IRS Form 15118 Instructions

If you received IRS notice CP562A concerning your request for an Adoption Taxpayer Identification Number (ATIN), you may need to respond with additional information. Also, the IRS encourages taxpayers to file IRS Form 15118, Response to Notice CP562A, once they receive the adopted child’s Social Security number.

In this article, we’ll go over what you need to know about IRS Form 15118, including:

- How to complete and file IRS Form 15118

- Filing considerations

- Frequently asked questions

Let’s begin with a step by step overview of this tax form.

Contents

Table of contents

How do I complete IRS Form 15118?

According to the Internal Revenue Service website, taxpayers should complete IRS Form 15118 when they’ve received their adopted child’s Social Security number. If you need to complete Form 15118, I strongly recommend that you complete the form in its entirety, even if you recently received a CP562A notice indicating only one or two items of missing information.

To make this easier, we’ve broken down this two-page IRS form into the following sections, in chronological order:

- Provide contact information

- Provide adoptive child’s information

- Signature

- Provide placement agency’s information

- Social Security number (SSN) of adoptive parents

- Change in contact information

Let’s take a closer look at each section.

Provide contact information

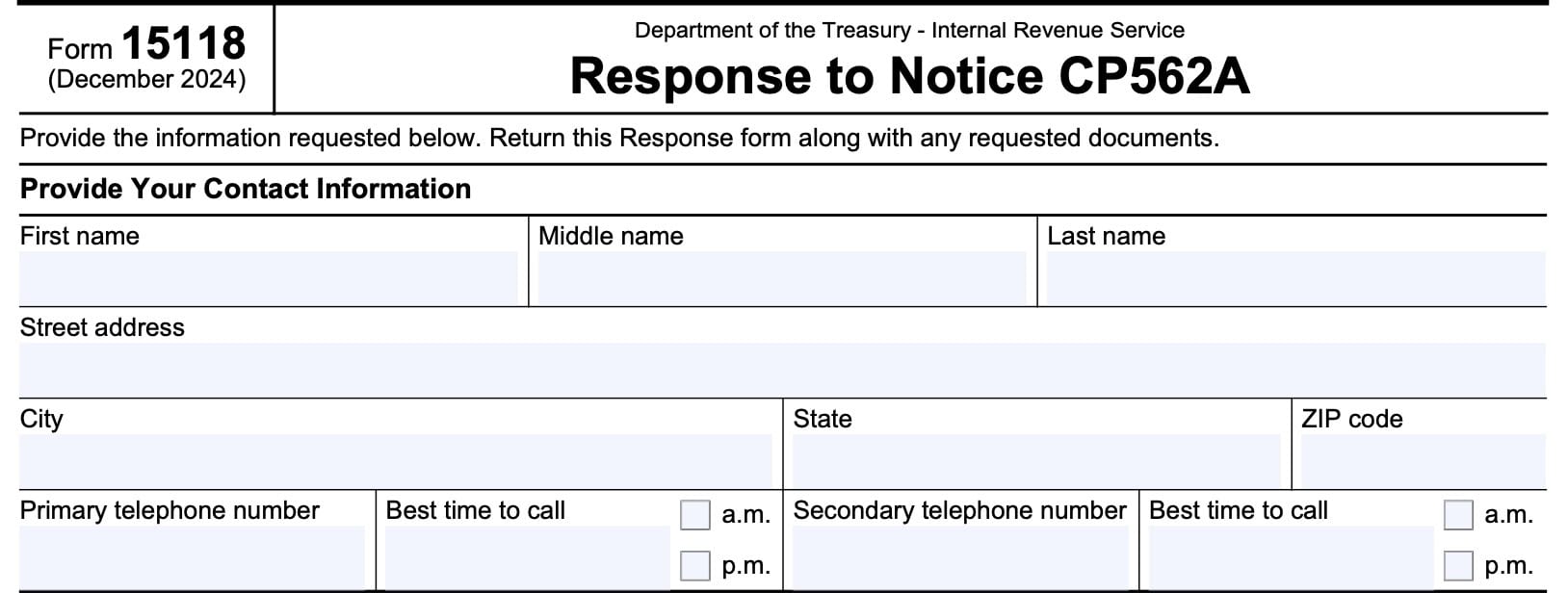

At the top of IRS Form 15118, you’ll need to enter your contact information, so that the Internal Revenue Service may reach you to address any questions.

