Form SSA-1-BK Instructions

If you’re filing a claim for Social Security retirement benefits, you can do so by filing Form SSA-1-BK, Application for Retirement Insurance Benefits. In this article, we’ll walk you through everything you need to know about Form SSA-1-BK, including:

- How to complete and file Form SSA-1-BK

- Filing considerations

- Frequently asked questions

Let’s begin with a step by step overview of this application form.

Table of contents

How do I complete Form SSA-1-BK?

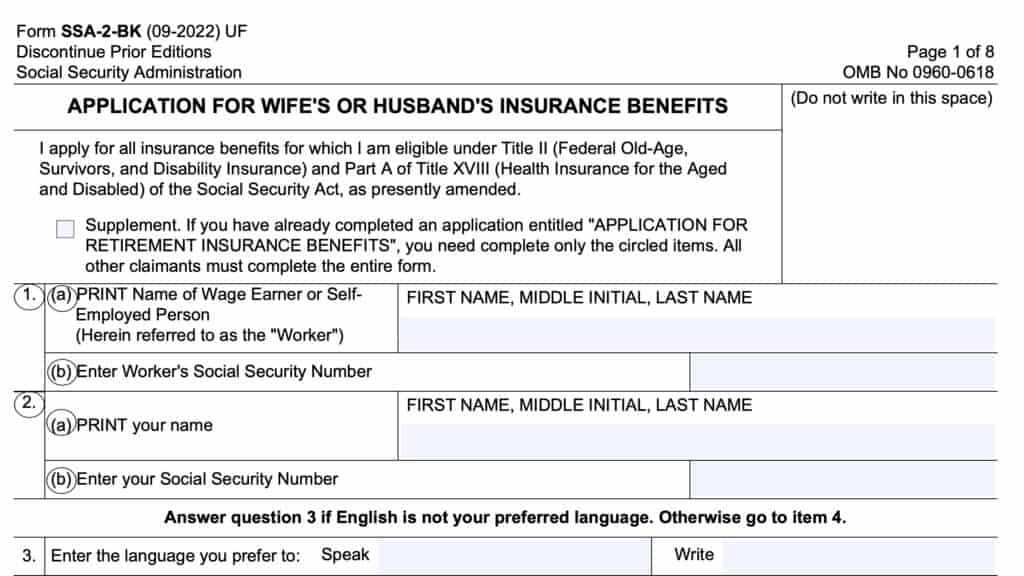

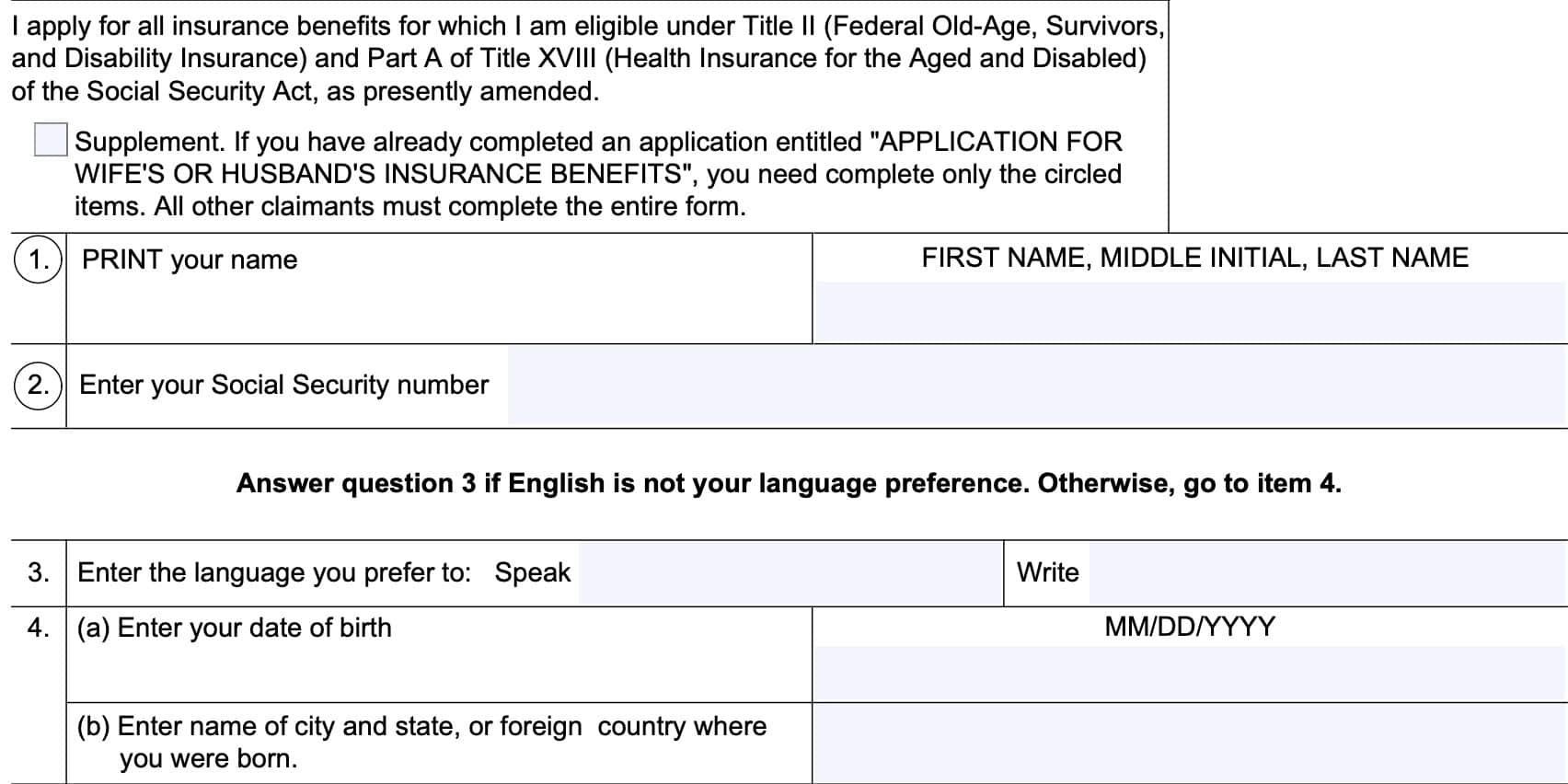

Before completing Line 1, please read the language just above, where it says, Supplement.

Supplement application information

If you’ve already completed Form SSA-2, which is the application for spousal benefits, then you should complete only the circled items on Form SSA-1-BK. These items include:

- Line 1: Claimant’s name

- Line 2: Social Security number

- Line 14: Names of children or dependent grandchildren

- Line 16: Recent employer history

- Line 17: Self-employment history

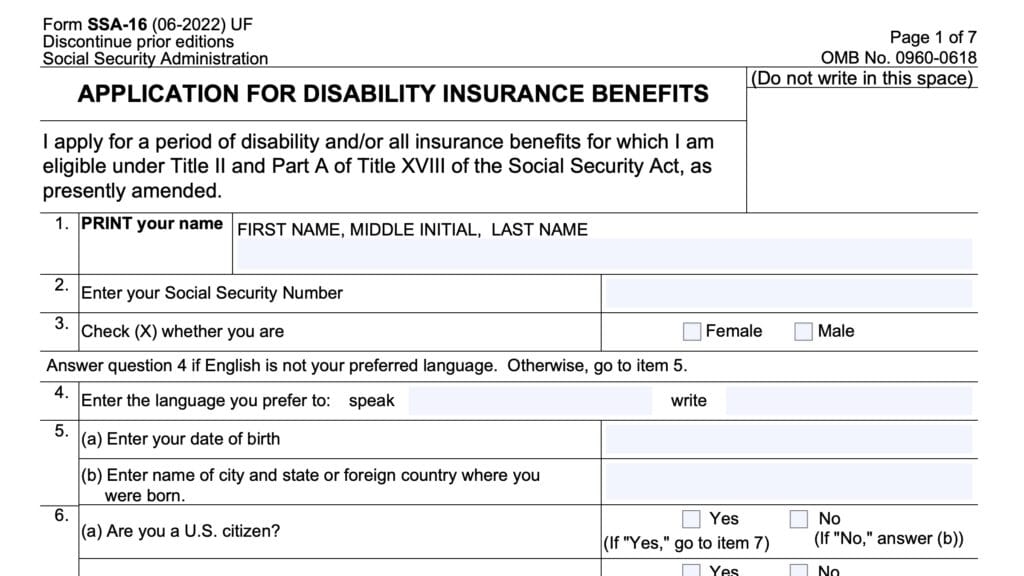

Line 1: Claimant’s name

Enter the claimant’s complete name in the space provided.

Line 2: Social Security number

Enter your Social Security number, or SSN, in this line. This should be a nine-digit number.

Line 3: Preferred language

If English is not your preferred language, then enter your preference in the space provided. You may choose:

- Speak: Enter your preferred spoken language

- Write: Enter your preferred written language

Line 4: Birth information

Enter information about your birth in the spaces provided.

