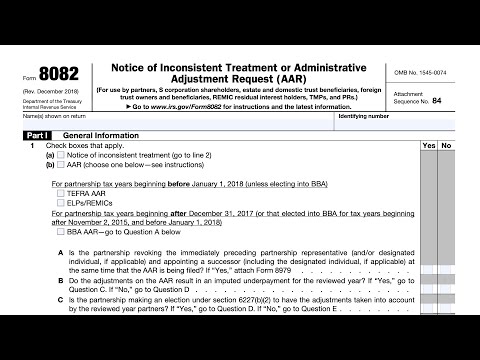

IRS Form 8082 Instructions

Taxpayers who receive inconsistent information from their partnership may need to report those items on IRS Form 8082 when filing their income tax return. Taxpayers may also use IRS Form 8082 to file an administrative adjustment request, or AAR, with the IRS.

In this article, we’ll walk through this tax form in depth, including:

- Step by step guidance on completing Form 8082

- How the Bipartisan Budget Act changed AARs

- How to account for imputed underpayments as a result of filing Form 8082

First, let’s take a deeper look into the tax form itself.

Table of contents

How do I complete IRS Form 8082?

There are three parts to this two-page tax form:

- Part I: General Information

- Part II: Inconsistent or Administrative Adjustment Request (AAR) Items

- Part III: Explanations

We’ll go over each part, line by line. Let’s start with Part I.

