Form SSA-11-BK: A Representative Payee Guide

If you’re providing support for a Social Security beneficiary, such as a minor child, you may be able to request that the Social Security Administration direct payment of those Social Security benefits to you, instead. You can do this by filing Form SSA-11-BK: Request to be Selected As Payee.

Contents

Table of contents

How do I fill out Form SSA-11-BK?

The official Form SSA-11-BK is not on the Social Security website. There are copies of this form on other federal government websites. However, any copies of this form you see (including on this website) may not be the most updated version.

Even if there are new versions of the form, walking through this form might help you be prepared for your interview with the Social Security office. Whether you fill out Form SSA-11-BK or apply via ERPS, you should be prepared to provide documents that prove your identity, including either:

- Proof of Social Security Number, if applying as an individual

- Proof of employer identification number (EIN), if applying on behalf of an organization

Here are the important points for each section.

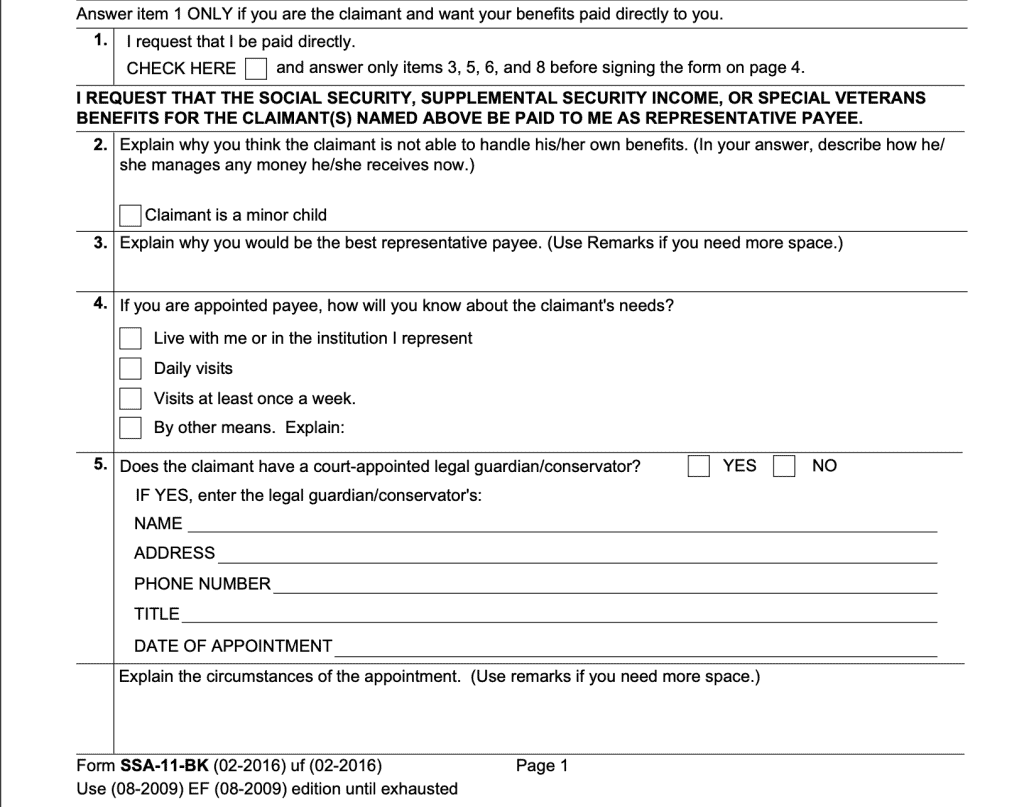

Items 1-5

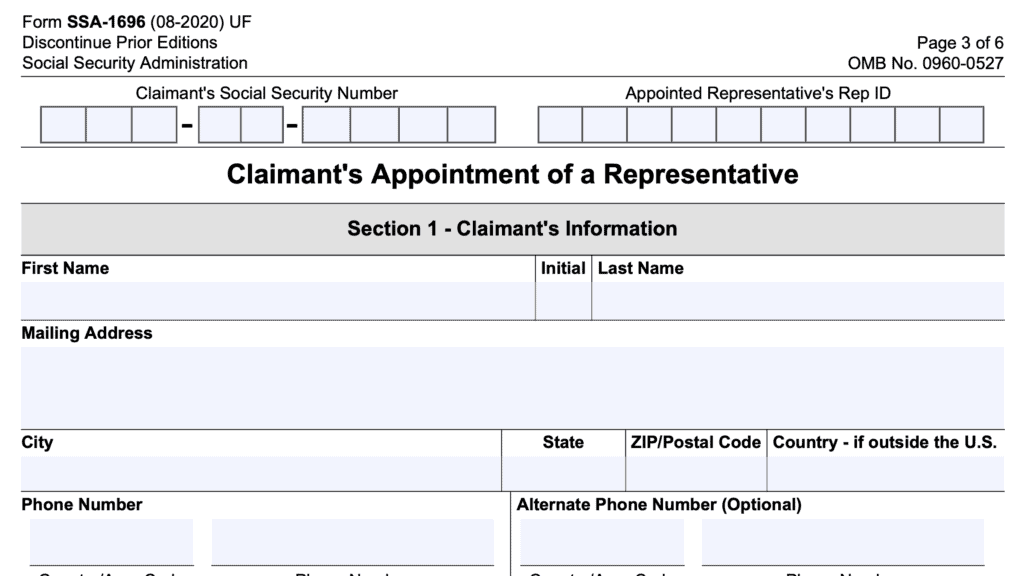

Page 1 contains the beginning of the application. This section will contain the Social Security number for both the rep payee applicant and the claimant. This section also contains the full legal name of each person.

If you are applying as the rep payee on behalf of the beneficiary

Skip Item 1. Only the claimant should fill out Item 1. When you are the rep payee, you’ll complete items 2-5, with justification for each field.

If you are the court-appointed legal guardian or conservator

Include information regarding the circumstances of the appointment at the bottom of Page 1. Because this is not a separate line item, this section is easy to miss.

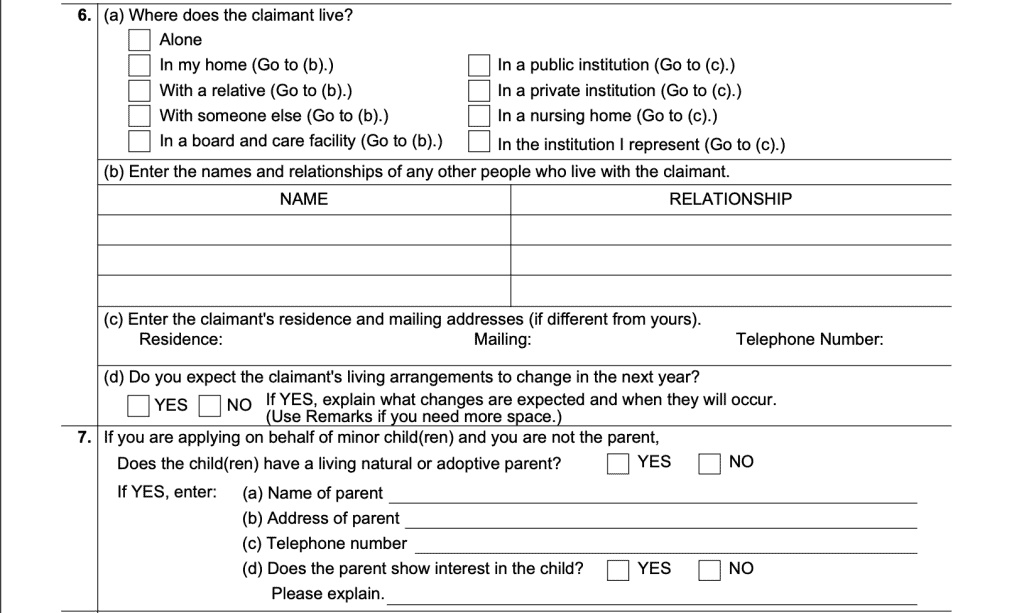

Items 6-7

These sections contain more information about the living conditions and care of the claimant.

