Form SSA-21 Instructions

If you’re claiming Social Security benefits from overseas, you may be asked to complete Form SSA-21, Supplement to Claim of Person Outside the United States.

In this article, we’ll go over everything you need to know about this Social Security form, including:

- How to complete Form SSA-21

- Video walkthrough

- Frequently asked questions

Let’s begin with a step by step walkthrough of Form SSA-21.

Table of contents

How do I complete Form SSA-21?

This five-page Social Security form can seem daunting. However, it is relatively straightforward to complete. We’ll break it down by pages, starting with Page 1.

Let’s begin at the top of Page 1.

Page 1

Before we get to Item 1, we should be familiar with the Social Security Administration definition of a person who is outside the United States. Specifically, for Social Security purposes, a person is considered to be outside the United States if he or she is physically outside any of the following for 30 consecutive days or more:

- The 50 listed United States

- District of Columbia

- Puerto Rico

- U.S. Virgin Islands

- Guam and the Northern Marianas Islands

- American Samoa

If this still applies to you, then proceed to Item 1.

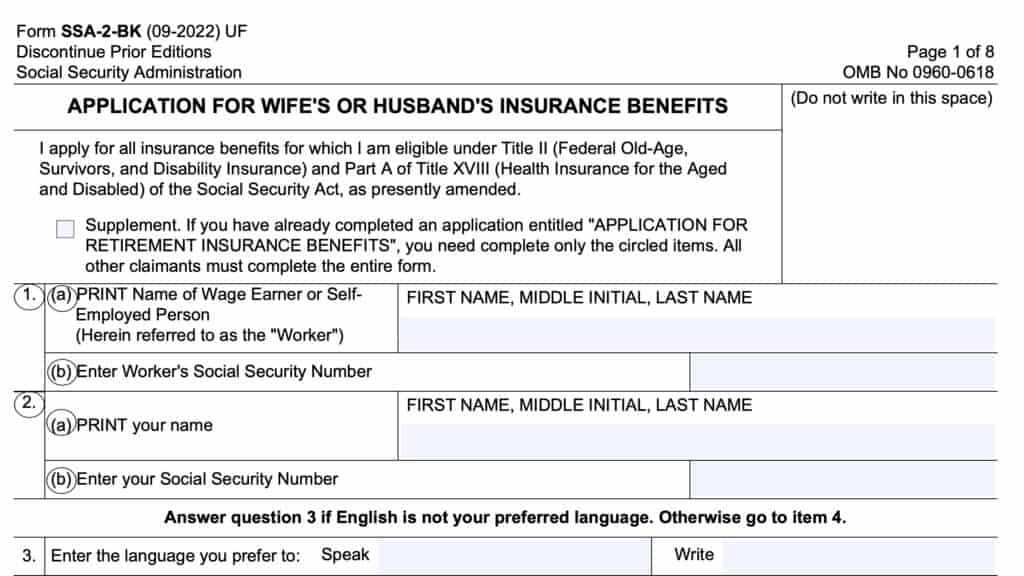

Item 1: Name of worker on whose earnings this claim is based

Enter the name of the worker whose earnings you are making this Social Security claim. The person making the claim does not have to be the same person worker whose earnings history is being evaluated for Social Security benefits.

Item 2: Worker’s Social Security number

Enter the worker’s Social Security number in Item 2. If the claimant and the worker are not the same person, be sure to use the worker’s SSN, not the claimant’s.

Item 3

Item 3 contains 2 parts:

- Line (a)

- Lines (b) through (d)

Let’s start with Line (a).

Line (a)

Enter the following information for the worker listed in Item 1, even if the worker is deceased:

- Full name

- Country or countries of citizenship

- Current or at time of death

- Passport number

- Date the passport was issued

Line(s) (b) through (d)

If applicable, enter the same information as outlined in Line (a) above for each claimant or Social Security beneficiary who is:

- Not a U.S. citizen

- Is either

- Currently outside the United States

- Has been outside the UnitedStates in the past 24 months, or

- Expects to be outside the U.S. for 30 consecutive days or more

- Living in the same household as the worker

Complete a separate Form SSA-21 for each household. If you need more space for additional information, use the Remarks section on Page 4.

