IRS Form 1099-QA Instructions

In 2014, the federal government passed the Achieving a Better Life Experience Act to allow states to create tax-advantaged account programs in support of a disabled individual. These accounts, known as ABLE accounts, allow for tax-free distributions for eligible expenses incurred on behalf of a qualifying account beneficiary, which are reported on IRS Form 1099-QA.

Each tax year, financial institutions must issue IRS Form 1099-QA, which reports distributions form ABLE accounts for the prior calendar year. In this article, we’ll walk through IRS Form 1099-QA, including:

- How to understand IRS Form 1099-QA

- What you might need to report on your income tax return

- Other frequently asked questions.

Let’s start with a walk through of the tax form itself.

Table of contents

IRS Form 1099-QA instructions

In most of our articles, we walk you through how to complete the tax form. However, since Form-1099 is issued to taxpayers for informational purposes, most readers will probably want to understand the information reported on their 1099-QA form, instead of how to complete it.

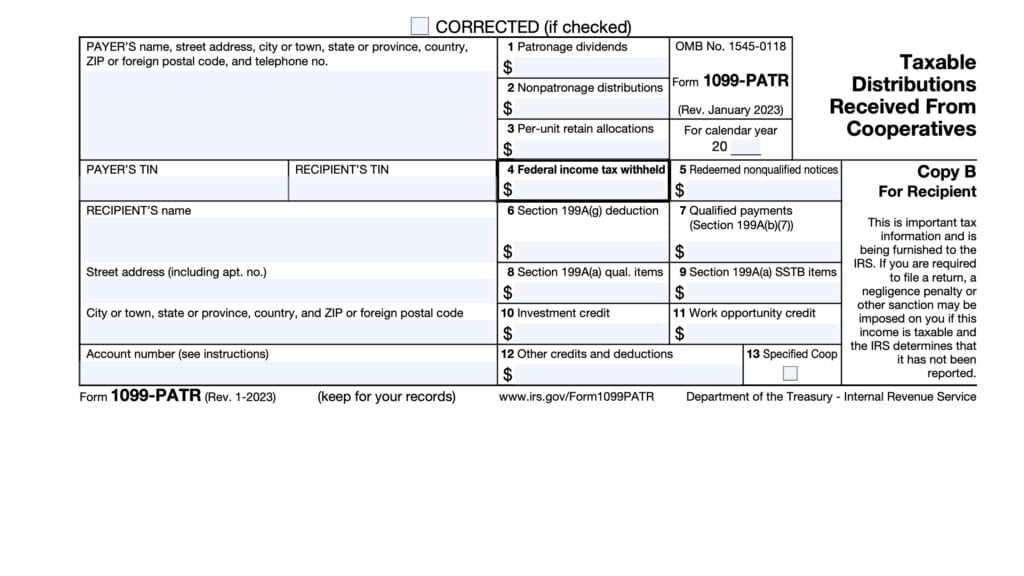

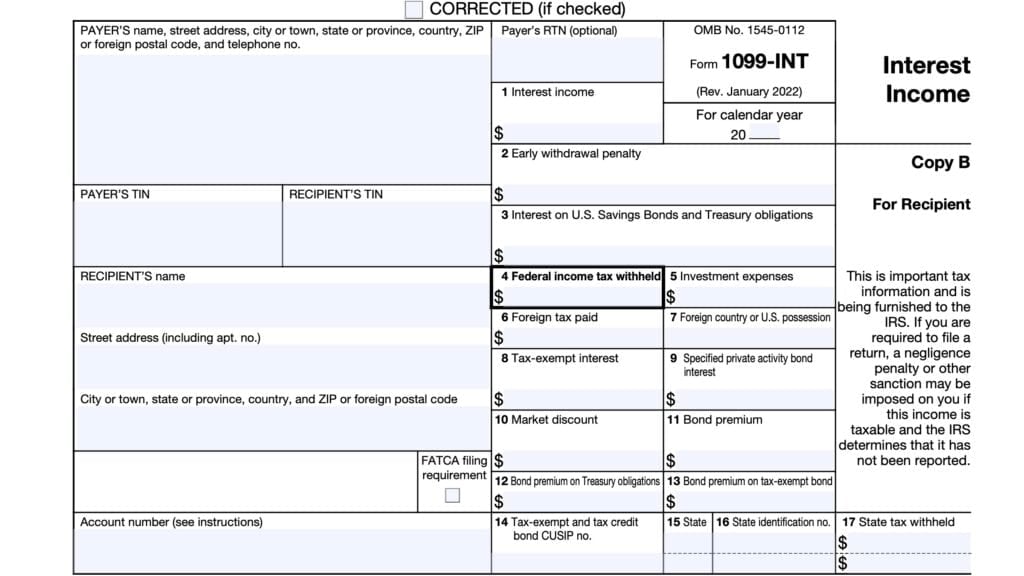

Before we start breaking down this tax form, it’s important to understand that there can be up to 3 copies of Forms 1099-QA. Here is a break down of where all these forms end up:

- Copy A: Internal Revenue Service center

- Copy B: For recipient’s tax records

- Copy C: For the payer

Let’s get into the form itself, starting with the information fields on the left side of the form.

Taxpayer identification fields

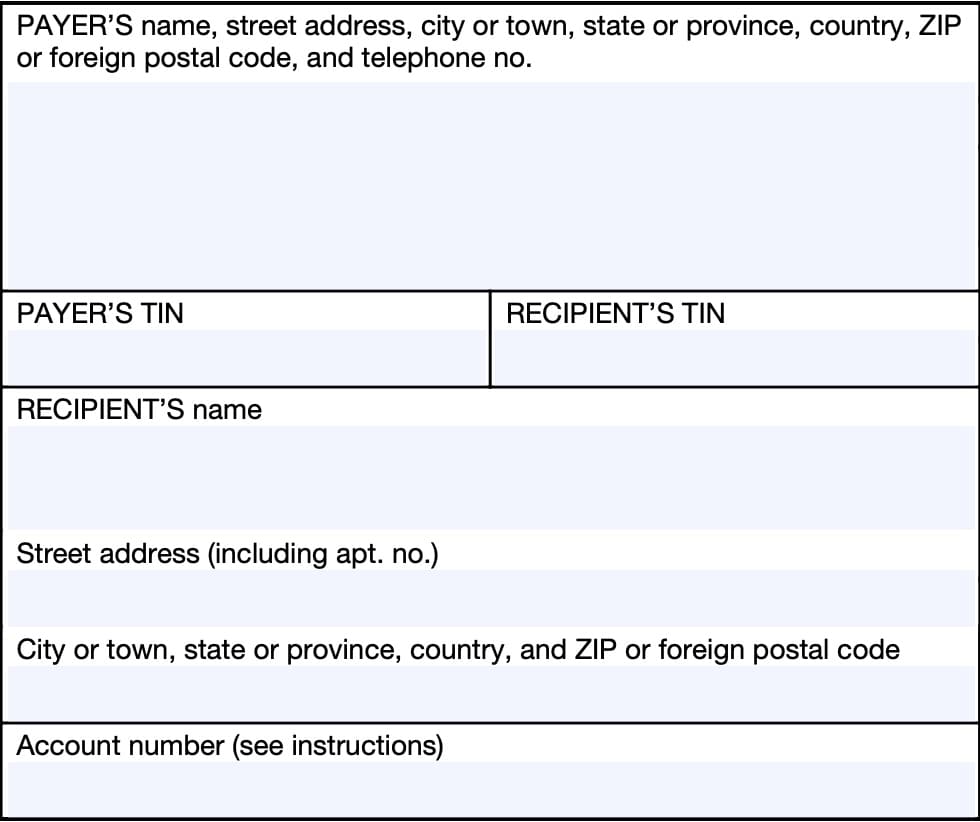

Payer’s Name, Address, And Telephone Number

You should see the payer’s contact information, with complete business name, address, zip code, and telephone number in this field.

