IRS Form 709 Instructions

If you made a taxable gift during the year, you may need to report that gift to the Internal Revenue Service on IRS Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return.

In this article, we’ll break down everything you need to know about this tax form, including:

- How to complete and file IRS Form 709

- Key concepts, such as gift-splitting

- Frequently asked questions

Let’s begin with a step by step overview of IRS Form 709.

Table of contents

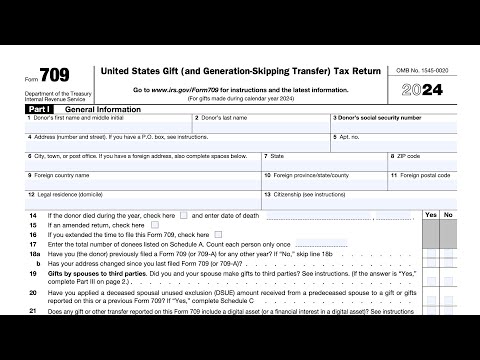

How do I complete IRS Form 709?

This tax form can be fairly intimidating. It contains 3 parts and 4 schedules:

- Part I: General Information

- Part II: Tax computation

- Part III: Spouse’s Consent on Gifts to Third Parties

- Schedule A: Computation of Taxable Gifts

- Schedule B: Gifts From Prior Periods

- Schedule C: Deceased Spousal Unused Exclusion (DSUE) Amount and Restored Exclusion

- Schedule D: Computation of Generation-Skipping Transfer Tax

Although you may need to complete one or more of the schedules before you begin Part I, we’ll proceed through IRS Form 709 in chronological order.

Part I: General Information

In Part I, we’ll begin your federal gift tax return with some important information about you as the taxpayer. Let’s go to Line 1.

Line 1: Donor’s first name and middle initial

In Line 1, enter the first name and middle initial of the donor.

Line 2: Donor’s last name

Enter the donor’s last name here.

Line 3: Donor’s social Security number

Enter the Social Security number, or SSN of the donor here.

Line 4: Address

Use Lines 4 through 8 to enter your mailing address. If you live in a foreign country, you’ll need to complete Lines 9 through 11 as well.

Changing addresses

If you’ve recently changed addresses, the IRS highly recommends that you update the address listed in your tax record. Although this happens automatically when filing your individual income tax return, you may also complete IRS Form 8822, Change of Address, to update your IRS records.

Line 5: Apartment number

If applicable, enter your apartment number in Line 5.

Line 6: City, town, or post office

Enter the name of the city or town where you receive mail. If you have a foreign address, enter the city

name here.

Post office box

If you have a P.O. Box, only enter your P.O. Box information if the United States Postal Service does not deliver mail to your street address.

Line 7: State

Enter the name of your state in Line 7.

Line 8: ZIP code

Enter your Zip code in Line 8. If you live in the United States, you can skip to Line 12. Otherwise, proceed to Line 9.

Line 9: Foreign country name

Enter the name of the foreign country where you live in Line 9. Do not abbreviate the country name.

Line 10: Foreign province, state, or county

Enter the province, county, or state in Line 10, using the country’s practice for reporting.

Line 11: Foreign postal code

Follow the country’s practice for entering the postal code, and enter the postal code here.

Line 12: Legal residence

For gift tax purposes, an individual acquires domicile in a place by living there, for even a brief period of time, with no definite present intention of later moving.

If you are in the United States, enter the state (including the District of Columbia), where you legally reside, or are domiciled, at the time of the gift. If living in a foreign country, enter the foreign country’s name.

Line 13: Citizenship

Enter your citizenship in this line.

According to the Internal Revenue Code, the term citizen of the United States includes a person who,

at the time of making the gift, met one of the following criteria:

- Was domiciled in a territory of the United States,

- Was a U.S. citizen, and

- Became a U.S. citizen for a reason other than being a citizen of a U.S. territory or being born or residing in a territory.

If you meet the above criteria, enter “United States.” Otherwise, enter the country of your citizenship.

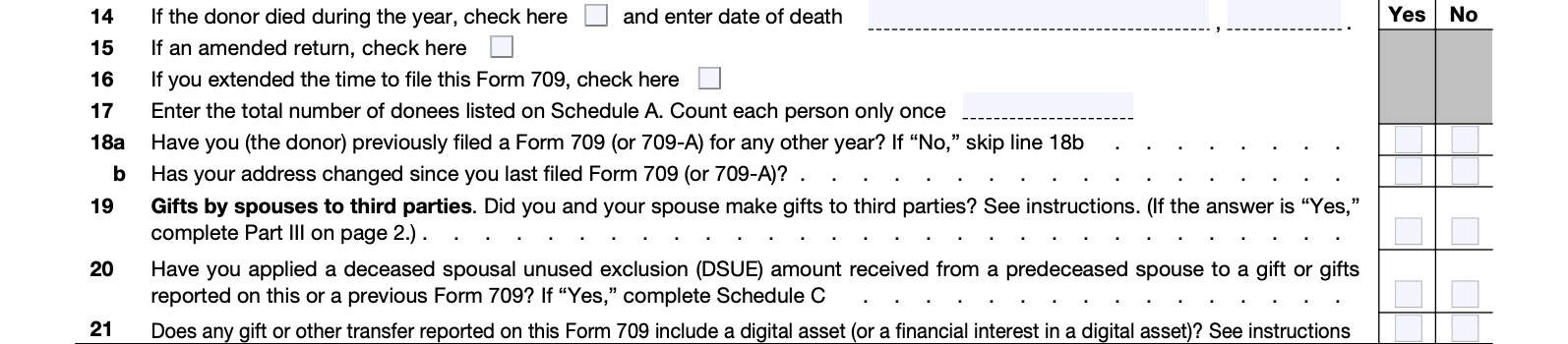

Line 14: Date of death

If the donor died during the tax year, check the applicable box and enter the date of death in the space provided.

Line 15: Amended return

If you are filing an amended gift tax return, then check the box.

Line 16

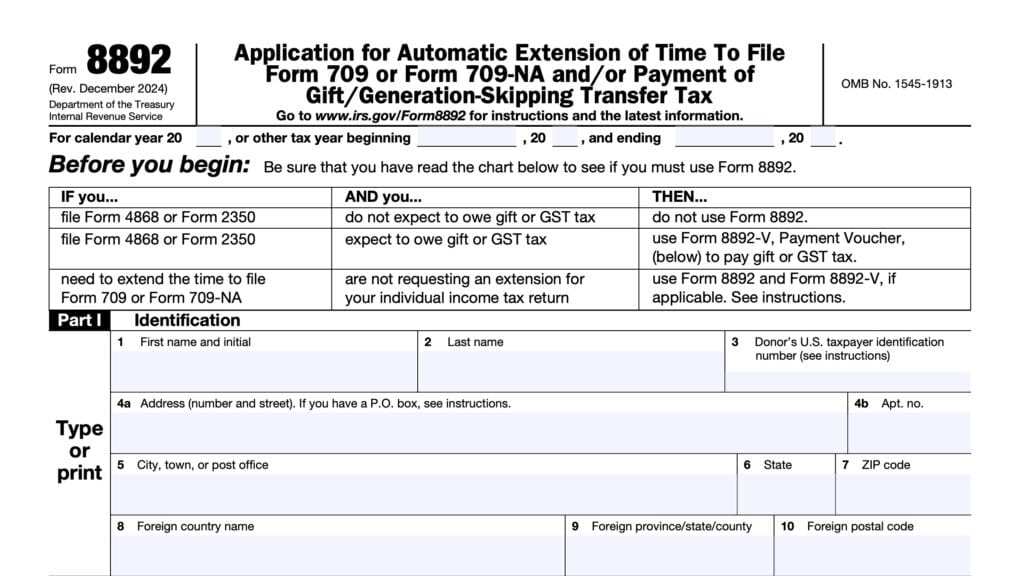

If you requested an automatic 6-month extension of time to file your gift tax return, check this box.

Automatic extension of time

Taxpayers may file IRS Form 8892, Application for Automatic Extension of Time To File IRS Form 709 and/or Payment of Gift/Generation-Skipping Transfer Tax, to request an automatic extension to file your gift tax return.

Line 17: Number of donees listed on Schedule A

Enter the total number of donees that you’ve listed on Schedule A, below. Be sure to count each person only one time.

Line 18

This line is broken down in to two parts.

Line 18a

Have you, as the donor, previously filed IRS Form 709 (or IRS 709-A) for any other year? If Yes, then go to Line 18b. Otherwise, go directly to Line 19.

Line 18b

If you’ve previously filed a gift tax return, has your address changed since your most recent filing? Indicate Yes or No.

Line 19: Gifts by spouses to third parties

Did you and your spouse make gifts to third parties? If Yes, then you should complete Part III, below.

Gift-splitting

If you and your spouse want your gifts to be considered made one-half by you and one-half by your spouse, check Yes and complete Part III. This is called gift-splitting.

If you are not married or do not wish to split gifts, skip to Line 20.

Line 20

Have you applied a deceased spousal unused exclusion (DSUE) amount received from a predeceased spouse to a gift or gifts reported on this or a previous IRS Form 709? If so, you’ll need to complete Schedule C, below.

Deceased spousal unused exclusion amount (DSUE)

If the donor is a citizen or resident of the United States and the spouse died after December 31, 2010, the donor may be eligible to use the deceased spouse’s unused exclusion (DSUE) amount.

The executor of the spouse’s estate must have elected on Form 706 to allow use of the unused exclusion amount.

If the executor of the estate made this election, attach the first four pages of Form 706 filed by the estate. Also, include any attachments related to DSUE that were filed with Form 706 and calculations of any adjustments to the DSUE amount like audit reports or previously filed IRS Forms 709.