Also, for each person listed in rows (a) through (d), enter the following information in the space provided:

- Country of birth

- Dates outside the United States

- Beginning date (From): Use MM-DD-YYYY format

- Ending date (To)

- Country where the person was living

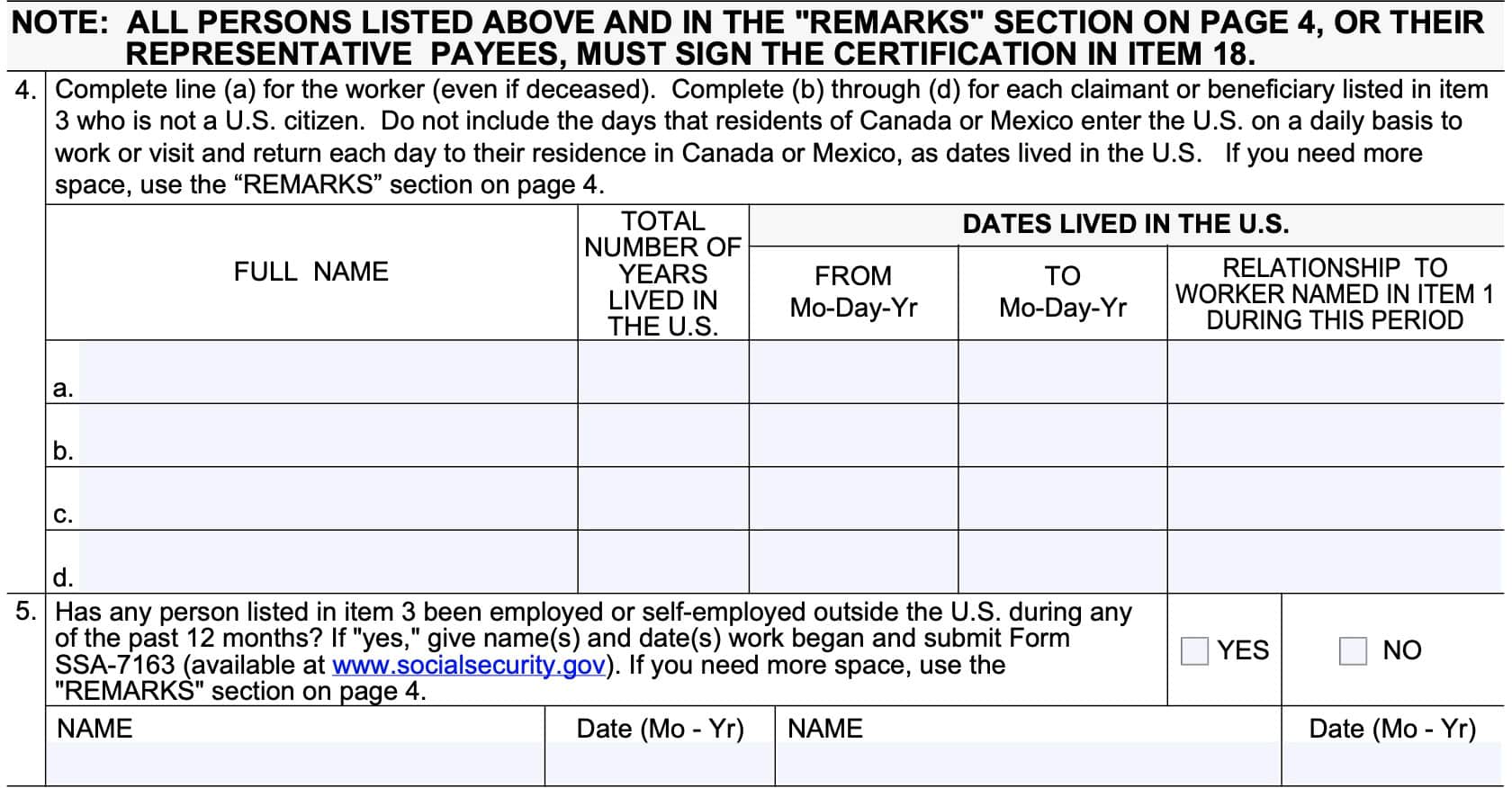

Item 4

According to the note just above Item 4, all persons listed in Item 3 above, or in the Remarks section, or their representative payees, must sign the certification in Item 18, at the end of this form.

In Item 4, you’ll need to enter the following information:

- Full name

- Total number of years person has lived in the United States

- Dates lived in the U.S.

- From date

- To date

- Relationship to worker named in Item 1, above

As with Item 3, use Line (a) for the worker (even if the worker is deceased), and Lines (b) through (d) for the same people outlined in those lines above.

For additional space, use the Remarks section on Page 4.

Dates lived in the U.S.

Do not include days that residents of Canada or Mexico entered the United States for work or to visit, when the person returned to their residence in Canada or Mexico.

Item 5

Has any person listed in Item 3 been employed or self-employed outside the United States at any point during the last 12 months?

If Yes, enter the name(s) and date(s) that work began. You will also need to submit Form SSA-7163, Questionnaire About Employment or Self-Employment Outside the United States for each person.

For additional space, use the Remarks section on Page 4.

