IRS Form 15620 Instructions

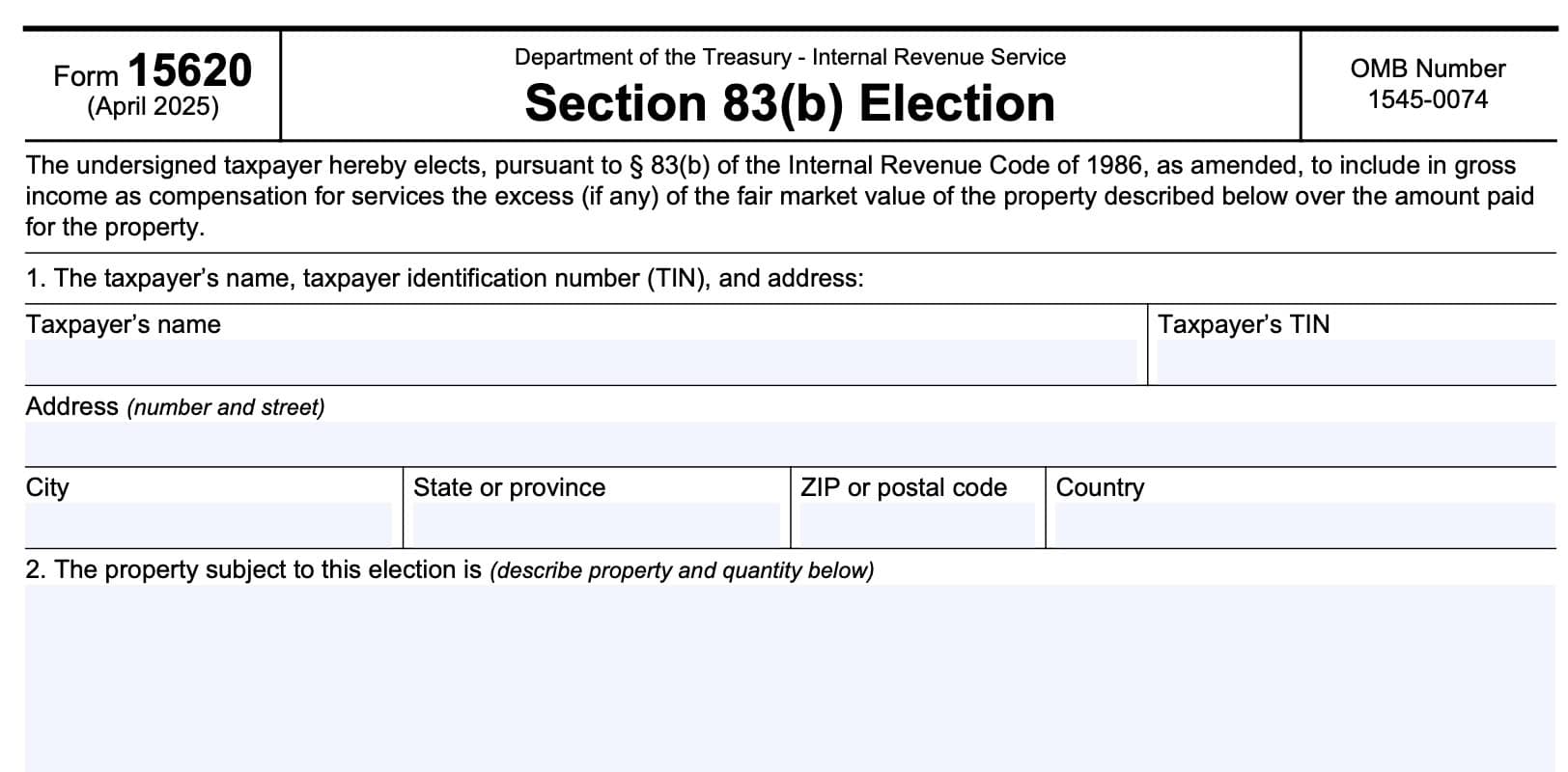

Taxpayers who receive stock options, stock grants, or other unvested property may choose to make a Section 83(b) election by filing IRS Form 15620, Section 83(b) Election.