Line 21: Digital assets

Does any gift or other transfer reported on this IRS Form 709 include a digital asset (or a financial interest in a digital asset)?

You must answer Yes or No.

Once finished, proceed to Part II.

Part II: Tax computation

Line 1

In Line 1, enter the amount from Schedule A, Part 4, Line 11. This is the total amount of taxable gifts for the given tax year.

If you have not yet completed Schedule A, then you should do so.

Line 2

Enter the amount from Schedule B, Line 3. This represents the total amount of taxable gifts from prior tax years.

If you have not yet completed Schedule B, and you made one or more taxable gifts in a prior year, you should do so before going further.

Line 3: Total taxable gifts

Add Line 1 and Line 2, then enter the results here. This represents the total amount of of taxable gifts.

Line 4: Tax computed on amount on Line 3

Using the Table for Computing Gift Tax (see below), calculate the gift tax liability for the amount reported on Line 3. See below for an example.

Table for computing gift tax liability

Let’s imagine that you had a taxable gift of $50,000. To compute the tax on this gift, you would follow these steps:

- In column A, find the two amounts where your taxable gift resides.

- In this case, the $50,000 gift would be between the $40,000 row and $60,000 row in Column A.

- Using the row that coincides with the lower number, double-check Column B to ensure that this amount equals the next row amount in Column A.

- The $60,000 in Column B is the same amount as the next row in Column A.

- Write down the Column C amount for this row.

- $8,200

- Subtract the Column A amount from the gift amount.

- $50,000 minus $40,000 equals $10,000.

- Multiply this difference by the percentage in Column D

- $10,000 multiplied by 24% equals $2,400.

- Add this amount to the Column C number.

- $8,200 plus $2,400 equals $10,600.

In this case, $10,600 is the computed gift tax for Line 4.

Line 5: Tax computed on amount on Line 2

Using the same tax table as in Line 4, calculate the gift tax for the amount reported on Line 2, for gifts previously reported. Enter the gift tax in Line 5.

Line 6: Balance

Subtract Line 5 from Line 4. This represents the gift tax calculated for prior years subtracted from the overall gift tax liability.

Line 7: Applicable credit amount

Enter the applicable credit amount in Line 7. The applicable credit (formerly unified credit) amount is the tentative tax on the applicable exclusion amount.

For gifts made in 2024, the applicable exclusion amount equals:

- The basic exclusion amount of $13,610,000, plus

- Any DSUE amount, plus

- Any Restored Exclusion Amount

If you are eligible to use a DSUE amount from a predeceased spouse or a Restored Exclusion Amount for taxable gifts to a same-sex spouse (or both), complete Schedule C—Deceased Spousal Unused Exclusion (DSUE) Amount and enter the amount from Line 5 of that schedule on Line 7 of Part II—Tax Computation.

Below is a brief explanation of several concepts.

Deceased Spousal Unused Exclusion (DSUE)

The amount of an unused exclusion received by the surviving spouse is called the deceased spousal unused exclusion, or DSUE, amount. If the executor of the decedent’s estate elects transfer, or portability, of the DSUE amount, the surviving spouse can apply the DSUE amount received from the estate of the last deceased spouse (defined later) against any tax liability arising from subsequent lifetime gifts and transfers at death.

Restored exclusion amount

Prior to 2013, taxpayers in a same-sex marriage were not entitled to claim a marital deduction for gifts or bequests to each other, due to the Defense of Marriage Act, or DOMA. Those taxpayers were required to use their applicable exclusion amount to defray any gift or estate tax imposed on the transfer or were required to pay gift or estate taxes, to the extent the taxpayer’s exclusion previously had been exhausted.

However, in 2013, the Supreme Court ruled that same-sex marriages were legal, and that spouses had the same rights and protections.

Under a new procedure, a donor who made a transfer to the donor’s same-sex spouse, which resulted in a reduction of the donor’s applicable exclusion amount, can now recalculate the remaining applicable exclusion. This is the restored exclusion amount.

This procedure is only available to transfers that did not qualify for the marital deduction for federal gift tax purposes at the time of the transfer, based solely on the application of DOMA.

Not eligible for DSUE or Restored exclusion amount

If you are a citizen or resident of the United States, you must apply any available applicable credit against gift tax. If you are not eligible to use a DSUE amount from a predeceased spouse, or Restored Exclusion Amount on taxable gifts made to a same-sex spouse, enter $5,389,800 on Line 7.

Nonresidents

Nonresidents who are not citizens of the United States may not claim the applicable credit and should enter zero on Line 7.

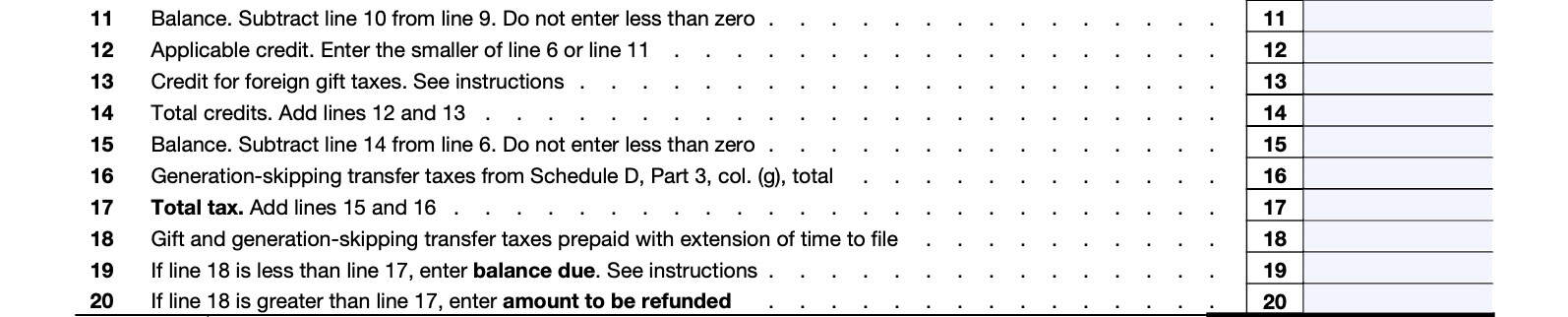

Line 8: Applicable credit against tax allowable for all prior periods

In Line 8, enter the applicable credit against tax allowable for all prior periods. You can find this information on Schedule B, Line 1, Column (c).

Line 9: Balance

Subtract Line 8 from Line 7, then enter the result. However, do not enter a negative number.

Line 10

If applicable, enter 20% (0.20) of the amount allowed as a specific exemption for gifts made:

- After September 8, 1976, and

- Before January 1, 1977

If applicable, these amounts will be among those listed in Schedule B, Column (d), for gifts made in the third and fourth quarters of 1976.

If this doesn’t apply, skip to Line 12.

Line 11: Balance

Subtract Line 10 from Line 9, then enter the result. However, do not enter a negative number.

Line 12: Applicable credit

Enter the smaller of:

Line 13: Credit for foreign gift taxes

Enter any credit for foreign gift taxes.

Foreign gift taxes

Gift tax conventions are in effect with the following countries:

- Australia

- Austria

- Denmark

- France

- Germany

- Japan

- United Kingdom

If you are claiming a credit for payment of foreign gift tax, figure the

credit and attach the calculation to IRS Form 709, along with evidence that the foreign taxes were paid.

See the applicable convention for details of computing the credit.

Line 14: Total credits

Add Lines 12 and 13. This represents your total credits for gift taxation purposes.

Line 15: Balance

Subtract Line 14 from Line 6, and enter the result. Do not enter a number less than zero.

Line 16: Generation-skipping transfer taxes from Schedule D, Part 3

Enter the generation-skipping transfer taxes (GSTT) calculated in Schedule D, Part 3.

Line 17: Total tax

Add Line 15 and Line 16. Enter the total here.

This represents your total tax liability associated with this gift tax return.

Line 18: Gift and generation-skipping transfer taxes prepaid with extension of time to file

If you prepaid any gift tax or GSTT when filing your extension, enter that amount here.

Filing a gift or generation-skipping transfer tax extension

Need to file a tax extension? You can do so by filing IRS Form 8892, Application for Automatic Extension of Time To File Form 709 and/or Payment of Gift/Generation-Skipping Transfer Tax.

Line 19: Balance due

If Line 18 is less than Line 17, then subtract Line 18 from Line 17 and enter the difference in Line 19. This represents your total gift tax due.

Paying your tax bill

Make your check or money order payable to “United States Treasury” and write the donor’s SSN on it. You may not use an overpayment on Form 1040 or 1040-SR to offset the gift and GST taxes owed on Form 709.

Checks over $100 million not allowed

The IRS cannot accept a single check (including a cashier’s check) for amounts of $100,000,000 ($100 million) or more.

If you’re sending $100 million or more by check, you’ll need to spread the tax payments over two or more checks, with each check made out for an amount less than $100 million.

If you are the rare taxpayer that insists on paying upwards of over $100 million, but refuses to pay $1,000 for a tax professional to prepare your tax return, please send your money to me. I guarantee that none of this will go towards paying your gift tax liability, but we all have to make sacrifices.

Line 20: Amount to be refunded

If Line 18 is more than Line 17, then subtract Line 17 from Line 18 and enter the difference in Line 20.