If No, select No and move onto Page 2.

Page 2

Page 2 contains additional questions, as well as a statement on how income tax withholding works for nonresidents.

We’ll start with Items 6 through 8, and then go over tax withholding, followed by the remaining questions.

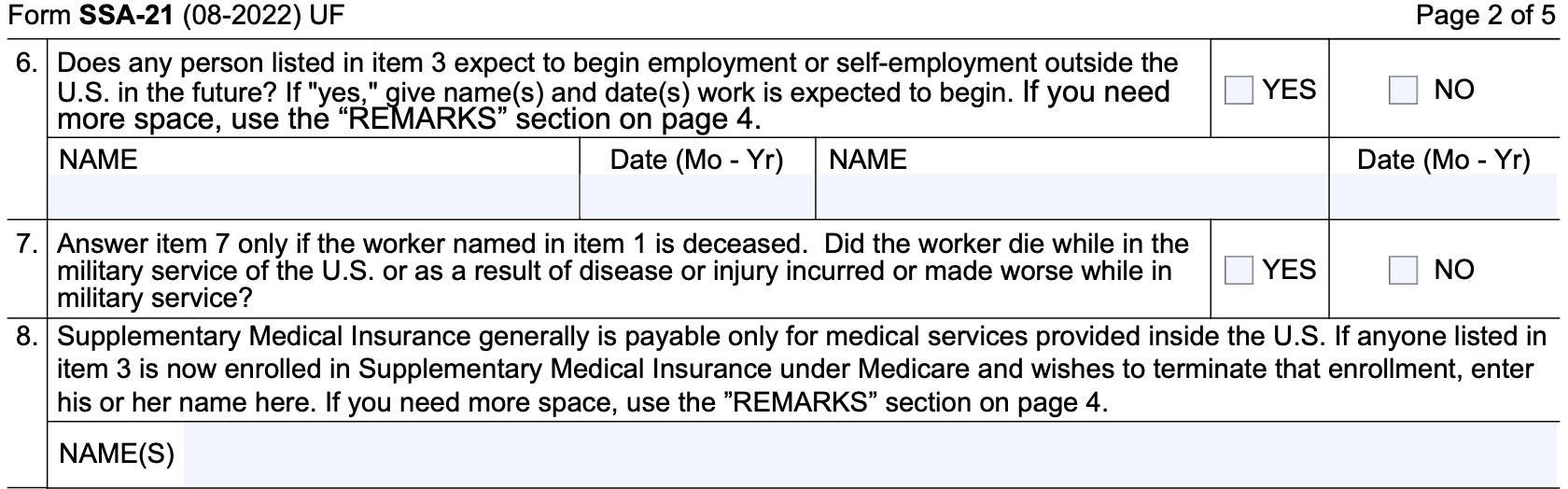

Item 6

Does any person listed in Item 3 expect to begin employment or self-employment outside the United States in the near future?

If No, select No and go to Item 7.

If Yes, then select Yes and enter the following information for each person:

- Person’s name

- Estimated date that you expect work to begin

For additional space, use the Remarks section on Page 4.

Item 7

Only answer this question if the worker named in Item 1 is deceased. If not deceased, skip to Item 8.

Did the worker die while:

- In the military service of the United States, or

- As a result of disease or injury incurred or made worse while in military service

Select Yes or No.

Item 8: Supplementary medical insurance

Generally, Supplementary Medical Insurance is only payable for medical services provided inside the United States.

Enter the name of any person listed in Item 3 who:

- Is currently enrolled in Supplementary Medical Insurance under Medicare, and

- Wishes to terminate their enrollment in Supplementary Medical Insurance

If you need additional space, use the Remarks section on Page 4.