Enter the following information, as indicated:

- Complete name, including first, middle, and last name

- Street address, including city, state, and zip code

- Telephone number, and preferred time to call

Provide adoptive child’s information

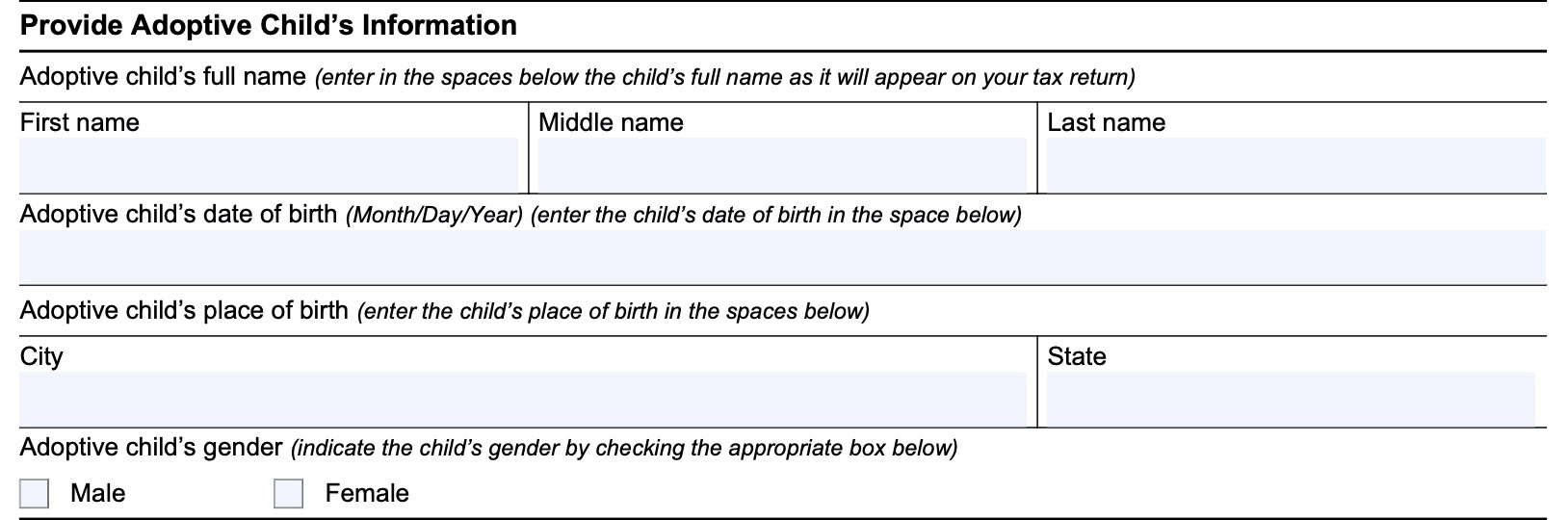

In the next section, enter information about the child that you’ve adopted:

- Complete name, including first name, middle, and last name

- Child’s date of birth (MM/DD/YYYY)

- Adoptive child’s place of birth (city and state)