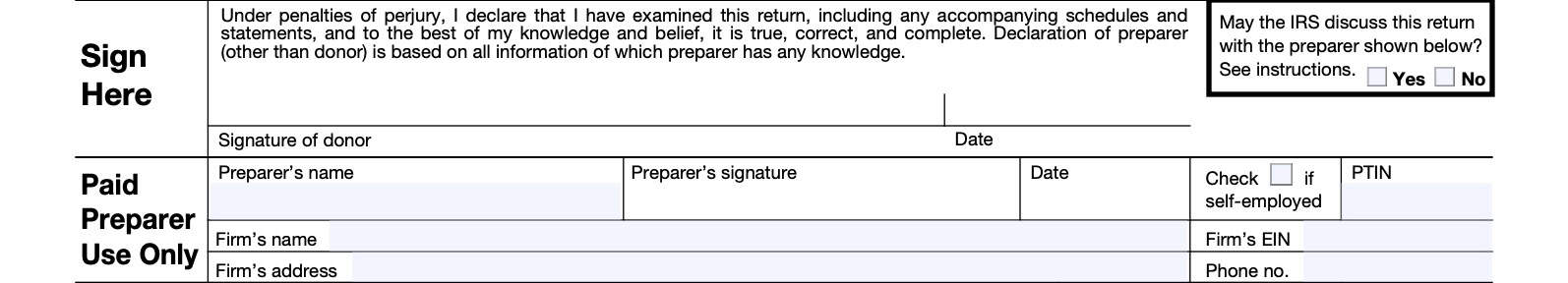

Signature fields

Underneath Line 20, the donor will sign and date IRS Form 709.

Additionally, check the Yes or No box if you had a paid tax return preparer, and you wish to give the Internal Revenue Service permission to go over your gift tax return with your preparer.

Part III: Spouse’s Consent on Gifts to Third Parties

Only complete Part III if you checked Yes on Part I, Line 19. This indicates that :

- You are married

- Your spouse consents to gift-splitting with you

Line 1: Gifts by spouses to third parties

Check Yes if you consent to have the IRS consider gifts made by you and your spouse to third parties during the calendar year as made one-half by each of you.

Check No if neither spouse consents to gift-splitting. Also, skip Lines 2 through 7.

Line 2: Name of consenting spouse

Enter the name of the consenting spouse in Line 2.

Line 3: SSN of consenting spouse

Enter the consenting spouse’s Social Security number in Line 3.

Line 4

If you were married to each other during the entire calendar year, check Yes. Otherwise, check No.

If you were divorced or widowed after you made the gift, you cannot elect to split gifts if you remarried before the end of the year.

Line 5

If Line 4 is No, then check the appropriate box:

- Married

- Divorced

- Widowed/deceased

Also, enter the date as appropriate.

Line 6: Will your spouse file a gift tax return?

Check Yes if your spouse will also file a gift tax return. Also, be sure to mail both gift tax returns to the IRS in the same envelope.

Line 7: Consent of spouse

Have you obtained your spouse’s consent to splitting gifts? If so, check Yes. Also, you must attach a Notice of Consent.

Notice of consent

The notice of consent must be signed and dated by the consenting spouse and must include a statement that the consenting spouse is electing to treat all gifts made to third parties as having been made one-half by each spouse.

If only one spouse is required to file a gift tax return, then only one Notice of Consent is required, and it must be attached to the donor spouse’s return.

If both spouses are required to file gift tax returns, then each spouse should execute a Notice of Consent to be attached to the donor spouse’s return.

The Notice of Consent may generally be signed at any time after the end of the calendar year with two exceptions:

- The consent may not be obtained after April 15 following the end of the year in which the gift was made. But if neither you nor your spouse has filed a gift tax return for the year on or before that date, the consent must be made on the first gift tax return for the year filed by either of you.

- The consent may not be obtained after a notice of deficiency for the gift tax for the year has been sent to either you or your spouse.

When both spouses do not need to file a gift tax return

In general, if you and your spouse elect gift splitting, then both spouses must file their own individual gift tax return.

However, only one spouse must file a return if the requirements of either of the exceptions below are met, not including political, educational, or medical exclusions:

- Exception 1

- Only one spouse made any gifts

- The total value of these gifts does not exceed the annual limit for both spouses (twice the single donor limit)

- All gifts were of present interests

- Exception 2

- Only one spouse made gifts of more than the annual gift tax exclusion, but less than the exclusion for both spouses when gift-splitting

- The only gifts made by the other spouse were less than the annual exclusion limit

- All gifts were of present interests

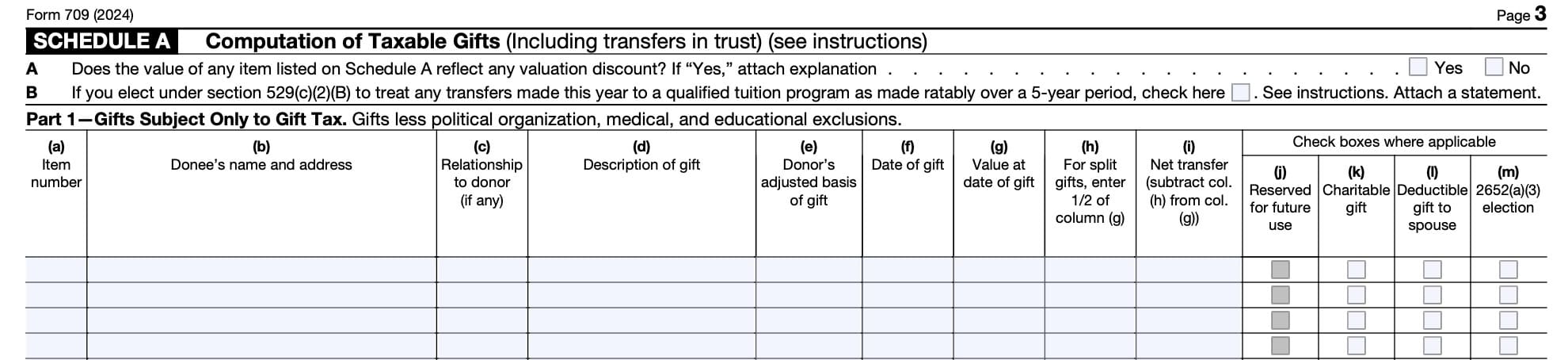

Schedule A: Computation of taxable gifts

In Schedule A, we’ll compute the total amount of taxable gifts. Before proceeding, there are several types of gifts that are not subject to gift or estate tax. As a result, you do not need to report them on Schedule A.

These gifts include:

- Transfers to political organizations

- Transfers to certain exempt organizations,

- Payments that qualify for the educational exclusion, and

- Payments that qualify for the medical exclusion

Here is a little more information about each type of exclusion.

Transfers to political organizations

The gift tax does not apply to a transfer to a political organization (defined in Internal Revenue Code Section 527(e)(1)) for the use of the organization.

Transfers to certain exempt organizations,

The gift tax does not apply to a transfer to:

- Any civic league or other organization described in IRC Section 501(c)(4);

- Any labor, agricultural, or horticultural organization described in IRC Section 501(c)(5); or

- Any business league or other organization described in Section 501(c)(6) for the use of such organization, provided that such organization is exempt from tax under section 501(a).

Payments that qualify for the educational exclusion

The gift tax does not apply to an amount you paid on behalf of an individual to a qualifying domestic or foreign educational organization as tuition for the education or training of the individual

Educational exclusion criteria

The payment must be made directly to the qualifying educational organization and it must be for tuition.

No educational exclusion is allowed for amounts that are not direct tuition costs. This includes expenses for books, supplies, room and board, or other similar expenses.

To the extent that the payment to the educational organization was for something other than tuition, it is a gift to the individual for whose benefit it was made, and may be offset by the annual exclusion if it is otherwise available.

Contributions to a qualified tuition program (QTP) on behalf of a designated beneficiary do not qualify for the educational exclusion.

Payments that qualify for the medical exclusion

The gift tax does not apply to an amount you paid on behalf of an individual to a person or institution that provided medical care for the individual.

The payment must be to the care provider. The medical care must meet the requirements

of IRC Section 213(d), which defines medical care for tax deduction purposes.

Medical care, defined

Medical care includes expenses incurred:

- For the diagnosis, cure, mitigation, treatment, or prevention of disease, or

- For the purpose of affecting any structure or function of the body, or

- For transportation primarily for and essential to medical care.

Medical care also includes amounts paid for medical insurance on behalf of any individual.

However, the medical exclusion does not apply to amounts paid for medical care that is reimbursed by health insurance. If payment for a medical expense is reimbursed by the donee’s insurance company, your payment for that expense, to the extent of the reimbursed amount, is not eligible for the medical exclusion and you are considered to have made a gift to the donee of the reimbursed amount.

Line A

Does the value of any item listed on Schedule A reflect a valuation discount? Check Yes or No.

Valuation discounts

Enter Yes if the value of any gift you report in either Part 1, Part 2, or Part 3 of Schedule A includes a discount for any of the following reasons

- Lack of marketability

- Minority interest

- Fractional interest in real estate

- Blockage

- Market absorption, or

- For any other reason

Also attach an explanation giving the basis for the claimed discounts and showing the amount of the discounts taken.

Line B: 529 transfers

If you elected to treat your 529 plan transfers as made ratably over a 5-year period, check the box.

Gifting 529 plans

Taxpayers may contribute more than the annual gift tax exclusion amount into a qualified tuition plan (QTP), otherwise known as a college 529 plan or 529 savings plan in a given year.

If you contributed more than $18,000 to a qualified tuition plan on any person’s behalf, you can treat up to $90,000 of the contribution as if you made it evenly over a 5-year period. This election allows you to apply the annual exclusion to a portion of the contribution in each of the 5 years, beginning with the first tax year.

