IRS Form 8906 Instructions

If you are an eligible wholesaler, or otherwise required to pay excise tax on distilled spirits, you may be eligible for federal income tax credits to help lower your tax liability. Eligible taxpayers may be able to claim the distilled spirits tax credit by filing IRS Form 8906 with their income tax return.

In this article, we’ll walk through what you need to know about IRS Form 8906, including:

- How to complete and file IRS Form 8906

- Taxpayers who are eligible for the distilled spirits credit

- Frequently asked questions about the distilled spirits credit

Let’s start by walking through IRS Form 8906.

Table of contents

How do I complete IRS Form 8906?

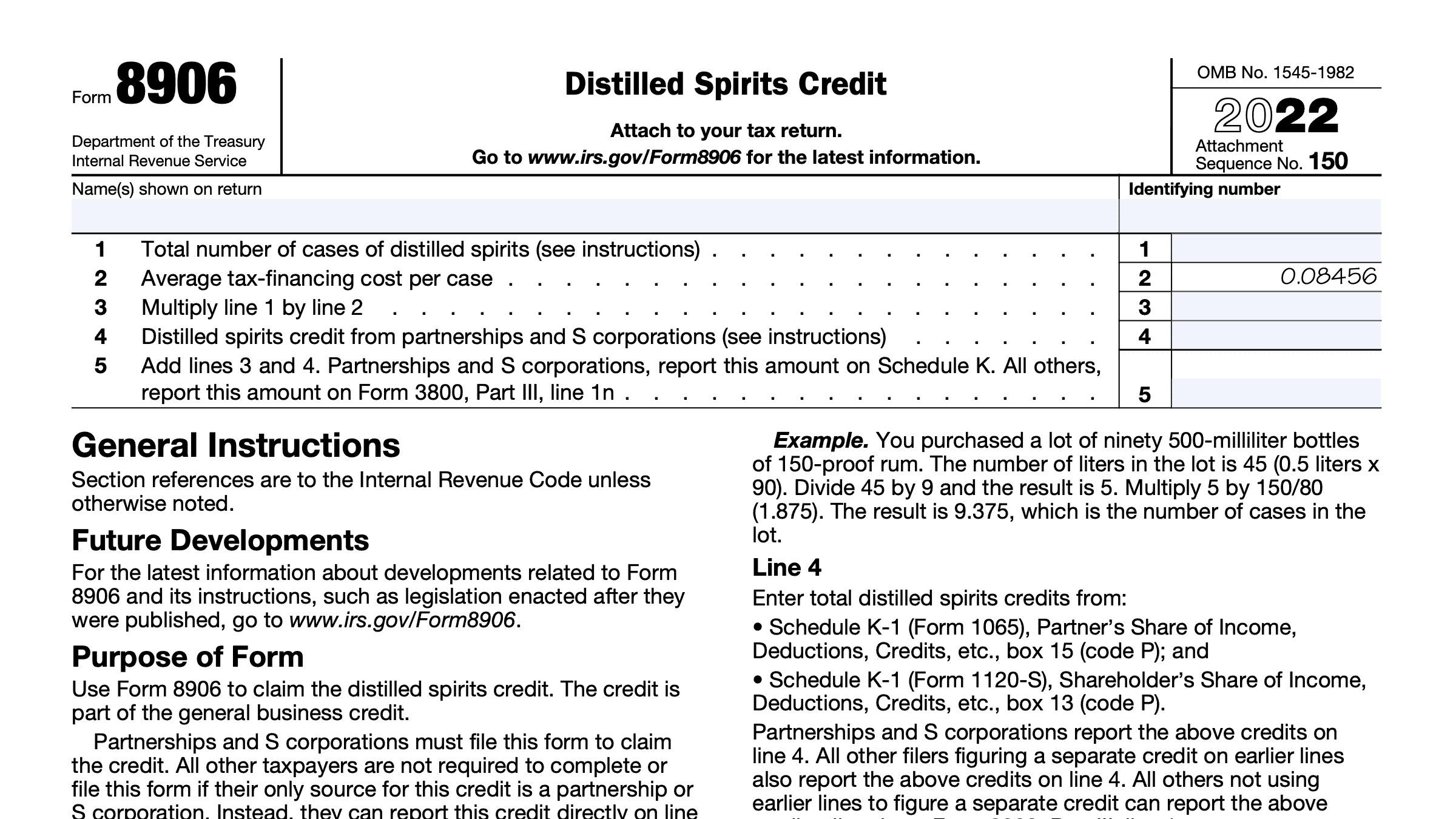

This one-page tax form is relatively straightforward.

