IRS Form 8882 Instructions

Employers who invest in childcare assistance for their employees may be able to take a tax credit for a portion of their expenses by filing IRS Form 8882, Credit for Employer-Provided Childcare Facilities and Services.

In this article, we’ll walk you through this tax form, so you can understand:

- How to complete IRS Form 8882

- How to calculate tax credits for qualified child care expenditures

- Answers to frequently asked questions

Let’s start with an overview of IRS Form 8882.

Table of contents

How do I complete IRS Form 8882?

At the top of the tax form, enter the taxpayer name and identifying number. For most individuals, the identifying number will be either:

- Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

For business entities, this probably will be your employer identification number.

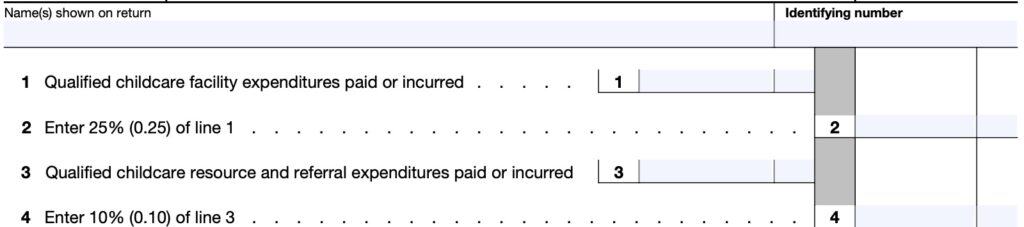

Line 1: Qualified childcare facility expenditures paid or incurred

Enter the total amount of qualified childcare facility expenditures that you either paid for or incurred during the current year.

Qualified childcare facility expenditures

Qualified childcare expenditures are amounts paid or incurred:

- To acquire, construct, rehabilitate, or expand property that is:

- To be used as part of a qualified child care facility of the taxpayer

- Depreciable or amortizable property

- Not part of the taxpayer’s principal residence or the residence of any taxpayer employee

- For the operating expenses of a qualified facility of the taxpayer, which can include expenses for:

- Employee training

- Scholarship programs

- Providing increased compensation to employees with higher levels of childcare training, or

- Under a contract with a qualified childcare facility to provide childcare services to employees of the taxpayer

Note: Any childcare expenses included in qualified childcare facility expenditures may not exceed the fair market value of that care.

Qualified childcare facility

A qualified childcare facility is a facility that meets the requirements of all applicable laws and regulations of the state or local government in which it is located. This includes the licensing requirements of the facility as a childcare facility.

The child care facility must meet the following conditions:

- The principal use of the facility must be to provide childcare

- Unless the facility is also the personal residence of the person operating the facility

- Enrollment in the facility must be open to employees of the taxpayer during the tax year

- If the facility is the principal trade or business of the taxpayer, at least 30% of the enrollees of the facility must be dependents of employees of the taxpayer

- The use of the facility (or the eligibility to use the facility) must not discriminate in favor of highly compensated employees

Line 2

Multiply the Line 1 amount by 25% (0.25) and enter the result in Line 2.

Line 3: Qualified childcare resource and referral expenditures paid or incurred

Enter the total qualified childcare resource and referral expenditures paid or incurred in the current tax year.

Qualified childcare resource and referral expenditures

Qualified childcare resource and referral expenditures are amounts that a taxpayer paid or incurred under a contract to provide childcare resource and referral services to employees.

The provision of the services (or the eligibility to use the services) must not discriminate in favor of highly compensated employees.

Line 4

Multiply the Line 3 amount by 10% (0.10). Enter the result in Line 4.

Line 5: Credit for employer-provided childcare facilities and services

Enter the tax credit for employer provided child-care facilities and services from pass-through entities such as partnerships, S-corporations, estates, and trusts.

These tax credits will be reported on Schedule K-1 of the respective pass-through entity’s tax return as follows:

- Partnerships: Form 1065, Schedule K-1, Box 15, Code AH

- S-corporations: Form 1120-S, Schedule K-1, Box 13, Code AH

- Estates & trusts: Form 1041, Schedule K-1, Box 13, Code N

Unless you are a partnership, S-corporation, estate, or trust, if your only source of this tax credit is from one of those pass-through entities, you do not need to complete IRS Form 8882.

