IRS Form 8818 Instructions

If you’re redeeming U.S. Treasury bonds for qualified higher education expenses, you don’t need to pay taxes on the interest earned on those bonds. However, the Internal Revenue Service does expect you to keep accurate records in case there are questions. IRS Form 8818, Optional Form To Record Redemption of Series EE and I U.S. Savings Bonds Issued After 1989, is the best way to keep accurate records for this purpose.

In this article, we’ll walk through what you need to know about IRS Form 8818, including:

- Step by step instructions on completing IRS Form 8818

- Frequently asked questions

- Recordkeeping tips

Let’s begin by going over this one-page tax form.

Table of contents

How do I complete IRS Form 8818?

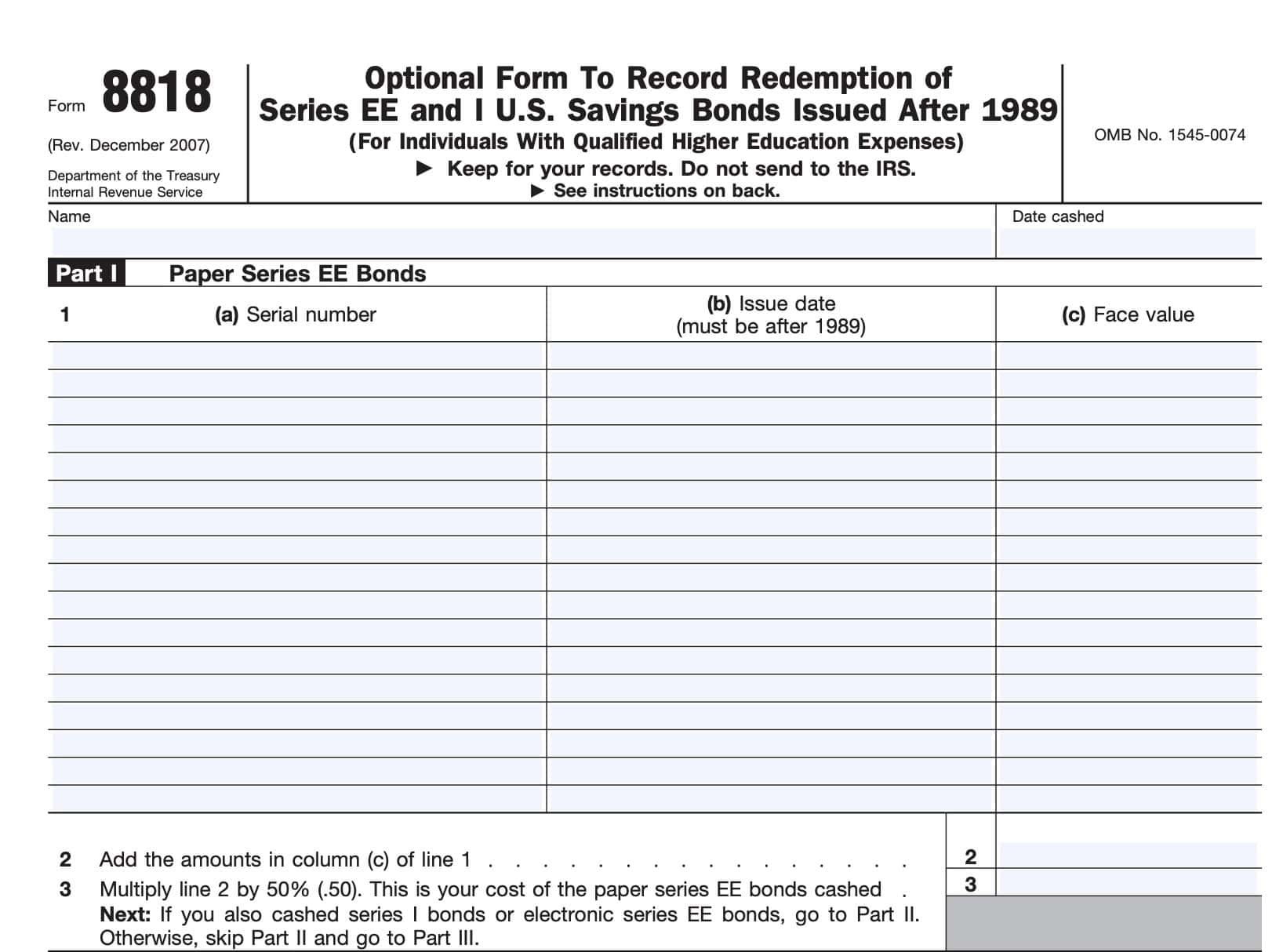

The Internal Revenue Service stresses that IRS Form 8818 is an optional tax form, and not required for you to prepare your federal income tax return. However, if you do wish to complete this form for recordkeeping purposes, there are three parts you should be aware of:

- Part I: Paper Series EE Bonds

- Part II: Series I Bonds and Electronic Series EE Bonds

- Part III: Total Redemption Proceeds and Interest

Let’s take a closer look at each part.

