Form SSA 795 Instructions

If you’re applying for Social Security benefits, you may be asked to provide additional information to the Social Security Administration. One method involves submitting a sworn statement on Form SSA 795.

In this article, we’ll cover what you should know in case you need to sign Form SSA 795, including:

- How to complete the form

- Reasons you may be requested to submit Form SSA 795

- Frequently asked questions about Form SSA 795

Let’s start with step by step instructions on completing this Social Security form.

Table of contents

How do I complete Form SSA 795?

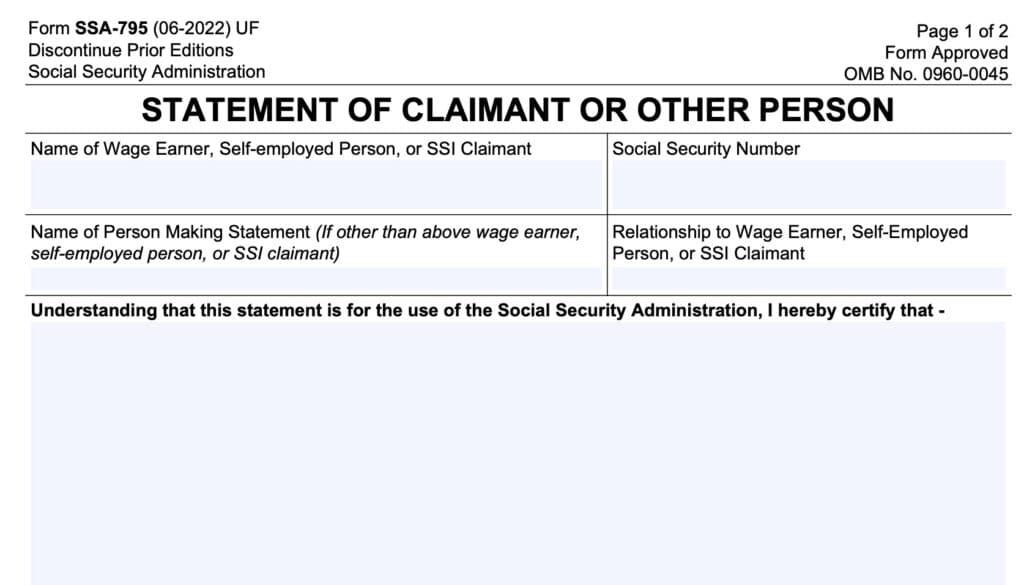

This two page SSA form is fairly straightforward. Let’s start at the top of Page 1.

Page 1

At the very top of the form, enter the following information:

- Name of the wage earner, self-employed person, or SSI claimant (Supplemental Security Income)

- Social Security number

- Name and relationship of person making statement, if different from the claimant, if applicable

Just below the claimant’s personal information fields, you’ll enter a sworn statement related to the application.