Instead, you can report this tax credit directly as a general business tax credit on IRS Form 3800, Part III, Line 1k.

Estates and trusts

If the estate or trust is subject to passive activity rules, you must include any unused credit for employer-provided child care facilities and services from passive activities that were disallowed in prior years and carried forward to the current tax year. Include this amount on Line 5.

You may need to complete IRS Form 8582-CR, Passive Activity Credit Limitations, to determine the allowed credit that you must allocate between the estate or trust and the beneficiaries.

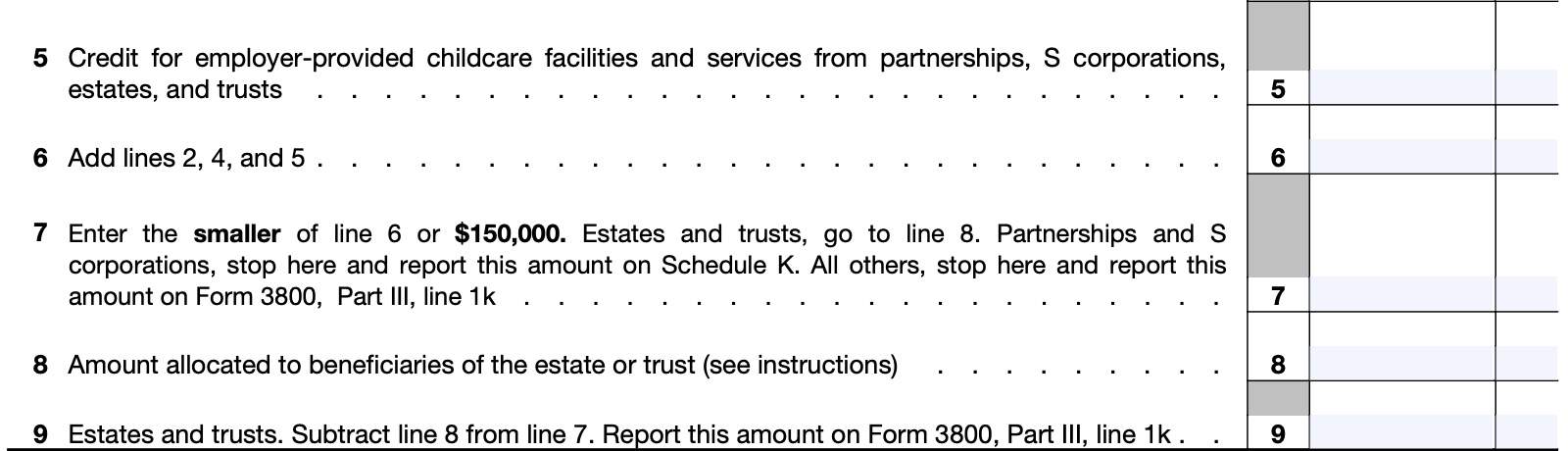

Line 6

Add the following:

Enter the total in Line 6.

Line 7

Enter the smaller of either:

- Line 6

- $150,000

Estates and trusts go to Line 8, below. All other taxpayers stop here.

Partnerships and S corporations will report this amount on Schedule K of their respective business tax return. All other taxpayers will report this amount on IRS Form 3800, Part III, Line 1k.

Line 8: Amount allocated to beneficiaries of the estate or trust

Estates and trusts must allocate the credit for employer provided childcare facilities and services reported on Line 7 between the estate or trust and beneficiaries in the same proportion as income was allocated.

Enter the beneficiaries’ share on Line 8.

Line 9

Subtract Line 8 from Line 7. Report the difference on IRS Form 3800, Part III, Line 1k.

Special considerations

There are some additional items you should be aware of as you go through this tax form.

No Double Benefit Allowed

As a general rule, you cannot take double benefits for the amount of the credit that you calculate on IRS Form 8882. You must reduce:

- The basis of any qualified childcare facility by the amount of the credit on Line 7 allocable to capital expenditures related to the facility,

- Any otherwise allowable deductions used to figure the credit by the amount of the credit on Line 7 allocable to those deductions, and

- Any expenditures used to figure any other credit by the amount of the credit on Line 7 allocable to those expenditures (for purposes of figuring the other credit).

For credits from passthrough entities that you entered on Line 5, only the pass-through entity is required to make this reduction.

