Form SSA-521 Instructions

If you’ve applied for Social Security benefits, then later choose to suspend or stop your benefit payments, you may do so by filing Form SSA 521, Withdrawal of Application. With an approved withdrawal, you may be able to:

- Increase your monthly retirement benefit over the long run

- Avoid any reduced Social Security benefits

- Maintain your Medicare coverage, while keeping your Medicare premiums at their current level

In this article, we’ll cover:

- How you can complete Form SSA 521

- Alternatives to filing your withdrawal of benefits application

- Frequently asked questions

Let’s start by going over the SSA-521 form itself.

Table of contents

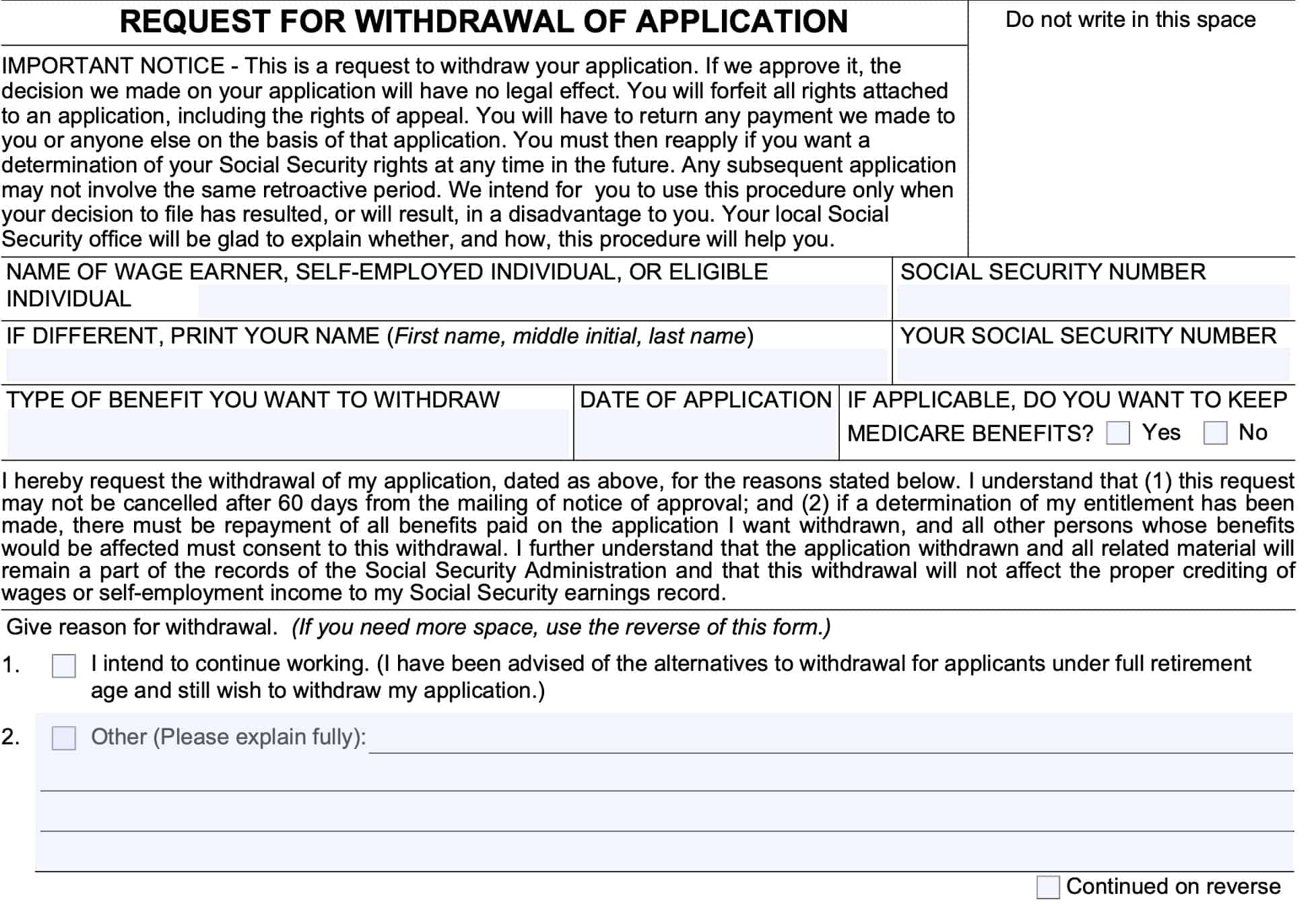

How do I complete Form SSA-521?

