IRS Form 2120 Instructions

If you are caring for an aging parent with other siblings, you may need to file IRS Form 2120 to claim tax benefits related to a qualifying relative.

In this article, we’ll cover what you need to know about your multiple support declaration, including:

- How to complete IRS Form 2120

- Situations that might require filing IRS Form 2120 with your tax return

- Other frequently asked questions about multiple support agreements

Let’s start with a brief overview of the tax form itself.

Table of contents

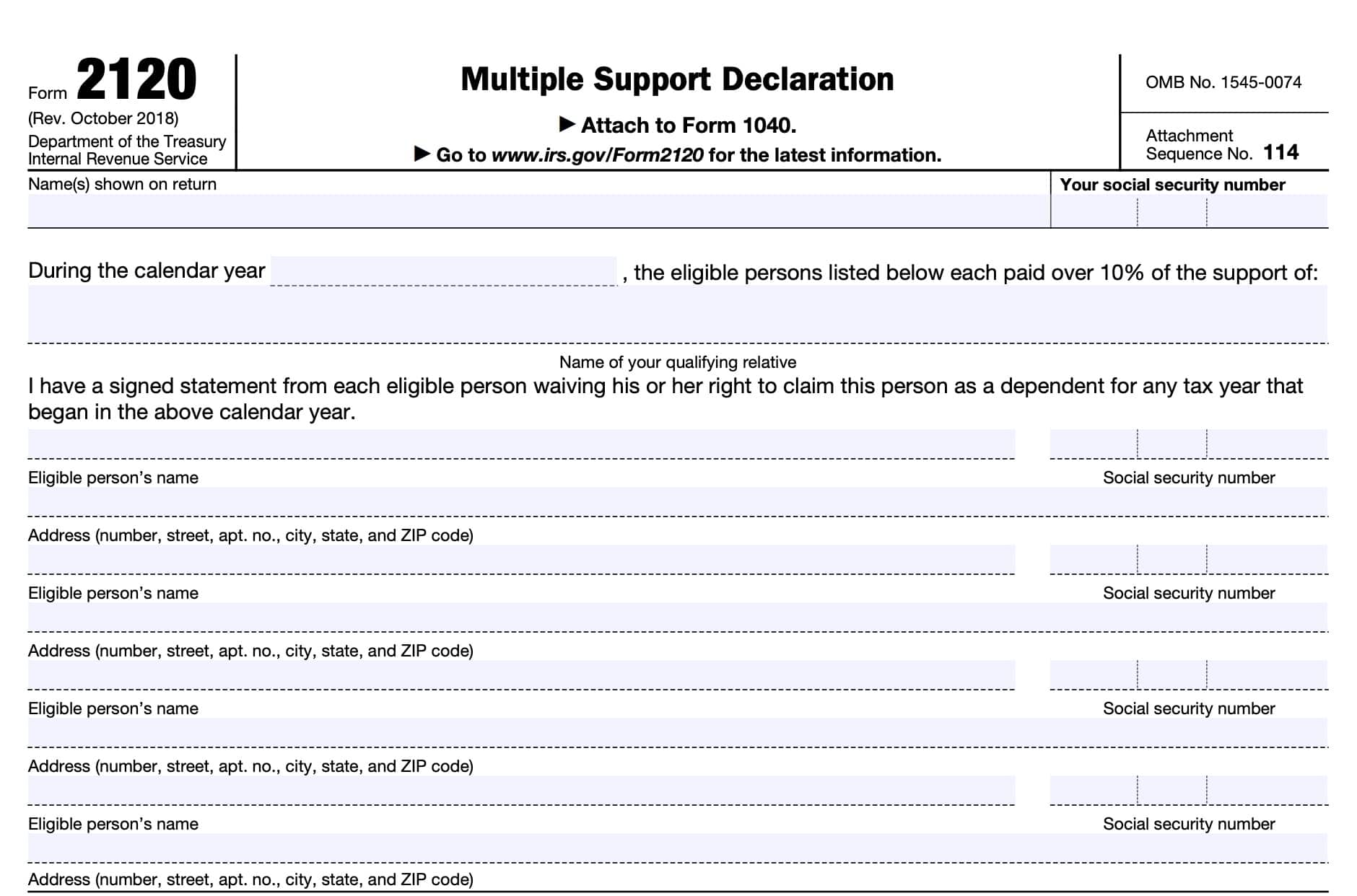

How do I complete IRS Form 2120?

This one-page tax form is fairly straightforward to complete.

Top of the form

At the top of the form, enter the taxpayer’s name and Social Security number as they appear on your income tax return.

