IRS Form 15109 Instructions

If you have served overseas in a combat zone or in support of contingency operations, the Internal Revenue Code allows certain tax breaks. Most military members are aware of the combat zone tax exclusion, but fewer people realize that you also can receive an extension by filing IRS Form 15109.

In this article, we’ll walk through what you need to know about this tax form, including:

- How to complete and file IRS Form 15109

- Filing considerations

- Frequently asked questions

Let’s begin with a top-down review of this one-page tax form.

Table of contents

How do I complete IRS Form 15109?

There are two sections to this tax form:

Let’s begin at the top of Section 1.

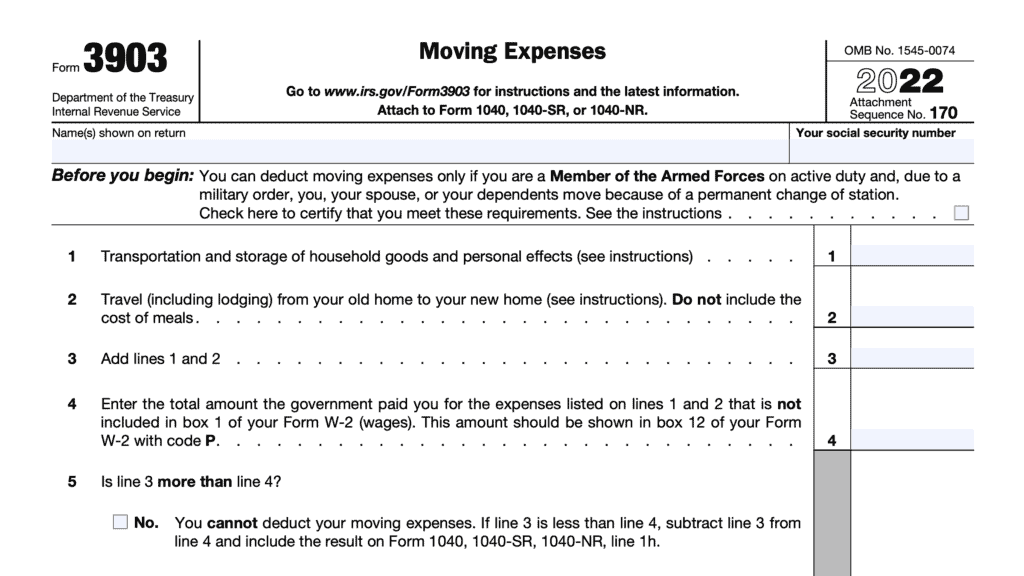

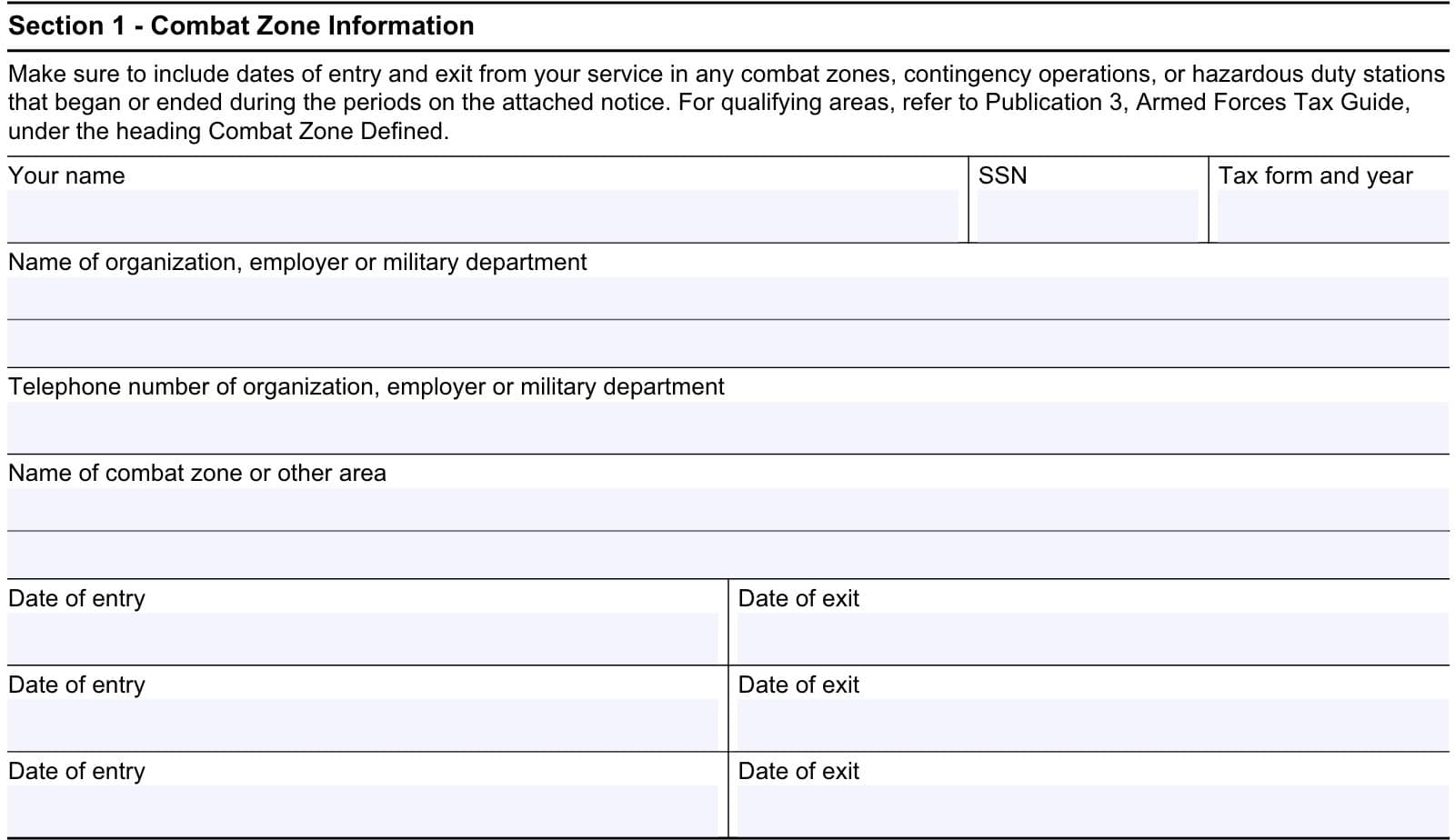

Section 1: Combat zone information

Section 1 should contain the dates of entry and exit from your service in a combat zone, contingency operation, or hazardous duty stations. See Qualifying Areas, below, for additional information about which areas are considered eligible for tax exclusion.

Taxpayer name

Enter your name as it appears on your income tax return.

Social Security number

Enter your Social Security number (SSN) in the field provided.

Tax form and tax year

Enter the type of tax form (typically Form 1040, for income tax purposes), and the tax year in question.