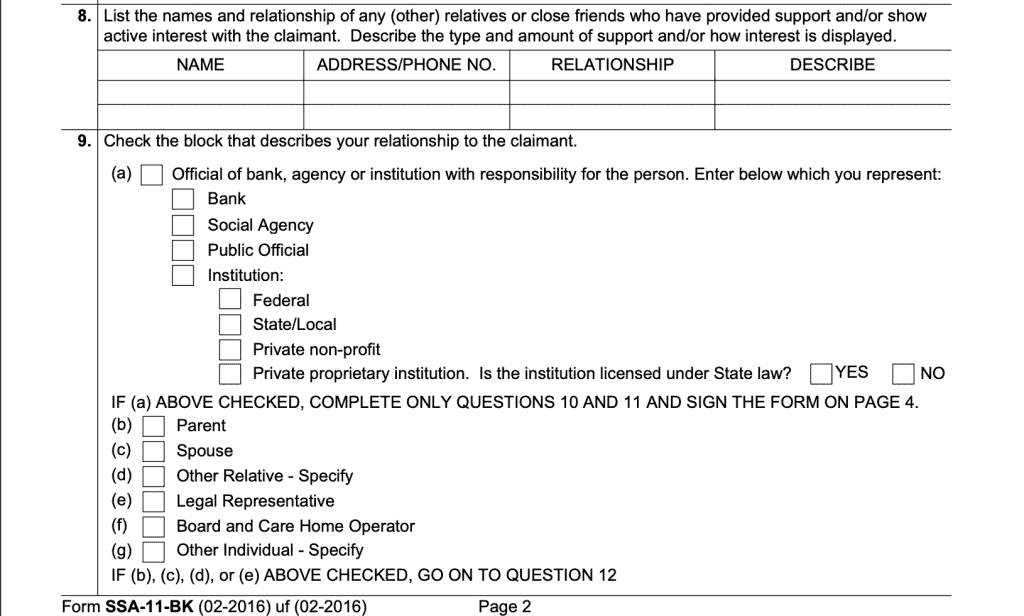

Items 8-9

The bottom of Page two explores the relationship of any person or entity who may have provided support or shown an active interest in the claimant.

