IRS Form 15106 Instructions

If you’ve received an LP64 notice from the Internal Revenue Service, it’s probably because they’re looking for a taxpayer and believe that you might be able to provide additional information. In addition to the LP64 notice, you might have received a copy of IRS Form 15106, Request for Updated Taxpayer Information.

In this article, we’ll help you better understand what you need to know about this IRS form, including:

- How to complete IRS Form 15106

- Filing considerations

- Frequently asked questions

Let’s start with a step by step overview of this tax form.

Table of contents

How do I complete IRS Form 15106?

This one-page tax form is relatively straightforward. For your convenience, we’ve broken this IRS form into three sections:

- Help IRS Locate a Taxpayer

- For Use by Post Office Only

- Other Third Party Contact

Let’s begin at the top.

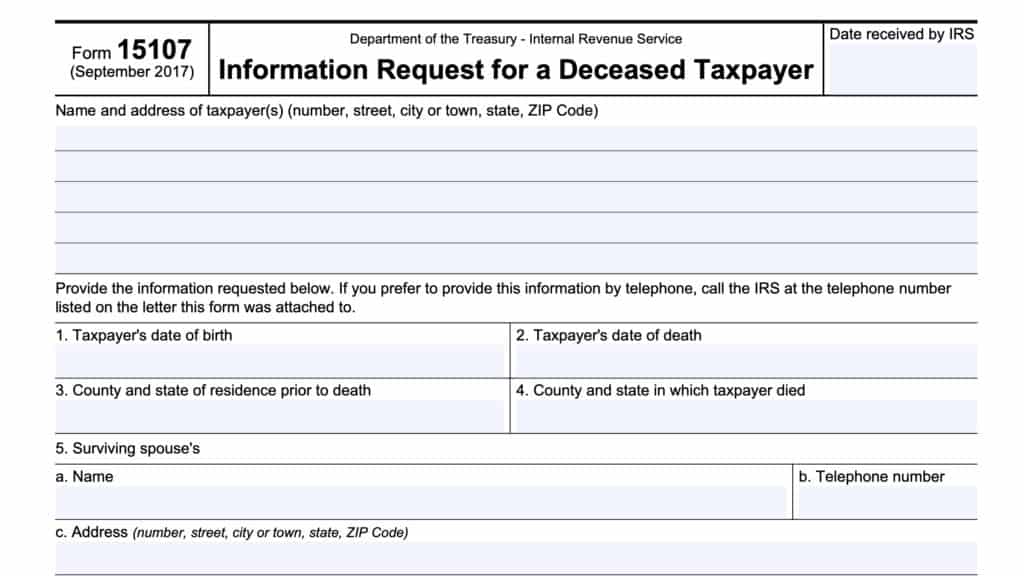

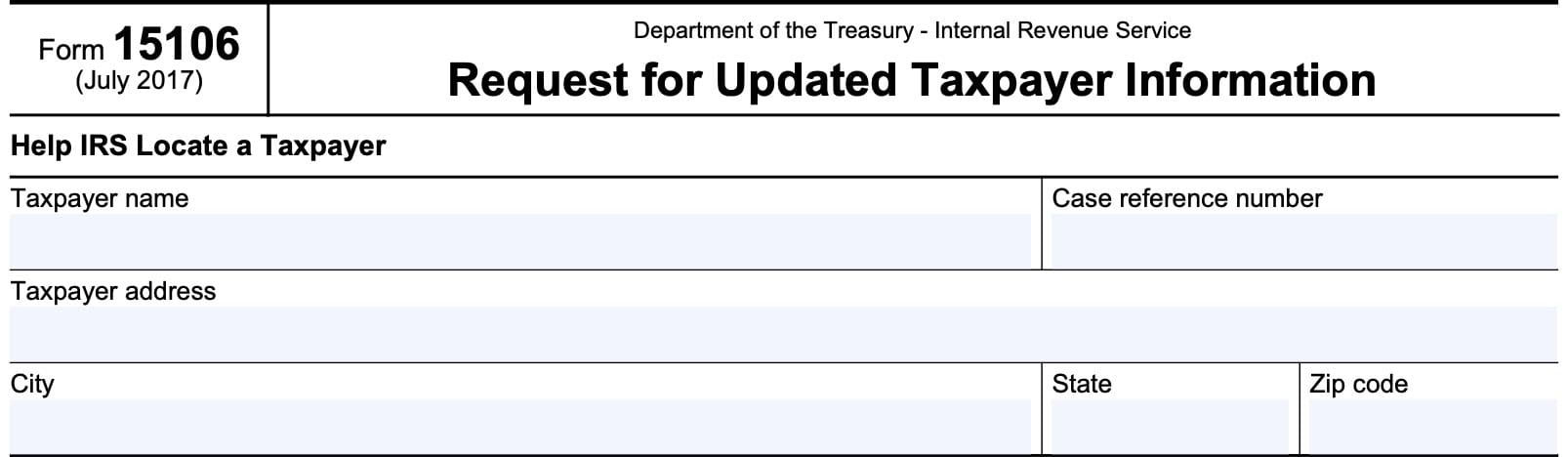

Help IRS Locate a Taxpayer

In the top section, you’ll enter the information related to the taxpayer reported in your LP64 notice. Let’s start at the beginning.

