IRS Form 12509 Instructions

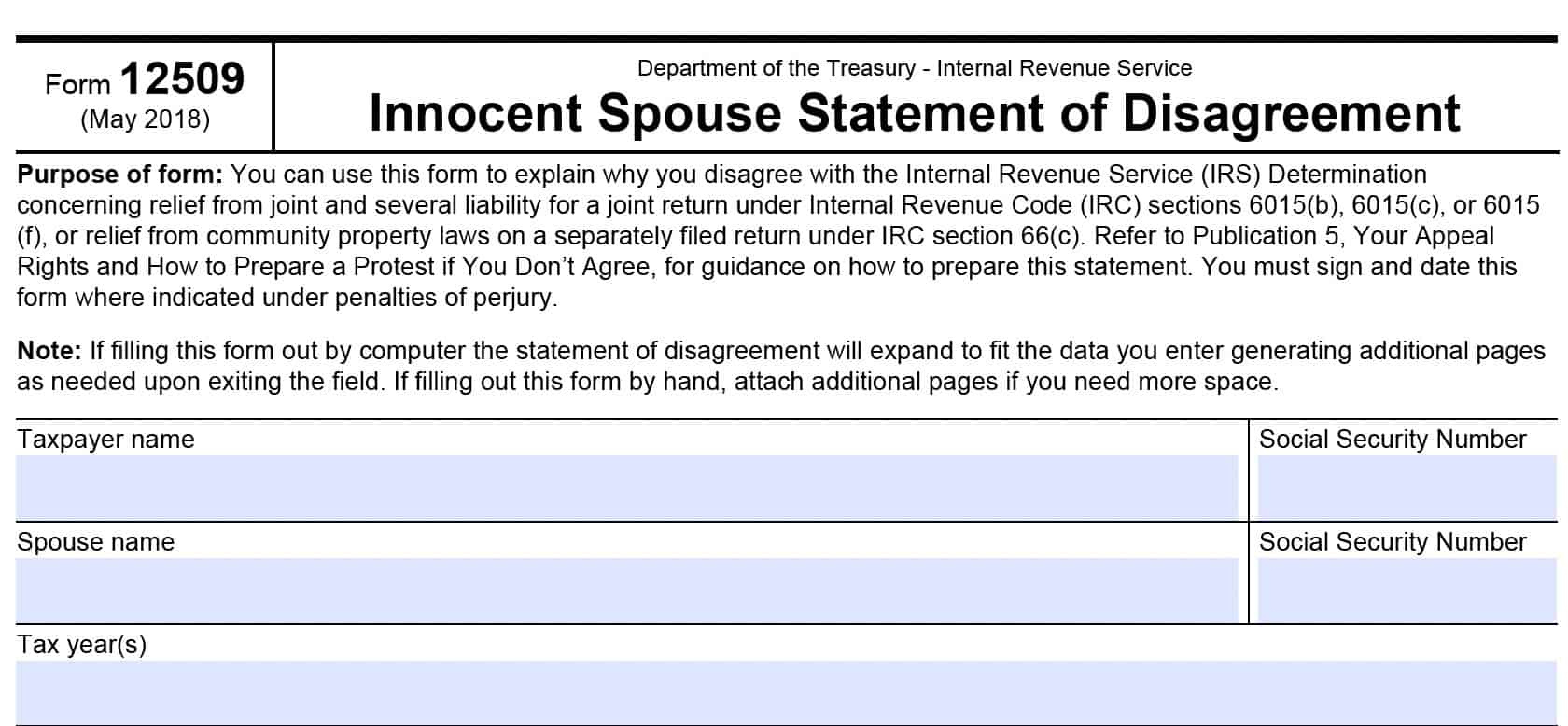

If you’ve received an innocent spouse determination that doesn’t go your way, you can appeal that IRS determination by filing IRS Form 12509, Innocent Spouse Statement of Disagreement.

In this article, we’ll cover everything you need to know about this tax form, including:

- How to complete and file IRS Form 12509

- How the IRS determinations work

- Your appeal rights

Let’s begin with a step by step overview of IRS Form 12509.

Table of contents

How do I complete IRS Form 12509?

This one-page tax form is relatively straightforward. To make it easier, we’ve broken IRS Form 12509 into three sections:

- Taxpayer information

- Statement of disagreement

- Taxpayer signature

Let’s start at the top with the taxpayer information fields.

