Form SSA 8240 Instructions

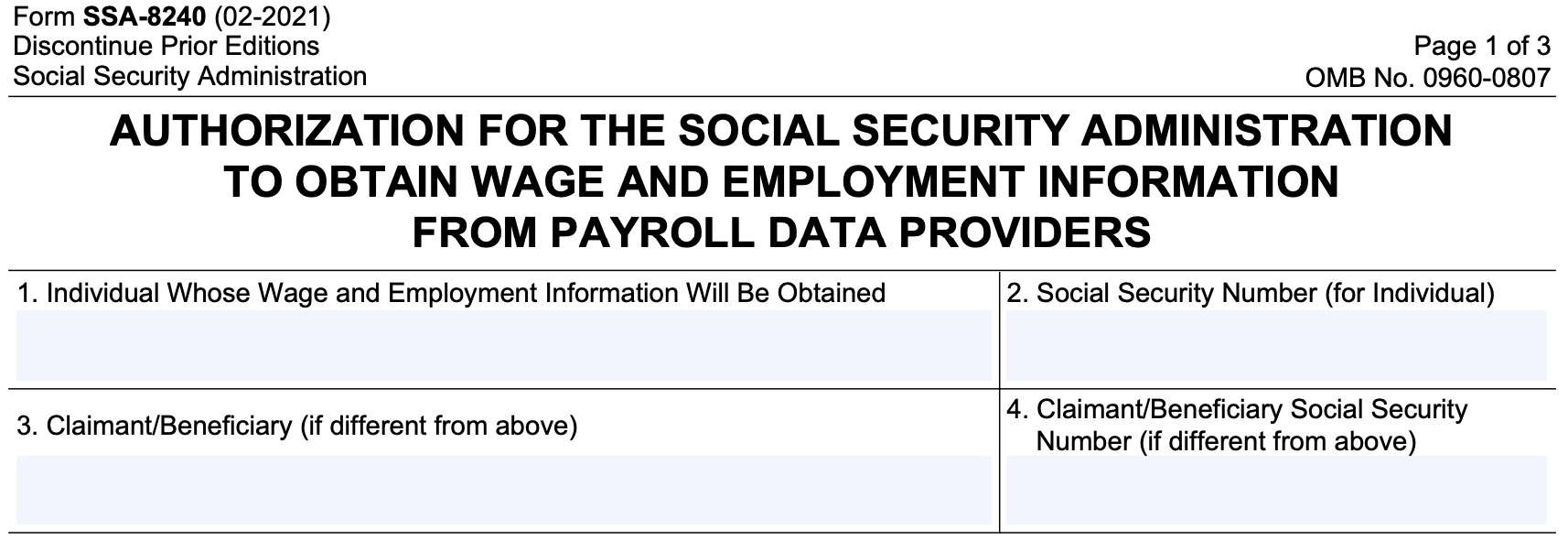

If you’re applying for Social Security disability benefits (SSDI) or Supplemental Security Income (SSI), the Social Security Administration (SSA) may ask you to complete Form SSA 8240. This form authorizes the SSA to obtain certain pay and income information from payroll providers for benefits determination purposes.

In this article, we’ll outline everything you need to know about Form SSA 8240, including:

- Step by step guidance on how to complete the form

- Disclosures you should be aware of before submitting the form

- How to submit the form

Let’s start by taking a closer look at Form SSA 8240.

Table of contents

How do I complete Form SSA 8240?

Completing Form SSA-8240 appears to be more difficult than it really is. We’ve broken this form down into a few digestible steps for you.

Let’s start at the top.

Applicant information

At the top of the form, you’ll see some information fields for the applicant.

Line 1

Enter the name of the person whose earnings records and personal information will be accessed through this authorization form.

Line 2

Enter the Social Security number (SSN) for the person named in Line 1.

Line 3

If different from Line 1, enter the beneficiary’s name or the claimant’s name in Line 3.

Line 4

If necessary, enter the claimant’s or beneficiary’s Social Security number in Line 4.