You can make this election for as many different people as you made QTP contributions. Below are some additional guidelines:

- In 2024, you can only apply the election to a maximum of $90,000

- You must report all 2024 QTP contributions for a single person that exceed $90,000

- For each of the 5 years, report 1/5 of the amount you gifted in Part 1, and list the date of the gift as the calendar year for the current IRS Form 709

- Do not list the actual year of contributions for subsequent years

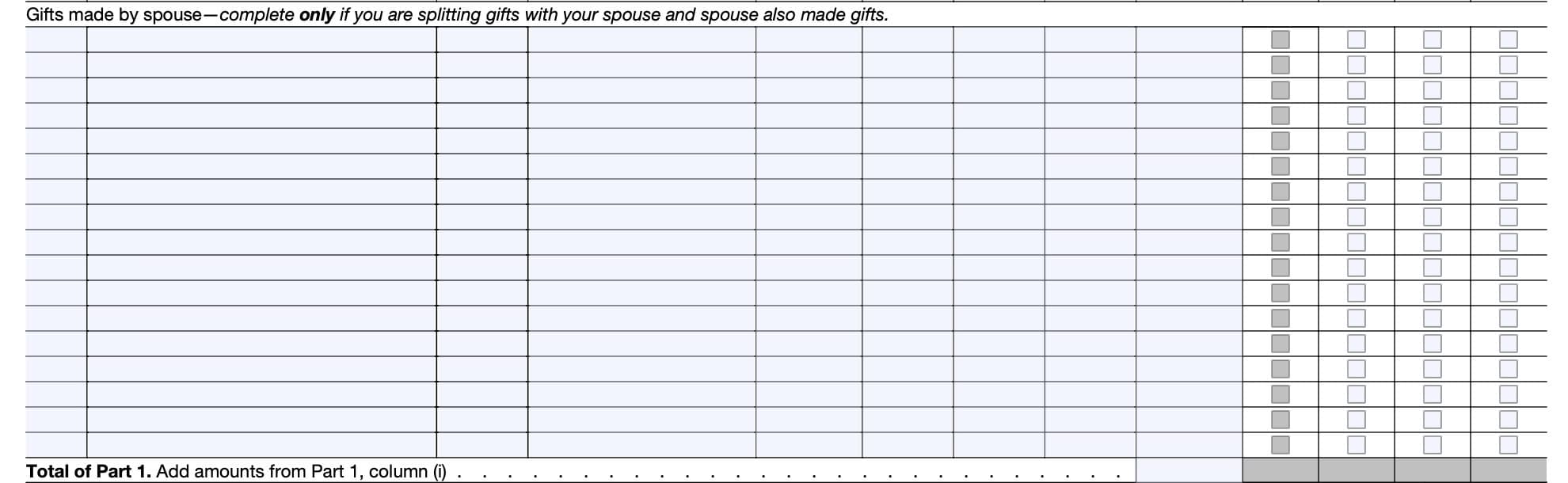

Part 1: Gifts subject only to gift tax

In Part 1, you’ll report gifts that are subject only to gift tax. Do not include either of the following:

- Gifts subject to both the gift and GST taxes (gifts made to skip persons)

- Reported in Part 2

- Gifts subject only to the gift tax at this time but which could later be subject to GST tax

- Gifts that are indirect skips

- Reported in Part 3

Generally, this should include all of the gifts you made to the following:

- Gifts to your spouse that are required to be listed

- Gifts to your children

- Gifts to charitable organizations that are not subject to GST tax but should be reported in Part 1

Group the gifts in four categories:

- Gifts made to your spouse.

- Gifts made to third parties that are to be split with your spouse.

- Charitable gifts (if you are not splitting gifts with your spouse).

- Other gifts.

If a transfer results in gifts to two or more individuals (such as a life estate to one with remainder to the other), list the gift to each separately.

At the bottom of Part 1, enter the total value of the gifts, as calculated in Column (i).

Below is additional guidance from the IRS instructions.

Column (a): Item number

For each listed item, use a unique item number to identify it.

Column (b): Donee’s name and address

Enter the donee’s name and address in this column.

Column (c): Relationship to donor (if any)

If applicable, enter the relationship between the donee and donor.

Column (d): Description of gift

Describe the gift in Column (d). Below is some additional guidance on acceptable descriptions.

Real estate

For real estate, give:

- A legal description of each parcel;

- The street number, name, and area if the property is located in a city; and

- A short statement of any improvements made to the property.

Bonds

For bonds, give:

- The number of bonds transferred

- The principal amount of each bond

- Name of obligor

- Date of maturity

- Rate of interest

- Date or dates when interest is payable

- Series number, if there is more than one issue

- Exchanges where listed or, if unlisted, give the location of the principal business office of the corporation; and

- Committee on Uniform Securities Identification Procedures (CUSIP) number.

- The CUSIP number is a nine-digit number assigned by the American Banking Association to traded securities

Stocks

For stocks, give the following information:

- Number of shares;

- State whether common or preferred

- If preferred, give the issue, par value, quotation at which returned, and exact name of corporation;

- If unlisted on a principal exchange, give the following:

- Location of the principal business office of the corporation

- State in which incorporated, and

- Date of incorporation

- If listed, give principal exchange; and

- CUSIP number

Column (e): Donor’s adjusted basis of gift

Enter the adjusted basis of your gift.

Adjusted basis

Generally, this means cost plus improvements, less applicable depreciation, amortization, and depletion. This is the basis you would use for income tax purposes if the gift were sold or exchanged.

Column (f): Date of gift

Enter the date that you made the gift.

Column (g): Value at date of gift

Enter the value of the gift on the date that you made the gift.

Fair market value

The value of a gift is the fair market value (FMV) of the property on the date the gift is made (valuation date).

The FMV is the price at which the property would change hands:

- Between a willing buyer and a willing seller

- When neither is forced to buy or to sell, and

- When both have reasonable knowledge of all relevant facts

Gifting stocks and bonds

The FMV of a stock or bond (whether listed or unlisted) is the mean (or average) between the highest and lowest selling prices quoted on the valuation date.

If only the closing selling prices are available, then the FMV is the mean between:

- The quoted closing selling price on the valuation date and

- On the trading day before the valuation date.

If there were no sales on the valuation date, figure the FMV as follows:

- Find the mean between the highest and lowest selling prices on the nearest trading date before and the nearest trading date after the valuation date.

- Both trading dates must be reasonably close to the valuation date.

- Prorate the difference between mean prices to the valuation date.

- Add or subtract (whichever applies) the prorated part of the difference to or from the mean price figured for the nearest trading date before the actual valuation date.

Column (h): For split gifts, enter 1/2 of column (g)

Only enter a value in Column (h) for gifts that you are splitting with your spouse.

Column (i): Net transfer

If splitting gifts with your spouse, subtract the column (h) amount from column (g). Enter the total here.

Otherwise, enter the column (g) amount here.

Column (j): Reserved

Do not check. Reserved for future use.

Column (k): Charitable gift

If the gift qualifies as a charitable gift, check this box.

Column (l): Deductible gift to spouse

If you made a deductible gift to your spouse, check here.

Column (m): Section 2652(a)(3) election

If you are making a Section 2652(a)(3) election, check this box. A Section 2652(a)(3) election applies to the special election for qualified terminable interest property for certain trusts.

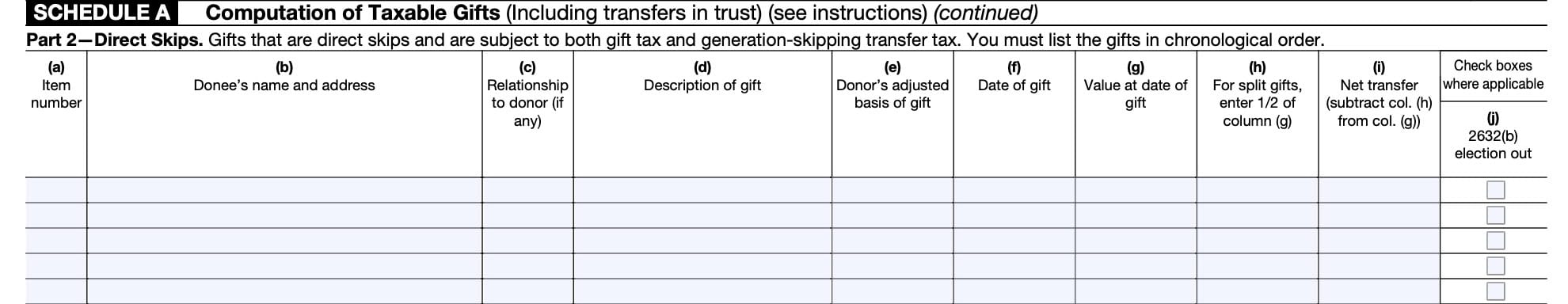

Part 2: Direct skips

Using the same steps outlined in Part 1, report any gifts considered to be direct skips here. The following columns do not apply here:

- Column (j): Reserved.

- Use the current column (j) to report a Section 2632(b) election

- Column (k): Charitable gifts

- Not considered direct skips

- Column (l): Deductible gift to spouse

- Not considered direct skips

- Column (m): Section 2652(a)(3) election

As with Part 1, add the total of all items in Column (i) and enter this amount at the bottom of Part 2.

Direct skips definition

Generally, direct skips are gifts given directly to beneficiaries that have ‘skipped’ a generation. A common example of this is grandparents who decided to gift assets to grandchildren. Certain direct skips are subject to generation-skipping transfer tax, or GST.

The GST tax you must report on IRS Form 709 is that imposed only on inter vivos direct skips. An inter vivos direct skip is a transfer that is:

- Subject to the gift tax,

- Of an interest in property, and

- Made to a skip person.

