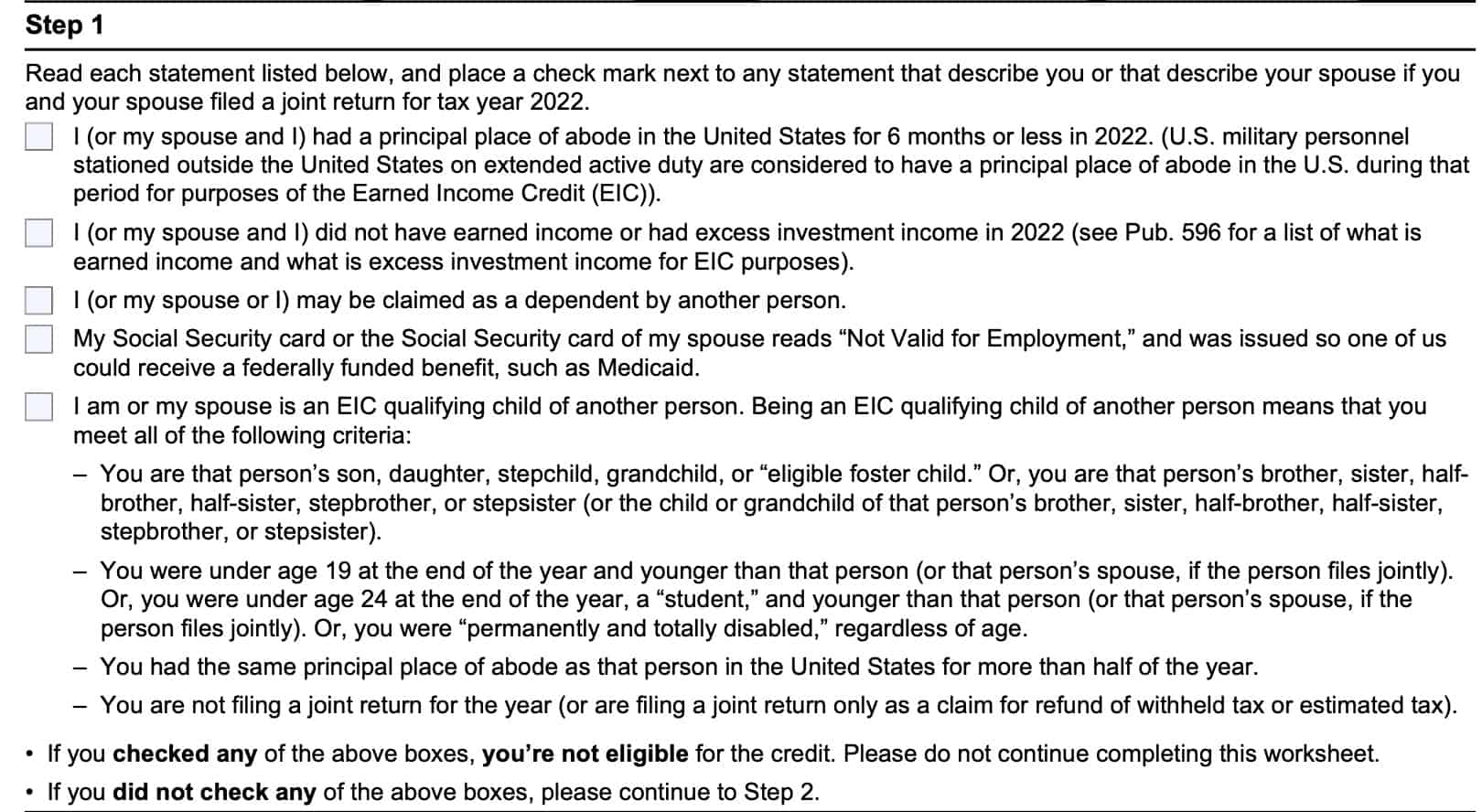

Step 1: Taxpayer statements

Step 1 contains several statements, which you must read and truthfully answer with a check mark next to each true statement. If none of these statements apply to your situation, then you may be eligible to complete the rest of the earned income tax credit worksheet.

Let’s review each of these statements in order.

Principal place of abode

This statement simply confirms whether you lived in the United States for at least half the year or not. There are a couple of points of clarification:

- The Internal Revenue Service considers the 50 U.S. states and the District of Columbia as the United States.

- U.S. military personnel stationed outside the United States are considered to meet this requirement, as long as they are on extended active duty for at least 90 days.