But before you start on Line 1, you’ll need to enter the following information as shown on your income tax return:

- Taxpayer name

- Identifying number

Your identifying number can be either a Social Security number or employer identification number.

Once complete, let’s move on to Line 1.

Line 1: Total number of cases of distilled spirits

In Line 1, enter the total number of cases of distilled spirits purchased or stored during the current tax year. According to the form instructions, the number of eligible cases can depend on whether you are an eligible wholesaler.

Eligible wholesalers

According to the Internal Revenue Service, an eligible wholesaler is any person who holds a permit under the Federal Alcohol Administration Act as a wholesaler of distilled spirits and is not a state or political subdivision thereof, or an agency of either.

If you are an eligible wholesaler, enter the number of cases of distilled spirits that were

- Bottled in the United States, and

- Purchased by you during the tax year directly from the bottler

Non-eligible wholesalers subject to IRC Section 5005

For non-eligible wholesalers that are still subject to Internal Revenue Code Section 5005, enter the number of cases of bottled distilled spirits which are:

- Stored in a warehouse operated by, or on behalf of a state, political subdivision, or an agency, and

- For which title has not passed on an unconditional sale basis

Calculating cases

For purposes of calculating the distilled spirits credit, the IRS generally considers a case to be twelve 80-proof 750-milliliter bottles. For any lot of distilled spirits that does not consist of 80-proof 750-milliliter bottles, below is how you can calculate the number of cases.

- Divide the number of liters in the lot by 9.

- Multiply the result by a fraction, the numerator of which is the stated proof of the lot and the denominator of which is 80.

- The result is the number of cases in the lot.

As an example, you purchased a lot of 90 500-milliliter bottles of 150-proof rum.

- The number of liters is 45 (500 milliliters X 90). Divide this number by 9, and the answer is 5.

- Multiply 5 by 150/80 (1.875).

- The answer is 9.375, which equals the number of cases in the lot

Line 2: Average tax-financing cost per case

This is a fixed number as determined by the federal government each year.

The average tax-financing cost per case for any calendar year is the amount of interest which would accrue at the deemed financing rate during a 60-day period on an amount equal to the deemed Federal excise tax per case.

The deemed financing rate is the average of the corporate overpayment rates under paragraph (1) of IRC Section 6621(a) (determined without regard to the last sentence of such paragraph) for calendar quarters of the given year.

According to IRC Section 5011, the deemed federal excise tax per case of distilled spirits is $25.68.

For the 2022 tax year, the average tax-financing cost per case is 0.08456.

Line 3

Multiply Line 1 by Line 2. This represents the amount of the credit you received for distilled spirits. Enter the result here.

Line 4: Distilled spirits credits from partnerships and S corporations

In Line 4, enter the distilled spirits credits you received from partnerships and S corporations. You will find these on the following tax forms:

- Partnerships: Schedule K-1 (Form 1065), Box 15, Code P

- S corporations: Schedule K-1 (Form 1120-S), Box 13, Code P

For a partnership or S corporation, report these credits on Line 4. If you used Lines 1 through 3 to calculate a separate tax credit, also report these credits on Line 4.

If you did not use earlier lines to calculate a federal tax credit, then you can report this credit amount as part of the general business credit directly on IRS Form 3800, Part III, Line 1n.

Line 5

Add Line 3 and Line 4, then enter the total here.

For partnerships and S corporations, report this credit on Schedule K. All other taxpayers may report this amount directly on IRS Form 3800, Part III, Line 1n.

Video walkthrough

Watch this informative video to learn more about claiming the distilled spirits credit on IRS Form 8906.

Frequently asked questions

The distilled spirits credit helps eligible taxpayers offset inventory holding costs after paying excise tax on distilled spirits they have not yet sold. The distilled spirits credit is part of the total general business credits taxpayers can claim on IRS Form 3800.

As it applies to the distilled spirits credit, the average tax-financing cost for any calendar year is the amount of interest which would accrue at the deemed financing rate during a 60-day period on an amount equal to the deemed Federal excise tax per case.

Where can I find IRS Form 8906?

You can find this tax form on the IRS website. For your convenience, we’ve attached this form to this article as a PDF file.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!