All three requirements must be met before the gift is subject to the GST tax.

A gift is subject to the gift tax if you are required to list it on Schedule A of IRS Form 709.

However, if you make a nontaxable gift (which is a direct skip) to a trust for the benefit of an individual, this transfer is subject to the GST tax unless:

- During the lifetime of the beneficiary, no corpus or income may be distributed to anyone other than the beneficiary; and

- If the beneficiary dies before the termination of the trust, the assets of the trust will be included in the gross estate of the beneficiary

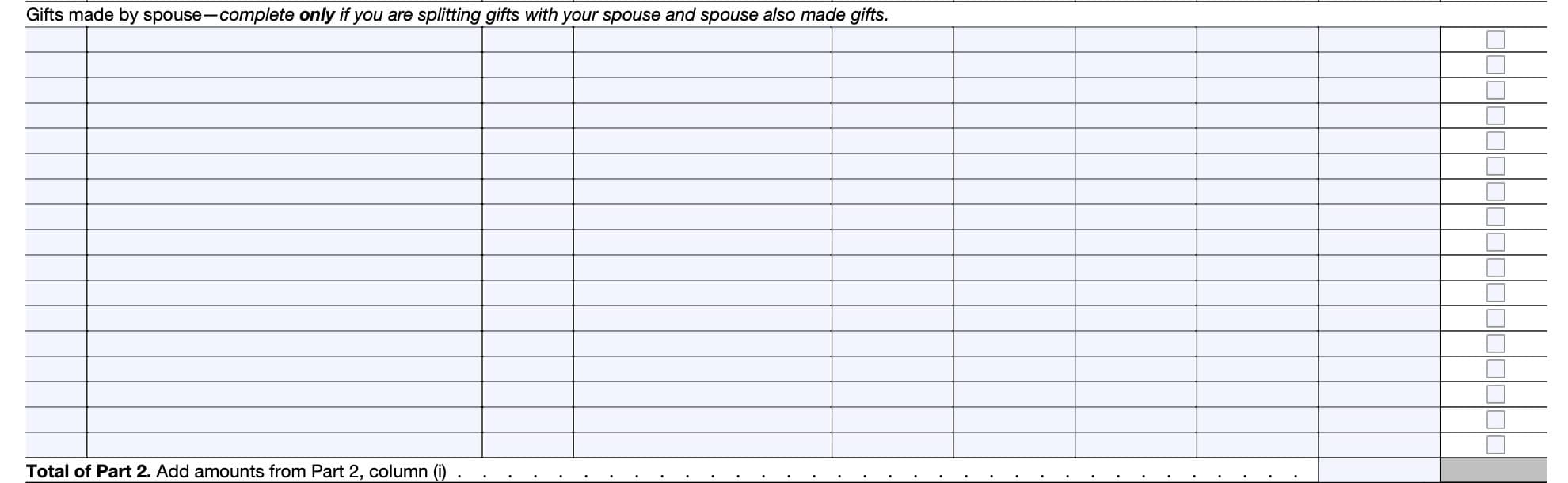

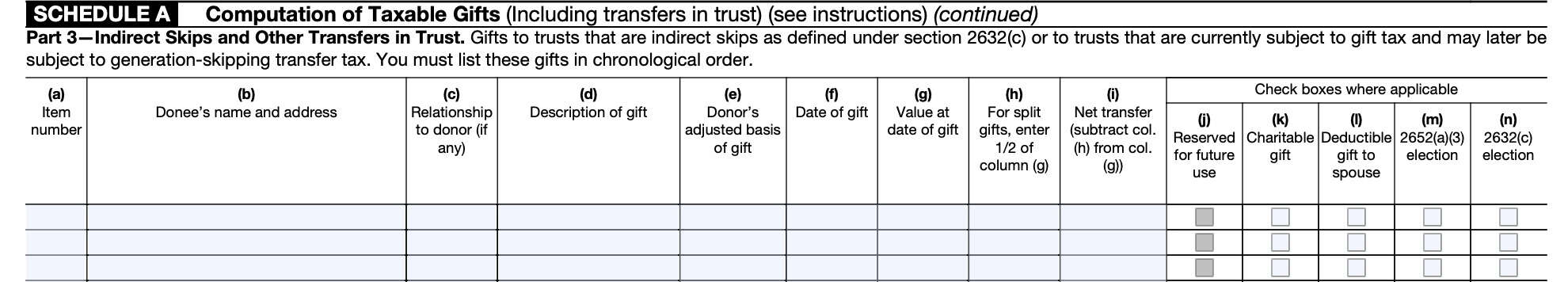

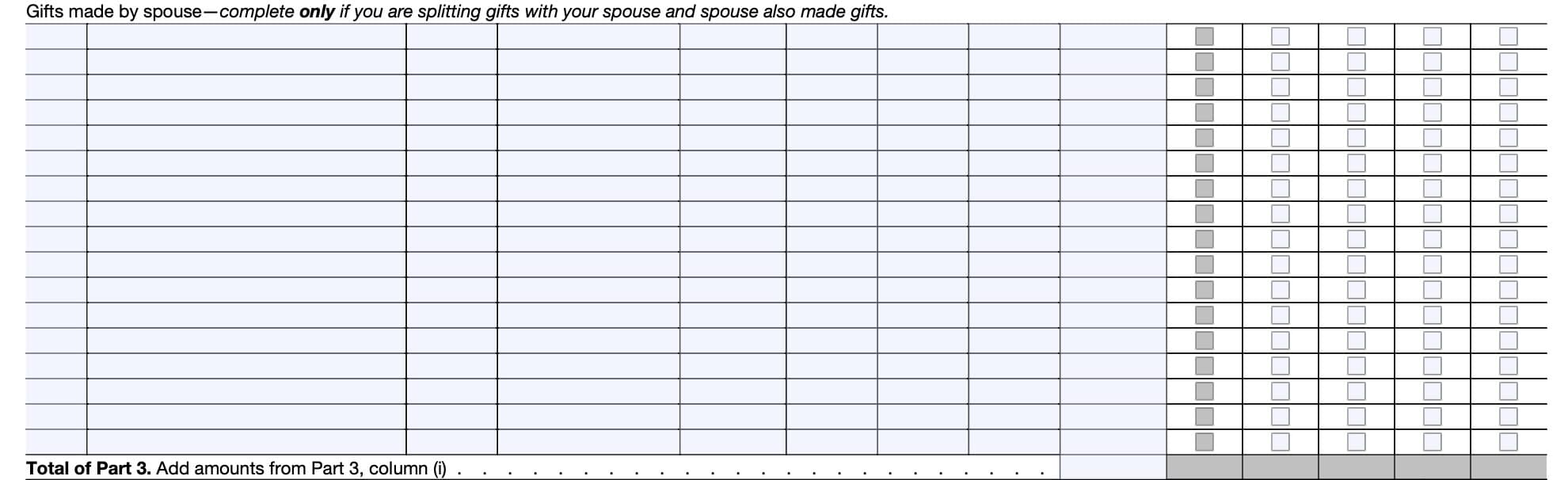

Part 3: Indirect skips and other transfers in trust

Using the same steps outlined in Part 1, report any gifts considered to be direct skips here. In addition to columns (a) through (m), there is another column, Column (n).

At the bottom of Part 3, add the total of values reported in Column (i).

Column (n): 2632(c) Election

Section 2632(c) provides for the automatic allocation of the donor’s unused GST exemption to indirect skips. This section also sets forth three different elections you may make regarding the allocation of exemption.

- Election 1: You may elect not to have the automatic allocation rules apply to the current transfer made to a particular trust

- Election 2: You may elect not to have the automatic rules apply to both the current transfer and any and all future transfers made to a particular trust.

- Election 3: You may elect to treat any trust as a GST trust for purposes of the automatic allocation rules.

When to make an election

Election 1 is timely made if it is made on a timely filed gift tax return for the year the transfer was made or was deemed to have been made.

Elections 2 and 3 may be made on a timely filed gift tax return for the year for which the election is to become effective.

To make one of these elections, check column (n) next to the transfer to which the election applies. You must also attach an explanation as described below.

If you are making Election 2 or 3 on a return on which the transfer is not reported, simply attach the statement describes the election you are making and clearly identifies the trusts and/or transfers to which the election applies.

Part 4: Taxable gift reconciliation

In Part 4, we’ll reconcile the total value of taxable gifts against available deductions. This should result in the total of taxable gifts. We’ll use this figure to compute your tax liability in Part II.

Line 1: Total value of gifts of donor

Add the total net transfer amounts from Column (i) in Part 1, Part 2, and Part 3. Enter the total in Line 1.

Note: Enter only gifts of the donor. If gift splitting has been elected, enter only the value of the gift that is attributable to the spouse that is filing the gift tax return.

Line 2: Total annual exclusions for gifts listed on Line 1

Enter the total annual exclusions you are claiming for the gifts listed on Schedule A. If you split a

gift with your spouse, the annual exclusion you claim against that gift may not be more than the smaller of the following:

- Your half of the gift, or

- $18,000

Line 3: Total included amount of gifts

Subtract Line 2 from Line 1. Enter the result here.

This represents the total included amount of gifts.

Lines 4 through 8 calculate total deductions. Let’s start with Line 4.

Line 4: Gifts of interest to spouse for which a marital deduction will be claimed

Enter the total value of items in Part 1 and Part 3 of Schedule A for which the box in Column (l) is checked. Do not enter any gift that you did not include on Schedule A.

You may deduct all gifts of nonterminable interests made during the year that you entered on Schedule A regardless of amount, and certain gifts of terminable interests as outlined below.

