IRS Form 8908 Instructions

In 2022, the federal government passed the Inflation Reduction Act, which extended the energy efficient home credit to cover qualified new energy efficient homes sold or leased after 2021 and before 2033. Additionally, the Inflation Reduction Act updated the Internal Revenue Code with increases to certain business tax credits for certain homes sold or leased after 2022. Taxpayers claim these credits by filing IRS Form 8908 with their income tax return.

In this article, we’ll cover everything you need to know about IRS Form 8908, including:

- How to complete IRS Form 8908

- How to claim energy efficient tax credits on your income tax return

- Frequently asked questions

Let’s begin with an overview of the tax form itself.

Table of contents

How do I complete IRS Form 8908?

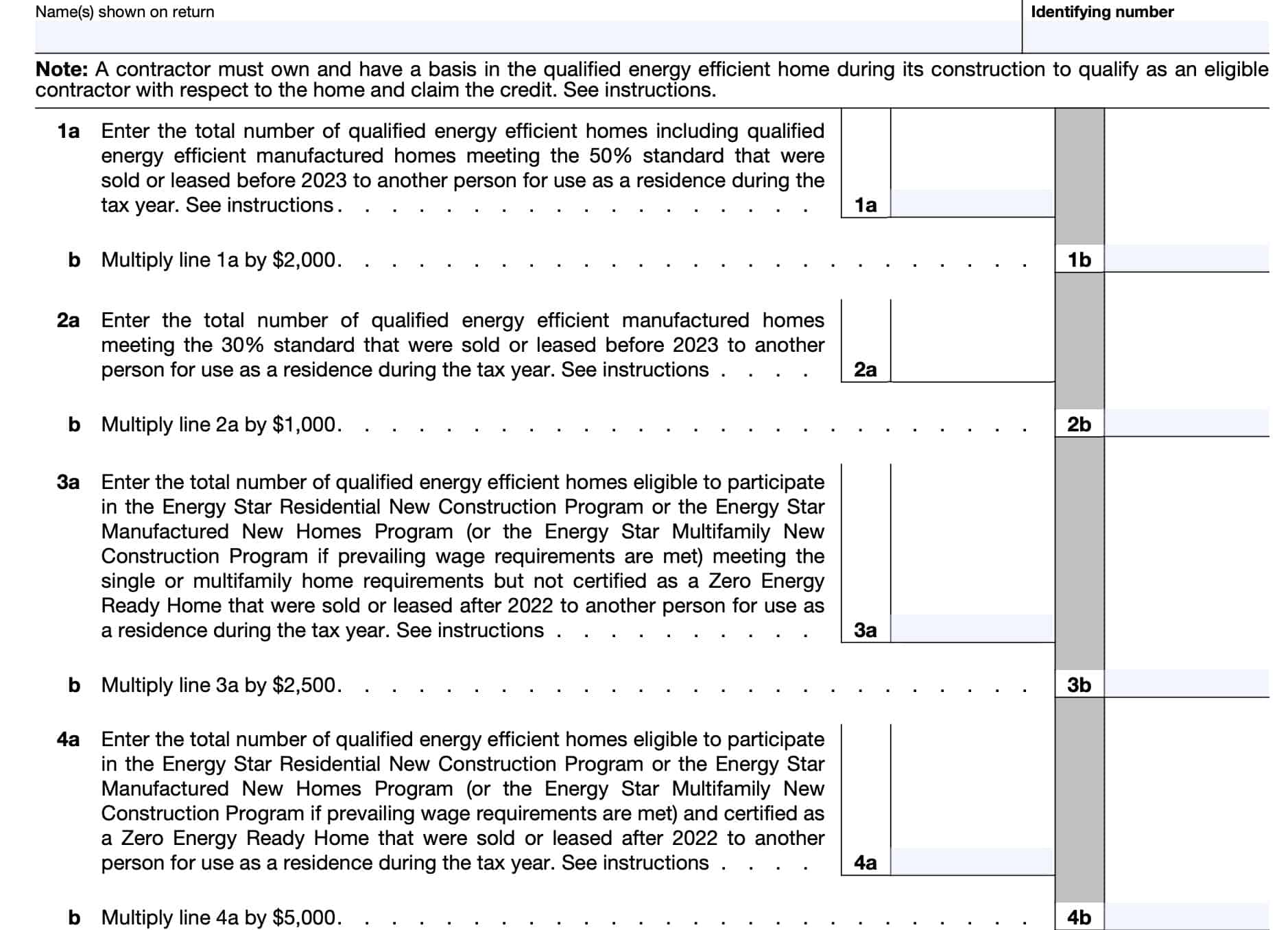

Let’s go through this one-page tax form, step by step. Before going to Line 1, there are a couple of notes.

