IRS Form 1099-Q Instructions

For taxpayers who have opened education savings accounts for their children, receiving your first 1099-Q form can be a daunting experience. However, it’s important to understand how IRS Form 1099-Q works, so you can properly account for your distributions.

In this article, we’ll help you understand:

- How IRS Form 1099-Q works

- How you might report distributions on your income tax return

- Frequently asked questions

Let’s start with a step by step breakdown of IRS Form 1099-Q.

Table of contents

IRS Form 1099-Q Instructions

In most of our articles, we walk you through how to complete the tax form.

However, since Form-1099 is issued to taxpayers for informational purposes, most readers will probably want to understand the information reported on their 1099-Q form, instead of how to complete it.

Before we start breaking down this tax form, it’s important to understand that there can be up to 3 copies of Forms 1099-Q. Here is a break down of where all these forms end up:

- Copy A: Internal Revenue Service center

- Copy B: For recipient’s tax records

- Copy C: For payer’s tax records

Unlike other 1099 forms, there are no state or local versions of this form for state tax returns.

Let’s first look at the taxpayer information on the left-hand side of the form.

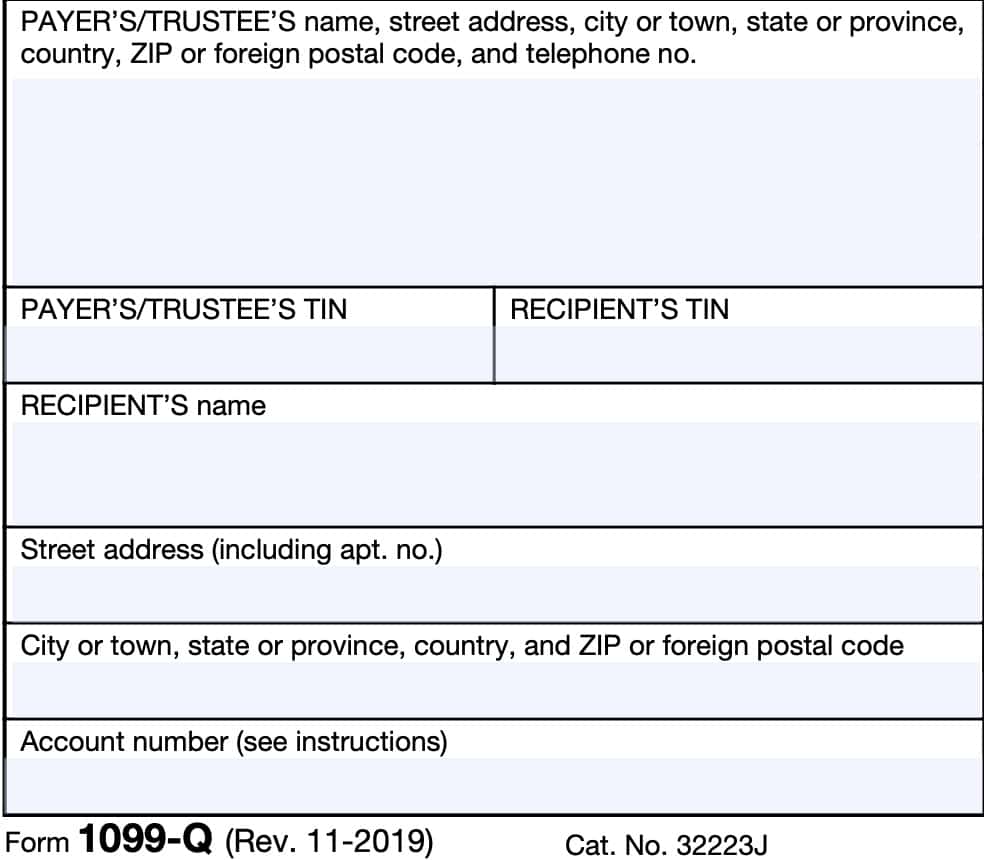

Taxpayer identification fields

On the left side, you’ll see the information for both the payer and the recipient. You’ll want to review these for accuracy.

Payer’s Name, Address, And Telephone Number

You should see the financial institution’s complete name, address, and telephone number in this field.

Payer’s TIN

This is the payer’s taxpayer identification number (TIN). In most situations, this will be the employer identification number (EIN).

The payer’s TIN should never be truncated.

Recipient’s TIN

As the recipient or payee, you should see your taxpayer identification number in this field. For payees, the TIN can be any of the following:

- Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

- Adoption taxpayer identification number (ATIN)

- Employer identification number (EIN)

Please review this field to make sure that it is correct.

However, you may see a truncated form of your TIN (such as the last four digits of your SSN), for privacy protection purposes. Copy A, which the financial institution sends directly to the Internal Revenue Service, is never truncated.

Recipient’s Name And Address

You should see your name and address reflected in these fields. If your address is incorrect, you should notify the financial institution and the IRS.