Line 4a: Date of birth

Enter your birth date in MM/DD/YYYY format in the space provided.

Line 4b: City and state where you were born

Enter the city and state where you were born. If you were born in a foreign country, enter the name of your foreign country as well.

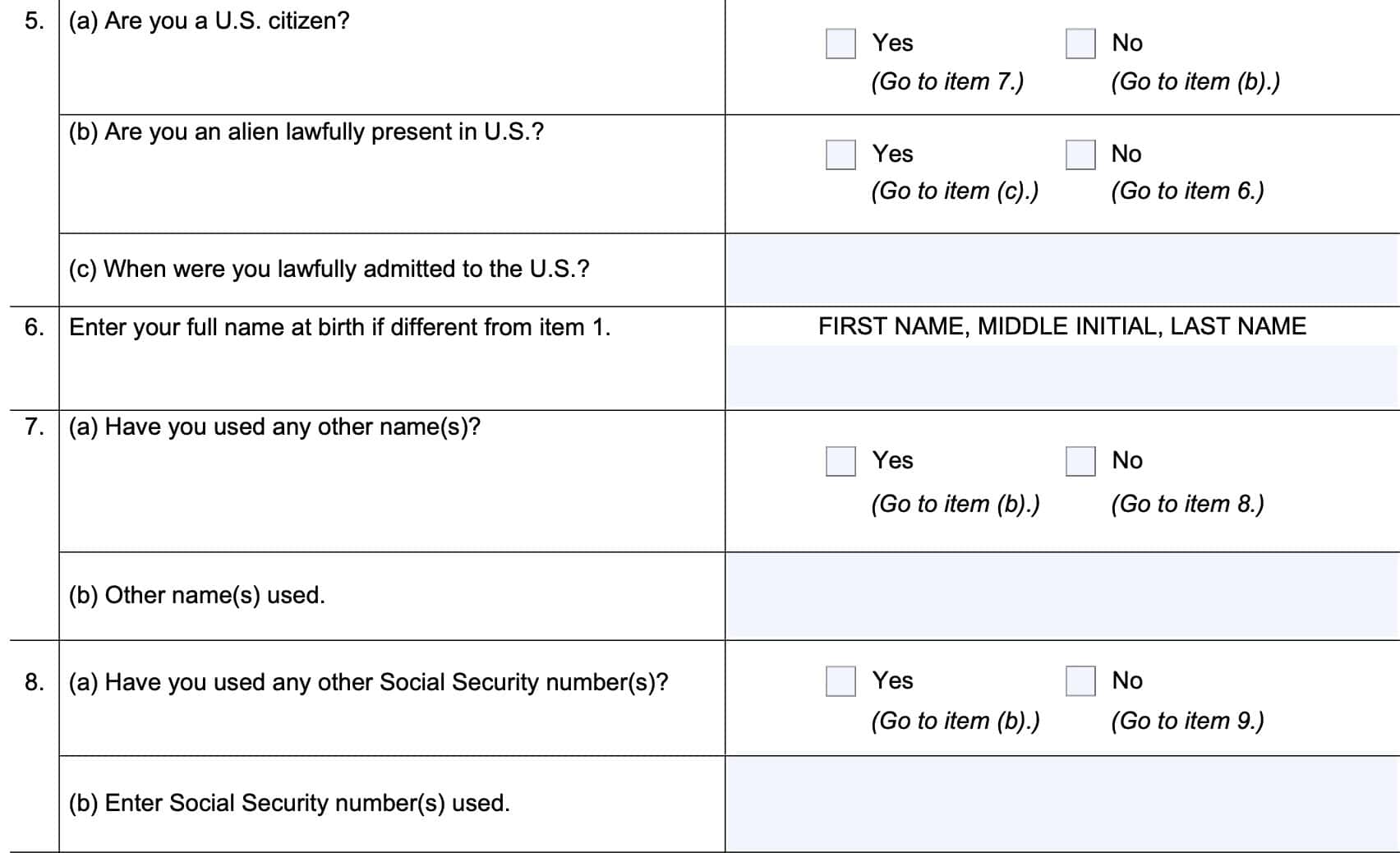

Line 5

In Line 5, you’ll answer questions about your citizenship or residency status, beginning with Line 5a.

Line 5a: Are you a U.S. citizen?

Answer Yes or No. If Yes, you can skip down to Line 7, below. If No, go to Line 5b.

Line 5b: Are you an alien lawfully present in U.S.?

Answer Yes or No. If Yes, you can skip down to Line 6, below. If No, go to Line 5c.

Line 5c: When were you lawfully admitted to the United States

Enter the date that you were allowed to come to the United States, then go to Line 6.

Line 6: Full name at birth

If your birth name is different from your current name, enter your complete birth name, including:

- First name

- Middle initial

- Last name

Proceed to Line 7.

Line 7: Other names used

Here, we’ll discuss other names or aliases you may have previously used.

Line 7a: Have you used any other name or names?

Answer Yes or No. If No, you can skip down to Line 8, below. If Yes, go to Line 7b.

Line 7b: Other name or names used

If you’ve used other names, list them in the space provided.

Line 8: Other Social Security numbers used

In this section, we’ll discuss other Social Security numbers you may have previously used.

Line 8a: Have you used any other Social Security numbers?

Answer Yes or No. If Yes, you can skip down to Line 9, below. If No, go to Line 8b.

Line 8b

List any previously used Social Security numbers, or SSNs, in the space provided.

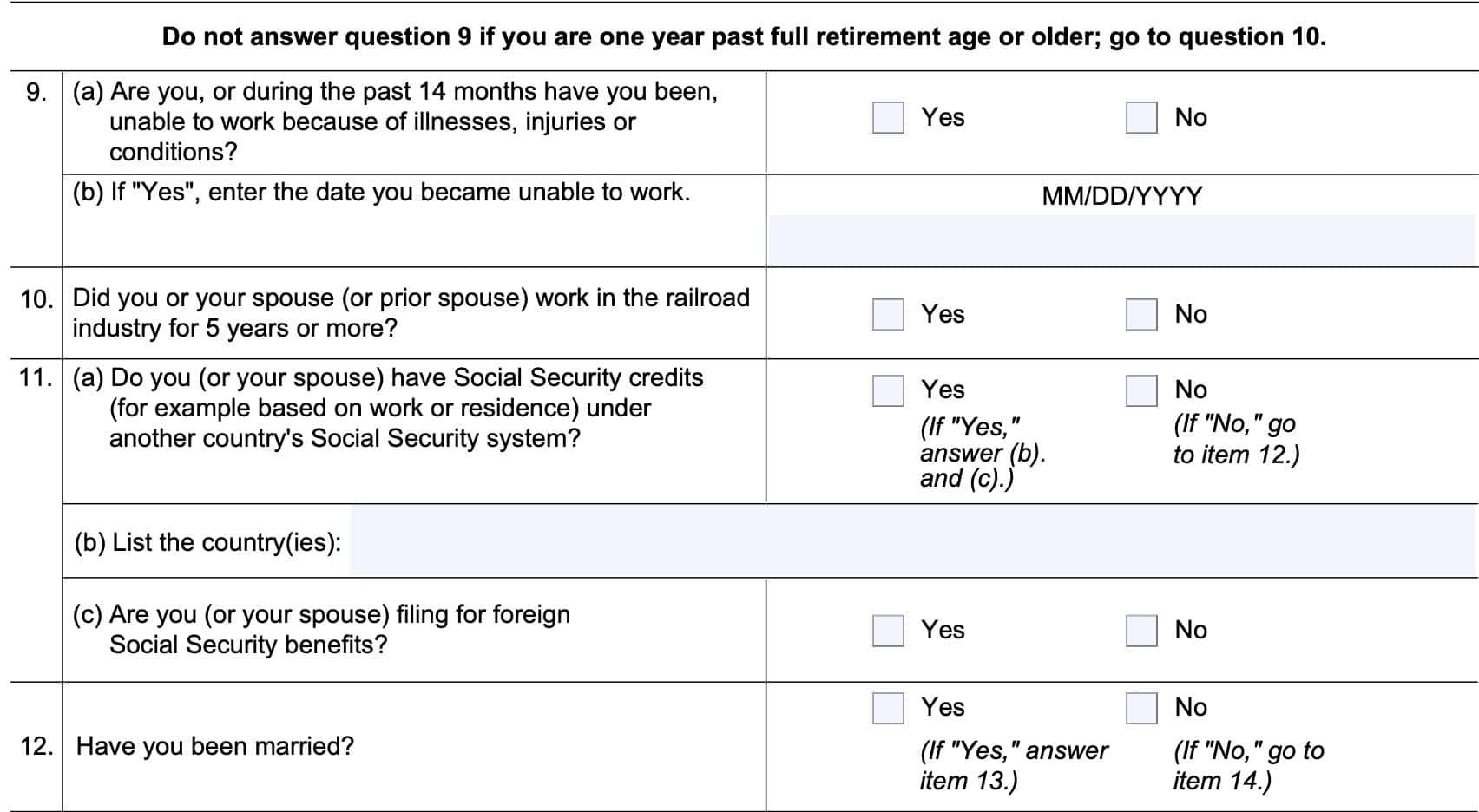

Line 9

Do not answer this question if you are more than one year older than full retirement age, or FRA. If you are not sure about your FRA, you can use this page on the Social Security Administration website to determine your FRA, based on the date you were born.