For tax year 2022, only use Lines 1, 2, 7, and 8, as applicable. Credits for Lines 3 through 6 are for homes sold or leased after 2022.

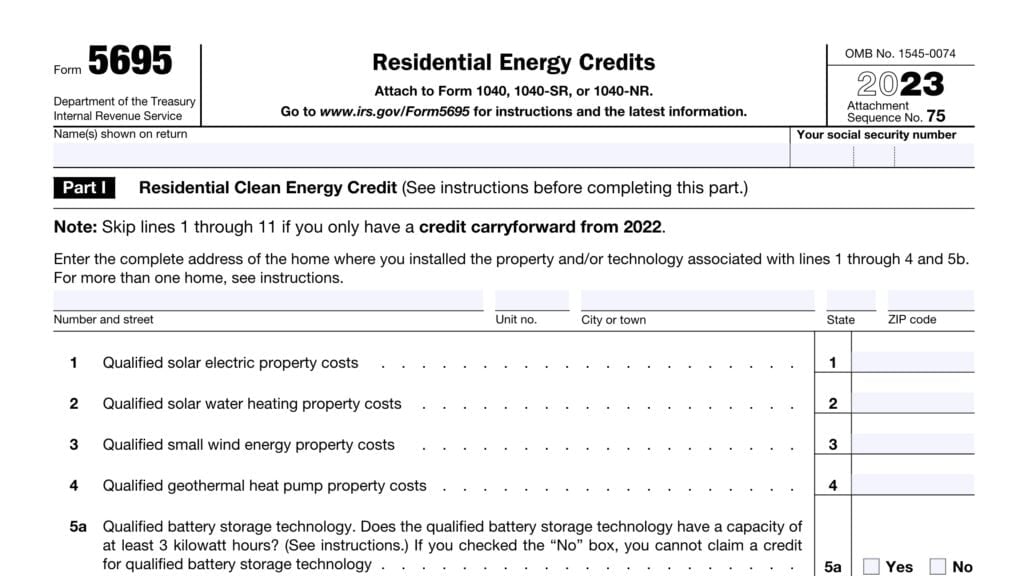

Line 1: Number of homes meeting the 50% standard

In Line 1a, enter the number of homes that meet the 50% energy efficient standard. Reduce the expenses incurred in the construction of each new home by the amount of the credit.

Expenses taken into account at the time of construction for either the rehabilitation credit or energy credit part of the investment tax credit cannot be used to calculate the energy efficient home credit.

In Line 1b, multiply the number in Line 1a by $2,000. This represents your total tax credit amount for new homes that meet the 50% energy efficiency standard.

What is the 50% energy efficient standard?

The federal tax credit is $2,000 for a dwelling unit that is certified to meet the energy efficiency requirements for homes sold or leased before 2023. To meet these requirements, the unit must have:

- An annual level of heating and cooling energy consumption at least 50% below the annual level of heating and cooling energy consumption of a comparable dwelling unit and

- Building envelope component improvements that account for at least 1/5 of the 50% reduction in energy consumption.

A manufactured home meeting the requirements described above and the Federal Manufactured Home Construction and Safety Standards (FMHCSS) requirements (see 24 C.F.R. part 3280) is also eligible for the $2,000 credit.

What is a comparable dwelling unit?

A comparable dwelling unit, for purposes of the energy-efficient homes credit,

- Is constructed in accordance with the standards of chapter 4 of the 2006 International Energy Conservation Code as such Code (including supplements) was in effect on January 1, 2006;

- Has air conditioners with a Seasonal Energy Efficiency Ratio (SEER) of 13, measured in accordance with 10 C.F.R. 430.23(m); and

- Has heat pumps with a SEER of 13 and a Heating Seasonal Performance Factor (HSPF) of 7.7, measured in accordance with 10 C.F.R. 430.23(m).

Line 2: Number of homes meeting the 30% standard

In Line 2a, enter the number of homes that meet the 30% energy efficient standard. Reduce the expenses incurred in the construction of each new home by the amount of the credit.

Expenses taken into account for either the rehabilitation credit or energy credit part of the investment tax credit cannot be used to calculate the energy efficient home credit.

In Line 2b, multiply the number in Line 2a by $1,000. This represents your total tax credit for new homes that meet the 30% energy efficiency standard.

What is the 30% energy efficient standard?