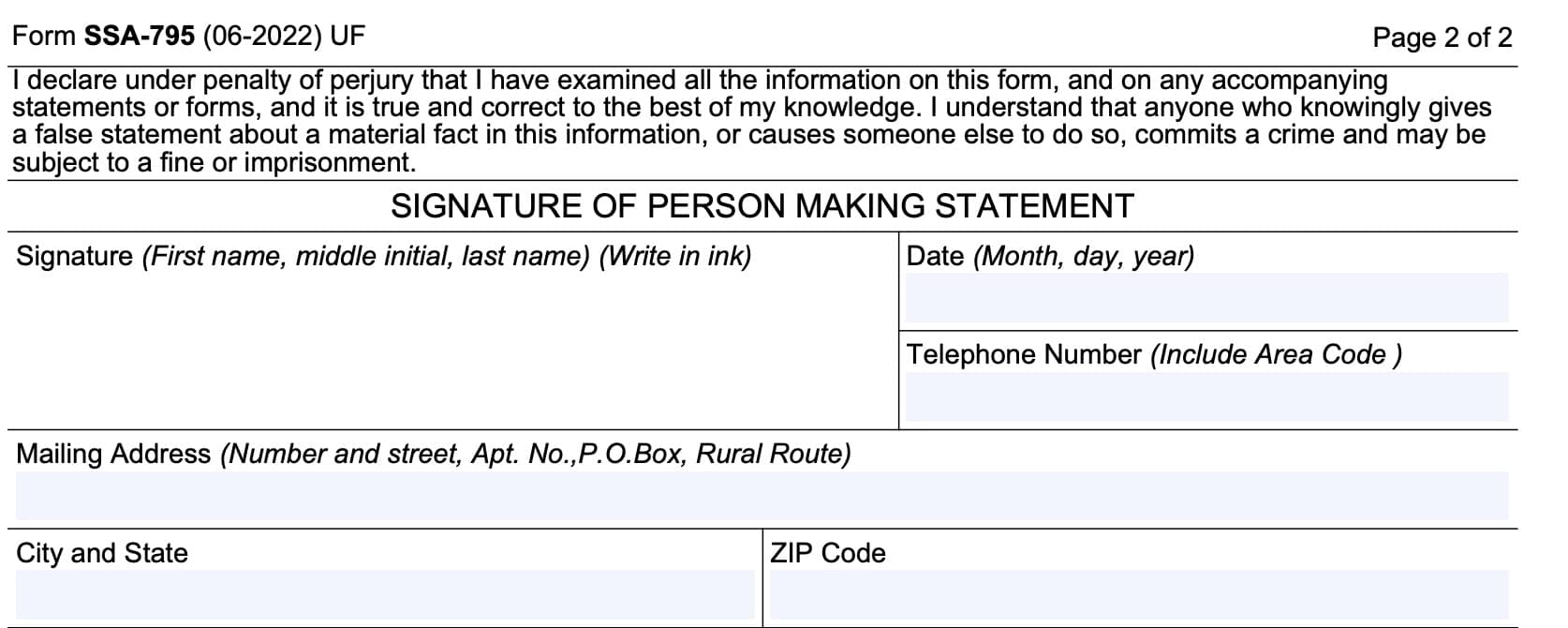

Signature

At the top of page two, you’ll enter your contact information and sign the form. Your contact information includes:

- Telephone number (including area code)

- Mailing address

- Include city, state, and zip code

There are a couple of notes worth discussing before you complete this signed statement.

Making intentional false statements is a punishable offense.

At the very top of the form, it states:

“I understand that anyone who knowingly gives a false statement about a material fact in this information, or causes someone else to do so, commits a crime and may be subject to a fine or imprisonment.”

The Social Security Administration also states that use of this form is completely voluntary, and that no applicant has to submit any information if they do not want to.

However, the SSA requires accurate information, so if you don’t submit the requested data, you might not receive SSA benefits, such as retirement payments, survivor benefits or SSI benefits.

If you’re informing on the other person, the SSA can’t guarantee that you’ll stay anonymous.

Sometimes, people wish to report someone fraudulently claiming disability benefits, such as a neighbor. Many times, they wish to do so in an anonymous manner, so the claimant does not know where the information came from.

However, the Social Security Administration’s Program Operations Manual System (POMS), tells SSA employees the following:

Occasionally an informant will provide information only in confidence; i.e., they do not want the claimant or beneficiary or other person with whom we might expect to discuss the information to know the source of our knowledge or possibly even the fact that we possess it. Inform the person making the request that we cannot promise that we will not disclose the information.

SSA POMS GN 00301.305 Statement(s) or Opinions of Claimant(s) or Other Person(s)

In other words, if you’re making a statement about another person, assume that they will find out.

Your information might be shared with third parties

In fact, count on this.

In the Privacy Policy section, the Social Security Administration gives a legal disclaimer that they might share some of your information with other federal agencies or contractors for the purpose of managing their programs more efficiently.

However, they also say that they can share your information to third parties for the purpose of overpayment recovery, or collection efforts.

In other words, if you are overpaid by the Social Security Administration, and you do not work with them in good faith on overpayment recovery, your personal information can go to debt collectors.

There are a couple of ways you can lower the odds that the SSA will get debt collectors involved:

File Form SSA 634: Request for Change in Overpayment Recovery

By filing this form, you aren’t disputing your overpayment. You’re simply asking for the SSA to collect the overpayment in a way that you can afford.

Most likely, this request would involve stretching the repayments over a longer period of time. For more information, check out our guide on filing Form SSA 634.

File Form SSA 632-BK: Request for Waiver in Overpayment Recovery

With this waiver form, you’re asking the Social Security Administration to forgive the overpayment, because the collection efforts would create an economic hardship.

Check out our Form SSA 632 guide to learn more about overpayment recovery waivers!

Words matter. The wrong ones might come back to haunt you if you’re not careful.

When you submit your Form SSA-795, you should be aware that the SSA is paying attention to what you say. Specifically, the SSA wants to see how your statement matches with other information that might be in their records.

Below is evaluation criteria contained in the SSA POMS manual for evaluating statements submitted on Form SSA-795:

Consider the following criteria when evaluating statements made by claimants or others:

- Is the statement free of inconsistencies? Is the statement clear and precise?

- Does someone who has a personal interest in the outcome make the statement?

- If so, we should consider this in determining how much weight to give the statement.