We’ll go through how to complete Form SSA-521. Let’s go through the steps of this process.

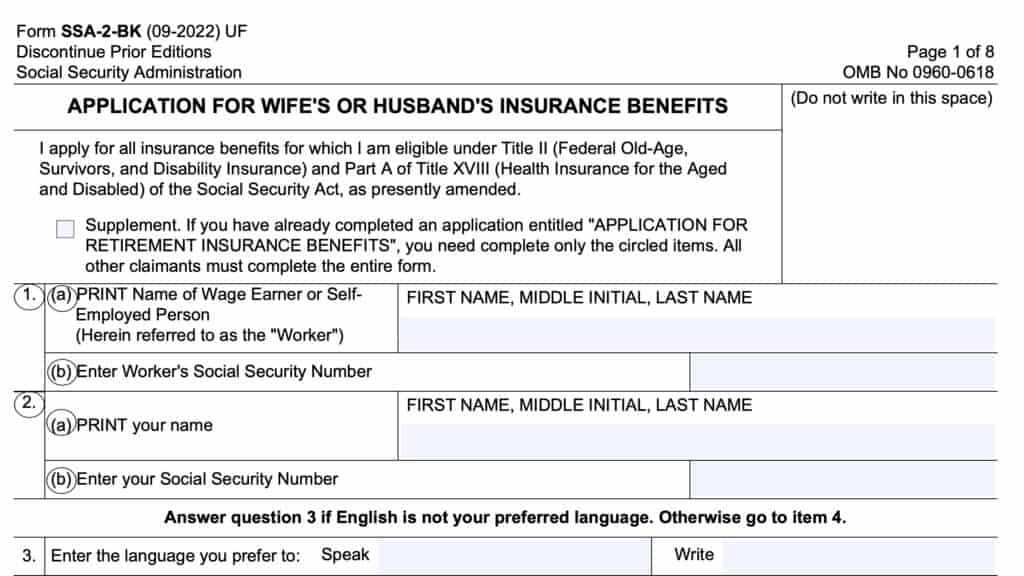

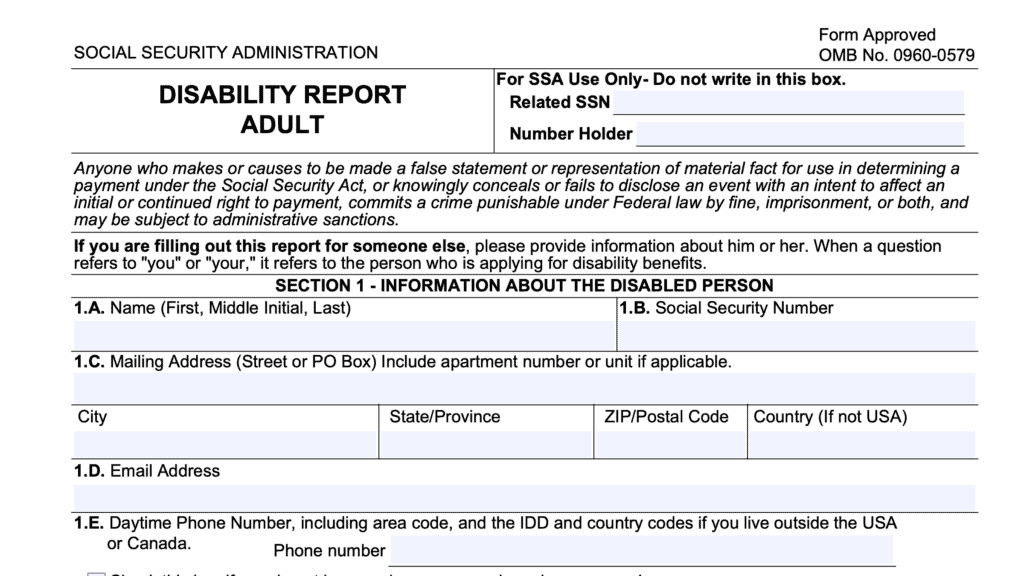

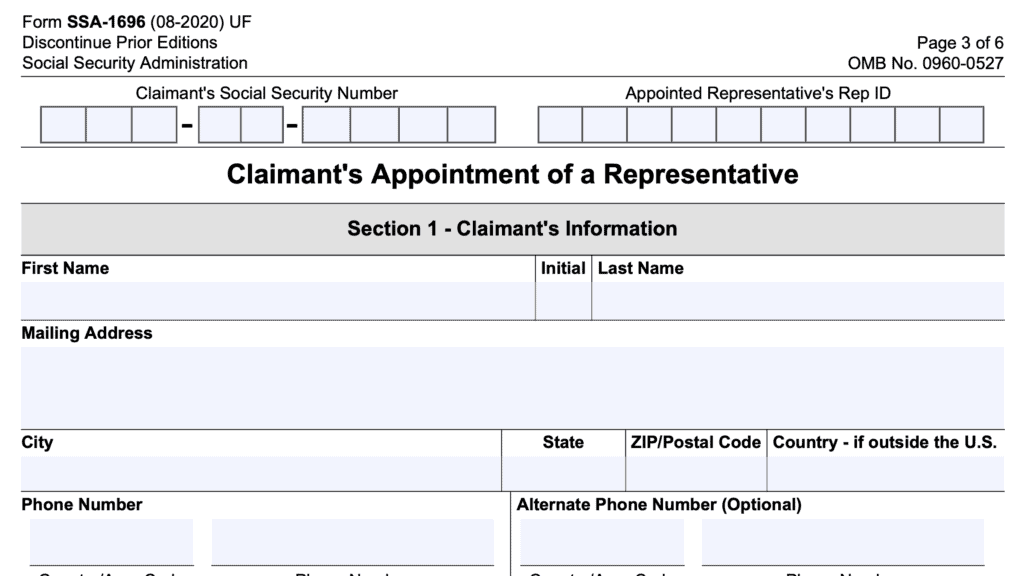

Applicant information

At the top of the form, enter the name of the wage earner, self-employed individual, or other eligible individual whose previous application you’re looking to withdraw, followed by that person’s Social Security number (SSN).

If you have entered the name of another person, then enter your own full name and Social Security number on the next line. If you are withdrawing your own original application, leave this field blank.

Finally, enter information about:

- The type of Social Security benefit you wish to withdraw

- This could be Social Security retirement benefits, Social Security disability benefits, spousal benefit, or survivor benefit

- Date of original application

- Whether or not you want to keep Medicare benefits, if applicable

If you are age 65 or older, you may want to talk with your financial advisor or a Social Security worker before stopping your Medicare coverage.

Reason for withdrawal

In this section, check the appropriate box for the reason you’re submitting this withdrawal request.

Box 1: You intend to keep working

If you intend to continue working, select the first box. This is one of the most common reasons that beneficiaries apply for a withdrawal of benefits.

You may also have other options besides submitting your withdrawal request. Checking this box indicates that you’ve been advised of these alternatives, but that you’re submitting this withdrawal request anyway.

Box 2: Other reason

If you are submitting this request for any other reason, select this option, then you must provide a written explanation in the given field. If needed, you may select the box marked, ‘Continued on reverse’ to continue your written narrative on the reverse of this form.