You can notify the IRS of your new address by filing IRS Form 8822, Change of Address. Business owners can notify the IRS of a change in their business address by filing IRS Form 8822-B, Change of Address or Responsible Party, Business.

Account number

This field may show an account or other unique number the payer has assigned to distinguish your account.

The Internal Revenue Service requires financial institutions to list an account number in this field if you have multiple accounts with the same institution and they are issuing more than one Form 1099-Q. In all other instances, the IRS encourages, but does not mandate the use of an account number.

Let’s take a look at the right hand side of the form.

Boxes 1 through 6

There are six boxes that report information about the Form 1099-Q payments. Let’s take a closer look and break down each part so we can better understand.

Box 1: Gross distribution

Box 1 will show the total distribution paid to you from a qualified tuition program (QTP) or a Coverdell Education Savings Account (Coverdell ESA) during the calendar year. This amount also includes in-kind distributions.

Box 1 should reflect the totals of earnings from Box 2, as well as basis reported in Box 3. IRS Publication 970, Tax Benefits for Education, should contain additional information.

Qualified tuition program accounts

Gross distributions from a QTP, whether in cash or in-kind can include amounts for the following:

- Tuition credits or certificates

- Payment vouchers

- Tuition waivers

- Other similar items

Gross distributions may also include a refund to the account owner or the designated beneficiary student, or to the beneficiary upon death or disability.

Coverdell ESA distributions

Gross distributions from a Coverdell ESA can also include the following:

- Amounts for a refund

- Payment upon death or disability, or

- Withdrawal of excess contributions and earnings

The Form 1099-Q instructions state that for Coverdell ESA distributions, the payer or trustee does not have to report any amounts in Box 2 or Box 3, except for earnings on excess contributions.

Instead, the payer or trustee may report the fair market value for Coverdell education savings accounts as of December 31 of the tax year. If so, the payer or trustee will report this value in the blank box below Boxes 5 and 6.

In this case, you would need to use the Coverdell ESA-Taxable Distributions and Basis worksheet, located in IRS Publication 970, to determine the taxable amount of the distribution.

Box 2: Earnings

Box 2 contains the earnings portion of the gross distribution shown in Box 1.

Generally, the following are not included in income when filing your federal income tax return:

- Amounts used to pay for qualified education expenses

- Amounts transferred between trustees

- Also known as a trustee-to-trustee transfer

- Rollovers to another qualified education program or to an ABLE account

- ABLE accounts are used for special needs individuals to help preserve eligibility for certain state or federal public benefits programs

- Rollovers between qualified education programs must be like-kind:

- Coverdell ESA to Coverdell ESA

- Qualified tuition program: From one QTP account to another, or to an ABLE account

If there is a loss and this is not the final year for distributions from the account or there are no earnings, you may see ‘0’ or a blank in Box 2. You may see a loss in this box if this is the final year for distributions from the account.

Earnings are not subject to backup withholding.

If the amount in Box 2 includes earnings on excess contributions, you may see Distribution code 2 or 3, as applicable, in the box below Boxes 5 and 6. See the Distribution Codes section, later, for more information.

Qualified tuition program Accounts

Under a QTP, the amount in Box 2 is included in income if there has been:

- More than one transfer or rollover within any 12-month period regarding the same beneficiary, or

- A change in the designated beneficiary and the newly designated beneficiary is not a family member

Coverdell ESA

Under a Coverdell ESA, the Box 2 amount is included in income if there has been a change in the designated beneficiary and the new beneficiary is:

- Not a family member, or

- Over age 30

- Exceptions exist for special needs beneficiaries)

If your Coverdell ESA distribution includes a returned contribution plus earnings, your financial institution may file two copies of the 1099-Q.

One copy will report the returned contribution plus earnings, while the other Form 1099-Q will report the distribution from the other portion of the account.

Additional notes

Your financial institution probably will issue a separate Form 1099-Q for any trustee-to-trustee transfer.

Also, an additional 10% tax may apply to part or all of any distribution amount included in taxable income from the Coverdell ESA or Qualified Tuition Plan account.

If applicable, you may need to complete and file IRS Form 5329, Additional Taxes, with your individual tax return. You’ll also need to report any taxable amount as other income on IRS Schedule 1, Additional Income and Adjustments to Income.

If you have made a final plan distribution from your account, and you have not recovered the total amount of your original contributions, you may have a deductible loss. IRS Publication 970 contains additional information about how to determine your loss and how to claim it on your tax return.

Box 3: Basis

Shows your basis in the gross distribution reported in Box 1. This is the total amount of your original investment, without regard to investment earnings.

According to the form instructions, if the financial institution can determine basis, then they must enter the basis that was included in the gross distribution that they reported in Box 1. The amount in box 3 must equal the total distribution amount reported in Box 1 minus the earnings posted in Box 2.

Box 4: Trustee-to-trustee transfer

This box is checked if a trustee-to-trustee transfer was made from:

- One QTP to another QTP

- One Coverdell ESA to another Coverdell ESA

- A Coverdell ESA to a QTP, or

- A QTP to an ABLE account

However, if your custodian does not have records showing that a gross distribution from a Coverdell ESA made in the current year was a trustee-to-trustee transfer, they will likely leave Box 4 blank.

