IRS Form 4506-C Instructions

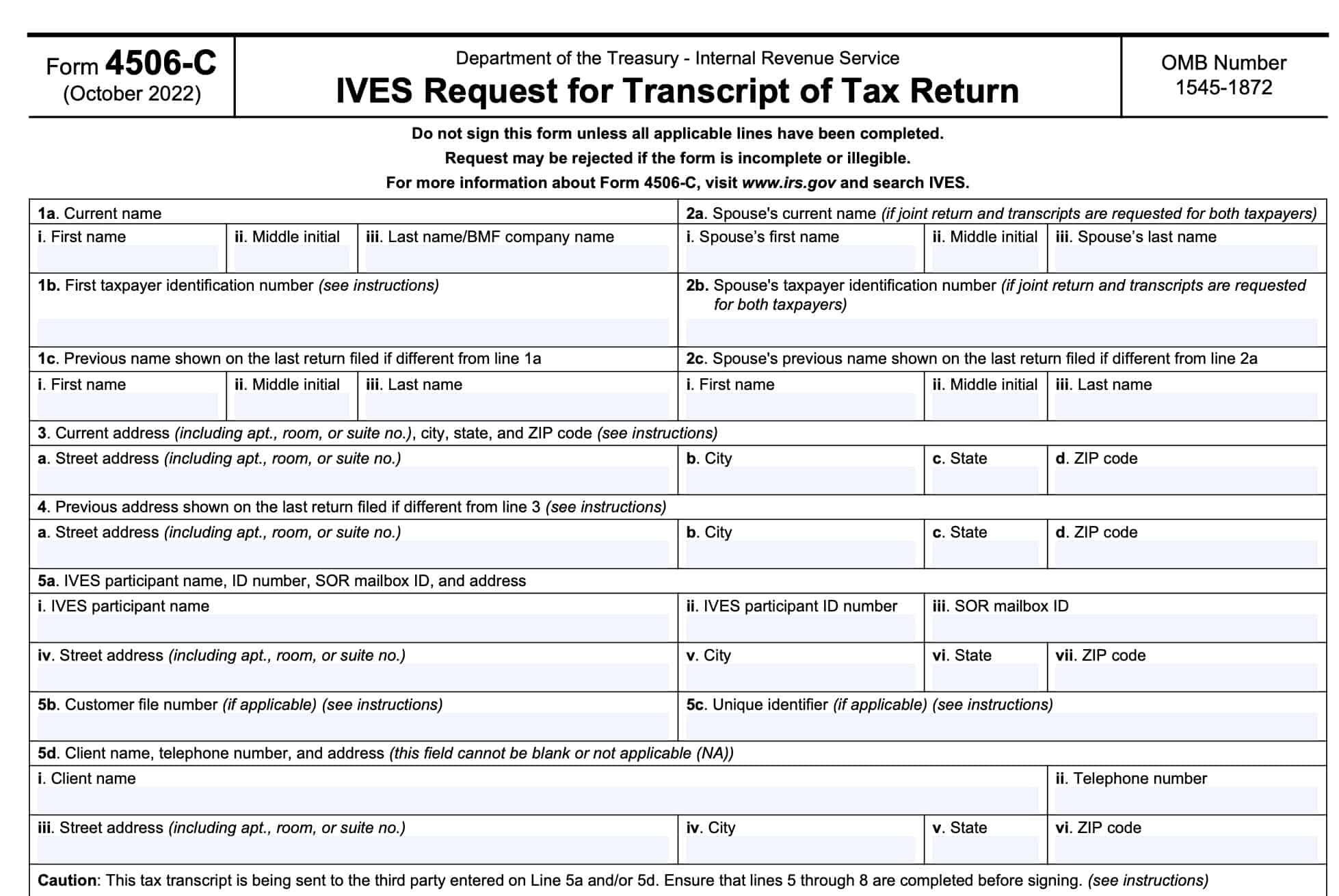

The IRS allows third parties, such as mortgage lenders, to obtain certain taxpayer data through the Income Verification Express Service, also known as IVES. To obtain this information, they must obtain taxpayer permission through IRS Form 4506-C, IVES Request for Transcript of Tax Return.

In this article, we’ll walk through everything you need to know about IRS Form 4506-C, to include:

- How to complete Form 4506-C

- Information about IVES

- Frequently asked questions about how the tax form is used

Let’s start by taking a look at the tax form itself.