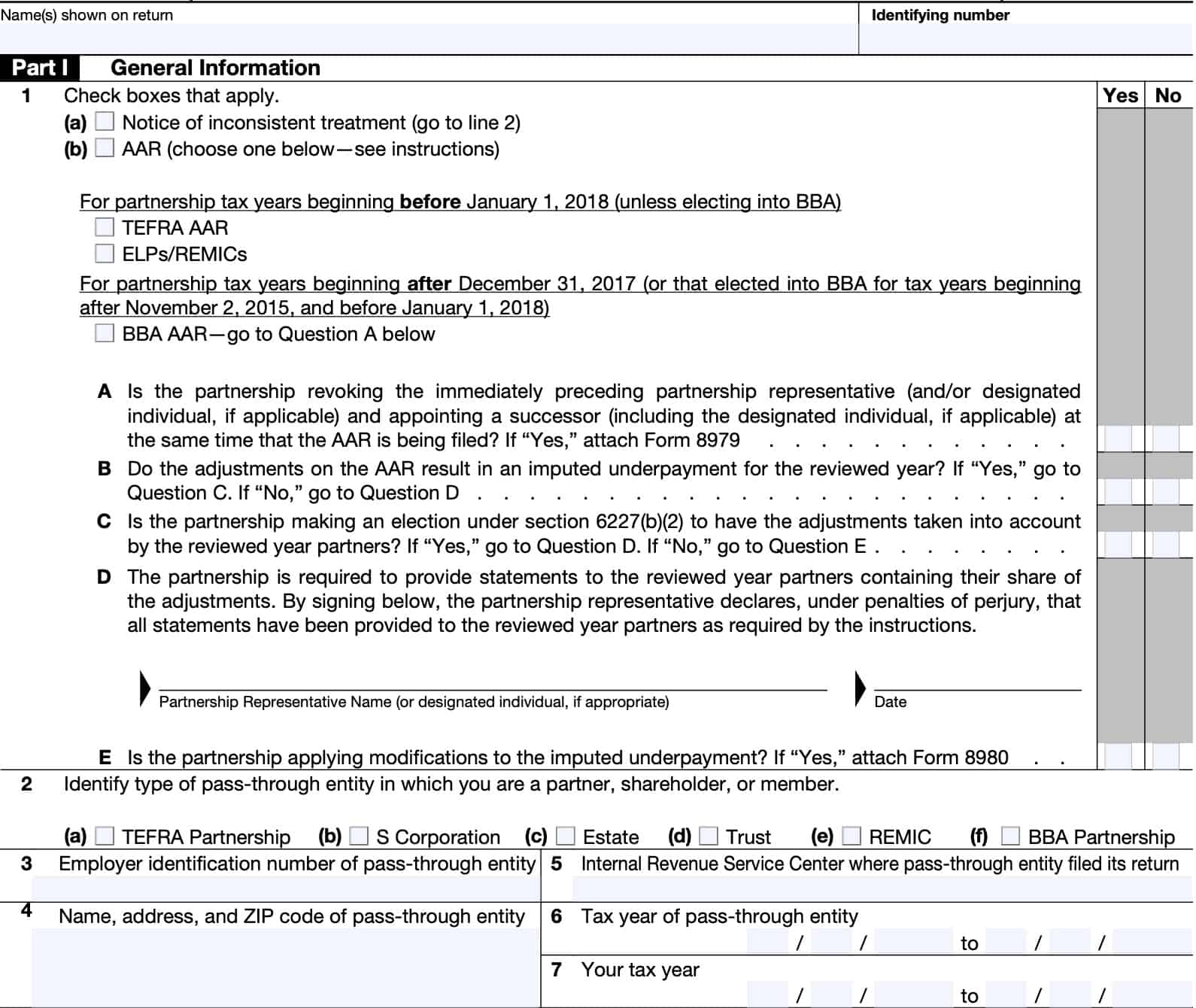

Part I: General Information

At the top of the form, enter the legal name and tax identification number of the tax entity.

Line 1

In Line 1, there are several steps, depending on whether you are reporting a notice of inconsistent treatment or if you are filing an administrative adjustment request.

Notice of inconsistent treatment

Check box (a) if you believe an item wasn’t properly reported on one of the following:

- Schedule K-1

- Schedule K-3

- Schedule Q

- IRS Form 8986, Partner’s Share of Adjustment(s) to Partnership-Related Item(s)

- Any foreign trust statement that you received

Also check box (a) if you haven’t received any of the previously mentioned items by your tax return’s due date (or extended due date, if you have filed for a tax extension).

Administrative Adjustment Request

Check box (b) to notify the Internal Revenue Service that you are requesting a change in the amount or treatment of any item from the way you reported it on your original return or on an amended return.

A partnership-partner may check both boxes (a) and (b) if it is also a BBA partnership that is filing an AAR that is inconsistent with any of the following that it has received:

- Schedule K-1

- Schedule K-3

- IRS Form 8986 (only with respect to an AAR)

A partner, including a partnership-partner, cannot file inconsistently with an IRS Form 8986 it was issued with respect to an audited partnership.

Subject to the particular filing rules, an AAR can be filed by the following:

- Partnerships subject to TEFRA proceedings (TEFRA AAR)

- Partnerships subject to BBA proceedings (BBA AAR)

- Electing large partnerships (ELPS)

The following partners may also file an AAR:

- Partners of a TEFRA partnership;

- Residual interest holders; or

- Partnership-partners in a BBA partnership (but only for the purpose of providing notice of inconsistent treatment with the AAR).

TEFRA vs BBA

The Bipartisan Budget Act, known as BBA, created a new centralized partnership audit regime generally effective for partnership tax years beginning after 2017. The Tax Equity and Fiscal Responsibility Act of 1982 (TEFRA) generally applied to tax years beginning before 2018.

BBA repealed TEFRA and the electing large partnership (ELP) rules. Consequently, former ELPs are now treated as other partnerships under the BBA regime.

Partnership tax years beginning before January 1, 2018

Check the box for either TEFRA AAR or ELPs/REMICs.

TEFRA AAR

The consolidated audit proceedings of Internal Revenue Code Sections 6221 through 6234 (prior to amendment by BBA) are referred to as “TEFRA proceedings.”

Partnerships that are subject to TEFRA proceedings are referred to as “TEFRA partnerships.” An AAR filed by the tax matters partner (TMP) of the TEFRA partnership is a TEFRA AAR.

The Form 8082 is also used by any partner in a TEFRA partnership filing an AAR. TEFRA proceedings will not apply to partnerships with tax years beginning after 2017.

A partnership with a tax year beginning before 2018 that is not subject to TEFRA proceedings is referred to as a “nonTEFRA partnership.”

The ELP procedures were repealed for tax years beginning after 2017. However, ELPs filing an AAR after 2017 for a tax year that began before 2018 will use IRS Form 8082.

Partnership tax years beginning after December 31, 2017

BBA AAR: All partnerships with tax years beginning after 2017 are subject to the centralized partnership audit regime unless an eligible partnership makes a valid election under IRC Section 6221(b) to elect out of the centralized partnership audit regime.

