What is MAGI, and How Does it Affect IRMAA?

If you’re reading this article, you might be wondering about your IRMAA surcharge and how to reduce or eliminate it. IRMAA is an extra charge Medicare beneficiaries must pay, on top of their standard monthly premium.

IRMAA is determined by your modified adjusted gross income (MAGI), which we will explore in this article.

This article will cover:

- How IRMAA is determined

- IRMAA Brackets

- Why you might want to know about IRMAA well before you start Medicare coverage

- Why the timing of your IRMAA determination is important

- What you can do about your IRMAA in the current year

- What you might be able do to keep your IRMAA lower in the future

Contents

How is IRMAA determined?

IRMAA, otherwise known as income-related monthly adjustment amount, is determined by the Social Security Administration (SSA). The SSA does this by obtaining information from your income tax returns.

From there, the SSA calculates a modified version of your adjusted gross income (AGI). This is known as modified adjusted gross income (MAGI).

What is MAGI?

MAGI is known as modified adjusted gross income. This number is often used by the Internal Revenue Service to determine various income based thresholds and phaseouts.

MAGI calculations may be different depending on the circumstances. For example, the MAGI used to determine whether a taxpayer can contribute to a Roth IRA is different from the MAGI used for IRMAA purposes.

For IRMAA determination purposes, MAGI is used to determine how much (if any) surcharge will be applied to your Medicare premiums.

There are two numbers used to determine MAGI for IRMAA calculations. Those numbers are obtained from your IRS Form 1040:

- Line 2a: Tax-exempt interest income

- Line 7: Adjusted gross income (AGI)

If your income is above a certain income threshold, then IRMAA applies. In other words, IRMAA is a Medicare surcharge based solely upon your income.

As we’ll discuss below, the IRMAA premium surcharge applies to both Medicare Part B plans as well as Medicare Part D. But first, we need to understand the impact of timing on your IRMAA amounts.

Which tax return impacts this year’s IRMAA?

Generally speaking, IRMAA calculations are performed using IRS tax return data from two years prior to the current year. For example, 2022 IRMAA calculations were performed by using IRS tax returns from the 2020 tax year.

The reason for this is pretty straightforward:

- Many people received their 2022 IRMAA determination notices in fall of 2021.

- 2021 tax information isn’t available until tax returns are filed with the Internal Revenue Service. This cannot happen until the 2022 tax season.

- The most recent reliable information is probably going to be from the 2020 tax returns.

Similarly, the 2023 IRMAA determinations will be based upon 2021 tax returns.

If SSA determines that you must pay IRMAA, then you can expect to see these charges to Medicare Part B and Part D premiums. If you receive Social Security benefits , you would see the IRMAA surcharges as an additional deduction to your normal Medicare premiums.

Let’s look at the IRMAA surcharge brackets.

IRMAA Surcharge Brackets

If you’re in the lower tax brackets, you might not even have to worry about IRMAA surcharges. To make this easier for you, we’ve broken this down in the table below.

If your MAGI is below these numbers, then you don’t have to worry about IRMAA in the current year, and you can skip ahead to learn about avoiding IRMAA in future tax years.

| Taxpayer filing status | MAGI |

| Single | $97,000 |

| Married couple filing separately | $97,000 |

| Married couple filing jointly | $194,000 |

If your MAGI was below these thresholds in 2021, you do not pay IRMAA in 2023.

IRMAA tiers

As we’ve discussed, IRMAA applies to both Medicare Part B and Part D. If you have to pay IRMAA, you’ll fall into one of 5 IRMAA tiers.

IRMAA tiers are based upon income and tax filing status. So high-income retirees will pay a higher IRMAA surcharge than those who are barely above the threshold. And a married couple will probably be in a lower IRMAA tier than a single taxpayer with the same income.

IRMAA surcharges are also broken down into Medicare Part B surcharge as well as Medicare Part D surcharge. Although the Part B and Part D surcharges appear in separate tables, a taxpayer in one IRMAA income tier for Part B will be in the same IRMAA tier for Part D.