Line 5

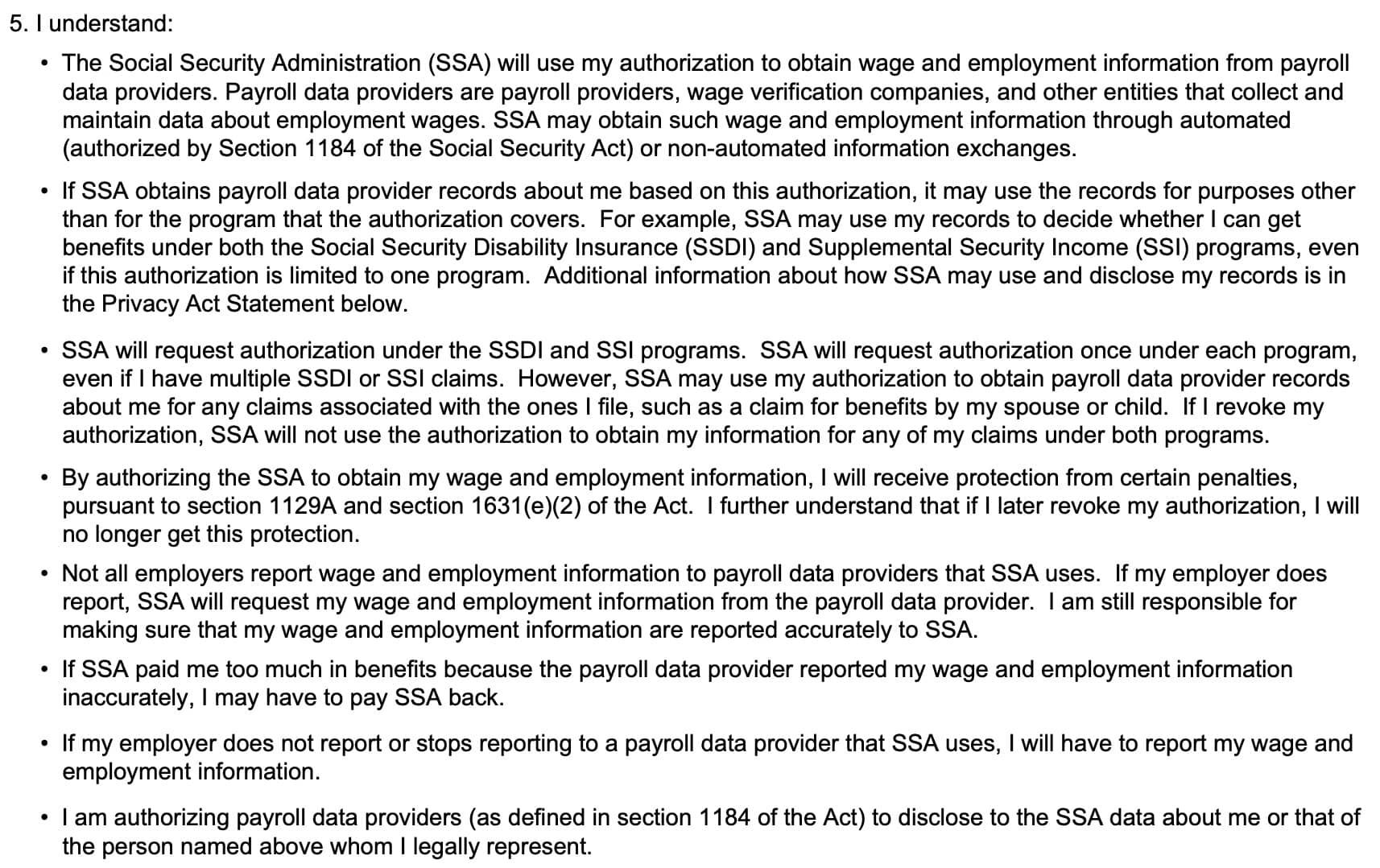

Before you have to answer additional questions, the Social Security Administration wants you to understand some basics about Form SSA-8240.

Let’s take a closer look at the fine print.

What you are signing

In this section, you are acknowledging that you understand certain things about your request. Let’s go through each of these acknowledgements for a better understanding.

The SSA will obtain wage and employment information from payroll data providers through automated or non-automated information exchanges.

In other words, the Social Security Administration can go to payroll providers, wage verification companies, or other entities to collect information about your employment wages.