- Is there any indication of bias for or against the claimant?

- Is the statement one that denies knowledge of a fact although the statement-maker was clearly in a position to know the facts?

- Is the statement one that contains elements, which we can independently corroborate by other evidence?

- Is the statement one containing information against the statement-maker’s own best interests or is it self-serving?

- When did the claimant or other person make the statement?

- Is the claimant’s or other person’s statement based on memory of something that occurred recently or long ago?

- Is the claimant’s or other person’s statement based upon first-hand knowledge, rather than opinion, inferences, or hearsay?

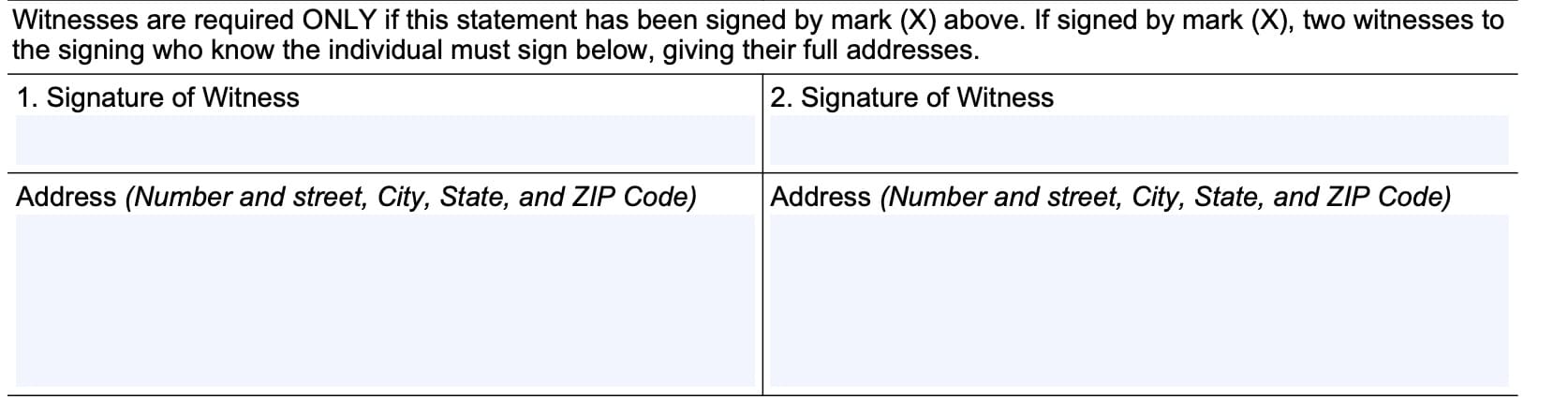

Witness signature

This section is only required if the person signing this form signed with a mark (such as the letter X), instead of their legal name.

In this situation, the person’s signature must accompany two witness signatures. Each witness must attest to their personal knowledge of the applicant, and each witness must list their full mailing address in the provided space.

A witness isn’t affirming the accuracy of the statement of fact, or to the truthfulness of any submitted information. The witness is only attesting to the fact that they personally know the person signing the form.

Reasons you may need to submit Form SSA 795

This form is pretty versatile, and can be used for a variety of purposes. For example, the Social Security Administration may use this to help document other types of correspondence, such as phone calls or in person visits.

According to the SSA POMS, here is a partial list of uses for this form:

- Statements on legal and equitable adoption;

- Statements about divorce and termination of a prior marriage of a claimant or number holder (NH);

- When there is a conflict in the evidence;

- Special situations where unusual development is found necessary by one of the following:

- The field office (FO)

- The foreign service post (FSP), or

- The payment center (PC);

- Developing wage discrepancy and coverage cases which involve specific problems; and

- Joint bank account rebuttal or designation of burial fund for Title XVI claims.

Video walkthrough

Frequently asked questions

Generally, you’ll submit your completed Statement of Claimant form (Form SSA 795) in person at your local Social Security office.

Any person can complete Form SSA 795 to provide additional information. In many situations, the SSA employee may complete a statement of claimant form on your behalf, then ask you to sign it or mail it to your for your signature.

Unfortunately, this form does not support electronic signatures. You must print this as a paper form and sign it with a pen, then submit it to your Social Security office.

The SSA may ask for additional information about you as you’re applying for Social Security benefits or Medicare Part B. This is not always a necessary form, but may be used to provide related information about your case to the SSA to support an initial application.

Where can I find Form SSA 795?

As with other Social Security forms, you can find Form SSA 795 on the Social Security Administration’s website as PDF forms for download.

For ease of use, we’ve attached the latest version of Form SSA-795 as a fillable form in this article.