If a BBA partnership files an AAR and it needs to make its partners aware of their allocable share of adjustments, then it will furnish to each partner of the partnership for the reviewed year a Form 8986 reflecting the partner’s share of the adjustments. The BBA partnership should not provide amended Schedules K-1 or K-3.

The partnership is also required to file with the AAR any Forms 8986 required to be furnished to partners along with Form 8985. The form instructions for those specific forms contain additional information.

The partnership will need to furnish such statements to make its partners aware of their allocable share of adjustments when:

- The adjustments in the BBA AAR result in an IU of zero or less than zero or the adjustments don’t result in an IU, or

- The adjustments in the BBA AAR do result in an IU greater than zero but the BBA partnership makes a valid election under IRC Section 6227(b)(2) to have each reviewed partner take its share of adjustments into account.

Check Yes or No for each of the following, as applicable.

Item A

Is the partnership revoking the immediately preceding partnership representative (and/or designated individual, if applicable) and appointing a successor (including the designated individual, if applicable) at the same time that the AAR is being filed?

If Yes, complete IRS Form 8979 and attach it to your completed AAR.

Item B

Do the adjustments on the AAR result in an imputed underpayment for the reviewed year?

If “Yes,” go to Item C. If “No,” go to Item D.

BBA partnerships filing an AAR will need to determine if the partnership adjustments result in an IU. The IRS web site provides the following formula for calculating a possible IU:

- Total netted partnership adjustments (TNPA) times

- Highest rate in effect for the reviewed partnership tax year under IRC Section 1 or 11 plus

- Sum of net positive adjustments to creditable expenditure and credit groupings, equals

- Total Imputed Underpayment (IU)

The Form 8082 instructions contain a step by step review of the IU calculations, as well as helpful definitions.

Item C

Is the partnership making an election under IRC Section 6227(b)(2) to have the adjustments taken into account by the reviewed year partners?

If “Yes,” go to Item D.

Otherwise, go to Item E.

If the adjustments contained in the BBA AAR result in an IU, the partnership must pay the IU at the same time the AAR is filed.

However, under IRC Section 6227(b)(2), the partnership can elect to have its reviewed year partners take the adjustments into account. This is an election to push out the adjustments to the partners as alternative to payment of the IU.

See IRC Section 6226(a)(2) for details. If this valid election is made, the partnership is no longer liable for the IU.

If the adjustments in the BBA AAR don’t result in a positive IU or the BBA partnership makes a valid election under section 6227(b)(2), the partnership must furnish to each partner of the partnership for the reviewed year a Form 8986 reflecting the partner’s share of the adjustments.

Item D

The partnership representative, or designated individual, will sign and date Item D.

The partnership is required to provide statements to the reviewed year partners containing their share of the adjustments. By signing Item D, the partnership representative declares, under penalties of perjury, that all statements have been provided to the reviewed year partners as required by the instructions.

Item E

If the partnership is applying modifications to the IU, then the partnership must also attach a completed IRS Form 8980.

Under Section 6227(b)(1), the partnership may modify the IU resulting from adjustments reported in a BBA AAR in accordance with the provisions under IRC Section 6225(c), disregarding the provisions under paragraphs (2), (7), and (9).

Any modification made to the IU under IRC Section 6227(b)(1) must be disclosed and fully explained on IRS Form 8980 included with the AAR.

Line 2

For Lines 2 through 6, the information for these lines can generally be found on one of the following:

- Schedule K-1

- IRS Form 8986

- Schedule Q, or

- The foreign trust statement

For Line 2, identify the type of pass-through entity in which you are a partner, shareholder, or member. You may choose from the following:

- TEFRA partnership

- S corporation

- Estate

- Trust

- Real Estate Mortgage Investment Conduit (REMIC)

- BBA partnership

Line 3: Employer identification number

Enter the employer identification number (EIN) of the pass-through entity.

Line 4: Name, address, and zip code of pass-through entity

Enter the name, address, and zip code of the pass-through entity in question.

Line 5

In Line 5, enter the IRS center where the pass-through entity filed its income tax return.

Line 6

Enter the tax year of the pass-through entity’s tax return. Enter both the beginning date and end date in mm/dd/yyyy format.