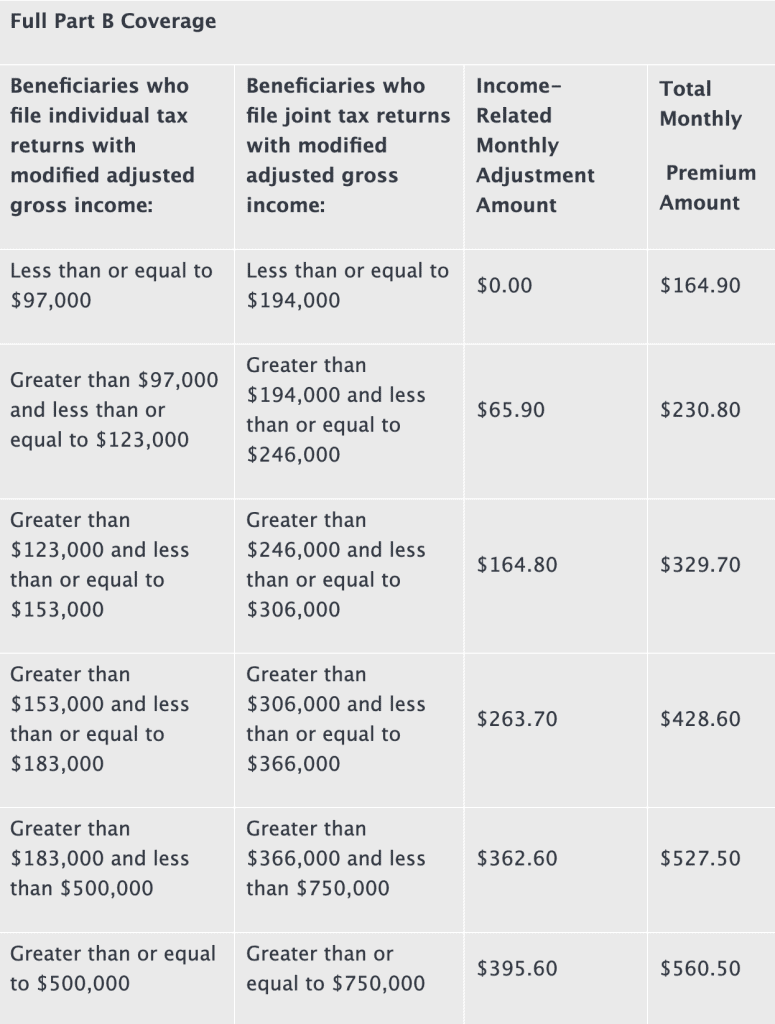

Below is the IRMAA tier breakdown for Medicare Part B in 2023 for single filers and married couples filing a joint return.

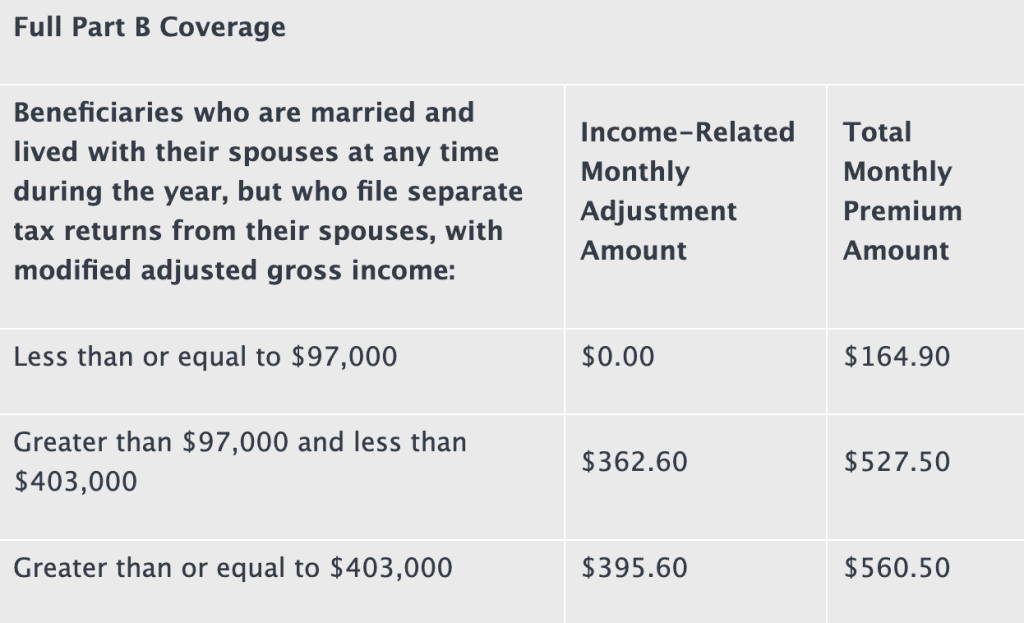

Below is the table for married couples filing a separate tax return.