If you must answer Line 9, there are two parts to this question.

Line 9a

Are you, or during the past 14 months, have you been unable to work because of illnesses, injuries, or other conditions?

Answer Yes or No. If Yes, go down to Line 9b, below. If No, go to Line 10.

Line 9b

If applicable, enter the date that you became unable to work, in MM/DD/YYYY format.

Line 10: Railroad industry experience

Did you or your spouse, or a prior spouse, work in the railroad industry for five years or more? Answer Yes or No.

Line 11: Foreign Social Security status

There are three parts to this question.

Line 11a

Do you or your spouse have Social Security credits under another country’s Social Security system? Answer Yes or No. If Yes, go down to Line 11b, below. If No, go to Line 12, below.

Line 11b

List the country or countries where you have Social Security credits under another country’s system.

Line 11c

Are you or your spouse filing for foreign Social Security benefits? Answer Yes or No.

Line 12: Have you been married?

Answer Yes or No. If Yes, go to Line 13. If No, go to Line 14 instead.

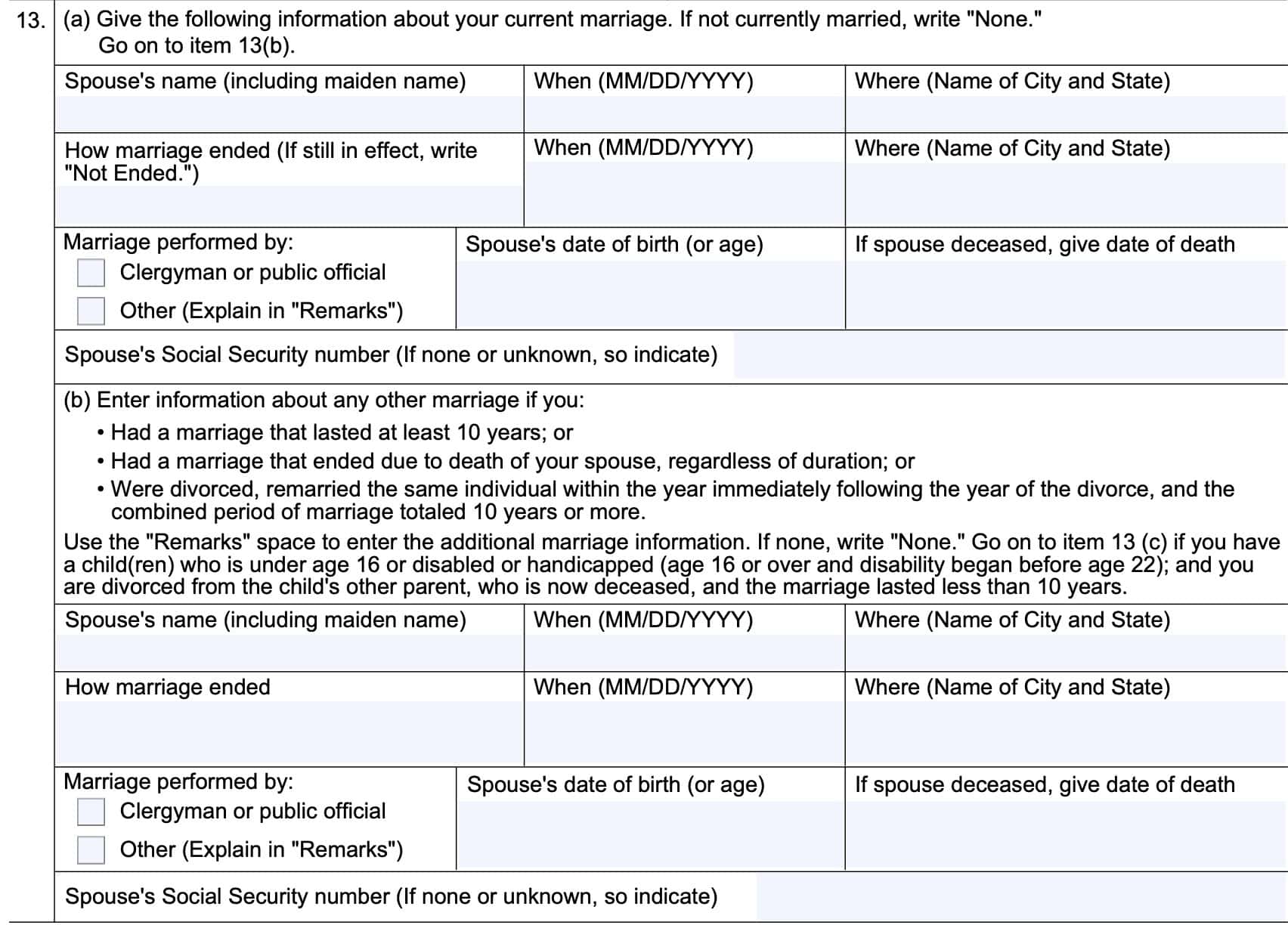

Line 13: marriage information

There are three parts to Line 13:

- Line 13a: Current marriage

- Line 13b: Previous qualifying marriages

- Line 13c: Other previous marriages

Line 13a: Current marriage

In this section, enter information about your current marriage. If you are not currently married, write None and go on to Line 13b.

Enter the following information:

- Spouse’s name, including maiden name

- When you were married

- Where you were married

- How the marriage ended (divorce, death, etc.)

- If this marriage is still in effect, write Not Ended in the space provided

- When and where your marriage ended, if applicable

- Who performed your marriage

- Spouse’s date of birth (or age)

- If your spouse is deceased, date of death (MM/DD/YYYY format)

- Spouse’s Social Security number, if known.

Line 13b: Previous qualifying marriages

In this section, you’ll need to enter information about any marriage that meets one or more of the following conditions:

- Lasted at least 10 years

- Ended due to the death of your spouse, regardless of duration

- Divorced, remarried the same individual immediately after the year of the divorce, and the combined marriage length totals 10 years or more

Enter the following information:

- Spouse’s name, including maiden name

- When you were married

- Where you were married

- How the marriage ended (divorce, death, etc.)

- If this marriage is still in effect, write Not Ended in the space provided

- When and where your marriage ended, if applicable

- Who performed your marriage

- Spouse’s date of birth (or age)

- If your spouse is deceased, date of death (MM/DD/YYYY format)

- Spouse’s Social Security number, if known.

If required because of more than one prior marriage, use the Remarks section below to enter the required information.

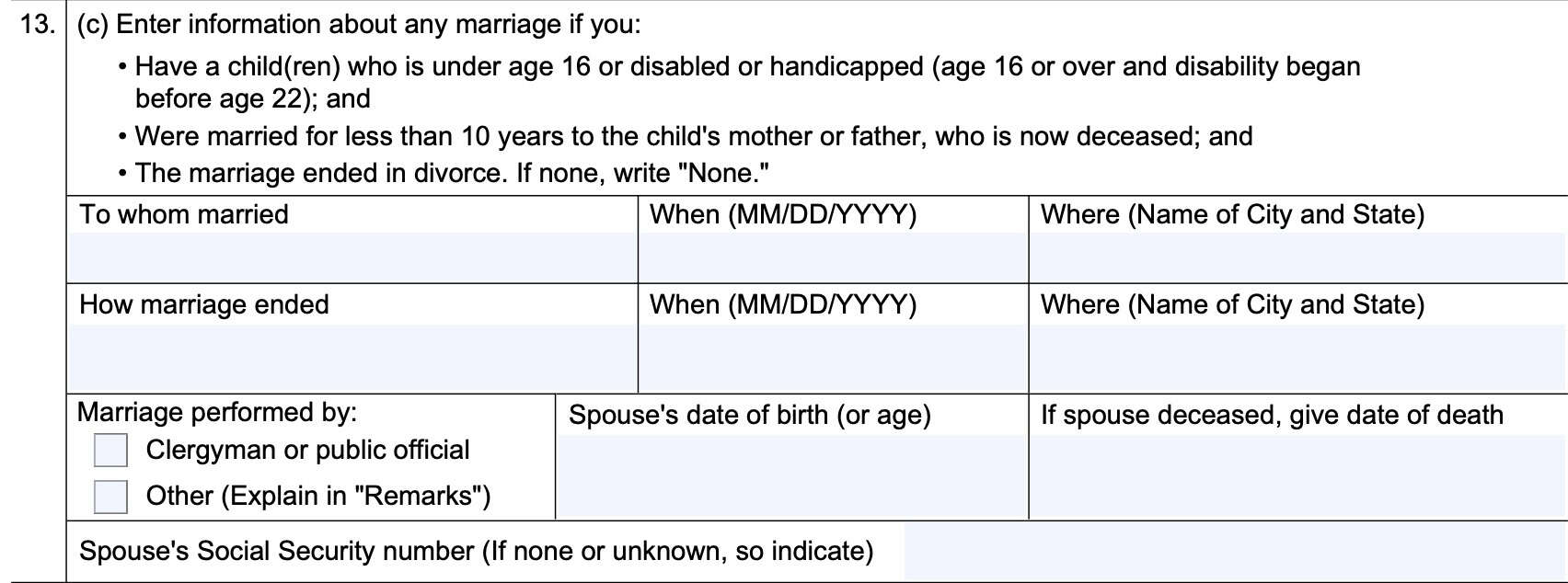

Line 13c: Other previous marriages

In this section, you’ll enter information about any marriage if you:

- Have at least one child who is

- Under age 16

- Disabled or handicapped (disability began before age 22), and

- Were married for less than 10 years to the other parent, who is now deceased, and

- The marriage ended in divorce

If not applicable, write None, and move onto Line 14.