In this article, we’ll walk you through everything you need to know about IRS Form 15620, including:

- How to complete and file IRS Form 15620

- When you should make a Section 83(b) election

- Other frequently asked questions

Let’s begin with step-by-step instructions for this one-page tax form.

Contents

Table of contents

How do I complete IRS Form 15620?

This one-page tax form is pretty straightforward to complete. Let’s begin at the top.

Box 1: Taxpayer’s name, taxpayer identification number, and address

Box 1 should include the following information:

- Taxpayer’s complete name (first name, middle initial, last name)

- Taxpayer identification number

- Social Security number or individual taxpayer identification number (ITIN)

- Address

- Including city, state, zip code, and country, if applicable

If you’ve recently changed your address, you may need to update your address in the IRS records. You can do this by filing IRS Form 8822, Change of Address.

Watch this YouTube video to learn more about using IRS Form 8822 to update your tax records.

Box 2: Property subject to election

In Box 2, enter a description of the property that is subject to the Section 83 election, including the quantity transferred. For example, you might enter something like 1,000 shares of Class A common stock of Corporation B.

What is Section 83(b)?

According to the Internal Revenue Code, if a taxpayer receives property or other noncash compensation for services provided, then the recipient is responsible for recognizing the excess of the fair market value, over the price paid for that property.

For certain property, such as nonvested stock options, the property is not automatically considered taxable income in the year that it is granted, because the taxpayer might not end up with the stock options or the underlying stock in the future.

By making a Section 83(b) election for the current tax year, the taxpayer chooses to recognize the excess of:

- Fair market value of the property, minus

- Amount paid for the property

For example, let’s imagine that you received a grant for stock options for 1,000 shares of ABC corporation. These options have a 3 year vesting period, so they cannot be exercised until 3 years after the grant date.

Normally, a stock option grant is not considered taxable income until the options have vested. In other words, the risk of forfeiture from leaving the company before the 3-year vesting period means that you do not need to recognize the options as income this year.

However, you have the option to recognize the current value of these options as income in the current year, instead of after they have vested. This is known as a Section 83(b) election.

Many people choose a Section 83(b) election if they believe:

- They will still be with the company when the options actually vest

- The underlying stock will be significantly more in the future than it is today

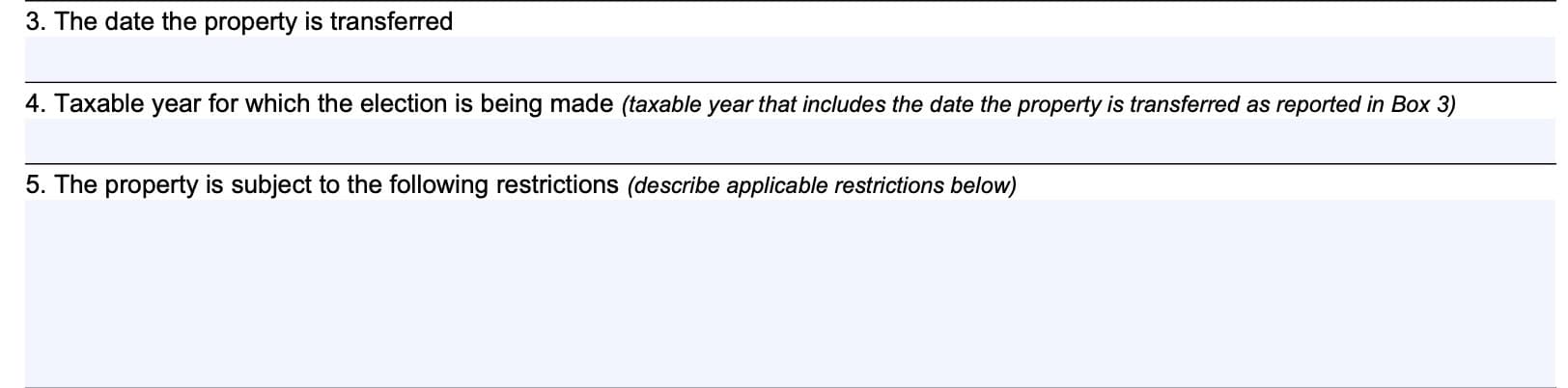

Box 3: Date the property is transferred

In Box 3, enter the date that the property was transferred.