The SSA can do this through automated information changes or by using manual methods.

If the SSA obtains payroll data provider records about you through this authorization, it may use those records for purposes other than for the program that the authorization covers

This is an important acknowledgement, and the SSA even outlines a hypothetical scenario for you.

For example, let’s imagine that you authorize the SSA to use your records for Social Security Disability Insurance (SSDI) purposes, but not for Supplemental Security Income (SSI) purposes.

In this situation, the SSA still maintains the right to use that authorization to decide whether you are eligible to participate in SSI.

Finally, the SSA can share any of this information with a third party. According to the Privacy Act provisions, the SSA can share your information with other federal agencies or with contractors that help maintain Social Security programs.

SSA requests authorization under both the SSDI and SSI programs

However, you don’t have to approve either.

Once you do, then that authorization will be used for future claims, including initial claims for Social Security benefits on behalf of a child or spouse. Presumably, but not stated, this could also include claims on behalf of an ex-spouse.

Any authorization will remain open until you choose to revoke it.

You may receive protection from certain penalties that you would be subject to if you did not sign the authorization

If you make this authorization, you’ll receive protections from certain penalties under the Social Security Act. Let’s take a closer look.

Section 1129A: Section 1129A of the Social Security Act outlines certain penalties for submitting false or misleading statements. These civil penalties include ineligibility for certain benefits that would otherwise be available, according to the following schedule:

- 1st offense: 6 months

- 2nd offense: 12 months

- 3rd and subsequent offenses: 24 months

Section 1631(e)(2): Outlines penalties for failure to report events or changes related to eligibility or benefits entitlements. This can also include delays without good cause. These penalties are:

- 1st offense: $25

- 2nd offense: $50

- 3rd and subsequent offenses: $100

If you revoke the authorization, then you may receive these penalties in the future.

Not all employers report wage and employment information to payroll data providers

However, you may still be responsible for making sure that my wage and employment information are properly reported to the SSA, even if the employer stops reporting on your behalf.

Otherwise, you’re authorizing payroll providers to disclose the information that SSA requests.

You might have to pay SSA back

If, during the discovery of your pay records, the SSA determines that you received excess SSDI payments or SSI payments, then they may issue SSDI or SSI redeterminations and can recoup the overpaid funds.

Although this is probably the scariest possibility for many beneficiaries, you have options in this situation. You can request that the SSA do one of two things:

Request that the SSA let you keep the money because collecting the overpayment would cause an undue financial hardship

By filing Form SSA-632-BK, you acknowledge that the SSA overpaid you. However, you also sincerely believe that you cannot repay over any timeframe because it would cause you an undue hardship.

Request that the SSA change their overpayment recovery

In this situation, you acknowledge that the SSA overpaid you, and that you may be able to repay the money without undue hardship.

However, you are asking the SSA to reduce your payment amounts and collect the money over a longer period of time so that you can continue to pay your living expenses.

You can request a change in the overpayment recovery method by filing Form SSA 634-BK.