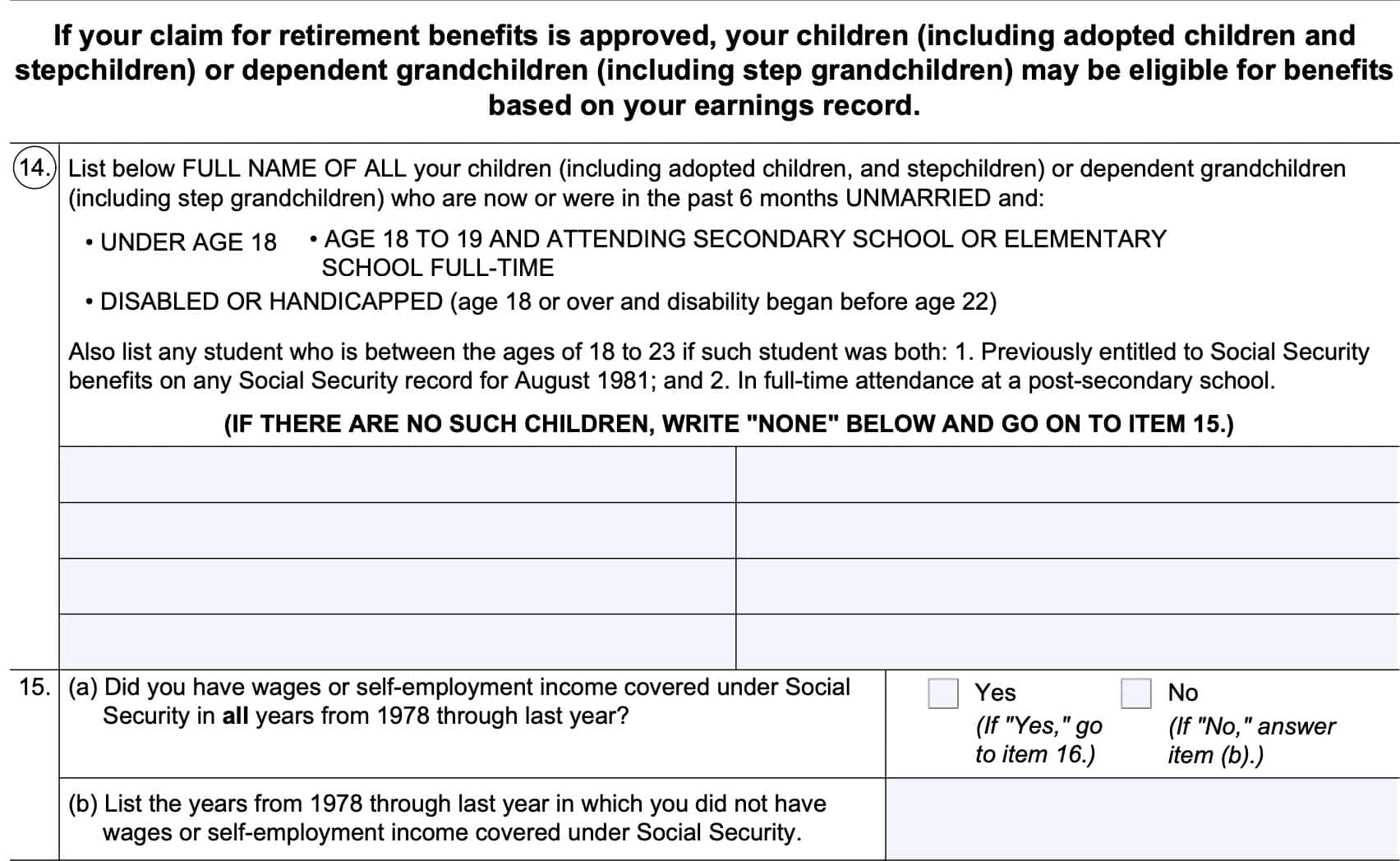

Line 14: Children or dependent grandchildren names

In this section, you’ll enter the complete name of all of your qualifying children who are now, or in the past 6 months, UNMARRIED, and:

- Under the age of 18

- Age 18 or 19, and attending school full-time, or

- Disabled or handicapped

- 18 or older, and the disability or handicap began before age 22

- Age 18 to 23 if the student was both:

- Entitled to Social Security benefits on any Social Security record for August 1981, and

- Attending post-secondary school on a full-time basis

Qualifying children

Children who may be eligible for benefits based upon your earnings history include:

- Children, including adopted children and stepchildren

- Dependent grandchildren, including step grandchildren

Enter the full name for all children in the space provided. If there are no such children, write NONE and move to Line 15.

Line 15

There are two parts to this section.

Line 15a

Did you have wages or self-employment covered under Social Security in all tax years, from 1978 through last year? Answer Yes or No.

If Yes, go to Line 16, below. If No, answer Line 15b.

Line 15b

If there are earning years after 1978 in which you did not have wage income or self-employment income, list them here.

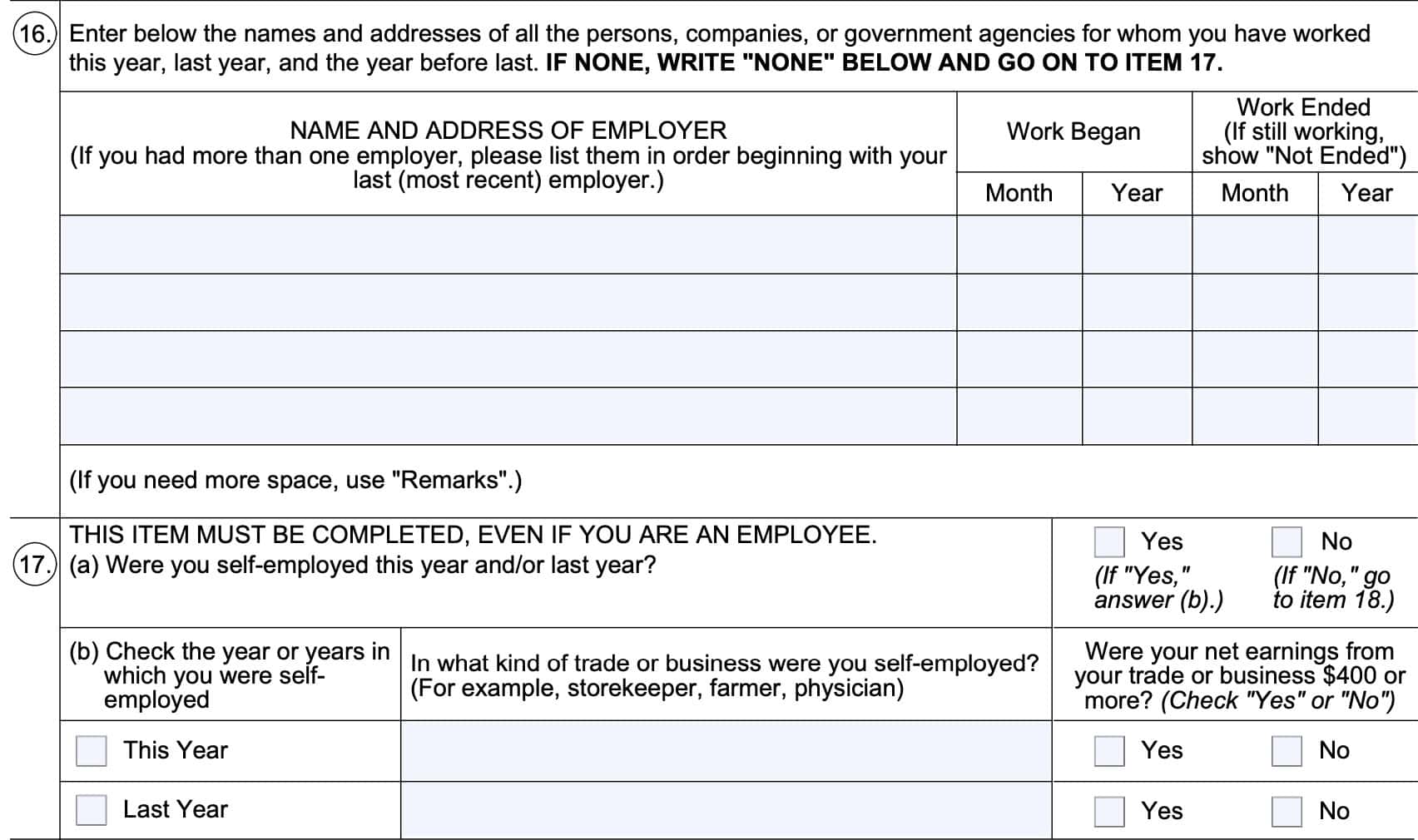

Line 16: Recent Employment history

Line 16 contains the employment history for each person, company, or government agency that you worked for in the past three years:

- Current year

- Prior year

- Year before last

As applicable, enter the following information:

- Employer’s name and address

- Work beginning date (MM/YYYY)

- Work ending date (MM/YYYY)

- If you are still working, indicate this by entering, “Not Ended.”