Recapture of Credit

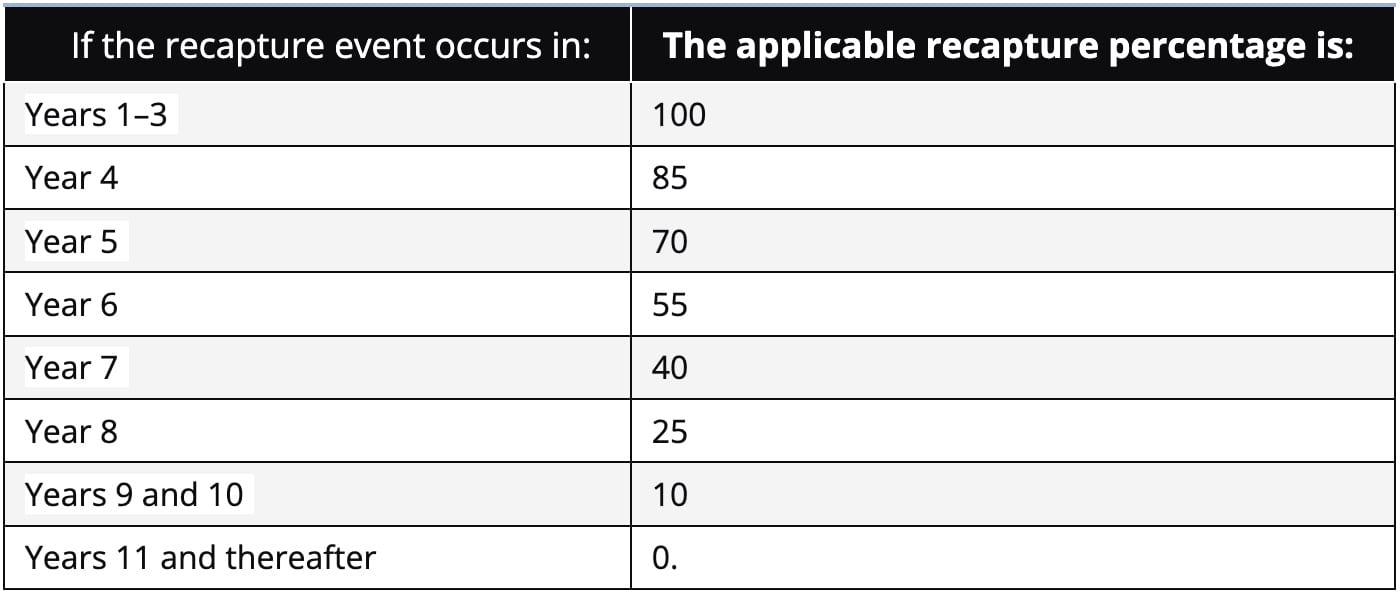

You may have to recapture part or all of the employer-provided childcare credit if one of the following happens before the 10th year after the tax year in which you placed the child care facility into service:

- The child care facility ceases to operate, or

- There is a change in ownership of the facility

However, a change in ownership will not be subject to recapture of the employer-provided child care credit if the new owner agrees, in writing, to assume the recapture liability. The below table indicates the total tax liability for recapture, based on when the recapture event occurs.

Any recapture tax is reported on the line of your tax return where other recapture taxes are reported. If there is no such line exists, enter the recapture on the Total Tax line.

The recapture tax may not be used in figuring the amount of any other tax credit amount or in figuring the alternative minimum tax.

Internal Revenue Code Section 45F(d) contains additional information on the recapture tax.

Video walkthrough

Watch this instructional video on IRS Form 8882 to learn more about claiming tax credits for providing childcare services to your employees.

Frequently asked questions

Taxpayers complete Form 8882 to claim the credit for qualified child care facility expenditures they paid or incurred in the current tax year. Claiming this credit allows employers to provide childcare benefits to employees while lowering their tax bill.

The employer-provided childcare tax credit allows employers to claim a tax credit for 25% of qualified childcare facility expenditures and 10% of qualified childcare resource and referral expenditures paid or incurred in the tax year, up to a total limit of $150,000.

Where can I find IRS Form 8882?

You can find IRS forms such as IRS Form 8882 on the IRS’ official website. For your convenience, we’ve enclosed the latest copy of Form 8882 here, in our article.