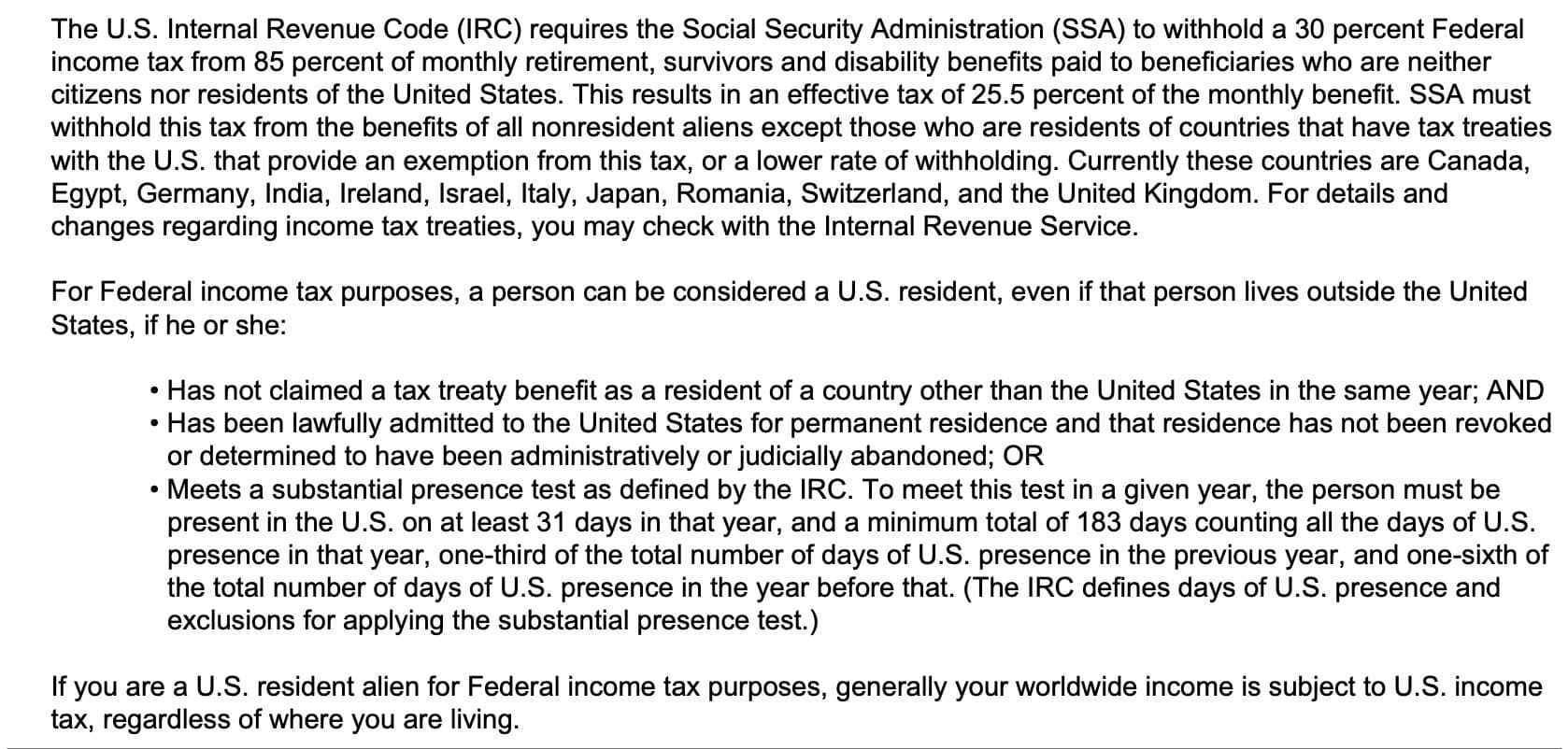

Tax statement

In the middle of Page 2, there is a statement that outlines how the federal government withholds taxes from Social Security payments to beneficiaries who are neither:

- A U.S. citizen

- A U.S. resident

Here are some of the highlights.

Tax withholding is mandatory for nonresidents

According to the Internal Revenue Code, the Social Security Administration must withhold 30% income tax from 85% of any monthly Social Security benefits paid to anyone who is not a U.S. citizen or U.S. resident. This includes the following benefits:

- Retirement benefits

- Survivor benefits

- Disability benefits

This 30% tax only applies to 85% of the total monthly payment. This results in a net effective tax of 25.5% of the monthly benefit amount.

There are exceptions for residents of countries with certain tax treaties

The Internal Revenue Code does make exceptions for certain nonresident aliens who are residents of certain countries that have tax treaties in place with the U.S. These countries include:

- Canada

- Egypt

- Germany

- India

- Ireland

- Israel

- Italy

- Japan

- Romania

- Switzerland

- United Kingdom

For more information on existing tax treaties that the United States has with foreign countries, you can check the Internal Revenue Service website.

Who is considered a U.S. resident

Finally, this passage gives an official definition of a U.S. resident, for federal income tax purposes. A person can be considered a U.S. resident, even if he or she lives outside the United States, if he or she:

- Has not claimed a tax treaty benefit of a country other than the United States in the same year, AND

- Has been lawfully admitted to the United States for permanent residence, OR

- Residence must not have been revoked or determined to have been abandoned

- Meets a substantial presence test as defined in the Internal Revenue Code

- Must be present in the United States for at least 31 days in the current year, AND a minimum of 183 days that include:

- 1/3 of the total days of United States presence in the previous year

- 1/6 of the total days of U.S. presence in the year prior to that

- Must be present in the United States for at least 31 days in the current year, AND a minimum of 183 days that include:

For federal income tax purposes, your worldwide income is generally subject to U.S. income tax, regardless of where you live.