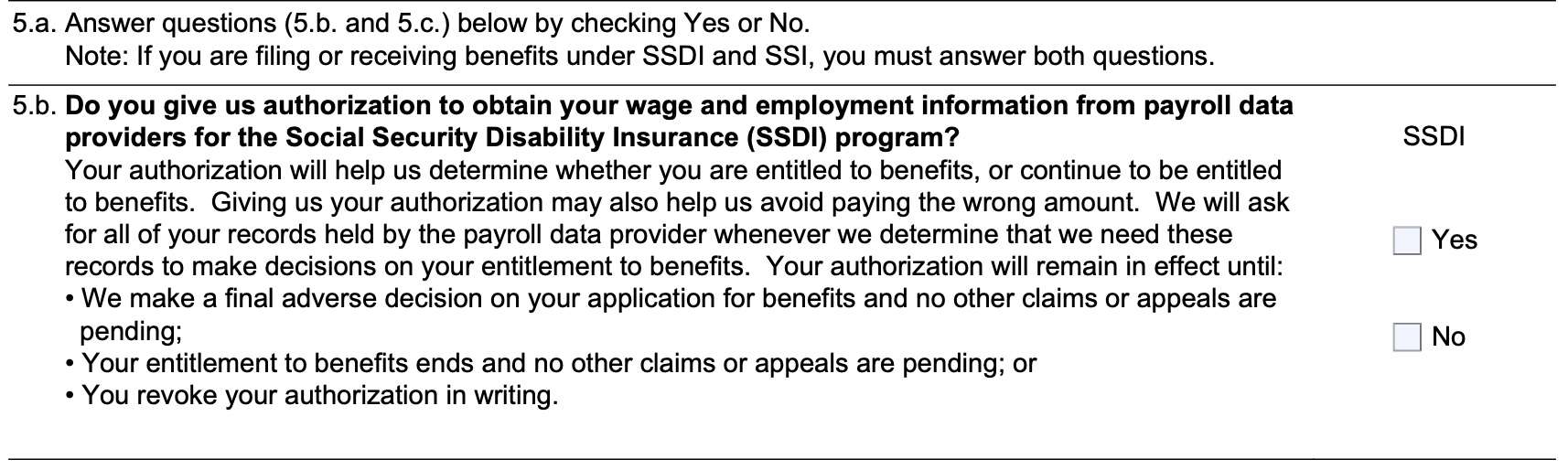

SSDI question

If you’re receiving or filing for either SSI benefits or SSDI benefits, you must answer both questions below.

Indicate whether you authorize the SSA to obtain your wage and employment information for the SSDI program.

If you select yes, your authorization will stay in place until:

- The SSA makes a final adverse decision on your disability application, and the entire application process, including the appeals process, has run its course

- Your disability benefits entitlement ends, or

- You revoke your authorization in writing

In light of the information outlined in the fine print above, you might consider revoking your authorization in writing when you no longer want the SSA to obtain information from data payroll providers.

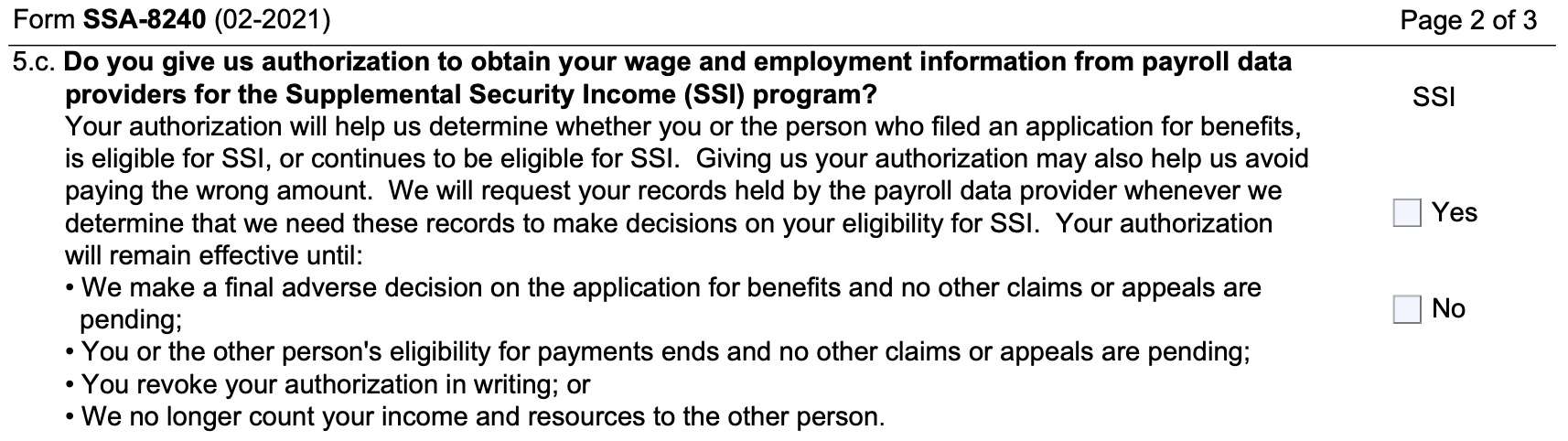

SSI question

In a similar manner as the SSDI question, you’ll need to check Yes or No to whether you will allow the SSA to obtain wage and employment information for SSI purposes.