Taxpayer information

At the top of IRS Form 12509, we’ll enter your taxpayer information for consideration. Enter the following information:

- Taxpayer name and Social Security number

- Spouse name and Social Security number

- Tax year or tax years related to the determination

Statement of disagreement

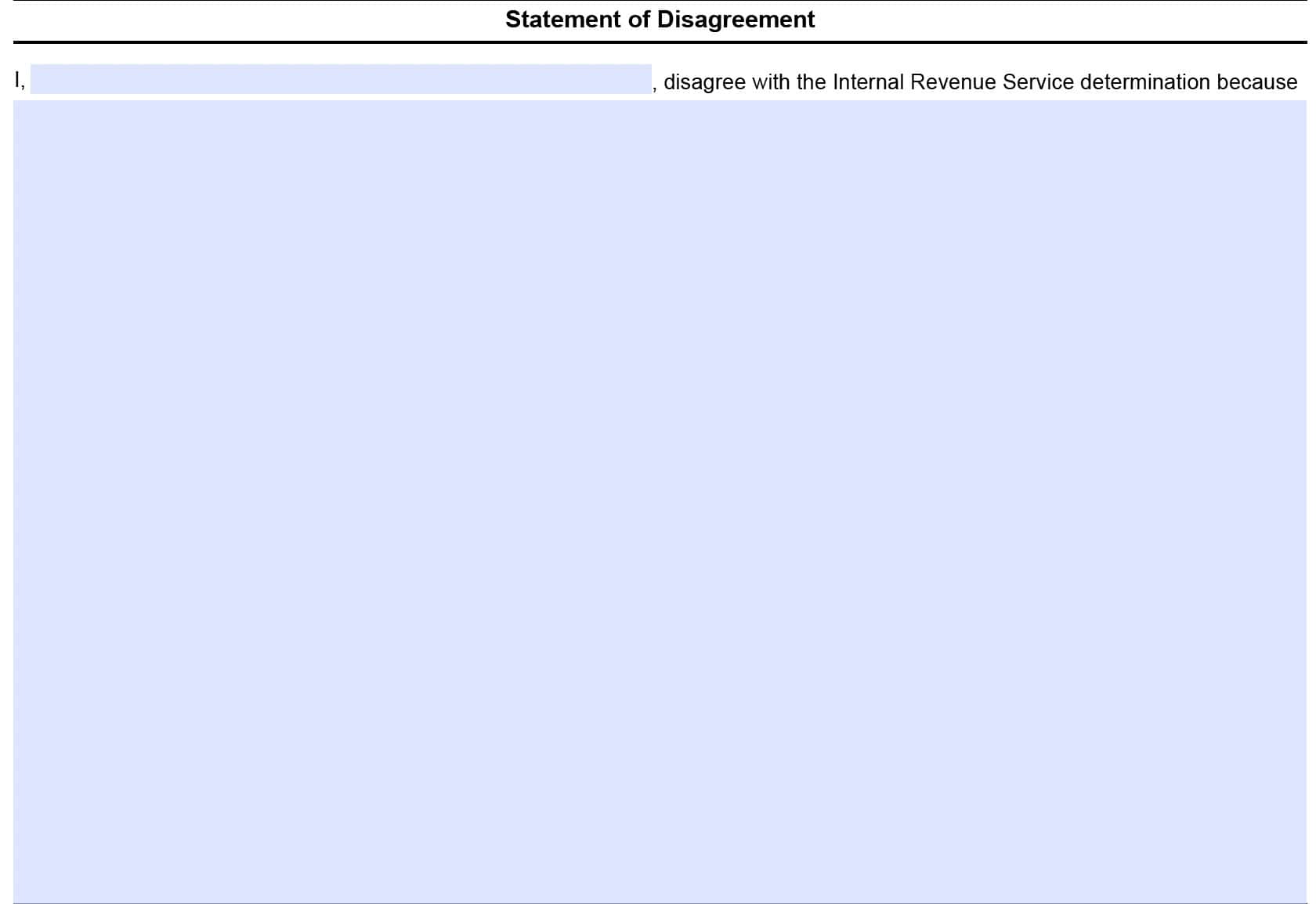

In this section, you’ll simply enter your name and supporting information on why you disagree with the IRS’ preliminary determination letter regarding your innocent spouse relief case.