Treasury Regulations § 1.83-3(a) contains additional guidance on what constitutes a transfer of property for purposes of IRC § 83.

Box 4: Taxable year for which the election is being made

Enter the tax year for which you are making the Section 83(b) election. This should be the taxable year that includes the date of property transfer that you reported in Box 3.

For example, you would enter one of the following:

- Calendar year 2025, or

- Fiscal year ending May 31, 2025

Box 5: Property restrictions

In Box 5, enter a description of the restrictions applicable to the substantially nonvested property that is transferred.

As an example, you could enter the following:

“the terms of the restricted stock agreement provide that 1,000 shares of Class A common stock of Corporation B will be forfeited if the person making the election ceases to provide services to Corporation B as an employee prior to April 1, 2027.”

For more information on what constitutes substantially nonvested property for purposes of IRC § 83, see Treasury Regulations § 1.83-3(b).

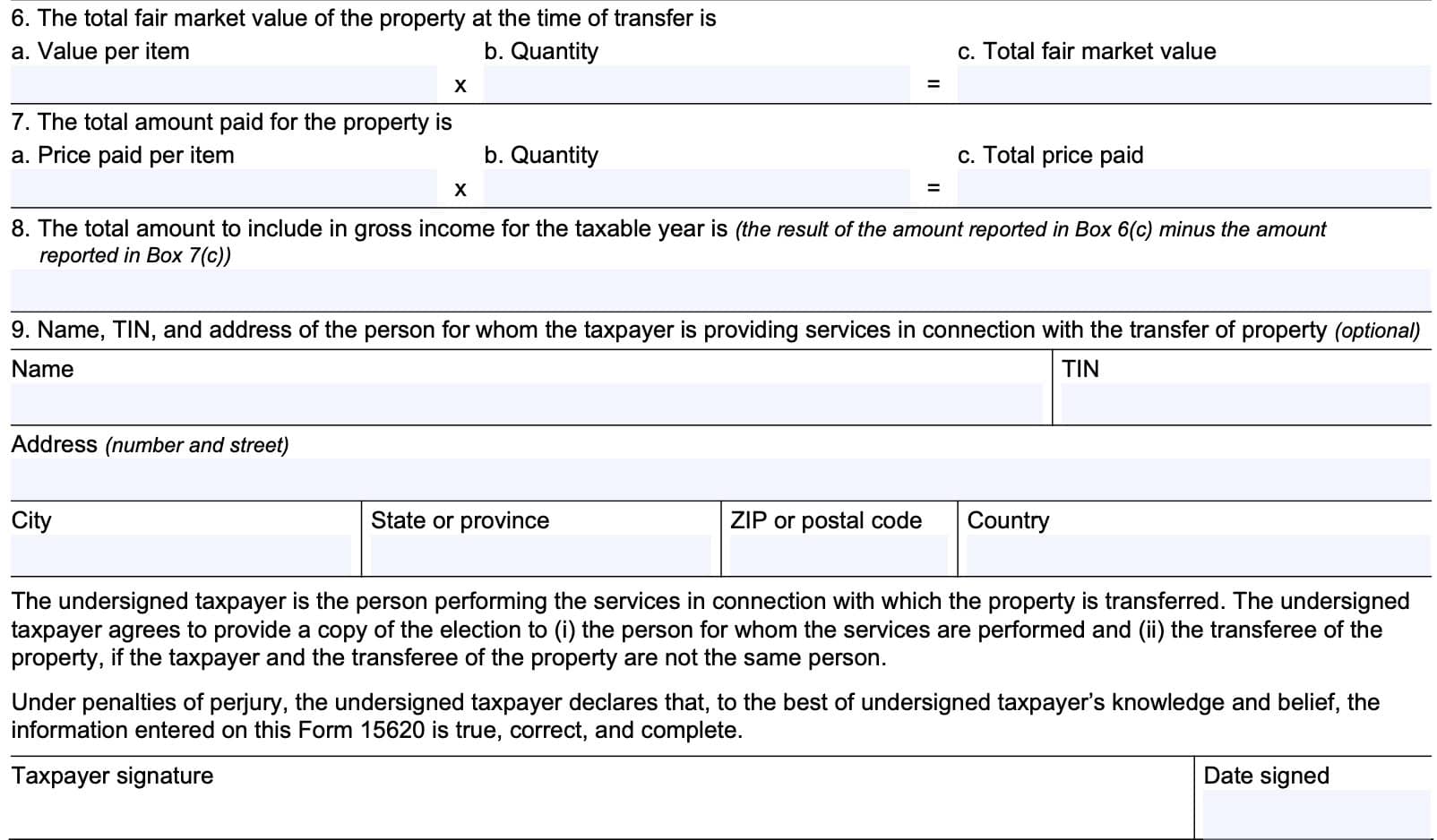

Box 6: Total fair market value of property at time of transfer

In Box 6a, enter the fair market value per item of property at the time of transfer. For stock options, this would be the fair market value for each option.

In Box 6b, enter the total quantity transferred. Using the example in Box 5, this would be 1,000 (1,000 options for each share of Class A common stock).

In Box 6c, multiply Box 6a by Box 6b, then enter the total. For example, if the fair market value at the time of transfer was $100 per option, and you listed 1,000 options in Box 6b, then Box 6c should contain $100,000 ($10 times 1,000 options).

The fair market value is determined without regard to any lapse restriction, as defined in Treas. Reg. § 1.83-3(i).

Box 7: Total amount paid for property

In Box 7a, enter the amount you paid per item of property at the time of transfer.

In Box 7b, enter the total quantity transferred. Using the example in Box 5, this would be 1,000 (1,000 options for each share of Class A common stock).

In Box 7c, multiply Box 7a by Box 7b, then enter the total.

For example, if you paid $10 per option at the time of transfer, and you listed 1,000 options in Box 7b, then Box 7c should contain $10,000 ($10 times 1,000 options).