If there is more than one employer, list them in chronological order, beginning with your most recent employer.

If more space is required, use the Remarks section below, as needed.

Line 17: Self-employment history

There are two parts to this section.

Line 17a: Were you self-employed this year and/or last year?

Answer Yes or No. If Yes, answer Line 17b, below. If No, go to Line 18.

Line 17b

Check the year in which you were self-employed: This year, or last year. If you were self-employed both years, check both boxes.

For each item checked, list the type of trade or business for your self-employment. Also, answer whether or not your net earnings from your trade or business exceeded $400 in each year. Answer Yes or No as applicable.

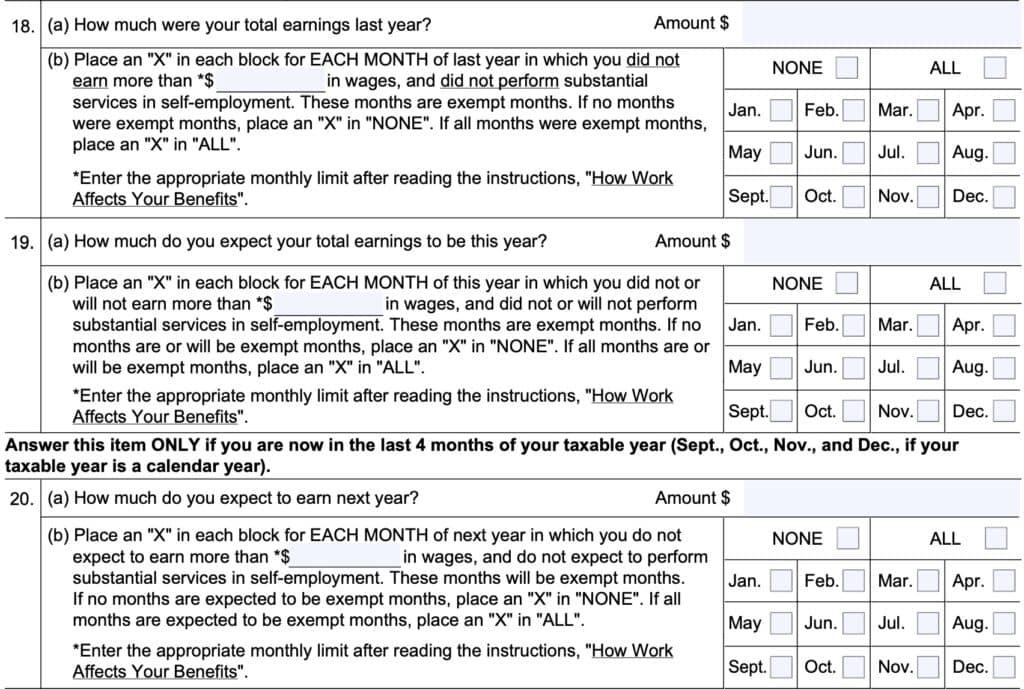

Line 18: Last year’s earnings

There are two parts to this question.

Line 18a

Enter the total amount of earned income from the prior year.

Line 18b

Place an X in each block for each month in which you did not earn more than $1,950, and did not perform substantial services in self-employment, according to the SSA Guide, How Work Affects Your Benefits.

You may select either NONE or ALL, if one of these applies to your situation.

Self-employment

According to the SSA, your self-employment activity impacts the determination on whether you are retired.

If you work less than 15 hours per month, the SSA considers you to be retired. If you work more than 45 hours per month, you’re not considered retired. If you work between 15 and 45 hours per month, then you won’t be considered retired if it’s in a job that requires a lot of skill, or you’re managing a sizable business.

Line 19: This year’s earnings

There are two parts to this question.

Line 19a: How much Are your total earnings this year?

Enter the total amount of income you expect to earn this year.

Line 19b

Place an X in each block for each month in which you did not, or do not expect to earn more than $1,950, and did not perform substantial services in self-employment, according to the SSA Guide, How Work Affects Your Benefits.

You may select either NONE or ALL, if one of these applies to your situation.

Self-employment

According to the SSA, your self-employment activity impacts the determination on whether you are retired.

If you work less than 15 hours per month, the SSA considers you to be retired. If you work more than 45 hours per month, you’re not considered retired. If you work between 15 and 45 hours per month, then you won’t be considered retired if it’s in a job that requires a lot of skill, or you’re managing a sizable business.

Line 20: Next year’s expected earnings

There are two parts to this question.

Line 20a

Enter the total amount of income you expect to earn next year.

Line 20b

Place an X in each block for each month in which you do not expect to earn more than $1,950, and did not perform substantial services in self-employment, according to the SSA Guide, How Work Affects Your Benefits.

You may select either NONE or ALL, if one of these applies to your situation.

Self-employment

According to the SSA, your self-employment activity impacts the determination on whether you are retired.

If you work less than 15 hours per month, the SSA considers you to be retired. If you work more than 45 hours per month, you’re not considered retired. If you work between 15 and 45 hours per month, then you won’t be considered retired if it’s in a job that requires a lot of skill, or you’re managing a sizable business.

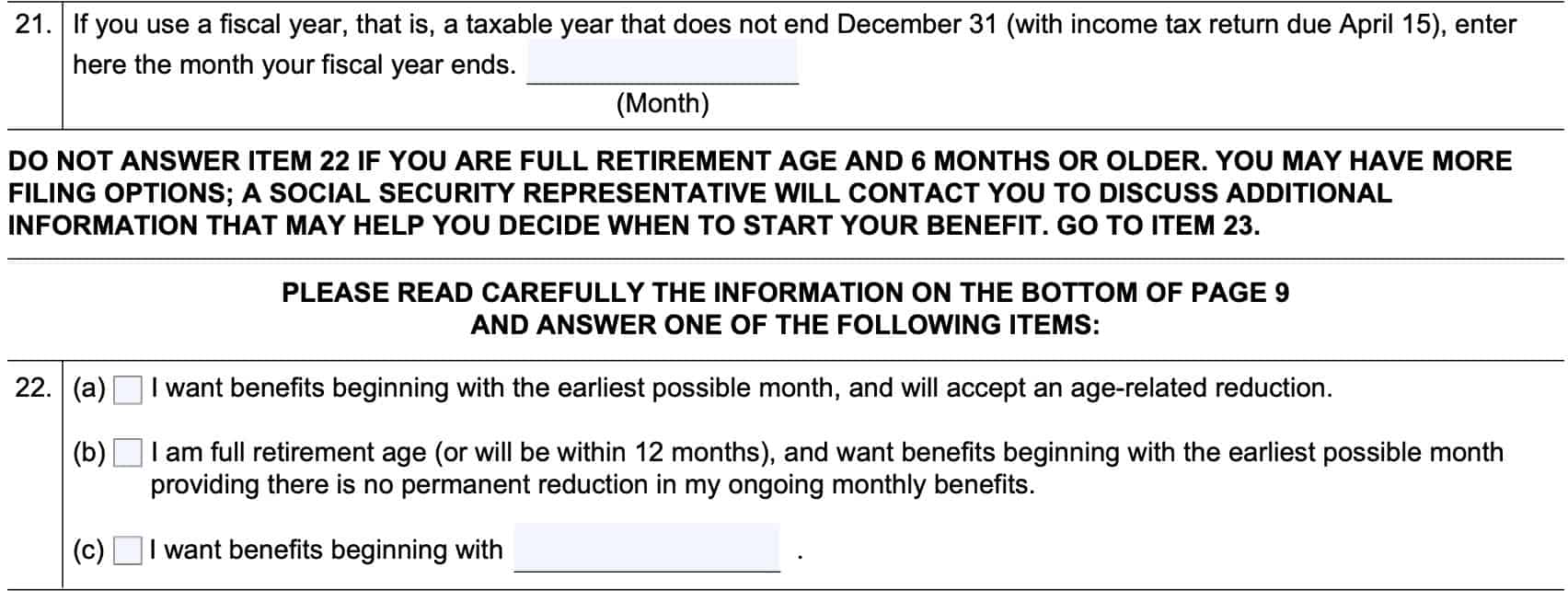

Line 21: Fiscal year

If you use a taxable year that ends in any month except December, enter the month that your fiscal year ends.

