IRS Form 8879-CORP Instructions

When filing an excise tax return, the taxpayer may choose to allow their tax professional to electronically sign the federal tax returns on his or her behalf. The donor can do this by using IRS Form 8879-CORP, E-file Authorization for Corporations.

In this article, we’ll go over what you need to know about IRS Form 8879-CORP, including:

- How to complete IRS Form 8879-CORP

- Taxpayer responsibilities

- Frequently asked questions

Let’s start with an overview of how to complete this tax form.

Table of contents

How do I complete IRS Form 8879-CORP?

There are three parts to IRS Form 8879-CORP:

- Part I: Information

- Part II: Declaration and Signature Authorization of Officer

- Part III: Certification and Authentication

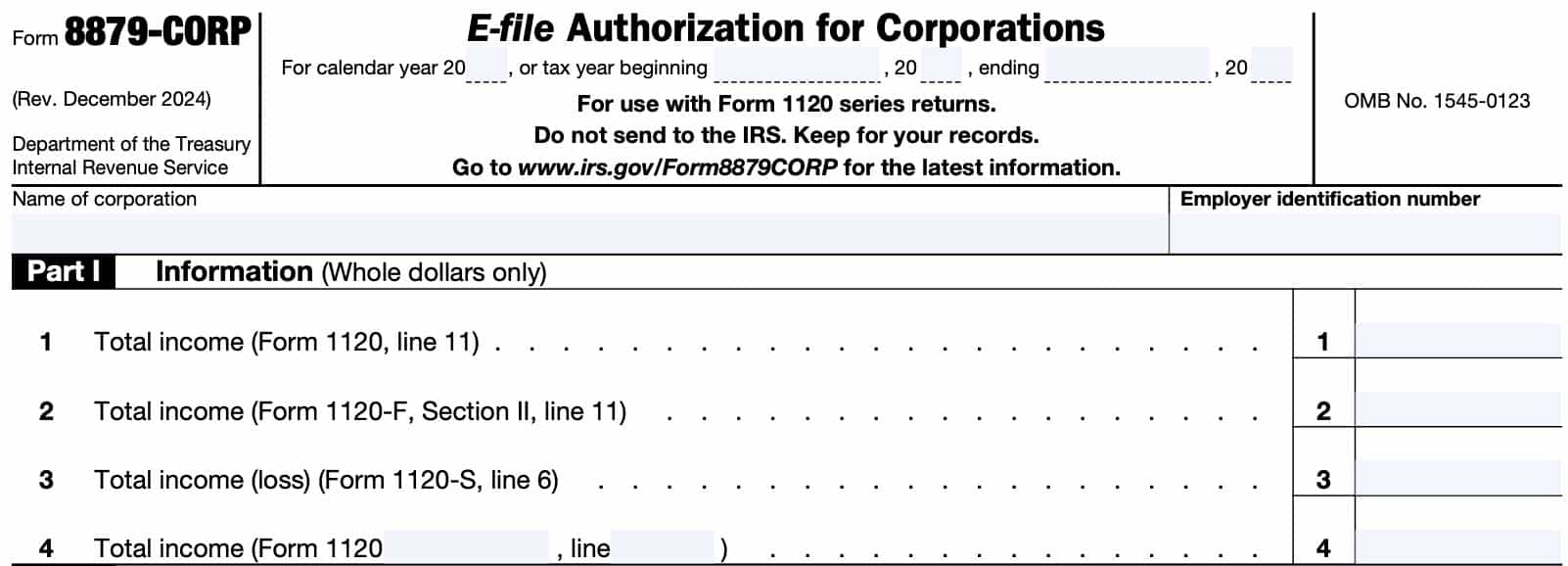

Before we begin with Part I, let’s take a look at the information fields at the very top of IRS Form 8879-CORP.

Top of form

At the very top of IRS Form 8879-CORP, there are a few information fields to complete.

Reporting period

Enter the calendar year or fiscal tax year of your corporation’s tax return. If using tax preparation software, your software should automatically complete this field.

name of corporation

Enter the corporation’s name, as shown on the e-filed return.

Employer identification number

Enter the employer ID number, or EIN, in this field.