Table of contents

How do I complete IRS Form 4506-C?

This one-page tax form is fairly straightforward. Let’s start at the top.

Line 1: Current name

In Line 1a, enter the following:

- First name

- Middle initial

- Last name

For a business, you may need to enter the company’s name as it appears in the IRS’ business master file (BMF).

For Line 1b, enter your taxpayer identification number. This can be any of the ofllowing:

- Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

- Employer identification number (EIN)

Businesses primarily use EIN for identification purposes.

For Line 1c, enter any previous name that you may have used on your tax return, if it is different from the name you entered into Line 1a.

Line 2: Spouse’s current name

If you are requesting a joint tax return or for joint transcript requests, you will need to enter the same information for the spouse listed on the tax reutrn.

In Line 2a, enter the spouse’s current name. For Line 2b, enter the taxpayer identification number, and in Line 2c, enter any previous name the spouse may have used for a previous tax return.

Line 3: Current address

In Line 3, enter the current address, including:

- Street number

- Street name

- City

- State

- Zip code

Line 4: Previous address

If the address on your past tax returns is different from your current address, then enter your previous address.

If you have not already done so, you may need to file one of the following forms with your signed IRS Form 4506-C:

- IRS Form 8822, IRS Change of Address Form

- IRS Form 8822-B, Change of Address or Responsible Party

Line 5: IVES participant name

In Line 5, you will enter the information for the third party that you intend for your IRS tax transcripts to go to.

Starting with Line 5a, enter the following information:

- IVES Participant name

- IVES Participant ID number

- SOR Mailbox number

- Street address, including city, state, and zip code

For Line 5b, you may enter up to 10 numeric characters to create a unique customer file number that will appear on the transcript. However, the customer file number cannot contain an SSN, ITIN or EIN. You do not need to complete Line 5b.

In Line 5c, you may enter up to 10 alpha-numeric characters to create a unique identifier, if required. You do not need to complete Line 5c.

In Line 5d, enter the client company name, address, and phone number. The client company is a company that receives the requested tax return transcripts from the IVES participant.

If the client company is also the IVES participant, then the IVES participant information should be in both Line 5a and Line 5d.