- Child’s gender

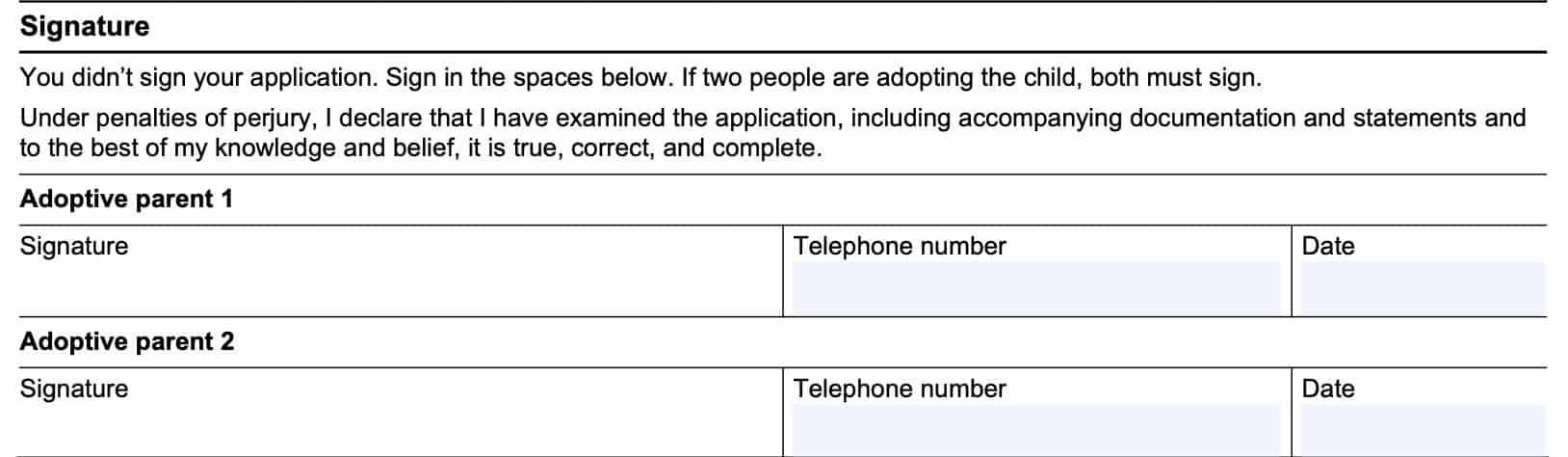

Signature

This section contains the adoptive parent signature fields. If a married couple is adopting this child, then both parents must sign.