Name of organization, employer, or military department

If you’re a member of the Armed Forces serving on active duty, enter your military department or branch.

For Department of Defense civilian employees or contractor personnel, enter the name of the organization you work for.

Telephone number of employer

Enter your employer’s telephone number in this space.

Name of combat zone or other area

Enter the name of the combat zone or other area that might qualify for such combat zone relief.

Date of entry/Date of exit

Enter the date you entered the combat zone in the space provided. If you left the combat zone or contingency operation area during the tax year, enter the exit date.

For multiple entries and exits, you may list up to 3 different instances.

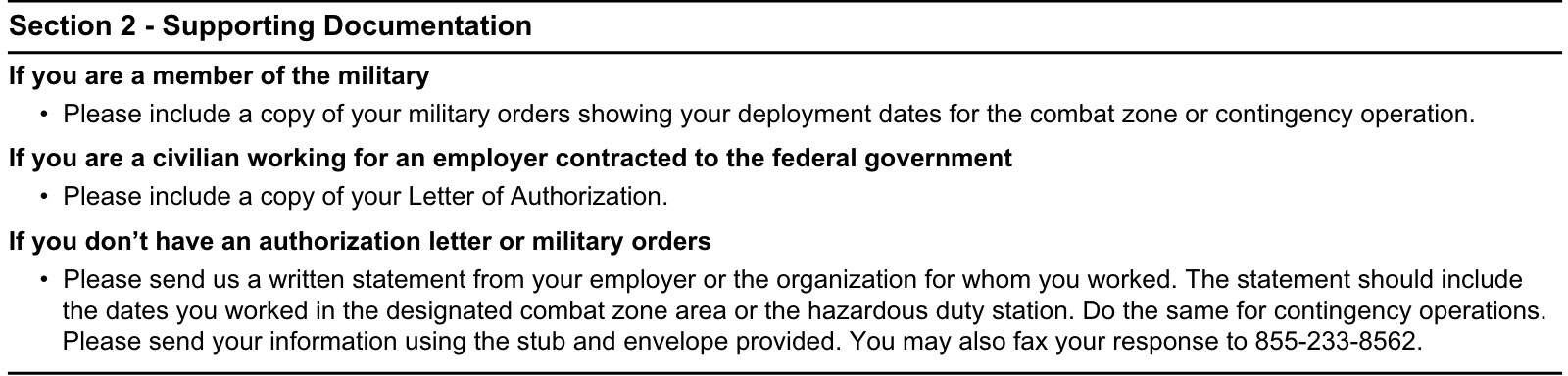

Section 2: Supporting documentation

In Section 2, we’ll outline the supporting documentation requirements, based upon your status.

If you are a member of the military

For servicemembers, you should provide a copy of your military orders that indicate your dates of deployment to the combat zone or contingency operation.

If your military orders do not indicate your deployment to a combat zone

Certain servicemembers may receive military orders to a unit or a command, yet the combat zone deployment might not be reflected on those orders.