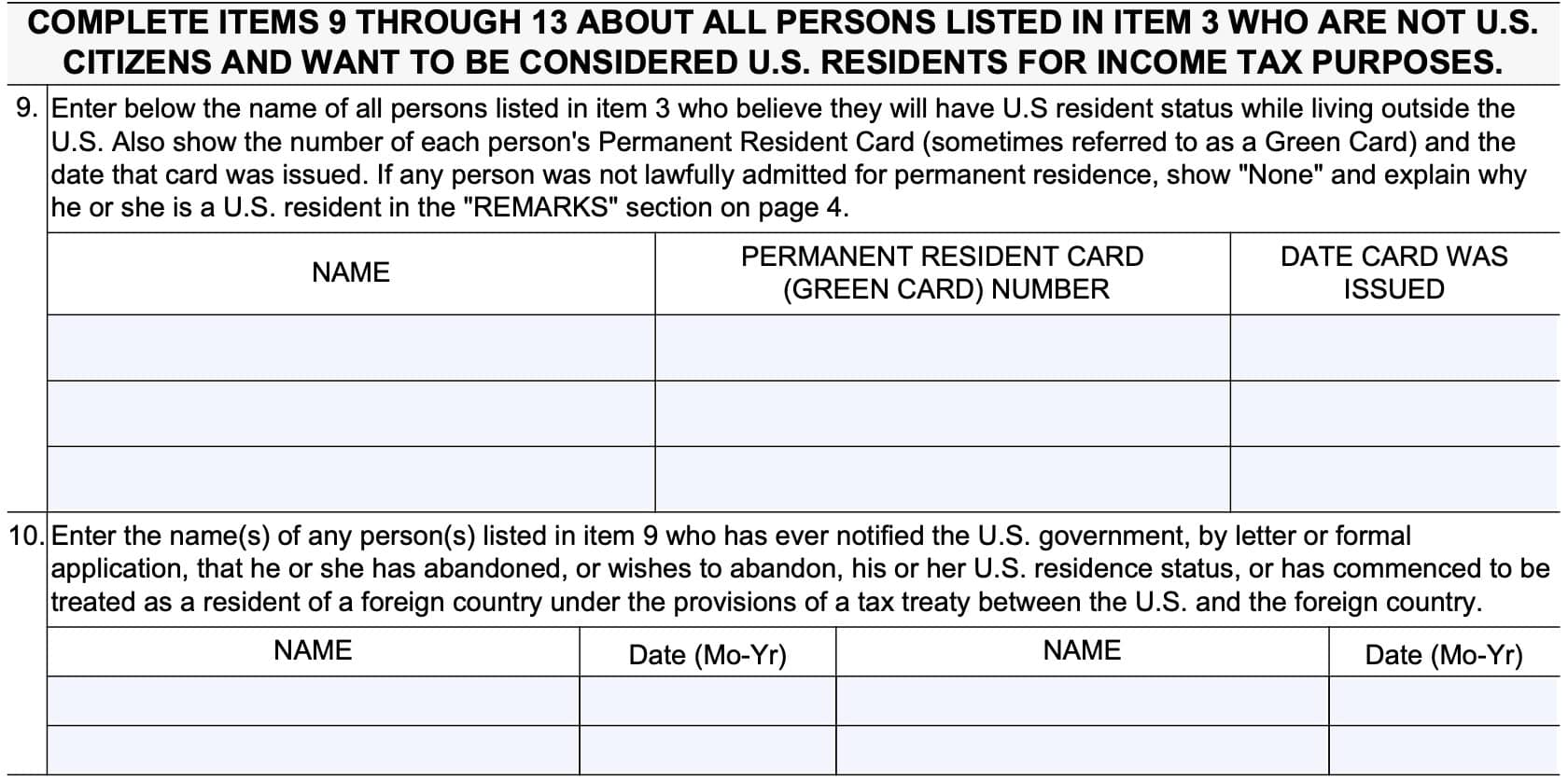

Item 9: Persons who believe they will have U.S. resident status while living outside the United States

In Item 9, enter the following information for each person listed in Item 3 who believes he or she will have U.S. resident status while living outside the United States:

- Person’s name

- Permanent resident card number (green card)

- Date your green card was issued

Item 10

In Item 10, you will enter certain information about any person listed in Item 9 who:

- Has notified the federal government that he or she has abandoned, or wishes to abandon, his or her residence status, or

- Either by letter or formal application

- Has started to be treated as a resident of a foreign country under the provisions of the tax treaty between the U.S. and that foreign country

Enter the person’s name and the date of abandonment. After this, go to Page 3.