- However, the IRS does not consider Puerto Rico or any U.S. territories or possessions, such as Guam or the U.S. Virgin Islands.

If your primary residence is inside the United States, you meet this requirement. If your principal place of abode was outside the United States for 6 months or more during the tax year, then you are not eligible for this tax benefit.

Earned income or excess investment income

There are several income-related rules, based upon IRS guidelines.

You must have earned income in the given tax year.

According to IRS Publication 596, Earned Income Credit, this credit is called the “earned income” credit because you must work and have earned income to qualify. If you are married and file a joint return, you meet this rule if at least one spouse works and has earned income.

If you are an employee, earned income includes all the taxable income you receive from your employer. Independent contractors can meet this requirement as long as they have compensation and pay self employment tax and income taxes on that income.

Your adjusted gross income must be under a certain threshold.

While you must have earned income during the tax year, there are limits on your overall income. Specifically, your adjusted gross income, or AGI, as calculated on your income tax return.

According to the IRS, below are the AGI thresholds for recipient taxpayers, based upon filing status and the number of qualifying children:

| Number of children | Married filing jointly | All other filing statuses |

| Zero qualifying children | $22,610 | $16,480 |

| 1 qualifying child | $49,622 | $43,492 |

| 2 qualifying children | $55,529 | $49,399 |

| 3 or more qualifying children | $59,187 | $53,057 |

If your AGI exceeds these limits, then you are not eligible for this tax credit. But even if your AGI is below the threshold, you still have to be mindful of one last source of income.

Your investment income cannot be excessive.

For EIC purposes, there is a limit on the amount of investment income you may have to qualify. If your investment income (from all sources) exceeds $10,300, then you are ineligible for the EITC.