Payer’s TIN

This is the payer’s taxpayer identification number (TIN). In most situations, this will be the employer identification number (EIN).

The payer’s TIN should never be truncated.

Recipient’s TIN

In this field, you should see the taxpayer identification number for the designated beneficiary of the account. The TIN can be any of the following:

- Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

- Adoption taxpayer identification number (ATIN)

- Employer identification number (EIN)

Please review this field to make sure that it is correct. However, you may see a truncated form of your TIN (such as the last four digits of your SSN), for privacy protection purposes.

Copy A, which is sent to the Internal Revenue Service, is never truncated.

Recipient’s Name And Address

You should see the name of the designated beneficiary reflected in these fields, as well as the address. If your address is incorrect, you should notify the plan administrator and the IRS.

You can notify the IRS of your new address by filing IRS Form 8822, Change of Address. Business owners can notify the IRS of a change in their business address by filing IRS Form 8822-B, Change of Address or Responsible Party, Business.

Account Number

On the lower left-hand side, you’ll see the account number field. This field is present in many information returns, such as IRS Form 1099-NEC or IRS Form 1099-MISC.

Your payer have established a unique account number for you, which may appear in this field. If the field is blank, you may ignore it.

Let’s turn to the information fields on the right-hand side of your 1099-QA form.

Boxes 1 through 6

On the right hand side of Form 1099-QA, you’ll see the information fields regarding your distributions. Let’s start at the top with Box 1.

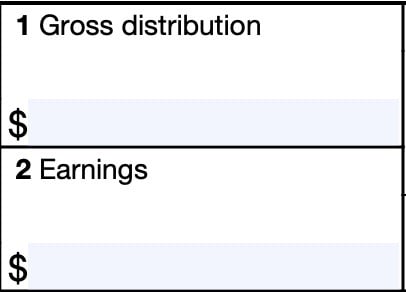

Box 1: Gross distribution

Box 1 shows the gross distribution paid to you from an Achieving a Better Life Experience (ABLE) savings account in the calendar year being reported.

Gross distribution includes the following distributions from the ABLE account:

- Distributions for qualified disability expenses

- Distributions for nonqualified disability expenses

- Amounts that the designated beneficiary intends to roll over to another ABLE account

- Return of excess contributions plus earnings

However, a gross distribution does not include program to program transfers.

Qualified disability expenses

According to IRS Publication 907, Tax Highlights for Persons With Disabilities,

Qualified disability expenses include any expenses incurred at a time when the designated beneficiary is an eligible individual. The qualifying disability expenses must relate to either blindness or disability, including expenses for maintaining or improving health, independence, or quality of life.

Examples of qualified disability expenses include eligible expenses for the following:

- Education

- Housing

- Transportation

- Employment training and support

- Assistive technology

- Personnel support services

- Health, prevention, and wellness

- Financial management

- Administrative services and legal fees

- Oversight and monitoring

- Funeral and burial expenses

Box 2: Earnings

Box 2 shows the earnings portion of the gross distribution shown in Box 1.

In general, distribution amounts are not included in gross income if the distribution is:

- Used to pay for qualified disability expenses, or

- Rolled over to another ABLE account within 60 days

Taxpayers should report taxable amounts as ‘Other income’ when filing IRS Form 1040 or IRS Form 1040-SR. Also, taxpayers reporting taxable distributions may need to calculate additional taxes on IRS Form 5329 when filing their federal income tax return.