Page 3

On Page 3, we will continue answering questions related to the application. Let’s begin with Item 11, at the top.

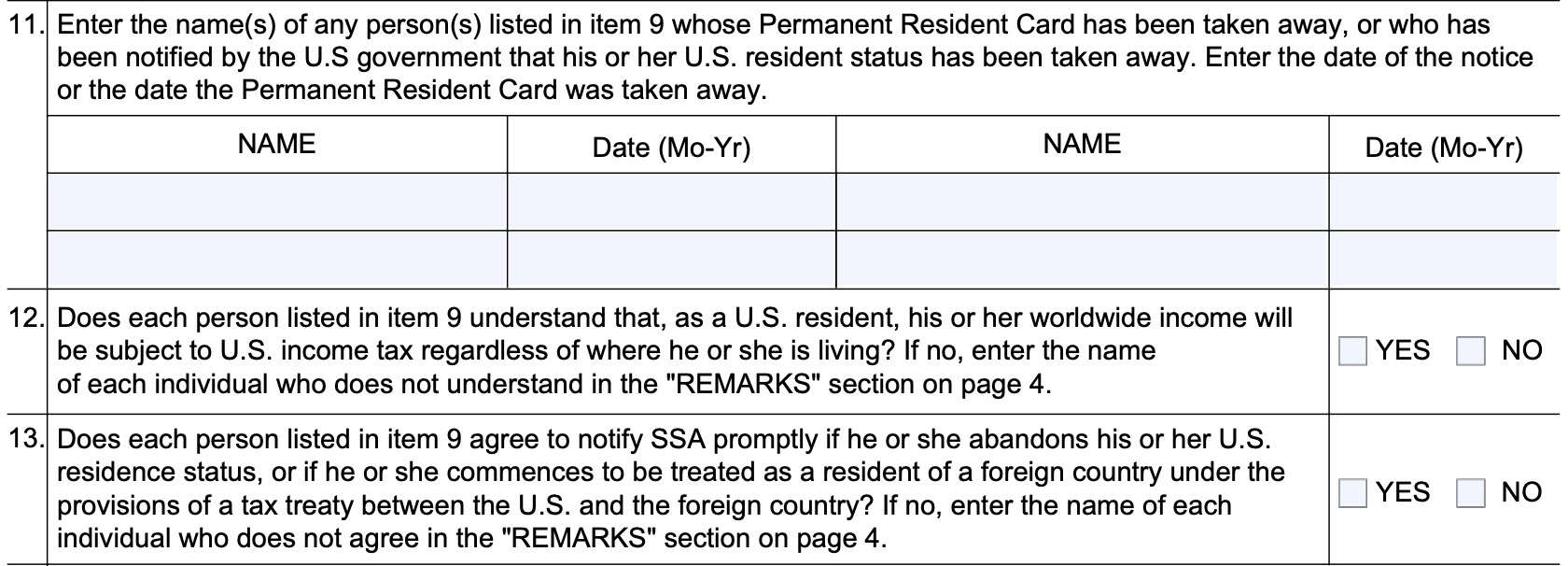

Item 11

In this field, you should enter the name(s) of any person listed in Item 9 who has been notified that:

- Their green card has been taken away or revoked, or

- That his or her U.S. resident status has been taken away

For each person, enter the person’s name and the date (MM/YYYY) that the notice was issued or that the permanent resident card was taken away.

Item 12

Check Yes or No to the following question:

Does each person listed in Item 9 understand that as a U.S. resident, his or her worldwide income will be subject to U.S. income tax, regardless of where he or she lives?

If you answer No, please enter the individual’s name in the Remarks section on Page 4.

Item 13

Check Yes or No to the following question:

Does each person listed in Item 9 agree to notify the Social Security Administration if either of the following occurs:

- He or she abandons his or her U.S. residence status, or

- He or she commences to be treated as a resident of a foreign country under the provisions of a tax treaty between the United States and that foreign country

If you answer No, please enter the individual’s name in the Remarks section on Page 4.