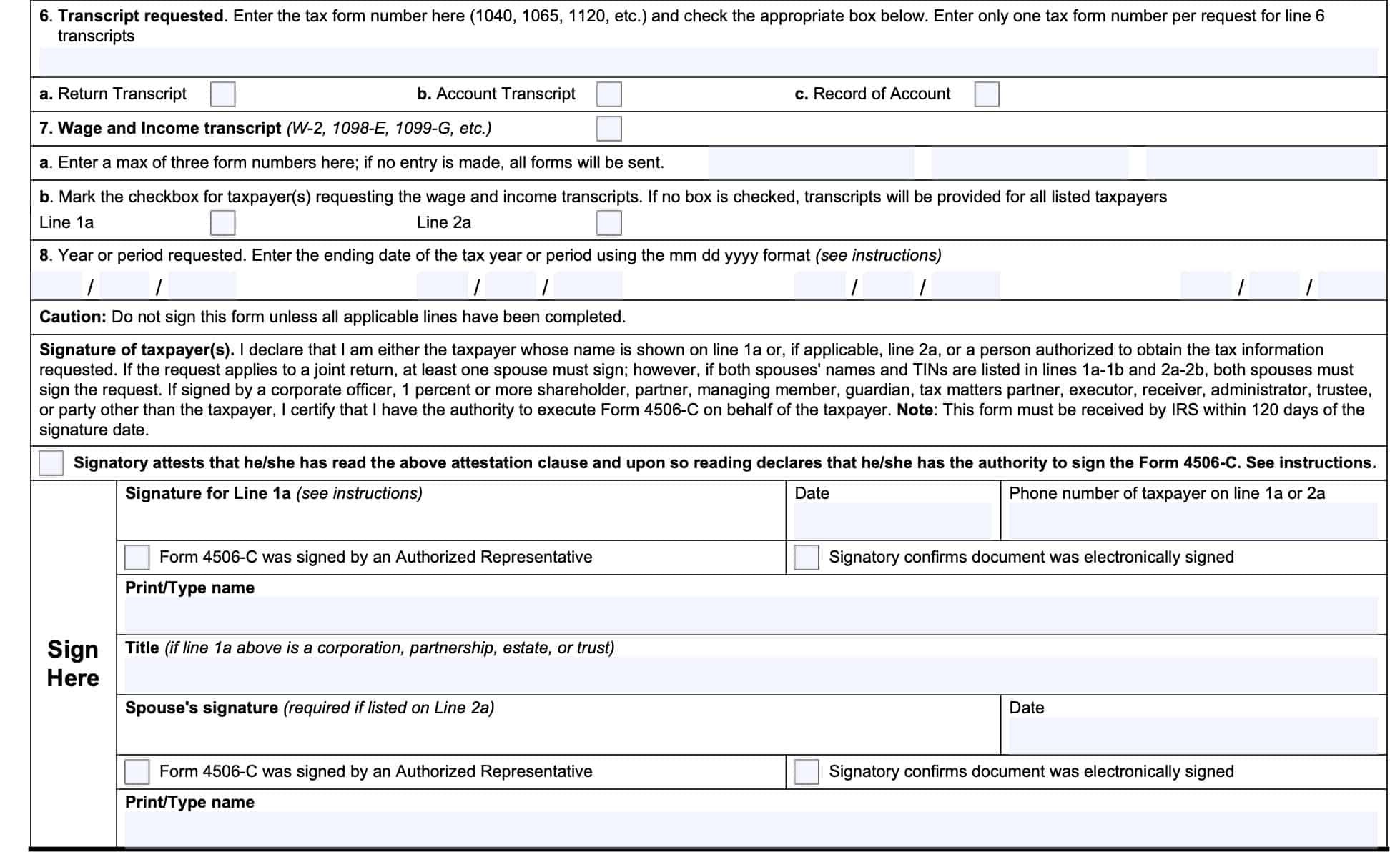

Line 6: Transcript requested

Enter the tax form number for the transcript you are requesting. You may only enter one tax form number for each request. If you require more than one type of tax form, you must submit multiple requests.

Below the form number, select the box that corresponds to one of the following:

Line 6a: Return transcript

A tax return transcript includes most of the lines of an income tax return as filed with the Internal Revenue Service. The tax return transcript does not reflect changes made to the account after the return is processed.

Return transcripts are available for the current tax year and past tax returns processed during the 3 prior tax years. Transcripts are only available for the following tax returns:

- IRS Form 1040 series

- IRS form 1065

- IRS Form 1120

- IRS Form 1120-H

- IRS Form 1120-L

- IRS Form 1120-S

Line 6b: Account transcript

An account transcript contains information on the financial status of the account, such as:

- Payments made on the account

- Penalty assessments, and

- Adjustments made by you or the IRS after you have filed the return

Return information is limited to items such as tax liability and estimated tax payments. Account transcripts are available for most returns.

Line 6c: Record of account

A record of account provides the most detailed information. A record of account is a combination of the return transcript and the account transcript.

Record of account information is available for the current year and 3 prior tax years.

Line 7: Wage and income transcript

In addition to tax return information, the IRS can provide a transcript that includes IRS data from these information returns:

- IRS Form W-2

- IRS Form 1099 series

- IRS Form 1098 series

- IRS Form 5498

You may enter up to 3 types of information returns. If you do not specify a type of form, the IRS will provide all forms.

W-2 information does not include state or local information. This information is available for up to 10 years.

Generally, information for the current year is not available until the year after it is filed with the IRS. For example, Form W-2 information for 2020 is filed in 2021. This form would not be available from the IRS until 2022.

Line 8: Year or period requested

Enter the end date of the tax year or period requested in mm/dd/yyyy format. This may be any of the following:

- Calendar year

- Fiscal year or

- Fiscal quarter

Enter each quarter requested for quarterly returns.

Signature

The signature section is at the bottom of the form. First, you must check the box stating, “Signatory attests that he/she has read the above attestation clause and upon so reading declares that he/she has the authority to sign the Form 4506-C.“

Below that line, sign and date the form, and provide a telephone number. For joint returns, both spouses must sign, if listed on Line 2.

The IRS must receive Form 4506-C within 120 days of the date signed by the taxpayer or the form will be rejected.

In addition, there are two boxes below the signature fields.