Part I: Paper Series EE Bonds

In Part I, we’ll discuss how to track any paper series EE bonds.

There is a key note from the IRS instructions: Before you cash your Series EE bonds, separate the bonds issued after 1989 from the bonds issued before 1990. Specifically, this is so that you can keep track of any bonds that may be eligible for tax exclusion when used to pay for qualified higher education expenses.

Line 1

For each qualifying paper bond, you’ll need to enter the following information:

- Serial number

- Issue date (must be after 1989)

- Face value

Paper series EE bonds

According to the TreasuryDirect website, the federal government stopped issuing paper series EE bonds after 2012. This means that the only Series EE paper bonds that should be listed in Part I are those issued between 1990 and 2012.

This includes certain savings bonds issued between 2001 and 2011 that were marked ‘Patriot Bonds,’ as part of a special issue that was used to fund anti-terrorism efforts.

Line 2

In Line 2, add up the face values of all bonds listed in Line 1. Enter the total in the space provided.

Line 3

Multiply the Line 2 amount by 50%. This should represent the cost of the paper series EE bonds that you cashed in during the year.

If you also redeemed Series I bonds or electronic EE bonds, then go to Part II. Otherwise, go directly to Part III, below.

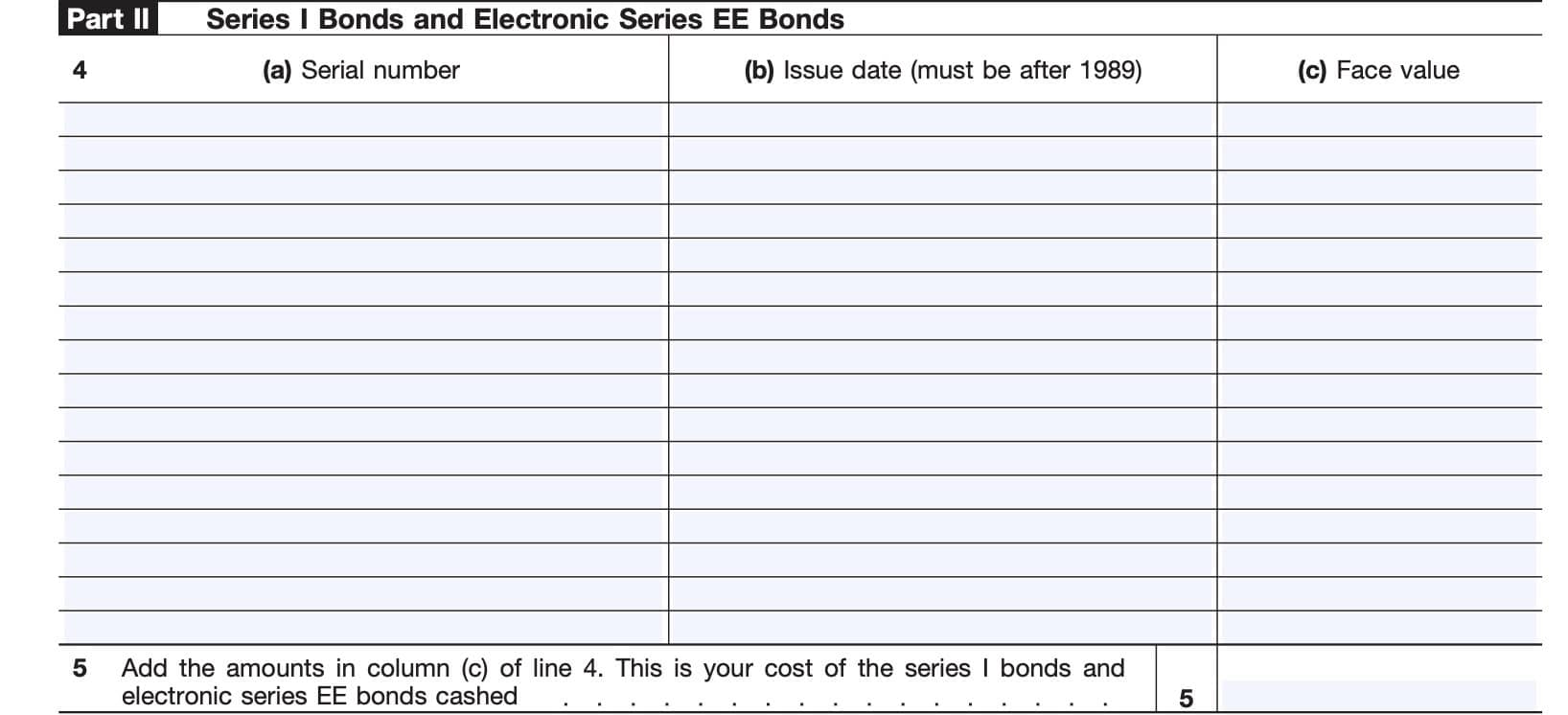

Part II: Series I Bonds and Electronic Series EE Bonds

In Part II, you’ll enter relevant information about any Series I bonds and electronic series EE bonds.