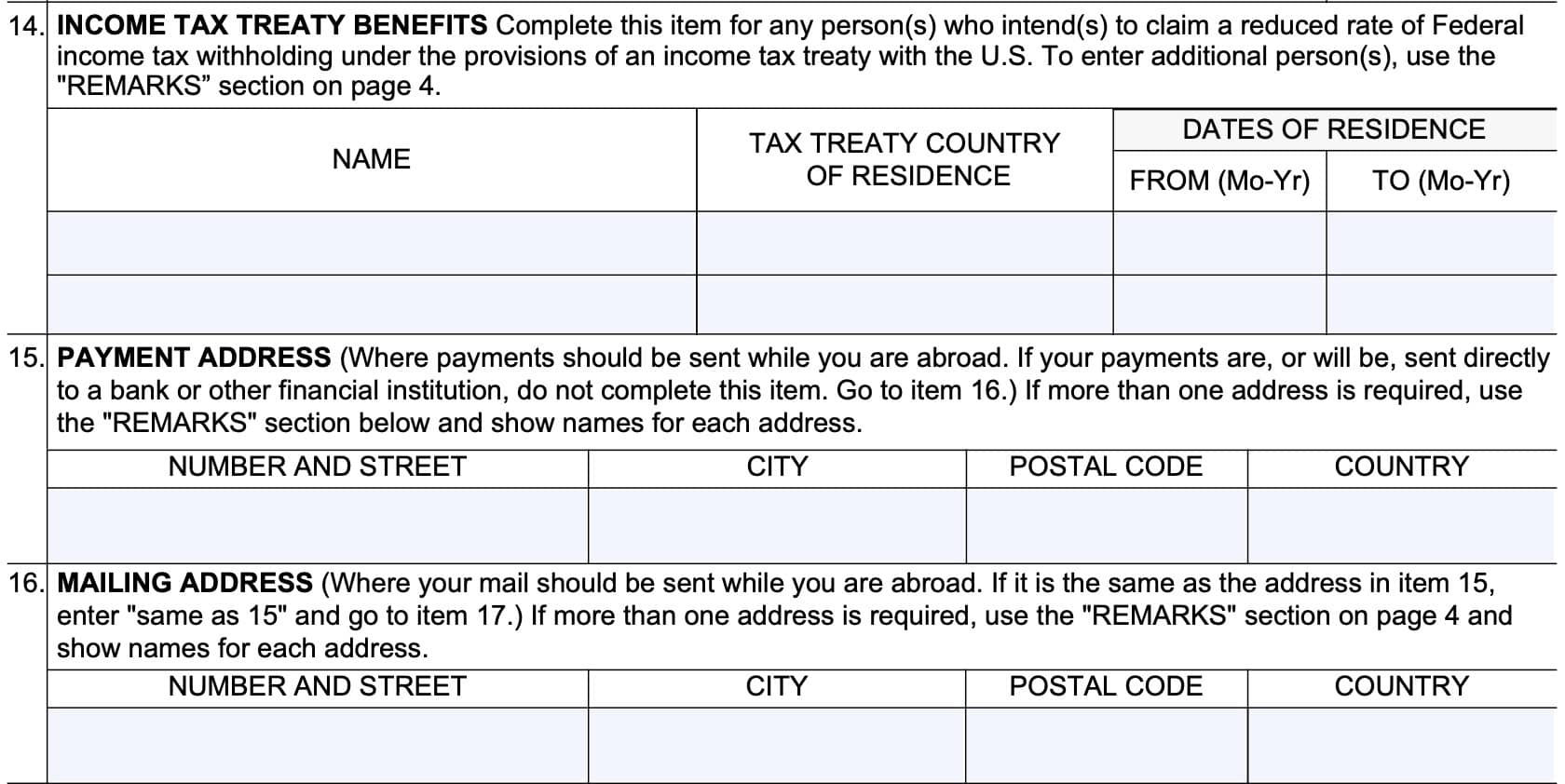

Item 14: Income tax treaty benefits

Complete Item 14 for any person or persons who intend to claim a reduced rate of Federal income tax withholding under the provisions of an income tax treaty with the U.S.

You will need to enter the following information:

- Person’s name

- Tax treaty country of residence

- Dates of residence

- From

- To

If you wish to enter information for more than two people, use the Remarks section on Page 4.

Item 15: Payment address

Item 15 contains the payment address where you wish your benefit payments to be sent while you are overseas. You will need to enter the following information:

- Street name and number

- City

- Postal code

- Country

If you expect to receive payments to your bank or other financial institution while you are out of country, you can leave Item 15 blank and go to Item 16.

Item 16: Mailing address

Item 16 contains the mailing address where you wish your Social Security correspondence to be sent while you are overseas. You will need to enter the following information:

- Street name and number

- City

- Postal code

- Country

If this is the same address as in Item 15, you can simply state ‘same as 15,‘ then proceed to Item 17, below. If you require more than one address, then use the Remarks section on Page 4.