Terminable interests

Generally, you cannot take the marital deduction if the gift to your spouse is a terminable interest. In

most instances, a terminable interest is nondeductible if someone other than the donee spouse will have an interest in the property following the termination of the donee spouse’s interest.

Some examples of terminable interests are:

- A life estate,

- An estate for a specified number of years, or

- Any other property interest that after a period of time will terminate or fail.

If you transfer an interest to your spouse as sole joint tenant with yourself or as a tenant by the entirety, the interest is not considered a terminable interest just because the tenancy may be severed.

Life estate with power of appointment

You may deduct, without an election, a gift of a terminable interest if all four requirements below are met.

- Your spouse is entitled for life to all of the income from the entire interest.

- The income is paid yearly or more frequently

- Your spouse has the unlimited power, while alive or by will, to appoint the entire interest in all circumstances.

- No part of the entire interest is subject to another person’s power of appointment (except to appoint it to your spouse).

Line 5: Exclusions attributable to gifts on Line 4

Enter the amount of the annual exclusions that were claimed for the gifts listed on Line 4.

Line 6: Marital deduction

Subtract Line 5 from Line 4. This represents the total marital deduction.

Line 7: Charitable deduction

Enter the total value of items in Part 1 and Part 3 of Schedule A for which the box in Column (k) is checked. This should represent your total charitable, public, or similar gifts (minus annual exclusions allowed).

Eligible charitable deductions

You may deduct from the total gifts made during the calendar

year all gifts you gave to or for the use of:

- The United States, a state or political subdivision of a state, or the District of Columbia for exclusively public purposes;

- Any corporation, trust, community chest, fund, or foundation organized and operated only for:

- Religious, charitable, scientific, literary, or educational purposes, or

- To prevent cruelty to children or animals, or

- To foster national or international amateur sports competition

- If none of its activities involve providing athletic equipment unless it is a qualified amateur sports organization,

- As long as no part of the earnings benefits any one person, no substantial propaganda is produced, and no lobbying or campaigning for any candidate for public office is done;

- A fraternal society, order, or association operating under a lodge system, if the transferred property is to be used only for religious, charitable, scientific, literary, or educational purposes, including the encouragement of art and the prevention of cruelty to children or animals; or

- Any war veterans’ organization organized in the United States (or any of its territories), or any of its auxiliary departments or local chapters or posts, as long as no part of any of the earnings benefits any one person.

Line 8: Total deductions

Add Lines 6 and 7. This represents the total gift tax deductions reported on your gift tax return.

Line 9

Subtract the total deductions in Line 8 from the total included amount of gifts in Line 3. Enter the total in Line 9.

Line 10: Generation-skipping transfer taxes payable with this Form 709

If applicable, enter any generation-skipping transfer taxes (GSTT) that are payable with this IRS Form 709. You’ll find this amount in Schedule D, Part 3, Column (g).

Line 11: Taxable gifts

Add Line 9 and Line 10. This represents the total taxable gifts.

Enter this amount in Part II, Line 1.

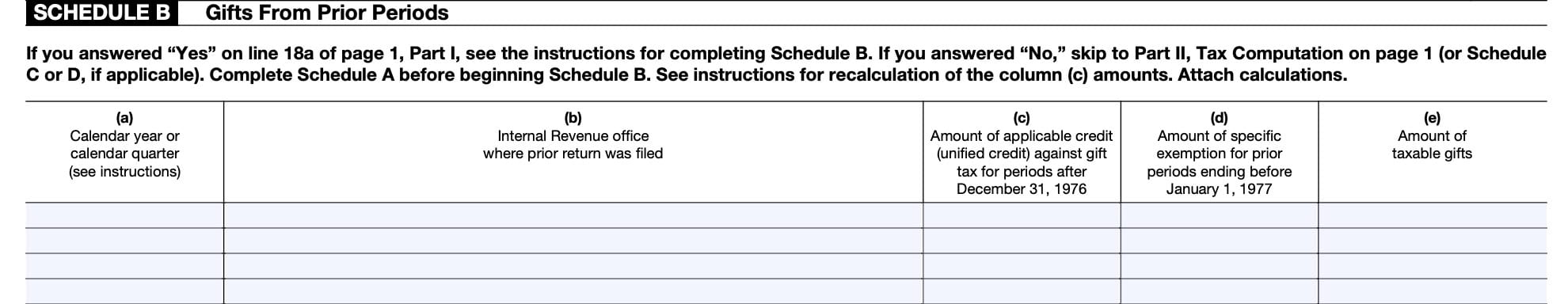

Schedule B: Gifts from prior periods

If you answered Yes on Line 18a in Part I, you will need to complete Schedule B. If you answered No, then skip to either:

- Schedule C (if calculating DSUE amount and restored exclusion)

- Schedule D (if calculating GSTT)

- Part II if neither of the above applies

Before we get to Line 1, we’ll need to enter the following information, by column:

- Column (a): Calendar year or quarter

- Column (b): IRS office where prior return was filed

- Column (c): Amount of unified credit against gift tax for periods after December 31, 1976

- Column (d): Amount of specific exemption for period ending before 1977

- Column (e): Amount of taxable gifts

Let’s take a closer look at each column for specific instructions. If you need further assistance, the IRS Form 709 instructions contain examples and tables for basic exclusion and credit amounts by tax year.

Column (a): Calendar year or quarter

If you filed returns for gifts made before 1971 or after 1981, show the calendar years in column (a).

If you filed returns for gifts made after 1970 and before 1982, show the calendar quarters.

Column (b): IRS office where prior return was filed

In column (b), identify the IRS office where you filed the returns. If you have changed your name, be sure to list any other names under which the returns were filed.

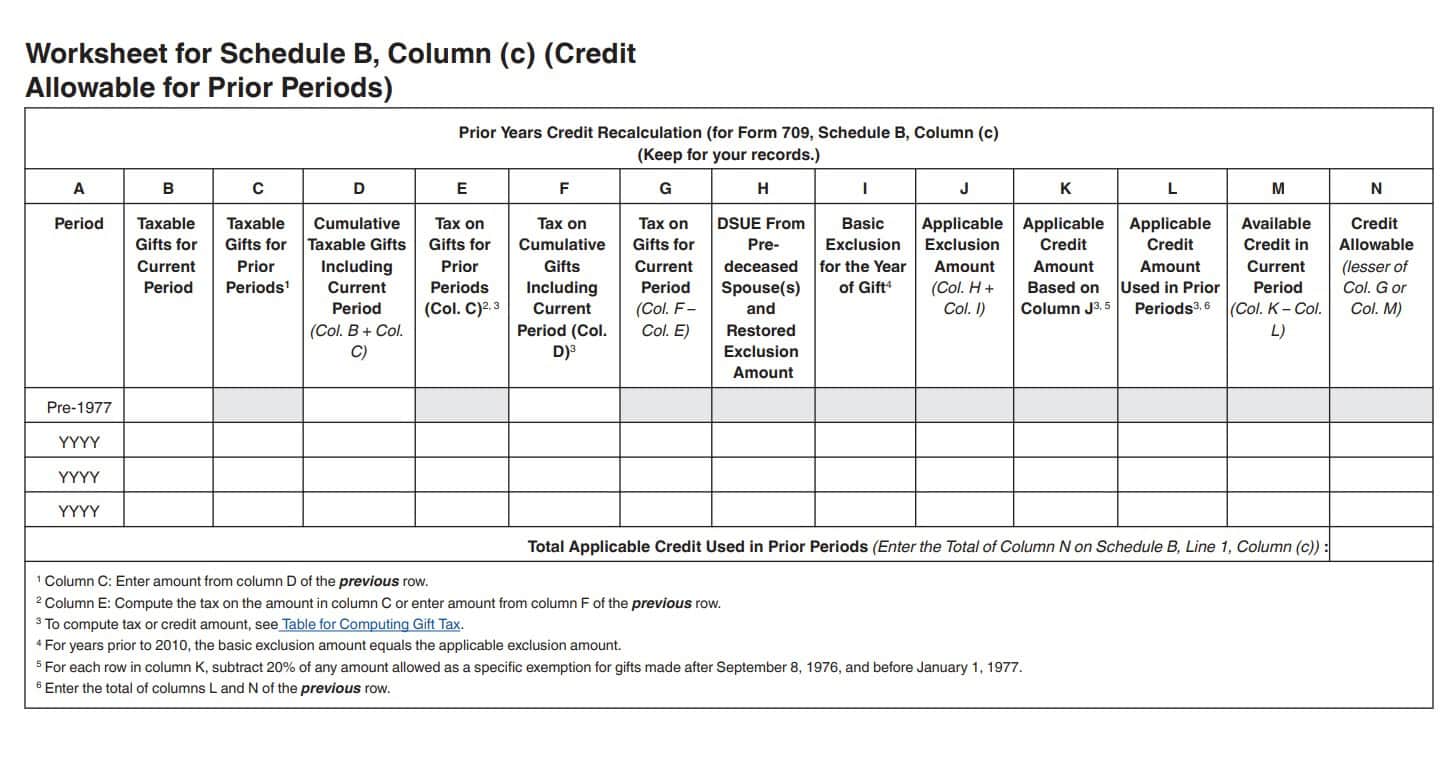

Column (c): Amount of unified credit against gift tax for periods after December 31, 1976

Your Column (c) entry depends on whether the total value of prior gifts is more than $500,000.

Prior gifts totaling $500,000 or less

Enter the amount of applicable credit actually applied in the prior period.

Prior gifts totaling more than $500,000

If your prior gifts totaled more than $500,000, the IRS requires you to use the following worksheet to calculate the total amount of unified credit against gift tax for prior gifts.