Just below the taxpayer information field, enter the tax year in question, and list the qualifying dependent in question.

Eligible persons

List all eligible persons who paid at least 10% of the financial support of your qualifying relative. For each eligible person, list the following information:

- Eligible person’s name

- Address, including city, state, and ZIP code

- Social Security number

The form allows you to enter up to 4 eligible persons. If there are more than 4 eligible persons, you should attach a written statement to your tax return with the additional information.

Once you’ve completed the multiple support declaration, file it with your income tax return.

Using IRS Form 2120 With a Multiple Support Agreement

In many cases, especially where multiple adult children are caring for an elderly parent, there may be a multiple support agreement. As part of the support agreement, the children may agree on who is able to claim tax benefits associated with the personal exemption for that qualifying relative.

In general, the following rules must apply when using a multiple support agreement:

- The dependent is a qualifying relative

- The qualifying relative received more than 50% of support from two or more relatives

- No single person gave more than 50% of support

- The contributing relatives agree to allow a single, chosen relative to claim the individual as a dependent

- The selected relative furnishes more than 10% of the dependent’s support

- All other relatives who also contribute more than 10% of the funds sign multiple support agreements which waive their right to claim dependency for that taxable year

- When filing taxes, the chosen relative attaches IRS Form 2120 to identify the waiving relatives.

- It is a good idea to maintain a copy of this completed form and all other tax records for future reference

Video walkthrough

Watch this instructional video to learn more about making your multiple support declaration to the Internal Revenue Service using IRS Form 2120.

Frequently asked questions

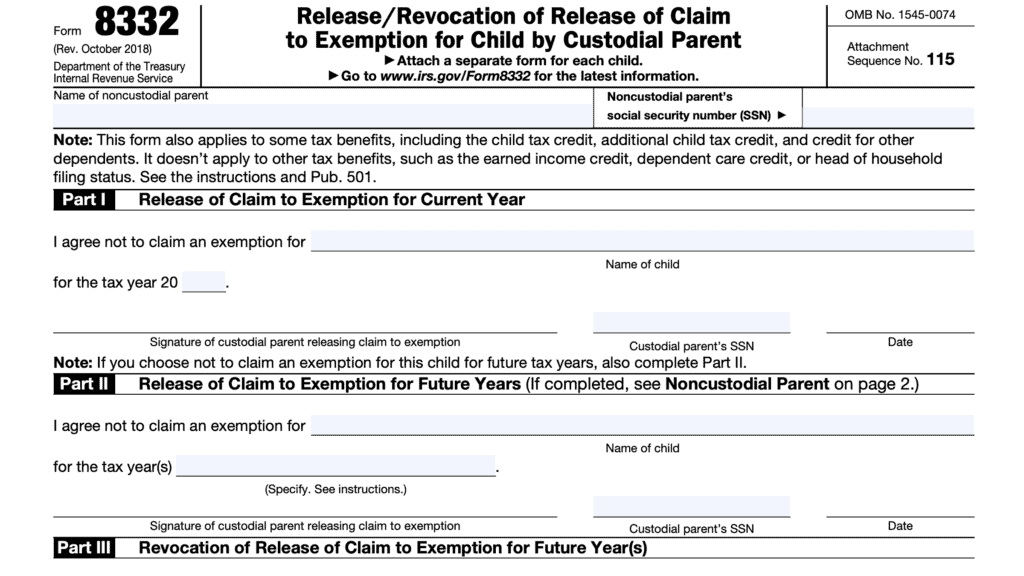

Taxpayers who wish to claim tax benefits for a qualifying relative, but did not provide over half of the support for that person may file IRS Form 2120. Doing so will allow the taxpayer to claim those benefits, and to indicate that all other eligible persons have waived their right to claim that person as a dependent on their tax return.

You may still claim a dependent if no one else provided over half of the support for the qualifying relative, you paid at least 10% of their support, and you have a signed statement from other eligible persons indicating that they do not seek tax benefits on this person’s behalf.

Due to the Tax Cuts and Jobs Act of 2017, the tax deduction for the personal exemption for dependents has been suspended for tax years 2018 through 2025. As the tax law is currently written, the tax deduction will return in 2026. However, several tax benefits, such as the dependent care credit, may depend on who is able to claim the personal exemption.

Each completed statement must include the eligible person’s waiver of his or her right to claim the exemption, the calendar year the waiver applies to, the name of your qualifying relative the eligible person helped to support, and the eligible person’s name, address, and social security number.

Where can I find IRS Form 2120?

You can find this tax form on the IRS website. For your convenience and easier access, we’ve attached the latest version here.

Related tax forms

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!