- Form 4506-C was signed by an authorized representative

- Signatory confirms document was electronically signed

Form 4506-C was signed by an authorized representative

Check this box if an authorized representative signed Form 4506-C. A representative can sign

Form 4506-C for a taxpayer if:

- The taxpayer has specifically delegated this authority to the representative on IRS Form 2848, and

- If the taxpayer attaches Form 2848 to the Form 4506-C request.

If you are an heir at law, next of kin, or beneficiary, you must be able to establish a material interest in the estate or trust.

Signatory confirms document was electronically signed

Check this box if you electronically signed this form.

Only IVES participants that opt in to the Electronic Signature usage can accept electronic signatures. Contact the IVES participant for approval and guidance for electronic signatures.

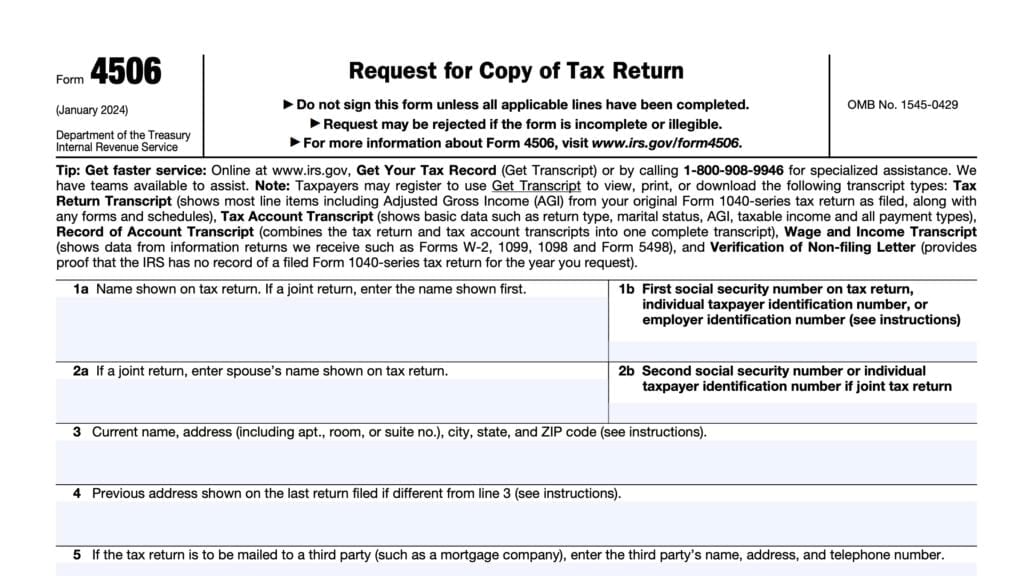

Looking For A Different Version Of Form 4506?

If you stumbled upon this page by accident, don’t feel bad. There are many versions of Form 4506, each with different purposes.

We’ve written articles on literally all of the 4506 tax forms. Instead of hitting the ‘Back’ button, take a quick second to peruse the list below to find the version that you want.

- IRS Form 4506, Request for Copy of Tax Return

- IRS Form 4506-A, Request for a Copy of Exempt or Political Organization IRS Form

- IRS Form 4506-B, Request for a Copy of Exempt Organization IRS Application or Letter

- IRS Form 4506-F, Identity Theft Victims Request for Copy of Fraudulent Tax Return