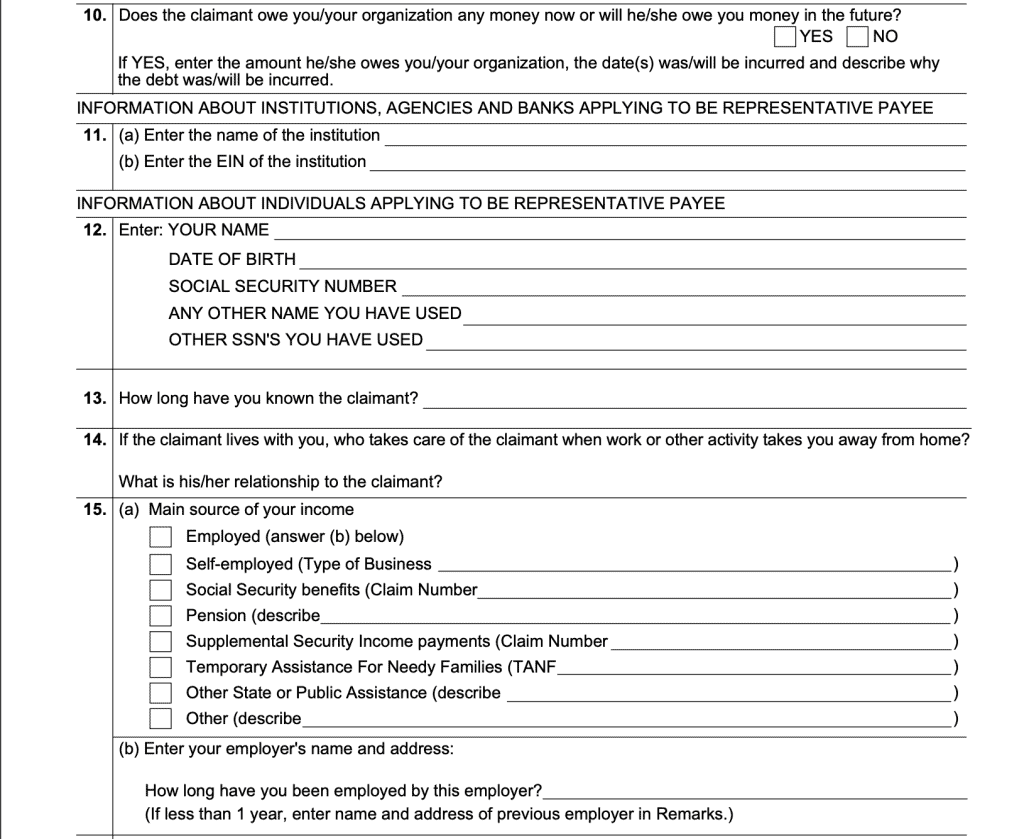

Items 10-15

At the top of Page 3, the questionnaire asks about financial information, including:

- Does the claimant owe money to the applicant?

- If an institution is applying, name of the institution, as well as the institution’s EIN

- Applicant’s main source of income (for example, the applicant’s own benefits from Social Security)

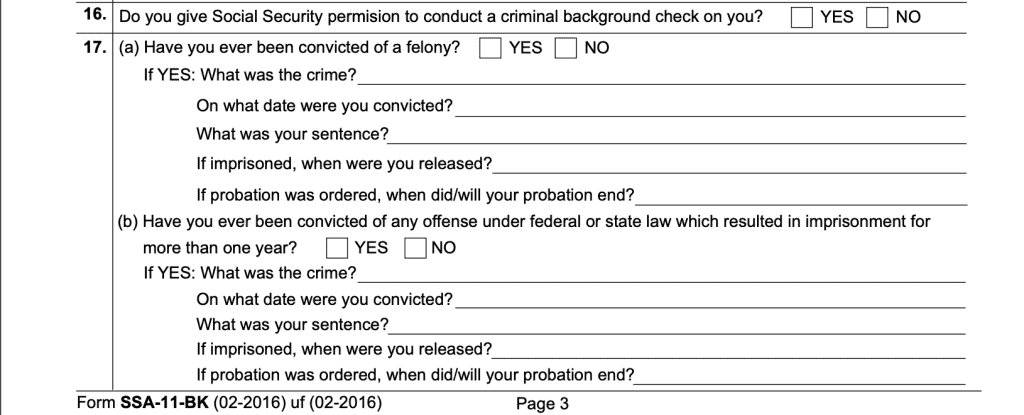

Items 16 & 17

At the bottom of Page 3, the applicant gives permission for the Social Security Administration to conduct a criminal background check and asks about any felony convictions.

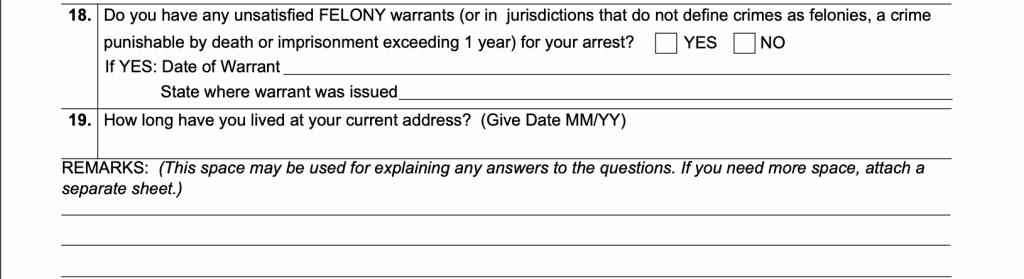

Items 18 & 19

The top of page 4 asks for information on unsatisfied felony warrants (like date of the warrant and where the warrant was issued), as well as how long you’ve lived at your current address.