Line 22

Answer Line 22 with a check in either:

- Box (a): I want to receive my retirement insurance benefits as early as possible, and will accept an age-related reduction

- Box (b): I am full retirement age (or will be within 12 months) and want benefits beginning with the earliest possible month providing there is no permanent reduction in my ongoing monthly benefits

- Box (c): I want benefits beginning with _______

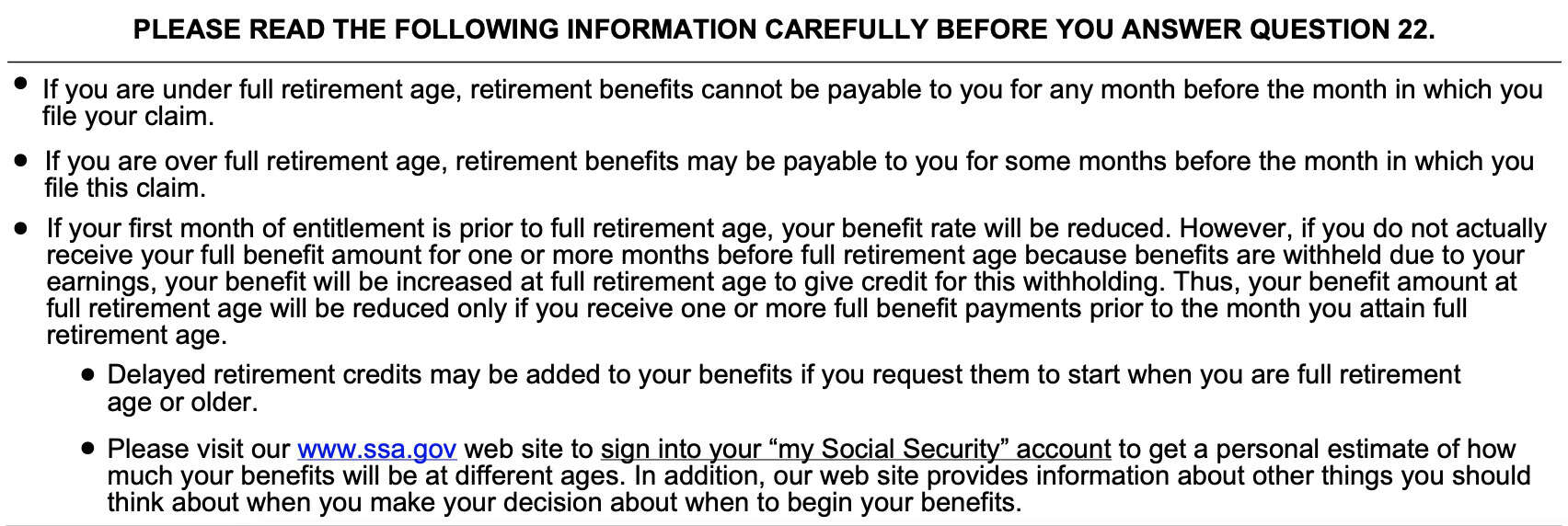

What you should read before answering Question 22

There are a couple of key points that the Social Security Administration would like you to know before you select the answer to Line 22:

- If you have not reached FRA, then you cannot receive retirement benefits for any month before the month in which you file your SSA claim

- If you have reached FRA, then you may be able to receive retirement benefits for some months before the month in which you file

- If your first month of benefits is before you’ve reached FRA, then your benefit rate will be reduced

- If you don’t actually receive your full benefit amount, because benefits are withheld due to your earnings, then your benefit will be increased once you reach FRA to give you credit for this withholding

- Your benefit amount at FRA is reduced only if you receive one or more full benefit payments prior to FRA

- Delayed retirement credits may be added to your benefits if you request them to start after you’ve reached FRA.

- You can log into your “my Social Security” account to receive a personal estimate of your benefits at different ages, from age 62 to 70.

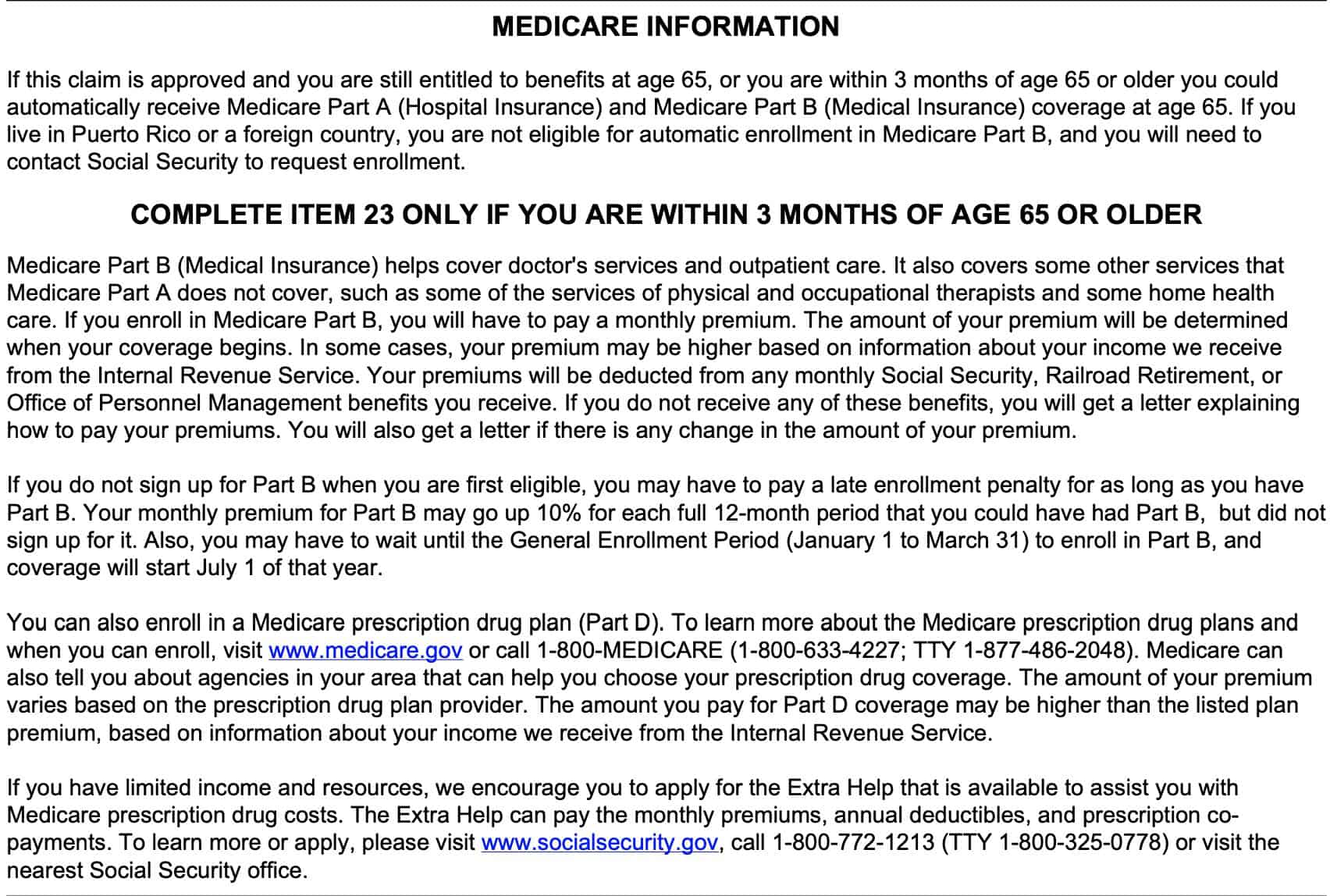

Line 23: Medicare enrollment

Only complete Line 23 if you are within 3 months of age 65 or older.

Answer Yes or No. If you are still working, and covered by a qualifying employer-sponsored health care plan, you can delay Medicare enrollment. However, in most situations, if you do not enroll in Medicare Part B when eligible, you may have to pay a late enrollment penalty.

Medicare late enrollment penalty

Your monthly premium for Medicare Part B may increase by 10% for each full 12-month period in which you were eligible, but did not sign up. Additionally, you may have to wait until the general enrollment period, which runs from January 1 to March 31 to enroll. If this occurs, your coverage will start July 1.

This early enrollment penalty does not apply to those still covered by a qualified employer health care plan. Once you have stopped working, or are no longer eligible for the health care plan, you should be eligible for an eight month special enrollment period.