This authorization remains in place until:

- The SSA makes a final adverse decision and there are no other claims or appeals pending

- You or the other person’s benefits eligibility ends

- You revoke your authorization in writing, or

- The SSA no longer considers your income and resources for the other person

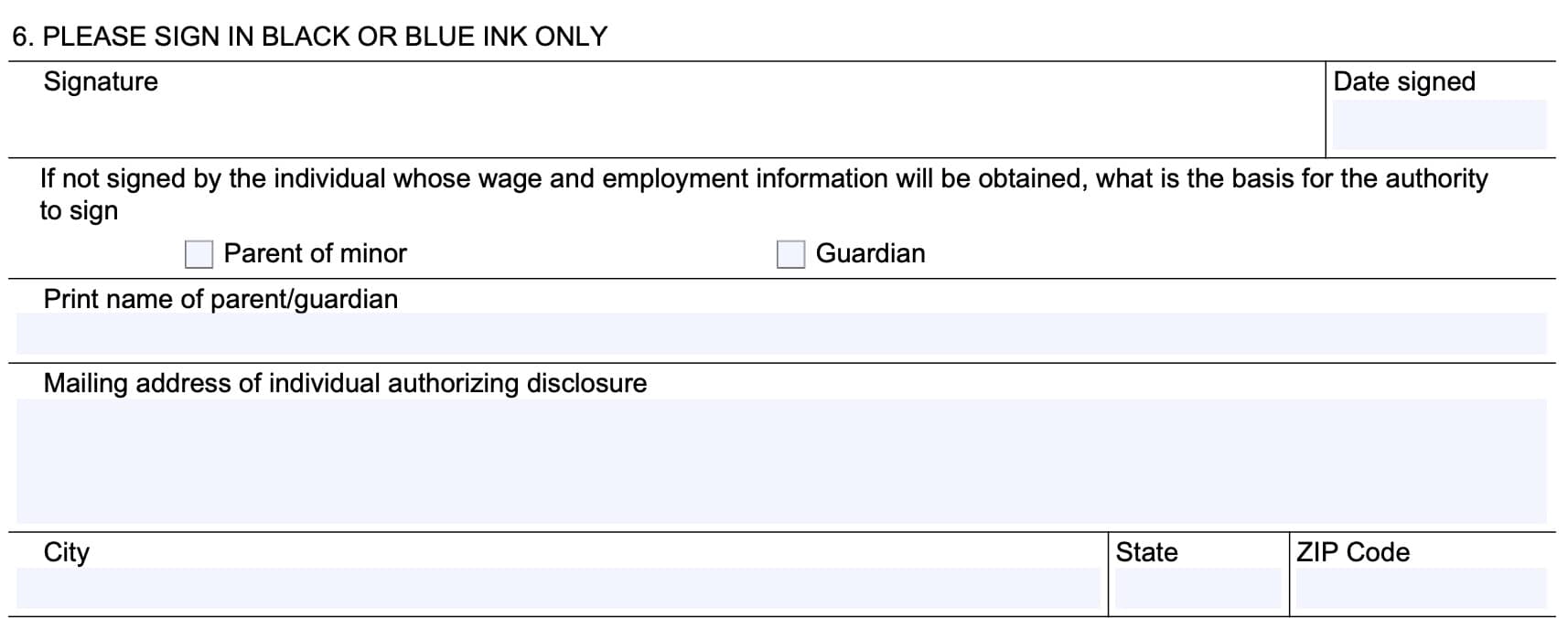

Applicant signature

As directed, sign and date the form in blue ink or black ink only.

If you are signing this form, but you are not the individual whose information will be obtained, then you need to indicate why you have authority to sign. You can check one of two boxes:

- Parent of minor

- Guardian

Afterwards, print the name of the parent or guardian, as well as the mailing address for that individual.

