IRS Form 8859 Instructions

During the Great Recession, there were many homebuyer assistance programs, designed to encourage people to become homeowners. This includes a first-time homebuyer assistance program for residents of the District of Columbia, for which qualified taxpayers could claim a tax credit on IRS Form 8859.

While the D.C. first time homebuyer program expired in 2011, the tax form (and the tax credit) still exists for some of those taxpayers. In this article, we’ll walk you through what you need to know about IRS Form 8859, including:

- How to complete IRS Form 8859

- Which other tax credits may interfere with taking this tax credit

- Other frequently asked questions

Let’s start with a walkthrough of this relatively straightforward tax form.

Table of contents

How do I complete IRS Form 8859?

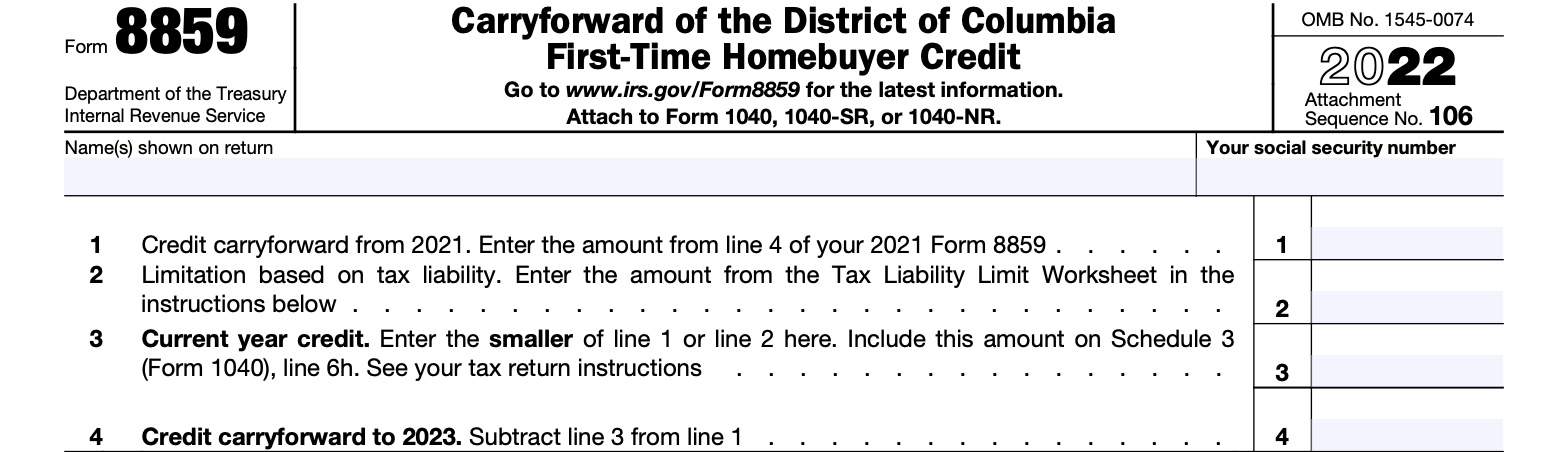

This one-page tax form is very simple to complete, as there are only 4 lines.

Line 1: Credit carryforward from previous tax year

In Line 1, enter the tax credit carryforward from the previous year. This should be the Line 4 amount from your prior year’s IRS Form 8859.

Line 2: Limitation based on tax liability

Here, enter the number you calculated in the tax liability limit worksheet, from the form instructions.

Line 3: Current year credit

Here, enter the smaller of either Line 1 or Line 2.

Also, enter this amount as a nonrefundable tax credit on IRS Schedule 3, Line 6h.

Line 4: Credit carryforward to next tax year

The result is the amount of tax credit carryforward to the next tax year.