If you are a partner filing a notice of inconsistent treatment from a Form 8986 received as a result of a BBA partnership AAR, use the date contained in Part II, box D (“Review year of the partnership”), from the Form 8986.

Line 7

Enter your tax year. Enter both the beginning date and end date in mm/dd/yyyy format.

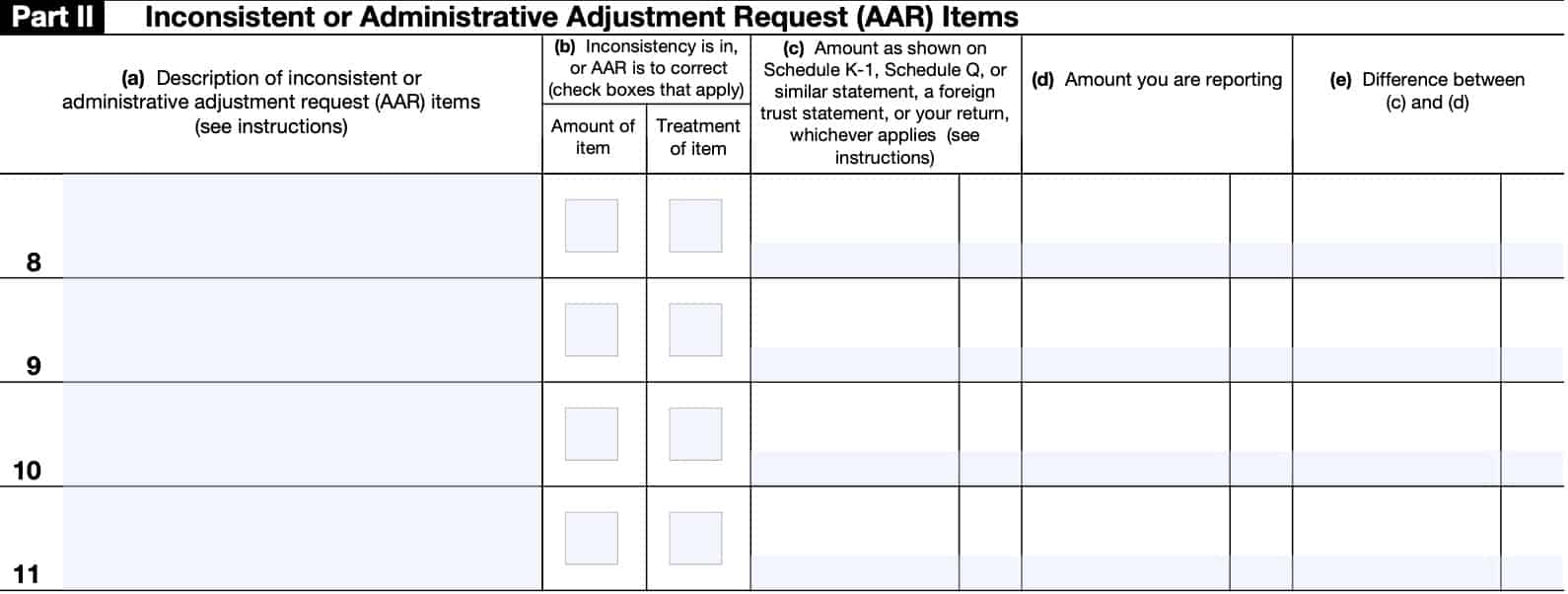

Part II: Inconsistent or Administrative Adjustment Request (AAR) Items

The IRS provides specific instructions for certain situations, outlined below.

- TEFRA partnerships and ELPs filing AARs

- TEFRA partner filing an AAR

- Partner filing a notice of inconsistent treatment for a Schedule K-1 received from a TEFRA partnership

- BBA partnerships filing AARs

- Partner filing a notice of inconsistent treatment for a Schedule K-1 and/or Schedule K-3 received from a BBA partnership

- Pass-through partner filing a notice of inconsistent treatment for IRS Form 8986 received from a BBA partnership filing an AAR

- Other than pass-through partner filing a notice of inconsistent treatment from a BBA partnership

Read the applicable instructions for your entity’s tax situation, as applicable. Afterwards, review the instructions for Columns (a) through (e), below.

