Per Stirpes Vs Per Capita Beneficiary Designations

Beneficiary designations are an important part of estate planning. Even if you have your basic documents, like a last will and testament, at the time of your death, beneficiary designations will determine where most of your financial assets go.

So knowing the difference between per stirpes and per capita asset distributions is important to help ensure your money ends up where you want it to go.

Contents

Why are beneficiary designations so important?

The answer is simple. Once you pass away, your beneficiary designations override anything that’s stated in your estate planning documents.

This holds true for virtually any financial account. This includes:

- Banking accounts

- Life insurance policies

- Investment accounts

- Retirement accounts

But while it’s important to designate beneficiaries in the first place, that might not be enough. If you have contingent beneficiaries (such as grandchildren or nieces and nephews), there’s a distinction you should be aware of: per stirpes versus per capita designation.

This article won’t suggest either course of action. The right decision is the one that truly reflects your intent. And it should complement the rest of your estate plan).

However, this article aims to help illuminate the difference between how per stirpes works and per capita works. That way, that you can make a fully informed decision when updating your beneficiary designations.

Does everyone have to worry about beneficiary designations?

Not everyone. Let’s make that very clear. If you only have one heir (other than your spouse), then it might not matter.

It also doesn’t matter if you plan to give your fortune to charity. Or if you simply don’t care where the money goes. As a financial planner, I was surprised at how many times clients said this to me.

But most people have multiple children. And grandchildren. And a lot of people have special needs situations.

In short, if you expect to name a contingent beneficiary, you definitely should know the difference between per stirpes vs per capita distribution rules.

It’s also important to note that this distinction only really plays out if a primary beneficiary pre-deceases the account holder. If all of the primary beneficiaries are alive when the account holder passes, then the account is simply distributed as outlined on file.

With that in mind, let’s look at each designation.

Per Stirpes Beneficiary Designation (Latin phrase for ‘by branch’)

Per stirpes means that if the original beneficiary passes before the account holder, then any assets that would have gone to that person are distributed to that person’s direct descendants instead.

Pointing out the Latin derivative (by branch) might make this easier to remember. A per stirpes distribution plan keeps it within the branch of the family for future generations.

In other words, per stirpes distribution passes the money onto the descendants of a beneficiary if that beneficiary predeceases the account holder. This might be something to consider if you want your grandchildren to eventually end up with that money.

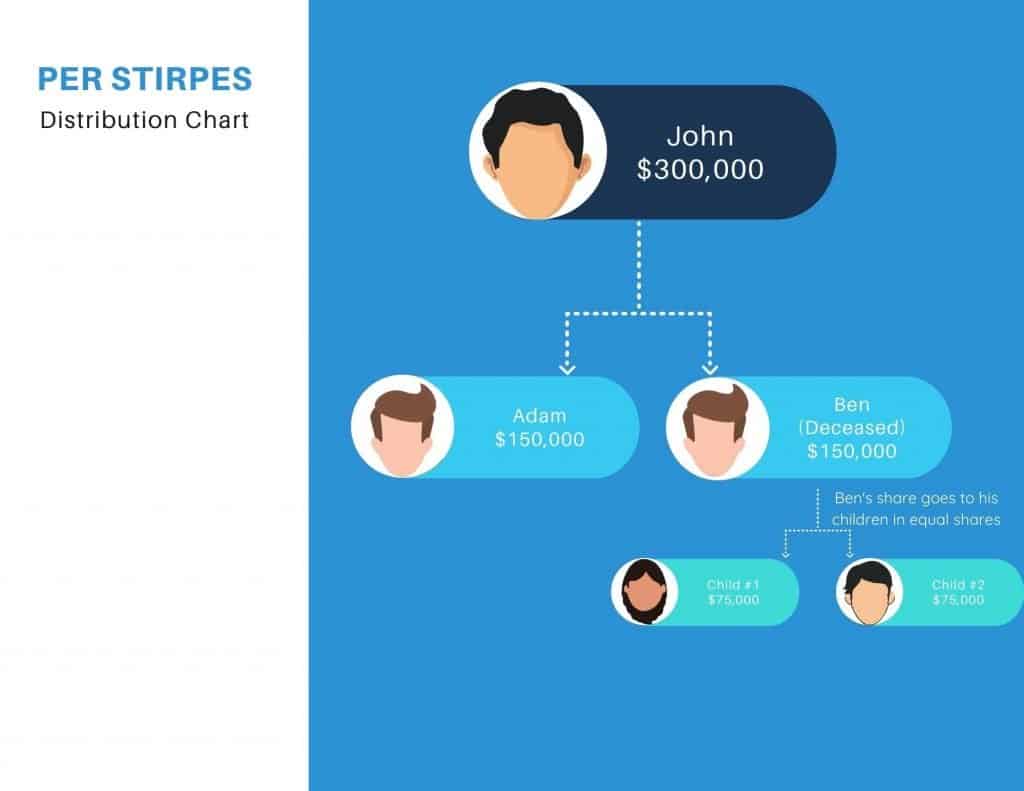

Per Stirpes Distribution Example

For example, John Smith has an IRA worth $300,000. He has two sons, Adam and Ben.