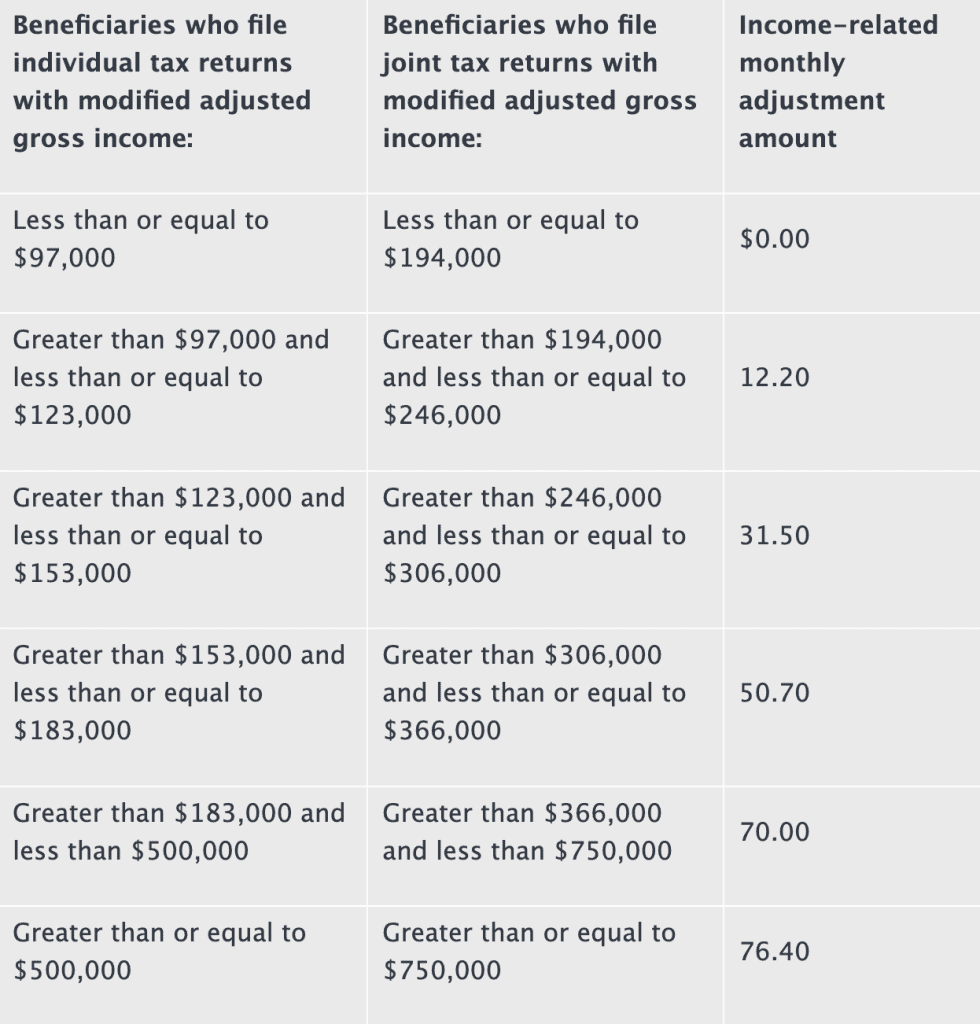

Similarly, below is the breakdown for Part D prescription drug coverage premiums.