Once complete, calculate the total of Column N entries from the worksheet and enter this amount in Column (c).

Column (d): Amount of specific exemption for period ending before 1977

In Column (d), enter the amount of specific exemption claimed for gifts made in periods ending before January 1, 1977.

Column (e): Amount of taxable gifts

In Column (e), show the correct amount (the amount finally determined) of the taxable gifts for each earlier period. This should reflect all taxable gifts, even if no gift tax was paid due to the applicable (formerly unified) credit.

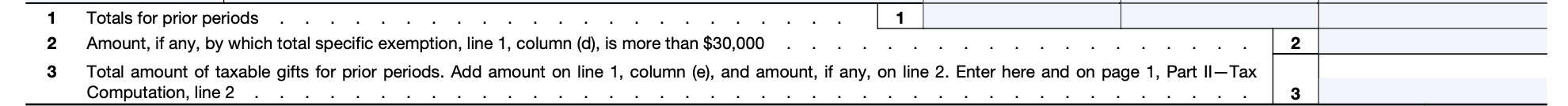

Line 1

In Line 1, enter the totals of the following column entries:

- Column (c): Amount of unified credit against gift tax for periods after December 31, 1976

- Column (d): Amount of specific exemption for periods ending before 1977

- Column (e): Amount of taxable gifts

Line 2

In Line 2, enter the amount, if applicable, by which the total specific exemption from Line 1, Column (d) exceeds $30,000.

In other words

- Subtract $30,000 from the Column (d) amount in Line 1

- Enter the result in Line 2

Line 3

Add the amount from Line 1, Column (e), and Line 2. Enter the result both here and in Part II, Line 2.

Schedule C: Deceased spousal unused exclusion (DSUE) amount and restored exclusion

Starting in 2011, the Internal Revenue Code was updated to allow estates of decedents dying on or after to elect to transfer any unused exclusion to the surviving spouse. This is known as the deceased spousal unused exclusion amount, or DSUE.

In Schedule C, we’ll calculate the amount of DSUE from one or more previously deceased spouses. You can skip Schedule C if:

- You were not predeceased by a spouse, or

- You were predeceased by a spouse, but not after December 31, 2010

You must complete Schedule A before starting Schedule C.

Part 1: DSUE received from last deceased spouse

In Part 1, we’ll calculate the DSUE from your most recently deceased spouse. To do this, we’ll need to enter information according to the following:

- Column (a): Name of deceased spouse

- Column (b): Date of death

- Column (c): Portability election made?

- Column (d): If ‘Yes,’ DSUE amount received from spouse

- Column (e): DSUE amount applied by donor to lifetime gifts

- Column (f): Date of gifts

Let’s take a closer look at the columns that require further explanation.

Column (c): Portability election made?

If Yes, attach proof of each portability election reported on Schedule C.

Column (d): DSUE amount received from spouse

Enter the DSUE amount that you received from your deceased spouse.

Column (e): DSUE amount applied by donor to lifetime gifts

Enter the total of the amount in column (d) that the donor has applied to gifts in previous years and is applying to gifts reported on this return.

A donor may apply DSUE only to gifts made after the DSUE arose. DSUE cannot be applied retroactively to gifts made prior to the portability election.

Column (f): Date of gifts

Enter the date of gifts using MM/DD/YY format.

Part 2: DSUE Received From Predeceased Spouse(s)

In Part 2, you’ll report DSUE received from previous spouses, if applicable. The primary difference is that in Column (f), you should report the date of gift(s) by year format (YYYY), not MM/DD/YY format.

Line 1: Donor’s basic exclusion amount

On Line 1, enter the donor’s basic exclusion amount. For 2024, this amount is $13,610,000. For 2025, this exclusion amount is $13,990,000.

Line 2

Add the amounts listed in Column (e) from Parts 1 and 2 and enter the total on Line 2.

Line 3: Restored exclusion amount

On Line 3, enter the Restored Exclusion Amount.

Restored exclusion amount

Restored exclusion amount applies to limited situations, specifically same-sex marriages where portability was denied due to the Defense of Marriage Act (DOMA).

However, this was overturned in a 2013 Supreme Court decision, United States v. Windsor, which allowed same-sex marriages to be treated as opposite-sex marriages for tax purposes.

The restored exclusion amount applies to those limited scenarios between the beginning of portability (in 2011) and the 2013 Supreme Court decision.

Line 4: Applicable credit on amount on Line 4

Add Lines 1, 2, and 3. Enter this amount on Line 4.

Line 5

Using the Table for Computing Gift Tax, determine the donor’s applicable credit by applying the

appropriate tax rate to the amount on Line 4.

Enter this amount here and on Line 7 of Part II—Tax Computation.

Schedule D: Computation of generation-skipping transfer tax

In Schedule D, we’ll calculate any generation-skipping transfer tax (GSTT), as applicable. If you do not have any gifts considered to be subject to GSTT, then you can skip Schedule D.

Generation-skipping transfer tax

The GST tax you must report on IRS Form 709 is that imposed only on inter vivos direct skips. An inter vivos direct skip is a transfer that is:

- Subject to the gift tax,

- Of an interest in property, and

- Made to a skip person

All three requirements must be met before the gift is subject to the GST tax

Who is a skip person?

A donee, who is a natural person, is a skip person if that donee is assigned to a generation that is two or more generations below the generation assignment of the donor.

A donee that is a trust is a skip person if all the interests in the property transferred to the trust (as defined above) are held by skip persons.

A trust will also be a skip person if there are no interests in the property transferred to the trust held by any person, and future distributions or terminations from the trust can be made only to skip persons.

The IRS Form 709 instructions contain additional information for determining a donee’s generation in situations where this is not straightforward.

You must complete Schedule A before completing Schedule D.

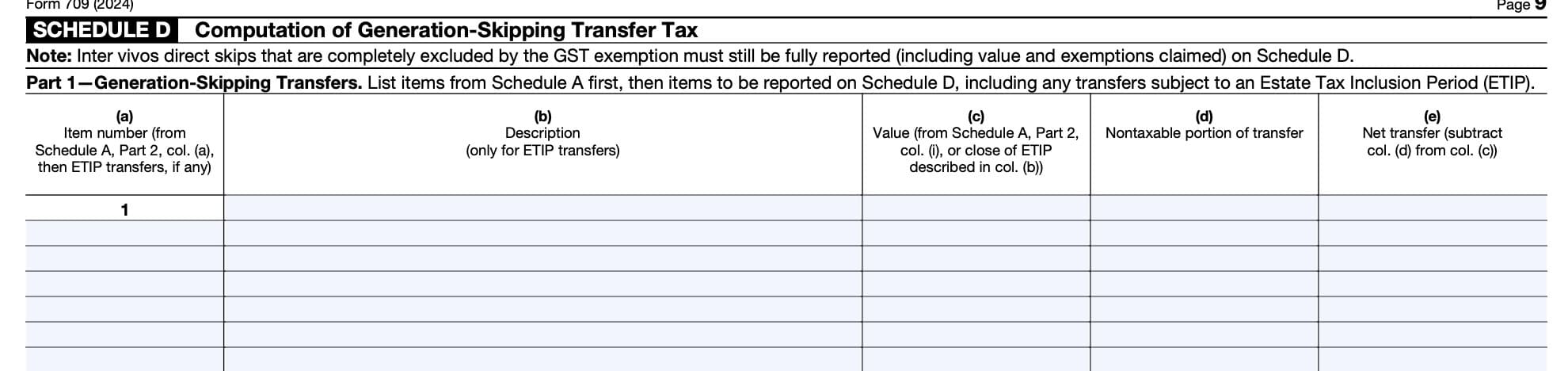

Part 1: Generation-skipping Transfers

Part 1 contains all of the gifts you listed in Part 2 of Schedule A, in the same order and showing the same values. You’ll enter information into each column as described below.

Column (a): Item number

List items from Schedule A, Part 2, Column (a), in the same order.

Next, list other items to be reported on Schedule D (including ETIP transfers), if any.

Column (b): Description

Only provide descriptions for ETIP transfers; otherwise, leave blank.

ETIP Transfers

If you are reporting a GST that occurred because of the close of an ETIP, use Column (b) to describe each transfer as provided in the instructions for Schedule A, Part 1. In addition, use Column (b) to do the following:

- Describe the interest that is closing the ETIP

- Explain what caused the interest to terminate

- List the date that the ETIP was closed

- List the year that the gift portion of the transfer was reported and its item number on Schedule A originally filed to report the gift portion of the ETIP transfer

Column (c): Value

Enter the value of the gift. This would be from either:

- Schedule A, Part 2, Column (i), or

- Close of ETIP described in Column (b)

ETIP Transfers

If the GST exemption is being allocated on a timely filed (including extensions) gift tax return, enter the value as of the close of the ETIP.

If the GST exemption is being allocated on a late-filed (past the due date including extensions) gift return, enter the value as of the date the gift tax return was filed.

Column (d): Nontaxable portion of transfer

Enter the nontaxable portion of your gift transfer.

You are allowed to claim the gift tax annual exclusion currently allowable for your reported direct skips (other than certain direct skips to trusts) using the rules and limits discussed earlier for the gift tax annual exclusion.

However, you must allocate the exclusion on a gift-by-gift basis for GST computation purposes. You must allocate the exclusion to each gift, to the extent desired but not exceeding the maximum allowable amount, in chronological order, beginning with the earliest gift that qualifies for the exclusion.

Be sure that you do not claim a total exclusion greater than the annual exclusion amount per donee.

Column (e): Net transfer

Subtract Column (d) from Column (c).