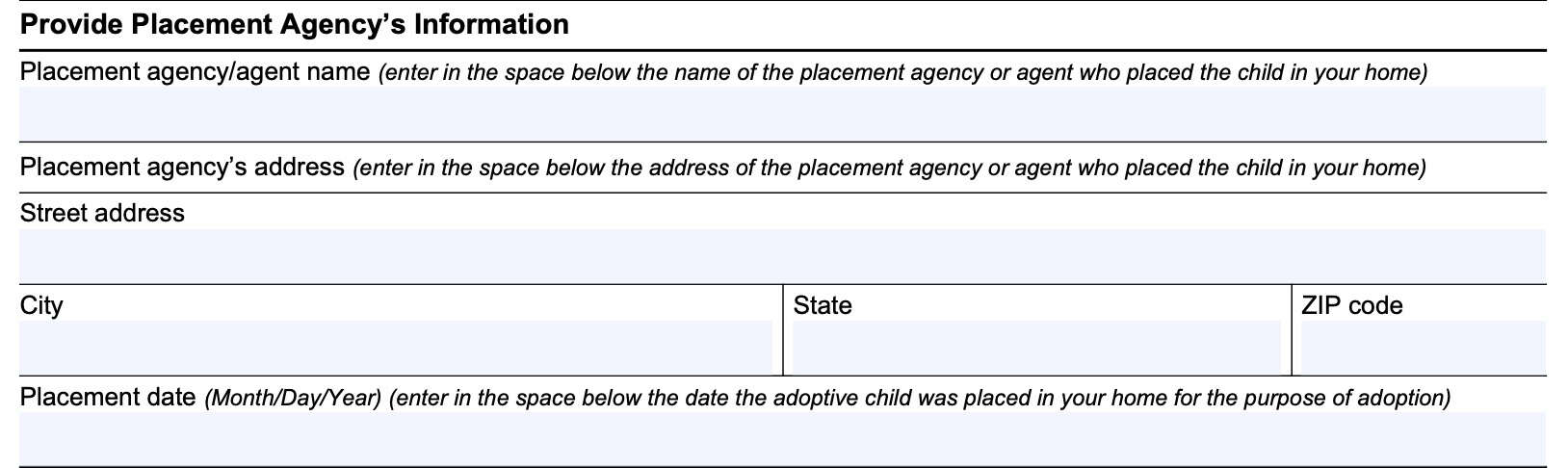

Provide placement agency’s information

In this section, enter the relevant information for the placement agency or the agent who helped with the adoption process. Include the following information:

- Placement agency or agent’s name

- Placement agency’s address, including city, state, and zip code

- Placement date (MM/DD/YYYY)