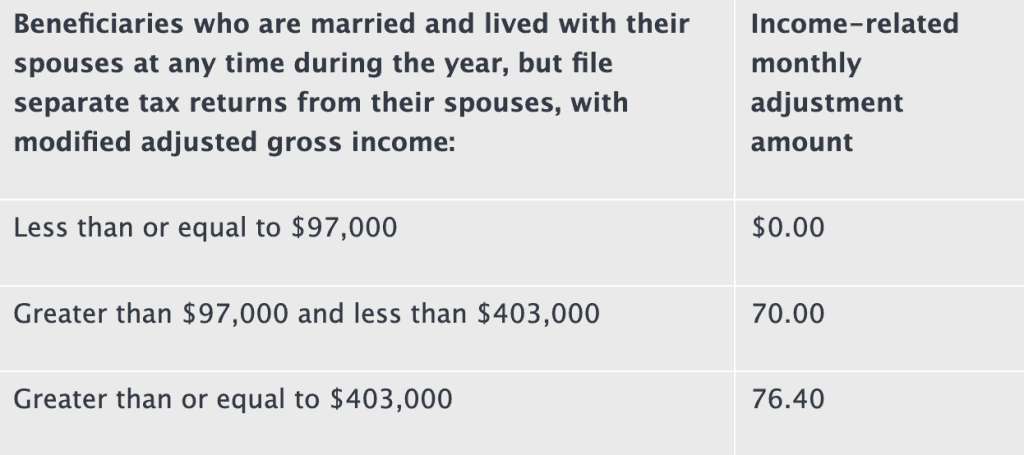

And Part D premiums for married couples filing separate tax returns.

Why is my income going up?

There is exactly one reason taxpayers find themselves paying IRMAA. They are Medicare beneficiaries whose income is too high. Here are some of the reasons Medicare beneficiaries might pay more in IRMAA than they expected.

The power of compound interest

It’s said that compound interest is the eighth wonder of the world. A magical thing happens to people who save a little at a time, stay employed, and work for 30-40 years.

All of that saving, combined with average market-rate investment returns, causes your wealth to explode.

If this growth happens in your Roth IRA accounts, or if you’ve been doing Roth conversions for a while, most of this might be tax-free growth. Great!

But if you’ve been doing this savings in a tax-deferred or a taxable account, this will impact your taxable income when you start withdrawing the money.

More income than expected

This happens to a lot of people who have significant amounts of tax-deferred savings in their retirement plans. Especially after a taxpayer files for Social Security benefits AND starts receiving required minimum distributions (RMDs) from their IRA accounts.

But many people also have things like deferred compensation, stock options, or other executive compensation. All of these things eventually become taxable income.

Social Security is the big surprise. Even though Social Security isn’t completely taxed, you would be surprised at how much of an impact it has on your income. If you wait until age 70 (which makes sense for most people), the income is even higher, which means even more taxable income.

Also, interest income plays a major role. As older investors put more of their money into fixed income instruments, municipal bonds become appealing. However, the MAGI calculations include tax-free interest income, specifically from municipal bonds.

Once your income goes up, it might stay up

As your taxable income goes up, it could possibly stay up. Other than inherited accounts, most investment accounts go up over time. In many cases, compound interest increases portfolio size beyond many people’s ability to spend.

Much of the time, this will cause taxable income will go up. This is true even with tax-efficient investment management.

For example, RMDs are calculated by using a table that forces a higher percentage of IRA balances to be distributed each year. Pensions and Social Security payments usually have cost-of-living adjustments (COLA) each year.

Even if your deferred comp and other executive benefits are paid out, they will likely generate additional future income.

Life changes

Aside from income, life changes can cause IRMAA calculations to go against a taxpayer.

Inheritances can cause income to go up, particularly when it comes to inherited IRAs. Changes in marital status, one-time settlements from an employer upon retirement, or simply retirement are all examples of life changes.

Fortunately, there might be some relief from IRMAA, if you’ve experienced certain life changing events.

For example, retirement is one of the qualifying life-changing events.

Retirement

Many Medicare beneficiaries do the following:

- Retire at or after age 65

- Immediately go onto Medicare

- Get assessed IRMAA surcharges based upon income they earned when they were working.

A lot of these people don’t realize that they might be able to reduce or avoid IRMAA under these circumstances. This could also apply if you reduced your work hours (like going from full time to part time employment).

There are 7 different situations that the SSA considers to be life-changing events. Work stoppage (like retirement) and work reduction (like going to a part-time job) are two of those situations.

If you expect that your income will go down because of this event, then you may be able to have the SSA recalculate your IRMAA based upon your new expected MAGI. This is known as a new initial determination.

But there may be ways to manage your taxable income so you don’t have to worry about IRMAA.

How to manage taxable income

Fortunately, there are some things you might be able to do about managing your taxable income.