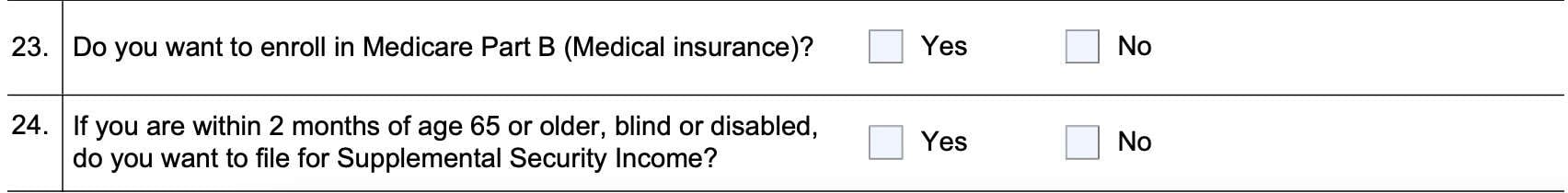

Line 24: SSI enrollment

If you are within 2 months of age 65 or older, blind, or disabled, do you want to enroll in Supplemental Security Income (SSI)?

Answer Yes or No.

Supplemental Security Income

SSI provides monthly payments to people with disabilities and older adults who have little or no income or resources.

Adults and children might be eligible for SSI if they have:

- Little or no income, and

- Little or no resources, and

- A disability, blindness, or are age 65 or older.

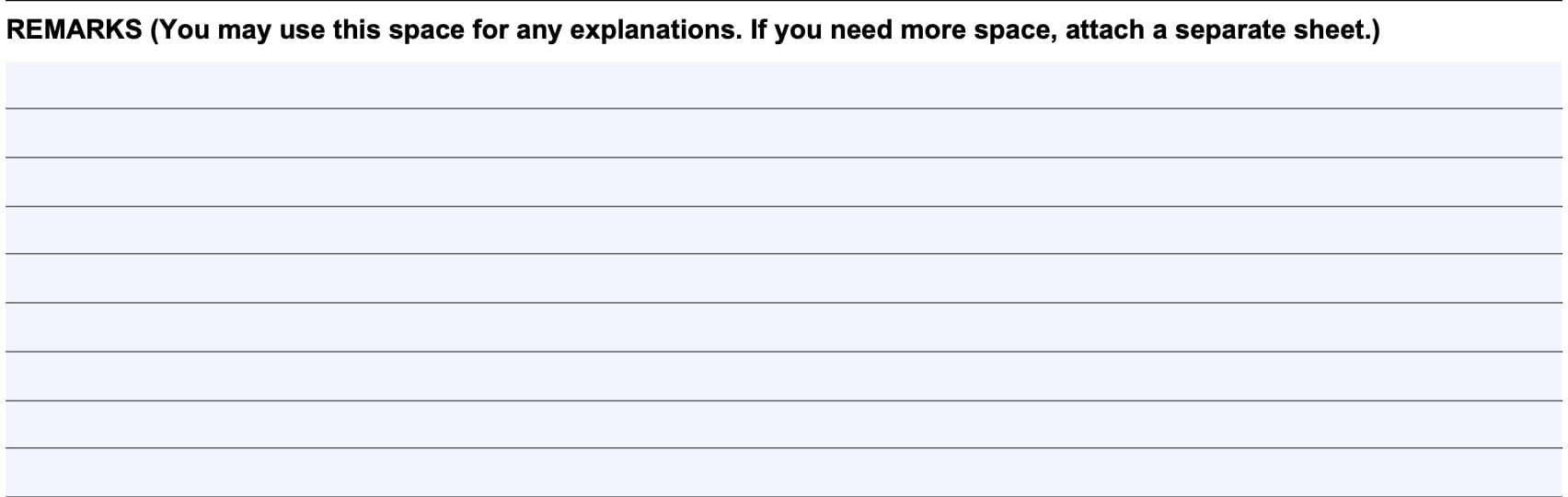

Remarks

If necessary, use the Remarks section to provide additional information. If you use the Remarks section to answer more than one question, be sure to separate each section, and include the question or line number. This will make it easier for the SSA to process your benefits application.

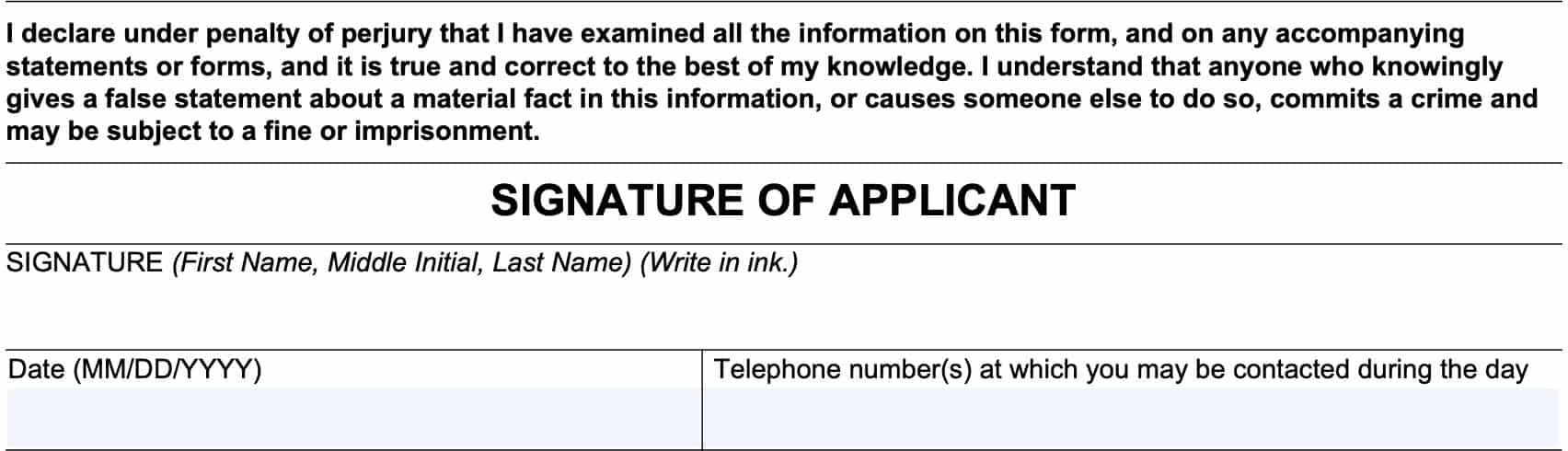

Applicant signature

Using an ink pen (blue or black ink), sign and date this section in the spaces provided. Also, include a telephone number where you can be reached to answer questions.

The SSA still allows a mark (indicated by the letter X) instead of a signature. If you choose to use a mark, you must have two witnesses who are willing to sign below to verify your identity.

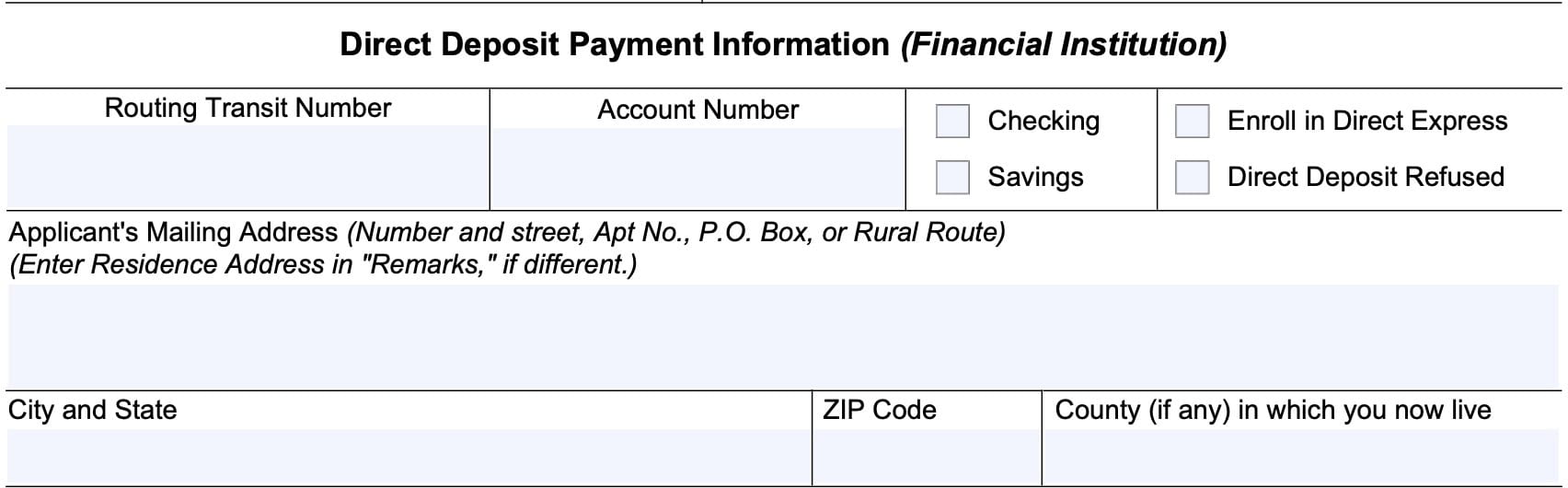

Direct deposit information

Enter your direct deposit information in the space provided. This includes:

- Routing transit number: This is the nine-digit number that corresponds to your bank or financial institution. When looking at a check, it is the first number at the bottom of the check.

- Account number: This is the number that corresponds to your banking account. At the bottom of the check, it is the number between the routing transit number and the check number.