Applicable tax situations

TEFRA partnerships and ELPs filing AARs

If a TEFRA partnership or ELP is filing an AAR to change items that were reported on its original return, follow these steps:

- Determine the required changes

- Complete Form 8082 to identify the changes being made.

- On Form 8082, check box (b) under Part I, Line 1.b.

- Follow the steps for Columns (a) through (e) on Lines 8 through 11

- Complete Form 1065.

- File an amended Form 1065 (checking box G5).

- The TMP must sign the amended return.

- Attach amended Schedules K-1 showing the corrected amounts for each partner.

- File Form 8082 along with Form 1065 and attach any other required supporting documents

- Give a copy of the amended Schedules K-1 to the applicable partners

TEFRA partner filing an AAR

If a partner in a TEFRA partnership is filing an AAR to change items associated with its investment in the TEFRA partnership that were reported on its original return, take the following actions

- Determine the required changes

- Complete Form 8082 to identify the changes being made.

- On Form 8082, check box (b) under Part I, Line 1.b.

- Follow the steps for Columns (a) through (e) on Lines 8 through 11

- Complete the applicable amended return.

- File Form 8082 along with the applicable amended return and attach any other required supporting documents.

Partner filing a notice of inconsistent treatment for a Schedule K-1 received from a TEFRA partnership

A partner may file a notice of inconsistent treatment if it:

- Doesn’t receive a Schedule K-1 from a TEFRA partnership, or

- Does receive a Schedule K-1 but disagrees with some or all of the reported treatment and or reported amounts.

In this situation, do the following:

- On IRS Form 8082, check box (a) under Part I, Line 1

- Follow the steps for Columns (a) through (e) on Lines 8 through 11

- File Form 8082 along with the applicable return and attach any other supporting documents required.

BBA partnerships filing AARs

If a BBA partnership is filing an AAR to change items that were reported on its original return, do the following:

- Determine the required changes

- Complete Form 8082 to identify the changes being made.

- Check box (b) under Part I, Line 1.b.

- Follow the steps for Columns (a) through (e) on Lines 8 through 11, below

- Figure an IU and determine if there are any adjustments that don’t result in an IU.

- Determine if you will pay the IU or push out the adjustments to the partners.

- If paying an IU, complete Form 1065 and report the IU appropriately. Complete IRS Forms 8985 and 8986 (pushout package) pertaining to the adjustments that don’t result in an IU as applicable.

- If pushing out all the adjustments to the reviewed year partners, complete IRS Form 1065. Also complete Forms 8985 and 8986 (pushout package).

- File Form 8082 along with Form 1065, and attach any other required supporting documents

- This includes copies of Forms 8985 and 8986 as applicable

- If applicable, distribute the Forms 8986 to reviewed year partners according to the Form 8986 instructions.

Partner filing a notice of inconsistent treatment for a Schedule K-1 and/or Schedule K-3 received from a BBA partnership

When a partner receives a Schedule K-1 and/or Schedule K-3 from a BBA partnership, it must generally file consistently with that Schedule K-1 and/or Schedule K-3.

However, a partner may file inconsistently if it provides valid notice to the IRS of inconsistent treatment.

- On IRS Form 8082, check box (a) under Part I, Line 1

- Follow the steps for Columns (a) through (e) on Lines 8 through 11

- File Form 8082 along with the applicable return and attach any other supporting documents required.

Pass-through partner filing a notice of inconsistent treatment for IRS Form 8986 received from a BBA partnership filing an AAR

When a pass-through partner receives a Form 8986, or pushout statement, as a result of an AAR filed by a BBA partnership in which it is an indirect or direct investor, that pass-through partner will take one of the following actions prior to the date annotated in Box F, Part II on the Form 8986:

- Push out all the Form 8986 adjustments to its partners, shareholders, and/or beneficiaries

- For the adjustments resulting in an IU:

- Pay an IU on those adjustments

- Prepare and issue to its partners, shareholders, and/or beneficiaries a pushout statement package for those adjustments that don’t result in an IU

- Where the Form 8986 only contains adjustments that don’t result in an IU, prepare a pushout statement package for those adjustments and issue to its partners, shareholders, and/or beneficiaries

However, a pass-through partner may file inconsistently if it provides valid notice to the IRS of inconsistent treatment.