For example, members of the United States Navy will often receive orders to a ship or aircraft squadron. In these cases, your disbursing or administrative personnel should have placed the proper service entries into your record to indicate your deployment dates.

Under normal circumstances, these service entries would reflect on your leave and earnings statement for the duration of your combat zone deployment. However, you may need to send additional documentation from your command to provide the Internal Revenue Service with complete information about your combat zone or hazardous duty station deployment.

If you are a civilian working for an employer contracted to the federal government

For civilian taxpayers, you may receive a letter of authorization that specifies your eligibility to receive an extension of time to provide your tax return information. Include a copy this letter of authorization as your supporting documentation.

If you do not have an authorization letter or military orders

If you don’t have an authorization letter or military orders, then you may need to provide a written statement to the IRS.

There is no standard template for such a statement. However, it should contain all of the relevant information that the IRS needs to ensure that you qualify for the tax deferment under IRC Section 7508:

- Employer’s name and active employer identification number (EIN)

- Name of the designated combat zone area, contingency operation or hazardous duty station

- Dates of entry into and exit from designated zone

If you received a CP04 notice from the IRS, you should follow the instructions provided. Watch the below video for more detail.

Filing considerations

Below are some filing considerations you may need to know about IRS Form 15109. Let’s start with examining exactly what a tax deferment is.

How does a tax deferment work?

Internal Revenue Code Section 7508 allows for certain military members and civilian employees to receive an extension of time to file tax returns, make tax payments, and other tax-related issues.

Generally, this extension is for up to 180 days after the later of:

- The last day you are:

- In a combat zone

- Have qualifying service outside of the combat zone, or

- Serve in a contingency operation

- The last day of any continuous qualified hospitalization for injury from service in the combat zone or contingency operation or while performing qualifying service outside of the combat zone

Tax matters eligible for tax deferment

Below is a comprehensive list of all tax matters eligible for deferral under IRC Section 7508:

- Filing any of the following tax returns:

- Income tax

- Estate tax

- Gift tax

- Employment tax

- Excise tax

- Payment of any income, estate, gift, employment, or excise tax or any installment thereof or of any other liability to the United States in respect thereof

- Filing a petition with the Tax Court, or filing a notice of appeal from a decision of the Tax Court

- Allowance of a credit or refund of any tax

- Filing a claim for credit or refund of any tax

- Bringing suit upon any such claim for credit or refund

- Assessment of any tax

- Giving or making any notice or demand for the payment of any tax, or with respect to any liability to the United States in respect of any tax

- Collection, by the Secretary, by levy or otherwise, of the amount of any liability in respect of any tax;

- Bringing suit by the United States, or any officer on its behalf, in respect of any liability in respect of any tax or in respect of any erroneous refund and

- Any other act required or permitted under the internal revenue laws specified by the Secretary

Combat zones, contingency support operations, and hazardous duty areas

According to IRS Publication 3, Armed Forces’ Tax Guide, the following areas are considered combat zones (or areas in direct support of combat operations), and the beginning eligibility dates for each:

- Afghanistan: September 19, 2001

- Jordan and Pakistan

- Djibouti

- Yemen

- Somalia and Syria

- Kosovo: March 24, 1999

- Federal Republic of Yugoslavia (Serbia/Montenegro).

- Albania

- Kosovo

- The Adriatic Sea

- The Ionian Sea—north of the 39th parallel

- Arabian Peninsula: January 17, 1991

- The Persian Gulf

- The Red Sea

- The Gulf of Oman

- The part of the Arabian Sea that is north of 10 degrees north latitude and west of 68 degrees east longitude

- The Gulf of Aden

- The total land areas of the following countries:

- Iraq

- Kuwait

- Saudi Arabia

- Oman

- Bahrain

- Qatar, and

- the United Arab Emirates

- Sinai Peninsula: June 10, 2015

When do I file IRS Form 15109?

Most likely, you will have received a CP04 notice from the IRS. If this is the case, then the IRS is looking for you to provide documentation of your entitlement to a tax deferment. You should either follow the instructions on the notice, or file IRS Form 15109.

If you did not receive a notice, you might not need to file this tax form.

How do I file IRS Form 15109?

If filing IRS Form 15109 in response to a CP04 notice, then you should follow the instructions in the notice. Otherwise, you may fax your completed form to the IRS at: 855-233-8562.

Video walkthrough

Watch this informative video to learn more about requesting a tax deferment with IRS Form 15109.

Frequently asked questions

IRS Form 15109, Request for Tax Deferment, is the tax form taxpayers may use to request an extension to file a tax return or pay taxes, due to eligibility under Internal Revenue Code 7508.

A CP04 notice is an IRS letter that notifies the taxpayer that he or she may be eligible for a tax deferment, but that the IRS needs additional documentation. This request may be satisfied by responding directly to the notice or by filing IRS Form 15109, Request for Tax Deferment.

Where can I find IRS Form 15109?

You can find the latest versions of IRS forms on the Internal Revenue Service website. For your convenience, we’ve enclosed the latest version of IRS Form 15109 in this article.