Box 8: Total amount to include in gross income for the taxable year

Calculate this amount by subtracting the Box 7c number from the amount in Box 6c. This represents the total amount that you should include in gross income for the taxable year that you indicated in Box 4.

Box 9: Person for whom taxpayer is providing services

In Box 9, enter the information for the person for whom services are being provided. In the case of a company issuing stock options, this would be the company’s information.

Enter the following:

- Name

- Taxpayer identification number (can be SSN, ITIN, or employer identification number)

- Complete address

Providing a response in Box 9 is optional and not required to make a valid Section 83(b) election.

Signature

Sign and date at the bottom.

Filing considerations

Filing IRS Form 15620

You have 30 days from the date you received the property to make a Section 83(b) election, in writing, and submit your completed Form 15620 to the IRS. Do this by filing your Form 15620 with the IRS office where you would normally file your federal income tax return.

For electronic filers, or taxpayers who do not know where to file your income tax return, you can find a list of addresses, by state, here, on the Internal Revenue Service website.

Deciding Whether to Make a Section 83(b) Election

It’s important to note that a Section 83(b) election means that you’re paying taxes now for property that might become:

- Worthless by the time it vests

- Forfeited if you decide to leave during the vesting period

With this in mind, you should only make a Section 83(b) election if you believe:

- You will not leave prior to the end of the vesting period

- The future value of the property will become much higher by the time the property vests

Video walkthrough

Learn more about completing your Form 15620 to make a valid Section 83(b) election by watching this instructional video.

Frequently asked questions

A taxpayer receiving unvested property as compensation for services provided normally does not recognize income until the property becomes vested. However, by making a Section 83(b) election, the taxpayer can choose to recognize income on the value of that property in the year received.