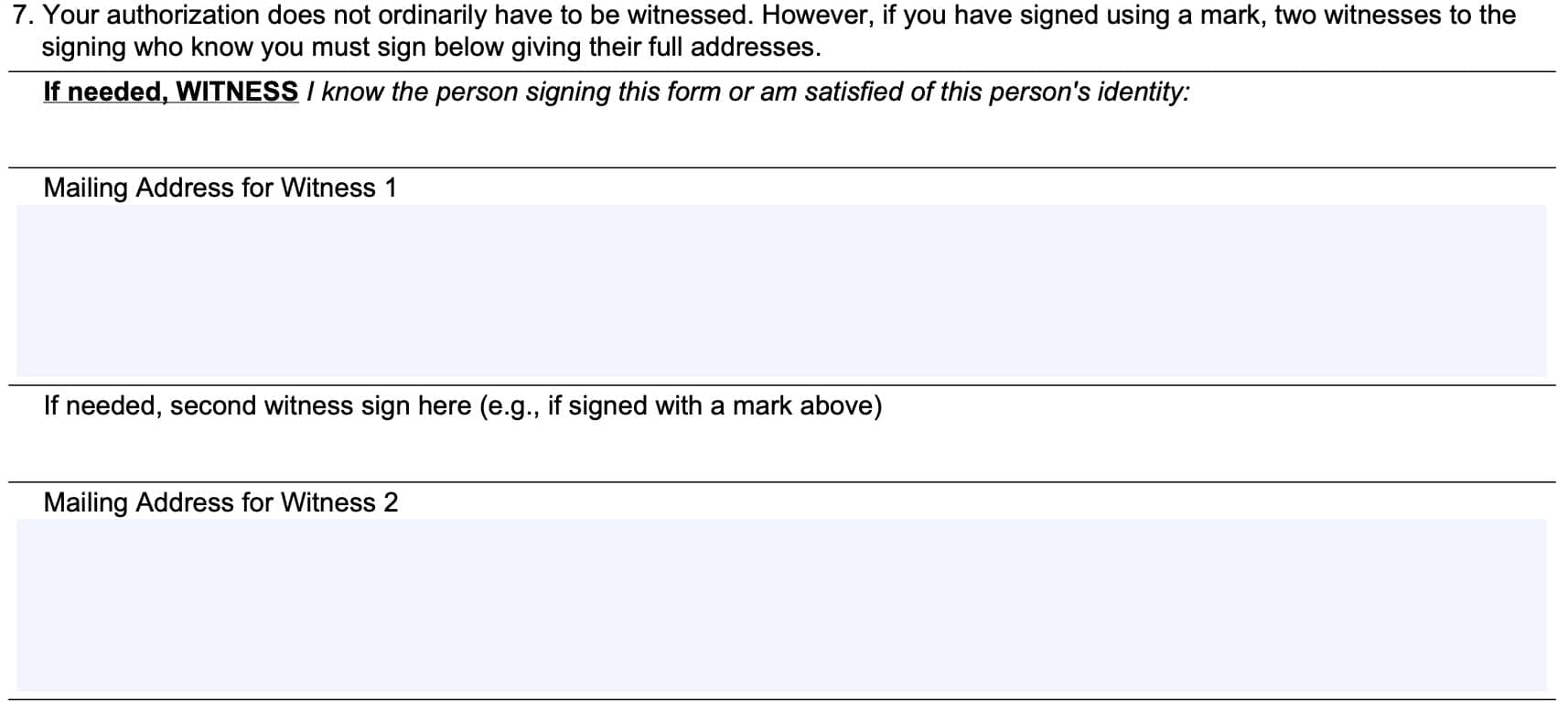

Witness signature

The witness signature field is optional. However, if this form is signed by a person who uses a mark (such as ‘X’) instead of an official signature, then you will need two witnesses to:

- Sign the form attesting that they personally know the person, and

- Enter their mailing address as contact information

How do I file Form SSA 8240?

Unfortunately, there is no guidance on how to complete this form online, nor are their mailing instructions.

Unless you are directed otherwise, you should make arrangements to file your completed paper Form SSA 8240 with the SSA at your local office.

Video walkthrough

Check out our video tutorial for an overview of Form SSA-8240!

Frequently asked questions

Form SSA 8240 allows the Social Security Administration to obtain information directly from payroll data providers for purposes related to SSDI and SSI benefits.

According to the form, there is no mailing address to send your completed form to. Your best bet is to submit your completed form in person at the closest SSA field office.

Where can I find Form SSA 8240?

As with most Social Security forms, you can obtain Form SSA-8240 from your local Social Security office, or from the SSA website. For your convenience, we’ve enclosed the most current version in this article.