Taxpayer name

At the top, enter the taxpayer’s name as you know him or her, based on what was reported to you.

Case reference number

In this field, enter the case reference number. The case reference number should be located in the top right-hand corner of your LP64 notice.

Taxpayer address

In these fields, enter the taxpayer’s most recent address, based on your records. Be sure to include the city, state, and ZIP code where indicated.

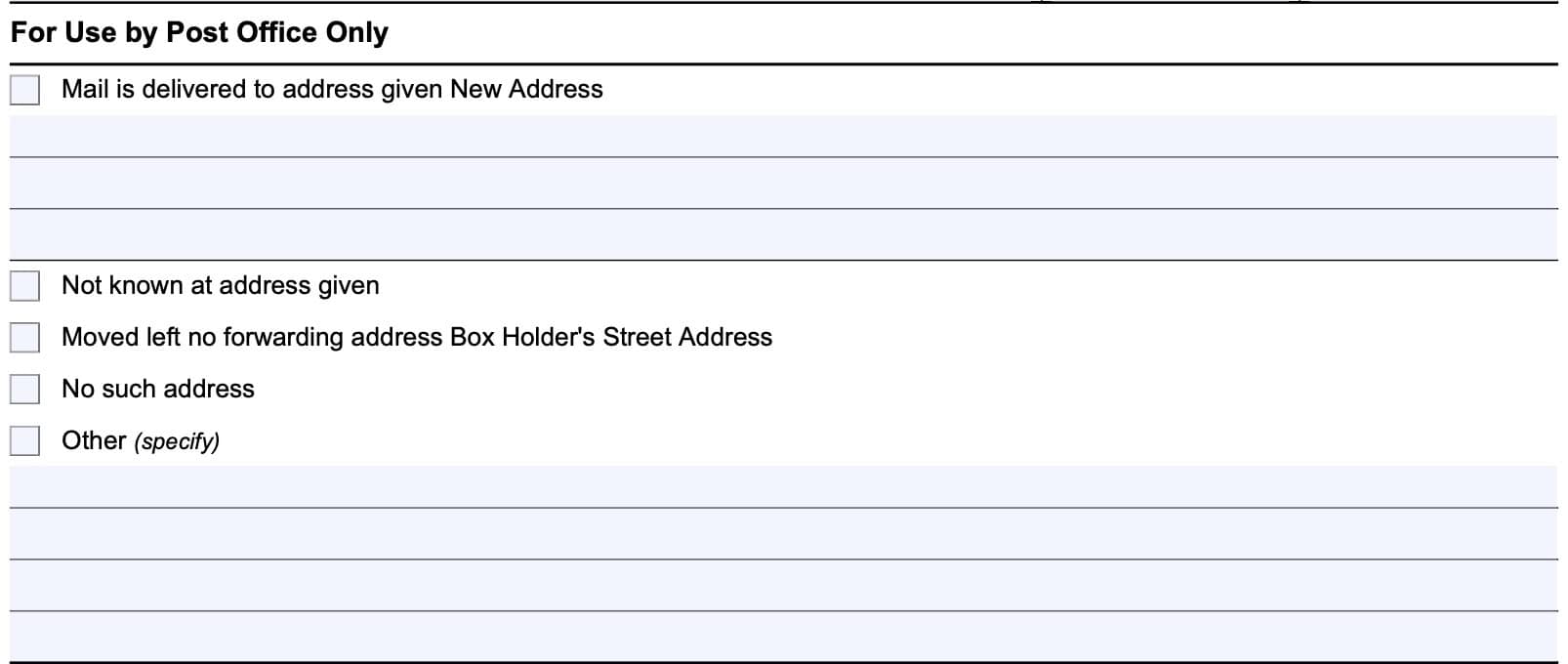

For Use by Post Office Only

This section of IRS Form 15106 should be completed by a post office employee only. In this section, the mail employee will indicate one or more of the following:

- Mail is delivered to address given New Address

- Not known at address given

- Moved left no forwarding address Box Holder’s Street Address

- No such address

- Other (specify)

If responding to an LP64 notice, leave this section blank and move on to the bottom of the form.