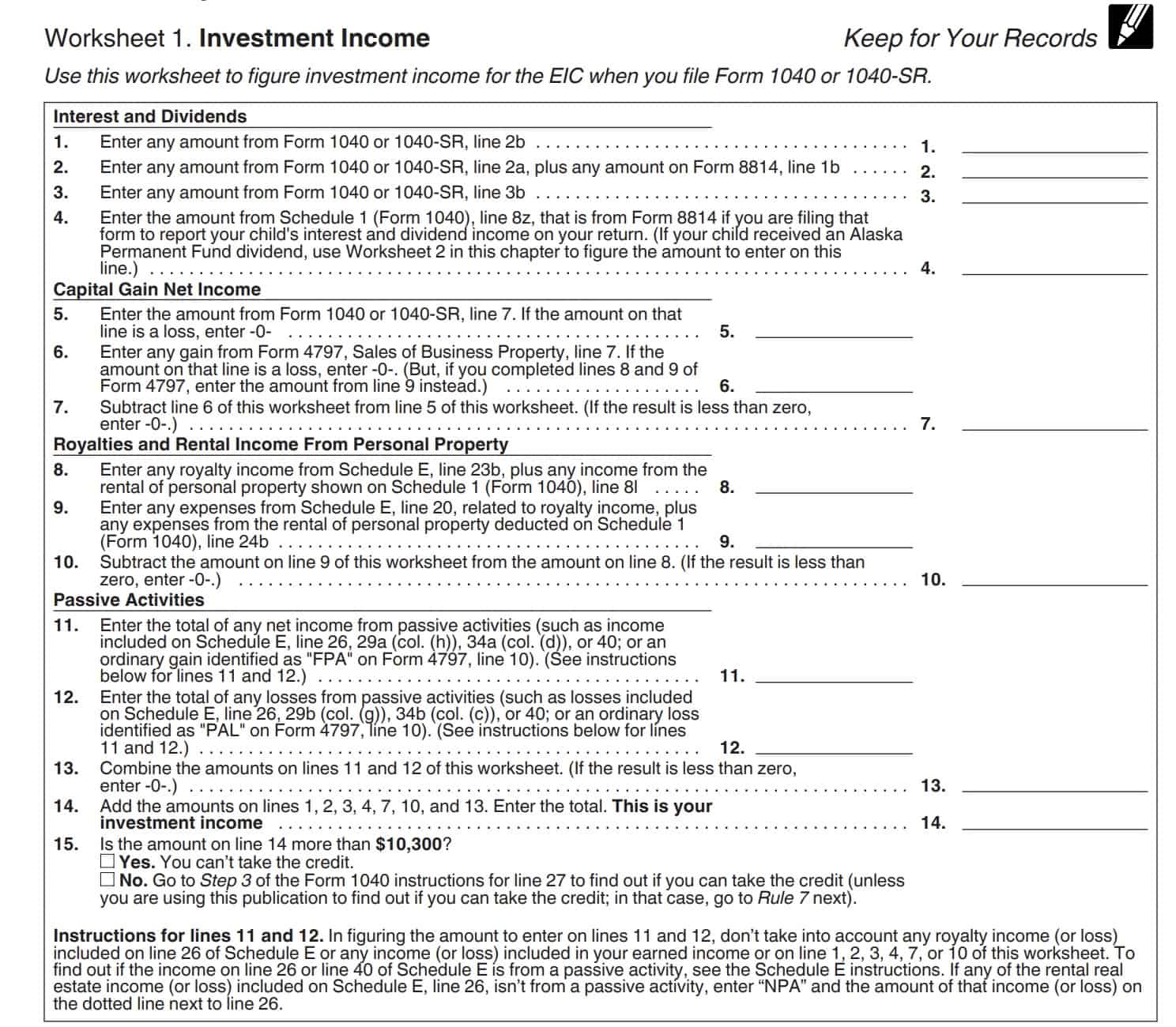

What is considered investment income?

IRS Publication 596 contains a worksheet to help taxpayers calculate how much investment income they have, from all sources. This might include:

- Dividend and interest income

- Capital gains

- Royalties

- Rental income

- Passive activities

If you meet the earned income, AGI, and investment income thresholds, then you do not need to check this box. Move on to the next question.

Another person may claim me as a dependent

If another taxpayer can claim you as a dependent on their federal tax return, then do not complete Form 15111. You cannot claim the earned income credit.

Social Security card

If either your Social Security card, or your spouse’s Social Security card reads ‘Not Valid For Employment,’ then you may not claim the EIC. This might happen if you are a nonresident alien who requires a valid Social Security number for federal benefits, such as Medicaid.

If you are a U.S. citizen or resident alien, this restriction generally will not apply.

EIC qualifying child

You cannot be a qualifying child of another person for EIC purposes. A taxpayer cannot receive the earned income tax credit if that same person is a qualifying child for another taxpayer applying for the credit.

If you checked any boxes, then you should stop. You are not eligible for the EITC.

If you did not check any boxes, then you may go through with the rest of the EIC eligibility form.