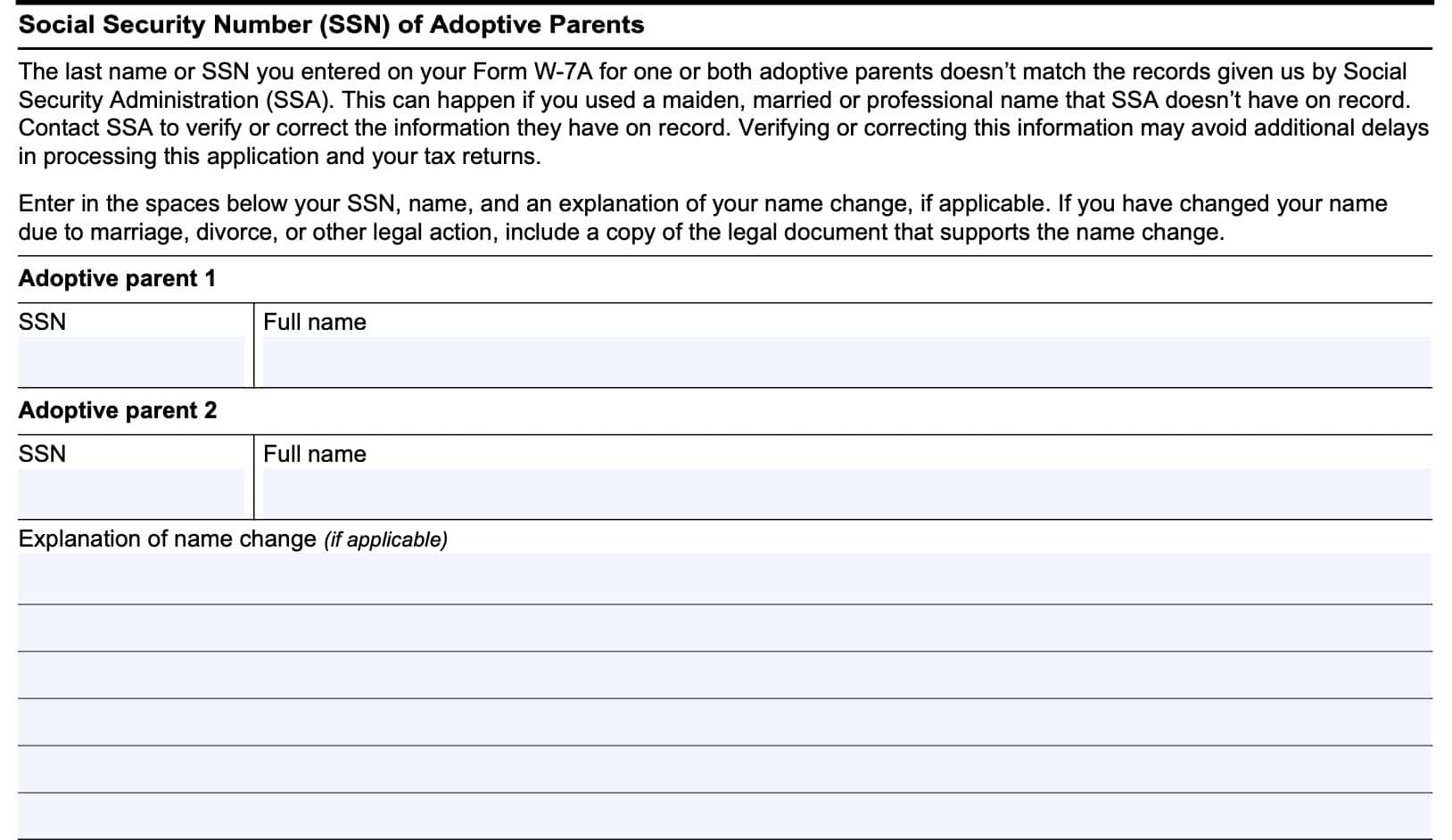

Social Security number (SSN) of adoptive parents

If the last name or Social Security number on your Form W-7A does not match the Social Security Administration’s records, you may need to complete this information.

This can happen if you used one of the following names that the SSA does not have in its files:

- Maiden name

- Married name

- Professional name

Enter the proper SSN and complete name in one or both fields, as applicable. Below, enter the explanation for the name change. Additionally, you’ll need to include a copy of the legal document that supports your name change.

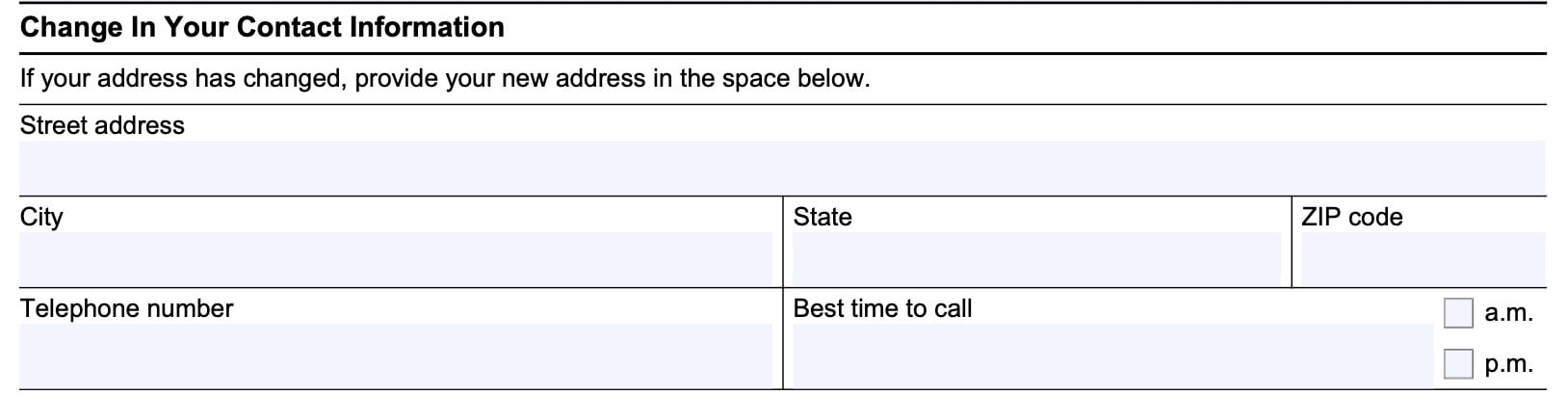

Change in contact information

If you’ve changed your contact information, you can update it in this field. Enter your new address or phone number as indicated below.

Filing considerations

Here are some filing considerations that you may want to take into account when filing IRS Form 15118.