The remarks section is for any additional information you may need to provide to further explain any of the other fields.

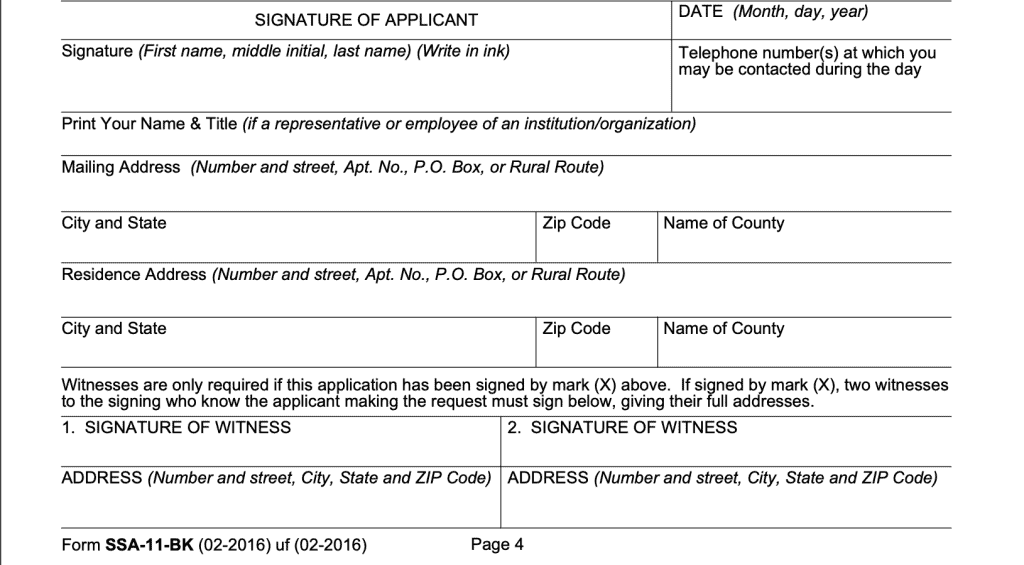

Signature Block

The signature block contains your sworn signature that the information you’ve given is accurate to your knowledge. It’s important to note that this is punishable under penalty of perjury. If there is proof that false information was provided, or that the applicant filed a fraudulent application, that person can be prosecuted by the United States government.

You’ll also enter:

- Full legal name

- Mailing address

- Residence address (if different from mailing address)

- Date

- Telephone number

This is known as a representative payee, and may help you handle the finances of the beneficiary in a way that better serves their best interest. This article will walk you some of the details you need to know about Form SSA 11-BK, and how to become a representative payee.

What is a representative payee?

A representative payee is an individual or organization that the SSA has appointed to receive Social Security benefits or Supplemental Security Income payments (SSI) on behalf of a beneficiary who cannot manage their own finances.

This might include:

- Legal guardian or adoptive parent of a minor child

- Caretaker for an incompetent adult

In cases where a representative payee is appointed, the rep payee is expected to maintain detailed records to document that the Social Security payments were used on the beneficiary’s behalf.

Video walkthrough

Frequently asked questions

Form SSA-11-BK is the legal form that must be completed if a representative payee application cannot be completed through the electronic Representative Payee System (ERPS). For example, an applicant without a Social Security Number must complete Form SSA-11-BK.

Unlike most other Social Security forms, Form SSA-11-BK is not available online on the SSA’s federal government site. There is a huge potential for fraud impacting Social Security beneficiaries. Because of this, the SSA requires the representative payee to come to their local Social Security office. This allows a field office technician to conduct a face to face interview with the applicant.

During the face to face interview, the Social Security technician will determine whether your application can be processed through the electronic Representative Payee System (ERPS) or if Form SSA-11-BK must be filed.

Where can I find Form SSA-11-BK?

Most likely, you’ll be providing this information to the Social Security office, and your application will be filed electronically. If you have any technical questions, you should contact the local Social Security office or go to the representative payee home page on the SSA website.

For your convenience, the most recent version of this form is provided below.