- Checking or savings account: Check the appropriate box. When doing so, be sure that the type of account that you select corresponds to the account number that you entered in the previous field

- Direct Express: Check this box if you would prefer to receive a debit card instead of monthly payments into your banking account, you may check this box.

- Direct Deposit Refused: You may be able to select this box, but the Social Security Administration highly encourages people to receive their benefits electronically to reduce errors and theft risk.

Below the direct deposit information, enter your mailing address, including:

- Street name and number, or P.O. Box number

- City and state

- Zip code

- County where you live

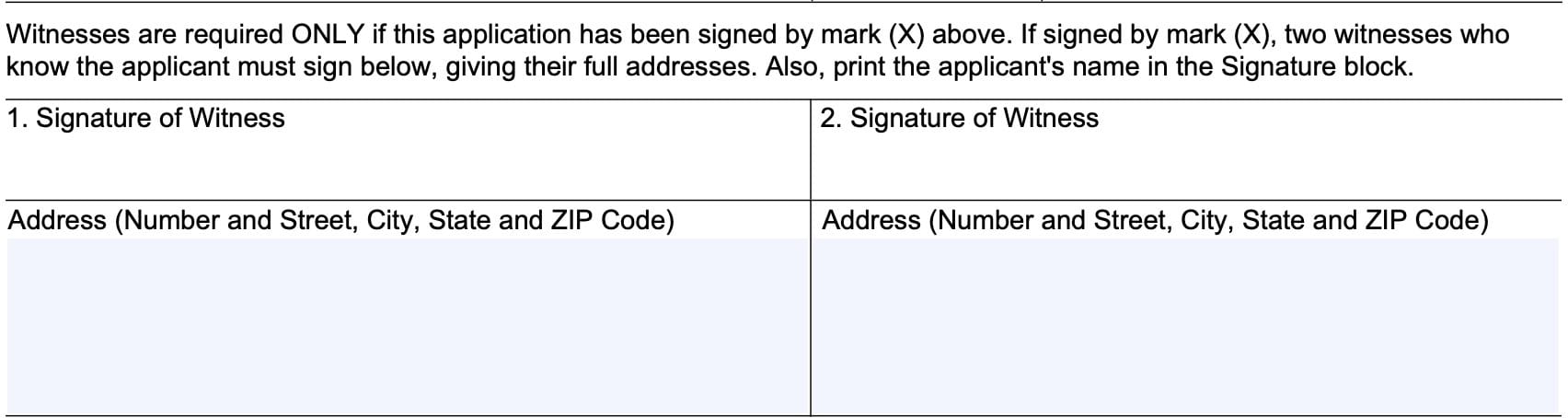

Witness signature

If needed, you may provide witness signatures for two people who personally know you. They must sign and provide their complete address in the spaces provided.

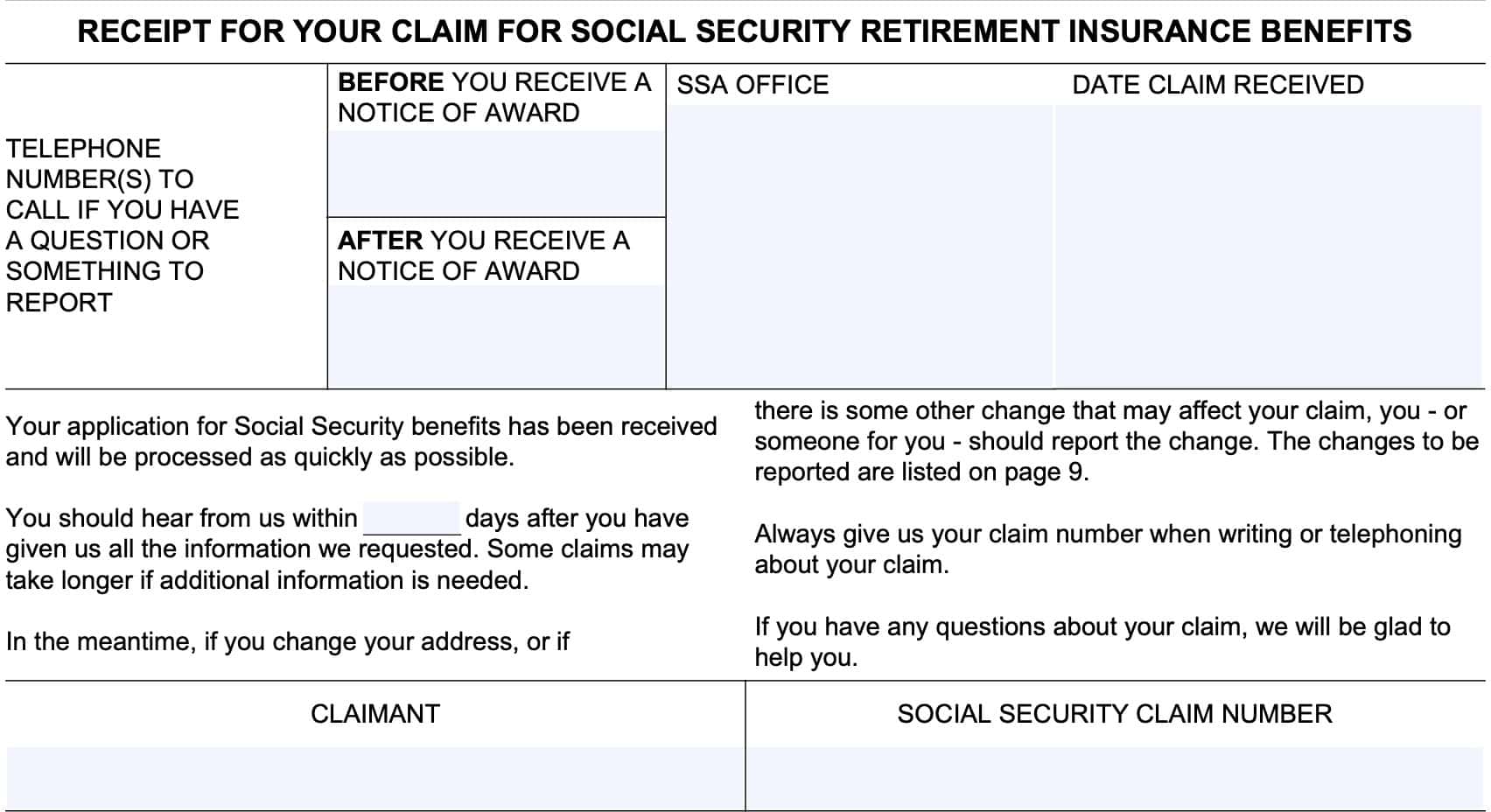

Benefits claim receipt

If you file Form SSA-1-BK in person at the SSA office, you should receive a receipt for your claim. The receipt should contain the following information:

- Phone number to call for questions before you receive your notice of award

- Phone number to call for questions after you receive your notice of award

- SSA office location where you filed your benefits claim

- Date the SSA received your claim

- Approximate number of days you should expect to receive a response from the SSA

- Claimant name and claim number

Filing considerations

There are several filing considerations that you may want to ponder before applying for retirement benefits.

Reduced Benefits before FRA

If you apply for Social Security benefits before reaching full retirement age, your benefits could be reduced. Conversely, unclaimed benefits after reaching FRA will continue to increase, up to the age of 70. After age 70, retirement benefits no longer increase.

Over time, the delayed, increased benefits may present a greater amount of payments over the course of your lifetime than claiming early. This should be a consideration when you decide to file.

Reporting changes to your situation

If your situation changes, the Social Security Administration expects certain changes to be reported. This will reduce the likelihood of overpayments and other impacts to your Social Security benefits.

What changes are you supposed to report

The SSA expects beneficiaries to report the following changes in status:

- Change in mailing address for checks or residence

- Change in citizenship or immigration status

- Leaving the United States for 30 consecutive days or longer

- Death of a beneficiary or inability to handle benefits

- Work changes

- Imprisonment for more than 30 days

- Unsatisfied warrant for more than 30 days

- Entitlement to a pension, annuity, or lump sum payment based upon employment not covered by Social Security

- Stepchild entitlement to benefits on your record

- Custody change

- Change in marital status

- Becoming a new parent

How to report changes

You can report changes to your situation online through the SSA website, by telephone, mail, or in person, based on your preference.

SSA website

To report changes online, you’ll need to log into your mySocialSecurity account, on the SSA website.

Telephone

You can call the SSA to report changes by dialing (800) 772-1213.

Local Social Security office

You can write or schedule an appointment at your local SSA office to notify them of any changes. You can use this SSA office locator tool to find the closest SSA office by zip code.

Video walkthrough

Frequently asked questions

Most people can file for retirement benefits as early as age 62, or as late as age 70. Early benefit claims may be lower than your entitlement at full retirement age, and may be reduced further if you are still earning income through employment or self-employment.

You can calculate future retirement benefits using the benefits calculator on your mySocialSecurity account. If you cannot log into your account, you can contact the SSA for estimated benefits information.