Any partner that receives a Form 8986 as a result of an audit is not permitted to treat items on that Form 8986 inconsistently and must report consistently with the information provided on the Form 8986.

Other than pass-through partner filing a notice of inconsistent treatment from a BBA partnership

If you are a partner, other than a pass-through partner, filing inconsistently from a BBA partnership, complete IRS Form 8082 and attach it to your original return or amended return.

Lines 8 through 11

Lines 8 through 11 contain 5 columns:

- Column (a): Description of inconsistent or AAR items

- Column (b): Consistency is in, or AAR is to correct the following

- Column (c): Amount as shown on statement

- Column (d): Amount you are reporting

- Column (e): Difference between (c) and (d)

Column (a): Description of inconsistent or AAR items

Provide a written description of the inconsistent or AAR items, as outlined below.

AAR items

If you are filing an AAR, enter the line number and description from the form for which you are making the change.

For example, if you are changing the amount reported on Schedule K, Line 1, enter “Schedule K, Line 1.”

Inconsistent treatment

Enter the line number and description as shown on one of the following, if applicable:

- Schedule K-1

- Schedule K-3

- Schedule Q

- IRS Form 8986

- Filed as a result of a BBA AAR, and not as a result of an audit

- Foreign trust statement

Otherwise, enter a complete description of the item.

If you didn’t receive the applicable statement, but are still reporting estimated amounts on your original filing, enter a completed description of the item and where you are reporting the estimated amount on your original return.

Column (b): Consistency is in, or AAR is to correct the following

AAR

If you are filing an AAR, check the box under “Amount of item” if you are changing the amount from what was previously filed.

Check the box under “Treatment of item” if you are reporting the amount unchanged but are changing another treatment of the item.

Check both boxes if you are changing the amount and another treatment besides amount.

Inconsistent treatment

If you believe that the amount of any item shown on a statement wasn’t properly reported, check “Amount of item.”

If you believe that treatment of any item (other than the amount of the item) wasn’t properly reported, check “Treatment of item.” An example might be a long-term capital loss that a partner thinks should be an ordinary loss.

Check both parts of column (b) if either (1) or (2) below applies.

- You believe that both the amount and another treatment (besides the amount) of the item shown on the applicable statement weren’t properly reported, or you believe an item was omitted from the form.

- The pass-through entity didn’t file a return or give you a Schedule K-1, Schedule K-3 (and the pass-through entity was required to provide one to you according to the instructions for Schedule K-2), Schedule Q, and/or foreign trust statement.

Note: If you only check ‘Treatment of Item,’ you do not need to complete Column (d) or Column (e), below.

Column (c): Amount as shown on statement

AAR

If you are filing an AAR, report the amount you previously reported for the item listed in Column (a).

Inconsistent treatment

If you attach Form 8082 to your return, to make a notice of inconsistent treatment, enter the amount as shown on the statement you received.

If the pass-through entity didn’t file a return, or if you didn’t receive a schedule or statement, or if you are reporting items that you believe were omitted, enter zero in column (c).

Column (d): Amount you are reporting

Enter the amount you are reporting in Column (d).

Column (e): Difference between (c) and (d)

Enter the net increase or decrease for each line being changed in column (e).

If Column (d) exceeds Column (c): enter the difference as a positive number.

If Column (d) is less than Column (c): enter the difference as a negative number, and use parentheses.

Explain the reason for the change (increase or decrease) in Part III.