While there isn’t much IRS guidance on what information you should include in this statement, there are a couple of helpful tips:

- Present your information in chronological order.

- Give specific dates

- Include supporting documentation as necessary

- Send the completed form and your supporting documentation to the IRS office address on your determination letter

- Do not send IRS Form 12509 to the Independent Office of Appeals. This will delay processing of your case

IRS Publication 5

IRS Publication 4, Your Appeal Rights and How to Prepare a Protest if You Disagree, contains some additional information about innocent spouse cases.

How you appeal the IRS decision depend on whether you are the requesting spouse or the non-requesting spouse.

If you are the requesting spouse

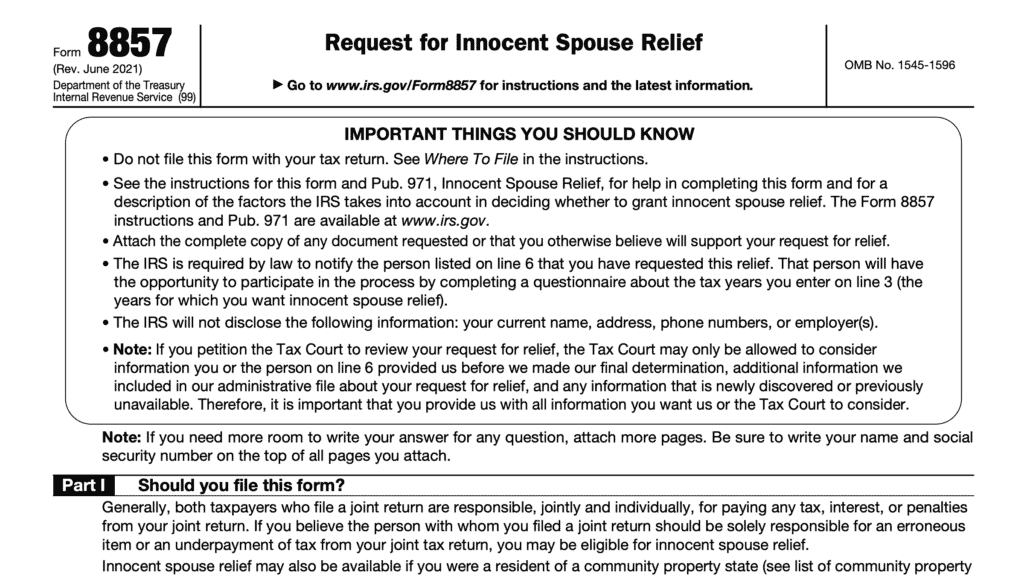

If you are the spouse who filed IRS Form 8857, Request for Innocent Spouse Relief, requesting innocent spouse relief, you’re generally referred to as the requesting spouse. As the requesting spouse, you can generally request an appeal if the IRS denies your request in whole or in part.

If you are the non-requesting spouse

If you are a non-requesting spouse, you can request an appeal if the IRS grants innocent spouse relief in whole or in part to your requesting spouse (or former spouse). However, a non-requesting spouse cannot appeal an IRS decision to deny relief to the requesting spouse (or former spouse).