Similar to the 50% standard, the 30% energy efficient standard applies to a dwelling unit with new energy-efficient systems that produce an energy savings of 30% when compared to a comparable dwelling unit.

Line 3: Homes eligible for Energy Star but not certified as Zero Energy

Tax credits discussed in Lines 3 through 6 are eligible for various tax credits for buildings sold or leased after the 2022 tax year.

In Line 3a, enter the number of qualified energy efficient homes that meet the following criteria:

- Are eligible to participate in one of the following:

- Energy Star Residential New Construction Program

- Energy Star Manufactured New Homes Program

- Energy Star Multifamily New Construction Program, as long as prevailing wage requirements are met

- Are not certified as a Zero Energy Ready Home

- Was sold or leased after 2022 to another person for use as a residence during the tax year

Homes that meet these energy efficiency requirements are eligible for a $2,500 credit in tax years 2023 through 2032.

In Line 3b, multiply the number in Line 3a by $2,500 and enter the result here.

What are prevailing wage requirements?

With respect to any qualifying new energy-efficient home, the prevailing wage requirements are that the eligible contractor shall ensure that any laborers and mechanics involved in the construction shall be paid wages at least equal to the prevailing rates for construction, alteration, or repair of a similar nation in the local area.

This requirement applies to anyone employed by the contractor, an authorized subcontractor, or other third-party contractor involved in the project. The Secretary of Labor determines the prevailing rates for localities.

For more detail, the Internal Revenue Service has posted guidance through Notice 2022-61, 2022-52 I.R.B. 560.

Line 4: Homes eligible for Energy Star and certified as Zero Energy

In Line 4a, enter the number of qualified energy efficient homes that meet the Energy Star requirements listed in Line 3, but are certified as a Zero Energy Ready Home.

What is a Zero Energy Ready Home?

A dwelling unit meets this requirement if the qualified energy-efficient home is certified as a zero energy ready home under the Zero Energy Ready Home Program of the Department of Energy.

According to the Department of Energy, a zero energy ready home is so energy efficient that a renewable energy system could offset most or all the home’s annual energy use. Specifics on zero energy ready home requirements depend on dwelling type.

The Department of Energy’s website contains more information on zero energy requirements:

- Zero energy requirements for single-family homes

- Zero energy requirements for manufactured homes

- Zero energy requirements for multi-family units, such as apartment buildings

Homes that meet these energy efficiency requirements are eligible for a $5,000 credit in tax years 2023 through 2032.

In Line 4b, multiply the number in Line 3a by $5,000 and enter the result here.