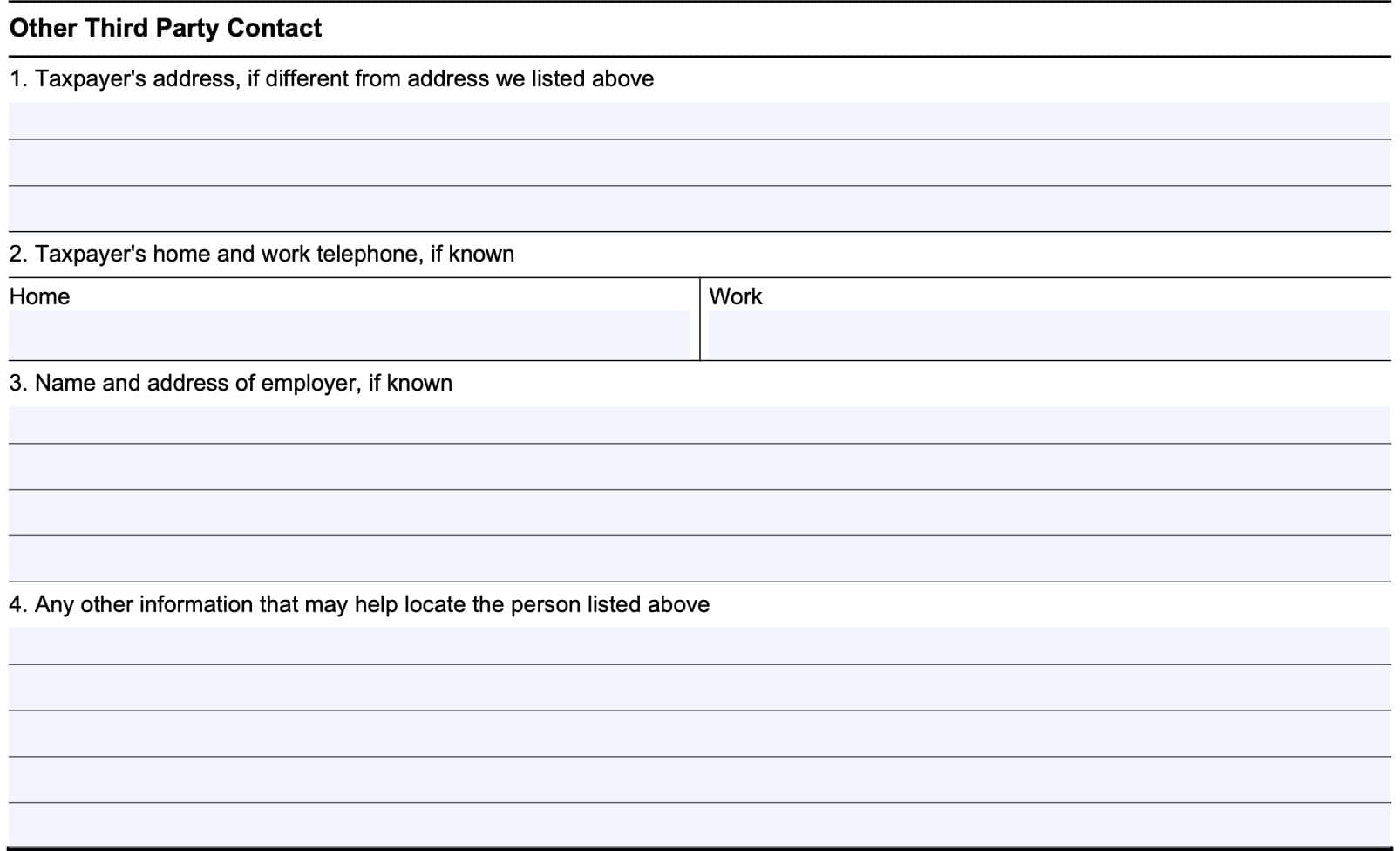

Other Third Party Contact

In this section, enter any additional information that you believe may help the Internal Revenue Service in locating this person.

Taxpayer’s address

If the taxpayer has changed his or her address from the address listed by the IRS, then enter the taxpayer’s new address if you are able to do so.

Taxpayer’s home and work telephone

If you know either the taxpayer’s home or work telephone number, or both, enter them as applicable.

Name and address of employer, if known

If known, enter the name and address of the employer.

Any other information that may help locate the person listed above

If you are aware of any additional information that may help the IRS in locating the person listed in the LP64 notice, enter it in this area.

Filing considerations

Below are some things you may wish to consider when filing IRS Form 15106.

How to file IRS Form 15106

Since IRS Form 15106 is usually sent with an LP64 notice, taxpayers should follow the filing guidance located in the LP64 notice.

When to file IRS Form 15106

Taxpayers generally receive a copy of IRS Form 15106 when they receive an LP64 notice from the IRS. An LP64 notice might be issued when the Internal Revenue Service is having difficulty finding a specific taxpayer.

If you receive an LP64 notice from the IRS, you should follow the instructions provided in the notice. Otherwise, you probably will not need to file IRS Form 15106.

Video walkthrough

Frequently asked questions

Taxpayers might receive an LP64 notice from the IRS if the federal government is having difficulty locating another taxpayer and believes that the person receiving the notice might have additional information.

When issuing an LP64 notice, the IRS usually encloses a copy of IRS Form 15106 for the taxpayer to complete. IRS Form 15106 generally isn’t used unless responding to an LP64 notice.

If you receive a copy of IRS Form 15106 and wish to use it to respond to the IRS, you should follow the guidance in the accompanying LP64 notice.