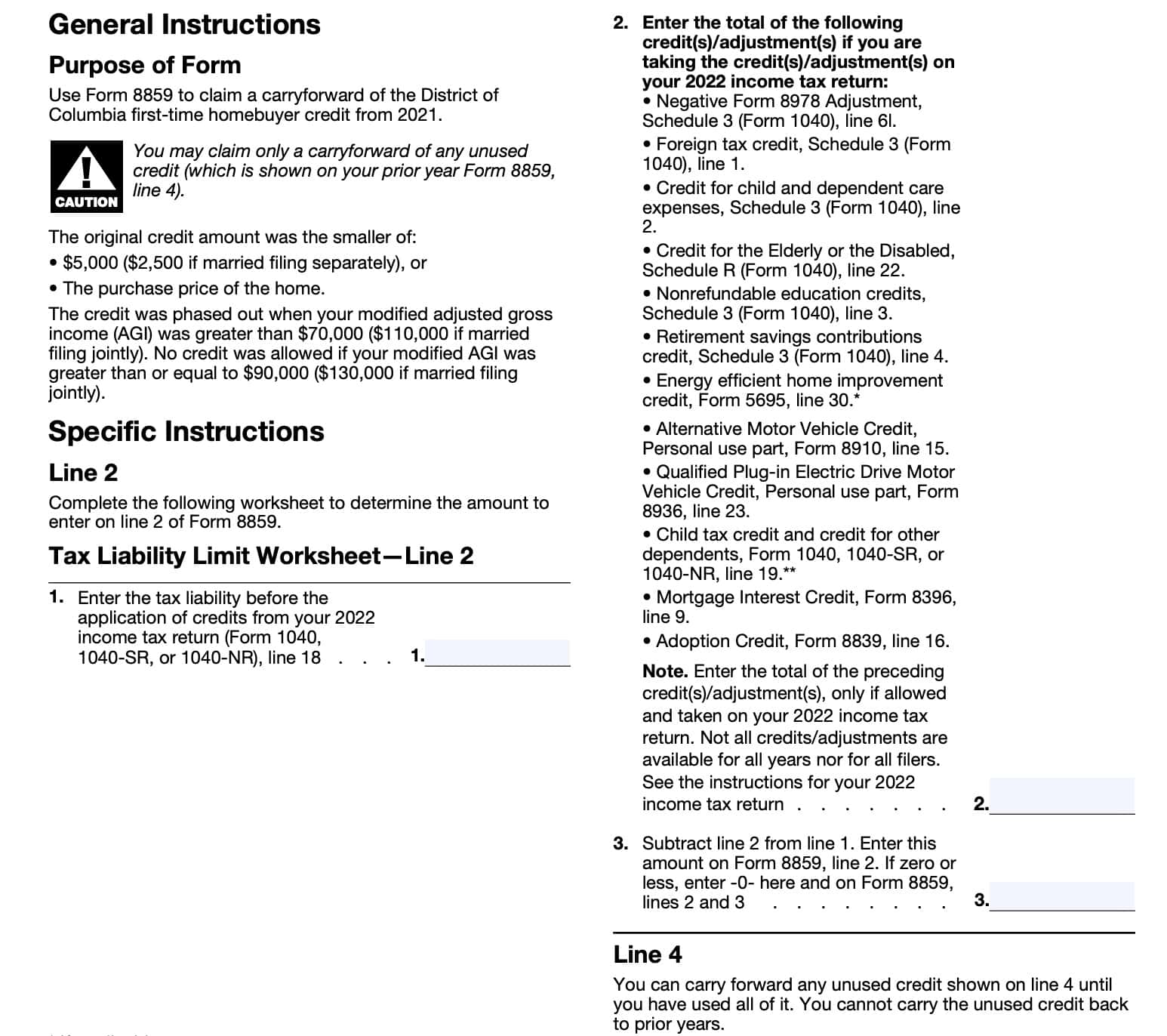

Completing the tax liability limit worksheet

The tax liability limit worksheet, used to complete Line 2, helps taxpayers determine whether they can take the District of Columbia first-time homebuyer credit in the current tax year, or if they need to carry the credit amount forward to future tax years.

The worksheet is fairly simple:

Step 1

Enter your income tax liability from our federal income tax return. You’ll find this number on Line 18 of your Form 1040, Form 1040-SR, or Form 1040-NR.

Step 2

Enter the total of the following credits:

- IRS Schedule 3, Line 6l: Negative IRS Form 8978 Adjustment

- IRS Schedule 3, Line 1: Foreign tax credit from IRS Form 1116

- IRS Schedule 3, Line 2: Credit for child and dependent care expenses from IRS Form 2441

- IRS Schedule R, Line 22: Credit for the elderly or disabled

- IRS Schedule 3, Line 3: Nonrefundable education credits from IRS Form 8863

- IRS Schedule 3, Line 4: Retirement savings contributions credit from IRS Form 8880

- IRS Form 5695, Line 30: Energy efficient home improvement credit

- IRS Form 8910, Line 15: Alternative motor vehicle credit

- IRS Form 8936, Line 23: Qualified plug-in electric drive motor vehicle credit

- IRS Form 1040, Line 19: Child tax credit and credit for other dependents

- You may need to use the number from Schedule 8812, Credit Limit Worksheet B, Line 14, if you were required to complete Credit Limit Worksheet B

- IRS Form 8396, Line 9: Mortgage interest credit

- IRS Form 8839, Line 16: Adoption credit

Only calculate the amount of tax credits that you actually used to offset income tax liability in the current tax year. If any of the other tax forms contain tax credit carryovers to a future tax year, do not include those in this amount.

Step 3

Subtract the nonrefundable tax credits in Step 2 from the federal tax liability in Step 1. The difference represents the maximum credit that you can take in the current tax year.

Enter this result in Line 2, above.

Video walkthrough

Check out our video tutorial on IRS Form 8859 right here!

Frequently asked questions

No. This tax credit expired to new individuals on December 31, 2011. Taxpayers may use IRS Form 8859 to carry forward this non-refundable credit until their tax situation allows them to use the credit to lower their federal tax bill.

Before December 31, 2011, the D.C. first time homebuyer credit was the smaller of $5,000 or the home’s purchase price. There were also adjusted gross income limitations, with a credit phaseout from $70,000 to $90,000 for single taxpayers, or $110,000 to $130,000 for married homeowners.

Most taxpayers should file this form with the rest of their tax return. As a result the due date is the same as the due date for IRS Form 1040, U.S. Individual Income Tax Return.

Where can I find IRS Form 8859?

The Internal Revenue Service makes this federal form available on the IRS website. For your convenience, we’ve attached the latest version of this tax form as a PDF file here in this article.

Related tax forms

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!