This is a response to a computer-generated IRS notice

The title of this tax form is, Response to Notice CP562A. The CP refers to computer paragraph, indicating that this is automatically generated based upon certain criteria, without human interaction.

As indicated on the IRS’ CP562A page, the criteria is that:

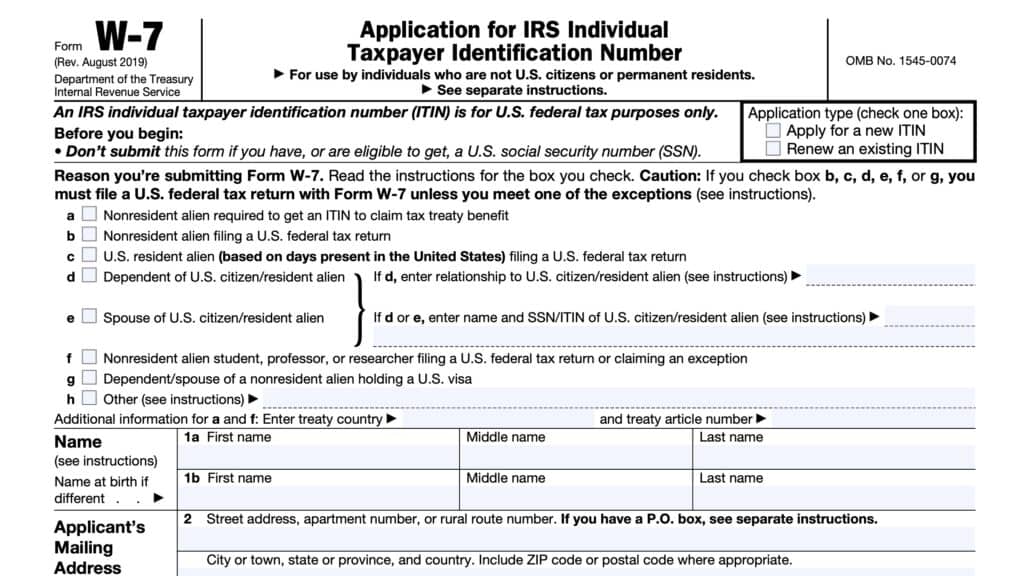

The taxpayer’s request for an adoption taxpayer identification number (ATIN) on Form W-7A, Application for Taxpayer Identification Number for Pending U.S. Adoptions, application was incomplete.

However, your actual CP562A notice may contain a different response form that specifies the exact information fields required to complete the Form W-7A application.

You might not need to complete the entire form

Your CP562A notice might indicate that you only need to provide specific information, such as:

- Complete taxpayer information

- Information about the adopted child

- Information about the placement agency who assisted with the adoption

- Signature (if your original submission was missing a signature)

- SSN of one or both adoptive parents

- Changes in your contact information

If you’re responding to a notice, you may only need to provide the missing information that is specified in the notice. If the CP562A notice gives you a response form, you may be able to use that in your response.

The information available on the IRS website might be confusing

According to the IRS website, taxpayers should file IRS Form 15118 when their adopted child obtains a Social Security number:

When you receive a Social Security number (SSN) for this child:

- Complete the response Form 15118 Response to Notice CP562A, with the SSN and

- Mail it using the information provided on the form

- If you prefer, you can fax your information to the fax number in the notice using either a fax machine or an online fax service

If you’ve received a CP562A notice, follow the instructions carefully. If you must file Form 15118 to report your child’s Social Security number, you may download it from the IRS website or in the tax form download section below.

Video walkthrough

Frequently asked questions

IRS Form 15118, Response to CP562A Notice, is a tax form that you might see to provide additional information to the Internal Revenue Service regarding an adopted child who recently received a Social Security number to replace a previous Adoption Taxpayer Identification Number (ATIN).

Not necessarily. You should provide the information that is specifically requested in the CP562A notice, using the information request form provided. If no such form is provided with the notice, then you may use IRS Form 15118 to supply the requested information.