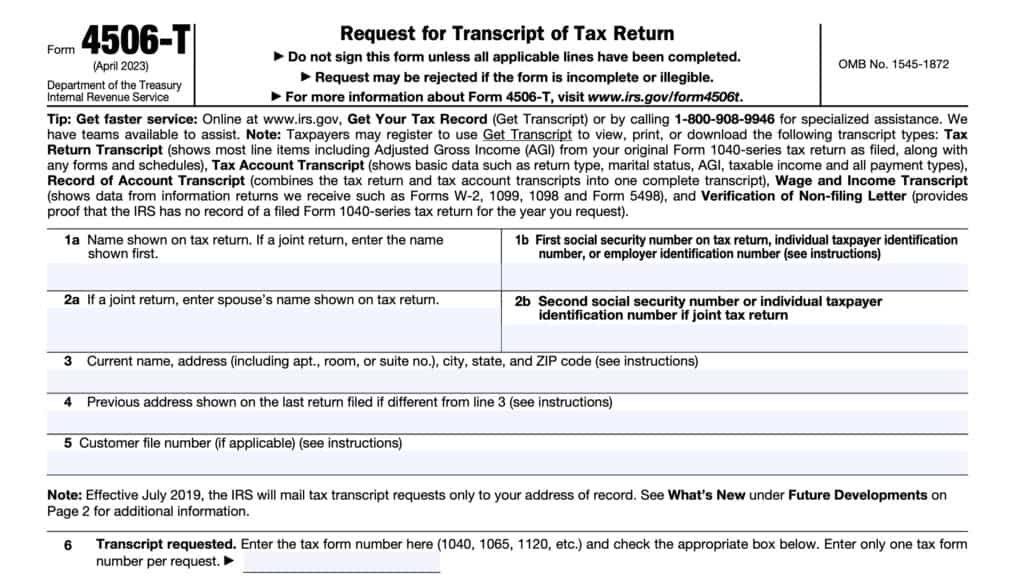

- IRS Form 4506-T, Request for Transcript of Tax Return

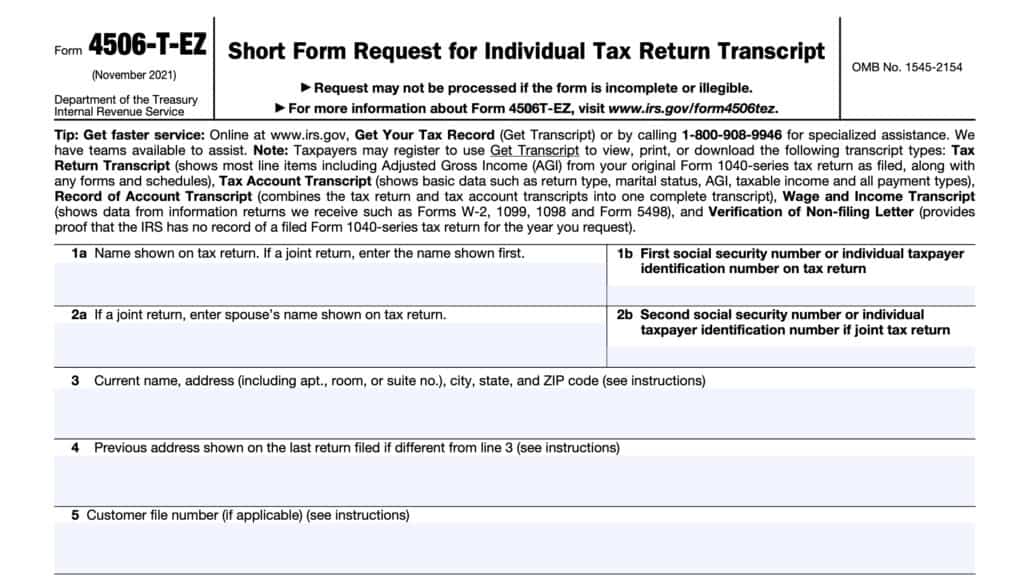

- IRS Form 4506-T-EZ, Short Form Request for Individual Tax Return Transcript

How do I file IRS Form 4506-C?

Generally speaking, the IVES participant will file IRS Form 4506-C to request your tax transcript information on behalf of the client. The IVES participant will send your request to one of the following 3 locations, based upon which IRS Service Center is responsible for their tax processing:

- Austin Submission Processing Center

- Kansas City Submission Processing Center

- Ogden Submission Processing Center

Video walkthrough

Watch this informative video to learn more about completing IRS Form 4506-C to authorize an IVES participant to request your tax transcript.

Frequently asked questions

IVES stands for Income Verification Express Service, and is used by mortgage lenders and other mortgage professionals as an authorized income verification program for lending purposes. Using IVES, IRS provides return transcript, W-2 transcript and 1099 transcript information to a third party with the consent of the taxpayer.

IRS Form 4506-C, IVES Request for Transcript of Tax Return, allows taxpayers to authorize certain third parties, such as mortgage lenders, to obtain specific information for lending purposes while safeguarding sensitive data. IRS Form 4506-C replaced IRS Form 4506-T, Request for Transcript of Tax Return, in 2021.

No. However, Freddie Mac and Fannie Mae do have requirements for mortgage lenders to use IVES for income verification for loans unless another viable service, such as Fannie Mae’s DU Verification Service, is used.

How do I get IRS Form 4506-C?

As with other tax forms, you can obtain the 4506-C Form on the IRS website. For your convenience, we’ve attached a new IRS Form 4506-C to this article.