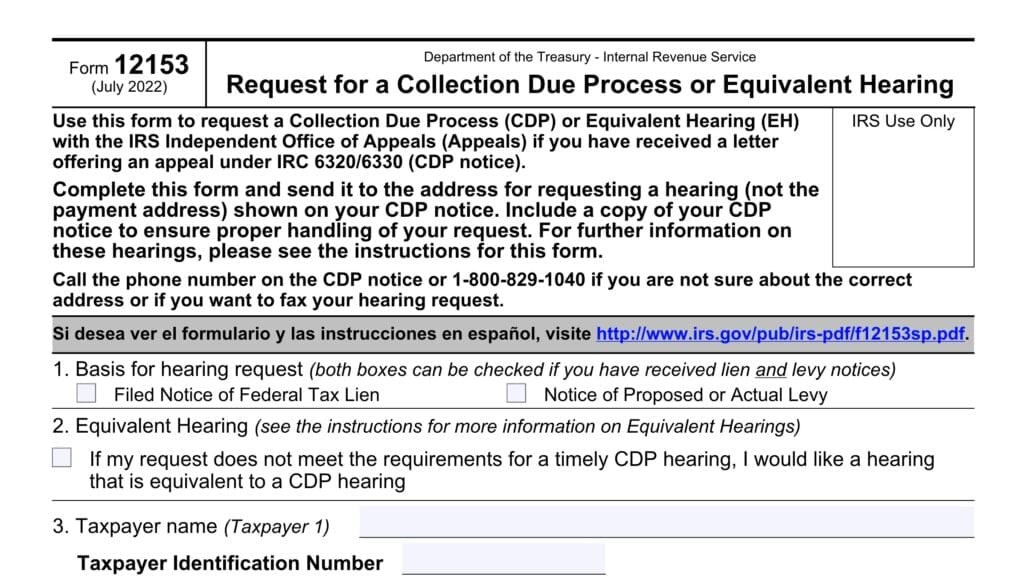

To start the appeals process, your appeal request must be submitted in writing.

You can use IRS Form 12509, Innocent Spouse Statement of Disagreement, to explain why you disagree with the IRS’s proposed determination concerning your request or your (current or former) spouse’s request for innocent spouse relief.

Appealing to the United States tax court

In certain cases, you may appeal the IRS decision to the U.S. Tax Court.

If you are the requesting spouse, you can petition the U.S. Tax Court to review your request for innocent spouse relief if:

- Six months have passed since you filed IRS Form 8857 and you have not received a final determination letter from the IRS; or

- You have received a final determination letter denying relief in full or in part and you petition the U.S. Tax Court no later than 90 days after the IRS sent you that letter.

- Your final determination letter should have a specified date. If it does not, you should use a conservative estimate that 90 days means 90 calendar days, not business days from the date of the letter.

- If the 90th day falls on a weekend or holiday, assume that you need to submit your petition before that weekend or holiday.

If you petition the U.S. Tax Court for relief, the Tax Court’s scope of review will be limited to:

- The IRS’s administrative record established at the time of the determination (the date of the final determination letter), and

- Any newly discovered or previously unavailable evidence.

Therefore, it is important for both the requesting and non-requesting spouse to provide all relevant, available evidence to the IRS before it issues its final determination. This allows the tax court to consider as much relevant information as possible when making its decision.

Taxpayer signature

At the bottom of your completed Form 12509, you’ll sign the document under penalties of perjury. Also, enter the date, a daytime telephone number, and preferred calling time.

Filing considerations

Here are some things to consider when filing your disagreement statement.

Appeals process

Below is a simplified version of how the IRS handles innocent spouse relief requests:

- IRS issues a preliminary determination letter to both spouses after one spouse files IRS Form 8857

- Either spouse may appeal the preliminary letter within 30 days of the date of the letter

- IRS issues a final determination letter

- Requesting spouse may appeal to the U.S. Tax Court:

- Within 90 days of the date, or

- If no final letter has been received within 6 months of the filed appeal

Factors for determining whether to grant equitable relief

According to IRS Publication 971, Innocent Spouse Relief, an IRS examiner should consider the following factors in innocent spouse cases when considering equitable relief:

- Marital status

- Economic hardship

- Will you be unable to pay reasonable basic living expenses if equitable relief is not granted?

- Knowledge or reason to know about:

- Understatement of tax on a joint return

- Unpaid taxes on their joint account

- Spousal abuse

Generally speaking, the spouse, or secondary taxpayer, would be more likely to receive equitable relief if:

- The spouses are already divorced

- Denial of relief would cause an economic hardship

- The spouse did not know, or would not reasonably be expected to know, about understatement or non-payment of taxes

- He or she is the victim of spousal abuse

Where you should file your disagreement statement

As a general rule, determination letters contain specific instructions on how and when to file Form 12509. Send your completed form and any supporting documents to the address in the determination letter.

Video walkthrough

Frequently asked questions

IRS Form 12509, Innocent Spouse Statement of Disagreement, is the IRS form that taxpayers can use to appeal an Internal Revenue Service decision regarding a negative innocent spouse determination. In most cases, this is the first step in the appeals process.

If an IRS decision results in the rejection of an innocent spouse claim, then both spouses (or each former spouse, if divorced) remain responsible for any outstanding tax liability, as well as accrued penalties and interest.

Where can I find IRS Form 12509?

You can find the latest versions of IRS forms, such as Form 12509, on the IRS website, as a PDF file. For your convenience, we’ve included IRS Form 12509 here, in this article. You may need to download the latest version of Adobe Acrobat to open the file.