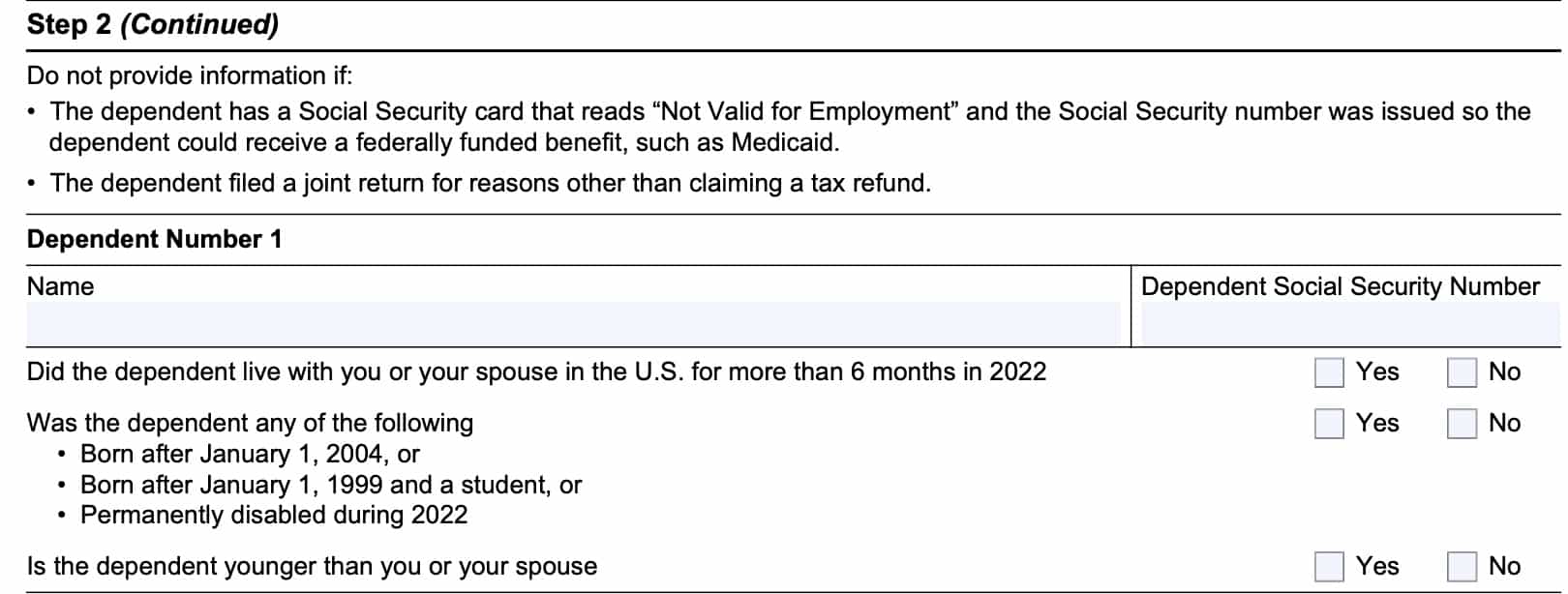

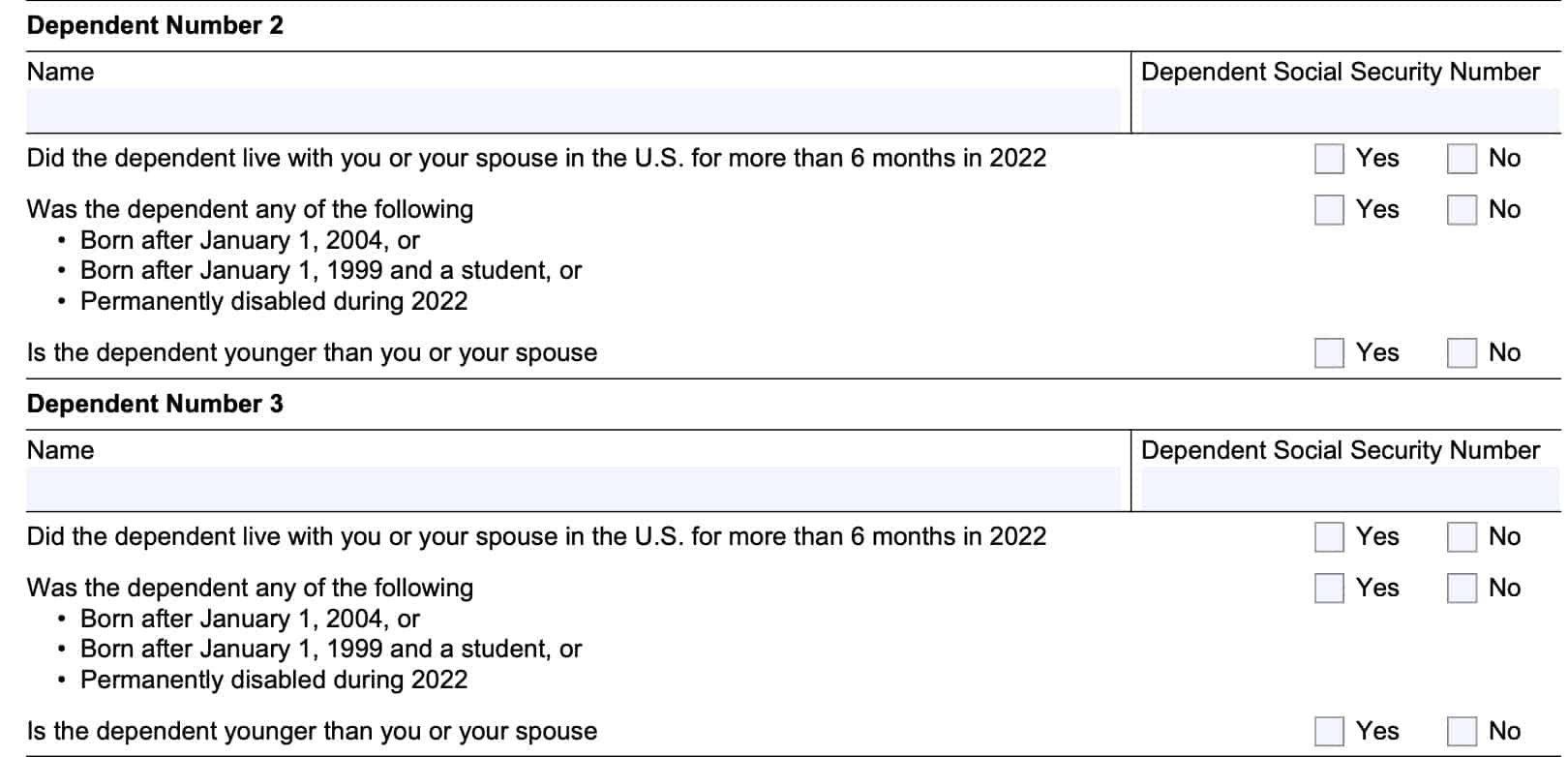

Step 2: Qualifying children

In Step 2, you will provide information for up to three of your children who:

- Lived with you or your spouse in the United States during the tax year, and

- Met the relationship test to be a qualifying child

- Must be son, daughter, stepchild, adopted child, sibling (includes stepbrothers & step sisters), or eligible foster child

You must include information as you provided it in your original tax return. If you want to report qualifying children not originally reported on your tax return, you must file an amended return using IRS Form 1040-X.

Additional criteria

Your qualifying child must also meet the following criteria:

- Have a valid Social Security number

- Unless he or she was born and died in the tax year

- Must provide verification of a live birth

- Have lived with you or your spouse in the United States for more than 6 months

- Meet certain age restrictions (outlined on the form), or be permanently disabled

- Be younger than you or your spouse

For each qualifying child, you will enter their name and Social Security number, and check ‘Yes’ to the three boxes in Step 2. Additional space is provided other dependents. Do not submit information for more than 3 qualifying children.

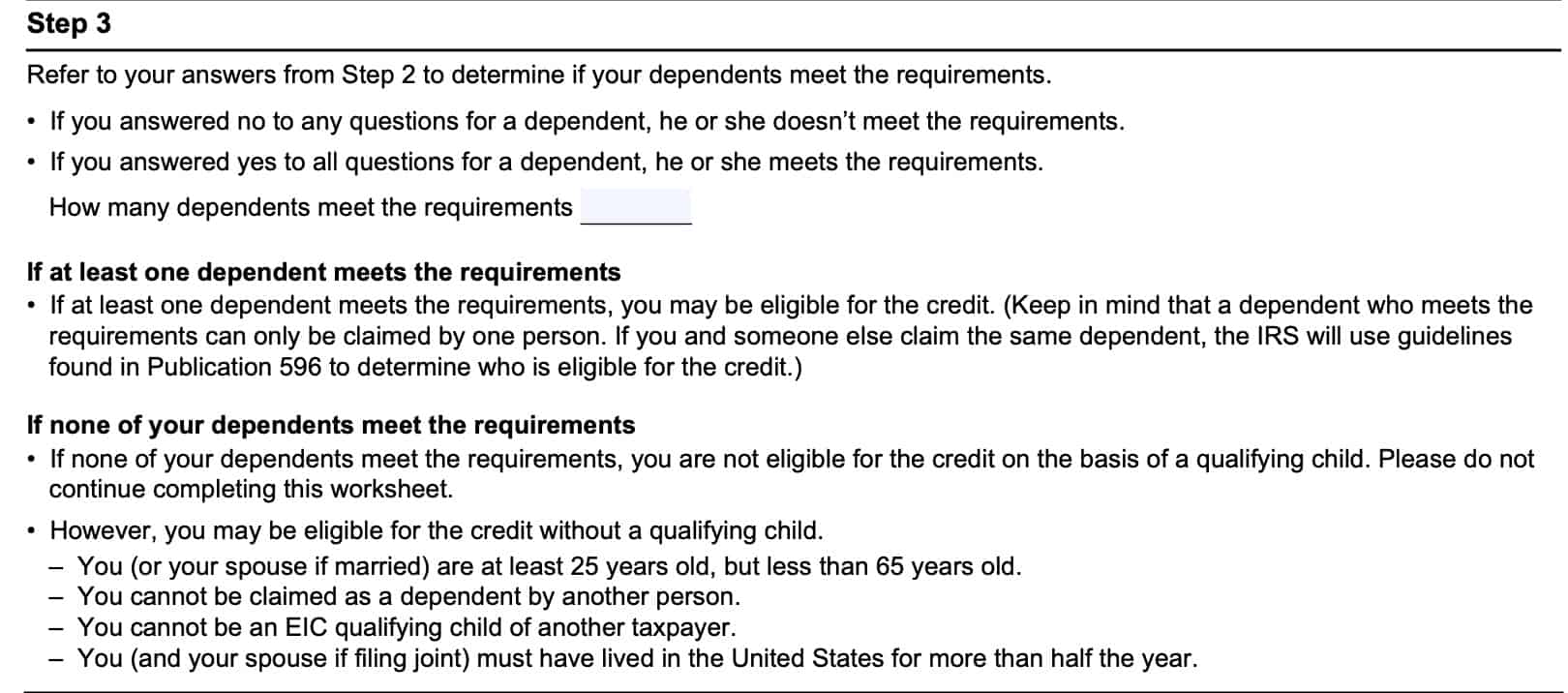

Step 3: Number of qualified dependents

In Step 3, you will simply affirm the number of dependents that meet the requirements outlined in Step 2.

If you answered ‘No’ to any questions regarding your dependent, then he or she doesn’t meet the requirements. If you answered ‘Yes’ to all questions, then that is a qualifying child.

In Step 3, simply enter the number of dependents that meet the IRS requirements.

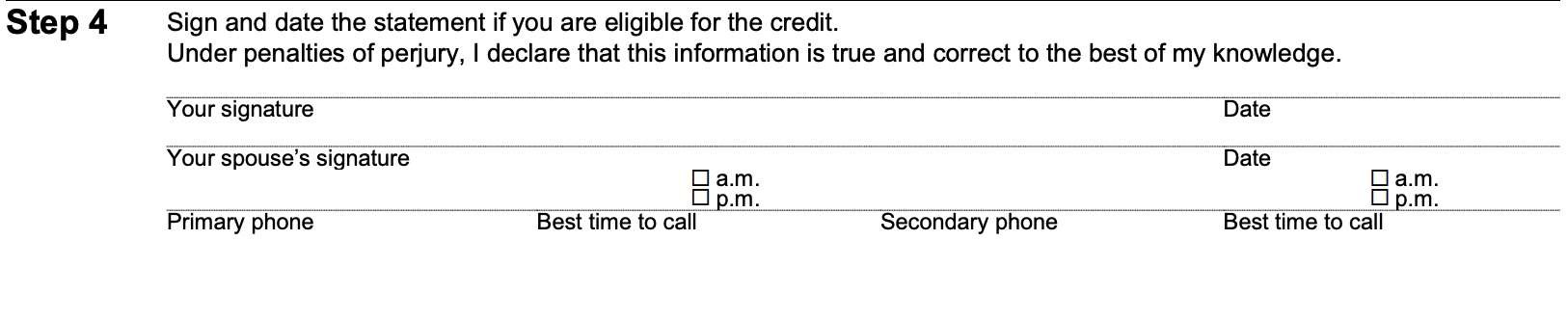

Step 4: Taxpayer signature

If you received an IRS notice CP 09 letter, you’ll probably see Step 4 on the back. This contains the taxpayer’s sworn signature, under penalty of perjury, that their submission is accurate and complete to the best of their ability.