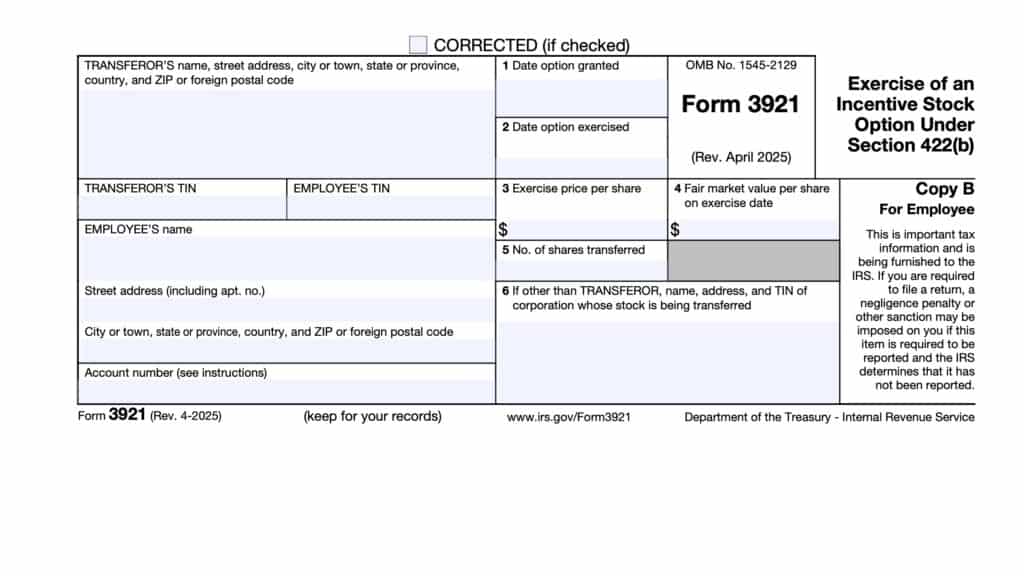

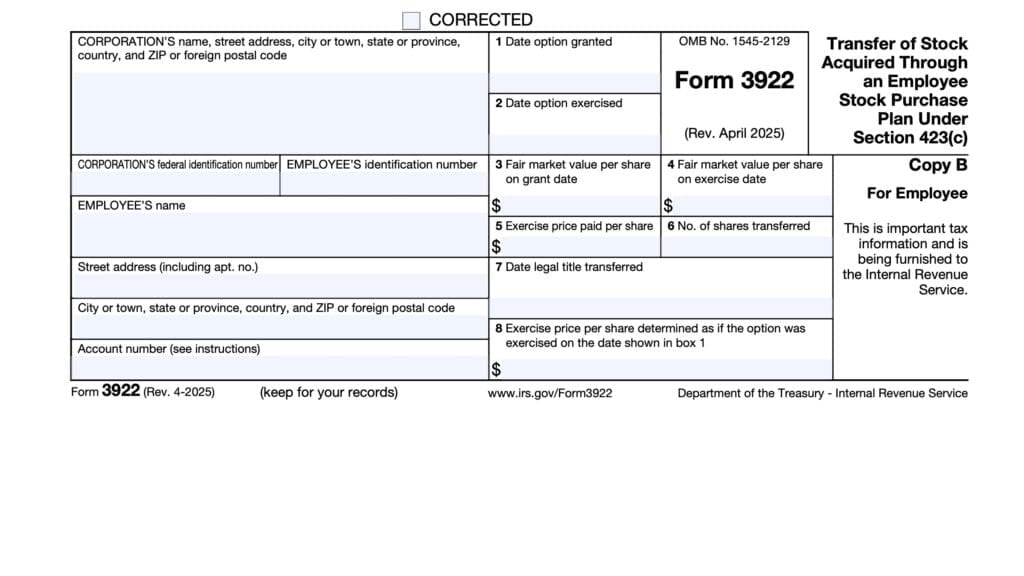

Taxpayers must file IRS Form 15620 with the Internal Revenue Service within 30 days of receipt. Additionally, the taxpayer must provide the grantor with a copy of the filed Form 15620.

Taxpayers may not revoke a Section 83(b) election without express consent of the IRS. For additional guidance regarding the revocation of an 83(b) election, refer to Treasury Regulations § 1.83–2(f) and Revenue Procedure 2006-31.

Where can I find IRS Form 15620?

Usually, your employer will provide a copy of IRS Form 15620 to employees who may be considering a Section 83 election for their stock options. If not, you can download a blank version of the latest form from the IRS website.

For your convenience, we’ve enclosed a copy of IRS Form 15620 here, in our exclusive guide.