If you’re in your working years, you’ve probably got more time than someone who is about to file for Medicare benefits. Even after you’ve filed, there still might be options based upon your financial situation.

Before retirement

Prudent tax planning will always be beneficial in mitigating the impacts of IRMAA. If you’re working with a financial advisor, you should always include tax planning as part of your financial planning.

But tax planning isn’t just about tax deductions and lowering your taxes in the current tax year. Proper tax planning involves looking at your lifelong tax liability.

Your financial advisor might suggest long term strategies, like:

- Maximizing your Roth IRA contributions while working

- Making nondeductible traditional IRA contributions if your income is too high to contribute to a Roth account

- Roth conversions after you’ve retired, but before filing for Medicare

- Harvesting capital gains in lower income tax years

Many of these strategies can be applied after you’ve retired, but before you’ve filed for Medicare benefits. In fact, these early retirement years might be your best opportunity to maximize your Roth conversions.

Before filing for Medicare benefits

If you’ve retired, but aren’t old enough to qualify for Medicare, you might have some opportunities to manage taxable income. But it’s difficult. Here are some reasons.

Participation in the health care exchange

Many people who go to the health insurance marketplace might try to qualify for income-based subsidies under the Affordable Care Act. But it might be worth comparing the benefits of reduced health care costs with a possibly higher impact of IRMAA surcharges down the road.

Generating cash flow

Depending on your financial situation, you may need to generate replacement cash flow to subsidize living expenses. How you do this, and the tax impact of doing so, will dictate how much flexibility you have in keeping your long-term tax bill as low as possible.

Short-term vs. long-term tax impact

Roth conversions might be beneficial in the long term, but raise your taxable income in the short term. Same with harvesting capital gains.

These are all reasons that you should work with a financial planner that focuses on tax planning. The right advisor can also help you mitigate your health care costs after filing for Medicare.

After filing for Medicare benefits

At this point, you might not have as much flexibility in keeping your taxes down as you did before. But there are some things you can do.

File for Medicare on time.

Filing for Medicare benefits within the enrollment window is the single biggest thing that you can do to minimize the lifetime cost of Medicare. The penalty for delayed enrollment is completely avoidable.

Qualified charitable distributions

If you’re charitably inclined, you may consider charitable donations from your IRA once you reach age 70 ½.

These are known as qualified charitable distributions (QCDs). For people who were already giving to charity, this is the most tax-efficient way to do so.

And when you start having to take required distributions, QCDs count towards the total amount of that year’s RMD. For example, if you have a $30,000 required minimum distribution, and donate $10,000 as a QCD, you only need to receive a $20,000 taxable distribution that year.

You can do QCDs for up to $100,000 per taxpayer, per year.

How a life-changing event works

Let’s imagine you just retired from your job and applied for Medicare. A couple years later, you get assessed IRMAA surcharges based on the income from when you were working.

If that’s the case, then you might be able to lower (or eliminate) your IRMAA because of what’s called a life-changing event.

For example, let’s imagine you and your spouse had MAGI of $400,000 in 2020, but then retired in 2021. You probably would have received an IRMAA determination letter for 2022.

Let’s say that after retirement, your income goes down to $80,000 per year. However, the SSA calculated your IRMAA based upon your working income.

Because of this, you can send them updated information to reflect that your income is now expected to be $80,000 per year. This is done by using what’s called an SSA-44 ‘Medicare Income-Related Monthly Adjustment Amount – Life Changing Event Form.’

From there, you can request that SSA recalculate your IRMAA based on your current financial situation.

If that new calculation ends up with your MAGI being below the IRMAA threshold, then SSA will simply remove the IRMAA surcharges (Part B and Part D) from your Social Security withholdings.

SSA will also go back to the beginning of the year to credit any IRMAA surcharges that you’ve already paid. In other words, when IRMAA is adjusted, it is retroactive for the entire calendar year.

Even if your IRMAA isn’t completely removed, but simply lowered, you can expect SSA to make the appropriate adjustments.

Conclusion

Medicare can be complicated. Having to pay IRMAA on top of your Medicare premiums can be frustrating. However, you don’t always have to pay IRMAA simply because you received a letter from the Social Security Administration.

By doing proper tax planning and knowing how to navigate the process, you can often find ways to lower or eliminate your IRMAA surcharges.