John dies, leaving the IRA to his sons. Each adult son is entitled to $150,000—these are equal shares under either per stirpes or per capita distribution.

Per stirpes distribution gives money to Ben’s children if Ben predeceases John.

Let’s now assume that Ben pre-deceases John, but Adam does not. Under per stirpes distribution, Adam would still receive his $150,000 share. Ben’s half share of the estate would now be divided in equal parts amongst his two children: $75,000 each.

Generally speaking, spouses are not considered when it comes to ‘per stirpes’ distribution.

For example, if Ben predeceased John, then under ‘per stirpes’ distribution, Ben’s share would go to his children (or a trust established for the benefit of his children), not his spouse.

Per Capita Beneficiary Designation (Latin term for ‘by the heads’)

Per capita means that if a named beneficiary predeceases the account holder, then that beneficiary’s share is simply distributed amongst the same class of beneficiaries.

Remembering the Latin word might help here as well—distributing the money to the ‘remaining heads’ of the family. If a beneficiary dies, per capita distribution leaves that person’s children in the cold.

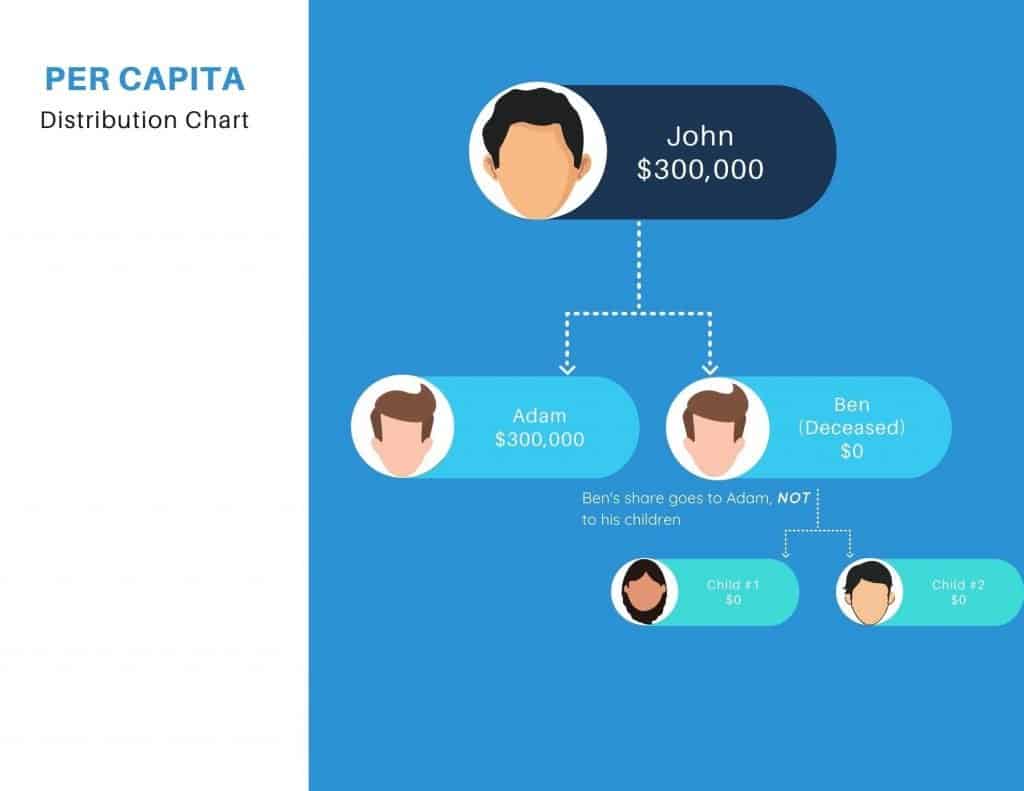

Per Capita Distribution Example

In this scenario, if Ben were to pre-decease John, then Adam would receive the entire IRA distribution, while Ben’s children would receive nothing.

This might be something for grandparents to consider who do not want their grandchildren receiving the money directly. Or if they’re concerned about generation-skipping transfer tax.

What happens if I don’t make a selection?

That’s a good question. It depends on what the situation is.

However, if you do not select per stirpes or per capita designation, most financial institutions, like Schwab or Fidelity, default to ‘per capita.’ In other words, all assets within the primary class of beneficiary designation.

On Fidelity’s paperwork, you have to actually select a box marked ‘Per Stirpes.’ Otherwise, it’s treated as per capita.

And as a general rule of thumb, contingent beneficiaries do not get anything unless all of the primary beneficiaries predecease the account holder.

Conclusion

The advice in this article stops here. There are plenty of different scenarios that could play themselves out in different ways. Those complicated estate issues are well beyond the scope of any article.

That is why it is a good idea to periodically take a closer look at your estate planning with an experienced estate attorney. And you should regularly review your beneficiary designations with your financial advisor as part of your estate planning reviews.

At the very least, you should review this each time someone passes away, someone is born, or if there is another significant life change (such as a marriage or divorce).