At this time, Step 4 does not appear in the version that you may download from the IRS website.

Submitting the form

Once you’ve completed IRS Form 15111, you’ll need to submit it to the correct IRS service center for review. The easiest way to do this is to submit the completed form using the IRS’ document upload tool.

To access the IRS document upload tool, you can scan the QR code in the top right corner of the notice. This will lead you to a secure IRS website that will prompt you for the following information:

- Taxpayer first and last name

- Social Security number

- Unique code or ID

- If you received a code, it will likely be in your IRS CP 09 notice

From there, you can upload scans, photographs, or digital copies of supporting documents in JPG, PNG, or PDF format. Before you leave the session, you should also receive a confirmation that your documents have been uploaded and are awaiting IRS review.

Video walkthrough

Watch this instructional video for step by step guidance on completing the Earned Income Credit worksheet.

Frequently asked questions

A CP09 letter is sent to taxpayers when the Internal Revenue Service determines you may be eligible to claim the earned income tax credit, if you did not do so on your tax return. Taxpayers may complete IRS Form 15111 to claim the credit, or ignore the notice if they do not qualify.

If you complete Form 15111, you may be entitled to an additional refund, even if you’ve already filed your tax return for the year.

Your tax refund may be used to offset certain debts, such as delinquent child support and back taxes, under the Treasury Department’s Treasury Offset Program. You may need to resolve your delinquent debts before receiving your full refund.

How can I get IRS Form 15111?

IRS Form 15111 is available on the Internal Revenue Service website. For your convenience, we’ve attached the latest version of this tax form below.