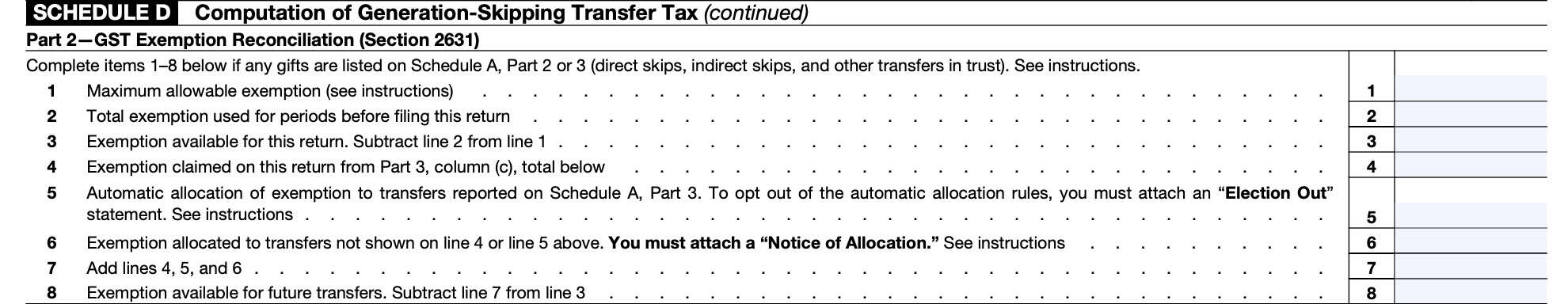

Part 2: GST Exemption reconciliation (Section 2631)

Complete Part 2 if there are any gifts listed on Schedule A, Part 2 or Part 3.

Line 1: Maximum allowable exemption

Every donor is allowed a lifetime GST exemption. The amount of the exemption for 2024 is $13,610,000. For tax years before 1999, the exemption was $1 million.

The following table shows the exemption amounts for years 1999 through 2024:

| Year | Amount |

| 1999 | $1,010,000 |

| 2000 | $1,030,000 |

| 2001 | $1,060,000 |

| 2002 | $1,100,000 |

| 2003 | $1,120,000 |

| 2004-2005 | $1,500,000 |

| 2006-2008 | $2,000,000 |

| 2009 | $3,500,000 |

| 2010-2011 | $5,000,000 |

| 2012 | $5,120,000 |

| 2013 | $5,250,000 |

| 2014 | $5,340,000 |

| 2015 | $5,430,000 |

| 2016 | $5,450,000 |

| 2017 | $5,490,000 |

| 2018 | $11,180,000 |

| 2019 | $11,400,000 |

| 2020 | $11,580,000 |

| 2021 | $11,700,000 |

| 2022 | $12,060,000 |

| 2023 | $12,920,000 |

| 2024 | $13,610,000 |

Line 2: Total exemption used for periods before filing this return

Enter the total exemption that was used for prior periods, before filing this year’s tax return.

Line 3: Exemption available for this return

Subtract Line 2 from Line 1. This represents the total exemption remaining for this tax return.

Line 4: Exemption claimed on this return from Part 3

Enter the amount already claimed on this return from Schedule D, Part 3, Column (c), below.

Line 5: Automatic allocation of exemption to transfers reported on Schedule A

Enter the amount of GST exemption you are applying to transfers reported in Part 3 of Schedule A.

Automatic allocation of exemptions

Internal Revenue Code Section 2632(c) provides an automatic allocation to indirect skips of any unused GST exemption. The unused exemption is allocated to indirect skips to the extent necessary to make the inclusion ratio zero for the property transferred.

You may elect out of this automatic allocation as explained in the instructions for Part 3.

Line 6: Exemption allocated to transfers not shown on Line 4 or Line 5

Enter the amount of any exemption not shown on Line 4 or Line 5. You must attach a Notice of Allocation.

Notice of Allocation

You may wish to allocate GST exemption to transfers not reported on this return, such as a late allocation. To allocate your exemption to such transfers, attach a statement to this IRS Form 709 and entitle it Notice of Allocation.

The notice must contain the following for each trust (or other transfer):

- Clear identification of the trust, including the trust’s EIN, if known.

- If this is a late allocation, the year the transfer was reported on IRS Form 709.

- The value of the trust assets at the effective date of the allocation.

- The amount of your GST exemption allocated to each gift

- Or a statement that you are allocating exemption by means of a formula such as “an amount necessary to produce an inclusion ratio of zero”).

- The inclusion ratio of the trust after the allocation

Total the exemption allocations and enter this total on Line 6.

Line 7

Add Line 4, Line 5, and Line 6. Enter the total here.

Line 8: Exemption available for future transfers

Subtract Line 7 from Line 3. This represents the amount of exemption available for future transfers.

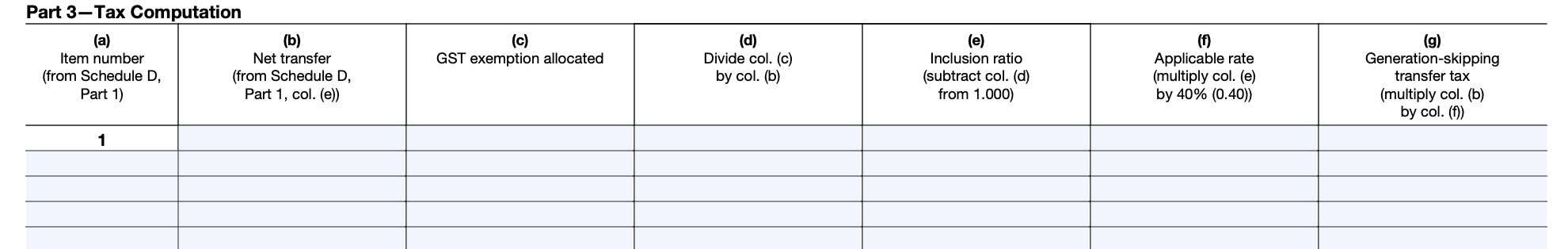

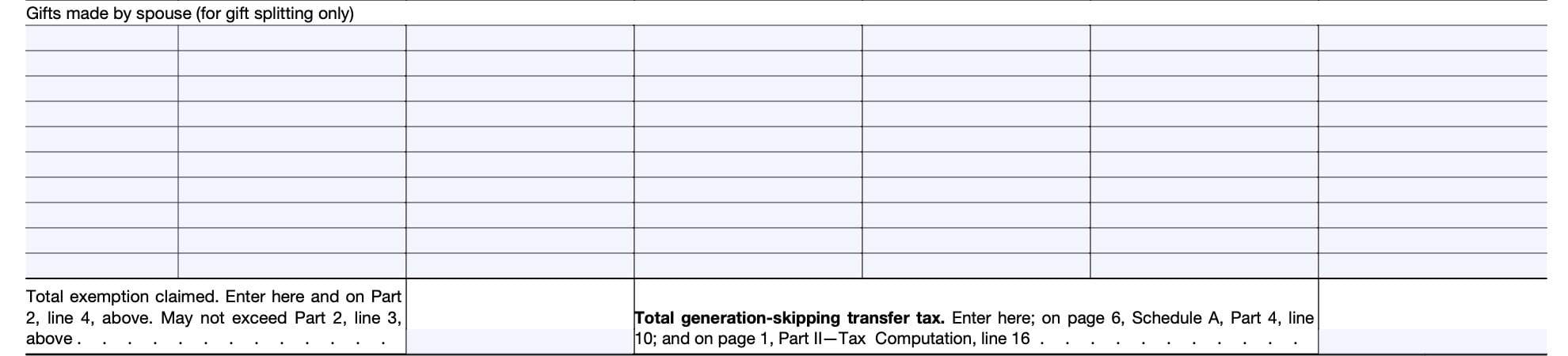

Part 3: Tax computation

In Part 3, you must list every gift that you listed in Part 1 of Schedule D. There are separate lines available to report gifts made jointly with your spouse, for gift-splitting purposes only).

Enter each gift in accordance with the following guidance for each column.

Column (a): Item number

Enter the gift’s item number from Schedule D, Part 1.

Column (b): Net transfer

Enter the net transfer amount. You’ll find this in Schedule D, Part 1, Column (e).

Column (c): GST exemption allocated

You are not required to allocate your available exemption.

You may allocate some, all, or none of your available exemption, as you wish, among the gifts listed in Part 3 of Schedule D. However, the total exemption claimed in column (c) may not exceed the amount you entered on Line 3 of Part 2 of Schedule D.

Column (d)

Divide the Column (c) amount by the amount in Column (b), and round the result to 3 digits (i.e. 1.000). Enter the result here.

Column (e): Inclusion ratio

Subtract Column (d) from 1.000. This represents the inclusion ratio.

Column (f): Applicable rate

Multiply the inclusion ratio by 40% (0.40). Enter the result here.

Column (g): Generation-skipping transfer tax

Multiply Column (b) by Column (f). Enter the result here.

This represents the generation-skipping transfer tax.

At the bottom of Part III, there are several additional lines.

Total exemption claimed

Add all of the figures in Column (c) and enter the total here. Also, enter the total in Part 2, Line 4, above.

Total generation-skipping transfer tax

Add all of the numbers in Column (g), then enter the total here and on:

Video walkthrough

Frequently asked questions

IRS Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return is the form taxpayers use to identify and calculate possible gift taxes.

Taxpayers who must file IRS Form 709 generally must file before April 15 of the year following the year of the taxable gift. If April 15th falls on a weekend or a legal holiday, then the due date falls on the next business day.

Where can I find IRS Form 709?

You may find tax forms such as IRS Form 709 on the Internal Revenue Service website. For your convenience, we’ve included the most recent version here in this article, as a PDF file.