Part I: Information

In Part I, we’ll enter certain tax return information from the corporate tax return. When completing IRS Form 8879-CORP, you will need to complete one of the following four lines, based on which corporate tax return you are filing:

- Line 1: IRS Form 1120, U.S. Corporation Income Tax Return

- Line 2: IRS Form 1120-F, U.S. Income Tax Return of a Foreign Corporation

- Line 3: IRS Form 1120-S, U.S. Income Tax Return for an S Corporation

- Line 4: IRS Form 1120___, any other type of corporate tax return

Let’s take a closer look at each line.

Line 1: Total income (Form 1120, Line 11)

In Line 1, enter the total income from your IRS Form 1120, Line 11.

Line 2: Total income (Form 1120-F, Section II, Line 11)

In Line 2, enter the total income from your IRS Form 1120-F, Line 11.

Line 3: Total income/loss (Form 1120-S, Line 6)

In Line 3, enter the total income from your IRS Form 1120-S, Line 6.

Line 4: Total income (Form 1120____)

In Line 4, enter the total income from your IRS Form 1120-series document. You will have to complete the fields specifying the type of corporation tax return, and which line represents the total income.

For reference, here is a list of other Form 1120 series tax forms and their income lines:

| Form variant | Form name | Line number |

| IRS Form 1120-C | U.S. Income Tax Return for Cooperative Associations | Line 10 |

| IRS Form 1120-H | U.S. Income Tax Return for Homeowners Associations | Line 8 |

| IRS Form 1120-IC-DISC | Interest Charge Domestic International Sales Corporation Return | Line 7 |

| IRS Form 1120-POL | U.S. Income Tax Return for Certain Political Organizations | Line 8 |

| IRS Form 1120-REIT | U.S. Income Tax Return for Real Estate Investment Trusts | Line 8 |

| IRS Form 1120-RIC | U.S. Income Tax Return for Regulated Investment Companies | Line 8 |