Line 4

For each series I bond and electronic series EE bond issued after 1989, enter the correct information for Columns (a), (b), and (c) of Line 4.

Include post-1989 Series EE bonds converted from paper to electronic bonds. Do not include them in Part I. Do not include any bonds that you reported in Part I.

Line 5: Cost of Series I bonds and electronic series EE bonds cashed

Add the total of the column (c) amounts from Line 4. Enter this number here.

Line 5 represents the total cost of your Series I and electronic Series EE bonds redeemed.

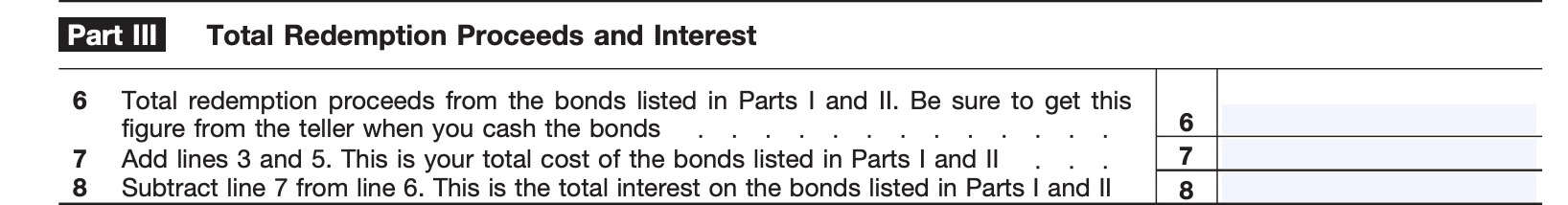

Part III: Total Redemption Proceeds and Interest

In Part III, we’ll total the amount of proceeds from all bonds, as well as the amount of interest that you earned on the bonds. This is important information for you to enter on IRS Form 8815 when reporting the exclusion of bond interest for education expenses.

Line 6: Total redemption proceeds from bonds listed in Parts I and II

Enter the total amount of proceeds from the bonds that you reported in Part I and Part II.

If you redeemed these bonds through a bank, you can obtain this figure from the bank teller. If you redeemed them through the TreasuryDirect website, you should be able to obtain the figure there.

Line 7: Total cost of bonds

Add Line 3 and Line 5, then enter the total here. This represents the total cost of your bonds, as listed in Part I and Part II.

Line 8: Total Interest

Subtract the total cost of the bonds (Line 7) from the total proceeds (Line 6), then enter the difference here. This represents the total interest on the bonds reported in Parts I and II.

Filing considerations

There really are no filing considerations for IRS Form 8818, as it is an optional form.

While the IRS does not require use of IRS Form 8818, it does require taxpayers to maintain accurate records for audit purposes.

This form serves to fulfill that function for U.S. Treasury Bonds, particularly when claiming the exclusion of interest income for qualified higher education expenses. Taxpayers can claim this credit on IRS Form 8815, Exclusion of Interest From Series EE and I U.S. Savings Bonds Issued After 1989.

If you use IRS Form 8818, here are a couple of key reminders:

- List only savings bonds issued after 1989. Since Treasury bonds stop paying interest after 30 years, this should not be an issue for most taxpayers.

- Do not list the same bond in Part I and Part II. This should be an easy mistake to avoid if you properly keep track of the serial numbers.

- The face value of your savings bonds is not the same as the total proceeds or the redemption value. You should receive the the redemption amount in the form of a receipt from either TreasuryDirect or the bank teller, if you’re redeeming paper bonds.

- Keep track of all savings bonds by their serial number. That way, if you ever lose a paper bond, you can still redeem it.

Video walkthrough

Frequently asked questions

No. This is an optional tax form that taxpayers may use for recordkeeping purposes. However, the IRS does require taxpayers to maintain adequate records to support income, deductions, and credits claimed on your tax return. IRS Form 8818 meets this requirement for Treasury bonds.

You do not need to report any information from IRS Form 8818 on your federal tax return. However, the information on IRS Form 8818 should match interest income that you include in income on Form 1040 or exclude on IRS Form 8815 if used for qualified higher education expenses.

Where can I find IRS Form 8818?

As with most tax forms, you can find IRS Form 8818 on the Internal Revenue Service website. For your convenience, we’ve included the most recent version of this tax form here, in our article.