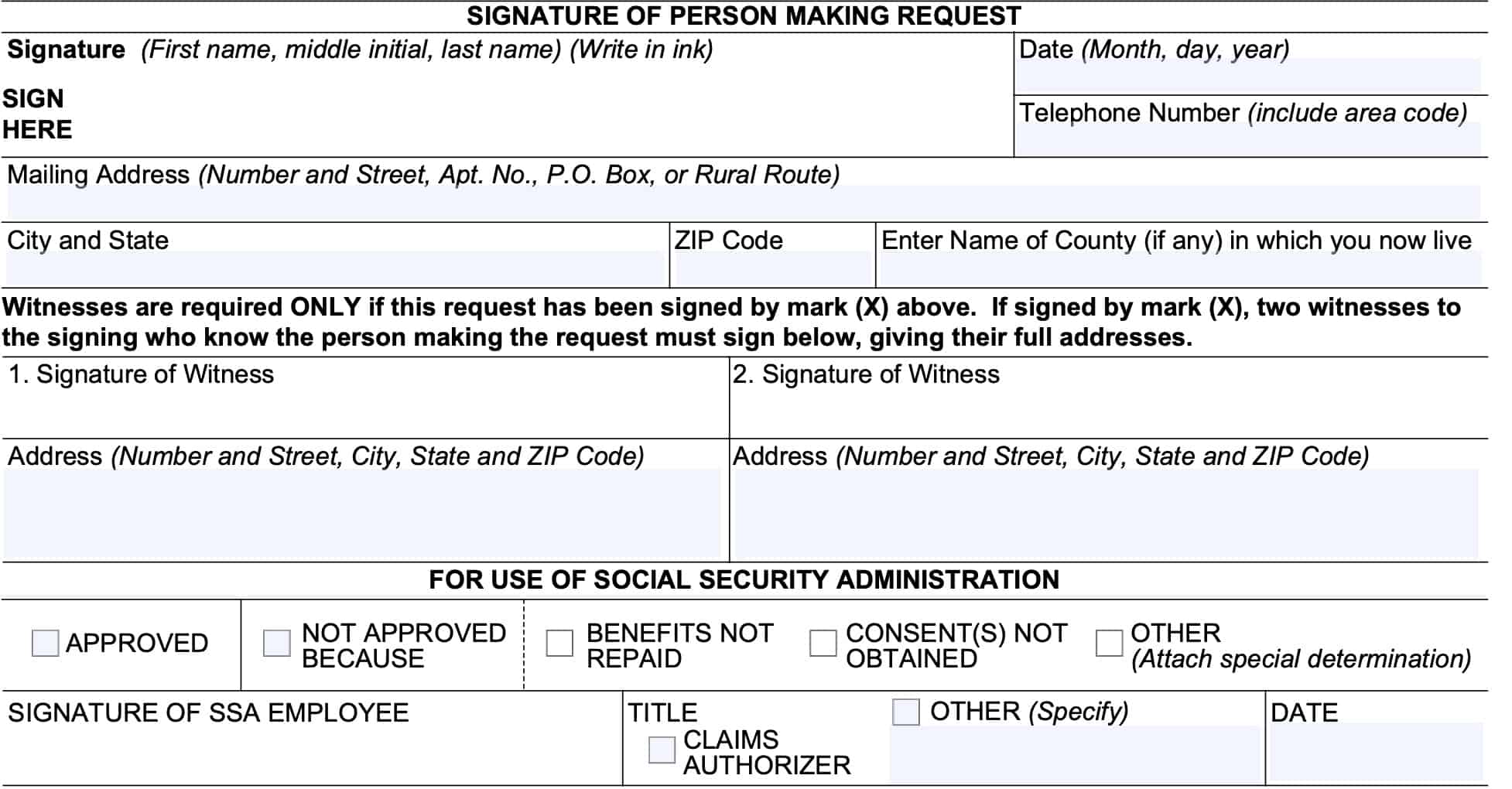

Signature field

Towards the bottom of the form, you’ll see the signature field.

Sign your name (regardless of whether you are the same person listed at the top of the form), as well as the date.

Enter your telephone number and your mailing address. Be sure to include the city, state, and zip code where you live.

Why would I file Form SSA 521?

You may choose to stop your Social Security benefit payments for several reasons.

You want to go back to work.

Many people decide to work past full retirement age (FRA). Some people decide to retire, but then find a new job in retirement.

If this is the case, working a couple of years past FRA might help accumulate delayed retirement credits, which will result in a higher benefit.

If you have not yet reached FRA but continue to work while receiving benefit payments, then the amount of benefits you receive may be reduced. By filing your withdrawal of application form, you’re able to avoid receiving the lower payment amount.

You want to receive a higher benefit amount at a later date.

Once an individual reaches FRA, there’s no reduced monthly benefit.

However, if the individual requests a suspension of benefits, then he or she will accumulate delayed Social Security credits. These delayed credits will raise the individual’s benefit entitlement for each month of delay, up until the age of 70. At age 70, the person has reached their maximum SS benefit.

Video walkthrough

Watch this informative video about how to submit a request for withdrawal of your Social Security application using Form SSA-521.

Frequently asked questions

You may not have to file this form to stop benefits. You may suspend your benefits for any month in which you have not yet received them. If you’ve already reached FRA, you may also consider requesting a lump sum payment of up to 6 months’ SS benefits. For a complete picture of your entitlements, you should talk with your local Social Security office.

You may suspend your Social Security income, while maintaining Medicare coverage. Simply check the box indicating that you want to keep your Medicare benefits on your withdrawal application.

You may have to pay back benefits you’ve already received. For a better understanding of the specific rules regarding your situation, and to calculate your payback amount, you may want to set up an appointment at your local Social Security office.

Where can I find Form SSA-521?

As with other forms, you may find Social Security Form SSA-521 on the Social Security Administration website. For your convenience, we’ve also included the latest version of this application form in this article.