Box 5: Distribution is from:

This Box shows whether the gross distribution was from a

- Private QTP, known as a private 529 plan

- State QTP, known as a state 529 plan or state prepaid tuition program

- Coverdell ESA

Box 6

Box 6 will be checked if the recipient is not the designated beneficiary under a QTP or a Coverdell ESA. The designated beneficiary is the individual named in the document creating

the trust or custodial account to receive the benefit of the funds in the account.

Distribution codes

For the calendar year, the payer/trustee may, but is not required to, report one or more of the following distribution codes, as applicable to the tax situation:

| Distribution code | Use this code for: |

| 1-Distributions | Distributions (including transfers) to the recipient and any direct payments to a qualified educational facility. However, use code 2 or 3 for withdrawals of excess contributions. |

| 2-Excess contributions plus earnings taxable in current year | Withdrawals of excess Coverdell ESA contributions and earnings unless code 3 applies. |

| 3–Excess contributions plus earnings taxable in prior year | Withdrawals of excess contributions from a Coverdell ESA. Advise payees, at the time the distribution is made, that the earnings are taxable in the year in which the excess contributions were made. |

| 4–Disability | Distributions you made after the recipient was disabled (see Internal Revenue Code Section 72(m)(7)). |

| 5-Death | Payments to a decedent’s beneficiary, including an estate. |

| 6–Prohibited transaction | Prohibited transactions. See IRC Sections 408(e)(2) and 408(e)(4) for similar rules that apply to a Coverdell ESA. |

Filing IRS Form 1099-Q

For tax entities who must file this tax form with the Internal Revenue Service, the IRS requires certain paper versions of information returns to be accompanied by IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

Check out our step-by step instructional guide for more information on how to submit your information return with IRS Form 1096.

Video walkthrough

Watch this instructional video to learn more about what you should expect when you receive IRS Form 1099-Q.

Are you tired of dreading tax season?

If you’re like most people, you push through the stress of filing, only to be hit with a bigger bill than expected—then put it all behind you until the same cycle repeats next year.

But what if you could change the game?

Tax planning puts you in control. It’s about being proactive, not reactive—taking small, smart steps throughout the year to reduce your tax burden, increase your savings, and keep more of your hard-earned money working for you.

Here’s what effective tax planning helps you do:

✅ Avoid the surprise of a high tax bill

✅ Understand how your income and decisions affect your taxes

✅ Strategically lower your tax liability over time

Ready to make smarter tax moves?

👉 Join my free weekly tax planning newsletter and get one actionable tip every week to help you reduce your taxes legally and effectively.

Start taking control—your future self will thank you.

Frequently asked questions

The amount of distributions that pays qualified higher education expenses is generally not taxable and not reported on either beneficiary’s income tax return or the account holder’s tax return. Distributions in excess of this amount may be reported based on your tax situation.

Both education savings plans are similar, but differences exist. Generally, a Coverdell ESA has more restrictions regarding annual contribution limits, beneficiary age, and income limits.

Recipients should expect to receive their 1099-Q form no later than January 31 of the year after the distribution. The due date for issuers to send Form 1099-Q to the IRS is February 28, if filing by paper, or March 31, if filing electronically.

Where can I find IRS Form 1099-Q?

As with other information returns, you can find IRS Form 1099-Q on the IRS website. For your convenience, we’ve enclosed a copy of the latest version right here.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!

Thank you for your help. I am filling form 1116 and asks for name of foreign country. My financial advisor just says “multiple” under passive category income. There is no where this year to say multiple. What can I do?

From the form instructions:

Generally, if you received income from, or paid taxes to, more than one foreign country or U.S. territory, report information on a country-by-country basis on Form 1116, Parts I and II. Use a separate column in Part I and a separate line in Part II for each country or territory. If you paid taxes to more than three countries or territories, attach additional sheets following the format of Parts I and II.

However, I would double-check to see if you need to file in the first place. Also from the form instructions:

You may be able to claim the foreign tax credit without filing Form 1116. By making this election, the foreign tax credit limitation (lines 15 through 23 of the form) won’t apply to you.

This election is available only if you meet all of the following

conditions.

• All of your foreign source gross income was “passive category income” (which includes most interest and dividends). See c. Passive Category Income, later. However, for this purpose, passive income also includes

(a) income subject to the special rule for high-taxed income, described later; and

(b) certain export financing interest.

• All the income and any foreign taxes paid on it were reported to you on a qualified payee statement. Qualified payee statements include:

Form 1099-DIV

Form 1099-INT

Schedule K-1 (Form 1041)

Schedule K-3 (Form 1065)

Schedule K-3 (Form 1120-S), or

Similar substitute statements.

• Your total creditable foreign taxes aren’t more than $300 ($600 if married filing a joint return).