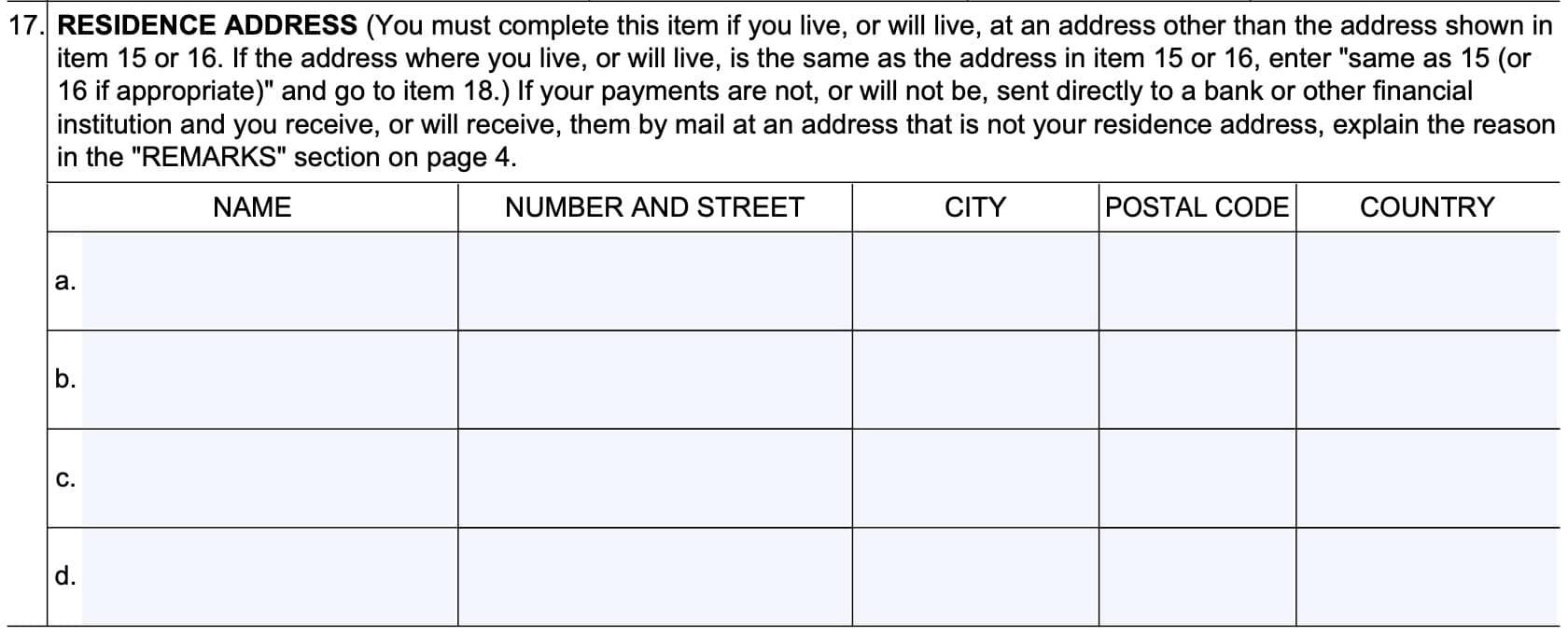

Item 17: Residence address

Complete Item 17 if you currently live, or plan to live, at an address other than the address shown in Item 15 or 16. If the address is the same, you can enter ‘same as 15 (or 16),’ then move to Item 18.

If your payments are not being sent to a bank or financial institution, and you plan to receive them by mail at an address besides your residence, then you should explain the reason in the Remarks section on Page 4.

Page 4

On Page 4, you’ll enter any additional information in the remarks section, then sign the form itself.

Remarks

Use this space to provide additional information or explanations from any of the previous items. For each item you should enter the item number, followed by the necessary information. For example, if you were providing additional information for Item 14 (Additional persons with income tax treaty benefits), you should enter:

Item 14, followed by the required information (name, country of residence, dates of residence).

If you need additional space, you may attach a separate sheet.

Item 18: Signature

Each person outlined will need to sign and date the respective line in Item 18. Additionally, you’ll need to enter a telephone number where you may be contacted during the day.

A representative payee must sign for minors and for incapable adults. Use blue or black ink to sign the form.

Item 19: Signature of witness

Item 19 is not required. However, if one of the signers in Item 18 made their signature with an X, then two people must sign in Item 19 and list their complete address. These signatures indicate that the person in Item 18 is known to the signer, and that the signer is vouching for their identity.

Video walkthrough

Watch this video to learn more about Form SSA-21.

Frequently asked questions

You may be able to file this form at your local Social Security office. If filing from overseas, you may be able to file with your closest U.S. embassy location. If you are not sure where you can submit your completed Form SSA-21, you should contact the Social Security Administration for specific guidance.

Certain eligible beneficiaries may be able to claim Social Security benefits, even from an overseas location. To do so, you may be required to complete Form SSA-21, Supplement to Claim of Person Outside the United States, as part of your benefits claim.