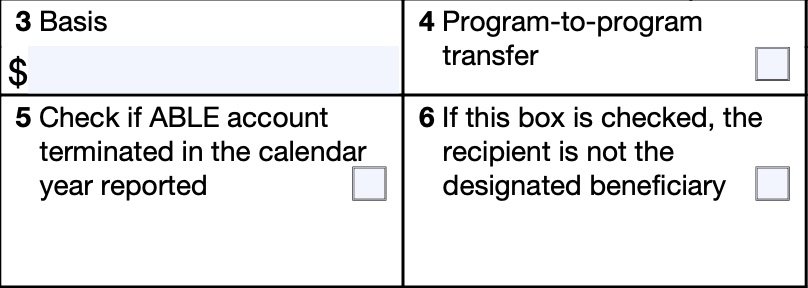

Box 3: Basis

This box shows your basis in the gross distribution reported in Box 1.

According to the form instructions, your financial institution must enter the portion of the distribution that constitutes the return of investment in the account. This amounts to the amount of the gross distribution minus the earnings portion of the distribution.

In other words, Box 3 equals Box 1 minus Box 2. This is the amount that might be subject to tax, if any portion of your distribution is taxable.

Box 4: Program-to-program transfer

Your account custodian will check this box if they made a program-to-program transfer from this ABLE account directly to another ABLE account.

Box 5

If you terminated the ABLE account prior to the close of the tax year, the payer will check Box 5.

Box 6

If Box 6 is checked, this indicates that the recipient was not the designated beneficiary on the ABLE account.

Designated beneficary

The designated beneficiary is the individual named in the document creating the ABLE account to receive the benefit of the funds in the account.

If this box is checked, you are not the designated beneficiary of this ABLE account. You and/or the designated beneficiary may be subject to additional taxes and/or penalties on the Box 1 gross distribution.

Calculating taxable distributions

According to IRS Publication 907, distributions are not taxable if they do not exceed the amount of qualifying expenses incurred during the tax year. However, if they do exceed the amount of qualifying expenses, then you must calculate the taxable distribution amount.

To do this, you would divide the total distributions for qualifying expenses by the total distributions reported in Box 1. Multiply this number by the total earnings reported in Box 2. This amount is your nontaxable portion of the distribution.

From there, you would subtract the nontaxable distribution from the total earnings to determine the taxable distribution. This is the amount that you would report on your Form 1040.

Taxable distribution calculation Example

For example, on August 2, 2023, the taxpayer’s ABLE account has a balance of $2,400. $2,000 is from contributions and $400 is earnings.

During 2023, the taxpayer has qualified disability expenses of $1,600, but they receive

distributions from their ABLE account totaling $2,400 on August 2, 2023. This means that 2/3 of the distribution earnings are nontaxable, but that 1/3 of the distribution earnings are taxable.

- $400 times 2/3 equals $266.67. This represents the nontaxable earnings

- $400 times 1/3 equals $133.33. This represents the taxable earnings

The tax on any distribution included in your taxable income is increased by 10%. You would figure this tax on Form 5329, Part II, and file it even if you’re not otherwise required to file a federal income tax return.

Filing IRS Form 1099-QA

For tax entities who must file this tax form with the Internal Revenue Service, the IRS requires certain paper versions of information returns to be accompanied by IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

Check out our step-by step instructional guide for more information on how to submit your information return with IRS Form 1096.

Filing IRS Form 1099-QA

For tax entities who must file this tax form with the Internal Revenue Service, the IRS requires certain paper versions of information returns to be accompanied by IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

Check out our step-by step instructional guide for more information on how to submit your information return with IRS Form 1096.

Video walkthrough

Learn more about what to do with IRS Form 1099-QA in this instructional video!

Frequently asked questions

For plan administrators, the due date to issue Form 1099-QA to account holders is January 31 of the following year for distributions that took place in the given tax year. If you have not received your form by early February, you should contact the IRS for assistance.

IRS Form 1099-QA reports distributions from a qualified ABLE program account, while Form 5498-QA reports contributions to an ABLE account. This includes transfers from a qualified tuition program or 529 plan, but not a Coverdell ESA account.

Where can I find IRS Form 1099-QA?

You can find IRS forms such as Form 1099-QA on the IRS website. For your convenience, we’ve enclosed the latest version of this tax form in this article.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!