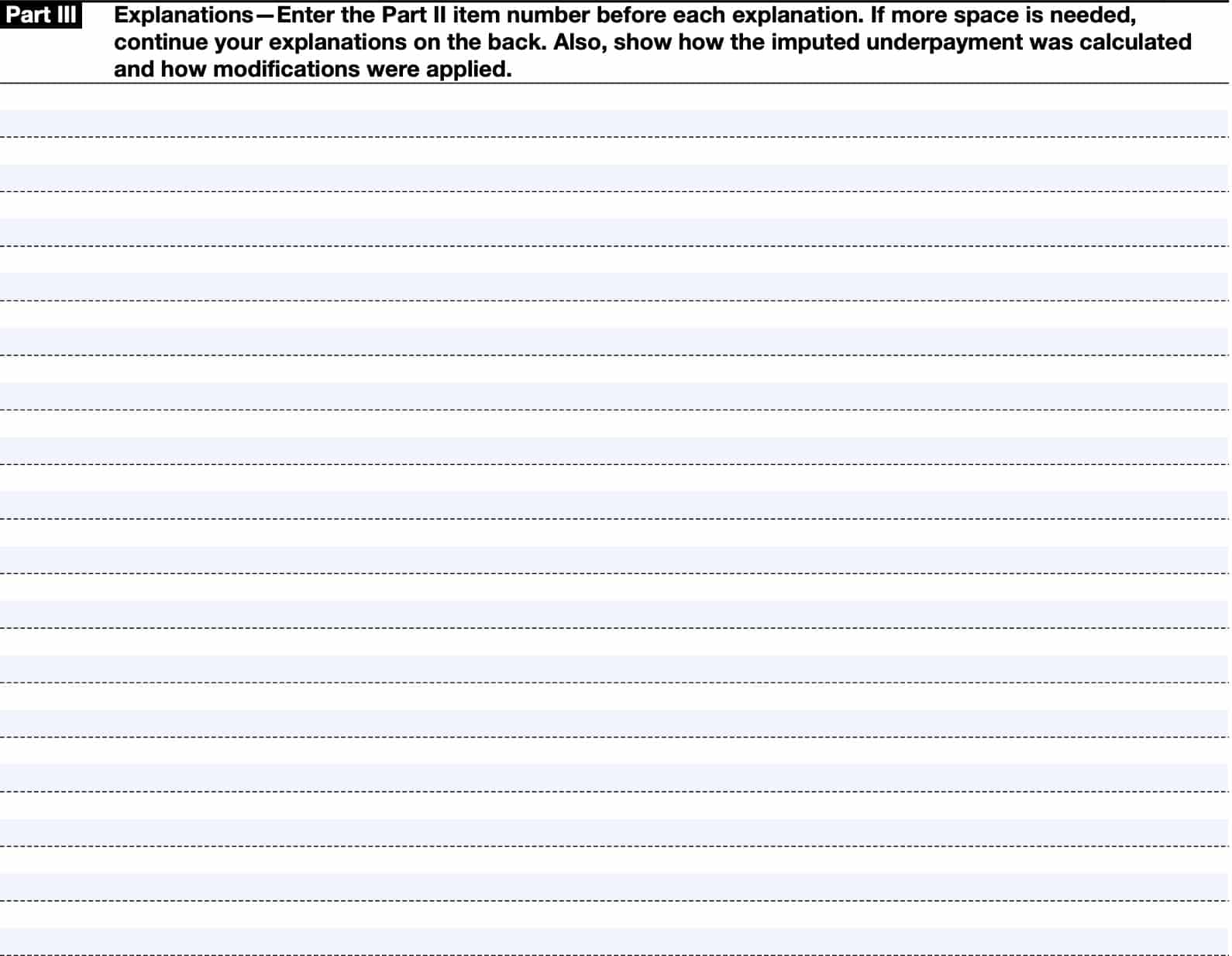

Part III: Explanations

In Part III, you’ll need to:

- Enter the Part II item number before each explanation

- Provide a written explanation for each inconsistent or AAR item liste

- Show how imputed underpayments were calculated, and how you applied any modifications

If you need more space, you may continue your narrative on the back of Part III. See the IRS Form 8082 instructions for more detailed guidance on calculating imputed underpayments.

Video walkthrough

Watch this instructional video to learn more about reporting inconsistent items or filing administrative adjustment requests with IRS Form 8082.

Frequently asked questions

IRS Form 8082 is the tax form that certain taxpayers may use to report inconsistent items reported to the IRS by a large partnership, or to request an administrative adjustment to line items as reported by the partnership.

Partners, S corporation shareholders, beneficiaries of an estate or trust, owners of a foreign trust, or residual interest holders in a REMIC file this form if they wish to report items differently than the way they were reported to them on Schedule K-1, Schedule Q, or a foreign trust statement. Also, they may use Form 8082 to file an administrative adjustment request, or AAR.

Taxpayers should file IRS Form 8082 if they receive an incorrect Schedule K-1 that has not been corrected by the time they file their income tax return. Taxpayers should also use Form 8082 to report a missing Schedule K-1 that has not been received by their tax return’s due date.

How do I find IRS Form 8082?

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!