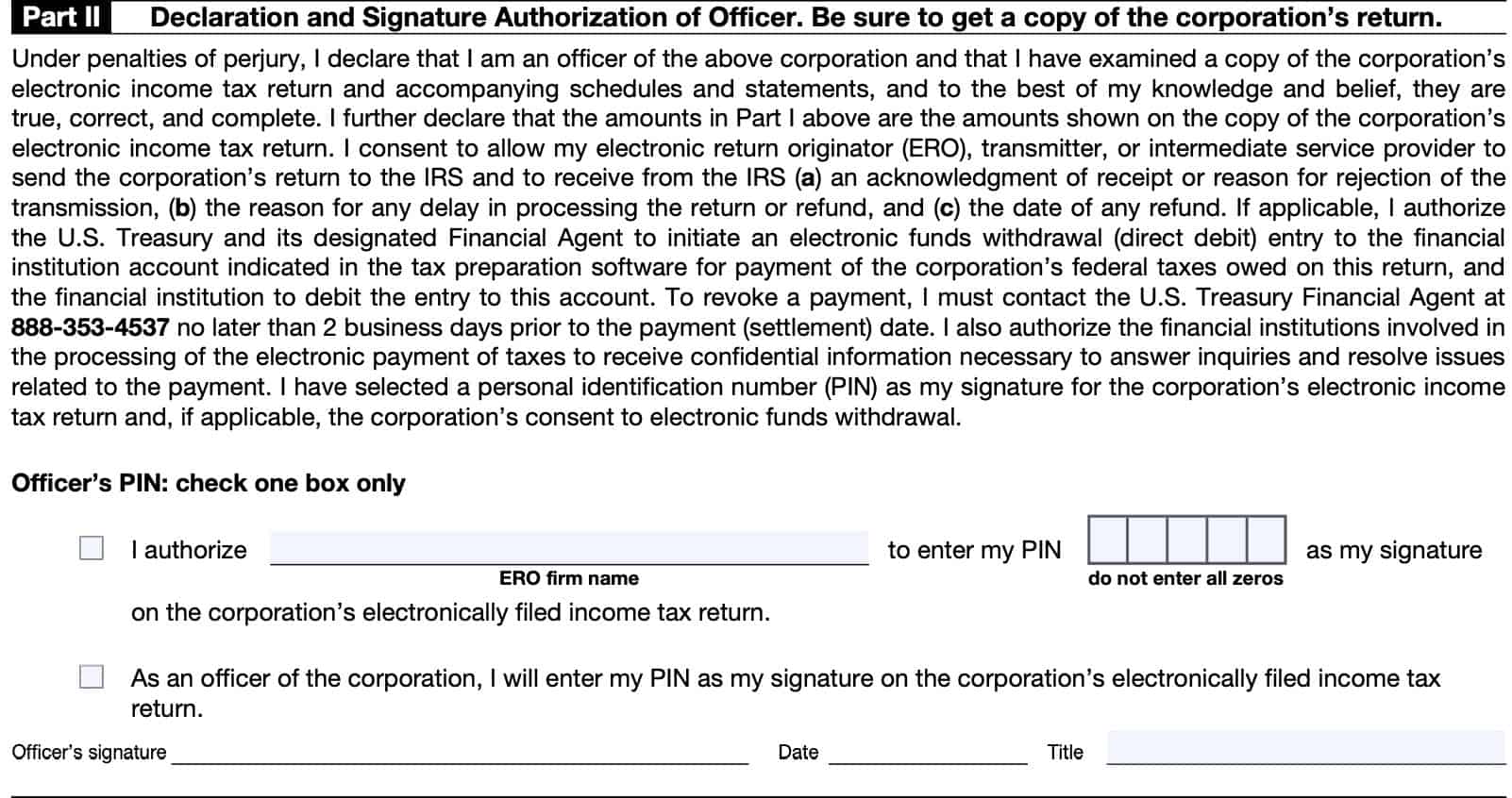

Part II: Declaration and Signature Authorization of Officer

In Part II, we’ll go over the declaration and electronic signature authorizations of the corporation’s officer. Before we get into the instructions, we should take a moment to go over some of the IRS requirements outlined in the finer print.

What does the declaration say?

There are a few main points you should know here.

You may be subject to legal penalties

In the first line, you are declaring, under penalties of perjury, that:

- You have personally reviewed the tax return, and

- The tax return is true, correct, and complete, to the best of your knowledge

You’re giving certain permissions to your tax professional

In the declaration, you are giving your electronic return originator (ERO), transmitter, or intermediate service provider permission to send and receive certain information to the IRS.

Specifically, you are granting permission to receive:

- Acknowledgment of receipt or reason for rejection of the transmission (tax return)

- Reasons for delays in processing the tax return or tax refund

- Date of any refund that may be owed to the estate or trust

You’re giving the federal government permission to conduct electronic funds withdrawal from a bank account

If you owe corporate income taxes to the United States government, your electronic signature authorizes the U.S. Treasury, through its designated financial agent, take electronic payment of the corporate tax bill.

The federal government will do this by direct debit from your financial institution account.

If you wish to revoke a payment, you must contact the financial agent no later than 2 business days prior to the payment or settlement date.

Officer’s PIN

Once you’ve read the tax declaration, you may choose one of the available personal identification number (PIN) methods:

- ERO enters your PIN for you

- Enter your own PIN

Select the first box if you authorize your tax preparer to enter your PIN. You’ll enter the five-digit PIN on the electronic Form 8879-CORP, which your paid preparer will use to provide your IRS electronic signature.

Otherwise, you will enter your own PIN in the tax preparation software prior to electronic filing of the tax return. Your tax professional will file the electronic corporate tax return using the practitioner PIN method.

Below the PIN, sign and date the form as the corporate officer.