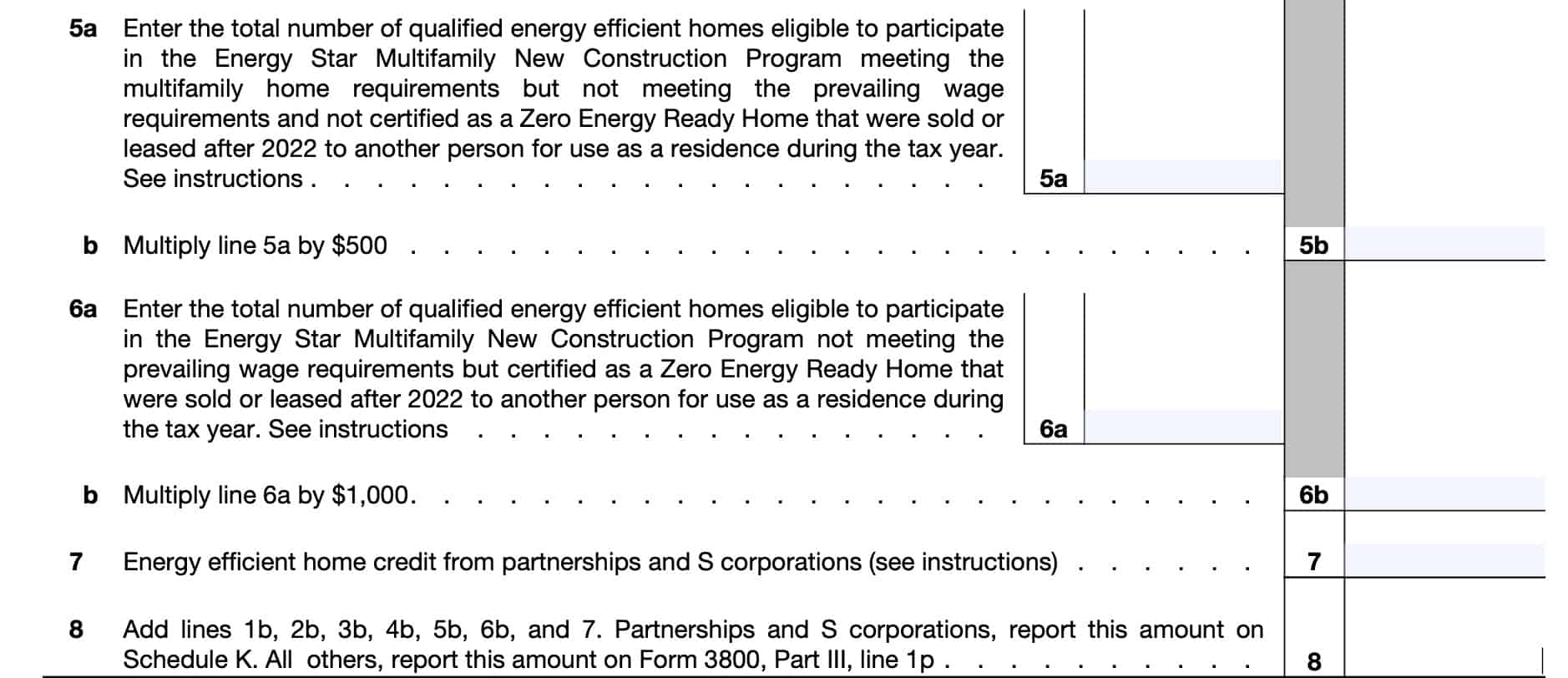

Line 5: Multifamily homes eligible for Energy Star, but not meeting prevailing wage requirements and not certified as Zero Energy

Lines 5 and 6 pertain to multifamily new construction homes that do not meet the prevailing wage requirements as outlined in Line 3, above.

In Line 5a, enter the number of qualified energy efficient homes that are eligible to participate in the Energy Start Multifamily New Construction Program, but

- Do not meet the prevailing wage requirements, and

- Are not certified as a Zero Energy Ready Home

In Line 5b, multiply the number in Line 5a by $500. Enter the total here.

Line 6: Multifamily homes eligible for Energy Star, not meeting prevailing wage requirements but certified as Zero Energy

In Line 6a, enter the number of qualified energy efficient homes that:

- Are eligible to participate in the Energy Start Multifamily New Construction Program

- Do not meet the prevailing wage requirements, but

- Are certified as a Zero Energy Ready Home

In Line 6b, multiply the number in Line 5a by $1,000. Enter the total here.

Line 7: Energy efficient home credit from partnerships and S-corporations

For Line 7, partners and S-corporation shareholders will report any energy efficient home credits reported to them on their Schedule K-1.

For partners, these credits are reported on Schedule K-1 (Form 1065), Box 15, with reporting code ‘P.’

S-corporation shareholders will find credits on their Schedule K-1 (Form 1120-S), Box 13, with reporting code ‘P.’

All other filers figuring a separate credit on earlier lines also report the above credits on Line 7. All others not using earlier lines to figure a separate credit can report the above credits directly on Part III of IRS Form 3800, Line 1p, as part of the general business credit.

Line 8: Total energy efficient home credit

Add the totals from Lines 1 through 7. Enter the total here.

For partnerships and S corporations, report this amount on Schedule K. Other taxpayers should report this number on Form 3800, Line 1p.

Video walkthrough

Watch this instructional video to learn more about claiming the energy efficient home credit with Form 8908.

Frequently asked questions

According to the IRS, an eligible contractor is the person that constructed a qualified energy efficient home, or produced a manufactured home that meets similar requirements. A person must own and have a basis in the qualified energy efficient home at the time of construction to qualify as an eligible contractor with respect to the home.

For example, if the person that hires a third-party contractor to construct the home owns and has the basis in the home during construction, the person that hires the third-party contractor is the eligible contractor, not the third-party contractor.

Wage requirements require all contractors involved in the new home construction pay their employees wages at a rate at least equal to that of the prevailing rates in the given locality. The Secretary of Labor determines prevailing rates for this requirement.

A qualified new energy efficient home is a dwelling unit located in the United States, whose construction is substantially completed after August 8, 2005, and sold or leased to another person after 2005 but before 2033, for use as a residence. The home must be certified and meet certain energy saving requirements. Construction includes substantial reconstruction and rehabilitation.

Where can I find IRS Form 8908?

As with any other IRS form, you may find Form 8908 on the IRS website. For your convenience, we’ve enclosed the latest version in this article.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!