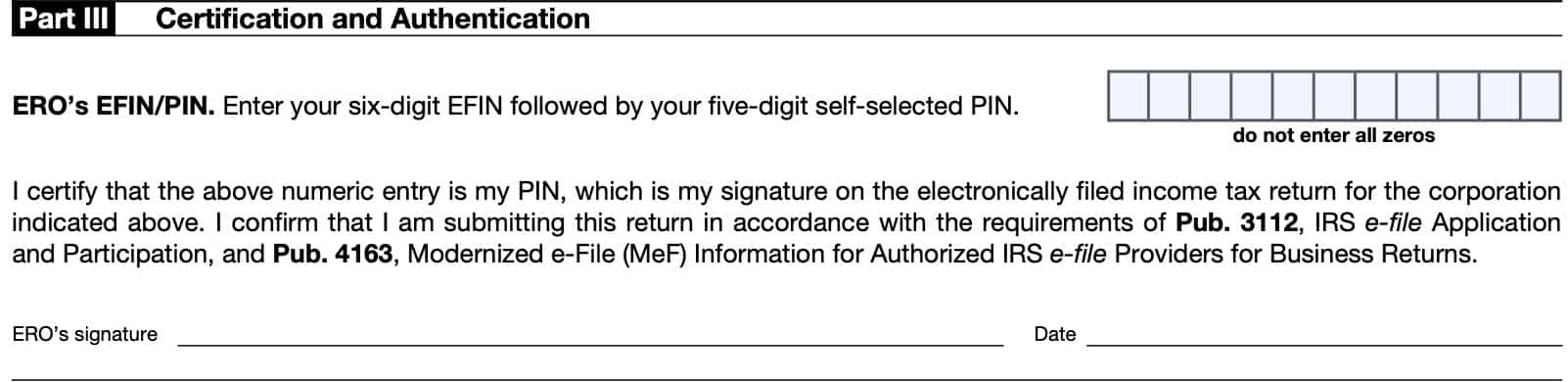

Part III: Certification and Authentication

In Part III, your tax return preparer will enter his or her PIN, which consists of:

- The ERO’s six-digit electronic filing identification number (EFIN), followed by

- A five-digit PIN

Below this field, the ERO will sign and date the Form 8879-CORP.

Filing IRS Form 8879-CORP

As the taxpayer, there are a couple of things you may want to know about IRS Form 8879-CORP.

Your tax return preparer won’t send this form to the IRS

In fact, the form itself says in bold print, “Don’t send to the IRS. Keep for your records.” Your tax return preparer is required to keep this form for at least 3 years after the tax return is filed, or after the IRS has received the tax return, whichever is later.

You don’t have to complete IRS Form 8879-CORP

A taxpayer and an ERO use Form 8879-CORP when the taxpayer wants to use a personal identification number (PIN) to:

- Electronically sign an estate’s or trust’s electronic income tax return and,

- Consent to electronic funds withdrawal (direct debit), if applicable

Any employer who doesn’t want to use Form 8879-CORP must use IRS Form 8453-CORP, E-file Declaration for Corporations.

Your tax preparer has certain responsibilities

According to the IRS instructions, your tax return preparer (or ERO) must do the following:

- Enter the name and EIN of the estate or trust at the top of the form;

- Complete Part I using the amounts from the estate’s or trust’s income tax return;

- Zero may be entered when appropriate

- Enter on the authorization line in Part II the ERO firm name if the ERO is authorized to enter the taxpayer’s PIN;

- Not the name of the individual preparing the return

- Give the taxpayer a copy of Form 8879-CORP for completion and review, and

- Acceptable delivery methods include hand delivery, U.S. mail, private delivery service, email, Internet website, and fax

- Complete Part III, including a signature and date

You have responsibilities as well

As the taxpayer, you must do the following:

- Verify the accuracy of the estate’s or trust’s prepared income tax return;

- Check the appropriate box in Part II to either:

- Authorize the ERO to enter the taxpayer’s PIN or

- Choose to enter it in person;

- Indicate or verify your PIN when authorizing the ERO to enter it

- The PIN must be five numbers other than all zeros

- Sign and date Part II; and

- Return the completed Form 8879-CORP to the ERO

The acceptable delivery methods include:

- Hand delivery

- U.S. mail

- Private delivery service

- Internet website, and

- Fax

Your tax return preparer will not submit the tax return until after he or she receives your signed form.

Video walkthrough

Frequently asked questions

IRS Form 8879-CORP, IRS e-file Signature Authorization for Forms 720, 2290, and 8849, provides the IRS e-file signature authorization that allows a tax return preparer to electronically file excise tax returns on behalf of the taxpayer.

According to the IRS instructions, a taxpayer does not have to complete IRS Form 8879-CORP. However, a taxpayer who does not use Form 8879-CORP must use Form 8453-CORP, E-file Declaration for Corporations, for an IRS e-file return.

Where can I find IRS Form 8879-CORP?

As with other tax forms, you can find IRS Form 8879-CORP on the Internal Revenue Service website. For your convenience, we’ve included the latest copy of this IRS e-file signature authorization form right here, in this article.